Abstract

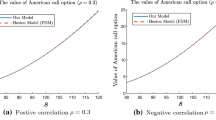

This paper proves the existence, uniqueness, monotonicity and continuity of the early exercise boundary attached to American-style standard options under the jump to default extended constant elasticity of variance model of Carr and Linetsky (Financ Stoch 10(3):303–330, 2006).

Similar content being viewed by others

Notes

The valuation of American-style contingent claims has a long history and a complete literature review on the topic is outside the scope of the present paper. A general overview of this literature may be found, for example, in the survey papers of Myneni [1], Broadie and Detemple [2] and Barone-Adesi [3], as well as in the monographs of Shreve [4, Chapter 8] and Detemple [5, Chapters 3, 4 and 8].

For any two real numbers x and y, we denote by \(x\vee y\) and \(x\wedge y\) , respectively, their maximum and minimum.

The default intensity specification as the negative power of the stock price has become also popular for pricing convertible bonds and other hybrid securities. See, for example, Das and Sundaram [55].

Intuitively, at time \(\tilde{\zeta }\), \(\mathcal {D}\) jumps from 0 to 1, \( dS_{t}^{\Delta }=-S_{t^{-}}^{\Delta }\), and the stock price falls to 0 where it remains forever.

See, for instance, Katori [36, p. 28].

A strict inequality is not obtained because it is possible that \(\theta ^{*}=T\wedge \zeta \).

See, for instance, Protter [60, p. 220].

Left-continuity has only been proved for strictly positive interest rates because Eq. (5.51) would be trivially satisfied if \(r\left( u\right) =q\left( u\right) =0\).

References

Myneni, R.: The pricing of the American option. Ann. Appl. Probab. 2(1), 1–23 (1992)

Broadie, M., Detemple, J.: Option pricing: valuation models and applications. Manag. Sci. 50(9), 1145–1177 (2004)

Barone-Adesi, G.: The saga of the American put. J. Bank. Financ. 29(11), 2909–2918 (2005)

Shreve, S.: Stochastic Calculus for Finance II: Continuous-Time Models. Springer, New York (2004)

Detemple, J.: American-Style Derivatives: Valuation and Computation. Chapman & Hall/CRC, Boca Raton (2006)

Broadie, M., Detemple, J.: American option valuation: new bounds, approximations, and a comparison of existing methods. Rev. Financ. Stud. 9(4), 1211–1250 (1996)

Huang, J.-Z., Subrahmanyam, M., Yu, G.: Pricing and hedging American options: a recursive integration method. Rev. Financ. Stud. 9(1), 277–300 (1996)

Ju, N.: Pricing an American option by approximating its early exercise boundary as a multipiece exponential function. Rev. Financ. Stud. 11(3), 627–646 (1998)

Nunes, J.: Pricing American options under the constant elasticity of variance model and subject to bankruptcy. J. Financ. Quant. Anal. 44(5), 1231–1263 (2009)

Ruas, J., Dias, J., Nunes, J.: Pricing and static hedging of American options under the jump to default extended CEV model. J. Bank. Financ. 37(11), 4059–4072 (2013)

Merton, R.: Option pricing when underlying stock returns are discontinuous. J. Financ. Econ. 3(1–2), 125–144 (1976)

Linetsky, V.: Pricing equity derivatives subject to bankruptcy. Math. Financ. 16(2), 255–282 (2006)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81(3), 637–654 (1973)

Merton, R.: Theory of rational option pricing. Bell J. Econ. Manag. Sci. 4(1), 141–183 (1973)

Carr, P., Linetsky, V.: A jump to default extended CEV model: an application of Bessel processes. Financ. Stoch. 10(3), 303–330 (2006)

Cox, J.: Notes on option pricing I: constant elasticity of variance diffusions. In: Working Paper, Stanford University. Reprinted in Journal of Portfolio Management, 23 (1996), pp. 15–17 (1975)

Emanuel, D., MacBeth, J.: Further results on the constant elasticity of variance call option pricing model. J. Financ. Quant. Anal. 17(4), 533–554 (1982)

Schroder, M.: Computing the constant elasticity of variance option pricing formula. J. Financ. 44(1), 211–219 (1989)

Davydov, D., Linetsky, V.: Pricing and hedging path-dependent options under the CEV process. Manag. Sci. 47(7), 949–965 (2001)

Davydov, D., Linetsky, V.: Pricing options on scalar diffusions: an eigenfunction expansion approach. Oper. Res. 51(2), 185–209 (2003)

Linetsky, V.: Lookback options and diffusion hitting times: a spectral expansion approach. Financ. Stoch. 8(3), 373–398 (2004)

Larguinho, M., Dias, J., Braumann, C.: On the computation of option prices and greeks under the CEV model. Quant. Financ. 13(6), 907–917 (2013)

Black, F.: Studies of stock price volatility changes. In: Proceedings of the Meetings of the American Statistical Association, Business and Economics Statistics Division, pp. 177–181 (1976)

Christie, A.: The stochastic behavior of common stock variances: value, leverage and interest rate effects. J. Financ. Econom. 10(4), 407–432 (1982)

Bekaert, G., Wu, G.: Asymmetric volatility and risk in equity markets. Rev. Financ. Stud. 13(1), 1–42 (2000)

Dennis, P., Mayhew, S.: Risk-neutral skewness: evidence from stock options. J. Financ. Quant. Anal. 37(3), 471–493 (2002)

Bakshi, G., Kapadia, N., Madan, D.: Stock return characteristics, skew laws, and the differential pricing of invididual equity options. Rev. Financ. Stud. 16(1), 101–143 (2003)

Campbell, J., Taksler, G.: Equity volatility and corporate bond yields. J. Financ. 58(6), 2321–2349 (2003)

Bakshi, G., Madan, D., Zhang, F.: Investigating the role of systematic and firm-specific factors in default risk: lessons from empirically evaluating credit risk models. J. Bus. 79(4), 1955–1987 (2006)

Cremers, M., Driessen, J., Maenhout, P., Weinbaum, D.: Individual stock-option prices and credit spreads. J. Bank. Financ. 32(12), 2706–2715 (2008)

Zhang, B., Zhou, H., Zhu, H.: Explaining credit default swap spreads with the equity volatility and jump risks of individual firms. Rev. Financ. Stud. 22(12), 5099–5131 (2009)

Carr, P., Wu, L.: Stock options and credit default swaps: a joint framework for valuation and estimation. J. Financ. Econom. 8(4), 409–449 (2010)

Borodin, A .N., Salminen, P.: Handbook of Brownian Motion—Facts and Formulae, 2nd edn. Birkhauser, Basel (2002)

Göing-Jaeschke, A., Yor, M.: A survey and some generalizations of Bessel processes. Bernoulli 9(2), 313–349 (2003)

Jeanblanc, M., Yor, M., Chesney, M.: Mathematical Methods for Financial Markets. Springer, New York (2009)

Katori, M.: Bessel Processes, Schramm-Loewner Evolution, and the Dyson Model (SpringerBriefs in Mathematical Physics). Springer, Tokyo (2016)

Mendoza-Arriaga, R., Linetsky, V.: Pricing equity default swaps under the jump-to-default extended CEV Model. Financ. Stoch. 15(3), 513–540 (2011)

Dias, J., Nunes, J., Ruas, J.: Pricing and static hedging of European-style double barrier options under the jump to default extended CEV model. Quant. Financ. 15(12), 1995–2010 (2015)

Nunes, J., Ruas, J., Dias, J.: Pricing and static hedging of American-style knock-in options on defaultable stocks. J. Bank. Financ. 58, 343–360 (2015)

Kolodner, I.: Free boundary problem for the heat equation with applications to problems of change of phase. Commun. Pure Appl. Math. 9(1), 1–31 (1956)

Samuelson, P.: Rational theory of warrant pricing. Ind. Manag. Rev. 6(2), 13–32 (1965)

McKean Jr., H.: Appendix: a free boundary problem for the heat equation arising from a problem of mathematical economics. Ind. Manag. Rev. 6(2), 32–39 (1965)

Van Moerbeke, P.: On optimal stopping and free boundary problems. Arch. Ration. Mech. Anal. 60(2), 101–148 (1976)

Bensoussan, A.: On the theory of option pricing. Acta Appl. Math. 2(2), 139–158 (1984)

Karatzas, I.: On the pricing of American options. Appl. Math. Optim. 17(1), 37–60 (1988)

Kim, I.: The analytic valuation of American options. Rev. Financ. Stud. 3(4), 547–572 (1990)

Jacka, S.: Optimal stopping and the American put. Math. Financ. 1(2), 1–14 (1991)

Carr, P., Jarrow, R., Myneni, R.: Alternative characterizations of American put options. Math. Financ. 2(2), 87–106 (1992)

Jamshidian, F.: An analysis of American options. Rev. Futur. Mark. 11(1), 72–80 (1993)

Detemple, J., Tian, W.: The valuation of American options for a class of diffusion processes. Manag. Sci. 48(7), 917–937 (2002)

Lamberton, D., Mikou, M.: The critical price for the American put in an exponential Lévy model. Financ. Stoch. 12(4), 561–581 (2008)

Monoyios, M., Ng, A.: Optimal exercise of an executive stock option by an insider. Int. J. Theoret. Appl. Financ. 14(1), 83–106 (2011)

Karlin, S., Taylor, H.M.: A Second Course in Stochastic Processes. Academic Press, San Diego (1981)

Linetsky, V., Mendoza-Arriaga, R.: Unified credit-equity modeling. In: Bielecki, T.R., Brigo, D., Patras, F. (eds.) Credit Risk Frontiers: Subprime Crises, Pricing and Hedging, CVA, MBS, Ratings, and Liquidity, chap. 18, pp. 553–583. Bloomberg Press, New Jersey (2011)

Das, S., Sundaram, R.: An integrated model for hybrid securities. Manag. Sci. 53(9), 1439–1451 (2007)

Andersen, L., Buffum, D.: Calibration and implementation of convertible bond models. J. Comput. Financ. 7(2), 1–34 (2003)

Zhang, X.: Analyse Numérique des Options Américaines dans un Modèle de Diffusion avec Sauts, Ph.D. thesis, Ecole des Ponts ParisTech (1994)

Pham, H.: Optimal stopping, free boundary, and American option in a jump-diffusion model. Appl. Math. Optim. 35(2), 145–164 (1997)

Detemple, J., Kitapbayev, Y.: On American VIX options under the generalized 3/2 and 1/2 Models. Math. Financ. 28(2), 550–581 (2018)

Protter, P.: Stochastic Integration and Differential Equations, 2nd edn. Springer, New York (2005)

Peskir, G.: A change-of-variable formula with local time on curves. J. Theor. Probab. 18(3), 499–535 (2005)

Øksendal, B.: Stochastic Differential Equations: An Introduction with Applications, 4th edn. Springer, Berlin (1995)

Karatzas, I., Shreve, S.: Methods of Mathematical Finance. Springer, New York (1998)

Bielecki, T.R., Rutkowski, M.: Credit Risk: Modeling Valuation and Hedging. Springer, Berlin (2002)

Pham, H.: Optimal stopping of controlled jump diffusion processes: a viscosity solution approach. J. Math. Syst. Estim. Control 8(1), 1–27 (1998)

Jaillet, P., Lamberton, D., Lapeyre, B.: Variational inequalities and the pricing of American options. Acta Appl. Math. 21(3), 263–289 (1990)

Chung, S.-L., Shih, P.-T.: Static hedging and pricing American options. J. Bank. Financ. 33(11), 2140–2149 (2009)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors thank the editor (Professor Huyên Pham) and an anonymous referee, whose suggestions and corrections have significantly improved this article. We also thank the participants in the 9th World Congress of the Bachelier Finance Society (New York) and in the Nova SBE 16/17 Economics Seminars (Lisbon) for useful comments on an earlier draft of this paper as well as Yerkin Kitapbayev for very helpful discussions. Financial support from Fundação para a Ciência e Tecnologia (FCT), grant number UID/GES/00315/2013, is also gratefully acknowledged. Of course, all the remaining errors are the exclusive responsibility of the authors. João Pedro Ruas: The analysis, opinions, and findings of this paper represent the views of the authors, and they are not necessarily those of the Sociedade Gestora dos Fundos de Pensões do Banco de Portugal, the Banco de Portugal, or the Eurosystem.

Rights and permissions

About this article

Cite this article

Nunes, J.P.V., Dias, J.C. & Ruas, J.P. The Early Exercise Boundary Under the Jump to Default Extended CEV Model. Appl Math Optim 82, 151–181 (2020). https://doi.org/10.1007/s00245-018-9496-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00245-018-9496-7