Abstract

Supply chain contracting is known to suffer from inefficiency in the presence of asymmetric information. Full vertical integration would eliminate the informational inefficiency but can be strategically undesirable. Yet today’s supply chain partnerships exhibit a certain degree of partial vertical integration via equity ties between the firms. Such governance forms received limited attention in supply chain research. Management literature suggests that partial vertical integration may help the firms to ease contracting problems by aligning their incentives, and thus improve the total surplus. We address this proposition by studying a model of a partially integrated supply chain in which the buyer holds an equity stake in the supplier. We adopt an operational perspective and investigate contracting between the firms within the joint economic lot size framework. We demonstrate that in this classical setting, partial integration can in fact be sufficient for eliminating informational inefficiency and achieving coordination. However, contrary to what one may expect, a tighter integration may harm supply chain performance and defeat coordination. We explain the underlying mechanism and investigate it analytically and numerically. Our results characterize sensitivity of supply chain performance to the degree of integration and stress the importance of the operational planning perspective for strategic decision making.

Similar content being viewed by others

1 Introduction

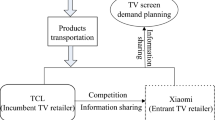

Most supply chain coordination models assume either independent firms engaging in a supply chain relationship or a vertically integrated supply chain structure with a common ownership (Cachon, 2003; Choi & Cheng, 2011). Nonetheless, today’s economy provides a large number of examples where firms are neither fully integrated nor entirely independent, being, to a certain degree, integrated partially—by owning equity in one another (Fee et al., 2006; Hunold & Stahl, 2016), cross-shareholding, or having joint ownership of another firm. The prominent examples are the Japanese keiretsu (Lincoln et al., 1992; Ahmadjian & Lincoln, 2001), international joint ventures (Desai et al., 2004), or, more generally, business groups and alliances (Granovetter, 1995; Gulati & Singh, 1998).

Such hybrid forms of governance in the supplier–buyer relationships emerge for a variety of reasons. Globalization of production and trade and competition on the global scale are often cited as the major driving forces behind partnerships with shared ownership (Al-Saadon & Das, 1996; Buckley & Ghauri, 2004; Lee, 2004). Firms entering local markets may, in fact, be restricted by the regulation in choosing the size of the foreign ownership; however, even in the absence of such legal requirements, they may still prefer a partial equity stake as entry mode—e.g., for the purpose of retaining control over intangible assets (Gulati & Singh, 1998; Nakamura, 2005), monitoring and access to information (Mjoen & Tallman, 1997; Nakamura & Xie, 1998), overcoming institutional complications (Gatignon & Anderson, 1988; Yamin & Golesorkhi, 2010; Bowe et al., 2014), or retaining flexibility in continuing or leaving the business (Powell, 1990; Buckley & Ghauri, 2004). It happens, therefore, that firms are negotiating and contracting ”with companies that they partly own” (Powell, 1990; Fee et al., 2006; Krishnaswami et al., 2013; Sasaki et al., 2010).

While partial vertical integration has been extensively studied in the economics literature (see Sect. 2), it received limited attention in supply-chain research. The recent work by Li et al. (2020b) and Chen et al. (2017) are notable exceptions. In these studies, the authors investigated the impact of partial integration on supply-chain coordination and competition while assuming complete information. They have shown that partial integration benefits supply chains and represents an equilibrium outcome under certain conditions. Our work extends this line of research by studying a setting with asymmetric information, which takes into account the uncertainty pertinent to supply-chain contracting. It is well known that private information, while being ”a key feature of real supply chain relationships” (Liu & Cetinkaya, 2009), makes contracting between the parties problematic and can lead to inefficiency and coordination failure (Cachon, 2003). At the same time, extant literature suggests that partial integration may help the partners to ease contracting problems by aligning their incentives, and so improve the total surplus (Pisano, 1989; Gulati, 1995; Allen & Phillips, 2000; Fee et al., 2006). The purpose of this paper is to investigate this proposition in a supply chain study setting. To this end, we adopt the joint economic lot size framework as a conventional tool for studying supply chain coordination (Corbett & de Groote, 2000; Voigt & Inderfurth, 2011; Zissis et al., 2015; Kerkkamp et al., 2018; Sucky, 2006; Pishchulov & Richter, 2016).

In an earlier pilot study, Pishchulov et al. (2016) have demonstrated that dependence between the level of partial integration and supply-chain performance may be counterintuitive. Specifically, partial integration can indeed remove informational inefficiency and enable coordination, yet a tighter integration may defeat it. However, Pishchulov et al. (2016) did not provide further insights into the drivers and properties of this dependence. This study closes this gap, first, by explaining the mechanism giving rise to such a counterintuitive dependence between the level of integration and supply-chain performance. Second, we obtain conditions, under which (i) supply-chain performance consistently improves with the level of integration, and (ii) supply-chain coordination, once achieved, persists with tighter integration. Third, our analysis establishes favourable properties of partial integration. Specifically, we show that a minor variation in the level of integration is likely to yield a substantial performance improvement in the absence of coordination, but it would not significantly detract from performance in the presence of coordination. Overall, the present work stresses the importance of taking operational-level planning into account when making strategic business decisions, and offers an analytical framework to this end.

The rest of the paper is organized as follows. Section 2 reviews the related literature. Section 3 presents the analytical model of coordination under partial vertical integration. Section 4 provides illustrative examples of dependence between the level of integration and supply-chain performance. Section 5 offers interpretation of that dependence. It further obtains conditions for achieving supply-chain coordination and its persistence with tighter integration. Section 6 establishes favourable properties of partial vertical integration via sensitivity analysis. Section 7 wraps up with a discussion and an outlook for future research.

2 Literature review

To date, partial vertical integration has been subject of substantial formal analysis in the economics literature and, to a smaller extent, in the supply chain literature.

Regarding the economics research, we divide the literature into cooperative and non-cooperative settings. Much of the work on non-cooperative settings has analyzed partial vertical integration as partial mergers without control rights. Flath (1989) studied a vertical channel with two tiers and Cournot competition between multiple identical firms in each tier. His analysis demonstrates that shareholdings by the suppliers in the buyers reduce the consumer price, while shareholdings in the opposite direction would countervail this effect. Greenlee and Raskovich (2006) considered a Cournot setting with a single supplier and multiple buyers, who can acquire non-controlling partial ownership in the supplier. Their results show that the consumer surplus does not depend on ownership, whereas the total surplus does. However, in the Bertrand setting with differentiated substitute products, the consumer surplus depends on the ownership structure. Hunold and Stahl (2016) found that when competition is sufficiently intense, the downstream buyers opt for non-controlling partial ownership in the most efficient supplier, which increases the consumer prices. Reiffen (1998) and Gilo and Spiegel (2011) discussed the effect of partial vertical integration on the economic mechanisms of foreclosure and analysed examples from industry practice.

Research on cooperative settings has a particular focus on incomplete contracting. Riordan (1991) studied a principal–agent setting in which a downstream firm (the principal) can ex ante acquire non-controlling partial ownership in an upstream supplier (the agent). His analysis reveals that partial integration effectively leads the principal to cost sharing with the agent and, therefore, reduces the principal’s incentive to exercise his monopsony power, thus increasing the agent’s incentive to expend an effort. On the other hand, with more integration, the agent’s incentive is diminishing as she receives a smaller share of the residual profit while still bearing the full costs of the unobservable effort. The interplay of these two effects ultimately determines an optimal degree of vertical integration. In the model by Aghion and Tirole (1994), an upstream R &D firm is to deliver an innovation whose value for the downstream buyer is non-contractible. Their analysis determines the optimal allocation of property rights on the innovation and shows that the buyer’s upstream ownership does not help to mitigate the effort and allocation inefficiencies. Dasgupta and Tao (2000) showed, however, that, in the presence of other potential downstream buyers, equity stake in the upstream partner does matter, as it decreases the attractiveness of the outside option to her and increases the likelihood of her relationship-specific investment. The analysis by Harbaugh (2001) further demonstrated that with ex post bargaining, a partial equity stake can be effective at overcoming the classical holdup problem. Van den Steen (2002) extended these insights to bilateral dependency, cross-shareholding and vertical joint ventures. Güth et al. (2007) studied a bilateral trade with one-sided asymmetric information and showed that non-controlling cross-shareholding with minority stakes allows the parties to achieve the first-best solution despite information asymmetry, whereas one-sided shareholding may not allow that.

In the supply chain literature, Chen et al. (2017) have been the first to study partial integration via cross-shareholding in a non-cooperative newsvendor setting with Stackelberg power structure. They found that supply-chain performance does not depend on the equity share held by the follower in the leader, while it improves with an equity share held in the opposite direction. Li et al. (2020b) have recently studied a setting with two competing supply chains that sell substitutable products. They found that partial vertical integration represents an equilibrium outcome as long as the degree of product substitutability is below a threshold. Nevertheless, Chen et al. (2017) and Li et al. (2020b) assume symmetric information, while pointing to information asymmetry as a further research direction—which we aim to address in this study.

It is known that asymmetric information can potentially worsen supply-chain performance, squeezing the pie that the parties share. A large body of supply-chain research studied coordination under asymmetric information in a variety of different settings, e.g. with the supplier being privately informed of capacity cost (Bolandifar et al., 2018), manufacturing cost (Cachon & Zhang, 2006; Liu & Cetinkaya, 2009; Çakanyıldırım et al., 2012; Shao et al., 2020; Davis & Hyndman, 2021), cost and quality (Chen & Hu, 2015), and supply reliability (Yang et al., 2009; Li et al., 2020a); or the buyer being privately informed of holding cost (Corbett & de Groote, 2000; Voigt & Inderfurth, 2011; Zissis et al., 2015; Kerkkamp et al., 2018), ordering and holding costs (Sucky, 2006; Pishchulov & Richter, 2016), manufacturing cost (Ha, 2001; Liu & Cetinkaya, 2009), demand (Burnetas et al., 2007), or shortage cost and service level (Lutze & Özer, 2008). Notably, study settings in Zissis et al. (2020) and Schoenmeyr and Graves (2021) involve bilateral information asymmetry between a supplier and a buyer. Recent reviews (Shen et al., 2019; Vosooghidizaji et al., 2020) offer a taxonomy of this body of work based on the underlying supply-chain structure, nature of demand, contract type and other features. However, this literature does not consider the possibility of partial vertical integration via equity participation. Our work differs in this regard. We study a setting involving both, information asymmetry and partial vertical integration. The latter potentially allows supply-chain partners to better align their interests by increasing the size of the pie they share. In contrast to Chen et al. (2017), we find that equity holding by the less powerful party (the buyer) in the more powerful party (the supplier) can help to improve supply-chain performance and achieve coordination. Furthermore, we find that supply-chain performance in our setting can deteriorate with tighter integration—due to changing incentives of the privately informed party.

For the purposes of this analysis, we employ the conventional joint economic lot size model under asymmetric information following related work (Corbett & de Groote, 2000; Sucky, 2006; Voigt & Inderfurth, 2011; Zissis et al., 2015; Pishchulov & Richter, 2016; Pishchulov et al., 2016; Kerkkamp et al., 2018; Zissis et al., 2020), as it allows us to study the problem on hand using a simple yet meaningful model of supply-chain coordination (Kohli & Park, 1989; Reyniers, 2001; Pibernik et al., 2011) and allows for closed-form solutions, which facilitates the subsequent analysis. To this end, we shall use the framework of Pishchulov et al. (2016) which extends the conventional model to the case of partial vertical integration. We adopt the operational planning perspective for two reasons. First, it is known that supply chains require coordination at the operational level (Banerjee, 1986; Sucky, 2006; Kerkkamp et al., 2018). Second, the analysis by Reyniers (2001) demonstrates that disregarding the operational-level aspects, such as lot-sizing and inventory-related costs, when making a strategic decision about vertical integration in a supply chain, may lead to outcomes not predicted by classical economics models. In this way, the operational setting can support strategic decision making.

3 The model

3.1 Basic assumptions and notation

Consider a supply chain consisting of a single supplier (she) and a single buyer (he), as depicted in Fig. 1 (in the following, we explain the notation used in the figure). The supplier and the buyer are labelled with literals P and A for principal and agent, respectively. The buyer serves a deterministic constant demand for a particular product and satisfies the demand from stock. Since the demand is deterministic, stock shortages are not permitted, which is a standard assumption in the literature (Banerjee, 1986; Corbett & de Groote, 2000; Sucky, 2006; Kerkkamp et al., 2018). The buyer replenishes his stock by re-ordering the product from the supplier. The supplier follows the lot-for-lot policy: upon receiving the buyer’s order, she sets up a production batch, manufactures the order, and ships it to the buyer. The lot-for-lot policy is commonly assumed in the literature (Corbett & de Groote, 2000; Sucky, 2006; Voigt & Inderfurth, 2011; Zissis et al., 2015; Kerkkamp et al., 2018), and we maintain this assumption too. Note that while manufacturing, the supplier accumulates the finished product until the order is completed and shipped, which leads to stock holding at the supplier side. Figure 2 illustrates evolution of the inventory levels at both firms. Note also that the buyer has to place the order ahead of the lead time, which is assumed constant. Problem data is comprised at the supplier side of:

- p:

-

production rate, in units per time unit,

- R:

-

fixed setup cost per production batch,

- \(h_P\):

-

unit inventory holding cost per time unit.

At the buyer side, the problem data is comprised of

- d:

-

deterministic constant demand for the product, in units per time unit (\(d<p\)),

which is known and verifiable to the supplier, and inventory-related cost parameters whose values represent the buyer’s private information and are not known to the supplier with certainty. We assume a discrete set of possible values for these parameters, as this assumption is realistic in practical applications (Zissis et al., 2020). Specifically, we assume that there are two possible cost structures that the buyer can possess, each respectively comprising the following two parameters (Sucky, 2006):

- \(B_i\):

-

fixed ordering cost assumed for the buyer’s cost structure no. i,

- \(h_{A,i}\):

-

unit holding cost per time unit assumed for his cost structure no. i (\(i=1,2\)).

For brevity, we shall refer to the buyer with cost structure no. i as buyer type i (Harsanyi, 1967; Myerson, 1979; Burnetas et al., 2007; Kerkkamp et al., 2018). We assume that the supplier knows the probability distribution over the buyer types—e.g., as the relative frequency of their occurrence in the entire population of buyers (Harsanyi, 1967; Myerson, 1979). This probability distribution is represented by

- \(\omega _i\):

-

probability for the buyer to be of type i (\(\omega _i>0\), \(i=1,2\), and \(\omega _1+\omega _2=1\)).

We express the inventory-related costs of the supplier and the buyer per time unit as the following functions of the order size x (Banerjee, 1986; Sucky, 2006), where the superscript indicates the supply-chain member, and the subscript—the buyer type:

The above cost functions are known to be strictly convex and unimodal—provided that all cost parameters are positive, which we assume to hold. Note that transportation time \(t_3\) in Fig. 2 has been assumed negligibly small and excluded from consideration to simplify the exposition. For tractability, and in line with the literature (Corbett & de Groote, 2000; Sucky, 2006; Zissis et al., 2015; Kerkkamp et al., 2018), we assume that (1) and (2) are the only decision-relevant costs.

Evolution of the inventory level over time at the buyer (above) and the supplier (below) (Banerjee, 1986)

3.2 Partial vertical integration

We shall address a setting in which the supplier and the buyer are partially integrated via a direct equity stake. To examine how the supply-chain contracting becomes affected by this, we shall assume that the buyer holds an ownership share in the supplier. The magnitude of this share will be denoted by \(\alpha \), where \(0<\alpha <1\). This entitles the buyer to appropriate the fraction \(\alpha \) of the supplier’s profit. Note that the extreme case of \(\alpha =0\) corresponds to the setting with fully independent firms (Sucky, 2006; Pishchulov & Richter, 2016), while the extreme case of \(\alpha =1\) represents a vertically integrated supply chain. As in most of the literature reviewed in Sect. 2, we will focus our analysis on the pure financial interest of the investing firm and exclude the control rights aspect from consideration. Thus, we assume that the supplier acts in her own interest—which is the maximization of her own profit. To proceed, we additionally introduce the following notation:

- c:

-

supplier’s unit production cost,

- v:

-

supplier’s wholesale price.

As the parties’ optimal lot sizes in (1) and (2) may differ, the supplier may find it beneficial to offer a side payment y to the buyer for adopting a particular order size x. The supplier’s net profit per time unit can accordingly be expressed as a function of the order size x and the side payment y as follows:

Note that such a contract between the parties translates into a unit price \(v-y/d\) charged to the buyer, which gives him a discount off the regular price v (Banerjee, 1986). The total relevant costs of the buyer are reduced by the side payment y and the fraction \(\alpha \) of the supplier’s net profit (3), and equal for the buyer type i to

Let

respectively represent the buyer’s own inventory-related costs plus those of the supplier which become partially internalized by the buyer (as indicated by the superscript \(\alpha \)). The order size that minimizes (5) is

Note that with \(\alpha =0\), it represents the classical economic order quantity (EOQ) of the buyer type i (Silver et al., 1998), and with \(\alpha =1\), it represents the joint economic lot size (JELS) of the supplier and that buyer type (Banerjee, 1986). In the latter case, we will denote the order size \(x^*_{\alpha ,i}\) by

For \(\alpha \in (0,1)\), we will refer to \(x^*_{\alpha ,i}\) as the partially joint economic lot size (PJELS) because in this case, the buyer holds a partial stake in the supplier. Since \(x^*_{\alpha ,i}\) minimizes the cost expression in (5) and, ultimately, in (4), this order size will be preferred by the respective buyer type i. On the other hand, the supplier’s preferred order size is the one that minimizes her cost function \(K^P(x)\) defined in (1), being thus represented by her economic lot size (ELS):

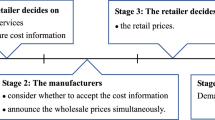

We assume the supplier to have the initiative of offering contracts to the buyer, which is a common assumption in the related literature (Corbett & de Groote, 2000; Sucky, 2006; Voigt & Inderfurth, 2011; Zissis et al., 2015; Kerkkamp et al., 2018); we maintain this assumption for all \(\alpha \in [0,1)\) in line with the studies reviewed in Sect. 2 (Dasgupta & Tao, 2000; Harbaugh, 2001; Van den Steen, 2002). Knowing the two possible buyer types \(i\in \{1,2\}\), the supplier can anticipate the respective order sizes \(x^*_{\alpha ,i}\). When an order size \(x^*_{\alpha ,i}\) for some \(i\in \{1,2\}\) happens to be unfavorable to her, she can offer the buyer a side payment for adopting a different order size instead—preferably, the joint economic lot size \(x^*_{1,i}\) (Banerjee, 1986). Since there are two possible buyer types, the supplier generally needs to prepare two such offers, each tailored to the specific cost structure of the buyer and comprising the respective JELS and the corresponding side payment. However, there is an opportunity for the buyer to pick an offer intended for the cost structure other than his true one if it is beneficial for him to do so (Sucky, 2006). This leads to opportunistic behavior of the buyer, raising the supplier’s costs and negatively impacting her net profit. Thus, the supplier’s contracting problem represents a principal–agent problem with adverse selection (Laffont & Martimort, 2002). Its solution can accordingly be approached as follows.

In view of the uncertainty about the buyer’s cost structure, the supplier needs to design the offers in a way that would maximize her expected net profit. According to the revelation principle, this can be achieved by means of a truth-inducing direct revelation mechanism (Myerson, 1979, 1982) that requests the buyer to reveal his type while ensuring that he does so truthfully. Such a mechanism can be implemented by designing a menu of take-it-or-leave-it offers:

each consisting of an order size \(x_i\) and a side payment \(y_i\), such that the buyer type i would prefer the i-th offer. This procedure is known as screening, which leads to self-selection by the buyer (Kreps, 1990). By virtue of (3)–(6), the supplier solves the following non-linear optimization problem:

where \(x_1,x_2,y_1,y_2\) are decision variables and \(x_1,x_2>0\) (note that \(y_1,y_2\ge 0\) by virtue of (10) and (11)). Objective (9) minimizes the supplier’s expected costs, which is equivalent to maximizing her expected net profit as per (3).Footnote 1 Constraints (10)–(11) represent the individual rationality constraints. They require that accepting the respective offer does not increase the buyer’s costs (5) beyond the level guaranteed by his optimal lot-sizing (6). These constraints hence ensure that the buyer of either type accepts the respective offer. Constraints (12)–(13) represent the incentive-compatibility constraints, which require the offers to be designed in a way that the buyer type 1 weakly prefers the 1\(^{\mathrm{st}}\) offer to the 2\(^{\mathrm{nd}}\), and vice versa—which ensures truthful revelation of the buyer type. We collate the model notation in Table 1. Table 2 summarizes the model assumptions. To facilitate the model solution, we apply the following transformation to problem (9)–(13):

Note that \(z_i\) represents the effective side payment received by the buyer type i, due to the buyer’s ownership share \(\alpha \) in the supplier. By virtue of (14)–(15), we can rewrite problem (9)–(13) as follows:

We solve problem (16)–(20) in closed form, which facilitates the analysis of optimal contracting in dependence from the ownership share \(\alpha \). A closed-form solution to (16)–(20) is derived using Karush–Kuhn–Tucker (KKT) conditions (Bazaraa et al., 2006, Chapter 4). The solution approach consists of (i) determining all KKT solutions of problem (16)–(20), and (ii) choosing from the KKT solutions one with the smallest objective value.

With regard to (i), we collate the results in Table 3 (detailed derivations are available from the authors). Specifically, Table 3 comprises 15 candidate solutions, each representing a menu of offers. The menus are divided into eight generic menu types, each corresponding to one possible combination of non-binding constraints in the problem (16)–(20) (Sucky, 2006; Pishchulov et al., 2016). Menu types 1–3 each comprise a single menu, called menus 1–3. Menu types 4, 5 and 7, 8 each comprise two menus, to which we shall refer as 4a–b, 5a–b, 7a–b and 8a–b, respectively. Menu type 6 comprises four menus, to which we shall refer as 6a–d. Sub-indexing of menus of the types 4 to 6 with literals a, b, c, d follows the lexicographic order of lot sizes \(x_{i_{1,2}}\) in the respective menu type in Table 3 (\(i=1,2\)): e.g., in the menu 4a, the order size \(x_2\) is set equal to \(x_{2_1}\), while in the menu 4b, to \(x_{2_2}\). Sub-indexing of menus of types 7 and 8 follows the order of their appearance in Table 3 (Pishchulov & Richter, 2016). If a candidate menu of offers satisfies the respective feasibility and necessary optimality conditions (Table 3), it qualifies as a KKT solution. There may exist multiple KKT solutions, hence in step (ii) we choose a KKT solution with the smallest objective value. Finally, by substituting \(y_i=\beta z_i\ (i=1,2)\), we obtain a menu of offers that solves the original problem (9)–(13). In the following, we shall elaborate properties of optimal solutions that will allow us to simplify steps (i) and (ii). For ease of exposition, we postpone this analysis to Sect. 6.

4 Effects of partial vertical integration on supply-chain coordination and performance

The optimal contracting solution presented in the previous section allows us to study the effect that the degree of partial integration between the supplier and the buyer takes on the level of coordination achieved in the supply chain. A supply chain is said to be coordinated if the actions taken by its members in their own interest happen to be optimal for the supply chain as a whole. If a particular form of the contract between supply-chain members is capable of inducing such behavior—by providing proper incentives to each party—then such contract form is said to coordinate the supply chain (Cachon, 2003).

Several studies have, however, demonstrated that coordinating contracts may lose their coordinating capability in the presence of asymmetric information (see e.g. Cachon, 2003; Corbett & de Groote, 2000; Corbett et al., 2004; Ha, 2001). This holds also true in our setting. To see this, consider first the case of fully independent firms—by assuming \(\alpha =0\). We know from Sect. 3 that order size \(\hbox {JELS}_i\) minimizes the supply-chain costs when the buyer is of type i. Hence, the supply chain is coordinated if the order size adopted by the supply-chain members happens to be \(\hbox {JELS}_i\), given that the buyer’s true cost structure is \(\{B_i,h_{A,i}\}\). In the case of symmetric information—i.e., when the buyer’s true type \({\hat{\imath }}\) is known to both parties, they can contract on the order size and size payment (x, y) defined as

where \(x^*_{0,{\hat{\imath }}}\) represents the buyer’s economic order quantity as per equation (6). This uniquely determined contract minimizes the supplier’s costs without making the buyer worse off, and, at the same time, it coordinates the supply chain by leading the parties to adopt the respective joint economic lot size (Banerjee, 1986; Sucky, 2006). The situation is, however, different in the presence of asymmetric information. The opportunity for the buyer to abuse his private information leads the supplier to solving the contracting problem (9)–(13). Obviously, the supply chain will become coordinated—regardless of the buyer’s true cost structure—whenever the optimal solution is represented by a menu of offers with order sizes \(x_1=\text {JELS}_1\) and \(x_2=\text {JELS}_2\). We can infer from Table 3 that these are, in particular: (i) the menu of offers of type 1 (menu 1), (ii) the first of the two menus of type 7 (menu 7a), and (iii) the first of the two menus of type 8 (menu 8a). We elaborate in Propositions 1 and 2 below the conditions under which these menus of offers represent an optimal solution to the supplier’s problem. This can indeed be the case for certain problem instances (see Example 4 in Table 4 below). In that event, the resulting supply-chain costs will, with certainty, be at their minimum due to coordination. When, however, optimal contracting leads to a menu of offers other than 1, 7a, 8a, supply-chain coordination will not be achieved with some non-zero probability. The loss of efficiency (in the expectation) occurs in such situations particularly due to the ability of the buyer to extract information rent from his private information, which is in line with the existing studies (Laffont & Martimort, 2002; Zissis et al., 2015; Kerkkamp et al., 2018).

A proposition made in the literature is that partial vertical integration via equity participation may facilitate contracting between supply-chain partners by aligning their incentives, thus improving the total surplus (Pisano, 1989; Gulati, 1995; Allen & Phillips, 2000; Fee et al., 2006). ’Common sense’ may suggest that the firms’ incentives become progressively aligned with the increase of partial integration (manifested in parameter \(\alpha \)), so that the total surplus increases in \(\alpha \), approaching its maximum as \(\alpha \) approaches unity. We below demonstrate that this intuition does not, in general, hold true. We first introduce additional definitions and notation based on Pishchulov et al. (2016).

Given the constancy of demand d met by the supply chain under study, as well as the constancy of unit costs and revenues assumed for our setting, a reduction of total supply-chain costs represents accordingly an improvement of total surplus, which is thus maximized when the supply chain becomes coordinated. Therefore, we will use the minimum total costs of the vertically integrated supply chain as a benchmark for the performance of that supply chain when it lacks full vertical integration and is controlled by the participating firms in a decentralized fashion. We denote the total relevant supply-chain costs when the buyer is of type i and x is the order size adopted by the parties by

From both the supplier’s and the supply-chain perspective, there is uncertainty about the buyer’s true cost structure—embodied in probabilities \(\omega _i\)—which leads us to considering the expected value of (21) as the performance indicator of the supply chain (see also Corbett et al., 2004). We will be interested in the supply-chain performance under optimal contracting as determined by an optimal solution of problem (9)–(13). Let such solution be represented, for the given \(\alpha \), by the menu of offers

We then define the following expected costs under optimal contracting:

as the performance level realized by the supply chain, with \(\alpha \) representing the degree of partial integration. We assume that, if there are several menus of offers (22) that solve (9)–(13) and, thus, happen to be optimal to the supplier, then she chooses from them one for which the expected supply-chain costs in (23) are minimal. The resulting performance level \({\hat{K}}(\alpha )\) is then to be compared with the benchmark

which represents the minimum expected supply-chain costs under full integration, and where \(x^*_{1,i}\equiv \text {JELS}_i\), as defined in (6). The difference \( {\hat{K}}(\alpha ) - K^*\) is called coordination deficit, which is obviously a non-negative value that captures the informational inefficiency of contracting. In accordance with the definition of coordination given at the beginning of this section, the supply chain is coordinated when the coordination deficit equals zero. Indeed, in this case, actions taken by the supply-chain members in their own interest yield a supply-chain performance matching the optimal level \(K^*\). Otherwise, when the coordination deficit is positive, supply-chain performance is suboptimal, and hence the supply chain lacks coordination.

We next consider a number of examples that illustrate possible effects of partial integration on supply-chain coordination and performance. Table 4 presents seven problem instances, of which we refer here to Examples 1 to 5. Figure 3a–e depict supply-chain performance \({\hat{K}}(\alpha )\) in the respective examples.

Supply-chain performance realized at various degrees of partial vertical integration in Examples 1–5. \(K^*\) represents the performance benchmark in each example. Graph colouring highlights the ranges of \(\alpha \) over which a specific menu type is optimal (see Table 3). The numbers in circles indicate menu type

In each graph, the degree \(\alpha \) of partial integration varies from 0 to 1. The respective performance benchmark \(K^*\) is indicated in each figure as well. Each plot also highlights the menu type (cf. Table 3) that proves to be optimal in the respective range of \(\alpha \); the numbers in circles indicate that menu type. Note that we employ closed-form solutions derived in Sect. 3 to produce Fig. 3a–e. Specifically, \({\hat{K}}(\alpha )\) and \(K^*\) are defined by Eqs. (23)–(24). Equation (23), in turn, uses an optimal menu of contracts which we obtain in Sect. 3 as a solution to contracting problem (16)–(20) and present in closed form in Table 3. Equation (24) uses optimal lot sizes presented in closed form in equation (7). Figure 3a–e confirm the observations below (Pishchulov et al., 2016).

Observation 1

In certain problem instances, a partial vertical integration via a minority equity holding can be sufficient for achieving supply-chain coordination under optimal contracting, thus obviating the need for the full vertical integration (Fig. 3a, c).

Observation 2

Supply-chain performance needs not to be strictly monotonic in the degree of partial vertical integration (Fig. 3b), nor does it need to be weakly monotonic (Fig. 3c, d).

Observation 3

Coordination can be lost with increasing degree of partial integration (Fig. 3c), even if it persisted from the outset (Fig. 3d)—whereas in other cases, coordination may not be achievable at any degree of partial vertical integration (Fig. 3e).

Observation 1 highlights the cases in which partial vertical integration takes a positive effect on supply-chain performance and coordination. It comes about because equity participation creates a bond between the partners, helping them to align their incentives and overcome contractual complications, as discussed in Sect. 1. In such situations, tighter integration strengthens this bond by making the investing firm ”partially internalize the effect of its actions on a trading partner” (Fee et al., 2006). Observation 2 indicates, however, that supply-chain performance does not need to always improve with tightening integration because the partners’ incentives may remain insensitive to equity participation within certain bounds or may even become distorted so that supply-chain performance deteriorates. Indeed, Observation 3 stresses that increasing integration beyond a certain point may become detrimental for supply-chain coordination when this creates incentives for the investing firm to act opportunistically. In such situations, there are limits to which firms can usefully internalize the effect of their actions. In practice, limits to partial integration may also exist due to reluctance of the investee to be exposed to too much influence by the investing partner (Allen & Phillips, 2000; Fee et al., 2006).

Observation 1 further indicates that coordination can be achieved in our setting with a minority stake of the less powerful party (the buyer) in the more powerful party (the supplier), which is in contrast to findings by Chen et al. (2017) for their non-cooperative setting. Furthermore, Observation 2 is in marked contrast with the monotonic dependence of supply-chain performance on the degree of integration in their setting. Observations similar to ours have been made by Illing (1992) in a bargaining setting with shared property rights. It becomes of interest to derive more general conclusions about the relationship between the degree of partial integration and supply-chain performance and coordination. In the following section, we establish its key properties and make them subject to interpretation.

5 Emergence and persistence of coordination

In this section we investigate conditions, under which supply-chain coordination emerges and persists with varying degrees of partial integration. We divide this analysis into two cases: when the system-optimal JELS does not depend on the buyer’s cost structure, and when it does. To simplify the subsequent exposition, we employ the following notation:

Furthermore, let \(\text {ELS}\equiv x_P^*\) represent the supplier’s economic lot size and \(\text {EOQ}_i\equiv x^*_{0,i}\)—the economic order quantity of the buyer type i as per (6), (8).

5.1 When JELS does not depend on the buyer’s cost structure

Consider first the class of problem instances in which the buyer’s specific cost structure does not affect the system-optimal lot sizing—so that \(\text {JELS}_1=\text {JELS}_2\). We obtain the following result, which is a generalisation of Pishchulov and Richter (2016, Proposition 3).

Proposition 1

Let \(\text {JELS}_1=\text {JELS}_2\) hold. Then the buyer’s possible cost structures either coincide or strictly dominate one another in Pareto sense. Without loss of generality, assume that \(B_1\ge B_2\) and \(h_{A,1}\ge h_{A,2}\). Then the following is true:

-

i)

If \(\text {EOQ}_1=\text {EOQ}_2=\text {ELS}\) then the supply chain happens to be coordinated at every degree of partial vertical integration \(\alpha \in [0,1)\) without contracting on the lot size.

-

ii)

Otherwise, if \(\omega _1\le H_2/H_1\) holds, then optimal contracting leads to supply-chain coordination at every degree of partial vertical integration \(\alpha \in [0,1)\).

-

iii)

Otherwise, optimal contracting does not lead to supply-chain coordination at any \(\alpha \in [0,1)\).

Proof

The proof follows that of Pishchulov and Richter (2016, Prop. 3) and is available on request. \(\square \)

Assertion i) of the proposition concerns cases when contracting on the lot size is unnecessary, and is in accordance with intuition. For all other cases, assertions ii)–iii) state that optimal contracting either yields coordination irrespective of the degree of partial vertical integration, or is otherwise unable to do so at any degree \(\alpha \in [0,1)\)—despite the identity \(\text {JELS}_1=\text {JELS}_2\) (see Fig. 3e). Specifically, the proof of Proposition 1 shows that in ii), it is optimal for the supplier to offer a menu 1, 7a, or 8a to the buyer, which yields coordination, whereas in iii), the supplier will offer a menu of type 4 or 5, so that coordination fails. Pishchulov and Richter (2016, p. 717) provide interpretation of this result for the case of \(\alpha =0\), which carries over to \(\alpha >0\) in a straightforward way (we therefore omit this exposition here for reasons of space).

To summarize, by applying Proposition 1 to a problem instance with \(\text {JELS}_1=\text {JELS}_2\), we can easily determine once and for all \(\alpha \in [0,1)\) whether coordination is achievable. The implication of the proposition is that managerial decision-making with regard to the choice of \(\alpha \) becomes significantly simplified when the system-optimal policy is insensitive to the buyer’s cost structure. Especially when assertions i) or ii) of the proposition hold, the decision-makers are assured that the supply chain can be coordinated under any specific choice of \(\alpha \). Otherwise, when assertion iii) holds, the supply chain is expected to operate inefficiently at any degree of partial integration. In the latter case, the expected amount of inefficiency still depends on \(\alpha \). We will investigate this dependence in Sect. 6 below.

5.2 When JELS depends on the buyer’s cost structure

We next refer to the class of instances with \(\text {JELS}_1\ne \text {JELS}_2\)—i.e., when the buyer’s cost structure affects the system-optimal lot sizing. For brevity, let

Further, for an order size x, let

represent the difference in the supply-chain costs under the buyer’s cost structures no. 1 and 2. Let further

represent the difference in the effective inventory-related costs incurred by the buyer types 1 and 2 when adopting the respectively optimal partially joint economic lot sizes. We then obtain the following result.

Proposition 2

Let \(\text {JELS}_1\ne \text {JELS}_2\) hold, and let \(\alpha \in [0,1)\) be given. Optimal contracting yields supply-chain coordination if and only if the following holds:

Proof

The proof is straightforward and based on the feasibility conditions of the menu of offers of type 1 (see Table 3). We present the proof in Sect. A.1 of Appendix A in full detail. \(\square \)

Thus, given \(\text {JELS}_1\ne \text {JELS}_2\), optimal contracting yields coordination whenever \({\widetilde{K}}(\alpha )\) is found within the bounds \([{\overline{K}}(\text {JELS}_1),{\overline{K}}(\text {JELS}_2)]\). Figure 4 illustrates this in Examples 1 and 3 of Sect. 4 (Fig. 3a, c). Note that given \(\text {JELS}_1\ne \text {JELS}_2\), coordination can only be achieved with the menu of offers of type 1, whereas menus 7a and 8a cannot be coordinating. The reason of this is that the latter menus are either undefined (when the buyer’s possible cost structures are weakly Pareto-efficient) or fail to offer the order sizes \(x_i=\text {JELS}_i\) to the buyer types \(i=1,2\) (see Table 3).

Using condition (28), we can easily determine whether optimal contracting leads to supply-chain coordination without any vertical integration. If not, then it becomes of interest to know the minimum degree of (partial) integration at which coordination would emerge. This question is answered by the following corollary from Proposition 2 and continuity of \({\widetilde{K}}(\alpha )\).

Corollary 1

Let \(\text {JELS}_1\ne \text {JELS}_2\) hold. If optimal contracting does not lead to supply-chain coordination in the absence of partial integration then the minimum degree of integration at which it does is the smallest \(\alpha \), for which any of the two inequalities in (28) holds as equality.

Figure 4 illustrates this. Note that exactly one of the two inequalities in condition (28) is violated when there is no coordination. When the graph of \({\widetilde{K}}(\alpha )\) enters the corridor of values \([{\overline{K}}(\text {JELS}_1),{\overline{K}}(\text {JELS}_2)]\) for the first time, condition (28) becomes satisfied as equality, which enables coordination. We have not been able to derive a closed-form expression of such a minimum ’coordinating’ degree of partial integration, but it can be easily obtained for a given problem instance by solving the respective equation numerically. Below we gain insight into the mechanism underlying the ’coordinating’ capability of partial integration.

Achieving supply-chain coordination by virtue of condition (28) in Examples 1 (left) and 3 (right)

Interpretation 1

(Achieving coordination via partial integration) We use Example 1 for this purpose, see Fig. 3a. Figure 5a depicts the cost curves and the menu of offers of type 1 when \(\alpha =0\). There is obviously a lack of coordination because the menu of type 1 is not incentive-compatible, as buyer type 1 prefers to pick the 2\(^{\mathrm{nd}}\) offer. In turn, Fig. 5b represents the situation with \(\alpha =0.36\), where the menu of type 1 happens to be incentive-compatible and yields coordination (note that for ease of exposition, we represent the side payments in terms of \(z_1,z_2\)). Thus, increasing \(\alpha \) from 0 to 0.36 is just sufficient to make the incentives of the system-optimal menu of offers compatible with the buyer types.

To see the reason of this, observe that at each value of \(\alpha \), the (in)compatibility of the said incentives results from interaction between three curves: \(K^P(x)\), \(K^A_1(x)\) and \(K^A_2(x)\). Specifically, a degree \(\alpha \) of partial vertical integration makes the buyer type i act in terms of the cost function \( K^\alpha _i(x) = K^A_i(x) + \alpha K^P(x). \) Thus, with growing \(\alpha \), his effective cost function becomes determined to an ever bigger extent by the supplier’s cost function \(K^P(x)\). This changes the shape and position of both buyer types’ curves \(K^\alpha _i(x)\), as illustrated by Fig. 5a, b. This, in turn, has two consequences: first, the order size \(\text {PJELS}_1\) moves away from \(x_2=\text {JELS}_2\), which increases the cost of adopting \(x_2\) instead of \(\text {PJELS}_1\) for the buyer type 1; second, the order size \(\text {PJELS}_2\) moves closer to \(x_2=\text {JELS}_2\), which decreases the side payment \(z_2\) intended as compensation for adopting the order size \(x_2\). Both these effects—increasing cost and decreasing compensation—jointly reduce the attractiveness of choosing \((x_2,z_2)\) for the buyer type 1, until any benefit of doing so disappears at \(\alpha \approx 0.36\), as it is presented in Fig. 5b.

We can gain a deeper insight into the magnitude of the above two effects by considering the components \(K^A_i(x)\) and \(\alpha K^P(x)\) of the i-th buyer type cost function separately. Note that in Fig. 5a, function \(K^\alpha _i(x)\) represents just \(K^A_i(x)\), \(i=1,2\). Let \(\alpha =0\), and refer to buyer type 1 first. We know that with increasing \(\alpha \), his individually optimal order size \(\text {PJELS}_1\) shifts to the right. Looking at Fig. 5a, we can see that two forces then come into play: (i) the component \(K^A_1(\text {PJELS}_1)\) of his optimum costs will increase, so that the contribution \(K^A_1(\text {JELS}_2)-K^A_1(\text {PJELS}_1)\) to his cost of adopting \(\text {JELS}_2\) instead of \(\text {PJELS}_1\) will decrease; and (ii) the supplier’s cost \(K^P(\text {PJELS}_1)\) will decrease, so that the contribution \(\alpha \cdot [K^P(\text {JELS}_2)-K^P(\text {PJELS}_1)]\) to his cost of adopting \(\text {JELS}_2\) instead of \(\text {PJELS}_1\) will increase. Note that force (i) drives this buyer type’s own cost, whereas force (ii)—his internalized cost due to shared ownership. The second force is dominating, so that, in effect, the cost of adopting \(\text {JELS}_2\) instead of \(\text {PJELS}_1\) by the buyer type 1 will increase.

We proceed in a similar way with the buyer type 2. We know that, with increasing \(\alpha \), his individually optimal order size \(\text {PJELS}_2\) shifts to the right. We can see in Fig. 5a that the following two forces then emerge: (iii) the cost component \(K^A_2(\text {PJELS}_2)\) will increase, so that the respective contribution \(K^A_2(\text {JELS}_2)-K^A_2(\text {PJELS}_2)\) to the compensation \(z_2\) will decrease; and (iv) the supplier’s cost \(K^P(\text {PJELS}_2)\) will decrease, but the negative contribution \(\alpha \cdot [K^P(\text {JELS}_2)-K^P(\text {PJELS}_2)]\) to the compensation \(z_2\) will decrease with \(\alpha \) either (i.e., its absolute value will increase)—which happens due to smallness of the multiplier \(\alpha \).Footnote 2 Thus, both forces jointly lessen the amount of compensation \(z_2\).

Table 5 collates the meaning of forces (i)–(iv). Summarizing, forces (ii)–(iv) act to restore incentive-compatibility, while force (i) counteracts. The former are dominating to the extent that incentive-compatibility becomes restored when \(\alpha \approx 0.36\). In general, the strength and direction of these forces depend on the shape and position of the cost curves \(K^P(x)\), \(K^A_1(x)\), \(K^A_2(x)\), and so does their net effect. \(\square \)

Figure 4 suggests that tightening integration may, however, defeat coordination, forcing \({\widetilde{K}}(\alpha )\) to leave the corridor of values \([{\overline{K}}(\text {JELS}_1),{\overline{K}}(\text {JELS}_2)]\). Figure 3c, d in Sect. 4 illustrate this by depicting supply-chain performance \({\hat{K}}(\alpha )\). We below explain this mechanism in greater detail.

Interpretation 2

(Coordination loss due to partial integration) We use Example 4 for this purpose. Recall that in this example, supply-chain coordination is achieved without any vertical integration (see Fig. 3d). Figure 6a shows that the system-optimal menu of offers of type 1 is indeed incentive-compatible when \(\alpha =0\): none of the buyer types would benefit from choosing the offer intended for the other type. A slight increase of \(\alpha \) to \(\approx 0.012\) leads, however, to coordination failure as it becomes more attractive for the buyer type 2 to choose the 1\(^{\mathrm{st}}\) offer. For illustrative purposes, we depict this situation in Fig. 6b with \(\alpha =0.12\). Note that, as \(\alpha \) increases, both \(\text {PJELS}_1\) and \(\text {PJELS}_2\) move to the right.

The above Interpretation 1 has identified forces (i)–(iv) that govern the development of incentives in the system-optimal menu of offers with varying \(\alpha \) (Table 5). We can similarly observe action of these forces here by referring to Fig. 6a: (i) the contribution \(K^A_2(\text {JELS}_1)-K^A_2(\text {PJELS}_2)\) to the cost of adopting \(\text {JELS}_1\) instead of \(\text {PJELS}_2\) by the buyer type 2 is decreasing; (ii) the contribution \(\alpha \cdot [K^P(\text {JELS}_1)-K^P(\text {PJELS}_2)]\) to that cost is decreasing either (i.e., its absolute value is increasing)—due to smallness of the multiplier \(\alpha \); (iii) the contribution \(K^A_1(\text {JELS}_1)-K^A_1(\text {PJELS}_1)\) to the compensation \(z_1\) is decreasing; and (iv) the contribution \(\alpha \cdot [K^P(\text {JELS}_1)-K^P(\text {PJELS}_1)]\) to the compensation \(z_1\) is also decreasing. Thus, both the costs of adopting \(\text {JELS}_1\) by the buyer type 2 and the compensation for that are decreasing. The former effect is, however, more pronounced—so that the compensation exceeds the costs. This is determined by the position of the curves \(K^A_{1,2}(x)\): first, observe that the order size \(\text {EOQ}_2\equiv \left. \text {PJELS}_2\right| _{\alpha =0}\) deviates from \(\text {JELS}_2\) more so than \(\text {EOQ}_1\equiv \left. \text {PJELS}_1\right| _{\alpha =0}\) deviates from \(\text {JELS}_1\) (Fig. 6a). As a result, \(\text {PJELS}_2\) moves with increasing \(\alpha \) faster to the right than \(\text {PJELS}_1\) does, as Fig. 6b illustrates. This leads to stronger growth along the curve \(K^A_2(x)\) in Fig. 6a than along the curve \(K^A_1(x)\), despite the latter growing steeper than the former. As a result, force (i) is stronger than force (iii). Secondly, although the curve \(K^P(x)\) exhibits a bigger reduction in the magnitude of decline over the interval \([\text {PJELS}_2,\text {JELS}_1]\) than it does over \([\text {PJELS}_1,\text {JELS}_1]\), force (ii) is still stronger than force (iv) due to smallness of \(\alpha \). In effect, the cost of adopting \(\text {JELS}_1\) by the buyer type 2 declines faster than the respective compensation, which distorts the incentives and leads to the loss of coordination despite a higher degree of partial integration. \(\square \)

It thus becomes of interest to derive the conditions under which supply-chain coordination, once attained at a particular \(\alpha _0\), persists also for \(\alpha >\alpha _0\). To this end, let \(H_P\), \({\overline{B}}\), \({\overline{h}}_A\) be as defined in (26). Consider the following two critical numbers:

Note that a critical number is undefined if its expression in (29) has a zero denominator. We will below prove that critical numbers \({\hat{\alpha }}\) and \({\check{\alpha }}\), when defined, represent stationary points of \({\widetilde{K}}(\alpha )\). The following intermediate result is helpful in characterizing the persistence of coordination.

Lemma 1

At most one of the two critical numbers \({\hat{\alpha }}\) and \({\check{\alpha }}\) is defined and positive.

Proof

See Sect. A.2 of Appendix A. \(\square \)

Hence, by virtue of Lemma 1, critical numbers \({\hat{\alpha }}\) and \({\check{\alpha }}\), when both are defined, cannot be both positive. Let now some \(\alpha _0\in [0,1)\) be given. If there is a critical number that lies within the open interval \((\alpha _0,1)\) then this number is uniquely determined by virtue of Lemma 1. We will denote this number by \({\widetilde{\alpha }}_0\), and otherwise consider \({\widetilde{\alpha }}_0\) as undefined. Thus, in formal terms:

Then, we obtain the following

Proposition 3

Let \(\text {JELS}_1\ne \text {JELS}_2\) hold, and let \(\alpha _0\in [0,1)\) be given. Optimal contracting yields supply-chain coordination at every \(\alpha \in [\alpha _0,1)\) if and only if condition (28) holds for \(\alpha =\alpha _0\) and for \(\alpha ={\widetilde{\alpha }}_0\) when the latter is defined.

Proof

See Sect. A.3 of Appendix A. \(\square \)

Using Proposition 3, we can easily establish whether supply-chain coordination persists with an increasing degree of partial vertical integration in a problem instance when \(\text {JELS}_1\ne \text {JELS}_2\). If coordination is achieved with some \(\alpha _0\in [0,1)\), it requires then to verify condition (28) for at most one additional value of \(\alpha \). Indeed, when condition (28) holds at \(\alpha =\alpha _0\), and \({\widetilde{K}}(\alpha )\) has no local extrema on \((\alpha _0,1)\), then (28) will automatically hold for all \(\alpha \in [\alpha _0,1)\)—as it can be shown that (28) is guaranteed to hold for \(\alpha =1\). This is illustrated by the left-hand graph in Fig. 4. The proof of Proposition 3 shows that, in such cases, \({\widetilde{\alpha }}_0\) is undefined. However, when \({\widetilde{K}}(\alpha )\) has a local extremum on \((\alpha _0,1)\), then it must occur at \({\widetilde{\alpha }}_0\); for this reason, it suffices to check condition (28) at \(\alpha ={\widetilde{\alpha }}_0\) in order to establish the persistence of coordination for all \(\alpha \in [\alpha _0,1)\). For example, the right-hand graph in Fig. 4 exhibits an extremum beyond the corridor \([{\overline{K}}(\text {JELS}_1),{\overline{K}}(\text {JELS}_2)]\). As a result, there exists a range of values around \({\widetilde{\alpha }}_0\approx 0.46\) at which optimal contracting does not lead to supply-chain coordination (cf. Fig. 3c). Propositions 1 and 3 further imply:

Corollary 2

If optimal contracting yields coordination at some \(\alpha _0\) then there exists at most one interval \(({\underline{\alpha }},{\bar{\alpha }})\subseteq (\alpha _0,1)\), maximal by inclusion, where optimal contracting will not yield coordination.

Figures 3a–d demonstrate this for problem instances when \(\text {JELS}_1\ne \text {JELS}_2\): once supply-chain performance \({\hat{K}}(\alpha )\) reaches the benchmark level \(K^*\) at some \(\alpha _0\), it leaves that level with increasing \(\alpha \) at most once. This is because function \({\widetilde{K}}(\alpha )\) has at most one extremum on interval (0, 1), as explained by the following

Interpretation 3

(Corollary 2) We refer to Example 3 for this purpose. Figure 3c depicts supply-chain performance \({\hat{K}}(\alpha )\), whereas the right-hand graph in Fig. 4 depicts the corresponding function \({\widetilde{K}}(\alpha )\). At \(\alpha =0\), \({\widetilde{K}}(\alpha )\) is found beyond the corridor \([{\overline{K}}(\text {JELS}_1),{\overline{K}}(\text {JELS}_2)]\), which implies incentive-incompatibility of the menu of offers of type 1 and lack of coordination, as per Proposition 2. However, increasing \(\alpha \) allows to gradually remove incentive-incompatibility, as per Interpretation 1, so that \({\widetilde{K}}(\alpha )\) enters the said corridor. Increasing \(\alpha \) even further distorts the incentives again, as per Interpretation 2. The maximum distortion obviously occurs at the extremum of \({\widetilde{K}}(\alpha )\), after which incentives begin to restore towards compatibility, ultimately leading to coordination. This turnaround in the development of incentives can be explained in terms of forces (i)–(iv) (see Table 5). In fact, these forces come to balancing each other at the functions’s extremum because the latter occurs at \(\alpha ={\check{\alpha }}\), which is the degree of partial integration at which \(\hbox {PJELS}_1\) and \(\hbox {PJELS}_2\) coincide. By inspecting the contributions to the cost and compensation driven by forces (i)–(iv), as expressed in Interpretation 2, it is easy to verify that such \(\alpha \) for which \(\text {PJELS}_1=\text {PJELS}_2\) holds indeed makes the marginal cost (a combined effect of forces (i)–(ii)) equal to the marginal compensation (a combined effect of forces (iii)–(iv)). Thus the process of incentives distortion, manifested in the stronger increase of compensation received by the buyer type 2 when picking the 1\(^{\mathrm{st}}\) offer, as compared to his cost of doing so, stops at this point and begins to move in the opposite direction towards restoration of incentive-compatibility. By inspecting the motion of \(\hbox {PJELS}_1\) and \(\hbox {PJELS}_2\) in Fig. 6a, b, it is easy to see that they may cross only once. Furthermore, the proof of Proposition 3 reveals that the extremum of \({\widetilde{K}}(\alpha )\) may also occur at \(\alpha ={\hat{\alpha }}\), which is the degree at which the supplier’s ELS is equal to the geometric mean of \(\hbox {PJELS}_1\) and \(\hbox {PJELS}_2\). Again, by inspecting Fig. 6a, b, it easy to see that this is not possible to happen in the given example. This explains the uniqueness of extremum of \({\widetilde{K}}(\alpha )\) and the assertion of Corollary 2 that coordination can be lost ’at most once’. \(\square \)

The key outcomes and implications of the analysis in this section are three-fold. First, when the system-optimal policy does not depend on the buyer’s cost structure (so that \(\text {JELS}_1=\text {JELS}_2\)), Proposition 1 states that coordination will either persist at all degrees of partial integration or cannot be achieved at any. In contrast, when the system-optimal policy depends on the buyer’s cost structure (so that \(\text {JELS}_1\ne \text {JELS}_2\)), dependence of supply-chain coordination on the degree of partial integration is more intricate: an ownership share of the buyer in the supplier can help the supply chain to remove informational inefficiency from the operational stage and thus achieve coordination. This share can be determined by means of Proposition 2 and Corollary 1. Yet increasing this share must not necessarily do better, as it may distort the buyer’s incentives to the extent that inefficiency reappears and coordination fails. Proposition 3 derives conditions for this to happen, which needs to be accordingly checked for when choosing the level of integration.

6 Dependence of supply-chain performance on the degree of partial integration

We now turn to investigating properties of dependence between the degree of partial vertical integration and supply-chain performance. From Sect. 3, we know that candidate solutions to contracting problem (9)–(13) are determined by 15 expressions of menus of offers, which are divided into eight generic types according to the feasibility and necessary optimality conditions. Table 3 specifies expressions of these 15 menus of offers. We can treat these expressions as vector-valued functions

where the menus of the same type are sub-indexed with literals (see Sect. 3). For the given value of \(\alpha \), an optimal menu of offers is selected from \(\left\{ \nu _m(\alpha )\right\} _{m\in M}\) as described in Sect. 4: see eqs. (22) and (23). The following result stems directly from Pishchulov and Richter (2016, Proposition 2) and indicates that we can restrict attention to certain menus only.

Proposition 4

In an optimal menu of offers, \(x_i=\text {JELS}_i\) holds for at least one \(i\in \{1,2\}\).

Proof

The proof follows that of Pishchulov and Richter (2016, Prop. 2) and is available on request. \(\square \)

Hence, for the given \(\alpha \), we may take only those menus into consideration that offer \(x_i=\text {JELS}_i\) to at least one buyer type i. Further, consider the following subset of M:

Then, the proof of Proposition 4 implies the following

Corollary 3

For the given \(\alpha \), an optimal menu of offers \(\nu _o(\alpha )\) with \(o\in \{6\text {a--d},\,7\text {b},\,8\text {b}\}\) must coincide with some other menu \(\nu _m(\alpha )\) such that \(m\in M^*\).

We can therefore disregard menus \(6\text {a--d},\,7\text {b},\,8\text {b}\) and evaluate only those contained in \(M^*\). Further, based on the derivation of the 15 candidate menus of offers in Sect. 3 and their specification in Table 3, it is straightforward to verify the following properties [see also Pishchulov and Richter (2016, Section 4)]: (i) if \(\text {JELS}_1=\text {JELS}_2\) then menus 7a and 8a either coincide with or replace menus 3 and 2, respectively; (ii) if \(\text {JELS}_1\ne \text {JELS}_2\) then menus 7a and 8a cannot be optimal. Hence in either case, we can restrict the analysis to just seven candidate menus of five types (1, 4a–b, 5a–b, 7a, 8a, and 1, 2, 3, 4a–b, 5a–b, respectively). Further to this, we can establish that (iii) menus 7a and 8a are the only candidate menus in \(M^*\) that pool buyer types—that is, contain an identical offer for them both; thus, (iv) with \(\text {JELS}_1\ne \text {JELS}_2\), pooling never occurs in an optimal menu of offers, which means that in such a case, it is always optimal for the supplier to discriminate between the buyer types.

Consider further the partition of \(M^*\) into two subsets:

Assume that for some \(m\in {\overline{M}}\), the menu of offers \(\nu _m(\alpha )\) is respectively optimal for each \(\alpha \) in an open interval \(({\underline{\alpha }},{\bar{\alpha }})\). Then supply-chain performance \({\hat{K}}(\alpha )\) is constant on \(({\underline{\alpha }},{\bar{\alpha }})\). Indeed, Table 3 reveals that the order sizes in the menus of types 1–3 and 7–8 do not depend on \(\alpha \). As a result, optimality of a menu of any of these types for \(\alpha \in ({\underline{\alpha }},{\bar{\alpha }})\) implies that varying \(\alpha \) within these limits does not affect supply-chain performance \({\hat{K}}(\alpha )\). From the preceding discussion, we know that optimality of a menu \(\nu _m(\alpha )\) with \(m\in \{1,\,7\text{ a },\,8\text{ a }\}\) leads to supply-chain coordination and, hence, to the best possible—and constant—supply-chain performance on \(({\underline{\alpha }},{\bar{\alpha }})\). Given optimality of a menu of offers of type 2 or 3, supply-chain performance will remain at a constant level too, which, however, does not need to be the best possible one. This is illustrated by Fig. 3b–d in which menus of offers of type 2 and 3 happen to be optimal over certain ranges of \(\alpha \), so that varying the degree of partial integration within these ranges does not help to improve supply-chain performance. The reason for this invariance of supply-chain performance is that one of the individual rationality constraints (10)–(11) is not binding, so that the optimal solution of the contracting problem (9)–(13) responds to variation of \(\alpha \) within \(({\underline{\alpha }},{\bar{\alpha }})\) by properly adjusting side payments \({\hat{y}}_{\alpha ,1},\,{\hat{y}}_{\alpha ,2}\) while keeping the order sizes \({\hat{x}}_{\alpha ,1},\,{\hat{x}}_{\alpha ,2}\) unchanged (see also Illing, 1992). This is illustrated on Example 2 in Fig. 7: offering \(\text {JELS}_2\) with the effective side payment \(z_2^{\min }\) to buyer type 2 is not feasible because it would lead to buyer type 1 picking this offer. Instead, \(({\hat{x}}_{\alpha ,2},{\hat{z}}_{\alpha ,2})\) is offered to buyer type 2. To prevent buyer type 1 from picking that offer, an effective side payment \({\hat{z}}_{\alpha ,1}={\hat{z}}_{\alpha ,2}+K^\alpha _1({\hat{x}}_{\alpha ,1})-K^\alpha _1({\hat{x}}_{\alpha ,2})\) must be offered to buyer type 1.

We therefore conclude that supply-chain performance can vary only within those ranges of \(\alpha \) where a menu of offers of type 4 or 5 holds optimal. Indeed, individual rationality constraints (10)–(11) happen to be binding at these menus of offers, so that one of the order sizes in the optimal solution becomes subject to variation with varying \(\alpha \), which makes supply-chain performance \({\hat{K}}(\alpha )\) vary as well (cf. Illing, 1992). To further characterize the latter dependence, let

Proposition 5

Assume that, for some \(m\in {\widetilde{M}}\), the menu of offers \(\nu _m(\alpha )\) is respectively optimal for each \(\alpha \) in an open interval \(({\underline{\alpha }},{\bar{\alpha }})\). If supply-chain performance \({\hat{K}}(\alpha )\) is varying on \(({\underline{\alpha }},{\bar{\alpha }})\), then it does so in a strictly monotone way provided that the following condition holds:

Proof

See Sect. A.4 of Appendix A. \(\square \)

Figure 3a–e in Sect. 4 illustrate a strictly monotone dependence of supply-chain performance \({\hat{K}}(\alpha )\) on \(\alpha \) within those ranges where menus of offers of type 4 and 5 happen to be optimal. Note that when the supplier’s economic lot size ELS is found between the buyer’s two possible economic order sizes \(\hbox {EOQ}_1\) and \(\hbox {EOQ}_2\), condition (31) requires that the critical number \({\hat{\alpha }}\), as defined in (29), does not lie within the interval \(({\underline{\alpha }},{\bar{\alpha }})\) to ensure strict monotonicity of \({\hat{K}}(\alpha )\) on that interval. This condition cannot be relaxed, as the following Example 6 demonstrates. Problem data for this example are given in Table 4. It holds that \(\text {EOQ}_1<\text {ELS}<\text {EOQ}_2\), and \({\hat{\alpha \approx }}0.026\). A menu of offers of type 5 happens to be optimal within the range of \(\alpha \in [0,0.11]\). Figure 8a shows the dependence of supply-chain performance on \(\alpha \). Since \({\hat{\alpha \in [}}0,0.11]\), we observe that \({\hat{K}}(\alpha )\) is changing its behaviour at this point, from increasing to decreasing.

In order to gain insight into the likelihood of the emergence of this effect, we have conducted an extensive numerical study encompassing 100,000 randomly generated problem instances (Pishchulov et al., 2016). Specifically, we have set \(p=100\,000\) for all problem instances, and sampled the values of the remaining parameters independently from a uniform distribution. Table 6 indicates sampling ranges. Results reveal that 2,932 problem instances (ca. 3% of their total number) satisfy conditions \(\text {EOQ}_{\min }<\text {ELS}<\text {EOQ}_{\max }\) and \({\hat{\alpha \in [}}0,1]\). At the same time, only 16 of these instances (ca. 0.02% of the total number) exhibit a non-monotonic behavior of supply-chain performance \({\hat{K}}(\alpha )\) within an optimality interval of a menu of type 4 or 5 (Pishchulov et al., 2016) —for the reason that only in that few instances, \({\hat{\alpha }}\) falls within such an interval.Footnote 3

To summarize, increasing or decreasing the degree of partial integration within certain ranges may not have any impact on supply-chain performance. Otherwise, supply-chain performance is likely to change monotonically with the varying degree of integration. An important consequence of the proof of Proposition 5 is the following

Corollary 4

If supply-chain coordination is attained at some \({\bar{\alpha }}\in [0,1)\) then \({\hat{K}}'({\bar{\alpha }})=0\).

Figures 3 and 8 illustrate this: at every point where the graph of supply-chain performance \({\hat{K}}(\alpha )\) attains the benchmark \(K^*\), the gradient of \({\hat{K}}(\alpha )\) vanishes. Therefore, slight variations of the degree of integration in a supply chain that happens to be coordinated should not have a substantial adverse impact on its performance.

Figure 3a–e in Sect. 4 illustrated dependence of supply-chain performance on the degree of partial vertical integration under different parametrizations of the model. These figures may further suggest that when supply-chain performance is monotonic in \(\alpha \), then it exhibits convex behaviour. The following Example 7 demonstrates that this does not need to be the case. Problem data for this example is given in Table 4. Figure 8b shows that, despite a monotonic decrease of \({\hat{K}}(\alpha )\) over interval [0, 0.088], its behavior on this interval is non-convex—in contrast to the previously considered examples. We have not been able to obtain a closed-form characterization of convexity similar to monotonicity results of Proposition 5. However, we found in Pishchulov et al. (2016) that only \(\approx 0.03\%\) of the problem instances in the above numerical study exhibit monotonic but not strictly convex behavior of \({\hat{K}}(\alpha )\).\(^3\) This suggests that, whenever supply-chain performance can be improved by increasing or decreasing the degree of integration, this is likely to occur in a super-linear way; thus, a slight initial increase of \(\alpha \) in Fig. 3a–c is capable of quickly absorbing a substantial portion of coordination deficit.

7 Conclusion and outlook

This paper studied the effects of partial vertical integration on supply-chain coordination and performance—a topic that has been previously understudied in the supply-chain literature. We have employed a conventional model of supply-chain coordination and studied it in a setting with asymmetric information, which may lead to coordination failure and underperformance. Our objective was to investigate the extent to which the proposition made in the literature with regard to the ability of partial integration to improve the total surplus, holds true for the setting under study. From the managerial perspective, ’common sense’ suggesting that supply-chain performance will always improve with tighter integration, proves wrong in our setting. Specifically, a tighter integration may actually harm supply-chain performance, or not have any effect.

Further, our results demonstrate that supply-chain coordination under asymmetric information may be achieved with just a minority equity stake—which is able to absorb coordination deficit and yield the efficiency of a fully integrated supply chain. We provided an economic interpretation of this capability. A ’coordinating’ degree of partial integration turns out to be an outcome of the interplay of four forces that drive the buyer’s cost and compensation, both own and internalized. Specifically, these forces act so that cost and compensation come to balance each other at a ’coordinating’ degree of integration—to the extent that the buyer does not benefit from choosing the offer intended for another buyer type. Furthermore, we have analytically characterized the persistence of efficiency with tighter integration and established conditions under which supply-chain performance would consistently improve with varying degree of partial integration. We have observed such consistent behaviour in most simulated instances. Our analysis also revealed other favourable properties of partial integration: its minor variation is likely to yield a substantial performance improvement in an uncoordinated supply chain, but it would not significantly hurt the performance of a coordinated supply chain.

It must be noted that coordination may be attained in some problem instances at a degree of partial integration of over 50%—so that the assumption of absence of the buyer’s control rights may not hold in practice, unless the buyer obtains his majority ownership by acquiring non-voting shares. In fact, offering non-voting stock can be an attractive option for the supplier when it helps to improve overall efficiency while avoiding dilution of control (Van den Steen, 2002); furthermore, using non-voting stock can help to reduce anticompetitive effects of partial integration (Gilo & Spiegel, 2011; Gilo, 2000).

Our study refers to supply-chain coordination and performance at the operational level, following a strategic decision about partial integration. We acknowledge that negotiating the level of integration requires its own analysis which goes beyond the scope of this study and represents an interesting avenue for future research. The closed-form solution derived in our study facilitates such analysis and can be easily implemented in software. Future work should further investigate coordination effects of partial integration in settings with more general production and shipment policies, settings involving more than two possible cost structures of the buyer, more than two supply-chain members, and closed-loop supply chain settings. Furthermore, it would be of interest to study contracting between the parties when their bargaining power depends on the level of integration.

Notes

The effect of small \(\alpha \) can be explained as follows: consider a negative-valued, increasing function \(f(\alpha )\). Then the derivative \(\left( \alpha f(\alpha )\right) ^\prime =f(\alpha )+\alpha f^\prime (\alpha )\) is obviously negative for sufficiently small values of \(\alpha \), making \(\alpha f(\alpha )\) decrease.

We note that the figures reported are specific to the sample used and may differ depending on the sampling procedure.

References

Aghion, P., & Tirole, J. (1994). The management of innovation. Quarterly Journal of Economics, 109, 1185–1209.

Ahmadjian, C. L., & Lincoln, J. R. (2001). Keiretsu, governance, and learning: Case studies in change from the Japanese automotive industry. Organization Science, 12, 683–701.

Al-Saadon, Y., & Das, S. P. (1996). Host-country policy, transfer pricing and ownership distribution in international joint ventures: A theoretical analysis. International Journal of Industrial Organization, 14, 345–364.

Allen, J. W., & Phillips, G. M. (2000). Corporate equity ownership, strategic alliances, and product market relationships. Journal of Finance, 55, 2791–2815.

Banerjee, A. (1986). A joint economic-lot-size model for purchaser and vendor. Decision Sciences, 17, 292–311.

Bazaraa, M. S., Sherali, H. D., & Shetty, C. M. (2006). Nonlinear programming: Theory and algorithms. Hoboken, NJ: Wiley.

Bolandifar, E., Feng, T., & Zhang, F. (2018). Simple contracts to assure supply under noncontractible capacity and asymmetric cost information. Manufacturing & Service Operations Management, 20, 217–231.

Bowe, M., Golesorkhi, S., & Yamin, M. (2014). Explaining equity shares in international joint ventures: Combining the influence of asset characteristics, culture and institutional differences. Research in International Business and Finance, 31, 212–233.

Buckley, P. J., & Ghauri, P. N. (2004). Globalisation, economic geography and the strategy of multinational enterprises. Journal of International Business Studies, 35, 81–98.

Burnetas, A., Gilbert, S. M., & Smith, C. E. (2007). Quantity discounts in single-period supply contracts with asymmetric demand information. IIE Transactions, 39, 465–479.

Cachon, G. P. (2003). Supply chain coordination with contracts. In A. G. de Kok & S. C. Graves (Eds.), Supply chain management: Design, coordination and operation (pp. 229–339). Amsterdam: Elsevier. chapter 6.

Cachon, G. P., & Zhang, F. (2006). Procuring fast delivery: Sole sourcing with information asymmetry. Management Science, 52, 881–896.

Çakanyıldırım, M., Feng, Q., Gan, X., & Sethi, S. P. (2012). Contracting and coordination under asymmetric production cost information. Production and Operations Management, 21, 345–360.

Chen, J., & Hu, Q. (2015). Optimal payment scheme when the supplier’s quality level and cost are unknown. European Journal of Operational Research, 245, 731–742.

Chen, J., Hu, Q., & Song, J. S. (2017). Effect of partial cross ownership on supply chain performance. European Journal of Operational Research, 258, 525–536.

Choi, T. M., & Cheng, T. C. E. (Eds.). (2011). Supply chain coordination under uncertainty. International Handbooks on Information SystemsBerlin: Springer.

Corbett, C. J., & de Groote, X. (2000). A supplier’s optimal quantity discount policy under asymmetric information. Management Science, 46, 444–450.

Corbett, C. J., Zhou, D., & Tang, C. S. (2004). Designing supply contracts: Contract type and information asymmetry. Management Science, 50, 550–559.

Dasgupta, S., & Tao, Z. (2000). Bargaining, bonding, and partial ownership. International Economic Review, 41, 609–635.

Davis, A. M., & Hyndman, K. (2021). Private information and dynamic bargaining in supply chains: An experimental study. Manufacturing & Service Operations Management, 23, 1449–1467.

Desai, M. A., Foley, C. F., & Hines, J. R., Jr. (2004). The costs of shared ownership: Evidence from international joint ventures. Journal of Financial Economics, 73, 323–374.

Fee, C. E., Hadlock, C. J., & Thomas, S. (2006). Corporate equity ownership and the governance of product market relationships. Journal of Finance, 61, 1217–1251.

Fiocco, R. (2016). The strategic value of partial vertical integration. European Economic Review, 89, 284–302.