Abstract

Poland has been estimated to possess large volumes of technically recoverable shale gas resources, which has raised national hopes for increasing energy security and building export capacity. In this paper, we aim to examine political claims and hopes that Poland could achieve natural gas self-sufficiency and even become a gas exporter by harnessing domestic shale potential. We do so by relying on well-by-well production experience from the Barnett Shale in the USA to explore what scope of shale gas extraction, in terms of the number of wells, would likely be required to achieve such national expectations. With average well productivity equal to the Barnett Shale, at least 420 wells per year would be necessary to meet the domestic demand of 20 Bcm in 2030. Adding Poland’s potential export capacity of five Bcm of gas per year would necessitate at least 540 wells per year. Such a significant amount of drilling and hydraulic fracturing would require reconsideration and verification of national energy security plans and expectations surrounding shale gas production. A more informed public debate on technical aspects of extraction would be required, as extensive fracking operations could potentially have implications in terms of environmental risks and local land-use conflicts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During the last two decades, the widespread use of horizontal drilling and hydraulic fracturing (“fracking”) caused a surge of gas and oil production from shale deposits in the USA. Shale deposits are typically formed in depositional environments where fine-grained particles with mostly clay-sized materials fall out of suspension and become rocks (Jackson, 2011). Significant amounts of organic material can become embedded in shales and allow significant generation of hydrocarbons. Low matrix permeability (typically ranging from nD to μD) is the challenge that necessitates fracturing technologies that can help increase permeability to create gas flows for commercial exploitation (Guo et al., 2016). Any technically and economically viable production of gas from shale rocks requires adequate geological assessments, access to technology and investments, evaluation of environmental impacts, as well as supporting political incentives and legal frameworks, and public acceptance. These and other factors for successfully unlocking shale gas remain uncertain or deficient in several countries that wish to develop this energy source in the future (Andreasson, 2018; Godzimirski, 2016; Hu & Xu, 2013; Mistré et al., 2018; Soeder, 2018). Estimates of resource recoverability alone do not guarantee a successful path toward commercial production and improved energy security.

Since 2009, a range of optimistic yet highly uncertain geological appraisals indicated a significant abundance of shale gas resources around the world, triggering interest from other countries to tap this unconventional source of fossil fuels (McGlade et al., 2013; UKERC, 2012). Due to lack of sufficient amount of test wells and credible, up-to-date geological data, the assessments often speculated the volumetric potential by using productive American shale plays as analogues for estimating recoverable resource potential outside the USA (Kama & Kuchler, 2019; Kuchler, 2017; McGlade et al., 2013). Following several such estimates (e.g., EIA/ARI, 2011, 2013), Poland was highlighted as having one of the largest (technically) recoverable shale gas resource potentials among member-states of the European Union (EU) and was quickly deemed to become the first EU country where a shale gas “revolution” could take place outside the USA (Kuhn & Umbach, 2011). Although highly uncertain, the significant volume of unconventional gas in the amount of 5300 billion cubic meters (Bcm), estimated by Advanced Resources International (ARI) in the report for the US Energy Information Administration (EIA), spurred widespread public enthusiasm for future shale gas production in Poland (EIA/ARI, 2011). The optimistic estimates attracted large international companies with financial and technical means to extract the resource (e.g., ExxonMobil, Shell, and ConocoPhillips), while national oil and gas producers (e.g., PKN Orlen, Lotos) became increasingly engaged in prospecting and exploration activities. As of July 2012, Poland led the way toward the first European gas production from shales, with 111 concessions for prospecting and exploration of unconventional gas resources (MOŚ, 2016).

The prospect of unconventional gas abundance within the Polish territory resonated strongly with the country that has long struggled with energy insecurity resulting from persistent dependence on substantial gas imports from Russia (Johnson & Boersma, 2013; Kuchler & Höök, 2020). Consequently, Poland’s uncertain but optimistic prospects for commercial production of unconventional gas from shales were quickly framed by the Polish public as a “great chance” for the country to achieve gas independence, increase national energy security, improve its geopolitical position in the region and even spur economic development (Jaspal et al., 2014; Lis & Stankiewicz, 2016). Energy security became a predominant dimension of the public debate through which policy-makers, industry representatives and energy experts alike expressed their high hopes for reducing substantial dependence on Russian gas imports and making Poland entirely self-sufficient in gas supply. In 2011, former Polish Prime Minister Donald Tusk declared that, with moderate optimism, the country would achieve its gas independence in 2035 (Gazeta Prawna, 2011). Apart from the energy security dimension, some policy-makers even argued that the Polish home-grown shale gas could be exported via the LNG terminal in Świnoujście. In a TV interview given in 2010, former Minister of Foreign Affairs Radosław Sikorski famously alluded to Poland as a “second Norway” in terms of becoming a major natural gas exporter for the European market (TVN24, 2010). The political hopes formed around shale gas were also inscribed in various national strategy documents in which shale production was most often viewed as a chance for improving energy security (Kuchler & Höök, 2020).

Yet, these bold but unsubstantiated political claims about Poland achieving gas self-sufficiency and even becoming a gas exporter have never been verified in terms of estimating the scale of production operations necessary for carrying out such assumptions. There were bold visions, but there were no concrete plans and evaluations as to how such visions could be attained concerning the scope of production. To date, no commercial production of gas from shales has been established yet. Both international and national companies engaged in prospecting and exploration between 2010 and 2016 left Poland or abandoned their shale-related activities.

Aim of the Study

Amid public expectations and political claims of Poland achieving gas self-sufficiency or becoming a major gas exporter, there is no study projecting extraction rates and exploring what number of wells would be needed to obtain necessary volumes to secure gas independence and export capacity. One recent study uses hypothetical exploration rates of 37–294 well pads every five years to analyze potential environmental impacts in Pomerania in northern Poland—a region often seen as the most potent for exploitation of shale gas resource (Baranzelli et al., 2015). In another paper, the authors only assumed annual production levels of 5, 10, and 50 billion cubic meters (Bcm) to project potential impacts of Poland’s unconventional gas on the regional distribution of natural gas supplies (Osička et al., 2016). Due to preoccupation with technical recoverability in geological assessments of the potential for shale gas resources, there have only been some attempts to estimate the economic recoverability and profitability of Polish shales (e.g., CASE, 2012; Siemek et al., 2013).

This paper aims to examine political claims that Poland could achieve gas self-sufficiency and even become a major gas exporter by developing commercial production of domestic shale gas resources. Following a range of resource estimates that employ American shale plays as analogues (EIA/ARI, 2011, 2013; PGI, 2012), this paper relies on extensive production experience from the prolific shale gas region in the USA—the Barnett Shale in Texas (Fry, 2013; Jarvie et al., 2007)—to illustrate a possible number of required drilled wells to substantiate Polish shale gas expectations.

The main objective is to fill the knowledge gap by exploring what production capacity could be required to meet Poland’s ambitions for securing gas self-sufficiency and export capability. For explorative scenario building purposes, we optimistically assume that the Polish gas production from shales kicked off in 2016, five years after the EIA/ARI (2011) report estimating 5300 Bcm. More specifically, we focus on assessing the scope of production in terms of the number of wells for three scenarios: (1) Low Scenario—gas self-sufficiency as of 2016, meeting the demand of 16 Bcm; (2) Base Scenario—gas self-sufficiency in 2030, meeting the projected demand of 20 Bcm according to the national strategy “Energy Policy of Poland until 2030” (MG 2009); and (3) High Scenario—gas self-sufficiency in 2030 plus 5 Bcm of gas for export (via the LNG terminal in Świnoujście readjusted for exports).

We assume simplistically that production profiles of average shale wells in Poland are like the patterns seen for wells in the Barnett Shale. For our explorative outlooks and desire to rely on some observed data rather than speculations, this assumption is sensible. However, identifying the most likely future outcome or accurate full regard of all geological and socioeconomic differences between the Barnett Shale and the Polish shale formations is beyond the scope of this study.

Furthermore, we discuss potential implications of projected extensive drilling and hydraulic fracturing operations required to secure significant volumes of gas in each scenario, including (1) the necessity to critically reconsider and verify national energy security objectives based on shale gas self-sufficiency, (2) a need for a comprehensive and unbiased national debate that would include the scope and technical aspects of unconventional gas extraction, and (3) the possible emergence of local land-use conflicts and environmental risks. Finally, we conclude our findings by calling for similar studies on the extent of drilling and fracturing in other countries that seek to develop domestic shale gas production, such as the UK that has recently rebooted exploration of unconventional gas resources from onshore shales.

Methodology and Data Sources

Shale exploitation for oil and gas has been around for a sufficiently long time in the USA to provide a relatively abundant number of producing wells for estimating characteristic production behaviour. Such studies often rely on decline curve analysis, i.e., methodology focused on fitting mathematical functions to observed production rates of a single well or group of wells to explore future performance by trend extrapolation (Höök, 2014). Earlier works, such as Hotard and Ristroph (1984) or Bezdek and Wendling (2002), also highlight how all past effects of economics, policies, technology, etc., are implicitly included in historical production series. Extrapolating historical trends could be reasonable for looking into the future under assumptions of no dramatic deviations. Even if significant changes of large magnitude were expected for some reason, it would still be valuable to have historical experience as a scale for sensible comparison (Hirsh & Jones, 2014).

In this study, we relied on well-by-well production experience from the USA to explore possible future scenarios for drilling and production in Poland. Several recent studies have assessed typical decline rates, lifetimes, and other parameters for individual gas and oil wells in US shale regions (Duong, 2011; Guo et al., 2016, 2017; Middleton et al., 2017; Valko, 2009; Wachtmeister et al., 2017). We used the Barnett region as a base for our analogy since it is one of the oldest shale production regions, with longer time series available.

For modelling individual production of a shale gas well, we used the hyperbolic function:

where IP is initial production, D and b decline curvature parameters, and t is time in months. We derived three supply scenarios from variable individual well productivity by using three different IP estimates as described in Table 1. Decline curvature parameters D and b are constant in all scenarios and are based on the median of Barnett wells as derived by Guo et al. (2017). Well lifetime was set to 30 years in all cases. EUR (estimated ultimate recovery) is, hence, cumulative production at year 30. The resulting hyperbolic well production profiles are presented in Figure 1.

The IP of 1.4 Mcm/month was equal to the mean of all wells in Barnett as of 2016, derived from the 20,000 well samples provided by Middleton et al. (2017). IP 0.8 and 2.0 were used as representative low- and high-productivity wells and can be compared to the mean ± one standard deviation of 1.4 ± 1 or, to the median of 1.1 and the first and third quantiles of Q1 = 0.6 and Q3 = 1.8 of the same 20 000 well IP sample.

Total aggregate production was calculated by simple multiplication of the individual well production profile and the number of drilled wells each month. Figure 2 illustrates this underlying bottom-up, well-by-well principle. In the Results section, only the resulting total aggregate production is shown.

To explore potential shale gas futures in Poland, we used three demand-side scenarios based on gas demand (16 Bcm) in 2016 and projected demand for 2030 (20 Bcm) (according to PEP 2030), as well as a high case scenario with self-sufficiency and export capacity combined (25 Bcm). We then derived stylized shale production scenarios based on three drilling rates (25, 35 and 45 drilled wells per month) and three individual well productivities (0.8, 1.4 and 2.0 Mcm/month) to explore what volume is required to match demand with domestic shale supply. The drilling scenarios were stylized to show the impact of the sensitivities. They provide production levels in the range of the assumed different future consumption levels rather than exactly matching the demand levels. The drilling campaign starts from zero, grows linearly to a certain level and stops entirely in a specific year. In this sense, the scenarios were stylized and explorative rather than predictive. The stylized shale production scenarios were designed to be symmetrical so that sensitivity to driving parameters (drilling rates and well productivity) is more clearly illustrated.

Unconventional Natural Gas in Poland: Geology and Prospecting

Following a range of promising yet highly uncertain estimates of shale gas resources in Europe (McGlade et al., 2013; UKERC, 2012), Poland was deemed by many to become the first EU country where commercial shale gas production would take place (Table 2). The highest volumetric appraisal of 5300 Bcm (EIA/ARI, 2011) was essential in triggering the Polish enthusiasm and expectations for domestic shale gas production. A year later, the Polish Geological Institute toned down national hopes for unconventional gas by estimating the recoverable shale gas resources to be in the range between 346 and 768 Bcm, with a maximum potential of 1922 Bcm (PGI, 2012).

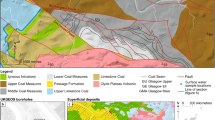

The Ordovician–Silurian claystone–mudstone rock formations hypothesized as having the potential in terms of technically recoverable resources (TRR) of shale gas stretch through the Polish territory from the northwestern part of the Baltic Basin to Podlasie and Lublin Basins in central-eastern Poland (PGI, 2012; Kiersnowski & Dyrka, 2013; Poprawa, 2010). Geologists and industry experts have long speculated about the potential existence of unconventional gas resources in the Baltic–Lublin–Podlasie, based on historical and limited geological data (e.g., ARI, 2009; Poprawa & Kiersnowski, 2008). Exploratory test drillings performed in the 1950s and 1960s found different levels of organic content with average total organic content (TOC) of 3–12% and the highest TOC occurring in Upper Ordovician shales in central-western parts of the Baltic Basin (PGI, 2012). Yet, the Baltic–Lublin–Podlasie Basin remains poorly understood with regard to productive area, gas quality and flow potential. Kiersnowski and Dyrka (2013) demonstrated that early shale gas estimates were not only based on historical and incomplete geological data, but they also differed in terms of criteria and methodologies used to assess the physical extent of examined area, reservoir properties and resource recoverability. A substantial amount of test wells would be required to assess the technical and economic feasibility. According to Poland’s National Audit Office, one would need to perform at least 200 test drillings to increase the certainty of volumetric appraisals (NIK, 2013).

Since 2007, the Polish Ministry of Environment has awarded 122 concessions for prospecting and exploration of unconventional gas (MOŚ, 2016). In 2010, the first exploratory well “Markowola-1” with hydraulic fracturing was done by the state-owned Polish Oil and Gas Company (PGNiG) in the Mazovian Voivodeship in central Poland. In late 2011, Lane Energy Poland—a subsidiary of 3Legs Resources Company—completed the initial testing phase of the well “Łebień LE-2H” in the Pomeranian Voivodeship in northern Poland. It is important to note that, to date, LE-2H has been the only successful Polish test well with production data made publicly available. According to the PGI’s environmental assessment (PGI, 2011), the total well depth was 4075 m and hydraulic fracturing done in 13 intervals according to the PGI’s environmental assessment. The 3Legs Resources (2011) reported that the initial gas production from the Łebień well initially reached an unstabilized rate of 62,300 cubic meters per day before declining and stabilizing at 12,700 to 14,700 cubic meters per day (3Legs Resources, 2011). The fracturing required 17,322 cubic meters of water, 1271 tonnes of quartz sand (i.e., proppant) and 462 cubic meters of chemicals injected during all associated drilling intervals (PGI, 2011).

In July 2012, Poland was leading the way for the shale gas “revolution” in Europe, with the highest number of 111 valid concessions for prospecting and exploration and the record number of 24 performed drills (MOŚ, 2016). The same year, the Polish Centre and Economic Research (CASE, 2012) published a broadly circulated economic assessment of the shale gas production potential. The report identified three scenarios for the 2015–2035 period (Fig. 3): in the “moderate growth” variant, the extraction potential was estimated to be 3.57 Bcm; in the “increased foreign investments” scenario, Poland would produce up to 6.37 Bcm, whereas the most positive “accelerated growth” model assumed shale gas production to reach 19.12 Bcm in 2034 (CASE, 2012). The report provided estimates of the number of wells necessary to meet the production potential in each scenario. For example, to reach the level of around 20 Bcm in the “accelerated growth” scenario, it is assumed that the total number of production wells would be 95 during 2012–2018 and 1175 during 2019–2025 (CASE, 2012). It is, however, unclear as to how the authors arrived at such estimates, as they suggest that the Polish shale plays would be more productive compared to some of the most potent shale formations in the USA (Kiersnowski & Dyrka, 2013).

Three shale gas production scenarios according to the Polish think-tank CASE (2012)

Another long-term scenario included in the EU Energy Reference Scenario 2016 (EC, 2016) assumed that Poland’s domestic natural gas production would reach 15.9 Bcm in 2050 (Fig. 4). All gas would most likely have to come from shale deposits as conventional sources are limited or likely depleted after 2035. In this Reference Scenario, Poland’s demand for natural gas would increase to approximately 27 Bcm by 2050, of which roughly 16 Bcm would come from domestic production and around 11 Bcm from imports (EC, 2016).

EU Energy Reference Scenario 2016 (EC, 2016)

By 2016, 91 concessions for prospecting and exploration expired. As of November 2017, there were only 20 active concessions, compared to the peak of 111 at the end of July 2011 (MOŚ, 2016). Between 2010 and 2016, 72 test wells were drilled—including eight within one concession in the Pomerania region—of which 25 used hydraulic fracturing and nine microfracturing treatments (also known as “Diagnostic Fracture Injection Test,” developed by Halliburton) (MOŚ, 2016). To date, no commercial production of unconventional gas has been established, and most concessionaries have left Poland or abandoned shale-related activities. The industry’s exodus from the Polish shale was, to a large extent, triggered by various institutional and bureaucratic hurdles, including a considerably delayed reform of national regulatory framework (e.g., mining law) necessary to accommodate future exploitation of unconventional gas, as well as a disorderly and unreliable process of granting licenses for prospecting and exploration (Godzimirski, 2016; NIK, 2013). Despite the low amount of test drillings, there were also concerns that Poland’s geological conditions—i.e., a limited content of organic matter and high presence of clay minerals—may be less favourable and thus challenging for the application of hydraulic fracturing technology (Jarzyna et al., 2017; Kiersnowski & Dyrka, 2013; PGI, 2012).

Quantifying Required Wells for Gas Self-Sufficiency Scenarios

Poland used almost 16 Bcm of natural gas in 2016 (ME, 2017), corresponding to 14.8% of total energy consumption (GUS, 2017). The national strategy “Energy Policy of Poland until 2030,” adopted by the Council of Ministers in November 2009, projects that the country’s gas demand would reach around 20 Bcm in 2030 (MG, 2009; Appendix 2, p. 14). The share of natural gas in Poland’s total primary energy supply was 13.6% in 2016. Around one-third of the Polish gas demand was met by domestic production at the level of 4.2 Bcm, whereas the remaining two-thirds were covered by imports at 13.8 Bcm in 2016 (ME, 2017). Russian Gazprom delivered almost 10.3 Bcm of gas—75% of total imports through entry points on the Polish borders with Belarus and Ukraine. In 2016, Poland also imported 2.5 Bcm of (Russian) gas from Germany by using a reverse flow on the Yamal pipeline that runs through the Polish territory. To reduce high import dependency on Russian gas and secure supplies from other producers, in 2015, Poland opened the liquefied natural gas (LNG) terminal in Świnoujście with an initial maximum regasification capacity of 5 Bcm/year. It is expected that the terminal’s expansion to 7.5 Bcm/year of regasification capacity will be completed in 2023.

We explored quantitatively possible Polish shale gas futures by starting with a set of assumed demand scenarios based on gas demand in 2016 (16 Bcm) and projected demand for 2030 (20 Bcm), as well as a high case with gas self-sufficiency in 2030 and export capacity via the LNG terminal (25 Bcm) (Table 3). We then derived stylized shale production scenarios based on drilling rates and individual well productivity to explore what is required to match demand with domestic shale supply. The stylized shale production scenarios were designed to be symmetrical so that sensitivity to driving parameters (drilling rates and well productivity) are more clearly illustrated. Therefore, derived supply does not exactly match assumed demand but is in the relevant range.

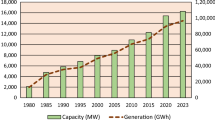

In Figure 5, the total shale production for the three different drilling rates 25, 35 and 45 drilled wells per month is illustrated. In this case, individual well productivity is based on the mean initial production rate from historical Barnett shale wells of 1.4 Mcm/month. As seen, constant drilling of 25 wells per month yields a long-term equilibrium between new wells and the decline of old wells on the level of 15 Bcm per year, almost matching 2016 demand. For the 2030 demand of 20 Bcm, 35 wells per month are required, while 45 wells per month yield long-term production equilibrium of 27 Bcm, matching 2030 demand and extra export capacity.

In these stylized constant drilling scenarios, the equilibrium plateau production level is reached after 30 years. To reach assumed demand earlier (e.g., in 2030), drilling rates need to be frontloaded, i.e., higher drilling rates at the beginning of the period with subsequent decreases. For illustrative purposes, new drilling stops after 40 years, showing the resulting declining production from existing wells.

In Figure 6, total shale gas production from 35 wells per month is shown but for three different well productivities based on initial production rates of 0.8, 1.4 and 2.0 Mcm/month, where 1.4 is the Barnett mean and 0.8 and 2.0 are examples of low- and high-productivity Barnett wells. As seen, total production is very sensitive to individual well productivity. With 35 wells per month, possible differences in well productivity cover the whole total demand scenario spectrum from 12 to 30 Bcm per year. With the limited knowledge of possible future production rates of Polish wells, any accurate projection of required drilling and potential impacts is not possible. However, using the Barnett mean of 1.4 as an analogy can be assumed to be optimistic, since existing geological assessments see Polish shales as less favourable than US ones (EIA/ARI, 2013), and it is reasonable to assume that at least the drilling rates presented in Figure 5 are required to match the different demand scenarios.

Discussion

Our results, presented in Figures 5 and 6, and Table 3, indicate that the Polish ambition to be self-sufficient in natural gas and even become a gas exporter would likely require substantial drilling and hydraulic fracturing activities to develop and further sustain the necessary level of gas production from shales. A minimum of 300 wells per year are likely needed to meet the Polish gas demand of 16 Bcm in Low Scenario, and the self-sufficiency would be achieved no earlier than in 30 years if the drilling campaign is constant and not frontloaded. After ten years of sustained production, the cumulative number of wells would reach around 3000. The Base Scenario with increased gas demand of 20 Bcm in 2030 would require at least 420 drilled wells per year. Finally, the High Scenario—assuming the increased gas demand of 20 Bcm plus 5 Bcm of gas for export via the LNG Terminal in Świnoujście—would necessitate at least 540 wells per year (Fig. 5, Table 3).

Although natural gas remains a marginal fuel in Poland’s coal-dominated energy mix (Kuchler & Bridge, 2018), particularly in the power sector, its use has increased by more than 20% since 2005 (ME, 2017). The national strategy document “Energy Policy of Poland until 2030” projects that the country’s gas demand would reach slightly more than 20 Bcm in 2030 (MG, 2009; Appendix 2, p. 14). Such an increase in gas demand would pose a considerable challenge to the supply side. In 2016, one-third of Poland’s gas demand was met by domestic production, whereas the remaining two-thirds were covered by imports (ME, 2017). Since 2005, domestic production of conventional gas has stabilized roughly above four Bcm per year, but the exploitable resource deposits would last approximately 30 years if no new discoveries were made (PGI, 2017). Hence, the country relies heavily on imports to cover the remaining gas demand. In 2016, 75% of total imports were delivered by Russian Gazprom (ME, 2017). Poland’s “lock-in” and high dependence on Russian gas supplies have, for decades, fueled substantial concerns regarding national energy insecurity amid several geopolitical tensions surrounding onshore and offshore gas transit routes from Russia (Johnson & Boersma, 2013; Kuchler & Höök, 2020).

Unsurprisingly, the prospect of extracting shale gas resources was quickly taken up by the Polish decision-makers, industry representatives and media commentators alike. The Polish public debate, influenced by major national media outlets, has predominantly framed unconventional gas from shales as a “great chance” for achieving energy independence and improving national security (Jaspal et al., 2014; Lis & Stankiewicz, 2016). Following a range of optimistic but highly uncertain resource estimates (e.g., EIA/ARI, 2011, 2013), bold political claims were advanced, suggesting that Poland could attain gas self-sufficiency and even become a major gas exporter. Although the Polish government realized that more test wells were necessary to better understand and assess the shale gas potential underground, several assumptions on the role of shale gas in the country’s energy mix were loosely translated into various national strategies (Kuchler & Höök, 2020). Yet, no specific policy concerned with assessing and planning for the large-scale extraction of gas from shales has been proposed or adopted. Bold political visions lacked any outline as to how the future commercial production of shale gas would be accommodated in an old gas system that requires significant improvements in, among others, pipeline networks and storage capacity.

Furthermore, the political claims of natural gas self-sufficiency and export capacity were inadequately discussed in public or credibly substantiated. Poland’s public endorsement of unconventional gas has been one of the highest in the entire EU, with 72% of Polish citizens being positive about the prospect of shale gas production (TNS Polska, 2013). However, about 50% of society also admitted having poor knowledge about the exploitation of unconventional gas (TNS Polska, 2013). The bulk of Polish society appeared to acquire information on shale gas from the Internet, television, radio and newspapers—largely mirroring the situation in the USA (Arnold et al., 2018). According to Lis and Stankiewicz (2016), the Polish media played a major part in shaping the public debate by focusing on possible benefits that “home-grown” unconventional gas resources might bring for national energy security and economic development (Lis & Stankiewicz, 2016).

According to Jaspal et al. (2014:259), the Polish shale gas debate not only included “little discussion of the scientific, technological and practical aspects of fracking,” but there also “appeared to be a certain naiveté regarding the process of generating shale gas.” Apart from economic appraisals (e.g., CASE, 2012; PKN Orlen, 2012; DnB Nord & Deloitte 2013), the number of wells that would be required for the country’s gas independence and export capability has never been disclosed to and/or discussed in public. Hence, the political claims about self-sufficiency and export capacity—advanced by the Polish government and echoed by industry representatives and energy experts—were never publicly substantiated or revised. Consultations with local communities often excluded discussions on techno-environmental aspects of gas extraction from shale rocks (Materka, 2012). Sparse local resistance to shale extraction operations, like the protest of villagers in Żurawlow in northeast Poland in 2011, was marginalized by the political representatives and national media (Lis & Stankiewicz, 2016). In any scenario explored in this paper, the absence of a transparent and well-informed debate might have only deepened discord and boost controversy between those who promoted shale gas as an energy security issue and an economic opportunity vs those who perceived shale gas through the lens of environmental risks (Jacquet, 2014; Mazur, 2016).

Finally, the political claims of gas independence and export capacity were devoid of any discussion about a long-term, sustainable strategy. To date, no assessments have been made as to how the country could accommodate large-scale hydraulic fracturing operations in terms of land-use, spatial planning and environmental risks associated with extraction. If a large recoverable resource potential were in place (Table 2), harnessing the abundance of shale gas—e.g., the enthusiastically welcomed estimate of 5300 Bcm of shale gas (EIA/ARI, 2011)—would require considerable drilling and fracturing activities to sustain the production for years to come. For example, by highly optimistically projecting that all estimated shale gas resources in the Baltic–Podlasie–Lublin Basin could be technically recovered in the future, extracting 5300 Bcm of gas from shales would require around 100,000 wells covering the entire area, with at least one well per square km. The resource estimate of 1360 Bcm (Wood Mackenzie, 2009) would allow for 26,824 of our mean productivity wells, accounting for 50 years of continuous production at 540 wells/year. Consequently, major environmental impacts could emerge, as Baranzelli et al. (2015) illustrate for their hypothetical shale gas development in the Baltic Basin. This comes primarily from increased competition for land (e.g., between drilling operations and agricultural practices or natural reserves), but also the consumption of drinking water and landscape fragmentation. Thus, any large-scale deployment of horizontal drilling and hydraulic fracturing operations would require a substantial (re)consideration of current and future plans for area development (Fry et al., 2017). This includes land-use conflicts with new infrastructures necessary for extraction, transport and distribution of natural gas from shales—as well as legal issues related to extractive practices (e.g., depth of wells), water quality (Fontenot, 2013; Schmidt, 2011), methane contamination (Osborn et al., 2011), environmental protection (Uliasz–Misiak et al., 2014) and seismic events induced by hydraulic fracturing operations and wastewater disposal (Li et al., 2019; Schultz et al., 2020). Balthrop and Hawley (2017) also found that shale wells within 1 km of a property reduce property values. Although the ability to site more wells per pad would help alleviate some land conflicts and environmental concerns, the spacing of more advanced, multi-well pads would likely depend on the Polish (local) geology, access to know-how and technology, as well as a substantial commitment from investors.

Hence, the question remains as to whether local communities in prospective Polish regions would be able to socioculturally accept and adjust to the large-scale implementation of horizontal drilling and hydraulic fracturing technologies and risks associated with them, as well as what potential benefits would such production bring in terms of local economic development. For example, Christenson et al. (2017) demonstrate that arguments stressing the economic benefits of shale gas bolster public support for shale exploitation. Yet, such gains are cancelled out if paired with arguments highlighting associated environmental impacts. As Kronenberg (2014) observes, the “perceived abundance of shale gas in Poland” strengthened “a false sense of security” that, consequently, led to policy-makers downplaying or even disregarding the complexities and risks associated with large-scale fracking. Long-term, extensive extraction of shale gas abundance, spurred by optimistic but uncertain resource estimates, was turned into political claims that were not substantiated nor realized.

Conclusions

The paper illustrates that a significant amount of drilling and hydraulic fracturing operations would likely be required to meet Poland’s hopes for gas self-sufficiency and export capacity today and in the future. To accommodate large-scale extraction of shale gas through “fracking,” the Polish government would need to critically reconsider and verify the future role of “home-grown” unconventional gas and the potential scope of its production in achieving national ambitions concerned with gas self-sufficiency. The Polish policy-makers would have to considerably revise plans for area developments and assure that robust socio-environmental regulations are in place to minimize potential tensions over local issues associated with shale operations. Moreover, a more informed and comprehensive public debate that includes technical aspects of shale gas extraction would be necessary to better inform and prepare local communities for possible trade-offs, not only opportunities associated with the commercial production of gas from shales.

The implemented method and findings of this paper have broader applicability for demonstrating the potential extent of drilling in other countries that seek to develop domestic shale gas production, particularly the UK. After the government’s moratorium on hydraulic fracturing imposed in 2011, the UK has recently restarted its efforts to develop domestic production of gas from onshore shales, although resource estimates are highly uncertain. In 2015, the UK government stated that shale gas extraction could help meet national “objectives for secure energy supplies, economic growth and lower carbon emissions” (DECC/DCLG, 2015). Yet, British gas consumption is much higher than in Poland and accounted for more than 80 Bcm. With depleting reserves of conventional gas in the North Sea and the inevitable increase of imports (Höök et al., 2009; Söderbergh et al., 2009), the question arises as to how much of gas from onshore shales and what extent of shale operations would be needed to cover current and especially future demand for gas in the UK.

References

3Legs Resources. (2011). “Operations on Lebien LE-2H horizontal well. Operations on Warblino LE-1H horizontal well”, 26 September 2011, 3Legs Resources plc. Retrieved February 02, 2021, from https://web.archive.org/web/20111005082702/http://www.3legsresources.com:80/media/Operational-update-260911.pdf.

Andreasson, S. (2018). The bubble that got away? Prospects for shale gas development in South Africa. The Extractive Industries and Society, 5(4), 453–460. https://doi.org/10.1016/j.exis.2018.07.004.

ARI. (2009). Worldwide Gas Shales and Unconventional Gas: A Status Report. Prepared by V.A. Kuuskraa. December 12, 2009. Arlington, VA: Advanced Resource International, Inc.

Arnold, G., Farrer, B., & Halohan, R. (2018). How do landowners learn about high-volume hydraulic fracturing? A survey of Eastern Ohio landowners in active or proposed drilling units. Energy Policy, 114, 455–464. https://doi.org/10.1016/j.enpol.2017.12.026.

Baranzelli, C., Vandecasteele, I., Barranco, R. R., Mari i Rivero, I., Pelletier, N., Batelaan, O., & Lavelle, C. (2015). Scenarios for shale gas development and their related land use impacts in the Baltic Basin, Northern Poland. Energy Policy, 84, 80–95. https://doi.org/10.1016/j.enpol.2015.04.032.

Balthrop, A. T., & Hawley, Z. (2017). I can hear my neighbors’ fracking: The effect of natural gas production on housing values in Tarrant County, TX. Energy Economics, 61, 351–362. https://doi.org/10.1016/j.eneco.2016.11.010.

Bezdek, R. H., & Wendling, R. M. (2002). A half century of long-range energy forecasts: Errors made, lessons learned, and implications for forecasting. Journal of Fusion Energy, 212(3–4), 155–172. https://doi.org/10.1023/A:1026208113925.

CASE. (2012). Ekonomiczny potencjał produkcji gazu łupkowego w Polsce w latach 2012–2025: Analiza scenariuszowa. Warszawa: CASE.

Christenson, D. P., Goldfarb, J. L., & Kriner, D. L. (2017). Costs, benefits, and the malleability of public support for “Fracking.” Energy Policy, 105, 407–417. https://doi.org/10.1016/j.enpol.2017.03.002.

DECC/DCLG. (2015). Shale gas and oil policy statement by DECC and DCLG, 13 August 2015. Retrieved February 02, 2021, from https://www.gov.uk/government/publications/shale-gas-and-oil-policy-statement-by-decc-and-dclg/shale-gas-and-oil-policystatement-by-decc-and-dclg.

DnB Nord & Deloitte. (2013). Kierunki 2013. Pozytywne szoki gospodarcze? Warszawa: DnB Nord & Deloitte.

Duong, A. N. (2011). Rate-decline analysis for fracture-dominated shale reservoirs. SPE Reservoir Evaluation & Engineering, 14(3), 377–387. https://doi.org/10.2118/137748-PA.

EC. (2016). EU reference scenario 2016: Energy, transport and GHG emissions Trends to 2050. Brussels: European Commission.

EIA/ARI. (2011). World Shale Gas Resources: An Initial Assessment of 14 Regions outside the United States. Prepared by Advanced Resources International for the U. S. Energy Information Administration. Washington, DC: US Department of Energy.

EIA/ARI. (2013). World Shale Gas and Shale Oil Resource Assessment Technically Recoverable Shale Gas and Shale Oil Resources: An Assessment of 137 Shale Formations in 41 Countries outside the United States. Prepared by Advanced Resources International for the US Energy Information Administration. Washington, DC: US Department of Energy.

EIA/ARI. (2015). Technically Recoverable Shale Oil and Shale Gas Resources: Poland. Prepared by Advanced Resources International for the US Energy Information Administration. Washington, DC: US Department of Energy.

Fontenot, B. E., et al. (2013). An evaluation of water quality in private drinking water wells near natural gas extraction sites in the barnett shale formation. Environmental Science & Technology, 47(17), 10032–10040. https://doi.org/10.1021/es4011724.

Fry, M. (2013). Urban gas drilling and distance ordinances in the Texas Barnett Shale. Energy Policy, 62, 79–89. https://doi.org/10.1016/j.enpol.2013.07.107.

Fry, M., Brannstrom, C., & Sakinejad, M. (2017). Suburbanisation and shale gas wells: Patterns, planning perspectives, and reverse setback policies. Landscape and Urban Planning, 168, 9–21. https://doi.org/10.1016/j.landurbplan.2017.08.005.

Gazeta Prawna. (2011). “Tusk zapowiada: eksploatacja gazu łupkowego od 2014 roku, a w 2035 r osiągniemy bezpieczeństwo gazowe”, Gazeta Prawna, 18 September 2011. Retrieved 02, 2021, from http://biznes.gazetaprawna.pl/artykuly/548509,tusk-zapowiada-eksploatacja-gazu-lupkowego-od-2014-roku-a-w-2035-r-osiagniemy-bezpieczenstwo-gazowe.html.

Godzimirski, J. M. (2016). Can the Polish shale gas dog still bark? Politics and policy of unconventional hydrocarbons in Poland. Energy Research & Social Science, 20, 158–167. https://doi.org/10.1016/j.erss.2016.06.009.

Guo, K., Zhang, B., Aleklett, K., & Höök, M. (2016). Production patterns of eagle ford shale gas: Decline curve analysis using 1084 wells. Sustainability, 8(10), 973. https://doi.org/10.3390/su8100973.

Guo, K., Zhang, B., Wachtmeister, H., Aleklett, K., & Höök, M. (2017). Characteristic production decline patterns for shale gas wells in Barnett. International Journal of Sustainable Future for Human Security, 5(1), 12–21.

GUS. (2017). Gospodarka paliwowo-energetyczna w latach 2015 i 2016. Warszawa: Główny Urząd Statystyczny.

Hirsh, R. F., & Jones, C. F. (2014). History’s contributions to energy research and policy. Energy Research & Social Science, 1, 106–111. https://doi.org/10.1016/j.erss.2014.02.010.

Hotard, D. G., & Ristroph, J. H. (1984). A regional logistic function model for crude oil production. Energy, 9(7), 565–570. https://doi.org/10.1016/0360-5442(84)90063-X.

Hu, D., & Xu, S. (2013). Opportunity, challenges and policy choices for China on the development of shale gas. Energy Policy, 60, 21–26. https://doi.org/10.1016/j.enpol.2013.04.068.

Höök, M. (2014). Depletion rate analysis of fields and regions: A methodological foundation. Fuel, 121, 95–108. https://doi.org/10.1016/j.fuel.2013.12.024.

Höök, M., Söderbergh, B., & Aleklett, K. (2009). Future Danish oil and gas export. Energy, 34(11), 1826–1834. https://doi.org/10.1016/j.energy.2009.07.028.

Jackson, J. A. (2011). Glossary of geology (4th ed.). Alexandria, VA: American Geological Institute.

Jacquet, J. B. (2014). Review of risks to communities from shale energy development. Environmental Science and Technology, 48(15), 8321–8333. https://doi.org/10.1021/es404647x.

Johnson, C., & Boersma, T. (2013). Energy (in)security in Poland the case of shale gas. Energy Policy, 53, 389–399. https://doi.org/10.1016/j.enpol.2012.10.068.

Jaspal, R., Nerlich, B., & Lemańczyk, S. (2014). Fracking in the Polish press: Geopolitics and national identity. Energy Policy, 74, 253–261. https://doi.org/10.1016/j.enpol.2014.09.007.

Jarvie, D. M., Hill, R. J., Ruble, T. E., & Pollastro, R. M. (2007). Unconventional shale-gas systems: The mississippian Barnett shale of north-central Texas as one model for thermogenic shale-gas assessment. AAPG Bulletin, 91(4), 475–499. https://doi.org/10.1306/12190606068.

Jarzyna, J. A., Bała, M., Krakowska, P. I., Puskarczyk, E., Strzępowicz, A., Wawrzyniak-Guz, K., Więcław, D., & Ziętek, J., (2017). Shale Gas in Poland, In: Al-Megren, H., Altamimi, R., Advances in Natural Gas Emerging Technologies, IntTech, pp. 191–210. https://doi.org/10.5772/67301.

Kama, K., & Kuchler, M. (2019). Geo-metrics and geo-politics: Controversies in estimating European shale gas resources. In A. Bobbette & A. Donovan (Eds.), Political geology: Active stratigraphies and the making of life. London: Palgrave Macmillan. https://doi.org/10.1007/978-3-319-98189-5_4.

Kiersnowski, H., & Dyrka, I. (2013). Ordovician-Silurian shale gas resources potential in Poland: Evaluation of gas resources assessment reports published to date and expected improvements for 2014 forthcoming assessment. Przegląd Geologiczny, 61(11/1), 639–656.

Kronenberg, J. (2014). Shale gas extraction in Poland in the context of sustainable development. Problems of Sustainable Development, 9(2), 113–120.

Kuchler, M. (2017). Post-conventional energy futures: Rendering Europe’s shale gas resources governable. Energy Research & Social Science, 31, 32–40. https://doi.org/10.1016/j.erss.2017.05.028.

Kuchler, M., & Bridge, G. (2018). Down the black hole: Sustaining national socio-technical imaginaries of coal in Poland. Energy Research & Social Science, 41, 136–147. https://doi.org/10.1016/j.erss.2018.04.014.

Kuchler, M., & Höök, M. (2020). Fractured visions: Anticipating (un) conventional natural gas in Poland. Resources Policy, 68, 101760. https://doi.org/10.1016/j.resourpol.2020.101760.

Kuhn, M., & Umbach, F. (2011). Strategic Perspectives of Unconventional Gas: A Game Changer with Implications for the EU’s Energy Policy. King‘s College London: European Centre for Energy and Resource Security (EUCERS).

Li, L., Tan, J., Wood, D. A., Zhao, Z., Becker, D., Lyu, Q., & Chen, H. (2019). A review of the current status of induced seismicity monitoring for hydraulic fracturing in unconventional tight oil and gas reservoirs. Fuel, 242, 195–210. https://doi.org/10.1016/j.fuel.2019.01.026.

Lis, A., & Stankiewicz, P. (2016). Framing shale gas for policy-making in Poland. Journal of Environmental Policy & Planning, 19(1), 53–71. https://doi.org/10.1080/1523908X.2016.1143355.

Materka, E. (2012). Poland’s quiet revolution: Of shale gas exploration and its discontents in Pomerania. Central European Journal of International and Security Studies, 6(1), 189–218.

Mazur, A. (2016). How did the fracking controversy emerge in the period 2010–2012? Public Understanding of Science, 25(2), 207–222. https://doi.org/10.1177/0963662514545311.

McGlade, C., Speirs, J., & Sorrell, S. (2013). Unconventional gas–a review of regional and global resource estimates. Energy, 55, 571–584. https://doi.org/10.1016/j.energy.2013.01.048.

ME. (2017). Gas supply security monitoring results report. Warszawa: Ministerstwo Energii.

MG. (2009). Poland’s Energy Policy until 2030. Adopted by the Council of Ministers on the 10th of November 2009. Warszawa: Ministerstwo Gospodarki.

Middleton, R. S., Gupta, R., Hyman, J. D., & Viswanathan, H. S. (2017). The shale gas revolution: Barriers, sustainability, and emerging opportunities. Applied Energy, 199, 88–95. https://doi.org/10.1016/j.apenergy.2017.04.034.

Mistré, M., Crénes, M., & Hafner, M. (2018). Shale gas production costs: Historical developments and outlook. Energy Strategy Reviews, 20(4), 20–25. https://doi.org/10.1016/j.esr.2018.01.001.

MOŚ. (2016). Shale Gas in Poland: prospecting and exploration 2007–2016. As of 29 February 2016. Warszawa: Ministerstwo Ochrony Środowiska.

NIK. (2013). Poszukiwanie, wydobywanie i zagospodarowanie gazu ze złóż łupkowych. Warszawa: Najwyższa Izba Kontroli.

Osborn, S. G., Vengosh, A., Warner, N. R., & Jackson, R. B. (2011). Methane contamination of drinking water accompanying gas-well drilling and hydraulic fracturing. PNAS, 108(20), 8172–8176. https://doi.org/10.1073/pnas.1100682108.

Osička, J., Ocelík, P., & Dančáka, B. (2016). The impact of Polish unconventional production on the regional distribution of natural gas supply and transit: A scenario analysis. Energy Strategy Reviews, 10, 1–17. https://doi.org/10.1016/j.esr.2016.02.001.

PGI. (2011). Environmental aspects of hydraulic fracturing treatment performed on the Łebień LE-2H Well. Warsaw: Polish Geological Institute.

PGI. (2012). Assessment of Shale Gas and Shale Oil Resources of the Lower Paleozoic Baltic-Podlasie-Lublin Basin in Poland. First Report. Warsaw: Polish Geological Institute.

PGI. (2017). Mineral resources of Poland: natural gas. Warsaw: Polish Geological Institute. Retrieved February 02, 2021, from http://geoportal.pgi.gov.pl/surowce/energetyczne/gaz_ziemny.

PKN Orlen. (2012). Gazowa (r)ewolucja w Polsce: Jaką drogą do sukcesu. Płock: PKN Orlen.

Poprawa, P. (2010). Potencjał występowania złóż gazu ziemnego w łupkach dolnego paleozoiku w basenie bałtyckim i lubelsko-podlaskim. Przegląd Geologiczny, 58, 226–249.

Poprawa, P., & Kiersnowski, H. (2008). Perspektywy poszukiwań złóż gazu ziemnego w skałach ilastych (shale gas) oraz gazu ziemnego zamkniętego (tight gas) w Polsce. Biuletyn Państwowego Instytutu Geologicznego, 429, 145–152.

Schmidt, C. W. (2011). Blind rush? Shale gas boom proceeds amid human health questions. Environmental Health Perspectives, 119(8), 348–353. https://doi.org/10.1289/2Fehp.119-a348.

Schultz, R., Skoumal, R. J., Brudzinski, M. R., Eaton, D., Baptie, B., & Ellsworth, W. (2020). Hydraulic fracturing-induced seismicity. Reviews of Geophysics, 58(3), e2019RG000695. https://doi.org/10.1029/2019RG000695.

Siemek, J., Nagy, S., & Siemek, P. (2013). Challenges for sustainable development: The case of shale gas exploitation in Poland. Problems of Sustainable Development, 8(1), 91–104.

Soeder, D. J. (2018). The successful development of gas and oil resources from shales in North America. Journal of Petroleum Science and Engineering, 163(4), 399–420. https://doi.org/10.1016/j.petrol.2017.12.084.

Söderbergh, B., Jakobsson, K., & Aleklett, K. (2009). European energy security: The future of Norwegian natural gas production. Energy Policy, 37(12), 5037–5055. https://doi.org/10.1016/j.enpol.2009.06.075.

TNS Polska. (2013). Wiedza, opinie i potrzeby ludności w zakresie gazu z łupków. TNS Polska dla Ministerstwa Środowiska.

TVN24. (2010). “Dzięki gazowi łupkowemu "Polska drugą Norwegią”, TVN24, 09 June 2010. Retrieved February 02, 2021, from https://www.tvn24.pl/wiadomosci-z-kraju,3/dzieki-gazowi-lupkowemu-polska-druga-norwegia,136346.html.

UKERC. (2012). A review of regional and global estimates of unconventional gas resources. London: UK Energy Research Centre.

Uliasz-Misiak, B., Przybycin, A., & Winid, B. (2014). Shale and tight gas in Poland—legal and environmental issues. Energy Policy, 65, 68–77. https://doi.org/10.1016/j.enpol.2013.10.026.

USGS. (2012). Potential for Technically Recoverable Unconventional Gas and Oil Resources in the Polish-Ukrainian Foredeep, Poland, 2012. Reston, VA: US Geological Survey.

Valko, P. P. (2009). Assigning value to stimulation in the Barnett Shale: A simultaneous analysis of 7000 plus production histories and well completion records. Presented at the SPE Hydraulic Fracturing Technology Conference, The Woodlands, Texas.

Wachtmeister, H., Lund, L., Aleklett, K., & Höök, M. (2017). Production decline curves of tight oil wells in eagle ford shale. Natural Resources Research, 26(3), 365–377. https://doi.org/10.1007/s11053-016-9323-2.

Wood MacKenzie (2009). Global unconventional gas trends. Proprietary report.

Acknowledgements

This study was made possible through the generous grants from the Swedish Research Council Formas (Project No. 2015-00455) and from the Swedish Research Council (Project No. 2014-05246), as well as the support from the STandUP for Energy Research Initiative. The authors would like to thank the reviewers for their constructive comments and valuable suggestions.

Funding

Open access funding provided by Uppsala University.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wachtmeister, H., Kuchler, M. & Höök, M. How Many Wells? Exploring the Scope of Shale Gas Production for Achieving Gas Self-Sufficiency in Poland. Nat Resour Res 30, 2483–2496 (2021). https://doi.org/10.1007/s11053-021-09858-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-021-09858-w