Abstract

We examine how the gender of business owners is related to the wages paid to female relative to male employees working in their firms. Using Finnish register data and employing firm fixed effects, we find that the gender pay gap is—starting from a gender pay gap of 11 to 12%—two to three percentage points lower for hourly wages in female-owned firms than in male-owned firms. Results are robust to how the wage is measured, as well as to various further robustness checks. More importantly, we find substantial differences between industries. While, for instance, in the manufacturing sector, the gender of the owner plays no role in the gender pay gap, in several service sector industries, like ICT or business services, no or a negligible gender pay gap can be found, but only when firms are led by female business owners. Businesses with male ownership maintain a gender pay gap of around 10% also in the latter industries. With increasing firm size, the influence of the gender of the owner, however, fades. In large firms, it seems that others—firm managers—determine wages and no differences in the pay gap are observed between male- and female-owned firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Motivation

Faced with a still significant gender pay gap between female and male employees (Blau and Kahn 2017), one strand of literature argues that the gender composition of firm management may matter for the size of the “unexplained” part of the gap. To the extent that this part of the pay gap is rooted in discriminatory practices against female workers and to the extent that female superiors are more motivated than male superiors to reduce this kind of discrimination or are concerned about gender pay equality, female superiors may be able to reduce the gender pay gap.Footnote 1 Most (but not all) research in this field points to small, but significant, effects when comparing firms where male managers dominate with firms where female managers dominate (see, e.g., Abendroth et al. 2017; Theodoropoulos et al. 2022), or when the effect of a change from male to female manager is analyzed for the employees reporting to that specific manager (see, e.g., Cardoso and Winter-Ebmer 2010; Hensvik 2014). However, as female managers are usually neither major shareholders nor owners of these firms, they are not necessarily able to freely determine how wages are set. Their bounded involvement in these firms and their constrained ability to determine wages might limit their moderating influence on the gender pay gap.

Previous research focuses on management gender but does not investigate how the gender of firm ownership influences the gender pay gap. Female entrepreneurs and firm owners have different access to organizational power through their capital investment and profit-sharing than female managers, but they also have more skin in the game. As owners, they may decide about the wages of their salaried employees in a different way than managers—in small firms, for instance, there might be no interference from other managers or executives. Moreover, women who become managers in established firms may get involved in the wage-setting process where a gender pay gap already exists. By contrast, female entrepreneurs may have the ability to implement equal pay irrespective of gender from day 1. In that sense, the wage structure deserves separate attention with regard to the gender pay gap among firms run by female versus male entrepreneurs. Therefore, in this paper, focusing on entrepreneurs and firm owners, we investigate what role their gender plays in the wages paid to women relative to the wages paid to men in their respective firms.

The gender of the entrepreneur (as much as of the manager) may matter for the gender pay gap when there exists some kind of pay discrimination against female in comparison to male employees. Following the distinctions made in psychological research when investigating gender pay gaps with regard to discrimination, women employees may either suffer from explicit discrimination (which is forbidden in most European countries), when male superiors explicitly favor male over female employees, or from implicit discrimination. Implicit discrimination occurs when women confront unconscious or unintentional forms of bias (Ellemers 2018), where male managers, who still often comprise the majority in management, might—for instance because of their homophilous preferences—be inclined to support or promote male employees more strongly than female employees (Ertug et al. 2022).

Parallel research in economics also discusses discrimination, with literature basically distinguishing between two models. There is “taste-based” discrimination (Becker 1971; Charles and Guryan 2008), where managers may experience disutility if they employ workers of the opposite gender. To compensate for such disutility, employees with a different gender than their manager must agree to relatively lower wages if they want to be employed. A second approach in economics argues that gender pay gaps are the consequence of statistical discrimination. Tracing back to the model of Phelps (1972), it is claimed that employers have incomplete information in the sense that the expected future productivity of women is less predictable than men’s expected future productivity. This is because women are more likely to quit their jobs for a variety of reasons (including, for instance, motherhood or moving to another job because their partner moves; see, e.g., Cooke et al. 2009). Female individuals, when they are not able to signal their individual future productivity value, must accept—as a consequence of their group membership—lower wages, are denied access to jobs that involve further investments like firm-specific training, or may face search frictions (Sulis 2012). Recent reviews claim that the psychological approach of classifying discrimination into implicit and explicit aspects also captures these two main economic models of taste-based and statistical discrimination (Bertrand and Duflo 2017).

The aim of this paper is to investigate whether female entrepreneurs and firm owners are willing and able to reduce the part of the observable gender pay gap that is related to any of the described discriminatory practices. Having the ability is a necessary, but not sufficient, condition to reduce this part of the pay gap. Female entrepreneurs (as much as female managers) also need to have the willingness to do so. Theoretical research is divided on whether women superiors have the willingness to rectify the gender wage gap to the extent that it is rooted in discrimination.

On the one hand, research argues in favor of the “same gender approach,” according to which female superiors—here female entrepreneurs—have homophilous preferences that lead to common interests between them and female workers within a firm (McPherson, Smith-Lovin, and Cook 2001; Rudman and Goodwin 2004). This may unfold effects in various ways. Female entrepreneurs may support, help, or mentor female employees, for instance by promoting them more often or by paying them higher wages (Baron and Pfeffer 1994; Matsa and Miller 2011). Female entrepreneurs may also serve as role models (Ely 1994), creating positive spillover effects on female employees (Zimmermann 2022). An alternative explanation for homophilous bonds is that managers are better able, due to differences in communication styles, to assess the skills of their employees if they are of the same gender (Flabbi et al. 2019; Theodoropoulos et al. 2022). Thus, applying the same gender approach to the present analysis means that female entrepreneurs and firm owners will act as “agents of change” (Cohen and Huffman 2007), seeking to nullify that part of the gender pay gap that is owed to discriminatory practices in the workplace, perhaps even creating different discriminatory practices against male employees.

On the other hand, the opposing argument suggests that the principal-agent relationship between female entrepreneurs and female employees may counteract homophilous preferences, resulting in a gender pay gap that remains the same, if it is not increasing. Women may share men’s taste for discrimination with respect to women in lower positions (Deaux 1985). Female superiors who work in male-dominated industries need to become “one of the team.” Therefore, female superiors may feel pressure to maintain the status quo and to not ease the discrimination against female workers in such firms. This may also hold for female entrepreneurs, according to which they have to behave like “cogs in the machine” to receive acceptance from their male workers when they operate in a male-dominated industry (Kanter 1977). Ridgeway (1997) argues that there might exist a culturally driven persistent gender status belief according to which both female and male superiors implicitly expect superiority and greater competence of men. In a similar direction, according to the “queen bee syndrome” (Bednar and Gicheva 2014), individually successful women (in particular, in male-dominated environments) may feel competitive threats from other women or may hold negative stereotypical views about other women’s career commitment (Derks et al. 2011). Thus, applying the “cogs in the machine” approach or the “queen bee syndrome” to the present analysis means that female entrepreneurs will not seek to reduce the part of the gender pay gap that is owed to discriminatory practices in the workplace; they may even work to increase discriminatory practices against female employees.

Overall, it is not fully clear which of the two effects will dominate, thus what kind of wages female entrepreneurs and firm owners pay to their female relative to their male employees in comparison to male entrepreneurs and firm owners. Yet, it becomes obvious that approaches—like the “cogs in the machine” approach—arguing in the direction that female workers will face the same pay gap irrespective of the gender owner are mostly explained by settings where female entrepreneurs act in a male-driven environment. In such an environment, like in the manufacturing sector, there is not only a strong gender gap in entrepreneurship (Caliendo et al. 2015) but also the working population is mostly male. Accordingly, the wage-setting process for female entrepreneurs might be different in environments where there is more gender balance or a majority of female workers. Hence, it is interesting to conduct a heterogeneity analysis that takes these kinds of differentiations into account.

Based on these theoretical considerations, we empirically investigate in what way the gender of entrepreneurs and firm owners matters for the gender pay gap. More specifically, using Finnish register data, we analyze—for the first time, to the best of our knowledge—the size of the gender pay gap in firms started and owned solely or predominantly by female entrepreneurs in comparison to firms started and owned solely or predominantly by male entrepreneurs. We hypothesize, first, that the gender of entrepreneurs and firm owners matters in the sense that the gender pay gap will be smaller in firms that are started and owned solely or predominantly by female entrepreneurs. Secondly, given the contrasting expectations from earlier research about the influence of female managers (not owners), which may be rooted in the gender structure of industries, we explicitly take the industry and the related gender structure of employees into account. By investigating gender pay gaps for firms operating in different industries at the one-digit level, we aim to find out whether the observed gender structure of the industry matters for how female entrepreneurs and business owners pay their female employees relative to their male employees. Third, as we also have information on firm size, we are able to analyze what kind of wages are set in small versus large firms run by entrepreneurs and how the gender pay gap changes as firms become larger, controlling for the gender of the entrepreneurs. By doing so, we reveal to what extent the potential influence of the gender of the owner on gender pay gaps depends on firm size.

To investigate our research questions, we rely on unique Finnish register data provided by Statistics Finland for 2006–2015. The data links various sources delivering information on firms in the private business sector of Finland as well as wages paid in these firms (for details on data sources, see Kankaanranta and Melakari 2021). Using these data for our empirical setting, we analyze differences in person-level hourly or monthly wages between different firm owner groups: female-owned, male-owned, mixed or balanced ownership, and unknown or more dispersed ownership. We study the pay gap and differences in the pay gap, i.e., the difference in the estimates between different owner groups, controlling for various background factors. We further divide firms into subgroups by their industry, firm size, and relative productivity to analyze the differing pay gaps between these subgroups.

Starting from an hourly wage gap of about 11 to 12% for the hourly wages, we observe that the gender pay gap is—depending on whether we include firm fixed effects in our estimations—two to three percentage points lower for hourly wages in female-owned firms than in male-owned firms. Moreover, we find in several service sector industries no or a negligible gender pay gap, but only when firms are led by female business owners. In male-owned businesses, pay gaps are still at around 10%, also in these industries. Finally, in large firms, the influence of the gender of the owner on this pay gap disappears.

2 Previous empirical research

Previous research in this area concentrates on the question of whether the gender of managers, and other dependently employed supervisors, influences the gender wage gap.Footnote 2 These studies can be divided according to their use of different identification strategies. Some focus on the impact of female manager on the gender pay gap by analyzing how the switch from male to female managers influences the pay gap of their direct female and male subordinates. Others use a comparison by examining differences of gender wage gaps in firms where the share of female managers is high in comparison to firms with no or a low share of female managers, with earlier studies being restricted to cross-sectional analysis and few more recent studies exploiting the panel structure of the data at hand.

The analysis of Portuguese firms between 1987 and 2000 by Cardoso and Winter-Ebmer (2010) is one of the first type: they investigate to what extent the wage differentials are reduced if the management in a firm is changed from male to female. They pool all kinds of female managed firms, but restrict the analysis to firms with more than 10 employees. Their main finding is that, under such a management change, the monthly wage differential is reduced by 1.5 percentage points.Footnote 3 Hensvik (2014) finds similar results—a narrowing of the gender pay gap by 1.2 percentage points—for Swedish data when the gender of the manager changes from male to female in a firm. In her further analysis, she reveals that the gap reducing effect mostly owes to worker sorting behavior. Thus, instead of actively reducing the wage gap among the existing staff, female managers hire more highly skilled women who then receive higher wages. In contrast, Srivastava and Sherman (2015), who also analyze the influence of female managers on the wage levels of their employees after a change from male to female manager, but who restrict their investigation to one single firm in the information services (a male-dominated industry), find no support for a reduction of the gender wage gap. They even observe, in a subsample of high-performing supervisors and low-performing employees, that low performing women who switched from a male to a female supervisor had a lower salary in the following year than the same type of men who made the same switch, thus increasing the gender pay gap in this specific group. Flabbi et al. (2019), who restrict their analysis to Italian manufacturing firms, another male-dominated industry, also do not find that female managers reduce the gender pay gap and rather observe (like Srivastava and Sherman 2015) increases in the wage gap for less productive female workers.

Cohen and Hofman (2007) and Hirsch (2013) report observations within the second domain of comparisons. Based on cross-sectional analyses of US census data from 2000 and German data from 2008, both papers examine whether the gender wage gap is lower if the share of female management is high. Both observe that a high share of female managers is associated with a slightly lower pay gap, but they report a diverging effect in one respect: while Hirsch finds for Germany a smaller wage gap if the number of female managers is high in the second level-management, Cohen and Hofman (2007) reveal the exact opposite for the US—the gap is lower if the share of females at the top management level is high. Further research by Lucifora and Vigani (2022) of 30 European countries, for the 1995–2010 period, finds an overall gender earnings gap of 20%, with the pay gap being 5 percentage points lower if female employees work in firms with female owners.

More recent analysis exploits the panel structure of these data and includes—in contrast to the previous approaches—among others firm fixed effects. Abendroth et al. (2017) use similar German data as Hirsch (2013), but from 2012 and 2013 and they concentrate on large firms, where they investigate the within-firm variance of wages. In this subset of firms, they find a gender earnings gap of 12% for monthly incomes, which was 2.4 percentage points lower if the firm had female managers. Zimmermann (2022) and Sondergeld and Wrohlich (2023) observe similar results for different time periods between 2004 and 2018. Starting with an overall gender pay gap of about 15%, reductions in the gender pay gap range from 1.2 percentage points for the first level female management and a stronger effect for the second level female management. This confirms the earlier suggestive observations of Hirsch (2013) that the female management at the second level has a higher influence on the reduction of gender pay gap in Germany.

Hence, the reviewed empirical research on the influence of female managers on the gender pay gap shows that although firms with a larger share of female managers tend to pay wages that are associated with a lower gender wage gap, a substantial gap remains. Analyzing the influence of a change in the supervisor’s gender finds very small positive effects, no effect at all, or even negative effects for specific subgroups. It should be noted, however, that the latter two observations (of no or negative influences of female managers on the gender pay gap) are found in male-dominated industries, the manufacturing sector (Flabbi et al. 2019) in information services (Srivastava and Sherman 2015).

Yet, the access of female managers to organizational power is limited. Therefore, our approach takes a new direction. We examine how the gender of the entrepreneur or of the firm owner is related to the gender wage gap of those who are working for these entrepreneurs. There are several reasons for analyzing the wage-setting of female entrepreneurs and business owners separately from female managers. Female entrepreneurs and business owners are, through their ownership, involved in the capital investment and profit-sharing of their own firms in a different way than female managers. Therefore, as a principal, they have a different relationship with their employees than do managers and, as such, may have greater autonomy. Typically, entrepreneurs and business owners directly decide on wages, in particular when firms are small and there is no further management in between them and their employees.Footnote 4 By contrast, female managers usually enter existing firms and are confronted with existing wage inequalities that they need to correct, if they aim to address the problem. At the same time, another important difference between entrepreneurs and managers is that female (as much as male) entrepreneurs will be aware that any wage changes will affect their own earnings.

We explore in the subsequent empirical analysis the gender pay gap in firms run by female entrepreneurs, comparing it with the pay gap of firms that are run by male entrepreneurs. Thus, we aim to identify what kind of gender pay gap we observe in firms that are owned solely or predominantly by female entrepreneurs. With a comprehensive analysis of the structures of gender pay gaps with the linked owner-employer-employee data along several dimensions, we test the research questions that can be derived from the economic and psychological literatures, as presented in the introduction.

3 Data and summary statistics

3.1 Data description

For our analysis, we construct a unique data set based on Finnish register data comprising limited liability firms in the private business sector and their employees by linking various data sources maintained for research purposes by Statistics Finland, among them the Structure of Earnings Statistics (SES), the Finnish Longitudinal Employer-Employee Data (FLEED), and the Finnish Longitudinal Owner-Employer-Employee (FLOWN), as well as the Finnish Patent and Registration Office data. The data is comprehensive and rich in its content, allowing versatile wage analysis by employee gender and firm owner gender over the 2006–2015 period, as FLEED was discontinued in 2016. The data is repeated cross-section data, meaning that firms can disappear from and enter the sample, as they enter and exit the market. Similarly, employees can exit and enter the job market or change firms. The repeated nature of the data allows us to follow employees and firms over time and allows the use of firm fixed effects. Wages are observed at the end of the year, so an employee’s employment status at the end of the year defines if they contribute to the sample that year and who their employer is.

One advantage of our data is that it is a matched owner-employer-employee data set, providing us with information on employment structure within firms, i.e., the gender of all employees and their wages, which can be linked to the gender of the firm owner(s) and other firm features. Our target population is limited liability companies in the Finnish Business Register data with the size of at least one person. We include private non-agricultural business sector firms but exclude specific sectors, namely mining and quarrying; coke and refined petroleum products; electricity, gas and steam, and air conditioning supply; and water supply, sewerage, and waste management and remediation activities; as well as financial and insurance activities (according to NACE Rev. 2 the included sectors are 10-18, 20-33, 41-43, 45-47, 49-53, 55-56, 58-63, 68-82). Exclusion of these sectors is rationalized by the challenges in the measurement of productivity, which is one dimension of our analysis. Firm age is defined according to its oldest establishment in a given year to mitigate the effects of organizational changes, like mergers and acquisitions, in the firm codes. In comparisons between firm groups, we use information on productivity, dividing firms into productivity quartiles according to employment-weighted labor productivity within each 2-digit industry.

The company information is linked with information on their personnel in each year, the Structure of Earnings Statistics (SES) data by Statistics Finland, which includes detailed information on hourly and monthly wages for each wage earner, as well as part-time jobs. SES data allows us to calculate monthly wages without special payments, e.g., for overtime work, working shifts or non-standard hours, standby pay, or fringe benefits. Hourly wages can be adjusted for additional annual bonuses and allowances. The disadvantage of the SES data is its relatively low coverage of small non-organized firms with fewer than 5–10 persons. Private sector coverage of the data is about 55 to 75% of all private sector employment depending on the year and industry.

To reveal potential biases in the SES data and check the robustness of our findings, we use the FLEED (Finnish Longitudinal Employer-Employee Data) by Statistics Finland as a second data source. FLEED data include information on the gender, age, education, number of children, and other background characteristics of employees between ages 15 and 70. It includes annual income and months worked for each person, which we use to build an alternative measure for monthly wages. Although it does not allow for calculating hourly wages, the advantage of FLEED data is that it has a high coverage of firms of all sizes.

Finally, we link ownership information on the firms from the Finnish Longitudinal Owner-Employer-Employee (FLOWN) data by Statistics Finland. The Finnish Tax Authority requires firms to report their ten largest shareholders. If there are more than ten shareholders, those having at least 10% of the company stock. To improve the data coverage on person owners, we traced person owners behind enterprise-type owners in two layers. We define firms with female ownership greater than 60% of the company shares as female-owned firms, and firms with male owners greater than 60% of the shares as male-owned. Mixed firms have 40–60% of both male ownership and female ownership. The remaining firms are categorized as firms with unknown person owners. This last category is the largest in employment terms because it includes publicly listed firms and larger firms with distributed ownership.

As one extension, we identify the CEO of the firm from the Finnish Patent and Registration Office data on firm board members. We define the manager-owner of the firm as the owner with more than 50% ownership and having a CEO position at the end of the year. As a result, we can compare the results in several ways, namely owner and manager, with firm type defined according to owner gender with those on firm type defined using the manager gender or the owner-manager gender.Footnote 5

3.2 Descriptive statistics

The aim of this paper is to examine whether female entrepreneurs and business owners set wages in the relationship between female and male employees that are different from the relative wages set by male entrepreneurs and firm owners. For this analysis, we use monthly gross and hourly gross earnings, including and excluding bonuses and other special payments or allowances, separating these by gender. Tables 1 and 2 as well as Tables 3 and 4 report summary statistics of individual and firm characteristics for both the SES and the FLEED data. We have information from SES (FLEED) on nearly 470,000 (nearly 950,000) workers working in 9200 (66,600) firms in the private business sector. Among these, we observe 831 (6411) firms as female-owned, 779 (5242) firms as mixed owned, and 4196 (40,267) as male-owned. Thus, among all firms where the gender composition of the owners can be identified, 14% (12%) are run by a majority of female owners and entrepreneurs, while another 13 % (10%) of firms are owned by a mix of both genders, meaning that 73% (78%) of all firms (with an identified gender composition) have a majority of male owners, mirroring the typically higher shares of male firm owners in many industrialized economies. The other workers have jobs in 3387 (14,679) firms where the gender of the owner is unknown—typically larger firms. Employees are, on average, a little more than 40 years old, with marginally older and higher educated people working in firms with unknown owners, i.e., larger firms. Moreover, firms with unknown owners and, to a certain extent, male-owned firms employ larger shares of workers with technical occupations and have more workers higher up in the hierarchy, like professionals or technicians.

The overall share of women workers varies depending on the data source between 23% and 31% in male-owned firms and 42% and 52% in female-owned firms, but this share again varies widely across industries, as Tables 3 and 4 shows. For instance, in manufacturing, the share of female workers is between 7 and 14% in all four types of ownership structures, while between 56 and 77% are female employees in the accommodation and food services. More importantly, there are several industries in the service sector where the gender of the entrepreneur correlates with whether more males or females are employed, on average, in the business, such as wholesale and retail (G), information and communication (J), professional, scientific, and technical services (M), and administrative and support services (N), where more females work in female-owned businesses and more males work in male-owned businesses. As it turns out in Section 4, this might be one important difference for how gender pay gaps develop in male- versus female-owned businesses.

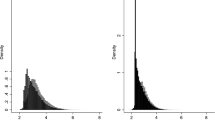

In terms of hourly earnings of female and male employees in female- and male-owned businesses (only available in the SES data), women always earn less than men on average; the differences fluctuate between three to four Euros per hour for all businesses where the gender of the owners are known, also including female-owned firms and firms with unknown person owners. Additionally, the differences in monthly earnings are similar across the three categories with known ownership, varying between 530 Euros in the FLEED data and 750 Euros in the SES data. Again, differences are higher at 800 to 900 Euros for firms with unknown ownership. It is important to highlight that, while the share of females running businesses is much lower than the share of males, the average size of these businesses is similar for the two genders as well for firms with mixed ownership. However, as Figure 1 shows, the size distributions differ for firms with different ownership structures. Female-owned firms are more commonly small than male-owned firms. Firms with less than 10 employees make up 70% of female-owned firms, but only 56% of male-owned firms. Male-owned firms are more likely than female-owned firms to have 10–50 and 50–250 employees. The largest firms with more than 250 employees are predominantly firms with unknown ownership structure.

4 Empirical analysis

4.1 Empirical strategy

To test the relationship between the entrepreneur’s gender and the gender pay gap along different dimensions, we estimate two kinds of Mincer-type (log) wage regressions at the employee level. In the first approach, we include employee gender, owner gender, their interaction, and several well-established control variables known to be relevant for explaining large parts of the gender pay gap (Blau and Kahn 2017). More specifically, next to gender, we control for age of the workers, the number of children below the age of 7, education level, education field, detailed occupation classes (i.e., occupation at the 3-digit level), firm size, firm age, and year dummies.

where wages are measured in natural logs and Female is an indicator variable that takes value 1 if the employee \(i\) who works in firm \(j\) is female and 0 if the employee is male. Female owner is an indicator that takes value 1 when the owner of the firm \(j\) is female and 0 otherwise. \({\alpha }_{j}\) represents firm fixed effects. The Control variables are described above.

In the second approach, we apply OLS regressions with Mincer-type (log) wage equations separately for each male- and female-owned firm. We further separate these from mixed-type firms where there is (nearly) an equal split between male and female owners and from firms with unknown owners—typically larger firms with dispersed ownership, including listed (publicly traded) companies. We define the pay gap as the coefficient of the indicator “female” in the Mincer type wage equation and study the difference in this gap between different owner groups. To further tease out various heterogeneities in the wage gap, we conduct separate regressions by dividing firms into subgroups by their industry, firm size, and relative productivity. Finally, we include robust standard errors with clustering by firms.

To assess the gender pay gaps differentiated by the gender of the entrepreneur, we present the following OLS regression for our estimation approach:

where wages are measured in natural logs and Female is an indicator variable that is 1 if the employee is female and 0 if the employee is male. The included Control variables are described above. This model is estimated separately for each firm-owner group and further for the sub-groups mentioned before. We extend this model by including firm fixed effects:

where \({\alpha }_{j}\) represents firm fixed effects that control for unobserved firm qualities that may influence the wage-setting and selection of employees to firms.

Since the model is estimated separately for female- and male-owned firms, the estimations have different samples and seemingly unrelated estimation methods are used to build a variance-covariance matrix that allows us to test for the statistical significance of the differences in the pay gap. Last, but not least, we make quantile regressions that are performed at the 10th, 25th, 50th, 75th, and 90th percentiles of the income distribution. Quantile regressions are useful for determining how the distribution of the wage gap is skewed, thus where the wage gaps are largest—at the bottom or the top incomes.

4.2 General estimation results

Table 5 provides the main results of our estimation of the gender pay gap for the full sample. In Finland, the hourly adjusted pay gap, during the observation period of 2006 to 2015, was 12.4%, when controlling for human capital, industry, and occupation beyond the basic variables, and 11.6% when also including firm fixed-effects. This gap is significantly lower in firms run by female entrepreneurs, by 3.3 percentage points in specification (1), and by 2.3 percentage points in specification (2) when we include firm fixed effects. Moreover, we observe a negative relationship between hourly wages and female owners that is offset for female employees through the positive interaction effect. This means that the reduction in the gender pay gap in female-owned firms is mostly realized through lower wage payments to male employees, while female employees realize similar wage payments in male- and female-owned firms.

In Table 6, we present estimations separated by the gender of firm owners to further understand the heterogeneous effects between the genders—and confirm these observations for both specifications (i.e., without and with fixed effects). In firms with mixed gender ownership, pay gaps are similar to female-owned firms; in firms with unknown ownership, the pay gap is of the same size as in male-owned firms. The result of a 3 percentage points lower gender pay gap among female entrepreneurs and firm owners (when not including firm fixed effects) is generally confirmed for all kinds of variations of control variables (see panels A–D in Appendix Table A1). We find the same difference in the gap for additional payments (bonuses) or when occupational variables are not controlled for. In the latter case, gender pay gaps are at higher levels, while more controls lower the overall gender pay gaps (Meara et al. 2020), but differences between male and female business owners remain similar. This also holds for firms where the CEO and firm owner are the same person (see panel E in Appendix Table A1): again, the gender wage gap is 3 percentage points lower (as among female owners when compared to male owners). For monthly wages, the gender pay gap in female-owned firms is about 4 to 5 percentage points lower than in male-owned firms.

When comparing the pay gaps for firms run by male and female CEOs (groups defined by CEOs instead of the owners of the firms, see panels F–G in Appendix Table A1), we observe that, in firms run by a male CEO, the wage gap is, at 12.2%, very similar to male owners; under female CEOs, wage differences are only 1.6 percentage points lower when compared to male CEOs. Hence, the difference in hourly wages (i.e., the difference in the gap) between male and female employees is (in estimations without firm fixed effects) about 3 percentage points in female-owned firms when compared to male-owned firms, thus larger than the difference under female CEOs in comparison to male CEOs.

We also estimate quantile regressions to reveal the pay gaps over the wage distribution. Figure 2 presents exemplary results for 2 years, 2011 and 2015. In both years, the same patterns are observed. The gender pay gap is getting larger in both male- and female-owned firms, the higher we move up the distribution ladder. At the same time, the increase in the gap between male and female workers is getting larger at a lower rate in female-owned firms. This means that gender pay gaps are highest in the upper percentiles of the wage distribution, at 12 percentage points in female-owned and 16 in male-owned firms.Footnote 6 Thus, the difference in the gap between male and female workers is also largest, at 4 percentage points, in the upper percentiles when comparing female- with male-owned businesses, while the difference in the gap is around 1 percentage point in the lower tails, with differences being significant only in the upper five deciles of the distribution.

Quantile regression for gender pay gaps in 2011 and 2015. Note: The figure shows how the gender pay gap develops over the wage distribution in female- versus male-owned firms. The figure graphs the coefficients of indicator “female” in a quantile regression with hourly (SES) wage as dependent variable and as controls “female,” age, no of children <7, education (2-digit), occupation (3-digit), firm size, firm age, and industry (2-digit).

4.3 Further analyzing the gender wage gap

We continue by examining firms in various industries, with various firm sizes, and various productivity levels.

Industries

It is important to differentiate the analysis of wage gaps according to industries as there are industries with more male than female employees and vice versa. Earlier research points to potential differences: in male-dominated industries, female entrepreneurs (like female managers) may be inclined to turn against female employees (see Flabbi et al. 2019) to signal to male employees that they, the female entrepreneurs, are “one of the boys” (see Srivastava and Sherman 2015, p. 1783). Our differentiation according to industries at the 1-digit level delivers several insights (Table 7).

Gender pay gaps in the secondary-sector industries (manufacturing and construction) and the more traditional third-sector industries (wholesale and retail) are generally larger than those in the other service-sector industries. Looking more deeply into differences, in the first three industries (with 1-digit codes C, F, and G), we observe gender pay gaps between 13.5 and 15% in male-owned businesses in the estimations without fixed effects and between 12 and 13% in the estimations with fixed effects. There are hardly lower pay gaps in female-owned business—only in construction the pay gap is significantly lower, by around 3 percentage points in female-owned firms. Much in contrast to this, in female-owned firms of service sector industries like information and communication (J), real estate (L), and administrative and support services (N), we observe no pay gaps at all, and in transportation and storage (H), and professional, scientific, and technical services (M) only a small gap of less than 5%. In these industries, gender pay gaps in male-owned businesses are still around 10%; thus, gender pay gaps are significantly lower in female-owned businesses with huge differences in (H) and, interesting enough, in information and communication (J). From the descriptive statistics, we know that, in these sectors, the share of women in the businesses greatly differ between male- and female-owned businesses. For instance, in information and communication (J), there are between 50 and 60% female employees in female-owned businesses, while in male-owned businesses, the share of male employees is above 80%. Last, but not least, the industry accommodation and food service (I) is an exception to these two “rules,” in the sense that the gender pay gap is relatively low with around 4% in the fixed effects estimation and does not differ across owner gender.

Firm size

From earlier research, we know that the size of the firm may influence the size of the gender pay gap (Jones and Kaya 2023). Table 8 reports results for three different firm sizes (small, medium, and large firms). Two patterns can be observed. On the one hand, gender pay gaps grow larger with increasing firm size. On the other hand, the influence of female owners on reducing the gender pay gap becomes smaller the larger the firms are. While in small firms the gender pay gap in female-owned businesses is at 4% (for the estimation with fixed effects), half of the gender pay gap in male-owned businesses, in large firms the pay gaps are more or less identical at around 12%. Thus, in large firms, the influence of female owners on the gender pay gap seems to fade and it might be more in the hands of managers to decide about what kind of wages are paid in large firms.

We also examine the impact of firm size by investigating the development of gender pay gaps when firm size increases. Table 9 reports the results for male-owned and female-owned firms separately. The negative coefficient of the interaction term in both male- and female-owned firms with firm fixed effects confirms the finding of the pay gap growing larger with increasing firm size. In the model with firm fixed effects, this firm size penalty for women is larger in female-owned firms than male-owned firms, which provides additional evidence of female firm owners having less influence on the gender pay gap in larger firms.

Productivity levels

With respect to the productivity levels, we sort firms into four groups, low, medium-low, medium-high, and high productivity firms. We define productivity of the firm as value added by hour worked (Table 10).

The highest differences in gender pay gaps can be found by comparing hourly with monthly wages. The analysis of hourly wages shows that the generally observed pay gaps of 11 and 12% (with and without fixed effects) as well as the 2 and 3 percentage point difference between female- and male-owned businesses are confirmed for all but the low productivity firms. At the latter group, pay gaps and differences of pay gaps between male- and female-owned firms are slightly lower. Different to this, the monthly gender pay gap is getting larger between male- and female-owned businesses, the higher the productivity levels are. The difference between male- and female-owned businesses in the gender pay gap peaks at 8 percentage points for high-productivity firms. Thus, differences in the pay gaps are much stronger for monthly than for hourly wages, as productivity levels get higher. Hence, for monthly wages, gender wage gaps are sensitive to firm productivity.

4.4 Robustness check

In this section, we assess the robustness of our results with respect to several specifications. First, we note that the main results are robust to different definitions of wages (see panels H–L in Appendix Table A1). With different wage measures that use SES data, the difference in the gender pay gap between female- and male-owned firms ranges from around 2 percentage points to 4 percentage points. With FLEED data, the difference is slightly larger, around five percentage points.

The second robustness check concerns the financial crisis of 2008 and 2009. According to Calligaris et al. (2023), the Finnish economy suffered a long period of stagnation between 2008 and 2016, which falls in our sample period. They summarize that the financial crisis only had a limited role. Instead, the mostly exogenous downfall of mobile phone manufacturer Nokia around year 2010 had a more important role. Additionally, the financial crisis did lead to reduced global demand, which hit another important Finnish industry at the time, the forest industry. To examine the impact of these crisis industries, we perform a robustness check by excluding the electronics and forestry industries from our sample. Eliminating these industries from the sample (see panel B in Appendix Table A2) results in virtually the same wage gaps in male- and female-owned firms as in the whole sample, and the difference in the pay gap between male- and female-owned firms remains at around 3 percentage points.

We continue our robustness check with an analysis where we exclude firms with unknown owners from our estimation procedure (see panel C in Appendix Table A2). Estimation results in the sense of observed gender pay gaps and differences between male- and female-owned firms are again fully confirmed.

In the next part of the sensitivity analysis, we exclude those female and male employees from our main estimation approach (in Table 6) who have children younger than 7 years in their household (Appendix Table A2 panel D). Eliminating this group from the regression lowers the overall gender pay gap by 0.6 to 0.7%; however, the differences in the pay gap between male-owned and female-owned businesses remains the same. The robustness check confirms one further source of the gender pay gap; namely female workers with small children at home are more likely to be primary caregivers than equivalent male workers.

Our last robustness check addresses potential endogeneity in firm age. Our data is repeated cross-section data, allowing firms and employees to exit and enter the sample. It is possible that some of the firm and employee movements are endogenous, driven by the wage gap. As an example, a higher wage gap in the firm might increase the probability of it exiting the market or being sold off. Alternatively, it could be that the growing gap within and between male- and female-owned businesses as firms mature might be driven by a survivor bias in the sense that firms were driven out of the market because they had no gender pay gap. To investigate whether such a bias exists, our robustness check compares wages in firms that survived the whole observation period 2006–2015 with those exiting before 2015. Moreover, we differentiate between firm ages and sort them into young firms (up to 5 years old), middle aged (5 to 10 years old), and mature firms (more than 10 years old). The comparison of hourly pay gaps between firms shows nearly no difference (see Appendix Table A3). For instance, among middle-aged firms, the pay gap in male-owned firms was around 15% and among female-owned businesses around 7%, irrespective of whether firms closed or not. There is only one minor exception: in male-owned young firms that exited the market, the gender pay gap was slightly smaller than that in male-owned firms that survived. However, this smaller difference does not allow for the conclusion of a relevant survivor bias.

In an unreported robustness check (available upon request), we estimate a model with the share of female employees in the firm as a dependent variable. We find that female owners are associated with a significantly higher share of female employees in the firm compared to male owners. This result confirms our descriptive findings and provides evidence that the gender of the owner impacts business decisions.

4.5 Limitations and future research

Our approach is not without limitations. First, selectivity issues and the omission of further control variables may lead to some bias in our results. While our firm fixed effects approach allows controlling for selection to firms and the wages within firms, in the current analysis, we are not able to control for some issues of selection bias, as our information on wages is only available for those male and female workers who were hired. Even if female employment has risen (Bertola et al. 2007) such that the overall share of female and male workers in the population no longer differs in Finland (see WEF 2021), it is important to control for self-selection into the work force (Humlum et al. 2019). Second, and related to the previous point, as in many other studies, we are not able to observe wage offers that may affect the wage-setting process and the further development of wages within firms. Such information would allow for analyzing what kind of wage offers had been turned down and which ones were accepted, differentiated by gender. Similarly, we have no information on what kind of negotiation processes took place once workers were hired or when they negotiated for wage increases. This might be important as negotiation behavior may differ between male and female employees (Babcock and Laschever 2004). Thirdly, it would have been preferable to have more control variables, as the still existing unexplained part of the gender pay gap under female firm ownership may include effects of unmeasured productivity differentials associated with unobservable worker or job characteristics. For instance, information on formal or informal training offers, job interruption due to motherhood, and similar variables are missing, as are more recently analyzed variables such as personality traits or cognitive skills (see Blau and Kahn 2017). Having estimated a specification with various levels of labor productivity at the firm level, we may have captured parts of these potential effects. A last limitation is that the (FLEED) data ended in 2015. To test for the validity of the analysis for later years, we checked how the gender pay gap in Finland has developed since 2015. The raw gap has been decreasing on average by 0.5 percentage points per year: it was at 15.3% in 2021, slightly lower than that in 2015. Even though the gap has somewhat reduced, a significant gender pay gap remains which makes us confident that our analysis also holds for later years.

This research could be extended in various ways to further the understanding of the reasons for differing gender wage gaps. First, it would be interesting to examine whether gender pay gaps change—as mentioned above—when the gender of the entrepreneur changes, for instance, after a firm is sold. Future research should also try to model worker performance and productivity in all firms, for instance by applying the method of Abowd et al. (1999). This analysis may allow for explaining parts of the unexplained portion of the gender pay gap. It would be further worth conducting a decomposition analysis separately for male- and female-owned businesses to understand which parts of the gender pay gap are accounted for by differences in characteristics and which ones by unexplained components. Such an analysis would be interesting when comparing female entrepreneurs and female managers, as it would allow for revealing whether differences in gender pay gaps are observed for the same or for different variables. Lastly, it would be interesting to investigate how gender pay gaps develop across owner gender when controlling for work councils (Heinze and Wolf 2010).

5 Discussion and conclusions

One strand of literature on the gender pay gap discusses whether the gender of a superior influences the size of the pay gap between male and female employees. While virtually all existing research analyzing this issue is based on the comparison of wage gaps observed under dependently employed female and male managers, we focus on the gender of entrepreneurs and firm owners. We argue that not only do entrepreneurs have stronger access to organizational power through their capital investment and profit-sharing, but they are also involved in their firms in different ways than managers. At least in smaller firms, they may decide more directly about the wages of their salaried employees without interference from other managers, executives, or firm owners. Therefore, we analyze what kind of gender pay gaps are observed when comparing wage payments in firms run by female entrepreneurs and firm owners with firms run by male entrepreneurs and firm owners. Our investigation delivers several findings that are also important for the general understanding of the gender pay gap.

For our analysis, we use Finnish data covering 2006 through 2015. We observe that, starting from a gender pay gap of about 12% for hourly wages in estimations without firm fixed effects and 11% in estimations including firm fixed effects, the gender pay gap is about three percentage points lower in female-owned firms than in male-owned firms in estimations without firm fixed effects, and about two percentage points lower in estimations with firm fixed effects. Differences in the pay gap are robust when including additional compensation schemes. This finding can be interpreted in the sense that two percentage points of the so far unexplained part of the gender pay gap could be attributed to male business owners (and to firms with unknown owner structure), where male business owners may discriminate their female employees to this extent, or where (in case of unknown owner structure) there might be less sensitivity for gender pay gaps. In particular, with respect to larger firms with an unknown owner structure, one could have expected more awareness of and sensitivity towards this topic.

More importantly, looking into industries at the 1-digit level delivers highly significant differences. In the more traditional and male-dominated industries, like manufacturing or construction, the overall gender pay gaps are larger than average. Even female business owners (like female managers) seem to behave rather like “one of the boys.” In their firms where they also employ mostly male workers, gender pay gaps are not much lower. Much in contrast, in large parts of the service sector, female firm owners realize relative wages that reduce the gender pay gap partly nearly, partly fully to zero. However, it seems to be a crucial point that in these industries, female entrepreneurs also employ on average more female than male workers in their businesses. These findings have implications for past and future research: generalization of findings to other industries is not possible if the previous analysis concentrated on one industry like manufacturing (Flabbi et al. 2019) or on one single firm (Srivastava and Sherman 2015). Future research further focusing on the influence of the gender of managers on gender pay gaps should start differentiating between industries and the gender-structure of employees in these industries—to the best of our knowledge this has not been done yet.

Investigating various firm sizes reveals where the influence of the owner gender ends. While in small firms female business owners can reduce relatively low gender pay gaps by half, their influence on gender pay gaps in larger firms is rather limited. If the aim of low gender pay gaps was high on the agenda of female business owners, they would need to hire female managers in their firms who are similarly willing to address the topic of a reduction of the gender pay gap, perhaps even needing to focus on the gender structure of their employees.

Beyond the industries and firm size relationships, our analysis reveals further important differences, as the gender pay gap varies with the productivity level of the firms, as well as with the wage distribution. The highest gender pay gaps are generally found among male-owned high productivity firms, but only when looking at the monthly wages. Therefore, the comparison between male- and female-owned businesses clarifies where the differences between hourly and monthly wages originate. While in male-owned firms the monthly (but not the hourly) gender pay gap grows with productivity levels, in female-owned firms, the hourly and the monthly gender pay gap remain relatively constant across all productivity levels. It could be that, in male-owned firms, high productivity is correlated with more hours worked per month and male workers are conducting such additional work. In female-owned high-productivity firms, there seems to be no such imbalance between hours worked per month and higher productivity. These results allow for the interpretation that there are not just different wage-setting processes, but also different management practices based on gender, when comparing female- with male-owned businesses.

Moreover, our analysis further reveals that gender pay gaps are lowest among firms that have a low relative productivity level in their industry while larger gaps are found in firms with relatively high productivity levels. In that sense, our findings point toward “rents-related” wage gaps, according to which one part of the observed pay gap might be owed to wage payments by firms that can “afford” to pay premia in a discriminatory manner. Further research needs to be done in this direction.

Lastly, we observe in which parts of the wage distribution female firm owners pay wages that lower the gap when compared to male firm owners. First, we confirm for both genders that the gender pay gap is higher as wage levels increase. Moreover, in the bottom part of the wage distribution, up to the median wage, pay gaps are more or less the same for both firm owner genders. However, at the top of the wage distribution, the pay gap for female employees is 8 percentage points larger than that at the bottom of the wage distribution when females work in a male-owned business, but only four percentage points larger when females work in a female-owned firm. Thus, it is for wages above the median where female firm owners pay wages that lead to a lower gender pay gap when compared to male firm owners.

We conclude that the gender of the entrepreneur and firm owner matters for the gender pay gap and that female entrepreneurs are able and willing to reduce the gender pay gap in their firms. We also observe that the industry and the gender structure of employees in each industry matter. For manufacturing, our observations confirm the “cogs in the machine” approach, as female entrepreneurs and business owners make the same relative wage payments as male business owners; in both firm types, more male workers are employed than female workers. Contrasting to this, female firm owners seem to introduce gender neutral wages (except for the wholesale and retail industry) in industries where they hire more female than male employees. Further, it is remarkable that in all service sector industries, the gender of the entrepreneur and firm owner highly correlates with the average gender structure of the firms. Future research should investigate whether it is the industry or the gender structure of employees in the firm that drives the result of gender-neutral wages in female-owned firms.

Data availability

This study uses third party data available under license that the authors do not have permission to share. Requests for access to the data should be directed to Statistics Finland at lupa.stat.fi.

Notes

The data set used in this study contains only a binary indicator of gender. Therefore, in this study, we use both terms—women and female—when we refer to individuals labelled as women in the data. We are, however, aware that individual’s gender identity can deviate from their assigned sex at birth.

There is, of course, a huge number of studies on the gender pay gap from a more general point of view, which we do not discuss here (for an overview, see Blau and Kahn 2017). However, from this research, it is important to note that the largest part of the difference between the unexplained and explained gap is described by industry and occupational differences as well as by work experience (Blau and Kahn 2017), while it is also shown in various studies that, for most industrialized economies, the gap increases in the upper percentiles of the wage distribution; this includes Finland (Christofides et al. 2013). Another study investigates for the first time firm size effects on the gender pay gap (Jones and Kaya 2023).

Their analysis remains silent with respect to the question of how large the size of the pay gap is in female-led firms. Moreover, one must emphasize that the segregation effect in Portugal of the 1990s was still huge, leading to substantially lower wages paid to women in female-led firms than women in male-led firms.

Maliranta and Nurmi (2019) examine the (initial) characteristics of the entrepreneurs (gender, education, previous experience, the productivity performance of the firm where they previously have worked as an employee, etc.) starting their new business and, in particular, how these characteristics are related to the performance of their firm in terms of productivity, survival, and growth.

In smaller firms, the owner of the firm is also the manager of the firm without having separation between the two positions.

References

Abendroth A-K, Melzer S, Kalev A, Tomaskovic-Devey D (2017) Women at work: women’s access to power and the gender earnings gap. ILR Review 70:190–222. https://doi.org/10.1177/0019793916668530

Abowd JM, Kramarz F, Margolis DN (1999) High wage workers and high wage firms. Econometrica 67:251–333. https://doi.org/10.1111/1468-0262.00020

Albrecht J, Björklund A, Vroman S (2003) Is there a glass ceiling in Sweden? J Labor Econ 21:145–177. https://doi.org/10.1086/344126

Arulampalam W, Booth AL, Bryan ML (2007) Is there a glass ceiling over Europe? Exploring the gender pay gap across the wage distribution. ILR Review 60:163–186. https://doi.org/10.1177/001979390706000201

Babcock L, Laschever S (2004) Women don’t ask: negotiation and the gender divide. Princeton University Press

Baron JN, Pfeffer J (1994) The social psychology of organizations and inequality. Soc Psychol Q 57:190. https://doi.org/10.2307/2786876

Becker GS (1971) The economics of discrimination. University of Chicago Press, Chicago, IL

Bednar S, Gicheva D (2014) Are female supervisors more female-friendly? Amer Econ Rev 104:370–375. https://doi.org/10.1257/aer.104.5.370

Bertola G, Blau FD, Kahn LM (2007) Labor market institutions and demographic employment patterns. J Popul Econ 20(4):833–867

Bertrand M, Duflo E (2017) Field experiments on discrimination. In: Handbook of Economic Field Experiments. Elsevier, Amsterdam, vol 1, pp 309–393. https://doi.org/10.1016/bs.hefe.2016.08.004

Blau FD, Kahn LM (2017) The gender wage gap: extent, trends, and explanations. J Econ Lit 55:789–865. https://doi.org/10.1257/jel.20160995

Caliendo M, Fossen FM, Kritikos A, Wetter M (2015) The gender gap in entrepreneurship: not just a matter of personality. CESifo Econ Stud 61:202–238. https://doi.org/10.1093/cesifo/ifu023

Calligaris S, Jurvanen O, Lassi A et al (2023) The slowdown in Finnish productivity growth: causes and consequences. OECD Science, Technology and Industry Policy Papers No 139, Paris. https://doi.org/10.1787/c1fad5b3-en

Cardoso AR, Winter-Ebmer R (2010) Female-led firms and gender wage policies. ILR Review 64:143–163. https://doi.org/10.1177/001979391006400107

Charles KK, Guryan J (2008) Prejudice and wages: an empirical assessment of Becker’s The Economics of Discrimination. J Polit Econ 116:773–809. https://doi.org/10.1086/593073

Christofides LN, Polycarpou A, Vrachimis K (2013) Gender wage gaps, ‘sticky floors’ and ‘glass ceilings’ in Europe. Labour Econ 21:86–102. https://doi.org/10.1016/j.labeco.2013.01.003

Cohen PN, Huffman ML (2007) Working for the woman? Female managers and the gender wage gap. Am Sociol Rev 72:681–704. https://doi.org/10.1177/000312240707200502

Cooke TJ, Boyle P, Couch K, Feijten P (2009) A longitudinal analysis of family migration and the gender gap in earnings in the United States and Great Britain. Demography 46:147–167. https://doi.org/10.1353/dem.0.0036

Deaux K (1985) Sex and gender. Annu Rev Psychol 36:49–81. https://doi.org/10.1146/annurev.ps.36.020185.000405

Derks B, Ellemers N, Van Laar C, De Groot K (2011) Do sexist organizational cultures create the Queen Bee? British J Social Psychol 50:519–535. https://doi.org/10.1348/014466610X525280

Ellemers N (2018) Gender Stereotypes. Annu Rev Psychol 69:275–298. https://doi.org/10.1146/annurev-psych-122216-011719

Ely RJ (1994) The effects of organizational demographics and social identity on relationships among professional women. Adm Sci Q 39:203. https://doi.org/10.2307/2393234

Ertug G, Brennecke J, Kovács B, Zou T (2022) What does homophily do? A review of the consequences of homophily. Annals 16:38–69. https://doi.org/10.5465/annals.2020.0230

Flabbi L, Macis M, Moro A, Schivardi F (2019) Do female executives make a difference? The impact of female leadership on gender gaps and firm performance. Econ J 129:2390–2423. https://doi.org/10.1093/ej/uez012

Heinze A, Wolf E (2010) The intra-firm gender wage gap: a new view on wage differentials based on linked employer–employee data. J Popul Econ 23:851–879. https://doi.org/10.1007/s00148-008-0229-0

Hensvik LE (2014) Manager impartiality: worker-firm matching and the gender wage gap. ILR Review 67:395–421. https://doi.org/10.1177/001979391406700205

Hirsch B (2013) The impact of female managers on the gender pay gap: evidence from linked employer–employee data for Germany. Econ Lett 119:348–350. https://doi.org/10.1016/j.econlet.2013.03.021

Humlum MK, Nandrup AB, Smith N (2019) Closing or reproducing the gender gap? Parental transmission, social norms and education choice. J Popul Econ 32:455–500. https://doi.org/10.1007/s00148-018-0692-1

Jones M, Kaya E (2023) The UK gender pay gap: does firm size matter? Economica 90:937–952. https://doi.org/10.1111/ecca.12481

Kankaanranta P, Melakari A (2021) Creating ready-made research datasets from national administrative registers. Manuscript presented at the conference of the European Statisticians, Statistics Finland, Dec 2021. https://unece.org/sites/default/files/2021-12/SDC2021_Day1_Kankaanranta_P.pdf

Kanter RM (1977) Some effects of proportions on group life: skewed sex ratios and responses to token women. Amer J Sociol 82:965–990. https://doi.org/10.1086/226425

Lucifora C, Vigani D (2022) What if your boss is a woman? Evidence on gender discrimination at the workplace. Rev Econ Household 20:389–417. https://doi.org/10.1007/s11150-021-09562-x

Maliranta M, Nurmi S (2019) Business owners, employees, and firm performance. Small Bus Econ 52:111–129. https://doi.org/10.1007/s11187-018-0029-1

Matsa DA, Miller AR (2011) Chipping away at the glass ceiling: gender spillovers in corporate leadership. Amer Econ Rev 101:635–639. https://doi.org/10.1257/aer.101.3.635

McPherson M, Smith-Lovin L, Cook JM (2001) Birds of a feather: homophily in social networks. Annu Rev Sociol 27:415–444. https://doi.org/10.1146/annurev.soc.27.1.415

Meara K, Pastore F, Webster A (2020) The gender pay gap in the USA: a matching study. J Popul Econ 33:271–305. https://doi.org/10.1007/s00148-019-00743-8

Phelps ES (1972) The statistical theory of racism and sexism. Amer Econ Rev 62:659–661

Ridgeway CL (1997) Interaction and the conservation of gender inequality: considering employment. Amer Sociol Rev 62:218. https://doi.org/10.2307/2657301

Rudman LA, Goodwin SA (2004) Gender differences in automatic in-group bias: why do women like women more than men like men? J Personal Soc Psychol 87:494–509. https://doi.org/10.1037/0022-3514.87.4.494

Sondergeld V, Wrohlich K (2023) Women in management and the gender pay gap. DIW Discussion Papers #2046, Berlin

Srivastava SB, Sherman EL (2015) Agents of change or cogs in the machine? Reexamining the influence of female managers on the gender wage gap. Amer J Sociol 120:1778–1808. https://doi.org/10.1086/681960

Sulis G (2012) Gender wage differentials in Italy: a structural estimation approach. J Popul Econ 25:53–87. https://doi.org/10.1007/s00148-010-0351-7

Theodoropoulos N, Forth J, Bryson A (2022) Are women doing it for themselves? Female managers and the gender wage gap*. Oxf Bull Econ Stat 84:1329–1355. https://doi.org/10.1111/obes.12509

World Economic Forum (2021) Global Gender Gap Report, World Economic Forum, Geneva

Zimmermann F (2022) Managing the gender wage gap—how female managers influence the gender wage gap among workers. Eur Sociol Rev 38:355–370. https://doi.org/10.1093/esr/jcab046

Acknowledgements

We would like to thank the editor-in-chief of this journal, Klaus F. Zimmermann, four anonymous referees, Jana Friedrichsen, and Katharina Wrohlich for their helpful and valuable comments. Further, we thank Statistics Finland for the access to the data and Pekka Laine for guidance with the data. We also thank the participants at the Finnish Economic Association XL Annual Meeting in Turku, at the Oxford Residence Week for Entrepreneurship, and at the Academy of International Business meeting in Warsaw for the helpful comments. Mika Maliranta and Satu Nurmi gratefully acknowledge funding from Etla–Research Institute of the Finnish Economy. Mika Maliranta and Veera Nippala gratefully acknowledge the financial support from Palkansaajasäätiö project “Innovation, productivity and economic growth.”

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Klaus F. Zimmermann

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kritikos, A.S., Maliranta, M., Nippala, V. et al. Does gender of firm ownership matter? Female entrepreneurs and the gender pay gap. J Popul Econ 37, 52 (2024). https://doi.org/10.1007/s00148-024-01030-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00148-024-01030-x