Abstract

Studies on disassembly for remanufacturing using strategic perspectives have been overlooked in current studies. This research uses a strategic approach to examine how product, process and organisational designs affect disassembly strategies for different remanufacturer types. Three companies consisting of two automotive and one jet engine remanufacturer were selected as subjects. A case study approach using qualitative data was adopted to examine how remanufacturers design their disassembly strategies. The analysis revealed that the two major factors influencing disassembly strategies are product complexity and the stability of core supply. It also determined and grouped the factors that affect disassembly within remanufacturing.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Background: remanufacturing operation

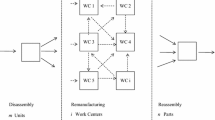

Remanufacturing is a process where used products, referred to as cores are brought back to as-new condition with matching guarantees [17]. Figure 1 depicts a generic remanufacturing process consisting of the following stages:

1. Receive core. Typically the core undergoes initial cleaning and examination to determine basic information such as its condition, model and year of manufacture. The cores will be tagged for identification and core details will be entered into the company database.

2. Clean and strip (disassembly). Following its receipt the core is disassembled. With the exception of components which are always discarded (for example, low cost items or items specified in an OEM mandatory replacement list), every component is thoroughly cleaned.

3. Investigate system and quote. All components are evaluated to determine extent of wear and to specify rectification solutions. A parts list is produced detailing the type and quantity of required new parts. The parts list is given to administration along with the details of rectification requirement. This information is used to determine an appropriate rectification strategy and product quote (where nominal charges are not in operation e.g., because there are no contractual arrangements). If the quote is accepted then the remanufacture of the core can commence.

4. Component remanufacture and put in stores. Component remanufacturing consists of the treatments required to bring component parts to current specification. It may involve surface treatment (for example, blasting to restore the surface of corroded parts) or mechanical and electrical treatment (for example, building up worn parts by metal spraying or welding). In the interest of economy, the process chosen for the component remanufacturing program will depend on the type of product and the volume of work involved. Subcontracting may be used to reduce costs or improve product quality. Rebuilt parts which pass the appropriate mechanical and electrical tests are labelled and put into parts inventory in stores. Generally the inventory record does not differentiate between remanufactured parts stock and new purchased parts because they are considered equal in quality. Replacements for items that must be discarded are ordered from suppliers or made by the remanufacturer. These are also put into the inventory stock.

5. Whole system remanufacture, Test and Despatch. Once all required components are available in stores, assembly kits are prepared using an assortment of remanufactured, purchased and manufactured parts (as many remanufactures undertake some basic manufacture for example to replenish parts that are no longer available in the market) according to the production schedule. These kits are brought out to the assembly area as required for subassembly and final assembly. Assembly is followed by whole system testing of the equipment to current specification. If the system passes then it is typically painted and labelled in a way that clearly distinguishes it from a new product from conventional manufacture. Finally the remanufactured product is given a guaranty that is at least equivalent to that of a similar new product and is shipped to a customer or else is put in finished goods stock to await purchase. The testing, measurement and quality control methods used are similar to those employed during the original manufacture. The only difference is that in remanufacture inspection is much more rigorous and in fact must be on a 100 % basis because in remanufacturing all parts are presumed faulty until proven otherwise.

Remanufacturing is complicated by a variety of operations control issues described in [18] and shown in Table 1, which also illustrates the importance that remanufacturing companies place on the impact of uncertainty on their operations. Remanufacturing companies have to manage uncertainties regarding when they will receive the cores (time uncertainty), as well as the numbers involved (quantity uncertainty) and conditions (quality uncertainty). These uncertainties cause difficulties in remanufacturing operations, particularly in the disassembly phase.

Remanufacturing disassembly

The disassembly process in remanufacturing is important for several reasons. Firstly it is an initial remanufacturing activity and is also essential since remanufacturing cannot occur without it. However, most products are designed to optimise assembly without consideration to the need for easy and efficient disassembly in order to facilitate recovery of the product at end of life. Even when disassembly is possible it would not necessarily be easy to undertake and in most cases is not optimised. As products are not designed for ease of disassembly during remanufacturing, cores may become defective in some way due to damage during the remanufacture process [39]. These circumstances present many challenges during the design of a viable recovery system [26]. Consequently, success in disassembly is a key success factor in remanufacturing operations [39]. Secondly, disassembly is the main gate for most information related to the remanufacturing operations [13, 24] and information can be obtained here that would be valuable in minimizing uncertainties in every phase of remanufacturing [8, 9].

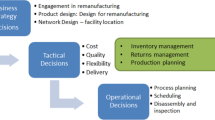

Most studies depict disassembly as technical activities which break down cores into component parts without considering other factors such as employee skills, tools, equipment and product knowledge. Furthermore, the majority of the research utilise positivist paradigms using operations research with strict assumptions. Most of the research focuses on remanufacturing operations particularly production planning and control. Example here includes inventory control [15, 43], demand forecasting [35] and production planning [32, 43] among others. However, there is a paucity of research specifically on remanufacturing disassembly. Bras and McIntosh [3] suggest that research which investigates the practice of disassembly should cover organisational design, product characteristics and process design (see Fig. 2). By incorporating these three factors, this research comprehensively analysed the disassembly operation as a system. In this system, there is a start and end point that can be used as boundaries. The starting point of the disassembly system in this case would be the point at which the disassembly area receives information about the cores. As soon as this happens facility set-up, tool selection, and job allocation can be carried out. The end point of the disassembly system would be when the cores have been disassembled into components and the components have been put in their designated areas either for further processing in remanufacturing operations, as stock, or for recycling. Boundaries and coverage of activities in the disassembly system are important in understanding the context in which the disassembly strategy is adopted.

Disassembly in the context of remanufacturing is embedded in a series of inter-related processes. The position of disassembly (strip core) within the process of remanufacturing was presented in Fig. 1 in previous pages. Uncertainties are frequently mentioned as the main issue in every process of Remanufacturing, including disassembly [13]. The uncertainties in Disassembly can be divided into three different types. These are: the uncertainties that exist Prior to disassembly, the uncertainties that happen during disassembly and the uncertainties that occur in other processes after disassembly. This is presented in Table 2. These uncertainties interplay with one another, and any failure to understand how these uncertainties interrelate would make research into disassembly less relevant.

Research objectives

Remanufacturing studies should cover three areas namely, organisational design, process design and product design Bras and McIntosh [3]. This is critical for a comprehensive investigation of the factors affecting disassembly operations. Of these three areas, organisational design is the least investigated in the literature. One of the studies focusing on this issue is Hermansson and Sundin [14] that found that inter-functional communication across different departments, such as product design, logistics, remanufacturing and procurement, is important to manage uncertainties about the return flow of the cores. However, the research gap to investigate organisational design with product and process characteristics remains. Issues such as types of relationship with Original Equipment Manufacturers (OEMs), employee skills [25] and information regarding know-how about the products [12, 22] should also be covered.

Product characteristics are the most popular topic investigated in disassembly for product recovery but few studies have been devoted to disassembly for remanufacturing. Most studies that investigate disassembly relate to recycling where destructive disassembly methods are acceptable. Disassembly for remanufacturing is different from that for other recovery operations because its resultant components should be viable to be returned to as-new condition. Hence, process requirements in disassembly for remanufacturing are higher compared to disassembly for other types of recovery operations. Based on the extant literature, we identify product characteristics that might affect disassembly strategy including type of materials [19, 21, 33], product structures [20, 38, 39], number of components [37], product variety [16], expected residual value [45].

The factors affecting process design for remanufacturing found in literature and considered for this study include tooling and equipment [34], employee skills, [1, 40], facility planning [11], capacity management [11], and cores’ volume [43]. These factors are interrelated and adoption of a particular factor may drive companies to implement particular practices. Literature also shows that remanufacturing is a labour-intensive industry that typically requires a greater ratio of low skilled workers in comparison to conventional manufacturing, multi-purpose equipment and flexible scheduling. This study investigated how remanufacturing companies manage these factors to develop disassembly strategies. Based on the preceding discussion, the research question for this study was: How do companies develop operations strategies for disassembly in remanufacturing?

The following sections is organised as follows: firstly, the methodology will be discussed and the case study companies described. This is followed by a cross case analysis of the case companies to compare differences and similarities then the conclusions and findings from the literature and the case study will be presented. Finally, the research limitations and future research will be outlined.

Methodology

This study investigated the research question proposed using a multiple case study approach. Case studies are appropriate when phenomena and the context cannot be investigated separately [46]. In addition, this method is suitable for analysing questions of why and how related to contemporary events on which investigators have little control [42, 46]. The multiple case study analysis involved three remanufacturing companies with different characteristics as presented in Table 5. Multiple case studies are preferred to single ones as the former offers higher validity, reduces the tendency of observer bias, and augments external validity [6, 42, 46]. Further, multiple case studies may provide deeper understanding and richer information since it permits researchers to undertake replication and pattern matching through cross case analysis [6, 46]. The rationale for selecting the three companies is that they form a continuum from relatively simple to highly complex organisations. Based on a number of characteristics, company A represents the simplest and company C the most complex organisation.

Information was collected through interviews with company managers since they are the people responsible for managing disassembly activities. Shop floor visits, observations and document analysis were conducted not only to collect more information but also as a means of triangulating information from interviews. If there were some conflicting findings, further analysis was conducted until consensus was achieved. Triangulation using different information sources as utilized in this case study is proven to enhance research validity [6, 46]. The unit of analysis is the main entity that will be the focus of the research [46]. Although formally stating it does not influence the research outcome, Barratt et al. [2] contend that the unit of analysis offers several advantages. First, it helps researchers to identify literature that may assist in analysing the phenomena under study. Secondly, it helps researchers to understand how that phenomena is linked to the broader body of knowledge. The product is selected as the unit of analysis in this study as it enables investigators to identify patterns from the subjects. Too many differences in the subjects will cause difficulties in identifying similar patterns while too few leads to difficulties in conducting cross case analysis since all subjects would have similar patterns [46].

Analysis and Findings/Results

Organisational design

In terms of organisational factors, the type of relationships with OEMs is one of the most important because of its influences on other factors such as technical support regards product knowledge, volume of incoming cores, and early information about the cores. Of the three cases, Company C is in a better position compared to Companies B and A because it is an OEM remanufacturer. Both Company B and A are not OEMs but Company B develops contractual agreements with OEMs and receives higher support from them regarding product technical knowledge. Company A also has contractual agreements with OEMs but only for certain products.

Company C is more advanced than the other two cases in various ways. For example, the company requires advanced and specialised knowledge due to the advanced technology of the products and this is almost impossible for independent remanufacturers to acquire due to the high cost involved. In this company when an employee has not used his capability for a certain period of time, the skill and knowledge involved are classified as “expired”. This differs vastly from the situation in typical remanufacturing companies where knowledge is hoarded long after it ceases to be useful in the organisation. Additionally, employees’ qualifications must comply with company policies as well as those from regulatory bodies such as International Aviation Safety Association (IASA) and Civil Aviation Authority (CAA).

At the other extreme, In Company A, the simplest of the three organisations employees do not require formal training and education for their work and skills are obtained through experience and coaching from longer serving peers. Workers here are multi skilled to enable flexibility thus ability to switch from one task to another. Company B requires slightly higher qualifications than Company A but is much less advanced than Company C. Company B operates a structured job matrix with 3-1-3 scheme. In this scheme, there are at least three employees that can do every job and each employee has 3 different skills to perform different jobs. This strategy allows a higher level of flexibility than in Company A, but is still lower than that of Company C.

In industrial settings, OEMs have the highest access to customers and thus in obtaining cores in comparison to the other types of remanufacturing practitioners (contract and independent). This fact was demonstrated in company C, an OEM remanufacturer. Here, the supply of cores is stable so that the company is able to avoid idle capacity due to lack of cores. In terms of product complexity, the jet engine is the most complex of the three cases since it consists of thousands of different components with unique serial numbers that have to be rebuilt into the same engines. Also, jet engines have many components that require particularly uncommon treatment and specific skills are required to carry out those tasks.

Company A is a retail player with small production volumes based on direct orders from customers. Although the company has contracts with industrial customers such as insurance companies, taxi operators and OEMs, the majority of cores come directly from customers. These circumstances lead to difficulties for the company in forecasting the quantity, type and timing of incoming cores. Typically, production volume may be in units rather than in batches due to the small number of incoming cores. When there are no customer orders, cores from storage are processed in order to avoid potential future idle capacity by developing stocks of remanufactured or partially remanufactured products.

In the case of Company B, a contract remanufacturer, production always starts after orders from customers are received. Usually orders are in high volumes so that the company can minimise fixed costs such as facility set up, tools and equipment preparations. Because of the high volume production runs, job specialisation can be organised to a certain extent.

Process design

There are considerable differences in facilities set up between the three cases. Company C has a large investment in its facility set up, both for physical and non-physical facilities such as R&D, training and employee certification. Even if the production volume is not as high as that for the other two companies, the huge number of components within jet engines leads to a very complex remanufacturing process. Company C uses a product-oriented layout where different engines types are processed in different areas. This strategy is adopted to ease identification and separation of components from different engines. The main components that have a unique serial number on them must be reassembled into the same engines. To avoid idle capacity, Company C relies on robust forecasting and scheduling which is facilitated by, early product information from the engine health management system.

On the other hand, Company A uses a common area, tools and equipment, and any employees available to disassemble cores. This is due to the low level of its products’ complexity in comparison to the jet engines of Company C. The company carries out full disassembly regardless of the conditions of cores. The production volume is small and typically in units rather than in batches. To run production processes of small volume and high fluctuation, the company employs multi skilled workers who have the flexibility to easily switch between tasks to reduce the potential for idle capacity.

With regards to process design complexity, Company B occupies a position between Company A and B. Like Company A, Company B performs full disassembly on all received cores but with a more structured disassembly process. It has a research and development team to design customised tools and equipment for different product models. Different product models are disassembled in dedicated areas that are equipped with customised tools and operated by employees with specific skills. As stated by one of the respondents, “moving people is much easier than moving tools and equipment”.

Company B undertakes sorting to identify obvious damage so that low quality cores are removed early and not processed further. Elimination of bad cores in the sorting process helps the company to streamline remanufacturing operations included in the disassembly stage. This process can run more smoothly without any disruptions as low quality cores – typically requiring more work and special treatments are removed early from processing.

Product characteristics

The expected residual value of components is another important factor in product characteristics that distinguishes Company C from the other two companies. A jet engine consists of high value components that require specific skills to perform particular treatments for particular components. The high value of jet engine components comes from two sources: (1) the type of materials to make the components, and (2) the manufacturing process of the components. The main material in a jet engine is titanium, a precious, light, strong metal, which is expensive and hence brings considerable costs to the complicated process of building the engine. Some of these high value components require extremely specialist treatments by experts in isolated laboratories.

Products remanufactured at Companies A and B have similarities and dissimilarities. The number of components in products in Company B is similar to those in Company A but there is greater product variation in the former. The number of components in a gearbox, transmission and automotive engine is considered moderate in comparison to simpler products such as printer cartridges that are popular for remanufacturing. Company B has higher production capacity, newer product types and a higher variety of product types to remanufacture. The combination of these factors makes the disassembly operations for company B more complicated than that for company A. However, company B has more stable core supply in comparison to Company A due to its contractual relationships with OEMs. Product types that are remanufactured in Company B are also more ‘state-of-the-art’ in comparison to Company A which remanufactures any model of gear box regardless of its year of production.

In general, profit margins per unit of product in Company A are higher than that in Company B because each customer has different service requirements. For example if the company were to service the transmission of a 1970’s car, the necessary equipment and components may no longer be available in the market and OEMs may no longer manufacture the product. The company must thus make the component itself or commission others to do so on its behalf and then charge the customer a premium price. For orders that come from OEMs, both company A and company B earn similar profit per unit of product but the quantity of orders in Company B is much greater than that for Company A.

Grouping the factors that affect disassembly

A total of 16 factors were identified from the empirical evidence thus too many to consider individually during this analysis due to time constraints. They were thus grouped based on their relationship in order to simplify the analysis because it is difficult to develop a framework of disassembly strategies that is based on a large number of factors due to the problems during the analysis. Moreover, an analysis that uses each individual factor separately will not result in comprehensive conclusions. Also not all the case companies have the factors that were identified in the empirical findings. Therefore, comparing the factors one by one will not produce satisfactory results. Using multidimensional constructs, consisting of different factors for product complexity and stability of core supply, will result in a more comprehensive analysis. In this research the factors that refer to the same construct were all grouped into one category. The grouping of the constructs is important to ensure that they are conceptually interrelated [7]. After this categorisation, there were eleven factors in the product complexity category, while the stability of core supply consists of five factors (Fig. 3).

Tables 3 and 4 present the logical relationships of how each dimension and the main factors (i.e., product complexity and the stability supply of cores) are interrelated. The main aim of the table is to demonstrate that the dimensions are related to the main factors. To emphasise the argument of how each dimension is related to the main dimensions (i.e., the stability supply of cores and product complexity), the phrases that are related to the main dimensions in the cells are written in bold and italic.

Discussion on disassembly strategies

From the foregoing discussion, it can be seen that remanufacturers use different schemes, (for example worker flexibility, specialised tools and equipment and rigid production schedules), to organise their disassembly systems. In general, the factors affecting a disassembly system can be classified into two broad categories: product complexity and stability of core supply as shown in Fig. 3. The product, process and organisational factors that affect disassembly strategies fall into these two camps Table 5.

The Strategies adopted in the three case companies can be summarised as in Fig. 4. Company A which is located at the bottom-left adopts opposite strategies to that of company C which is at the top-right of the figure. Company C is an OEM and uses a product-service system approach. Under this system, the ownership of the cores remains with the company and the customers pay the company based on its accessing of the services of the company’s product (e.g., power-by-the hour) - very much like a lease arrangement. The benefits of this system includes the company having better information regarding the condition of the cores, for example when the cores need to recovered and which parts need to be replaced.

There are some exceptions to these findings in the literature. Theoretically, to adopt specialised skills and knowledge, high product volume is not a compulsory requirement in remanufacturing. High product complexity, high value materials, and high numbers of product components are factors that contribute to the adopting of job specialisation. A highly complex product needs longer time for disassembly and hence increases the feasibility of using employees with specialised skills.

As can be seen from Fig. 4, both Company A and B remanufacture similar types of products but Company B has some advantages over Company A. The former can use a disassembly facility with some degree of specialisation in terms of employee skills, tools, equipment and facility. This is largely due to high production volume minimising the financial impact of the large fixed costs from setting up a more specialised disassembly facility. For example, to set up a typical shop floor facility for company B requires an investment of approximately 5000 GBP in fixed cost which will be spread over 5 years. This is a large investment for a company categorised as a small to medium enterprise (SME). This difference in strategy results in the companies having different cost structures although they remanufacture similar products. Company B bears a higher fixed cost due to the cost of setting up its shop floor facilities which will be used for a long time whereas Company A incurs higher expenses for variable costs mainly in terms of labour hours.

As discussed in the previous section, critical strategies for companies with lower product complexity and fluctuating core supply- include employing multi-skilled and hence flexible workers so that resources are shared by transferring employees between different tasks. Conversely, for remanufacturers that disassemble complex products but have with steady core supplies, utilising workers with specific skills would be a preferred option. This does not mean that companies positioned in the top right corner do not need multiple skilled workers and those in the bottom-left corner do not require specialised skilled workers. Any company regardless of its position in Fig. 4 needs these different types of skills but in different combinations [14].

Similar to conventional manufacturing, remanufacturing companies adopt different capabilities to face competitors within their industry. Flexibility is an important capability in order to enable remanufacturers to disassemble various product types [31]. This capability is important for companies located in the left-bottom corner of the graph whereas companies positioned on the right-top corner rely on fixed cost minimisation through rigid production schedule, idle capacity minimisation and streamlining production flows.

Limitation and future research

This study investigates three companies, two from the automotive industry and one from the aerospace industry. Future studies could cover broader industries with different characteristics so that more patterns of strategies are identified and generalisation of findings improved. In addition, further investigations will be carried out regarding whether there are any specific competitive priorities for remanufacturers and how disassembly strategies are related to the competitive priorities. Moreover this research will be built on to develop a new remanufacturing process model that for the first time comprehensively considers the needs and potential of disassembly. This development would significantly enhance the productivity of the entire remanufacturing operation.

Abbreviations

- CAA:

-

Civil Aviation Authority

- IASA:

-

International Aviation Safety Association

- R&D:

-

Research and development

- OEM:

-

Original Equipment Manufacturer

References

Ayres, R, Ferrer, G, Carolina, N, Leynseele, TVAN: Eco-efficiency, asset recovery and remanufacturing. Eur. Manag. J. 15(5), 557–574 (1997)

Barratt, M, Choi, TC, Li, M: “Qualitative case studies in operations management: trends, research outcomes, and future research implications”. J. Oper. Manag. 29(5), 329–342 (2011)

Bras, B, McIntosh, MW: “Product, process, and organizational design for remanufacture – An overview of research”. Robot. Comput. Integr. Manuf. 15(3), 167–178 (1999)

DePuy, GW, Usher, JS, Walker, RL, Taylor, GD: Production planning for remanufactured products. Prod. Plann. Control 18(7), 573–583 (2007)

Desai, A, Mital, A: Evaluation of disassemblability to enable design for disassembly in mass production. Int. J. Ind. Ergon. 32(4), 265–281 (2003)

Eisenhardt, KM: “Building theories from case study research”. Acad. Manag. Rev. 14(4), 532–550 (1989)

Eisenhardt, KM, Graebner, ME: “Thoeory building from cases: Opportunities and challenges”. Acad. Manag. J. 50(1), 25–32 (2007)

Ferrer, G: “Yield information and supplier responsiveness in remanufacturing operations”. Eur. J. Oper. Res. 149(3), 540–556 (2003)

Ferrer, G, Ketzenberg, ME: “Value of information in remanufacturing complex products”. IIE Trans. 36(3), 265–277 (2004)

Ferrer, G, Whybark, DC: Material planning for a remanufacturing facility. Prod. Oper. Manag. 10(2), 112–124 (2001)

Franke, C, Basdere, B, Ciupek, M, Seliger, S: “Remanufacturing of mobile phones - Capacity, program and facility adaptation planning”. Omega 34(6), 562–570 (2006)

Gehin, A, Zwolinski, P, Brissaud, D: “A tool to implement sustainable end-of-life strategies in the product development phase”. J. Clean. Prod. 16(5), 566–576 (2008)

Guide Jr, VDR: “Production planning and control for remanufacturing: Industry practice and research needs”. J. Oper. Manag. 18(4), 467–483 (2000)

Hermansson, H, Sundin, E: “Managing the remanufacturing organization for an optimal product life cycle”. In: Yamamoto, R, Furukawa, Y, Koshibu, H, Eagan, P, Griese, H, Umeda, Y, Aoyama, K (eds.) 4th International Symposium on Environmentally Conscious Design and Inverse Manufacturingand Inverse Manufacturing, pp. 146–153. IEEE, Tokyo (2005)

Hsueh, CF: “An inventory control model with consideration of remanufacturing and product life cycle”. Int. J. Prod. Econ. 133(2), 645–652 (2011)

Hu, SJ, Ko, J, Weyand, L, ElMaraghy, HA, Lien, TK, Koren, Y, Bley, H, Chryssolouris, G, Nasr, N, Shpitalni, M: “Assembly system design and operations for product variety”. CIRP Ann. Manuf. Technol. 60(2), 715–733 (2011)

Ijomah, WL: ‘A model-based definition of the generic remanufacturing business process’. PhD dissertation, University of Plymouth, UK (2002)

Ijomah, W, Childe, S, McMahon, C: A Robust description and tool for remanufacturing: a resource and energy recovery strategy. The Proceedings of The Ecodesign 2005: Fourth International Symposium on Environmentally Conscious Design and Inverse Manufacturing, 12–14 December 2005, Tokyo. (2005)

Ijomah, WL, McMahon, CA, Hammond, GP, Newman, ST: “Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development” Int. J. Prod. Res. 45(18), 4513–4536 (2007a)

Ijomah, W, McMahon, CA, Hammond, GP, Newman, ST: “Development of design for remanufacturing guidelines to support sustainable manufacture” Robot. Comput. Integr. Manuf. 23(6), 712–719 (2007b)

Ijomah, WL, Johansson, J, Luttropp, C: “Material hygiene: improving recycling of WEEE demonstrated on dishwashers”. J. Clean. Prod. 17(1), 26–35 (2009)

Inderfurth, K: “Impact of uncertainties on recovery behavior in a remanufacturing environment: a numerical analysis”. Int. J. Phys. Distrib. Logistics. Manage. 35(5), 318–336 (2005)

Jayaraman, V: Production planning for closed-loop supply chains with product recovery and reuse: An analytical approach. Int. J. Prod. Res. 44(5),981–998 (2006).

Junior, ML, Filho, MG: “Production planning and control for remanufacturing: Literature review and analysis”. Prod. Plann. Control 23(6), 37–41 (2012)

Kim, K, Song, I, Kim, J, Jeong, B: “Supply planning model for remanufacturing system in reverse logistics environment”. Comput. Ind. Eng. 51(2), 279–287 (2006)

Klausner, M, Grimm, WM, Hendrickson, C: “Reuse of electric motors: design and analysis of an electronic data log”. J. Ind. Ecol. 2(2), 89–102 (1998)

Kongar, E, Gupta, SM: Disassembly to order system under uncertainty. Omega 34(6), 550–561 (2006)

Lee, HB, Cho, NW, Hong, YS: A hierarchical end-of-life decision model for determining the economic levels of remanufacturing and disassembly under environmental regulations. J. Clean. Prod. 18(13), 1276–1283 (2010)

Li, SG, Rong, YL: The research of online price quotation for the automobile parts exchange programme. Int. J. Comput. Integr. Manuf. 22(3), 245–256 (2009)

Loomba, APS, Nakashima, K: Enhancing value in reverse supply chains by sorting before product recovery. Prod. Plann. Control 23(2–3), 37–41 (2012)

Ostlin, J: “Material and process complexity - Implications for remanufacturing.”. In: 4th International Symposium on Environmentally Conscious Design and Inverse Manufacturingand Inverse Manufacturing, pp. 154–161. (2005)

Poles, R: 'System dynamics modelling of a production and inventory system for remanufacturing to evaluate system improvement strategies', Int. J. Prod. Econ. 144:189-199. (2013)

Ryan, A, O’Donoghue, L, Lewis, H: “Characterising components of liquid crystal displays to facilitate disassembly”. J. Clean. Prod. 19(9–10), 1066–1071 (2011)

Seliger, G, Basdere, B, Keil, T, Rebafka, U: “Innovative Processes and Tools for Disassembly”. CIRP Ann. Manuf. Technol. 51(1), 37–40 (2002)

Shi, J, Zhang, G, Sha, J: “Optimal production planning for a multi-product closed loop system with uncertain demand and return”. Comput. Oper. Res. 38(3), 641–650 (2011)

Smith, SS, Chen, W-H: Rule-based recursive selective disassembly sequence planning for green design. Adv. Eng. Info. 25(1), 77–87 (2011).

Smith, S, Smith, G, Chen, WH: “Disassembly sequence structure graphs: an optimal approach for multiple-target selective disassembly sequence planning”. Adv. Eng. Inform. 26(2), 306–316 (2012)

Srivastava, R, Kraus, ME: “Product structure complexity and scheduling of operations in recoverable manufacturing”. Int. J. Prod. Res. 35(11), 3179–3200 (2010)

Sundin, E, Bras, B: “Making functional sales environmentally and economically beneficial through product remanufacturing”. J. Clean. Prod. 13(9), 913–925 (2005)

Tang, O, Grubbström, RW, Zanoni, S: Planned lead time determination in a make-to-order remanufacturing system. Int. J. Prod. Econ. 108(1–2), 426–435 (2007)

Vadde, S, Zeid, A, Kamarthi, SV: Pricing decisions in a multi-criteria setting for product recovery facilities. Omega 39(2), 186–193 (2011)

Voss, C, Tsikriktsis, N, Frohlich, M: “Case research in operations management”. Int. J. Oper. Prod. Manage. 22(2), 195–219 (2002)

Wu, C-H: “Product-design and pricing strategies with remanufacturing”. Eur. J. Oper. Res. 222(2), 204–215 (2012)

Wu, C-H: OEM product design in a price competition with remanufactured product. Omega, 41(2), 287–298 (2013).

Xanthopoulos, A, Iakovou, E: “On the optimal design of the disassembly and recovery processes”. Waste Manag. 29(5), 1702–1711 (2009)

Yin, RK: “Case study research: Design and methods”, 4th edn. Sage Publications, Inc., London (2009)

Author information

Authors and Affiliations

Corresponding author

Additional information

Competing interests

The authors declare that they have no competing interests.

Authors’ contributions

AP: Main researcher. As the PhD student AP was in charge of the day to day running of the research, undertaking the case study work and literature review. Dr. WLI: was the main research supervisor. She provided guidance on general research process and supported the analysis of information and data. She is the main source of remanufacturing academic knowledge for the project. Professor USB was the project second supervisor and as a specialist in operations manager provided the organizational and process knowledge required to progress the work. Like Dr WLI he also supported the analysis of information required to complete the work and hence be in a position to write this journal paper. All three authors were involved in the writing of this article. All authors read and approved the final manuscript.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Priyono, A., Ijomah, W.L. & Bititci, U.S. Strategic operations framework for disassembly in remanufacturing. Jnl Remanufactur 5, 11 (2015). https://doi.org/10.1186/s13243-015-0018-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13243-015-0018-3