Abstract

Temporarily plugged or “suspended” wells pose environmental and economic risks due to the large volume of methane gas leaked. In the Canadian Province of Alberta, which, by far, has the largest number of petroleum wells in Canada, there are no regulations stipulating the maximum length of time a well can be left suspended. In recent years, an increasing number of wells have been put into the suspended state by owners. We show using a large data set obtained from the Alberta Energy Regulator that leak spells have increased between 1971 and 2019. For the same time period, the probability of an unresolved leak has also increased, and the amount of methane emitted per leak has substantially gone up. Lastly, we provide simple social-cost-of methane computations indicating that responsible policies can incentivize well owners towards remediation and reclamation and support efforts to fight climate change and improve upon economic expedience.

Similar content being viewed by others

1 Introduction

Methane (CH4) is a powerful greenhouse gas possessing a 100-year global warming potential roughly 36 times greater than carbon dioxide (IPCC 2014). Although methane emissions come from a variety of sectors, the energy industry is the most significant contributor. In Canada, 44% of all methane emissions come from oil and gas facilities, predominantly from upstream operations such as exploration, drilling, production and field processing (Environment and Climate Change Canada 2014). In the Canadian Province of Alberta, where the economy is strongly linked to the energy sector, 70% of methane emissions come from upstream oil and gas activities (AER n.d.). Alberta has over 450,000 registered petroleum wells, and 155,000 of them are no longer producing and waiting to either be reactivated for production or permanently plugged and the land reclaimed (Dachis et al. 2017). Currently, there are roughly 81,000 petroleum wells in Alberta classified as suspended (Petrinex Alberta Public Data database). Figure 1 provides a geographical overview.

Although a suspended well is considered a temporary state of inactivity whilst owners decide to either reactivate or permanently plug (abandon) the well and reclaim the land, there exists no stipulated limit to the length of time a well is permitted to remain suspended (AER, Directive 013). The Alberta Energy Regulator (AER), which is the provincial body responsible for oversight of the oil and gas industry, allows indefinite suspension in hope that improving economic conditions or extraction technologies will once again make it profitable to produce from the well. Research has previously indicated that even a doubling of petroleum prices may result in reactivation of only 7 to 12% of wells, suggesting that corporate decision-making is governed more by avoidance of costs than gaining of benefit (Muehlenbachs 2015, 2017). Due to a decline in petroleum prices in 2014, Alberta has experienced a rapidly growing number of suspended wells—between 2011 and 2014, an average of 446 new suspensions and 363 abandonments were performed per month; by 2018, there was an average of 622 new suspensions and 380 abandonments performed each month (AER 2019).

A pressing issue and substantial concern for policy makers is the length of time a well remains in suspended status, because the longer a well stays suspended, the more likely the owner will go out of business and leave the well ‘orphaned’. Alberta is currently experiencing a rising number of orphan wells, leaving taxpayers and other industry participants to pay for monitoring and cleanup (Orphan Well Association n.d.). The number of orphan wells in the province increased from fewer than 100 wells in 2012 to over 3200 in 2017. To combat this issue, the AER established the Orphan Well Association (OWA), who assumes responsibility for these wells. However, their resources are limited and, should they fail, the liability ultimately becomes a public one.

Whilst all petroleum wells have the potential to leak methane gas, according to the AER ST60B report (2018), inactive wells are more than twice as likely to have a reported ‘surface casing vent flow’ or ‘gas migration event’ (see Appendix A for definitions). Studies have also pointed out that permanently plugged (abandoned) wells are less likely to leak than temporarily plugged (suspended) wells, see for example Ho et al. (2016). These gas leaks pose human health risks, such as explosion or asphyxiation within confined spaces (Jackson et al. 2013), pulmonary damage (Wilkinson et al. 2009) or possible increased risk of some forms of cancer due to the presence of other volatile organic compounds that frequently accompany methane (McKenzie et al. 2012). There are also environmental risks, particularly through contribution to climate change inducing greenhouse gas emissions (IPCC 2019), which would be of particular interest to policy makers tasked with enhancing public programmes and welfare.

The point of this paper is twofold. First, we uncover trends in well leakages from abandoned and suspended wells over time and in terms of volume emitted. We use a detailed data set acquired from the AER on surface casing vent flow (SCVF) and gas migration (GM) reports, dating back to 1971, for all Alberta petroleum wells. Through statistical analyses, we then identify current well issues related to the time a leak remains unresolved and the volume emitted that may provide policy makers and the public with additional information as to how to address these problems. Identifying these issues will also inform the literature about potential future research areas that have received not enough attention to date. Second, we apply a social cost of methane (SCM) value to the volume of emissions associated with suspended well leaks in Alberta. Incorporating a SCM, accounts for some of the externalities produced and allows for a more precise estimation of the total cost of emissions. A simple simulation exercise assesses whether paying for the cost of emissions could encourage increased well plugging and reclamation by firms and, in turn, helps policy makers design more effective climate policies moving forward.

The remainder of this paper is organized as follows: in section 2, we provide a brief background of the preceding literature, as well as policy and practices employed by government and industry related to suspended wells. In section 3, we present and discuss leak spells and volume between 1971 and 2019. In section 4, we present results from the SCM simulation. Lastly, in section 5, we conclude and briefly discuss policy options for how the government may use these results to address inefficiencies.

2 Background

The gas that is leaked from oil or natural gas wells is typically comprised of 95–99% methane (AER ST60B-2018). Methane is a particularly potent greenhouse gas, with a 100-year warming potential approximately 36 times that of carbon dioxide (CO2), the primary contributor to global warmingFootnote 1 (IPCC 2014). In the Canadian Province of Alberta, the largest producer of greenhouse gases amongst all Canadian Provinces and Territories, previous estimates have indicated that about 48% of oil and gas methane emissions are from intentional venting, whilst 46% are from unintentional releases that occur during the production, processing, transmission, storage, and delivery of fossil fuels. The unintentional releases are also termed fugitive emissions and accounted for 7.8% of all greenhouse gas emissions in Canada in 2017, fourth after energy (46%), transportation (28%) and agriculture (8.4%) (Environment Canada 2019). Though the volume of fugitive emissions is relatively small compared to the energy or transportation sectors as a whole, which has resulted in them receiving little public attention, they can play an important role in Alberta’s and Canada’s climate change policies.

Reliable estimates of fugitive emissions are hard to come by as leaks are reported to Environment Canada by the emitters themselves (Bachu 2017, Environment and Climate Change Canada 2018). The Canadian Association of Petroleum Producers (CAPP), an organization of upstream Canadian oil and gas firms, states that producers in Canada are self-guided by a set of methane management principles to support research and public policy, whilst collaborating with government and finding economic opportunities to reduce methane emissions (CAPP n.d.). In 2016, in collaboration with indigenous peoples, businesses and the public, the Canadian government released the ‘Pan-Canadian Framework on Clean Growth and Climate Change’ (the federal plan to address climate change through emission reductions, amongst other things). One of the core pillars of this framework is to utilize market-based instruments applied to a broad set of emission sources, e.g. carbon pricing. The framework specifically identified methane as a problem and aims to reduce methane emissions 40–45% by 2025 (Government of Canada 2016). Accordingly, a CAPP report from 2017 (CAPP n.d.) states that the industry is committed to reducing methane emissions by 45% by 2025. Moreover, in December 2020, the Canadian Government introduced its plan ‘A Healthy Environment and a Healthy Economy’, which builds on the Pan-Canadian Framework on Clean Growth and Climate Change and re-emphasizes Canada’s commitment to reduce emission through initiatives such as carbon pricing (Environment and Climate Change Canada 2020). South of the Canadian border, the newly elected Biden Administration in the USA signed executive order ‘Protecting Public Health and The Environment and Restoring Science to Tackle the Climate Crisis’, which aims at reducing methane emissions from the oil and gas sector and, similar to the Canadian approach, also emphasizes the need for market-based approaches to price methane (The White House 2021).

In addition to the framework outlined by the Canadian government, Alberta’s provincial government had issued a ‘Climate Leadership Plan’, which echoed the federal goal to reduce methane emissions by 45% by 2025. The plan emphasized applying new standards and regulations for design, leak detection and repair. As with the federal plan, the focus appeared to be on large facilities—leaving smaller releases, such as those from individual wells, untargeted. In May 2019, the newly elected government of Alberta repealed the Climate Leadership Plan, which also means that the Province of Alberta no longer collects a carbon tax (or any other greenhouse gas taxes) from its people (Alberta 2019). These changes occurred during the preparation of this manuscript and allowed the authors to specifically address the associated challenges in the discussion section of this paper; the analysis conducted below is justified and, in part, based on the remaining federal Climate Leadership Plan. A general challenge Alberta must contend with, if it wants to reach its stated (set under the Climate Leadership Plan) or any potential future emission targets, is that actual methane emission levels are likely larger than the reported numbers. Research has previously demonstrated that reported values often grossly understate the actual level of methane emissions—for a comprehensive review see Brandt et al. (2014).

To prevent the cost of orphan well reclamation being borne by the public of Alberta, the AER has established methods of industry funding for the OWA that are outlined in AER Directive 006. First, there is an annual levy applied to all oil and gas producers; each firm pays a share of that levy equal to the estimated portion of the total province wide liability contributed by their petroleum wells. Second, the AER collects a $10,000 fee from new first-time licensees (new owners) of wells and this is transferred to the OWA. Third, the AER created the Liability Management Rating (LMR) programme. Every producer firm receives an LMR rating equal to their deemed assets divided by deemed liabilities; if a firm has a rating of less than 1.0, they are at higher risk of becoming insolvent and must pay a security deposit to the AER for each well they drill. This deposit is used to offset the cost of well cleanup in the event the firm is unable to pay for the cleanup itself. Nonetheless, there is growing evidence that pure industry funding of the OWA is unsustainable. The 2017–2018 OWA Annual Report showed that the industry levy has increased from $15 million in 2014 to $45 million in 2018 and projected to reach $60 million in 2019 or 2020. Also, in 2017 the OWA took a $235 million repayable loan from the province of Alberta and the interest on this loan will be covered by a $30 million grant from the federal government. In April of 2020, the Canadian federal government announced funding of $1 billion for the cleanup of inactive oil and gas wells in AlbertaFootnote 2. These amounts demonstrate the increasing challenge of maintaining the current industry funded OWA model, calling for the need of improved policy approaches to deal with orphan wells and mitigate their potential burden to the public.

Common policy approaches to curb greenhouse gas emissions lie in the pricing of those emissions. For example, the social cost of carbon (SCC) is a well-established tool used by governments around the world to provide a dollar value to the environmental damages caused by CO2; Environment and Climate Change Canada began using a SCC in 2010 (Wright 2017). Unlike carbon, and partly due to the absence of a market, a methane price currently does not exist. Therefore, a common approach to price methane emissions is to use its global warming potential (GWP) and convert it to the CO2 equivalent (36 times CO2), and then value its economic impact by multiplying GWP by SCC (Shindell et al. 2017; Marten and Newbold 2012). However, because the GWP only incorporates radiative forcing and ignores other impacts of gas release, this method tends to underestimate the social costs of methane. Methane has a shorter lifespan than carbon dioxide, which affects its sensitivity to discount rates relative to CO2 and further complicates establishment of a proper SCM. For example, Marten and Newbold (2012) calculate a SCM by measuring the expected loss of future global economic output due to expected rise in temperature attributed to greenhouse gases and establish a social cost of methane (SCM) that is CDN$1050/t (converted from $US) at a 3% discount rate, but this value becomes just $479/t at 5% discount rate and increases to $1425/t at 2.5% discount. Another difference is that methane lacks the fertilization capacity of carbon, leading to greater negative impact on agricultural yields (Shindell et al. 2017; Interagency Working Group on Social Cost of Greenhouse Gases, United States Government 2016). Shindell et al. (2017) attempt to incorporate the decrease in forestry and agricultural yields, as well as damages to public health, to ascertain a SCM of CDN$4665/t at 3% discount rateFootnote 3. This wide range of SCM values reflects the lack of consensus as to whether calculations of climate change costs should include only the direct impacts on climate or be expanded to include broader environmental impacts on human health and productivity.

Other approaches to evaluating the potential social costs associated with petroleum wells in Alberta include work by Dachis et al. and by Muehlenbachs. Dachis et al. (2017) estimated an CDN$8 billion expense for well cleanup by applying average plugging and reclamation costs to both active and inactive wells that are either orphaned or belong to a firm with an LMR less than 2.0. Whilst they referred to this value as a social cost under the preposition that taxpayers are ultimately liable for the cleanup if industry goes bankrupt, they do not include externalities such as the cost of health and environmental damage, thus undervaluing the true cost. Muehlenbachs (2015, 2017) uses a real options model and data on the operating decisions of 84,000 wells in Alberta to create a model which predicts the decision of well owners to either reactivate or decommission a well. Her model finds the high costs of decommissioning (plugging and abandonment) to be the main reason wells are left inactive. Further to this, she offers that the externalities that result from these inactive wells may lead to a socially suboptimal outcome. Inspired, in part, by Dachis et al. (2017) and the economic modelling work conducted by Muehlenbachs (2015, 2017), this paper seeks to improve upon the state of the knowledge of the true risk and cost to the public of having these wells remain in the suspended state.

3 Abandoned and suspended wells by the numbers

The well leakage data was obtained from a surface case venting flow/gas migration report for all companies in Alberta which was requested from the AER via their online portal on March 8, 2019, and received via email on March 12, 2019. The report includes the daily flow rate and duration of all reported SCVF and GM leaks in Alberta, along with information on well location and ownership, beginning in 1971.

In what follows, we provide insights into SCVF and GM leaks from abandoned and suspended wells in Alberta between 1971 and 2019. Specifically, we focused on the length of time a leak persisted, i.e. the amount of time passed between ‘Report Date’ and ‘Resolution Date’—we call this variable ‘leak spell’; and the emitted volume measured by the daily flow rate—we refer to this variable as ‘leak volume’. We present these results below, which provide new information to policy makers and the public.

Figure 2 uses a nonparametric polynomial regression to depict the time trend of positive leak spells that is the duration in days between the date that a leak was reported to the AER and the date it was closed. According to the AER Interim Directive 2003-01, leaks are resolved according to the following process. Leaks can be serious or non-serious. A serious leak is greater than 300m3 of flow per day, in contact with usable water or presents an urgent hazard and must be resolved within 90 days. For a non-serious leak, the well licensee must perform tests on the well annually for 5 years, measuring the flow and stabilized pressure buildup to detect possible change. If there is no change in the flow and pressure after 5 years of testing, or if the flow dies out completely, the leak is considered resolved. Figure 2 considers both types of leaks, from abandoned and suspended wells.

The horizontal axis displays the date a leak was closed. The vertical axis shows the number of days the leak lasted before it was closed. Observations are drawn from daily data during the 1971–2019 time period. For example, a single scatter point identifies the number of days a leak spell persisted at any given leak closure date. As we move along the horizontal axis from left to right, the trend line picks up ever longer periods of leak spells, resulting in an upward sloping trend over time. The average spell in our data is 1753 days (approx. 5 years). The maximum spell is 13,869 days (approx. 37 years). To control for the fact that later time periods allow for longer possible spells, we also use a constant backward-looking time period of 20 years and only show leak spells during that 20-year period (Appendix B Fig. B1), which confirms the findings presented in Fig. 2 of increasing leak spells over time.

Moreover, Fig. 3 shows for any reported leak (x-axis), whether the leak was attended to and closed or was still unresolved at the end of our sample time period (2019). To this end, we ran a nonparametric regression of a dummy variable indicating that the reported leak was never resolved (open = 1) against the reported date. The trend line in Fig. 3 has the simple interpretation of the probability of a leak remaining open over the 1971–2019 time period. The figure suggests that the probability of leaks being unresolved and open has increased sharply over time, particularly in the late 2000s. However, since leaks early on in the sample have more time to be resolved than later leaks, we have also reported on the probability for a leak being resolved using a constant time window of 5 years and 10 years after being reported. These results can be found in Appendix C (Figs. C1 and C2) and confirm the finding of Fig. 3, i.e. unresolved leaks have increased sharply over time.

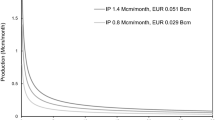

Finally, Fig. 4 shows a trend in volume of methane emissions measured as a Flow Rate (m3/day). There is an increasing trend in volume of methane emitted after the late 1980s. Specifically, there is a clear upward trend after 2010. This finding is concerning and should spawn new research exploring why we have experienced an increase in leak volume.

Combined, Figs. 2, 3, and 4 show that not only are leak spells increasing over time but also the probability of a reported leak remaining unresolved has increased, and the importance of these findings are further amplified given that the amount of methane emitted per leak has also increased over time. As society faces increasing negative uncertainties related to climate change, regulators need to be aware of these issues and solutions need to be brought forward as soon as possible. Our cost approach in the next section might provide some guidance.

4 Cost assessment preparation with and without the social cost of methane

4.1 Data preparation steps

To understand the financial motivations of owners of inactive wells, we must evaluate the costs associated with the choice to either leave a well in the suspended state or to undergo the process of abandonment and reclamation. To do so, we estimated the average costs associated with suspension and abandonment using publicly available data.

The choice to leave a well suspended will require annual surface lease payments to be paid by well owners until full reclamation has occurred and a certificate received. The annual surface lease rate was obtained by multiplying average surface lease costs per acre of $3100 (taken from Alberta Agricultural and Rural Development 2010 and supported by average land values reported by Government of Alberta 2019a) by the typical lease size of 1 ha (or 2.5 acres) as reported in Pasher et al. (2013). A suspended well must also be inspected at regular intervals; we assume these will occur in year one and every third year thereafter (a middle range of AER requirements) and have estimated the inspection cost using figures reported by the OWA. In 2017, the OWA completed 859 inspections at a total cost of $568 million for an average cost of $661 per inspection (OWA 2018).

Alternatively, the owner may choose to pay to have the well abandoned and reclaimed. Although this process often takes several years to complete, we assume that all necessary equipment is available and no complications are experienced, so abandonment occurs in year one, reclamation occurs in year 2, and the reclamation certificate is received at the end of year 5 to account for the additional 2–4 years that typically elapse before a reclamation certificate is received from the AER (OWA 2017). As such, our model features annual surface lease payments ($7750) in years 1 through 5 and well inspections to test for leaks, as required by AER Directive 020, in years 1 and 4. We have based our estimated abandonment cost on actual costs from the OWA. Between 2015 and 2017, the OWA completed 676 well abandonments at an average cost of $70,500 (see Appendix D for more information). Reclamation values are difficult to ascertain from OWA reports because the process can take place in several steps over multiple years, so we use a reclamation cost that reflects a simple average of the 7 regional values provided by the AER (Appendix D). This combined abandonment ($70,500) and reclamation ($28,321) expense (total $98,821) is in line with both total AER liability values and the $100,000 liability per well used by Dachis et al. (2017).

The choice of discount rate has a significant effect on long-term economic outcomes. We have chosen to compare outcomes using four different discount rates: 10% was chosen based on a survey of corporate hurdle rates in the oil and gas industry (The Oxford Institute for Energy Studies); 7% demonstrates a more conservative private discount rate; 3% is the median value used by the US EPA and by Environment and Climate Change Canada for the SCC (ECCC 2016); finally, we included a discount rate of zero, which may be appropriate considering that these analyses address climate change and other important inter-generational and inter-temporal issues (Goulder and Stavins 2002; Arrow et al. 1996). To assess the SCM, we need to first determine the amount of methane leaked by suspended wells. Watson and Bachu (2009) utilized a dataset from the AER (then called the Energy Resources Conservation Board) outlining SVCF/GM leak volumes and dates. We build on this approach by using our updated version of that dataset (SVCF/GM Report for all Companies in Alberta, March 2019) from the AER with a full history of recorded SCVF and GM migration data to calculate the expected methane emissions from a typical suspended well. This dataset contains a total of 34,186 reported cases of either form of gas leakage; 10,640 of which are ‘open’ or active cases and 23,546 which are considered ‘closed’. For most closed cases, the well is no longer leaking, either because it has been repaired or it was classified as non-serious and allowed to die out. However, there are nearly 3200 closed cases labelled ‘monitor as required’, suggesting that these leakages may be ongoing. A total of 11,779 of all cases belong to currently suspended wells, including 6631 closed and 5148 open. Currently abandoned wells account for 7276 of all cases, including 7142 closed and just 134 open. One of the weaknesses of the dataset is that it only provides the current status of each well, so we do not know the status of the well at the time of leak onset. As such, the open cases are more likely to present an accurate representation of leak instances by status type and reaffirms that abandoned wells are much less likely to leak than a suspended well. The relatively low ratio of open abandoned cases to closed abandoned cases also suggests that many of the closed cases may have been active or suspended when the leak began but have since been plugged and abandoned.

Many reported cases of SVCF or GM found in the dataset list either no value or zero for release volume; although these may reflect leaks that have ceased but are not yet officially reclassified as closed, no explanation is provided so we removed these records from our calculations. This leaves 3042 open cases of suspended wells with leaks. Based on a simple average, these leaks have been active for 3065 days (8.4 years) and have a daily release of 24.7m3/day. This volume is significantly higher than the data reported from 2015 of 13m3/day (Ho et al. 2016). A weighted average of release volumes [(∑ daily release x days leaking)/total days leaking], further increases the average daily release to 42.6m3 per day and demonstrates that wells leaking at higher volume rates tend to leak for a longer duration. Based on this weighted average, a typical leaking suspended well will emit 130,459 m3 of total gas volume (3065 days × 42.6m3/day). For comparison, we also performed the same calculation for the abandoned open cases; 53 wells with non-zero release rates have been releasing a simple average of 3.3m3/day for 2265 days (6.2 years). The weighted average release for open abandoned cases is 2.6m3/day for a total weighted release volume of 5834 m3 (2265 days × 2.6m3/day).

Although our analysis is focused on open cases, the leak data from closed cases does provide some potentially useful insights. Amongst all 23,546 closed cases of SCVF or GM, 10,572 (45%) of these were allowed to die out, 7495 (32%) were repaired—including categories ‘Problem Repaired’ and ‘Repaired – SVCF/GM’, 3196 (14%) are ‘monitor as required’ or ‘non-serious’, 1051 (4%) were found to have been reported as leaking in error, whilst the remainder fell under a variety of other small categories. As with the open cases, there were many release rates reported as zero or with no values which we eliminated from the calculation. A second challenge was establishing the duration of a leak for closed cases; the dataset reported numerous cases with a resolution date which precedes the onset date and no explanation for why. These negative or zero-day cases were also excluded from our calculation. This left 1902 closed suspended cases for evaluation. The proportion of suspended wells that were resolved by repair is significantly smaller when compared to the broader population of closed cases; this may suggest that leak repairs are often completed as part of the abandonment process. For the suspended closed cases allowed to die out, the weighted average release is 18.4m3/day for 1723 days (31,717m3 over 4.7 years). The repaired cases released a weighted average of 189.8 m3/day for 1092 days (207,212m3 over 3.0 years). As expected, a leak that requires repair tends to be resolved more quickly, but still releases significantly more gas. In aggregate, suspended well closed cases release an average of 37.6m3/day for 1550 days (58,323m3 over 4.2 years). Compared to suspended open cases, the daily release from suspended closed cases is comparable, but the duration is less than half.

Due to the increased uncertainty around the well status when the leak was active and ambiguity in the duration of many closed cases, we only use the data from open cases (130,459m3 total gas release) for the SCM evaluation. No information exists or is publicly available regarding leaked gas composition (Bachu 2017), but regional emissions analysis showed that gas releases are comprised of 97% methane (Johnson et al. 2017), so this paper will factor estimated gas emissions by 0.97 translating to 126,545m3 of methane per leaking well. The SCM is priced in $/tonne, so we convert the volume release to tonnes based on the molecular weight of methane at normal temperature and pressure which is a ratio of 0.668 kg/m3 (Engineering Toolbox 2003).

The final factor in determining expected methane emission from a suspended well is to estimate the percentage likelihood that any given suspended well will develop a leak. Although all wells, both active and inactive, have the potential to develop a leak, AER ST60B reports that whilst 7.2% of all drilled wells in the province report a SVCF or GM event, that figure increases to 10.9% when considering suspended wells only. Other work suggests a lower 4.6% chance of any well having a leak in 2005 (Watson and Bachu 2009) with the odds rising to 6.6% in 2013 (Bachu 2017). The work of Bachu and Watson also indicates that older wells are generally more likely to develop leaking due to outdated technology and regulations, but when comparing only newer wells those with suspended status are not more likely to leak than active wells; no direct comparison of suspended vs abandoned wells was provided. Given that these studies found a lower overall percentage of leaks, we applied a SVCF/GM percentage of 10.0% to the suspended well scenario, which is slightly lower than the value presented by the AER. However, empirical studies using regional airborne or ground-based measurement have indicated that well site methane emissions are significantly under reported (Johnson et al. 2017; Zavala-Araiza et al. 2018). An investigation of 178 well sites in the Montney play of British Columbia, Canada, where researchers physically visited and measured methane leakage at each well, found that 29% of abandoned and suspended wells currently have a SCVF or GM leak (Werring 2018), so we have also included a SCM estimate based on this 29% leak rate.

4.2 Cost estimates without the social cost of methane

Owners who do not intend to reactivate their suspended wells have two options; they may leave the well suspended indefinitely or they may undergo the abandonment and reclamation process. As alluded to earlier, abandonment and reclamation are the socially preferred option—permanently plugging the well and returning the land to its (more-or-less) original status—it also appears to be the ethically right choice once production ceases at the well head. Nonetheless, there are costs involved that largely determine owners’ decisions; what is more, just because a well has been abandoned and plugged, does not mean that it will not leak—corrosion, improper abandonment, or damage from other activities can cause an abandoned well to leak. However, we see from the relatively low number of leak occurrences and small emission volumes that well abandonment does lead to reduced environmental, human and animal health risks. Future research might determine the true percentage of leaks from abandoned wells and whether ambiguous monitoring requirements—‘conduct regular testing’—are responsible for some of the reduction.

The annual costs associated with suspension are small compared to abandonment and reclamation, at least in the short and medium run, which is precisely the time frame considered by most profit seeking firms. In contrast, we know that the decision to abandon and reclaim will eventually eliminate the monitoring and lease costs but will require a significantly greater capital investment now. Given the different cash flow timing for each option, we compare the total costs of each option and evaluate when the net present value of suspension is equal to the net present value of abandonment and reclamation. This is an important issue as suspension costs not only impact owners but, through the emitted methane gas, impact society and the environment. Hence, we specifically focus on the time frame that incentivizes owners to abandon and reclaim as opposed to leave a well suspended and leaking.

Our calculated estimate of the present value of abandonment and reclamation includes the abandonment expense ($70,500)Footnote 4 in year one, reclamation ($28,321) in year two, a well inspection ($661) in years 1 and 4, plus annual surface lease payments ($7750) in years 1 through 5. Suspension costs include annual surface lease payments, along with a well site inspection every 3 years, beginning in year 1, in perpetuity. Table 1 column (a) shows the results of this calculation, which demonstrate that there is little short-run financial incentive for a firm to undergo the abandonment and reclamation process with a well. Even using undiscounted cash flows, it would take nearly 18 years of suspension maintenance costs to equal the abandonment and reclamation costs.

The AER found that abandonment costs can be reduced by up to 40% if a programme is undertaken to abandon multiple wells in one region (AER, Area Based Closure). If a firm can reduce its abandonment cost by 40% (the year 1 abandonment expense is now $70,500 × 60% = $42,300), could this result in well owners favouring abandonment over suspension? We see from the calculated results, Table 1 column (b), that this reduction in abandonment costs fails to substantially impact the cost comparison. With no discount rate, it still takes 14 years of suspended well payments to equal the up-front abandonment and reclamation expense. This indicates that programmes designed at lowering abandonment costs may influence socially conscious firms to plug and reclaim their wells but are unlikely to affect the financial decision-making process of short-run focused organizations, unless new policy directives that place emphasis on future cost and time frames intervene. Together, what these calculations demonstrate is that, even when a firm is optimistic about abandonment costs, the myopic profit-seeking firm is likely to choose to leave an inactive well suspended.

4.3 Cost estimates with the social cost of methane

From our analysed dataset obtained from the AER, the average active SVCF/GM leak from a suspended well has been releasing 42.6m3 of methane per day for 3065 days (8.4 years) resulting in an estimated total lifetime methane emission of 130,459m3 per well. At 97% methane content and converted to tonnes using the molecular weight of methane:

Dividing this total emission by 8.4 years, the expected methane emission from a leaking suspended well is approximately 10.0 t in years 1–8 and 4.5 t in year nine. We find the cost of these emissions by applying a SCM.

Using the CDN$1050 (US$810) SCM suggested by Marten and Newbold (2012):

Using the CDN$4665 (US$3600) SCM suggested by Shindell (2017):

In the original scenario above (Table 1), we compared the cost to leave a well in the suspended state against the present value of abandonment and reclamation, using 10%, 7%, 3% and 0% discount rates. We find that, even with reduced abandonment expense and non-discounted cash flows (Table 2), suspension costs do not surpass abandonment and reclamation costs for 14 years.

If we apply an additional suspension cost equal to the SCM, based on an average SCVF/GM leak of 10.0 t for the first 8 years and 4.5 t in year 9, how will it impact the cost comparison? Table 2 row (a) shows in which year the suspension costs become equal to the non-reduced abandonment and reclamation cost based on discount rate and SCM. We see that, if a firm is forced to pay for the methane emitted from a leaking well, especially at the higher SCM, it becomes much less financially advantageous to leave that well suspended.

However, this assumes a leaking well and not all suspended wells will develop a leak. Most suspended wells are on private land, which makes assessment difficult, and there is no consistent data on the percentage of wells that leak—values from 10 to 29% have been suggested. To account for the 10% chance of suspended wells experiencing a methane leak, we also reduce the expected yearly cost attributed to methane to 10% of full value. The results, shown in Table 2 row (b), indicate that when using undiscounted cash flows, the costs of an abandoned or suspended well become equivalent in year 13.

On the other hand, if 29% of all suspended wells leak, Table 2 row (c), we get expected costs that would encourage profit-seeking firms to begin favouring abandonment and reclamation over suspension, especially at the higher SCM as the cost associated with abandoned or suspended wells become equivalent in year 7.

5 Conclusion and public policy discussion

Suspended petroleum wells are prone to gas leaks that release methane emissions into the atmosphere; these emissions contribute to climate change, impact human health and reduce agriculture yields, all of which pose an additional cost on the public that has been termed the social cost of methane (SCM). Currently, none of these costs are paid for by the owners of these wells. This is inefficient from an economic perspective, irresponsible from a policy perspective, and morally questionable behaviour from an owner’s perspective, particularly during a time when there is increasing urgency to reduce greenhouse gas emissions to combat climate change, which adversely affects people—particularly vulnerable and marginalised people.

Using data obtained from the Alberta Energy Regulator, we show that between 1971 and 2019 leak spells (the amount of time between a leak is first reported to the time a leak is reported as closed) have increased. We also show that the probability of a reported leak being unresolved has increased. Moreover, during the same time period, we find that the amount of methane emitted per leak has increased substantially. Lastly, the results from a SCM simulation revealed that when owners are forced to include the SCM in their decision to either leave a well in a suspended status or to undergo abandonment and reclamation, suspension becomes less desirable, especially in the medium-run. Likely, our estimates still understate the true SCM, as these costs do not account for all human health-related costs, the impacts on indigenous culture, and many poorly understood environmental and ecosystem impacts from air pollution.

Given the increase in wells drilled in Alberta over the years, and the recent uptick in orphan wells, there exists increased urgency in understanding the environmental and economic implications to the public. These findings are particularly relevant as it becomes more urgent to reach vital climate goals, such as those outlined by the federal Government of Canada. The Alberta government states that ‘Cutting methane emissions is a cost-effective way to reduce greenhouse gas emissions’ (Alberta n.d.); however, fugitive emissions are currently not subjected to any levy and recently updated AER Directives (such as 060 and 017) continue to exclude reporting requirements for methane release from SCVF or GM events (AER Bulletin 2018–37). Our analysis suggests that current policies disincentivize the remediation of abandoned wells, as it is significantly cheaper to leave wells in a suspended status. Without including the SCM, it makes far more monetary sense for a firm to pay the ongoing surface lease costs, which are far less than the immediate capital costs of abandonment and reclamation. A similar conclusion is also drawn by Muehlenbach (2015, 2017) and evident by the rising number of suspended wells relative to abandoned wells occurring in Alberta since 2014. Given the higher likelihood of leakage from suspended wells compared to reclaimed ones, policy makers should rethink existing policies that address these issues from a public health and climate policy perspective. Changing the status quo of owners who currently have little incentives to pay for abandonment and reclamation would likely reduce methane emissions and improve air and environmental quality, although appropriate policy instruments will be sensitive to the assumed percentage of suspended well leaks and selection of the discount rate.

Both a conservative SCM, adopted by the US EPA, and a higher SCM that attempts to incorporate the indirect effects of methane, have been suggested in the literature. The dataset obtained from the AER shows that open cases of suspended wells having gas leakage emit an average of 42.6m3/day for 8.4 years, which yields 84.5 t of methane for a typical leaking well. There are currently about 81,000 suspended wells in the Province of Alberta, which may or may not leak methane gas into the atmosphere. So far, these emissions have received little attention. If the government of Alberta is serious about addressing climate change, then the emissions from suspended wells deserve more attention and should be included in public decision-making. For example, reported leakage equalled 83 million m3 of natural gas in 2017, translating to 53,781 t of methane emitted to the atmosphere (roughly 3% of the oil and gas contributions to methane emissions in Canada), producing about $56–250 million in unaccounted social cost.

To reduce methane emissions, tighter regulations and increased monitoring, along with enforcement of repair timelines, would help to reduce gas leak volumes. However, the most effective solution may be to implement policy aimed at reducing the number of suspended wells, thus mitigating the future burden of clean up and helping the province achieve its 45% methane reduction goal.

Policy implications involve holding well owners accountable for the externalities they produce. Moreover, given the associated variability of the social cost of methane and the urgency to address climate change, policy makers may consider erring on the side of caution and use a higher SCM, such as that suggested by Shindell (2017)—this will also offset several decades of unaccounted externality, which were (and still are) paid by the public. Lastly, despite the analysis conducted in this article, policy makers may want to increase the cost associated with suspended wells just beyond the cost of abandonment and reclamation, thus providing additional incentives for short-sighted well owners to paid for reclamation of the land. The urgency surrounding the negative implications of climate change leave little time to significantly reduce greenhouse gas emissions, including those produced by suspended petroleum wells.

Data availability

The data is available upon request from the Alberta Energy Regulator.

Notes

Other important greenhouse gases include carbon dioxide (CO2), nitrous oxide (NO2), perfluorocarbons (PFCs), hydrofluorocarbons (HFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3).

This amount was part of a total $1.7 billion funding announcement that also included a $200 million loan for the OWA and $500 million in funding for orphan well cleanup in the provinces of Saskatchewan and British Columbia (https://www.canada.ca/en/department-finance/news/2020/04/canadas-covid-19-economic-response-plan-new-support-to-protect-canadian-jobs.html#Orphan_and_inactive_oil).

Both the Marten and Newbold (US$810) and Shindell (US$3600) papers report their respective SCM values in $US. To minimize any confusion we have converted these figures to Canadian dollars using the 2018 annual US/CDN exchange rate reported by the Bank of Canada of 1.2957 at https://www.bankofcanada.ca/rates/exchange/annual-average-exchange-rates/.

Abandonment and well inspection costs are based on OWA data, reclamation costs on AER liability tables, and lease costs on Government of Alberta land value data. A more detailed explanation on the calculation of these estimates can be found in the ‘Data Preparation Steps’ section.

References

Alberta (n.d.) Reducing methane emissions. Accessed Mar 26, 2019 from: https://www.alberta.ca/climate-methane-emissions.aspx

Alberta Agricultural and Rural Development (2010) “Compensation for surface leases,” [as cited in Muehlenbachs (2017): 80,000 Inactive Oil Wells: A Blessing or a Curse?]. The School of Public Policy Publications, Vol 10, Iss 3, Pp 1–16 (2017);(3):1

Alberta Energy Regulator (2003) Interim Directive ID 2003-01: [Retrieved Mar 27, 2019]. Available from: https://www.aer.ca/regulating-development/rules-and-directives/interim-directives/id-2003-01

Alberta Energy Regulator (2015) Directive 011: licensee liability rating (LLR) program: updated industry parameters and liability costs. [Cited 2019 Mar 1]. Available from: https://www.aer.ca/documents/directives/Directive011_March2015.pdf

Alberta Energy Regulator (2016) Directive 006: licensee liability rating (LLR) program and licence transfer process. [Cited 2019 Mar 1]. Available from: https://www.aer.ca/documents/directives/Directive006.pdf

Alberta Energy Regulator (2018a) Bulletin 2018-37: requirements aimed at reducing methane emissions finalized. [Cited 2019 Mar 1]. Available from: https://www.aer.ca/regulating-development/rules-and-directives/bulletins/bulletin-2018-37.html

Alberta Energy Regulator (2018b) Directive 013: suspension requirements for wells. [Cited 2019 Mar 1]. Available from: https://www.aer.ca/documents/directives/Directive013.pdf

Alberta Energy Regulator (2018c) Directive 020: well abandonment. [Cited 2019 Mar 1]. Available from: https://www.aer.ca/documents/directives/Directive020.pdf

Alberta Energy Regulator (2019) ST37: list of wells in Alberta monthly update – surface hole shapefile [retrieved mar 6, 2019]. From: https://www.aer.ca/providing-information/data-and-reports/statistical-reports/st37

Alberta Energy Regulator (n.d.) Area-Based Closure. [cited 2019 Mar 5]. Available from: https://www.aer.ca/regulating-development/project-closure/liability-management-programs-and-processes/area-based-closure

Alberta Energy Regulator (n.d.) Methane reduction. Available at: https://www.aer.ca/protecting-what-matters/protecting-the-environment/methane-reduction

Alberta Energy Regulator. Reclamation (n.d.) [cited 2019 Mar 3]. Available from: https://www.aer.ca/regulating-development/project-closure/reclamation

Arrow KJ, Cropper ML, Eads GC, Hahn RW, Lave LB, Noll RG, Portney PR, Russell M, Schmalensee R, Smith VK, Stavins RN (1996) Is there a role for benefit-cost analysis in environmental, health, and safety regulation? Science 272(5259):221–222

Bachu S (2017) Analysis of gas leakage occurrence along wells in Alberta, Canada, from a GHG perspective – gas migration outside well casing. Int J Greenhouse Gas Control, ISSN: 1750-5836 61:146–154. https://doi.org/10.1016/j.ijggc.2017.04.003

Bank of Canada (n.d.) Annual Exchange Rates. [cited Mar 29, 2019]. Available from: https://www.bankofcanada.ca/rates/exchange/annual-average-exchange-rates/

Brandt AR, Heath GA, Kort EA, O’Sullivan F, Pétron G, Jordaan SM, Tans P, Wilcox J, Gopstein AM, Arent D, Wofsy S (2014) Methane leaks from north American natural gas systems. Science 343(6172):733–735

Canadian Association of Petroleum Producers (2017) Managing methane emissions for oil and natural gas development. Publication #: 2017–0002. [Cited Mar 26, 2019]. Available from: https://www.capp.ca/publications-and-statistics/publications/307120

Canadian Association of Petroleum Producers (n.d.) Methane emissions. [cited Mar 26, 2019]. Available from: https://www.capp.ca/responsible-development/air-and-climate/methane-emissions

Caplin A, Leahy J (2004) The social discount rate. New York University Available from: http://www.econ.nyu.edu/user/caplina/sdr.pdf. Accessed Mar 18, 2019

Dachis, B., Shaffer, B., & Thivierge, V. (2017). All’s well that ends well: addressing end-of-life liabilities for oil and gas wells. C.D. Howe Institute Commentary, (492), COV. Retrieved from https://search.proquest.com/docview/1948408336

Engineering ToolBox (2003) Gases - densities. Available at: https://www.engineeringtoolbox.com/gas-density-d_158.html. Accessed Mar 28, 2019

Environment and Climate Change Canada (2014) Canada’s methane regulations for the upstream oil and gas sector. Available from: https://www.canada.ca/en/environment-climate-change/services/canadian-environmental-protection-act-registry/proposed-methane-regulations-additional-information.html. Accessed Jan 6, 2020

Environment and Climate Change Canada (2016) Technical update to environment and climate change Canada’s social cost of greenhouse gas estimates. [Cited Mar 27, 2019]. Available from: http://ec.gc.ca/cc/default.asp?lang=En&n=BE705779-1

Environment and Climate Change Canada (2018) National Inventory 1990–2016: greenhouse gas sources and sinks in Canada. [Cited Mar 21, 2019]. Available from: https://unfccc.int/documents/65715

Environment and Climate Change Canada (2020) A healthy environment and a healthy economy – Canada’s strengthened climate plan to create jobs and support people, communities and the plant. [Cited February 01, 2021]. Available from: https://www.canada.ca/content/dam/eccc/documents/pdf/climate-change/climate-plan/healthy_environment_healthy_economy_plan.pdf

Environment Canada (2019) Greenhouse gas sources and sinks: executive summary 2019. https://www.canada.ca/en/environment-climate-change/services/climate-change/greenhouse-gas-emissions/sources-sinks-executive-summary-2019.html#toc3. Accessed July 10, 2019

Environmental Defense Fund (2015) Economic analysis of methane emission reduction opportunities in the Canadian oil and natural gas industries. Pembina Institute. [cited Mar 18, 2019]. Available from: https://www.pembina.org/reports/edf-icf-methane-opportunities.pdf

Gorski J, Kenyon D (2018) Policy briefing: achieving methane reductions through carbon pricing in Alberta. Pembina Institute [Cited Mar 25, 2019]. Available from: https://www.pembina.org/reports/achieving-methane-reductions-through-carbon-pricing.pdf

Goulder LH, Stavins RN (2002) Discounting: an eye on the future. Nature 419(6908):673–674

Government of Alberta (2019a) Agricultural real estate transfers: 1999–2018. [Cited Mar 22, 2019]. Available from: https://open.alberta.ca/publications/agricultural-real-estate-transfers-1999-2018

Government of Alberta (2019b) Carbon tax repeal. https://www.alberta.ca/carbon-tax-repeal.aspx. Accessed July 12, 2019

Government of Canada (2016) Pan-Canadian framework on clean growth and climate change. Available from: https://www.canada.ca/en/services/environment/weather/climatechange/pan-canadian-framework/climate-change-plan.html. Accessed Mar 20, 2019

Grantham Research Institute on Climate Change and the Environment (2018) What are social discount rates? [cited Mar 21, 2019]. Available from: http://www.lse.ac.uk/GranthamInstitute/faqs/what-are-social-discount-rates/

Ho J, Krupnick AJ, McLaughlin K, Munnings C, Jhih-Shyang S (2016) Plugging the gaps in inactive well policy. Resources for the Future. Available from: http://www.rff.org/files/document/file/RFF-Rpt-PluggingInactiveWells.pdf

Interagency Working Group on Social Cost of Greenhouse Gases, United States Government (2016) Addendum to Technical Support Document on Social Cost of Carbon for Regulatory Impact Analysis under Executive Order 12866: Application of the Methodology to Estimate the Social Cost of Methane and the Social Cost of Nitrous Oxide. [cited Mar 18, 2019] Available from: https://www.epa.gov/sites/production/files/2016-12/documents/addendum_to_sc-ghg_tsd_august_2016.pdf

IPCC, (2014) Climate change 2014: synthesis report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, R.K. Pachauri and L.A. Meyer (eds.)]. IPCC, Geneva, Switzerland, 151 pp

IPCC (2019) Summary for policymakers. In: Climate Change and Land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems [P.R. Shukla, J. Skea, E. Calvo Buendia, V. Masson-Delmotte, H.- O. Pörtner, D. C. Roberts, P. Zhai, R. Slade, S. Connors, R. van Diemen, M. Ferrat, E. Haughey, S. Luz, S. Neogi, M. Pathak, J. Petzold, J. Portugal Pereira, P. Vyas, E. Huntley, K. Kissick, M. Belkacemi, J. Malley, (eds.)]. In press

Jackson RE, Gorody AW, Mayer B, Roy JW, Ryan MC, Van Stempvoort DR (2013) Groundwater protection and unconventional gas extraction: the critical need for field-based hydrogeological research. Ground Water 51(4):488–510. https://doi.org/10.1111/gwat.12074

Johnson M, Tyner D, Conley S, Schwietzke S, Zavala-Araiza D (2017) Comparisons of airborne measurements and inventory estimates of methane emissions in the Alberta upstream oil and gas sector. Environ Sci Technol 51(21):13008–13017. https://doi.org/10.1021/acs.est.7b03525

Marten AL, Newbold SC (2012) Estimating the social cost of non-CO2 GHG emissions: methane and nitrous oxide. Energy Policy 957

McKenzie LM, Witter RZ, Newman LS, Adgate JL (2012) Human health risk assessment of air emissions from development of unconventional natural gas resources. Sci Total Environ 2012:79

Muehlenbachs L (2015) A dynamic model of Cleanup: estimating sunk costs in oil and gas production. Int Econ Rev 56(1):155

Muehlenbachs L (2017) 80,000 inactive oil wells: a blessing or a curse? Schl Public Policy Publ 10(3):1–16

Orphan Well Association (2016) 2015/2016 Annual Report. [cited 2019 Mar 3]. Available from: http://www.orphanwell.ca/wp-content/uploads/2018/01/OWA-2015-16-Ann-Rpt-Final.pdf

Orphan Well Association (2017) 2016/2017 Annual Report. [cited 2019 Mar 3]. Available from: http://www.orphanwell.ca/wp-content/uploads/2018/01/OWA-2016-17-Ann-Rpt-Final.pdf

Orphan Well Association (2018) 2017 Annual Report. [cited 2018 Nov 5]. Available from: http://www.orphanwell.ca/OWA%201017-18%20Ann%20Rpt%20Final.pdf

Orphan Well Association (n.d.) FAQ General: Who Funds the OWA’s Activities? [cited 2020 Jan 3]. Available from: http://www.orphanwell.ca/faq/

Pasher J, Seed E, Duffe J (2013) Development of boreal ecosystem anthropogenic disturbance layers for Canada based on 2008 to 2010 Landsat imagery. Can J Remote Sens 39(1):42–58. https://doi.org/10.5589/m13-007

Petrinex Alberta Public Data (2019) Well license report. Published daily. [cited 2019 Mar 5]. Available from: https://www.petrinex.ca/PD/Pages/APD.aspx

Petroleum History Society (2001) Alberta’s first natural gas discovery. [cited Mar 25, 2019] Available from: http://www.petroleumhistory.ca/history/firstgas.html

Shindell DT, Fuglestvedt JS, Collins WJ (2017) The social cost of methane: theory and applications. Faraday Discuss 200:429–451. https://doi.org/10.1039/c7fd00009j

The Oxford Institute for Energy Studies (2019) Energy transition, uncertainty, and the implications of change in the risk preferences of fossil fuels investors. [cited Mar 29, 2019]. Available at: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/01/Energy-Transition-Uncertainty-and-the-Implications-of-Change-in-the-Risk-Preferences-of-Fossil-Fuel-Investors-Insight-45.pdf

The White House (2021) Executive order on protecting public health and the environment and restoring science to tackle the climate crisis. [cited Feb 01, 2021]. Available at: https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/20/executive-order-protecting-public-health-and-environment-and-restoring-science-to-tackle-climate-crisis/

Watson TL, Bachu S (2009, March 1) Evaluation of the potential for gas and CO2 leakage along wellbores. Soc Petrol Eng. https://doi.org/10.2118/106817-PA

Wilkinson P, Smith KR, Ridley I et al (2009, 2009) Public health benefits of strategies to reduce greenhouse-gas emissions: household energy. Lancet (British edition) (9705):1917

World Meteorological Organization (n.d.) Greenhouse gases. [cited Mar 25, 2019]. Accessed from: https://public.wmo.int/en/our-mandate/focus-areas/environment/greenhouse%20gases

Wright DV (2017) Carbonated fodder: the social cost of carbon in Canadian and U.S. regulatory decision-making. Georgetown Environ Law Rev (3):513

Zavala-Araiza D, Herndon S, Roscioli J, Yacovitch T, Johnson M et al (2018) Methane emissions from oil and gas production sites in Alberta, Canada. Elem Sci Anth 6(1):27. https://doi.org/10.1525/elementa.284

Werring J 2018. Fugitives in our midst: Investigating fugitive emissions from abandoned, suspended and active oil and gas wells in the Montney Basin in northeastern British Columbia. David Suzuki Foundation. Available at: https://davidsuzuki.org/science-learning-centre-article/fugitives-midst-investigatingfugitive-emissions-abandoned-suspended-active-oil-gas-wells-montney-basin-northeastern-british-columbia/

Author information

Authors and Affiliations

Contributions

DS contributes to the idea, analysis and writing of this paper, MK and SM contributed to the analysis and writing of this manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

ESM 1

(DOCX 829 kb)

Rights and permissions

About this article

Cite this article

Schiffner, D., Kecinski, M. & Mohapatra, S. An updated look at petroleum well leaks, ineffective policies and the social cost of methane in Canada’s largest oil-producing province. Climatic Change 164, 60 (2021). https://doi.org/10.1007/s10584-021-03044-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10584-021-03044-w