Abstract

Contrary to the claims made by several authors, a financial market model in which the price of a risky security follows a reflected geometric Brownian motion is not arbitrage-free. In fact, such models violate even the weakest no-arbitrage condition considered in the literature. Consequently, they do not admit numéraire portfolios or equivalent risk-neutral probability measures, which makes them unsuitable for contingent claim valuation. Unsurprisingly, the published option pricing formulae for such models violate classical no-arbitrage bounds.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a seminal paper, Skorokhod [27] studied the problem of inserting an instantaneously reflecting boundary into the state space of a one-dimensional Itô diffusion. The resulting process is described by an SDE that contains a new term—called a reflection term—that controls reflection off the boundary, along with the usual drift and diffusion terms. In addition to proving existence and uniqueness results for the solution to this SDE, Skorokhod [27] derived an explicit expression for the reflection term. Today we recognise the reflection term as the local time of the diffusion at the reflecting boundary.

Several studies have considered financial market models in which the price of a risky security follows a reflected geometric Brownian motion (RGBM). Such a process is obtained by applying Skorokhod’s [27] construction to a vanilla geometric Brownian motion, causing it to reflect off a lower boundary. For example, Veestraeten [30], Hertrich [10], Neuman and Schied [20] and Hertrich and Zimmermann [12] have used RGBMs to model exchange rates constrained by central bank target zone policies, while Gerber and Pafumi [9] and Ko et al. [17] modelled the value of an investment fund with a capital guarantee as an RGBM. Recently, Thomas [28] modelled house prices as an RGBM, under the assumption that the government will support the property market if prices fall enough. Related models, where the price of a risky security is constrained by reflecting boundaries but the underlying dynamics is not geometric Brownian motion, have been studied by Feng et al. [7] and Melnikov and Wan [19].

Veestraeten [29] claimed that the RGBM model does not offer any arbitrage opportunities. He justified this claim by noting that the security price follows a continuous process and that the time spent by it on the reflecting boundary has Lebesgue measure zero. Based on those observations, he reasoned that arbitrageurs cannot generate riskless profits by purchasing the security when its price reaches the boundary and selling it when its price is reflected off the boundary. On the strength of this heuristic argument, he concluded that the RGBM model is arbitrage-free and must therefore admit an equivalent risk-neutral probability measure. He then obtained an expression for the density of the putative equivalent risk-neutral probability measure and used it to derive pricing formulae for European puts and calls. Following an amendment to the put pricing formula by Hertrich and Veestraeten [11], and with some modifications to cater for dividends, these option pricing formulae have been used by Veestraeten [30], Hertrich [10], Hertrich and Zimmermann [12] and Thomas [28].

In this paper, we show that Veestraeten’s [29] argument is unsound and his claim that the RGBM model is arbitrage-free is incorrect. In fact, we demonstrate that the model fails to satisfy even the weakest no-arbitrage condition considered in the literature. Consequently, it does not admit a numéraire portfolio or an equivalent risk-neutral probability measure. These deficiencies make the RGBM model unsuitable for contingent claim valuation and undermine the validity of the option pricing formulae in the articles cited above. In fact, those formulae are shown to behave quite pathologically when the price of the risky security is close to the reflecting boundary.

We begin in Sect. 2 with a brief overview of a weak no-arbitrage condition, in the simplified setting of a financial market comprising a bank account and a single non-dividend-paying stock. The primary purpose of this overview is to serve as a roadmap for our subsequent analysis of the RGBM model. In particular, we derive a necessary and sufficient characterisation of the aforementioned no-arbitrage condition that subsequently allows us to pinpoint the exact source of the arbitrage trouble for the RGBM model.

We analyse the RGBM model in Sect. 3. After setting it up and cataloguing its basic properties, we construct a trading strategy that violates the weak no-arbitrage condition studied in Sect. 2, and we explain how this result is intimately related to the reflecting behaviour of the stock price in the model. The weak no-arbitrage failure of the RGBM model means that it does not admit an equivalent risk-neutral probability measure, which invalidates the risk-neutral approach to contingent claim valuation. Consequently, the published option pricing formulae for the model have no theoretical justification. We examine those formulae in detail, demonstrating that they violate classical no-arbitrage bounds, and we explain those violations in terms of the reflecting behaviour of the stock price.

In summary, this paper makes two significant contributions. First, it establishes that the RGBM model provides an interesting and nontrivial example of a financial market model that violates a weak no-arbitrage condition, and relates this failure to the characteristics of the model. Our analysis in this regard could potentially be extended to other models with reflecting boundaries, such as those studied by Feng et al. [7] and Melnikov and Wan [19], as well as to the geometric skew Brownian motion model studied by Rossello [25] and the closely-related geometric oscillating Brownian motion model studied by Pigato [21] and Lejay and Pigato [18]. The second contribution is to highlight the erroneous reasoning about the arbitrage properties of the RGBM model in Veestraeten [29], which has led to the publication of invalid option pricing formulae by Veestraeten [29, 30], Hertrich and Veestraeten [11], Hertrich [10], Hertrich and Zimmermann [12] and Thomas [28]. Of particular concern is the article by Thomas [28], which recommends the RGBM model to practitioners as a valuation framework for no-negative-equity guarantees, a large and important class of insurance products.

2 A weak no-arbitrage condition and its consequences

This section develops the theoretical prerequisites for our analysis of the reflected geometric Brownian motion model in Sect. 3. We begin by introducing a class of continuous financial market models that is general enough to encompass the reflected geometric Brownian motion model as a particular example. In the context of this modelling framework, we then formulate the so-called structure condition, which is expressed in terms of the characteristics of a model, before introducing a weak no-arbitrage condition, known as no increasing profit. Our main result establishes that the structure condition and the no-increasing-profit condition are equivalent in our setting. Finally, we summarise the economic and modelling consequences of a failure of the no-increasing-profit condition.

2.1 A general modelling framework

Throughout this paper, we assume the existence of a filtered probability space \((\Omega ,\mathscr{F},\mathbb{F},\mathrm{P})\), whose filtration \(\mathbb{F}=(\mathscr{F}_{t})_{t\geq 0}\) satisfies the usual conditions of completeness and right-continuity. It is understood that all random variables and stochastic processes are defined on this space and all stochastic processes are adapted to its filtration. Given a continuous semimartingale \(X\), we write \(\mathrm{L}(X)\) to denote the family of predictable processes \(\varphi \) such that the stochastic integral \(\int _{0}^{\cdot}\varphi _{s}\,\mathrm{d}X_{s}\) exists.

Consider a financial market comprising a risk-free security and a single risky security. For convenience, we refer to the former as a bank account and to the latter as a stock. The value \(B\) of the bank account is given by \(B_{t}:= \mathrm{e}^{rt}\), for all \(t\geq 0\), where \(r\geq 0\) is a continuously compounding risk-free interest rate. The stock price \(S\) is determined by the SDE

for all \(t\geq 0\), with initial value \(S_{0}>0\), where \(A\) is a continuous finite-variation process and \(M\) is a continuous local martingale. For convenience, we assume that \(\langle M\rangle _{t}<\infty \) for all \(t\geq 0\), which ensures that the stock price is strictly positive, by virtue of the law of large numbers for local martingales (see Revuz and Yor [24, Exercise V.1.16]).

Investors in the market described above are able to trade self-financing portfolios comprising the bank account and the stock. The following definition makes this concept precise.

Definition 2.1

A trading strategy is a predictable process \(\xi \in \mathrm{L}(S)\). Given a trading strategy \(\xi \in \mathrm{L}(S)\) and an initial endowment \(v\geq 0\), the stochastic process \(V^{v,\xi}\) determined by the SDE

for all \(t\geq 0\), with initial value \(V^{v,\xi}_{0}=v\), is called the portfolio value generated by \(v\) and \(\xi \).

Given a trading strategy \(\xi \in \mathrm{L}(S)\) and an initial endowment \(v\geq 0\), we interpret \(V^{v,\xi}_{t}\) as the value at time \(t\geq 0\) of a self-financing portfolio that holds \(\xi _{s}\) shares of the stock at each time \(s\in [0,t]\), with initial value \(V^{v,\xi}_{0}=v\). The SDE (2.2) follows from the self-financing requirement that the portfolio must hold \((V^{v,\xi}_{t}-\xi _{t}S_{t})/B_{t}\) units of the bank account at time \(t\geq 0\), if it holds \(\xi _{t}\) shares of the stock at that time.

2.2 The structure condition

Following Jacod and Shiryaev [14, Proposition II.2.9], there exists a continuous (and hence predictable) increasing process \(G\) such that

for all \(t\geq 0\), where \(\rho \), \(b\) and \(a\) are some predictable processes. One possible choice for \(G\) is obtained by setting \(G_{t}:= t+\operatorname{Var}(A)_{t}+\langle M\rangle _{t}\) for all \(t\geq 0\). The next definition formulates the so-called structure condition in terms of the processes \(\rho \), \(b\) and \(a\).

Definition 2.2

The financial market satisfies the structure condition if there is a predictable process \(\vartheta \) such that

for \(\mathrm{P}\otimes G \text{-a.a. }(\omega ,t)\in \Omega \times \mathbb{R}_{+}\).

The structure condition was first identified by Schweizer [26], who formulated it somewhat differently. To demonstrate that the two formulations are equivalent, let \(\hat{S}\) denote the discounted stock price defined by \(\hat{S}_{t}:= S_{t}/B_{t}=\mathrm{e}^{-rt}S_{t}\) for all \(t\geq 0\). It satisfies the SDE

for all \(t\geq 0\), with \(\hat{S}_{0}=S_{0}>0\), by an application of Itô’s formula. Next, define the continuous finite-variation process \(\hat{A}\) and the continuous local martingale \(\hat{M}\) by

for all \(t\geq 0\). If the structure condition holds, for some predictable process \(\vartheta \) satisfying (2.4), then

for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \Omega \times \mathbb{R}_{+}\). On the other hand, if there is a predictable process \(\lambda \) such that

for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \Omega \times \mathbb{R}_{+}\), then the same reasoning shows that the structure condition holds, with the predictable process \(\vartheta := \lambda \hat{S}\) satisfying (2.4). So the structure condition is equivalent to the existence of a predictable process \(\lambda \) that satisfies (2.6), which is how Schweizer [26] originally formulated it.

The reformulation of the structure condition above offers a useful insight that will help us interpret the arbitrage properties of the reflected geometric Brownian motion model studied in Sect. 3. First, note that the finite variation processes \(\hat{A}\) and \(\langle \hat{M}\rangle \) may be regarded as (possibly signed) random measures on \((\mathbb{R}_{+},\mathscr{B}(\mathbb{R}_{+}))\). With that interpretation in mind, (2.6) states that \(\hat{A}\ll \langle \hat{M}\rangle \), with predictable density \(\lambda \). This means that if \(\int _{0}^{\infty}\mathbf{1}_{U}\,\mathrm{d}\langle \hat{M} \rangle _{t}(\omega )=0\), then \(\int _{0}^{\infty}\mathbf{1}_{U}\,\mathrm{d}\hat{A}_{t}( \omega )=0\), for \(\mathrm{P}\text{-a.a.}\;\omega \in \Omega \) and any Borel-measurable set \(U\in \mathscr{B}(\mathbb{R}_{+})\). In particular, if there are measurable subsets of \(\mathbb{R}_{+}\) over which the sample paths of \(\hat{A}\) increase or decrease, but the sample paths of \(\langle \hat{M}\rangle \) remain constant, then the structure condition cannot hold.

2.3 The no-increasing-profit condition

An increasing profit is the strongest form of arbitrage for continuous-time financial market models. This concept of arbitrage was introduced by Karatzas and Kardaras [15] and thoroughly investigated by Fontana [8]. The following definition provides a formulation that is appropriate for our setting.

Definition 2.3

The financial market admits an increasing profit if there is a trading strategy \(\xi \in \mathrm{L}(S)\) such that

1) \(V^{0,\xi}\) is nondecreasing;

2) \(\mathrm{P}[V^{0,\xi}_{\infty -}>0]>0\), where the limit \(V^{0,\xi}_{\infty -}:=\lim _{t\uparrow \infty}V^{0,\xi}_{t}\) exists in \([0,+\infty ]\) because \(V^{0,\xi}\) is nondecreasing.

The market satisfies the no-increasing-profit (NIP) condition if no such strategy exists.

Putting the previous definition into words, a model admits an increasing profit if there is a trading strategy for which the value of the associated portfolio with an initial endowment of zero is a nondecreasing process with a positive probability of ultimately becoming strictly positive. Such arbitrage opportunities are unequivocally pathological, since they offer investors a chance of making something from nothing without incurring any risk or requiring any margin payments. Equilibrium asset prices cannot exist in a model that offers such opportunities, since there would be insatiable demand for the portfolios that exploit them. Consequently, a viable financial market model must satisfy the NIP condition.

The next theorem reveals that the NIP condition is equivalent to the structure condition. Fontana [8, Theorem 3.1] proved essentially the same result, but the formulation and proof in our setting are quite different and the proof is sufficiently instructive to merit inclusion. Karatzas and Shreve [16, Lemma 1.4.6] and Delbaen and Schachermayer [6, Theorem 3.5] proved related results in the “only if” direction.

Theorem 2.4

The NIP condition is satisfied if and only if the structure condition is satisfied.

Proof

(⇒) Suppose the NIP condition holds. Consider a portfolio with initial endowment \(v=1\) that implements a trading strategy \(\xi \in \mathrm{L}(S)\) specified by

for all \(t\geq 0\). In that case, the quadratic variation of the local martingale \(\int _{0}^{\cdot}\xi _{u}S_{u}\,\mathrm{d}M_{u}\) satisfies

for all \(t\geq 0\). This implies that \(\int _{0}^{\cdot}\xi _{u}S_{u}\,\mathrm{d}M_{u}=0\), since a local martingale whose quadratic variation is zero must remain constant. Using differential notation, the latter condition can be expressed as \(\xi _{t}S_{t}\,\mathrm{d}M_{t}=0\) for all \(t\geq 0\). Hence (2.2) gives

for all \(t\geq 0\). The solution to this equation is

for all \(t\geq 0\). Now consider another trading strategy \(\tilde{\xi}\in \mathrm{L}(S)\), with initial endowment \(\tilde{v}=0\), comprising a long position in \(\xi \) and a short position in the bank account. The value of the associated portfolio is given by

for all \(t\geq 0\). Since the integrand in this expression is nonnegative, it follows that \(V^{0,\tilde{\xi}}\) is a nondecreasing process. This implies that \(V^{0,\tilde{\xi}}_{\infty -}=0\) by virtue of the assumption that the NIP condition holds, which is to say that

From this we conclude that \(b_{t}(\omega )=\rho _{t}(\omega )\) for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \{a_{\cdot}(\, \cdot \,)=0\}\), whence the predictable process \(\vartheta \) defined by

for all \(t\geq 0\) satisfies (2.4) and verifies the structure condition.

(⇐) Suppose the structure condition is satisfied, and let \(\xi \in \mathrm{L}(S)\) be a trading strategy for which the value \(V^{0,\xi}\) of the associated portfolio with zero initial endowment is nondecreasing. It follows that \(V^{0,\xi}\) is a finite-variation process, which implies that

for all \(t\geq 0\), whence \(a_{t}(\omega )=0\) for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \{\xi _{\cdot}( \,\cdot \,)\neq 0\}\). Since the structure condition holds by assumption, it follows from (2.4) that \(b_{t}(\omega )=\rho _{t}(\omega )\) for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \{\xi _{\cdot}( \,\cdot \,)\neq 0\}\). Next, observe that \(\langle \int _{0}^{\cdot}\xi _{u}S_{u}\,\mathrm{d}M_{u} \rangle =0\) also implies that \(\int _{0}^{\cdot}\xi _{u}S_{u}\,\mathrm{d}M_{u}=0\) since a local martingale with zero quadratic variation remains constant. This can be expressed as \(\xi _{t}S_{t}\,\mathrm{d}M_{t}=0\) for all \(t\geq 0\). Consequently, (2.2) gives

for all \(t\geq 0\). Since \(b_{t}(\omega )=\rho _{t}(\omega )\) for \(\mathrm{P}\otimes G\text{-a.a.}~(\omega ,t)\in \{\xi _{ \cdot}(\,\cdot \,)\neq 0\}\) as established before, it follows from the expression above that \(\mathrm{d}V^{0,\xi}_{t}=rV^{0,\xi}_{t}\,\mathrm{d}t\) for all \(t\geq 0\), whence \(V^{0,\xi}_{t}=V^{0,\xi}_{0}\mathrm{e}^{rt}=0\) since \(V^{0,\xi}_{0}=0\). Consequently, we get \(V^{0,\xi}_{\infty -}=0\), implying that \(\mathrm{P}[V^{0,\xi}_{\infty -}>0]=0\). In summary, we have demonstrated that any trading strategy that satisfies the first condition in Definition 2.3 cannot satisfy the second condition. Hence the NIP condition holds. □

Inspection of (2.4) reveals that the structure condition fails if and only if there are periods during which the process \(a\) is zero and the processes \(b\) and \(\rho \) assume different values. Whenever that happens, the market effectively contains two risk-free securities with different rates of return. During such periods, the trading strategy constructed in the first part of the proof of Theorem 2.4 generates an increasing profit by borrowing at the lower rate and investing the proceeds at the higher rate. In light of Theorem 2.4, the NIP condition may be interpreted economically as stating that the market never contains two risk-free securities with different rates of return.

2.4 Contingent claim valuation

In order for a model to be suitable for contingent claim valuation, it should admit either a numéraire portfolio or an equivalent risk-neutral probability measure. Informally, a numéraire portfolio in our modelling framework is a well-behaved trading strategy \(\xi ^{*}\), whose portfolio value \(V^{1,\xi ^{*}}\), with initial endowment \(v=1\), provides a natural benchmark against which the value of every other well-behaved portfolio can be measured. More formally, the benchmarked processes \(B/V^{1,\xi ^{*}}\) and \(S/V^{1,\xi ^{*}}\) are required to be supermartingales. On the other hand, an equivalent risk-neutral probability measure in our setting is an equivalent probability measure \(\mathrm{Q}\approx \mathrm{P}\) such that the discounted stock price \(\hat{S}:= S/B\) is a local martingale under \(\mathrm{Q}\). If a model admits a numéraire portfolio, then the benchmark approach to contingent claim valuation (see Platen and Heath [23, Sect. 9.1]) can be used, while traditional risk-neutral valuation can be used if the model admits an equivalent risk-neutral probability measure.

Both the existence of a numéraire portfolio and the existence of an equivalent risk-neutral probability measure can be characterised in terms of no-arbitrage conditions. In a more general setting than ours, Karatzas and Kardaras [15] established that the existence of a numéraire portfolio is equivalent to the no-unbounded-profit-with-bounded-risk (NUPBR) condition, while Delbaen and Schachermayer [5] famously demonstrated that the no-free-lunch-with-vanishing-risk (NFLVR) condition is necessary and sufficient for the existence of an equivalent risk-neutral probability measure. Based on those results, a model that does not satisfy NUPBR or NFLVR cannot be used for pricing options and other contingent claims.

Crucially, both NUPBR and NFLVR are stronger conditions that NIP (the logical dependencies between the various no-arbitrage conditions for continuous financial market models are explained in the surveys by Hulley [13, Chap. 1] and Fontana [8]). Consequently, a model that does not satisfy the NIP condition will fail to satisfy the NUPBR and NFLVR conditions as well, which means that it will not admit a numéraire portfolio or an equivalent risk-neutral probability measure. Such a model is unsuitable for contingent claim valuation. This is unsurprising, since we have already argued that a model cannot sustain equilibrium asset prices if it does not satisfy the NIP condition.

3 A reflected geometric Brownian motion model

Veestraeten [29] proposed a modification of the Black and Scholes [2] model in which the price of a risky asset is a geometric Brownian with a reflecting lower boundary. A related model was employed by Gerber and Pafumi [9] and Ko et al. [17] for the value of an investment fund with a capital guarantee, while Veestraeten [30], Neuman and Schied [20], Hertrich [10] and Hertrich and Zimmermann [12] used similar models for exchange rates constrained by target zones. Finally, Thomas [28] recently used reflected geometric Brownian motion to model house prices protected by a government guarantee. This section provides a careful analysis of the arbitrage properties of the reflected geometric Brownian motion model. We begin with a rigorous formulation of the model, before describing its basic properties. Next, we demonstrate that it violates both the NIP condition and the structure condition, before analysing those failures in terms of the reflecting behaviour of the asset price in the model. Finally, we demonstrate that the option pricing formulae for the model, presented in several of the previously cited studies, exhibit numerous pathologies, which are once again related to the reflecting behaviour of the asset price in the model.

3.1 Reflected geometric Brownian motion

Skorokhod [27] showed that the SDE

for all \(t\geq 0\), with a lower reflecting boundary \(b>0\) and initial value \(S_{0}>b\), admits a unique strong solution. This solution comprises a pair of processes \(S\) and \(L\) such that

for all \(t\geq 0\), and where the integrals above are well defined. The process \(S\) is called a reflected geometric Brownian motion (RGBM), and the process \(L\) is called the reflection term.

Condition (3.2) ensures that the value of \(L\) does not change while the value of \(S\) exceeds \(b\), in which case condition (3.3) ensures that \(S\) behaves like a vanilla geometric Brownian motion (GBM). However, as soon as \(S\) reaches the boundary \(b\), the value of \(L\) increases, instantaneously reflecting \(S\) back into the interval \((b,\infty )\), after which \(S\) behaves like a vanilla GBM once again. It follows that the points of increase of \(L\) are limited to times when \(S\) visits \(b\). It is natural to interpret \(L_{t}\) as measuring the cumulative effect of reflection from the boundary up to time \(t\geq 0\).

In addition to establishing the existence of a unique strong solution to (3.1), Skorokhod [27] showed that the reflection term is given by

for all \(t\geq 0\), where the integral in this expression can be defined rigorously as a limit of integral sums. There is, however, a more useful interpretation of the reflection term. Define the process \(\ell ^{b}\) by setting

for all \(t\geq 0\). This process, which is known as the local time of \(S\) at \(b\), provides a nontrivial measure of the amount of time \(S\) spends in the vicinity of \(b\). Pilipenko [22, Theorem 1.3.1] showed that \(L_{t}=\ell ^{b}_{t}/2\) for all \(t\geq 0\), which is to say that the reflection term is just half the local time at the reflecting boundary.

3.2 Model specification

We now revisit the financial market described in Sect. 2, comprising a risk-free bank account and a non-dividend-paying stock. As before, the value \(B\) of the bank account is given by \(B_{t}:= \mathrm{e}^{rt}\) for all \(t\geq 0\), where \(r\geq 0\) is the risk-free interest rate. However, following Veestraeten [29], we now assume that the stock price \(S\) follows the RGBM (3.1).

We begin by noting that the RGBM model falls within the scope of the framework introduced in Sect. 2, which ensures that the analysis in that section is fully applicable to it. Indeed, (3.2) allows us to rewrite (3.1) as

for all \(t\geq 0\). This equation may in turn be expressed in the form (2.1), with the continuous finite-variation process \(A\) and the continuous local martingale \(M\) given by

for all \(t\geq 0\). As noted in Sect. 2, there exists a continuous increasing process \(G\) satisfying (2.3) for some predictable processes \(\rho \), \(b\) and \(a\). That is to say,

for all \(t\geq 0\). Setting \(G_{t}:= t+\ell ^{b}_{t}\) for all \(t\geq 0\) provides a convenient choice for the process \(G\).

3.3 Failure of the no-increasing-profit condition

The behaviour of the stock price at the reflecting boundary raises concerns about the arbitrage properties of the RGBM model. Indeed, it seems plausible that an arbitrageur could exploit this behaviour by purchasing the stock when its price reaches the boundary and unwinding the position immediately afterwards, as the stock price is reflected off the boundary. The guiding intuition is that upon reaching the boundary, the behaviour of the stock price is completely predictable over the next instant of time, and therefore arbitrageable. The following proposition confirms this intuition by explicitly constructing an immediate profit trading strategy that is similar in spirit to the trading strategy in Fontana [8, Example 7.1].

Proposition 3.1

The RGBM model violates the NIP condition.

Proof

Define the process \(\xi \) by setting \(\xi _{t}:= \mathbf{1}_{\{S_{t}=b\}}\) for all \(t\geq 0\). Then \(\xi \) is predictable since it is obtained by applying the measurable function \(\mathbf{1}_{\{\,\cdot \,=b\}}:\mathbb{R}\rightarrow \mathbb{R}\) to the continuous (and hence predictable) process \(S\). Moreover, since every bounded predictable process is integrable with respect to any semimartingale, it follows that \(\xi \in \mathrm{L}(S)\), which establishes that \(\xi \) is a valid trading strategy. Now, since we have for \(\mathrm{P}\text{-a.a.}~\omega \in \Omega \) that \(\operatorname{leb}\{t\in \mathbb{R}_{+} : S_{t}(\omega )=b\}=0\), the properties of Lebesgue and Itô integrals and the local time process ensure that

and

for all \(t\geq 0\). By substituting these identities into (2.2), we see that the value \(V^{0,\xi}\) of a portfolio that implements the strategy \(\xi \) with zero initial endowment satisfies the SDE

for all \(t\geq 0\). First, since \(L\) is nondecreasing, it follows that \(V^{0,\xi}\) is nondecreasing as well. Second, since \(\mathrm{d}L_{t}(\omega )>0\) for \(\mathrm{P}\otimes G\text{-a.a.}\:(\omega ,t)\in \{S_{\cdot}(\, \cdot \,)=b\}\), it follows that \(\mathbf{1}_{\{\tau _{b}<\infty \}}V^{0,\xi}_{t}>0\) for all \(t\geq \tau _{b}\), where \(\tau _{b}:= \inf \{t\geq 0 : S_{t}=b\}\) denotes the first passage time of \(S\) to \(b\). Since the properties of geometric Brownian motion ensure that \(\mathrm{P}[\tau _{b}<\infty ]>0\), this implies that \(\mathrm{P}[V^{0,\xi}_{\infty -}>0]>0\). Together, these observations confirm that \(\xi \) generates an increasing profit. □

Figure 1 plots a simulated path for the stock price and the corresponding path for the reflection term, together with the path for the stock position in the arbitrage portfolio described in the proof of Proposition 3.1. Figure 1(a) illustrates the reflection of the stock price off the boundary, while Fig. 1(b) illustrates the behaviour of the reflection term (which is effectively the local time of the stock price at the boundary). Each time the stock price visits the boundary, we see an instantaneous increase in the reflection term, which nudges the stock price away from the boundary. Figure 1(c) shows that the stock holding in the arbitrage portfolio switches from zero to one in that instant, before immediately switching back to zero as the stock price is instantaneously reflected off the boundary. In effect, the stock is purchased and immediately sold when its price reaches the boundary, realising a profit equal to the increment in the reflection term in that instant. This profit is deposited in the bank account, so that the value of the arbitrage portfolio at any time is the cumulative sum of the instantaneous profits realised up to that time, plus interest.

In the case when the risk-free interest rate is zero, it follows from (3.6) that the value of the arbitrage portfolio is simply the value of the reflection term (or half the local time process). In that case, Fig. 1(b) also illustrates the behaviour of the value of the arbitrage portfolio. We see that the portfolio requires no initial investment of capital, since its initial value is zero. We also see that its value is nondecreasing, which reflects the riskless nature of the strategy as well as the fact that it requires no trading capital to fund margin calls. Moreover, the portfolio value increases instantaneously from zero at the first passage time of the stock price to the reflecting boundary, and increases again each subsequent time the stock price visits the boundary. Effectively, the arbitrage strategy harvests the local time of the stock price at the boundary as a riskless profit.

Veestraeten [29] claimed that the RGBM model does not admit arbitrage opportunities. He justified this assertion by citing two properties of the stock price in the model. First, since reflection off the boundary is instantaneous, the Lebesgue measure of the time spent there by the stock price is zero. Second, the stock price follows a continuous process. Based on those two observations (both of which are correct), he argued that the model is arbitrage-free and therefore admits an equivalent risk-neutral probability measure. Although Proposition 3.1 refutes this argument, we shall nevertheless dwell on it because it has been repeated by several other authors.

The main problem is that Veestraeten’s [29] argument focuses on the wrong measure of the time spent by the stock price at the reflecting boundary. Although the Lebesgue measure of the time spent there is indeed zero, that is irrelevant. Instead, we should focus on the local time of the stock price at the boundary. Because \(S\) is a continuous process whose paths are of unbounded total variation on compact intervals, the sample paths of the stock price are extremely irregular. As a result of this irregularity, the stock price spends a non-zero amount of time infinitesimally close to the boundary each time it visits, even though it spends no time actually on the boundary. The time spent arbitrarily close to the boundary is what the local time process measures. Each time the stock price reaches the boundary, the clock measuring its local time there ticks over and the local time increment is added to the stock price, nudging it away from the boundary. The arbitrage strategy constructed in the proof of Proposition 3.1 exploits this behaviour, by purchasing and immediately selling the stock each time it reaches the boundary, risklessly harvesting the local time increments in the process.

Another problem with Veestraeten’s [29] argument is its apparent reliance on the idea that it is practically impossible for an arbitrageur to time their trades to coincide with the stock price reaching and leaving the reflecting boundary. Mathematically, an arbitrage is merely a predictable process that satisfies certain technical conditions, and a model is arbitrage-free (in the appropriate sense) if no such process exists. The question of whether the strategy could be implemented in practice has no bearing on its existence as a well-defined mathematical object, and is thus irrelevant to the arbitrage properties of the model. Even though no trader could implement the strategy described in the proof of Proposition 3.1, it nevertheless exists as a well-defined predictable process satisfying the conditions in Definition 2.3.

We conclude this section by noting that Proposition 3.1 is reminiscent of the resolution to the stop-loss start-gain paradox by Carr and Jarrow [4], who showed that the stop-loss start-gain strategy for hedging a European stock option is not self-financing, but requires periodic injections of capital determined by the local time of the stock price at the strike price of the option. Like the value (3.6) of the arbitrage strategy in Proposition 3.1, which is driven by the local time of the stock price at the reflecting boundary, Carr and Jarrow [4] demonstrated that the value of the hedging portfolio that implements the stop-loss start-gain strategy is driven by the local time of the stock price at the strike price of the option. In their case, however, local time enters the picture via the Itô–Tanaka formula, whereas in our case it is baked into the dynamics (3.1) of RGBM.Footnote 1

3.4 Failure of the structure condition

Theorem 2.4 shows that a continuous financial market model satisfies the NIP condition if and only if it satisfies the structure condition. Proposition 3.1 proves that the RGBM model does not satisfy the NIP condition, by explicitly constructing an increasing profit strategy. Hence, the structure condition must fail as well. The next proposition proves this directly.

Proposition 3.2

The RGBM model does not satisfy the structure condition.

Proof

Suppose that the structure condition does in fact hold. In that case, there is a predictable process \(\vartheta \) satisfying (2.4). Using (3.5), that equation can be manipulated as follows:

for \(\mathrm{P}\otimes G\text{-a.a.}\;(\omega ,t)\in \Omega \times \mathbb{R}_{+}\). This gives rise to a contradiction, since

for \(\mathrm{P}\text{-a.a.}~\omega \in \{\tau _{b}<\infty \}\), and \(\mathrm{P}[\tau _{b}<\infty ]>0\). Hence the structure condition cannot hold. □

We can approach Proposition 3.2 from a slightly more intuitive angle. Using (3.4), we obtain for the continuous finite-variation process \(\hat{A}\) and the continuous local martingale \(\hat{M}\) defined by (2.5) the expressions

for all \(t\geq 0\), where \(\hat{S}:= S/B\) is the discounted stock price. Since the local time of the stock price at the reflecting boundary increases instantaneously each time it gets there, while the Lebesgue measure of the time spent by the stock price at the boundary is zero, we have

for \(\mathrm{P}\text{-a.a.}~\omega \in \{\tau _{b}<\infty \}\). Consequently,

and

for \(\mathrm{P}\text{-a.a.}~\omega \in \{\tau _{b}<\infty \}\). Since \(\mathrm{P}[\tau _{b}<\infty ]>0\), it follows that \(\hat{A}\not \!\ll \langle \hat{M}\rangle \), in violation of the structure condition (see the interpretation of the structure condition following Definition 2.2). In other words, the structure condition fails because a nontrivial set of paths of \(\hat{A}\) (those for which the first passage time of the stock price to the reflecting boundary is finite) increase on sets of Lebesgue measure zero (corresponding to the times when the stock price is at the reflecting boundary), while the paths of \(\langle \hat{M}\rangle \) cannot change on sets of Lebesgue measure zero.

To conclude this section, we note that the RGBM stock price model is closely related to the geometric skew Brownian motion (GSBM) model, whose arbitrage properties were studied by Rossello [25]. Indeed, Rossello [25, Equation (10)] reveals that the SDE for GSBM is formally identical to (3.1), except that the increasing process \(L\) measures the local time of the underlying Brownian motion at the origin, rather than measuring the local time of the stock price at the reflecting boundary. With that in mind, it is unsurprising that the GSBM model also violates the structure condition, as demonstrated by Rossello [25, Propositions 2 and 3].Footnote 2

3.5 Inconsistent option pricing formulae

Proposition 3.1 establishes that the RGBM model does not satisfy the NIP condition. As a result, the NFLVR condition also fails, which rules out the existence of an equivalent risk-neutral probability measure. Operating under the mistaken belief that risk-neutral valuation is possible for the RGBM model, Veestraeten [29] derived pricing formulae for European options written on the stock. Subject to an amendment to the pricing formula for European put options by Hertrich and Veestraeten [11], these formulae have also been used by Hertrich [10] and Hertrich and Zimmermann [12]. Since their derivations are predicated on an incorrect assumption, we expect them to exhibit some inconsistencies.

Suppose we make the counterfactual assumption that an equivalent risk-neutral probability measure \(\mathrm{Q}\approx \mathrm{P}\) does in fact exist for the RGBM model. In that case, the discounted stock price process \(\hat{S}\) is a local \(\mathrm{Q}\)-martingale. Given a European contingent claim written on the stock, with maturity \(T\geq 0\) and payoff function \(h:[b,\infty )\rightarrow \mathbb{R}\), we may (by hypothesis) apply a standard risk-neutral valuation approach to obtain its pricing function \(V^{h}:[0,T]\times [b,\infty )\rightarrow \mathbb{R}\) as

for all \((t,s)\in [0,T]\times [b,\infty )\). Here \(\mathrm{E}^{\mathrm{Q}}_{t,s}[\,\cdot \,]\) is the expected value operator with respect to the risk-neutral probability measure \(\mathrm{Q}_{t,s}\) under which \(S_{t}=s\geq b\).

Consider European call and put options on the stock, with a common strike price of \(K\geq b\) and a common maturity date \(T\geq 0\). The pricing functions for these instruments are given by

for all \((t,s)\in [0,T]\times [b,\infty )\). Veestraeten [29] derived a putative risk-neutral transition density for the stock price, which Veestraeten [29], Hertrich and Veestraeten [11] and Hertrich [10] used to evaluate (3.7) and (3.8). In so doing, they obtained for European calls and puts the pricing functions

and

for all \((t,s)\in [0,T]\times [b,\infty )\), where

and where \(\Phi (\,\cdot \,)\) denotes the cumulative distribution function for a standard normal random variable. Note that the option pricing formulae above are formulated differently (but equivalently) in the cited papers. We have chosen the formulations in Hertrich [10, Equations (11) and (12)] which yield the most compact expressions. We also remark that (3.9) and (3.10) do not satisfy put–call parity; see Hertrich [10] and Hertrich and Veestraeten [11] for an explicit discussion of this issue.

As an immediate consequence of (3.7), we deduce that

for all \((t,s)\in [0,T]\times [b,\infty )\), where the second inequality follows because \(\hat{S}\) is a supermartingale under \(\mathrm{Q}\) by virtue of Fatou’s lemma. In more detail, since \(\hat{S}\) is (by assumption) a local martingale under \(\mathrm{Q}\), which is bounded from below, an application of Fatou’s lemma reveals that it is also a \(\mathrm{Q}\)-supermartingale. Consequently,

for all \(t\geq 0\).

Note that (3.11) is a model-independent upper bound on call prices, whose violation contradicts the assumption that \(\mathrm{Q}\) is an equivalent risk-neutral probability measure. The next lemma reveals that this bound can be violated if call prices are determined by (3.9).

Proposition 3.3

The price of a call option obtained from (3.9) violates the upper bound (3.11) under certain parameter regimes when the stock price is close to the reflecting boundary.

Proof

Suppose the model parameters satisfy \(\theta =1\), which is to say that \(r=\frac{1}{2}\sigma ^{2}\). We consider the price of a call option at time \(t\in [0,T)\) and assume that the stock price is located on the boundary \(b\) at that time. In that case, (3.9) gives for the call price the expression

Now since

we can choose a small enough strike price \(K'>b\) and a large enough risk-free interest rate \(r'>0\) to ensure that

Using those parameter values, (3.12) gives \(C(t,b)>b\), in violation of (3.11). The continuity of the call pricing function (3.9) with respect to the stock price ensures that the bound will also be violated for stock prices above the reflecting boundary, but sufficiently close to it. □

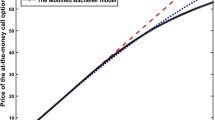

Proposition 3.3 shows that call prices obtained from (3.9) can exceed the upper bound (3.11) when the stock price is close to the reflecting boundary. This is illustrated in Fig. 2, which also illustrates that Black and Scholes [2] call prices are consistent with the upper bound. While the prices obtained from the two formulae converge as the stock price increases, we see that the RGBM call pricing formula (3.9) produces inflated prices that are inconsistent with risk-neutral valuation when the stock price approaches the reflecting boundary. This echoes our analysis of the failures of NIP and the structure condition, which revealed that the arbitrage pathologies of the RGBM model are intimately related to its reflecting behaviour.

The dependence of the RGBM call price (3.9) (solid red curve) and the Black and Scholes [2] call price (solid blue curve) on the stock price. The vertical dashed line is the reflecting boundary for the RGBM model, and the sloped dashed line is the upper bound (3.11) for the call price. The parameter values are \(T-t=10\), \(K=2\), \(r=0.125\), \(\sigma =0.5\) and \(b=1\)

We turn our attention now to put options. From (3.8), we obtain

for all \((t,s)\in [0,T]\times [b,\infty )\), where the second inequality follows because \(\hat{S}\) is a supermartingale under \(\mathrm{Q}\), as previously noted. In this case, (3.13) imposes a model-independent lower bound on European put prices, whose violation once again contradicts the assumption that \(\mathrm{Q}\) is an equivalent risk-neutral probability measure. The next lemma reveals that this bound can be violated if put prices are determined by (3.10).

Proposition 3.4

The price of a put option obtained from (3.10) violates the lower bound (3.13) under certain parameter regimes when the stock price is close to the reflecting boundary.

Proof

Suppose the model parameters satisfy \(\theta =1\), which is to say that \(r=\frac{1}{2}\sigma ^{2}\). We consider the price of a put option at time \(t\in [0,T)\) and assume that the stock price is located on the boundary \(b\) at that time. In that case, (3.10) gives for the put price the expression

Now since

we can choose a large enough strike price \(K'>b\) to ensure that

Combining this with the fact that

allows us to deduce from (3.14) that \(P(t,b)< K'\mathrm{e}^{-r(T-t)}-b\), in violation of (3.13). The continuity of the put pricing function (3.10) with respect to the stock price ensures that the bound will also be violated for stock prices above the reflecting boundary, but sufficiently close to it. □

Proposition 3.4 shows that put prices obtained from (3.10) can violate the lower bound (3.13) when the stock price is close to the reflecting boundary. This is illustrated in Fig. 3, which also illustrates that Black and Scholes [2] put prices are consistent with the lower bound. While the prices obtained from the two formulae converge as the stock price increases, we see that the RGBM put pricing formula (3.10) produces diminished prices that are inconsistent with risk-neutral valuation when the stock price approaches the reflecting boundary. In other words, the pathologies of the RGBM model are once again evident near the reflecting boundary.

The dependence of the RGBM put price (3.10) (solid red curve) and the Black and Scholes [2] put price (solid blue curve) on the stock price. The vertical dashed line is the reflecting boundary for the RGBM model, and the sloped dashed line is the lower bound (3.13) for the put price. The parameter values are \(T-t=10\), \(K=2\), \(r=0.02\), \(\sigma =0.2\) and \(b=1\)

We conclude by emphasising that any violation of the bounds (3.11) and (3.13) is inconsistent with the assumption that an equivalent risk-neutral probability measure exists. Consequently, Propositions 3.3 and 3.4 imply that either the option pricing formulae (3.9) and (3.10) are incorrect or the assumption that an equivalent risk-neutral probability measure exists is false, or both.

3.6 Problems with no-negative-equity guarantees

An equity release mortgage (ERM) (also known as a reverse mortgage outside the UK) is a loan made to an elderly property-owning borrower that is collateralised by their property. In the UK, ERMs typically embody a no-negative-equity guarantee (NNEG) stipulating that the amount due for repayment is no more than the minimum of the rolled-up loan amount and the property value at the time of repayment, which would be the time of the borrower’s death or their entry into a care home. This obligation to repay the minimum of two future values implies that an NNEG involves a put option issued to the borrower.

NNEG valuation plays a crucial role in the design and management of ERMs, and several valuation approaches have been considered (see Buckner and Dowd [3] for a survey). Thomas [28] recently proposed a new approach, built on the assumption that the government will intervene in the residential real estate market if property prices fall by more than a certain proportion, thereby establishing a de facto lower bound for house prices. Based on this idea, he proposed an RGBM model for house prices, where the lower reflecting boundary \(b>0\) corresponds to the level at which the government will enter the property market to support prices. By rearranging the pricing formula for a European put on a dividend-paying security in Hertrich [10], Thomas [28] obtained for the price of an NNEG with maturity date \(T>0\) and loan principal \(K\geq b\), written on a house whose current price is \(s\geq b\), the formula

for all \((t,s)\in [0,T]\times [b,\infty )\), where

As before, \(r\geq 0\) is the continuously compounding risk-free interest rate, while \(\sigma >0\) is the volatility of the price of the house. The parameter \(q\geq 0\), which is called the deferment rate, is the continuously compounding discount rate that yields the deferment price of the house when applied to its current price. (The deferment price is the price payable now, for possession at some future date, which means that the deferment rate \(q\) may be regarded as a type of convenience yield.)

Since (3.15) is a straightforward extension of the European put pricing formula (3.10) in order to accommodate a dividend-paying stock (with the deferment rate playing the role of a dividend yield), it shares the defects of that formula. First, the non-existence of an equivalent risk-neutral probability measure (or even a numéraire portfolio) for the RGBM model means that there is no economic justification that allows us to interpret (3.15) as a pricing formula for NNEGs. Second, an easy modification of Proposition 3.4 shows that (3.15) can violate the model-independent lower bound

for all \((t,s)\in [0,T]\times [b,\infty )\) when the house price is close to the reflecting boundary. This bound is a direct analogue of (3.13) for the case of a dividend-paying stock and can be derived in exactly the same way, if one assumes the existence of an equivalent risk-neutral probability measure. As before, any violation of (3.16) contradicts the existence of an equivalent risk-neutral probability measure.

The next lemma highlights an additional defect of (3.15) that makes it especially ill-suited to NNEG valuation.

Proposition 3.5

The price of a sufficiently long-dated NNEG obtained from (3.15) violates the lower bound (3.16), if \(r=0\) and \(0< q<\frac{1}{2}\sigma ^{2}\).

Proof

Suppose \(r=0\) and \(0< q<\frac{1}{2}\sigma ^{2}\), in which case \(-1<\theta <0\). Fix a current time \(t\geq 0\) and a house price \(s\geq b\), and observe that

for all \(T>t\). From this, it follows that

by virtue of \(-1<\theta <0\). Consequently, (3.15) gives

The second term in this expression is negative since \(K>b>0\) and \(\theta <0\), which implies that \(\lim _{T\uparrow \infty}P(t,s)< K\). We may therefore choose \(T'>t\) large enough such that

for all \(T>T'\), in violation of (3.16). □

Proposition 3.5 shows that NNEG prices obtained from (3.15) violate the lower bound (3.16) for sufficiently long-dated contracts, when the risk-free interest rate is zero and the deferment rate is not too large. (We could generalise the result by proving that long-dated NNEG prices obtained from (3.15) do not obey (3.16) for any parameter regimes with \(-1<\theta <0\), but the proof would be messier.) Since NNEGs are typically long-dated instruments, the upshot is that they are dramatically undervalued by (3.15) in low-interest-rate environments.

Figure 4 illustrates the issue described by Proposition 3.5. For the chosen parameter values, we see that (3.15) produces NNEG prices below the lower bound (3.16), for maturities in excess of 10 years. We also see that the prices obtained from that formula converge asymptotically to the limit (3.17). By contrast, Black [1] NNEG prices are consistent with the lower bound (3.16) for all maturities. (The Black [1] put pricing formula is proposed by advocates of a market-consistent approach to NNEG valuation, such as Buckner and Dowd [3].) To appreciate the severity of the undervaluation issue for long-dated contracts, note that the Thomas [28] price of a 20-year NNEG in Fig. 4 is only \(46\%\) of the value of the lower bound and a mere \(29\%\) of the value of the corresponding Black [1] NNEG price.

The dependence of the RGBM NNEG price (3.15) (solid red curve) and the Black [1] NNEG price (solid blue curve) on time to expiry. The horizontal dashed line is the long maturity asymptote (3.17) for the RGBM model, and the dashed curve is the lower bound (3.16) for the price of the NNEG. The parameter values are \(s=1\), \(K=0.9\), \(r=0\), \(q=0.03\), \(\sigma =0.3\) and \(b=0.5\)

4 Conclusions

Intuitively, an arbitrage is a trading strategy that realises a riskless profit without requiring an upfront investment of capital. But in the context of continuous-time finance, it is best to think of an arbitrage simply as a predictable process that satisfies certain technical conditions, with only a tenuous link to feasible real-world trading strategies. Moreover, there are several notions of arbitrage in continuous-time finance, with different implications for the mathematical features of a model. These observations warn us that intuition and heuristic reasoning are an unreliable substitute for mathematical rigour when analysing the arbitrage properties of a continuous-time financial market model.

The salience of this warning is illustrated by the recent literature advocating the use of reflected geometric Brownian motion (RGBM) as a security price model. Several authors have argued that the RGBM model does not offer any arbitrage opportunities, but their argument is informal and heuristic. In particular, they do not specify what type of arbitrage opportunities are precluded, and they do not formally verify the associated no-arbitrage condition. Instead, they appeal to an intuitive idea that arbitrageurs cannot profit from the reflecting behaviour of the security price in the model because the price process is continuous and the time spent on the reflecting boundary has Lebesgue measure zero. Based on these observations, they wrongly conclude that the RGBM model admits an equivalent risk-neutral probability measure, which leads them to derive invalid option pricing formulae.

A careful mathematical analysis of the RGBM model shows that it violates even the weakest no-arbitrage condition considered in the literature. Consequently, it does not offer any of the structural features required for contingent claim valuation. In particular, it does not admit a numéraire portfolio or an equivalent risk-neutral probability measure. As a result, there is no theoretical justification for the published RGBM option pricing formulae. Indeed, a close examination of those formulae reveals that they behave pathologically under certain conditions.

References

Black, F.: The pricing of commodity contracts. J. Financ. Econ. 3, 167–179 (1976)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Buckner, D., Dowd, K.: The Eumaeus Guide to Equity Release Mortgage Valuation: Restating the Case for a Market Consistent Approach, 2nd edn. KSP Books (2022)

Carr, P.P., Jarrow, R.A.: The stop-loss start-gain paradox and option valuation: a new decomposition into intrinsic and time value. Rev. Financ. Stud. 3, 469–492 (1990)

Delbaen, F., Schachermayer, W.: A general version of the fundamental theorem of asset pricing. Math. Ann. 300, 463–520 (1994)

Delbaen, F., Schachermayer, W.: The existence of absolutely continuous local martingale measures. Ann. Appl. Probab. 5, 926–945 (1995)

Feng, L., Jiang, P., Wang, Y.: Constant elasticity of variance models with target zones. Physica A 537, 1–22 (2020)

Fontana, C.: Weak and strong no-arbitrage conditions for continuous financial markets. Int. J. Theor. Appl. Finance 18, 1550005, 1–34 (2015)

Gerber, H.U., Pafumi, G.: Pricing dynamic investment fund protection. N. Am. Actuar. J. 4, 28–37 (2000)

Hertrich, M.: A cautionary note on the put-call parity under an asset pricing model with a lower reflecting barrier. Swiss J. Econ. Stat. 151, 227–260 (2015)

Hertrich, M., Veestraeten, D.: Valuing stock options when prices are subject to a lower boundary: a correction. J. Futures Mark. 33, 889–890 (2013)

Hertrich, M., Zimmermann, H.: On the credibility of the Euro/Swiss Franc floor: a financial market perspective. J. Money Credit Bank. 49, 567–578 (2017)

Hulley, H.: Strict local martingales in continuous financial market models. PhD Thesis, University of Technology, Sydney. https://opus.lib.uts.edu.au/handle/10453/35989 (2010)

Jacod, J., Shiryaev, A.N.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, Berlin (2003)

Karatzas, I., Kardaras, C.: The numéraire portfolio in semimartingale financial models. Finance Stoch. 11, 447–493 (2007)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1991)

Ko, B., Shiu, E.S.W., Wei, L.: Pricing maturity guarantee with dynamic withdrawal benefit. Insur. Math. Econ. 47, 216–223 (2010)

Lejay, A., Pigato, P.: A threshold model for local volatility: evidence of leverage and mean reversion effects on historical data. Int. J. Theor. Appl. Finance 22, 1950017, 1–24 (2019)

Melnikov, A., Wan, H.: On modifications of the Bachelier model. Ann. Finance 17, 187–214 (2021)

Neuman, E., Schied, A.: Optimal portfolio liquidation in target zone models and catalytic superprocesses. Finance Stoch. 20, 495–509 (2016)

Pigato, P.: Extreme at-the-money skew in a local volatility model. Finance Stoch. 23, 827–859 (2019)

Pilipenko, A.: An Introduction to Stochastic Differential Equations with Reflection. Potsdam University Press, Potsdam (2014)

Platen, E., Heath, D.: A Benchmark Approach to Quantitative Finance. Springer, Berlin (2006)

Revuz, D., Yor, M.: Continuous Martingales and Brownian Motion, 3rd edn. Springer, Berlin (1999)

Rossello, D.: Arbitrage in skew Brownian motion models. Insur. Math. Econ. 50, 50–56 (2012)

Schweizer, M.: On the minimal martingale measure and the Föllmer–Schweizer decomposition. Stoch. Anal. Appl. 13, 573–599 (1995)

Skorokhod, A.V.: Stochastic equations for diffusion processes in a bounded region. Theory Probab. Appl. 6, 264–274 (1961)

Thomas, R.G.: Valuation of no-negative-equity guarantees with a lower reflecting barrier. Ann. Actuar. Sci. 15, 115–143 (2021)

Veestraeten, D.: Valuing stock options when prices are subject to a lower boundary. J. Futures Mark. 28, 231–247 (2008)

Veestraeten, D.: Currency option pricing in a credible exchange rate target zone. Appl. Financ. Econ. 23, 951–962 (2013)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors thank Claudio Fontana, Alexander Melnikov and Johannes Ruf, as well as the two anonymous referees and the Editor, for several helpful comments.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Buckner, D., Dowd, K. & Hulley, H. Arbitrage problems with reflected geometric Brownian motion. Finance Stoch 28, 1–26 (2024). https://doi.org/10.1007/s00780-023-00525-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-023-00525-x