Abstract

Current accounting systems assume a purely financial approach, without including environmental information, such as environmental costs and companies’ expenses. On the one hand, this study proposes a framework that considers the environmental impact of firms within their accounting system, the Green Accounting System (GAS). On the other hand, and in the context of developing countries, Colombia carried out an exploratory study. With a sample of 150 Colombian industrial and commercial companies, this research revealed that 100% of them had not yet implemented environmental practices within the accounting system. Therefore, this research would be useful not only for academia, but also for practitioners and governments. As GAS would contribute to traceability in the quantification of environmental accounting, it would simultaneously generate a movement toward cleaner production that would increase environmental quality.

Similar content being viewed by others

1 Introduction

Few companies currently have a financial management system that not only focuses on the company’s economic aspects, but is also concerned about their environmental impact. Because of this, researchers constantly express the need to include new environmental processes and data in the General Accounting System (Aznar & Estruch, 2015; Van Thanh et al., 2016), constituting the basis for green or environmental accounting, therefore, enabling the identification and quantification of the use of natural resources. It also includes the costs of environmental management generated by cleanup of contaminated areas, environmental fines or taxes, green technology acquisitions, waste treatment, and the integration of environmental externalities, among other factors. With time, it will be recognized that environmental data must be a structural element in financial reports to provide information for third parties and as a basis for entrepreneurial decision-making.

Maunders and Burritt (1991) were pioneers in introducing the concept of green accounting. Lee et al. (2017) referred to the positive and negative interdependencies between economics and ecology, while Hens et al. (2018) advocated for the importance of implementing green accounting in the accounting system through the measurement of physical and monetary units.

Thus, building and applying green accounting models that lead to the incorporation of environmental processes, units, and activities is crucial as it impacts financial information. In turn, this will enable organizations to issue more complete and reliable financial information, based on both economic and environmental indicators that facilitate determining the evolution and current situation of organizations, which is useful for decision-making (Ojito et al., 2017).

In simpler terms, green accounting will translate into overall care for the environment, in particular helping to avoid pollution and deforestation (Schaltegger & Burritt, 2017; Zandi & Lee, 2019). The following will, therefore, utilize the term “green accounting” possessing the same definition as that of “environmental accounting” (El Serafy, 1997). Samaraweera et al. (2021) suggest including the term green because that color means loyalty and harmony, which, articulated with an accounting system, is understood as a subdiscipline designed to minimize the negative effects that organizations cause on the environment through measurement and assessment of processes to improve their eco-efficiency.

A series of definitions have been proposed for green accounting in the literature (Deegan, 2013; Gallhofer & Haslam, 1997; Greenham, 2010; Yang & Zhao, 2018; González & Herrera, 2020), however in the following research, the definition of Singh et al. (2019) will be used. They maintain that “Green accounting reflects the environmental impact generated by companies during all implemented productive and corporate activities.” (p. 482).

At a global level, there have been different proposals for green accounting (Aronsson et al., 1997; Mylonakis & Tahinakis, 2006; Nakasone, 2015; Vassallo et al., 2017). Some establish measurement units based on general equilibrium models that hinder quantifying environmental inefficiency and efficiency factors to enable the improvement of future actions (Aronsson et al., 1997). Researchers Mylonakis and Tahinakis (2006) propose the use of environmental accounting in the accounting information system of the cost-benefits sphere, without specifying other significant capital such as income or environmental assets.

Nakasone (2015) regards the green accounting model as a concern solely for mining, oil, and gas companies, leaving aside other industrial, commercial, and service sectors that also negatively impact environmental quality. Vassallo et al. (2017) propose robust methodologies and indicators in green accounting, but from the biophysical and trophodynamic perspective, without referring to the financial aspect.

In general, the proposals are diverse and use different green accounting methodologies that aim to measure and assess an organization’s environmental performance—these points of view do not aim to standardize all environmental activities or processes undertaken by organizations to be communicated in financial reports. Also, the grouping of environmental assessment and measurement methods are not coordinated with the general accounting plan, therefore are not communicated in comprehensive or independent financial reports. The main issue that green accounting models share is that they are conceived in developed countries and fail to consider the particularities of developing economies, such as that of Colombia. Some particularities are: (1) the economic is based on the primary sector, (2) low organizational culture related to the environment, (3) corrupt political regime, (4) lack of environmental and democratic institutions (5) these countries are laboratories in innovation of different ways because they do not have the levels of established infrastructures that are in the developed ones (6), little acceptance for the adaptation of new economic forms that reduce pollution.

In Latin America (LA), Colombia is one of the countries that promote the introduction of green accounting practices among its national companies (Galvis & Guevara, 2019; Martínez & Sánchez, 2019); Ceballos et al., 2020. According to the goals of sustainable development, the previous government, and the current government of this country, want to reduce the level of CO2 that comes from its national industry. Thus, promoting environmental practices by governments is a way to promote cleaner production (Chamorro, 2016). Therefore, it is appropriate to discuss green accounting in the context of the Colombian economy. Although it cannot represent all LA-economies, it can become a laboratory of innovation and practice in different ways because they do not have the established infrastructure levels that exist in developed ones (similar situation in all countries with developing economies.

Furthermore, it is relevant to build a new model for the adoption of green accounting in the accounting system. This is based on the models of Novillo and Hachi (2014), Higuera (2015), Urraca and Silvia (2017), who agreed on the essential points for including green accounting in the accounting discipline, taking into consideration important environmental parameters to be communicated in financial reports, such as prevention, integration and good practices.

Green accounting in Colombia dates back to 1990 with the publication by Araujo (1995) was relevant. The National Council for Economic and Social Policy [CONPES] developed in 1991 an environmental policy that sought to implement and quantify the national natural and environmental patrimony. The following year, the Institutional Committee for Environmental Accounts [CICA] presented an environmental program for Colombia. In 1994, the integrated environmental-economic accounting document for Colombia (Ortiz, 2017) was issued and in 1999, an International Environmental Accounts Forum was held, helping to establish the importance of implementing environmental accounts in the Colombian accounting system (Carvalho & Pozzetti, 2019).

Although Colombia has an interesting background in green accounting, there is no structure to support the integration of this type of accounting in financial reports (Chávez, 2020; Vélez et al., 2007; Yepes, 2008). This is due to the fact that most Colombian companies use financial accounting instead of green accounting. Therefore, this study attempts to fill the gap in the accounting and environmental literature from a double perspective, theoretical and exploratory. From a theoretical perspective, this study proposes a green accounting system that combines various categories of complete and reliable environmental information. As a result, companies could then identify areas of environmental inefficiency and efficiency, helping to improve decision-making in their productive and financial processes. And, from an exploratory perspective, we examine the degree of implementation of green accounting in firms in developing countries, by doing so; we have used a sample of 150 Colombian companies, allowing for the detection of formative problems and the development of essential bases from an academic approach. In turn, this will help those responsible for financial information and monitoring to integrate and communicate environmental damage along with investments made for ecological improvements through various ledger accounts that must demonstrate this.

The following research also contributes positively to Sustainable Development Goals [SDGs] because the study aims to establish the ninth goal (actions regarding climate) and thirteenth goal (industry, innovation, and infrastructure). Specifically, the main objective is to design a proposal for a Green Accounting System that allows companies to build administrative, commercial, and operational processes in an inclusive and sustainable manner and, consequently, to promote innovation in new forms of responsible production in the management of natural resources, an activity that will contribute to the environmental crisis.

More specifically, this research strengthens an academic circle with the methodological proposal that utilizes accounting knowledge and integrates environmental parameters in their financial records. Scientifically, it produces new methods and practices that reflect the convergence between the environment and accounting. This is an important initiative that organizations must implement globally.

In summary, this research will explore the following sections: a summary of the literature review referencing the main points associated with green accounting, a description of the methodology used to conduct the research and apply the data from the surveyed companies, an analysis of the results as they relate to the discussion, and finally the conclusions and implications of the research.

2 Green accounting system-literature review

Sustainability is one of the leading and most urgent new SDGs. In this context, tools and processes arise that aim to contribute to environmental care by organizations, offering various elements to combat competitive processes for companies’ social development. This is why productive environmental systems within organizations seek effective adaptation to climate change through their implementation of policies, processes, mechanisms, and tools, in order to develop and strengthen the companies' environmental productive activities (Fogarassy et al., 2018; Homan, 2016). This system also enables the possibility to undertake projects aimed at increasing resilience in communities in the area, achieving recovery and maintenance of the ecosystem (Cavalleti et al., 2020; Montagnini et al., 2015; Tiwari & Khan, 2020).

Alternatively, Moreno (2019) and Lehman (1995) mention that it has been axiomatic to incorporate environmental issues in research and education agendas that address evaluation mechanisms which would help companies and professionals implement systems or tools on behalf of the environment, such as green accounting (Angell & Klassen, 1999; Nilsson et al., 2017).

The nomenclature of green accounting (GA) is recognized as having begun with El Sefary (2000), who established the need to associate accounting with its green contribution; in other words, environmental protection and pollution prevention. In that regard, green accounting, in addition to being a social tool that enables reporting on qualitative and positive aspects of the environmental impact generated by organizations (Saleh & Jawabreh, 2020; Scarpellini et al., 2020), is also included in corporate sustainability and in the coordination of environmental and social processes. This ensures the responsible, ethical and continuous success of an enterprise (Hernádi, 2012; Ignat et al., 2016; Slawinski & Bansal, 2015).

The information provided by green accounting has four main objectives: (1) demonstrate environmental wealth, (2) represent temporary spaces for the existence and circulation of this type of wealth, (3) plan possible venues to monitor the behavior and circulation of environmental wealth using the quantitative and qualitative valuation, and (4) indicate a prospective aspect (Capusneanu, 2008; Geba et al., 2010; González, 2015; Zou et al., 2019). In short, green accounting is a technoscientific framework for a document that supports decision-making.

With this knowledge, companies must develop an internal environmental policy (Haque & Ntim, 2018; Evangelinos et al. 2015). In general, green accounting is considered an instrument that reduces a company’s environmental impact (Montemayor et al., 2019). Green accounting will support economic efficiency and promote an organizations' capacity for innovation and eco-efficiency (Islam & Managi, 2019; Rusell et al., 2017).

For this reason, it is important to communicate the processes, activities, strategies and practices that decrease an organization’s environmental impact. According to Rossi et al. (2016) and Higuera (2015), such communication must be presented through accounting recognition supported by a comprehensive or independent financial report. This would report on the monetary quantification of the main elements of green accounting: assets, liability, patrimony, expenses, costs, and provisions, among other accounts that categorize the environmental wealth of the organization which must be reflected in an independent environmental report (Bennett & James, 2017; Fleischman & Schuele, 2006; Gray & Laughlin, 2012).

According to the proposals presented in diverse models (Craig & Glasser, 1994; Cortes, 2016; Cairns, 2009; Mason & Simmons, 2014; Rodríguez, 2015), the characteristics that identify the integration of green accounting in a company are (A) implementation of environmental policy, (B) development of environmental strategies, (C) establishment of environmental financial reports, (D) introduction of environmental accounts, and (E) presentation of environmental reports that document the processes for reducing environmental impact.

Other models stress that green accounting must be established as a socioeconomic tool to facilitate company adaptation of principles and activities. This is vital to mitigate the environmental impact of their organizations through business processes and accounting recognition of the different environmental activities (Novillo & Hachi, 2014). According to Vasallo et al. (2017) and Zandi and Lee (2019), the implementation of environmental accounting is established as a competitive process that points towards new strategies such as the decrease of risks to environmental reputation, strategic innovation, entry into international markets, adaptation to the global market, among other benefits that contribute towards human and social development at companies.

In this scenario, organizations require accounting professionals with added knowledge in environmental matters since currently there are different standards that require measuring and evaluating environmental assets, liabilities, income, costs and expenses (Alvarado et al., 2016; Chamorro et al., 2019; Lieder & Rashid, 2016; Medina, 2019; Hernández, 2012).

3 Methodology

To develop the green accounting system, we carried out a thorough review of the literature on green accounting. Scopus and ISI web knowledge datasets were used mainly. The results revealed the scarcity of literature on the topic. To broaden the data to be evaluated, other databases such as Science Direct, Emerald, and Google Scholar (for Google, we used versions in both English and Spanish) were consulted. Astonishingly, the result was almost identical—little information was available. In fact, there was a proposal related to the context of developing economies that became part of this examination of gaps in the research. It also justifies the need for extensive research on green accounting topics.

The exploratory study is based on a sample of 150 Colombian companies. Thus, we first develop the green accounting system and then we continue with the exploratory analysis, which supports the idea that firms must count on an accounting system that can gather the environmental effects of corporative activities.

4 Green accounting system: an exploratory study in the colombian case

Our research identified that 6793 companies exist in the database maintained by the Chamber of Commerce in Colombia, but only 3771 are industrial and commercial companies (object of study). However, of 3771 companies, only 1000 were selected because the remaining did not count on financial managers.

The questionnaires were collected by email only; the financially responsible persons were invited to participate in the study. The letter of invitation indicated, on the one hand, the objective of this study (green accounting practices) and, on the other, the anonymity of the responses, assuring that the information received will be used on a global scale and never at an individual level. Of the 1000 selected companies, only 150 responded to the survey (56% industrial and 44% commercial). According to the studies by Malca et al. (2019) and Peña-Vinces et al. (2019), this is figure (i.e.,150) is considered acceptable within the Latin American context. The selected companies (1000) are recognized as large companies under Decree 30,233 of 2013 (see characteristics of the companies in Table 2). These companies were specifically selected due to their high degree of productive activity, which requires them to implement environmental strategies that guarantee national sustainability.

The exploratory survey aimed to determine the degree of implementation and knowledge about environmental accounting (EA), 64% of the professionals who filled out the survey were men and 36% were women, with an average age between 35 and 55. The great majority (52%) were between the ages of 45 and 54. Regarding the time in which these professionals have been managing their company’s finances, most have worked at their firms for at least 10 years.

The exploratory questionnaire was adapted to the Colombian context, based on the work of Moreno (2019) and Masud et al. (2017). It evaluated to what extent the companies had knowledge concerning green accounting, the application of green accounting, and communication about the factors associated with this type of accounting. In this regard, three experts in GA verified that the instrument was well structured and responded to the purpose of the study. Table 1 presents the questionnaire with the questions evaluated:

This diagnosis makes it possible to determine the importance of creating a methodological proposal for green accounting. This would enable Colombian companies to carry out processes and activities for the execution or implementation of green accounting.

4.1 Results of the exploratory analysis

Data were analyzed using SPSS version 22 software in order to determine the priority of corrective actions and the prevalence of variables for the incorporation of green aspects into the accounting system in Colombia.

The main objective was to determine from the results if there is a need to implement a GA system. Otherwise, there would be no logic in establishing the proposal. Similarly—and considering that this research does not pose as a confirmatory study—it does not justify the need to conduct a CFA or EFA since this research aims to evaluate the degree of implementation of GAS rather than to test it.

The early findings (Table 2) show that all companies analyzed had knowledge of green accounting (Q1), and that this knowledge was received from diverse sources such as scientific publications (8%), and personal research (52%). Secondly, they reveal that 54% of the companies have not established methods or strategies to implement green accounting (Q2), however, 86% are implementing environmental policies in their organizations (Q3). Under these circumstances, the adaptation of company principles and activities that would enable accounting and recognition of different environmental activities is important (Mason & Simmons, 2014).

Other results from the study on the application of green accounting showed that the organizations report environmental accounting factors such as assets, liabilities, income, costs, and expenses, but merely 12% record these factors in their financial reports (Q8).

In addition to this behavior, other latent factors hinder the evolution of green accounting in Colombia, however, all companies surveyed report that it is important to standardize a green accounting model (Q9) that would serve as a guide for its implementation in the accounting systems of organizations (Aznar & Estruch, 2015). Those responsible for financial information would thus be able to record, measure, and assess their organization’s environmental impact while providing financial reports in which environmental management headings are recognized (Chamorro, 2015; González & Herrera, 2020). This is why it is recommended that regulations are established that would encourage organizations to implement green accounting in the Colombian accounting system.

Finally, with the aim of evaluating whether there was a significant difference between the set of pair-studied questions, a McNemar test was carried out. We must point out that we grouped the variables that would make logical sense in the study of GA. The results in Table 3 indicate that there was a significant difference in the relationship between Q2 and Q7 (p < 0.00). Figures indicate that approximately half of the companies analyzed (47%) do not count on an accounting system which promotes the implementation of green accounting practices, which is coherent with the firms’ financial statements (FS) of the companies. In fact, a scarce number of them (7%) gather environmental practices in their FS. In the same vein, the results have shown statistical differences between Q3 and Q8 (p < 0.00). This indicates that the vast majority of companies (75%) had implemented an environmental policy. However, such environmental policy does not see reflected in the companies’ financial reports due to a reduced number of them doing this alone (7%). The results found support for such findings because the relationship between Q3 and Q7 (p < 0.00) has shown that a reduced number of companies (4%) have put into practice the environmental policy established by the company, as they do not include it within the FS. In the same direction, the association between Q3 and Q5 (p < 0.00) goes, indicating that a limited number of companies (10% only) maintain records of environmental income and expenses. This is coherent without including it in the FS because if the figures were not recorded by the company, it would be impossible to take the FS into account.

4.2 Green accounting system-framework

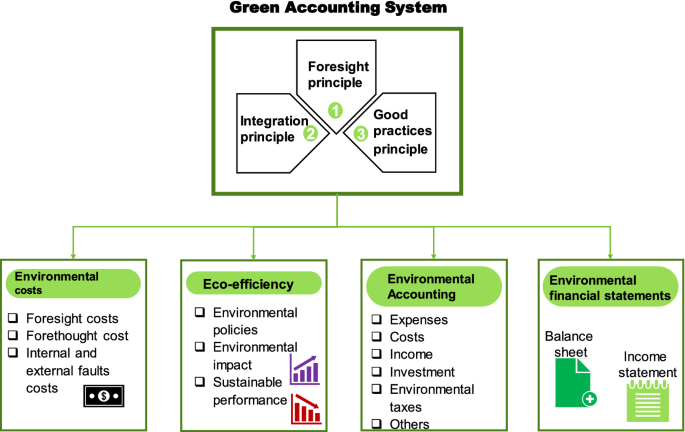

In this section, the technical models were selected to define the variables to use and process in the interrelationship between the elements of green accounting. Of all the models and theories identified in the literature, the proposals built by Novillo and Hachi (2014), Higuera (2015) and Urraca and Silvia (2017) were used. Subsequently, duplicate variables were eliminated. This research has a large, robust, and complete structuring in terms of the inclusion of green accounting. Similarly, in the structuring of the Green Accounting System, certain factors developed in the selection models were used as references. Novillo and Hachi (2014) select the initial principles for the execution of environmental accounting models. Higuera (2015) developed a deployment of environmental accounts to incorporate in the independent reports. Urraca and Silvia (2017) present coefficiency processes for the dissemination of environmental aspects. The model incorporates new factors for the process, structuring, and disseminating of environmental accounting aspects and introduces two equations for the development of reports on (1) environmental balance and (2) environmental profit and loss statement. Figure 1 thus summarizes the green accounting proposal:

The structuring of the model (Fig. 1) arises as a conceptual and practical proposal to interrelate the productive and commercial factors of the organizations that affect the ecosystem. This model is useful because it will allow the identification and reporting of environmental assets, liabilities, income, costs, and expenses, information that will allow decision making and operationalization in concrete actions and organizational processes of different environmental public policies that exist at the national and international levels.

This model is different from other frameworks found in the literature because it initially determines that organizations should create principles of prevention, integration, and good environmental practices, which in turn allow the development of socio-environmental initiatives in organizations from the perspective of eco-efficiency in the search to respond toward sustainable and sustainable development.

Moreover, with the aim of clarifying our GAS proposal concerning existing models. The following Table 4 details the similarities and differences with respect to other environmental accounting systems.

However, it is clear that globalization and the need to express global economic and financial operations in a universal language have accelerated the implementation of the International Financial Reporting Standards [IFRS]. The aim is to provide transparent financial information allowing users to obtain knowledge of the business under a real and objective scheme, avoiding overestimation or underestimation of the operations reflected in the accounts for assets, liabilities, income and expenses.

Details must therefore be provided about possible environmental aspects, issues, and concerns that can more explicitly be accounted for and reflected in the Financial Statements, in addition to showing a generic reclassification of the accounting ledgers.

Initially, the proposed model became valid through cleaner production, as affirmed by Novillo and Hachi (2014). This can be implemented to any process in the company; it ranges from basic changes and immediate execution of operational procedures of the product and service to large-scale changes that require the substitution of various factors, such as costs, raw materials, suppliers or production lines that allow greater efficiency.

Another differentiating factor of the GAS model is the interrelation with the cleaner production process that aims at the conservation of raw materials, water and energy, and the reduction of toxic raw materials, emissions and waste. Cleaner production is applied during the life cycle of a product from the extraction of raw materials to the final production of waste, the concept promotes environmentally friendly design according to the needs of future markets (Crissien-Borreroa, et al., 2016). In this proposal, three cleaner production processes will be taken into account for the integration of environmental processes into the accounting system: the prevention, integration, and good practices process (incorporating accounting practices). Their components are interrelated and are defined below:

4.2.1 Principle of prevention

The preventive principle refers to the search for changes in the chain of production and consumption of companies (Duvic-Paoli, 2018). The cleaner production suggests that the new solution must reconsider the design of the product, the amount of assets and services, the level of materials consumption, and others factors of the company's financial activity.

4.2.2 Principle of integration

Integration implies the adoption of a holistic vision throughout the production process and a method that allows introducing that idea in the lifecycle analysis of a product or service. However, there exist various difficulties with the preventive solution—one of them being the integration of measures referring to environmental protection through systemic frontiers (Ellingson et al., 2015). The traditional regulation associated with the phrase “at the end of the line” is generally applied up to a specific point in which measures for integrated processes to reduce pollution apply. By reducing the need for emissions of such substances into the environment, these measures provide integrated protection for the whole environment.

4.2.3 Principle of good practices

This refers to good environmental practices focusing on waste management, paper management, efficient use of water, energy and fuels, training, responsible purchases and mechanisms that contribute to the environmental sustainability of the company (Taleb, 2015). Green accounting becomes important through the integration of environmental accounting practices with the aim of revealing them in financial reports for administrative decision-making, which constitute an information system for third parties who also measure the environmental success that the company will have achieved.

The good environmental accounting practices set forth in this proposal according to the formulations of Novillo and Hachi (2014), Higuera (2015), Urraca and Silvia (2017) are: (1) identification and revelation of the costs, (2) implementation of Eco-Efficiency activities, (3) recording of environmental aspects in the accounting, and (4) the showing of environmental financial statements. These aspects are explained as follows:

4.3 Identification and revelation of environmental costs

Environmental accounting identifies and measures the use of resources, their impact, and cost, which include cleanup of contaminated areas, environmental fines, taxes, purchase of green technology, waste treatment, and the integration of environmental externalities. An environmental accounting system consists of an ecological account and an adapted conventional account. The adapted conventional account measures impacts on the environment in monetary terms. The ecological account measures the impact that a company has on the environment in physical terms; kilograms of waste produced, kilojoules of energy consumed (Cabello, 2016; Banguat, Url and Iarna, 2009), etc. In other words, it measures how much it costs a company to take care of (or not take care of) the environment. Environmental costs may be divided into the following categories:

-

(i)

Costs of prevention

-

(ii)

Costs of detection

-

(iii)

Costs of internal failures

-

(iv)

Costs due to external failures

These costs will provide the parameters to examine the outlays made for each cost. Environmental costs that are not included in a company’s accounting ledgers are called externalities and are costs supported by the rest of the society. Businesses can obtain exact numbers for various environmental costs through company-implemented measurement processes or purchase price diagnostics. However, this is a process that all companies normally do according to their internal policies or processes, which can also be applied for environmental costs.

4.3.1 Eco-efficiency

One of the most important concepts used in green accounting is that of Eco-Efficiency, which implies that an organization may create more and better goods and, simultaneously, reduce its consumption of resources and its costs (Burritt & Saka, 2006; Figge & Hahn, 2013). This concept involves four main ideas:

-

(i)

Establish environmental policies (Fogarassy et al., 2018; Homan, 2016).

-

(ii)

Improvement of financial performance and of ecological efforts by the company must go hand-in-hand (Möller & Schaltegger, 2005).

-

(iii)

Greater concern for the impact that the company’s activities may have on the environment. This must not be viewed as a mere question of social responsibility or even charity, but instead as a key factor for competitiveness. (Burritt & Saka, 2006; Correa et al., 2019; Passetti & Tenucci, 2016).

-

(iv)

Eco-Efficiency is complemented by, and supports efforts by, companies to achieve sustainable development; to satisfy current demands without sacrificing the possibility for future generations to satisfy theirs (Figge & Hahn, 2013)

4.3.2 Record environmental aspects in accounting

It is proposed that organizations record in their environmental accounting ledgers all activities that generate income, expenses, and environmental costs for the company (environmental assets and liabilities). The following (Table 5) are the activities that may be recorded (Higuera, 2015):

4.3.3 To make environmental reports

Initially, Tables 6 and 7 display the assets, passives, patrimonies, income, expenditure and costs that should appear in green environmental reports. The items refer to the environmental impacts interpreted as economic figures that are useful for decision-making.

-

(i)

Environmental balance

4.3.3.1 (EA) Environmental assets

Goods and investments to preserve and protect the environment and to reduce the environmental damage that could occur. Some of the assets are in the inventory of materials used in the production process to minimize pollution, such as the properties, installations, and equipment used for that purpose (Aznar & Estruch, 2015).

4.3.3.2 (EP1) Environmental liabilities

Liabilities that coincide in recognizing an environmental cost associated with the acquisition of assets to avoid environmental impacts (González, 2017). Contingent environmental liabilities are derived from environmental liabilities. These are defined as liabilities for future events or payments caused by current situations that damage the environment.

4.3.3.3 (EP2) Environmental patrimony

Consists of environmental goods and obligations pertaining to the organization. It constitutes environmental duties and rights in relation to the surroundings for which every organization must respond (Ellingson et al., 2015; Gómez, 2004).

-

(ii)

Environmental report (profit and loss statement)

4.3.3.4 (EI) Environmental income

Economic benefits that a company obtains thanks to its environmental management. For example, the sale of recycled waste, savings in energy and materials, and savings from the use of nonpolluting or less polluting materials (Kitchen et al., 2019).

4.3.3.5 (EE) Environmental expenses and costs

Costs that are recognized as a decrease in a company’s economic resources resulting from the cost of environmental measures adopted to mitigate their impacts on the environment (Chamorro, 2016). Environmental expenses include any cash flow aimed at avoiding, repairing, and reducing environmental damage.

4.3.3.6 (EU) Environmental utility

The benefits or profits the organization obtains in environmental aspects. It is derived from diverse aspects, such as income, assets, patrimony goods, etc. (Hens et al., 2018; Jara et al., 2017).

5 Conclusions

This research suggests that environmental performance factors require incorporating green accounting into the accounting system. In this sense, the proposal for a Green Accounting System [GAS] aims to contribute by measuring and reporting on the environmental performance of organizations in their accounting reports. This will in turn enhance traceability in the quantification of green accounting (Taleb, 2015). One advantage of the GAS proposal is that it is adaptable to any type of financial accounting system looking to reflect environmental impacts in its financial statements. The GAS implies that companies record and report data on materials, water, energy, the rational use of (toxic) raw materials, and emissions and wastes throughout the life cycle of their products from raw materials extraction to final waste disposal (Fowler, 2008; Soto & Mendoza, 2016; Van Thanh et al., 2016). Undoubtedly, the implementation of a GAS by companies could be the first step toward cleaner production.

The exploratory analysis revealed that the Colombian companies that were investigated do in fact demonstrate environmental accounting movements. However, these actions are not reflected in their accounting reports. The GAS model thus becomes a useful tool for green accounting since it enables the integration of all environmental elements into the financial context. Contrastingly, while the results show that the companies analyzed were familiar with the term green accounting, the data suggests it is not formally put into practice. Other researchers such as Wójcik (2015) and Taleb (2015) point to the importance of training employees on EA, because if they are not trained, it will be difficult to implement inside the organization.

Similarly, the data showed that the great majority of Colombian companies had developed environmental policies (86%). This concludes that these companies are aware that their economic results depend not only on economic-financial management, but are also influenced by their environmental management (Ikram et al., 2019; Opdam & Steingröver, 2018;). Unexpectedly, the organizations studied neither execute nor implement processes to build accounting structures or systems that recognize and inform their social and environmental responsibility (54%). In any case, this limitation on processes also hinders the creation of economic and accounting valuations assessing the use of scarce resources, which would make it possible to compare and contrast the well-being of a company with its environmental quality (Finsterwalder & Kuppelwieser, 2020; Pecl et al., 2017).

Focusing on more specific aspects of EA, it was found that half of the companies (50%) researched recorded accounting matters of an environmental nature as assets, liabilities, income, costs, and expenses. However, those responsible for directing the accounting at their organizations are not carrying out the accounting process as required; for example, they enter an environmental asset as a financial asset without specifying that it is environmental. This situation is not in accordance with the theory, and therefore, inadequate decisions may be made which could lead to false environmental solutions (Hernandez & Solorzano, 2017; Vasallo et al., 2017). Additionally, most of the companies surveyed recognize the importance of standardizing a green accounting model in order to recognize the environmental aspects in the accounting systems of their organizations (99%), which would constitute making larger investments in actions to repair damage caused to the environment (García-Sánchez et al., 2015).

This research has some interesting implications for both economies and businesses. In one aspect and according to empirical evidence for the context of developing economies (Peña-Vinces & Delgado-Marquez, 2013), very rarely have companies from those economies implemented proenvironmental practices by themselves. Most of the time, they react to pressure from stakeholders, customers, or the government. Therefore, to implement a Green Accounting System in Latin America, and particularly in Colombia, it is necessary to involve policymakers as their influence is needed to develop a national framework for GA. However, moving from financial accounting toward a Green Accounting System will not be an easy transition. In this regard, the government could provide tax reductions or payback incentives for companies who implement a Green Accounting System, as has been proposed here.

In contrast, and at the level of firms, a proposal that Latin American companies progressively adopt a Green Accounting System should be considered, since most still continue to work exclusively using the financial accounting system. A GAS provides advantages for companies and for the planet. Primarily, a GAS allows companies to have clarity about the amount of natural resources they use in manufacturing their outputs. This is crucial in the Latin American context, where industrial production makes intensive use of natural resources, particularly commodities (Peña-Vinces & Audretsch, 2021). Companies, therefore, would become more aware of environmental care since they use natural resources that may not be renewable. As a result, the goal would be to avoid future environmental consequences as their future could be at risk.

Ultimately, it is important to mention that green accounting must be integrated into existing systems in Latin America (Altamirano, 2020). Colombia and Mexico are in the vanguard of this process with the aim of issuing reports and demonstrating the concept of operating sustainably through information flow and transparency, as expressed by Alba and Torres (2018). However, Honduras, Panama, Nicaragua, Dominican Republic, and other countries are just beginning this process (Doria et al., 2020; Soto & Mendoza, 2016; Van Thanh et al., 2016).

In summary, the GAS proposal aims to measure and evaluate the environmental performance of all activities or processes developed by organizations to be communicated in environmental reports. This model is different from other systems because it integrates three categories: prevention, integration, and good practices. In addition, it considers the particularities of developing economies such as Colombia. For that reason, this model will be better for Latin American countries, since it includes the peculiarities of those developing economies, which are very different from developed countries. An important point of the model, unlike others, allows one to identify areas of inefficiency and environmental efficiency, helping to improve decision making in the production and financial processes. Finally, the proposal specifies and expresses the clarifications in (1) the identification and disclosure of the costs, (2) the implementation of Eco-Efficiency activities, (3) the recording of environmental aspects in the accounting, and (4) the showing of environmental financial statements.

One of the main limitations of green accounting's evolution can be seen in a series of barriers for effective implementation of environmental management, summarized as situations of administrative, political, and cultural nature. There are also limitations where Colombian accountants may become encouraged to adopt “green accounting” concepts due to lack of infrastructure and the scarce offering of environmental education for professionals.

A particular limitation of the research is associated with the availability of data, leading to a reduction in the variables considered in the construction of the GAS. Thus, future research should overcome the limitations indicated; it is important to undertake an analysis of robustness based on the comparison of these results with those of other proposals, to try to consolidate new principles and postulates that complement the GAS.

Regarding future research, it should be noted that there is an overwhelming amount of published research on environmental economics and environmental management and marketing. However, few studies have addressed the topic of green accounting. Therefore, a future line of research could be to investigate to what extent other companies in Latin America would be willing to implement GAS, as this research revealed that 100% of Colombian companies are eager to do so. However, the question arises as to whether companies in Peru, Chile, Ecuador, or other developing countries would be willing to adopt and implement it.

Finally, it would be interesting to investigate the role played by CEOs in the implementation of a GAS. Based on the above analysis, it is logical to believe that commitment by the board is essential to ensure its successful implementation, as efforts by the financial department alone may be insufficient.

Data availability

Upon request to the corresponding author.

References

Alba, M., & Torres, C. (2018). Articulación de procesos, flujos de información y conocimiento bajo criterios de infoconocimiento y sostenibilidad en el reporte corporativo. Cuadernos de Contabilidad, 19(47), 117–129. https://doi.org/10.11144/Javeriana.cc19-47.apfi

Altamirano, S. (2020). La contabilidad verde en el Ecuador. avances y desafíos para alcanzar su institucionalización. Prospectivas UTC Revista de Ciencias Administrativas y Económicas, 3(2), 186–202.

Alvarado, E., Ponguillo, K., & Carrera, F. (2016). Reflexiones sobre la contabilidad ambiental. Revista Publicando, 3(7), 156–166.

Angell, L., & Klassen, R. (1999). Integrating environmental issues into the mainstream: An agenda for research in operations management. Journal of Operations Management, 17(5), 575–598. https://doi.org/10.1016/S0272-6963(99)00006-6

Araujo, J. (1995). La contabilidad social. La contabilidad del recurso humano, el balance social y la contabilidad ambiental. Medellín. Centro Colombiano de Investigaciones Contables. Editorial Implicar.

Aronsson, T., Johansson, P., & Löfgren, K. (1997). Welfare measurement, sustainability and green national accounting: a growth theoretical approach. Edward Elgar Publishing Ltd.

Aznar, J., & Estruch, V. (2015). Valoración de activos ambientales (2nd ed.). Universitat Poletecnica de Valencia.

Banguat, U. & Iarna. (2009). El Sistema de Contabilidad Ambiental y Económica Integrada: Síntesis de hallazgos de la relación ambiente y economía en Guatemala. Documento 26, Serie técnica No. 24.

Bennett, M., & James, P. (2017). The Green bottom line: Environmental accounting for management—Current practice and future trends. Routledge.

Burritt, R. L., & Saka, C. (2006). Environmental management accounting applications and eco-efficiency: Case studies from Japan. Journal of Cleaner Production, 14(14), 1262–1275.

Cabello, J. (2016). Approaching a cleaner production as an environmental management strategy. IJMSOR, 1(1), 4–7. https://doi.org/10.17981/ijmsor.01.01.01

Cairns, R. (2009). Green accounting for black gold. The Energy Journal. https://doi.org/10.5547/ISSN0195-6574-EJ-Vol30-No4-4

Capusneanu, S. (2008). Implementation opportunities of green accounting for activity-based costing (ABC) in Romania. Theoretical and Applied Economics, 1(518), 57–62.

Carvalho, V., & Pozzetti, V. (2019). La contabilidad ambiental como una herramienta eficaz para la sostenibilidad. Derecho y Cambio Social, 56, 483–503.

Cavalletti, B., Di Fabio, C., Lagomarsino, E., & Ramassa, P. (2020). Contabilidad de ecosistemas para áreas marinas protegidas: Un marco propuesto. Economía Ecológica, 173, 106623.

Ceballos Sandoval, J., Villalobos Toro, B., Bolívar Anillo, H., Martínez Consuegra, D., García Barrios, D., Palomino Pacheco, K., González García, C., Romero Coronado, A., Pérez Olivera, H., Guillén Garcés, R. & Chamorro González, C. (2020). Residuos sólidos una alternativa de aprovechamiento para los municipios de Bolívar. Colombia: Editorial Universidad Simon Bolivar.

Chamorro, C. (2016). Estado actual de la contabilidad verde en Colombia: estudio de caso al sector minero. [Bachelor's thesis]. Universidad de la Costa. Colombia.

Chamorro, C. (2015). Investigación contable en los futuros contadores: Elemento ontológico del desarrollo de la contabilidad verde. Revista Red de Investigación Estudiantil Universidad de Zulia, 5(1–2), 164–172.

Chamorro González, C., Hoepfner Gutiérrez, L., Montaño Gallego, C., & Ríos Londoño, I. (2019). Procesos de gestión: Edificios sostenibles versus edificios tradicionales. Revista Activos, 17(2), 177–203. https://doi.org/10.15332/25005278/5737

Chávez, M. (2020). Reconocimiento de cuentas ambientales y presentación de estados financieros sustentables en el sector industrial de Tungurahua [Bachelor's tesis]. Universidad Técnica De Ambato. https://repositorio.uta.edu.ec/handle/123456789/30621

Correa, D. (2019). Retos que se presentan a la ciudad de Medellín para aplicar la contabilidad ambiental. [Bachelor's tesis]. Universidad de San Buenaventura. Medellin. Colombia.

Cortés, O. (2016). Sustainable development in synergistic relationship with proambient behavior and fair trade. IJMSOR, 1(1), 54–58. https://doi.org/10.17981/ijmsor.01.01.08

Craig, P., & Glasser, H. (1994). Transfer models for ‘green accounting’:Aan approach to environmental policy analysis for sustainable development. Assigning Economic Values to Natural Resources, 67–110.

Crissien-Borreroa, T., Cortés-Peña, O. & Herrera-Mendoza, K. (2016). Pro-environmental assessment and sustainable consumption of household public services in Barranquilla Colombia. Retrieved from: http://www.futureacademy.org.uk/files/images/upload/38_Beci2016.pdf

Deegan, C. (2013). The accountant will have a central role in saving the planet… really? A reflection on ‘green accounting and green eyeshades twenty years later.’ Critical Perspectives on Accounting, 24(6), 448–458. https://doi.org/10.1016/j.cpa.2013.04.004

Doria, D., Hernández, A., Vanegas, V., Vásquez, M., & Díaz, A. (2020). Sostenibilidad y contabilidad ambiental Análisis bibliométrico y revisión documental de la investigación científica en el periodo 2013–2017. Económicas. https://doi.org/10.17981/econcuc.41.1.2020.Org.2

Duvic-Paoli, L. (2018). The prevention principle in international environmental law (pp. 67–82). Cambridge University Press.

El Serafy, S. (1997). Green accounting and economic policy. Ecological Economics, 21(3), 217–229. https://doi.org/10.1016/S0921-8009(96)00107-3

Ellingson, M., Campbell, B. & Barrett, E. (2015). Episode 24: For future generations: Preamble & Environmental Provisions of 1972 Montana Constitution.

Evangelinos, K., Nikolaou, I., & Leal Filho, W. (2015). The effects of climate change policy on the business community: A corporate environmental accounting perspective. Corporate Social Responsibility and Environmental Management, 22(5), 257–270.

Figge, F., & Hahn, T. (2013). Value drivers of corporate eco-efficiency: Management accounting information for the efficient use of environmental resources. Management Accounting Research, 24(4), 387–400.

Finsterwalder, J., & Kuppelwieser, V. G. (2020). Equilibrating resources and challenges during crises: A framework for service ecosystem well-being. Journal of Service Management., 31(6), 1107–1129.

Fleischman, R. K., & Schuele, K. (2006). Green accounting: A primer. Journal of Accounting Education, 24(1), 35–66. https://doi.org/10.1016/j.jaccedu.2006.04.001

Fogarassy, C., Neubauer, É., Mansur, H., Tangl, A., Oláh, J., & Popp, J. (2018). The main transition management issues and the effects of environmental accounting on financial performance–with focus on cement industry. Administrative is Management Public, 31, 52–66. https://doi.org/10.24818/amp/2018.31-04

Fowler, E. (2008). Cuestiones Contables Fundamentales. Buenos Aires: La ley.

Gallhofer, S., & Haslam, J. (1997). The direction of green accounting policy: Critical reflections. Accounting, Auditing & Accountability Journal, 10(2), 148–174. https://doi.org/10.1108/09513579710166703

Galvis, M., & Guevara, A. (2019). La contabilidad ambiental en Colombia: Una revisión de las publicaciones en revistas contables nacionales en el periodo: 1982–2015. Libre Empresa, 16(2), 97–124.

García-Sánchez, I., das Neves Almeida, T., & de Barros Camara, R. (2015). A proposal for a composite index of environmental performance (CIEP) for countries. Ecological Indicators, 48, 171–188. https://doi.org/10.1016/j.ecolind.2014.08.004

Geba, N., Fernández, L., & Bifaretti, M. (2010). Marco conceptual para la especialidad contable socio-ambiental. Actualidad Contable Faces, 13(20), 49–60.

Gómez, M. (2004). Avances de la contabilidad medioambiental empresarial: Evaluación y posturas críticas. Revista Internacional Legis De Contabilidad & Auditoría, 18, 87–119.

González, C. (2015). Estado actual de la contabilidad verde en colombia. Saber Ciencia y Libertad, 10(2), 53–62. https://doi.org/10.18041/2382-3240/saber.2015v10n2.782

González, C., & Mendoza, K. (2020). Green accounting in Colombia: a case study of the mining sector. Environment, Development and Sustainability, 23(4), 6453–6465.

González, J. (2017). Contabilidad gubernamental. Pearson Education.

Gray, R., & Laughlin, R. (2012). It was 20 years ago today: Sgt Pepper, accounting, auditing & accountability journal, green accounting and the blue meanies. Accounting, Auditing & Accountability Journal, 25(2), 228–255. https://doi.org/10.1108/09513571211198755

Greenham, T. (2010). Green accounting: A conceptual framework. International Journal of Green Economics, 4(4), 333–345. https://doi.org/10.1504/IJGE.2010.037655

Haque, F., & Ntim, C. (2018). Environmental policy, sustainable development, governance mechanisms and environmental performance. Business Strategy and the Environment, 27(3), 415–435. https://doi.org/10.1002/bse.2007

Hens, L., Block, C., Cabello-Eras, J. J., Sagastume-Gutierez, A., Garcia-Lorenzo, D., Chamorro, C., & Vandecasteele, C. (2018). On the evolution of “Cleaner Production” as a concept and a practice. Journal of Cleaner Production, 172, 3323–3333.

Hernádi, B. (2012). Green accounting for corporate sustainability. Theory, Methodology, Practice, 8(2), 23.

Hernández, D. (2012). Modelo de contabilidad social que permita la medición, valoración y control de la responsabilidad social empresarial. [Master’s dissertation]. Universidad del Norte. Barranquilla.

Hernandez, M., & Solorzano, N. (2017). Vulgarización científica en cuentos ecológicos: Problemas y peligros. Revista Ciencia UNEMI, 10(23), 90–103.

Higuera, E. (2015). Valoración del costo ambiental estimado en los EEFF de la Universidad Militar Nueva Granada sede Bogotá [Bachelor's tesis]. Universidad Militar Nueva Granada. Colombia.

Homan, H. (2016). Environmental accounting roles in improving the environmental performance and financial performance of the company. South East Asia Journal of Contemporary Business, Economics and Law, 11(1), 9–15.

Ignat, G., Timofte, A., & Acostăchioaie, F. (2016). Green accounting versus sustainable development. Agronomy Series of Scientific Research/lucrari Scientific Seria Agronomies, 59(1), 245–248.

Ikram, M., Zhou, P., Shah, S., & Liu, G. (2019). Do environmental management systems help improve corporate sustainable development? Evidence from manufacturing companies in Pakistan. Journal of Cleaner Production, 226, 628–641. https://doi.org/10.1016/j.jclepro.2019.03.265

Islam, M., & Managi, S. (2019). Green growth and pro-environmental behavior: Sustainable resource management using natural capital accounting in India. Resources, Conservation and Recycling, 145, 126–138. https://doi.org/10.1016/j.resconrec.2019.02.027

Jara, A., Díaz, M., & Morales, E. (2017). La contabilidad ambiental en empresas del cantón morona, provincia de Morona Santiago. Ecuador. Revista Publicando, 4(12(2)), 213–237.

Kitchen, H., McMillan, M., Shah, A. (2019). Local income, sales, and environmental Taxes. In: Local public finance and economics (pp. 331–361). Palgrave Macmillan, Cham.

Lako, A. (2018). Conceptual framework of green accounting (pp. 60–66). Accounting.

Lee, W., Birkey, R., & Patten, D. (2017). Exposing students to environmental sustainability in accounting: An analysis of Its Impacts in a US setting. Social and Environmental Accountability Journal, 37(2), 81–96. https://doi.org/10.1080/0969160X.2016.1270225

Lehman, G. (1995). A legitimate concern for environmental accounting. Critical Perspectives on Accounting, 6(5), 393–412.

Lieder, M., & Rashid, A. (2016). Towards circular economy implementation: A comprehensive review in context of manufacturing industry. Journal of Cleaner Production, 115, 36–51. https://doi.org/10.1016/j.jclepro.2015.12.042

Malca, O., Peña-Vinces, J., & Acedo, F. J. (2019). Export promotion programmes as export performance catalysts for SMEs: Insights from an emerging economy. Small Business Economics. https://doi.org/10.1007/s11187-019-00185-2

Martínez, M., & Sánchez, A. (2019). Una mirada a la contabilidad ambiental en Colombia desde las perspectivas del desarrollo sostenible. Revista Facultad De Ciencias Económicas: Investigación y Reflexión, 27(1), 87–106.

Mason, C., & Simmons, J. (2014). Embedding corporate social responsibility in corporate governance: A stakeholder systems approach. Journal of Business Ethics, 119(1), 77–86. https://doi.org/10.1007/s10551-012-1615-9

Masud, M., Bae, S., & Kim, J. (2017). Analysis of environmental accounting and reporting practices of listed banking companies in Bangladesh. Sustainability, 9(10), 1717.

Maunders, K., & Burritt, R. (1991). Accounting and ecological crisis. Accounting, Auditing & Accountability Journal, 4(3), 12–18. https://doi.org/10.1108/09513579110003277

Medina, V., González, C., Peñaloza, L., Ramos, A., & Viloria, K. (2019). Contabilidad verde y desarrollo sostenible: tendencias y perspectivas. Tendencia en la investigación universitaria: una visión desde Latinoamérica (pp. 107–120). Fondo Editorial Universitario Servando Garcés.

Möller, A., & Schaltegger, S. (2005). The sustainability balanced scorecard as a framework for eco-efficiency analysis. Journal of Industrial EcoloGy, 9(4), 73–83.

Montagnini, F., et al. (2015). Sistemas agroforestales: funciones productivas, socioeconómicas y ambientales. Biocenosis (Costa Rica), 2(3), 5–6.

Montemayor, E., et al. (2019). Environmental accounting of closed-loop maize production scenarios: Manure as fertilizer and inclusion of catch crops. Resources, Conservation and Recycling, 146, 395–404. https://doi.org/10.1016/j.resconrec.2019.03.013

Moreno, B. (2019). La valoración de los recursos naturales en la discusión paradigmàtica en contabilidad. FACE: Revista de la Facultad de Ciencias Económicas y Empresariales, 18(2), 24–38.

Mylonakis, J., & Tahinakis, P. (2006). The use of accounting information systems in the evaluation of environmental costs: A cost–benefit analysis model proposal. International Journal of Energy Research, 30(11), 915–928. https://doi.org/10.1002/er.1194

Nakasone, G. (2015). Environmental accounting in peru: A proposal based on the sustainability reporting in the mining, oil and gas industries. Contabilidad y Negocios, 10(19), 5–26.

Nilsson, A., Bergquist, M., & Schultz, W. (2017). Spillover effects in environmental behaviors, across time and context: A review and research agenda. Environmental Education Research, 23(4), 573–589. https://doi.org/10.1080/13504622.2016.1250148

Novillo, M., Hachi, J. (2014). Metodología para contabilizar los aspectos ambientales generados por instituciones públicas y privadas en base al cumplimiento de la normativa ambiental vigente [Master's thesis, Universidad Politécnica Salesiana]. https://dspace.ups.edu.ec/bitstream/123456789/7432/1/UPS-GT000753.pdf

Ojito, V., Martínez, G., Restrepo, S., Rojas, O., & Franco, R. (2017). Environmental accounting, world research trends. Producción Limpia, 12(1), 88–96. https://doi.org/10.22507/pml.v12n1a9

Opdam, P., & Steingröver, E. (2018). How could companies engage in sustainable landscape management? An exploratory perspective. Sustainability, 10(1), 220. https://doi.org/10.3390/su10010220

Ortiz, G. (2017). La ética del contador público frente a la protección del medio ambiente [Bachelor's thesis, Universidad Militar Nueva Granada]. Retrieved from https://repository.unimilitar.edu.co/bitstream/handle/10654/15153/OrtizSuarezGerardo2017.pdf.pdf?sequence=1

Passetti, E., & Tenucci, A. (2016). Eco-efficiency measurement and the influence of organizational factors: Evidence from large Italian companies. Journal of Cleaner Production, 122, 228–239.

Pecl, G., et al. (2017). Biodiversity redistribution under climate change: Impacts on ecosystems and human well-being. Science. https://doi.org/10.1126/science.aai9214

Peña-Vinces, J., & Audretsch, D. (2021). Tertiary education and science as drivers of high-technology exporting firms growth in developing countries. The Journal of Technology Transfer., 46, 1734–1757.

Peña-Vinces, J. C., & Delgado-Márquez, B. L. (2013). Are entrepreneurial foreign activities of Peruvian SMNEs influenced by international certifications, corporate social responsibility and green management? International Entrepreneurship Management Journal., 9, 603–618. https://doi.org/10.1007/s11365-013-0265-4

Peña-Vinces, J., Sanchez-Ancochea, D., Guillen, J., & Aguado, L. F. (2019). Scientific capacity and industrial development as locomotors of international competitiveness in Latin America. Technological and Economic Development of the Economy., 25(2), 300–321. https://doi.org/10.3846/tede.2019.8073

Raouf, M. A. (2002). Theoretical framework for environmental accounting- application on the Egyptian petroleum sector. Ninth annual conference of the economic research forum, 26-28 October 2002. Retrieved Feb 20, 2022 from http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.631.8875&rep=rep1&type=pdf

Rodríguez, D. (2015). Fundamentos teóricos para la construcción de un modelo de contabilidad social. Perfil de Coyuntura Económica, 26, 115–134.

Rossi, M., Germani, M., & Zamagni, A. (2016). Review of ecodesign methods and tools. Barriers and strategies for an effective implementation in industrial companies. Journal of Cleaner Production, 129, 361–373. https://doi.org/10.1016/j.jclepro.2016.04.051

Russell, S., Milne, M. J., & Dey, C. (2017). Accounts of nature and the nature of accounts: Critical reflections on environmental accounting and propositions for ecologically informed accounting. Accounting, Auditing & Accountability JOurnal, 30(7), 1426–1458.

Saleh, M., & Jawabreh, O. (2020). Role of environmental awareness in the application of environmental accounting disclosure in tourism and hotel companies and its impact on Investor’s decisions in Amman stock exchange. International Journal of Energy Economics and Policy, 10(2), 417–426. https://doi.org/10.32479/ijeep.8608

Samaraweera, M., Sims, J. D., & y Homsey, D. M. (2021). ¿El color verde y las imágenes de la naturaleza harán que los consumidores paguen más por un producto verde? Revista de Marketing de Consumo., 38(3), 305–312. https://doi.org/10.1108/JCM-04-2020-3771

Scarpellini, S., Marín-Vinuesa, L. M., Aranda-Usón, A., & Portillo-Tarragona, P. (2020). Dynamic capabilities and environmental accounting for the circular economy in businesses. Sustainability Accounting, Management and Policy Journal. https://doi.org/10.1108/SAMPJ-04-2019-

Schaltegger, S., & Burritt, R. (2017). Contemporary environmental accounting: Issues, concepts and practice. Routledge.

El Sefary, S. (2000). La contabilidad verde y la sostenibilidad. Retrieved from: http://www.revistasice.com/CachePDF/ICE_800_15-30__2C1ABAAC7D97DE553F9D8D243BB3598C.pdf

Singh, S., Singh, A., Arora, S., Mittal, S. (2019). Revolution of green accounting: a conceptual review. In 2019 2nd International Conference on Power Energy, Environment and Intelligent Control (PEEIC). IEEE. pp. 481–485. https://doi.org/10.1109/PEEIC47157.2019.8976544

Slawinski, N., & Bansal, P. (2015). Short on time: Intertemporal tensions in business sustainability. Organization Science, 26(2), 531–549. https://doi.org/10.1287/orsc.2014.0960

Soto, E., & Mendoza, C. (2016). Contabilidad Ambiental: enfoque de publicaciones en Colombia (2009–2012). REICE: Revista Electrónica de Investigación en Ciencias Económicas, 4(7), 74–104.

Taleb, M. (2015). Fifty years of Sustainability Accounting: Does accounting for income in business sustainability really exist? International Journal of Accounting and Financial Reporting, 5(1), 36–47. https://doi.org/10.5296/ijafr.v5i1.6726

Tiwari, K., & Khan, M. (2020). Sustainability accounting and reporting in the Industry 4.0. Journal of Cleaner Production, 258, 120783. https://doi.org/10.1016/j.jclepro.2020.120783

Urraca, E., & Silva, J. (2017). Diagnóstico, evaluación y propuesta de manejo ambiental de los residuos sólidos y efluentes en una industria panificadora periodo junio-julio 2015. Revista Ciencia y Tecnología, 12(3), 25–39.

Van Thanh, N., Chamorro, C., Hens, L., & Lan, T. (2016). The widening concept of “cleaner production.” Cultura Educación y Sociedad, 7(2), 9–25.

Vassallo, P., Paoli, C., Buonocore, E., Franzese, P. P., Russo, G. F., & Povero, P. (2017). Assessing the value of natural capital in marine protected areas: A biophysical and trophodynamic environmental accounting model. Ecological Modelling, 355, 12–17. https://doi.org/10.1016/j.ecolmodel.2017.03.013

Vélez, B., Suarez, Z., Restrepo, T., Vélez, M., & Perea, M. (2007). Contabilidad Ambiental [Bachelor’s dissertation]. Universidad Antioquia.

Wójcik, D. (2015). Accounting for globalization: Evaluating the potential effectiveness of country-by-country reporting. Environment and Planning C: Government and Policy, 33(5), 1173–1189. https://doi.org/10.1177/0263774X15612338

Yang, W., & Zhao, J. (2018). Sources of China’s economic growth: A case for green accounting. Advances in Management and Applied Economics, 8(2), 33–59.

Yepes, H. (2008). Los avances de la contabilidad ambiental. Bamboo empresarial. (34). Disponible en, https://www.scribd.com/doc/36328786/Los-avances-de-la-contabilidad-ambiental

Zandi, G., & Lee, H. (2019). Factors affecting environmental management accounting and environmental performance: An empirical assessment. International Journal of Energy Economics and Policy, 9, 342–348. https://doi.org/10.32479/ijeep.8369

Zou, T., Zeng, H., Zhou, Z., & Xiao, X. (2019). A three-dimensional model featuring material flow, value flow and organization for environmental management accounting. Journal of Cleaner Production, 228, 619–633. https://doi.org/10.1016/j.jclepro.2019.04.309

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Contributions

CCG and JP-V: demarcated the research aim, made the statistical analysis with SPSS, they re-written the manuscript and wrote the first draft of the article.

Corresponding author

Ethics declarations

Conflict of interest

The authors declared that they have no conflict interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gonzalez, C.C., Peña-Vinces, J. A framework for a green accounting system-exploratory study in a developing country context, Colombia. Environ Dev Sustain 25, 9517–9541 (2023). https://doi.org/10.1007/s10668-022-02445-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02445-w