Abstract

Purpose

This study presents case studies of selected remanufacturing operations in Japan. It investigates Japanese companies' motives and incentives for remanufacturing, clarifies the requirements and obstacles facing remanufacturers, itemizes what measures companies take to address them, and discusses the influence of Japanese laws related to remanufacturing.

Methods

This study involves case studies of four product areas: photocopiers, single-use cameras, auto parts, and ink and toner cartridges for printers. Results and conclusions are based on the authors' discussions and interviews with 11 remanufacturers--four original equipment manufacturers (OEMs) and seven independent remanufacturers (IRs). In the discussions and the interviews, we asked the companies their motives for remanufacturing and asked the measures they take to overcome the obstacles of remanufacturing. This study highlighted three requirements for remanufacturing: (1) collection of used products, (2) efficient remanufacturing processes, and (3) demand for remanufactured products.

Results

Where OEMs are the main remanufacturers of products covered by this study, their motives are long-term economic and environmental incentives. Where IRs are the main remanufacturers, it is often because OEMs shun remanufacturing, fearing to cannibalize new product sales. Companies' efforts to meet the above mentioned three requirements were observed and documented: (1) establishing a new collection channel; (2) developing reverse logistics to collect used products; (3) designing products for remanufacturing (DfReman); (4) accumulating know-how to establish remanufacturing processes; and (5) controlling product quality to stimulate demand for remanufactured products. This study also notes that (6) OEMs who engage in remanufacturing build consumer demand by incorporating remanufactured components into new products. This point has not been particularly noted in previous studies, but it has an important implication for OEMs' remanufacturing. The authors found that Japan's Home Appliances Recycling Law and End-of-Life Vehicle Law have promoted material recycling but have been insufficient to stimulate remanufacturing within the country.

Conclusions

This study clarified the differences between OEMs' and IRs' remanufacturing. Both IRs and OEMs are important for remanufacturing. Institutional measures to encourage appropriate competition between OEMs and IRs and to enhance consumers' acceptance of remanufactured products is important to promote remanufacturing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

This study presents and analyzes case studies of selected remanufacturing operations in Japan. Remanufacturing can limit environmental impacts, and is a key strategy to for sustainable manufacturing and in turn for addressing the needs of sustainable development [1]. A multinational comparison of remanufacturing practices and relevant legislations is indispensable in assessing the measures to promote remanufacturing worldwide. Few existing international literature have analyzed remanufacturing practices in Japan. This study aims to examine this issue.

Remanufacturing is the process of restoring broken assemblies to a "like-new" functional state by rebuilding and replacing their component parts [2]. Remanufacturing has spread worldwide to sectors as disparate as auto parts, electric home appliances, personal computers, cellular phones, photocopiers, single-use cameras, cathode ray tubes, automatic teller machines, vending machines, construction machineries, industrial robots, medical equipment, heavy-duty engines, aircraft parts, and military vehicles. Japanese remanufacturing practices are advanced in some product areas, notably photocopiers and single-use cameras, and lagging in fields like auto parts, where remanufacturing is commonplace elsewhere [3]. Factors that determine whether remanufacturing prevails include the engagement of products' original equipment manufacturers (OEMs) and independent remanufacturers (IRs), consumers' awareness and preferences for remanufactured products, related legislations, and relevant social institutions. It is significant to verify which factors promote and hinder remanufacturing through case studies.

This study analyzes the following aspects through case studies in Japan. First, it investigates Japanese companies' motives and incentives for remanufacturing and explores the conditions to prompt OEMs and IRs to remanufacture. Previous studies have paid disproportionate attention to the advantages and incentives OEMs have in remanufacturing. However, in many industrial segments where OEMs lack incentive or have a negative attitude toward remanufacturing, IRs lead in remanufacturing. Therefore, understanding companies' motives for remanufacturing is essential to promote remanufacturing.

Second, this study clarifies the requirements and obstacles of remanufacturers and discusses what measures companies take to address them. Justifiably called a "Hidden Giant" [4], the remanufacturing industry has good market potential. However, companies have to overcome certain obstacles to achieve it. This study highlights three requirements for remanufacturing: (1) collection of used products, (2) efficient remanufacturing processes, and (3) demand for remanufactured products, as discussed in Section 2. Case studies presented here investigate measures taken by companies to meet these requirements.

Third, this study discusses Japanese legislation related to remanufacturing and its influence. Such arguments are crucial to design legislation and institutions that support remanufacturing.

The paper is organized as follows. Section 2 reviews the existing literature. Section 3 describes the case studies, their method, and instructive conclusion. Section 4 discusses relevant legislation and its influence on remanufacturing. Section 5 describes discussing issues in the paper. The final section summarizes key findings and their contribution to remanufacturing.

Literature review

Over the past few decades, increasing interest in remanufacturing has prompted several studies. These studies have emphasized OEMs, which have numerous advantages over IRs and perhaps greater incentive to remanufacture. Lund and Skeels [5] and Lund [6] pointed out the advantages unique to OEMs: feedback on product reliability and durability, competition in lower-priced markets, a manufacturer's reputation for quality, and gaining advantages over IRs in data, tooling, and access to suppliers. Similarly, Haynsworth and Lyons [7] envisioned how OEMs could realize the potential for remanufacturing through appropriate marketing and product design and by developing a product distribution and return system. Many studies have confirmed that remanufacturing is profitable for OEMs [8, 9]. Some studies even consider profitability as given, since resources used in manufacturing products are reused and production costs of remanufactured products are less than new production [10, 11].

On the other hand, OEMs face unique obstacles. Although remanufacturing may reduce sales of new products, profits on sales of new products often exceed profits on those of remanufactured products [12–14]. There are several counter-arguments to support this claim. First, new and remanufactured products are targeted toward different market segments, minimizing their potential conflict [15]. Second, economic incentives are not OEMs' primary motive for remanufacturing. Studies have cited considerations such as ethical responsibility [16], corporate brand protection [17], intellectual property protection [18], and other considerations (see also [15, 19, 20]).

Previous studies have described other requirements and obstacles faced by companies in developing a new remanufacturing business. Lund and Skeels [5] pointed the following issues: (1) product selection, (2) marketing strategy, (3) remanufacturing technology, (4) financial aspects, (5) organizational factors, and (6) legal considerations. Steinhilper [21] proposed eight criteria to be evaluated in establishing the suitability of products for remanufacturing: (1) technical criteria (type or variety of materials and parts, suitability for disassembly, cleaning, testing, reconditioning), (2) quantitative criteria (amount of returned products, timely and regional availability), (3) value criteria (value added from material/production/assembly), (4) time criteria (maximum product life time, single-use cycle time), (5) innovation criteria (technical progress regarding new products and remanufactured products), (6) disposal criteria (efforts and cost of alternative processes to recycle the products and possible hazardous components), (7) criteria regarding interference with new manufacturing (competition or cooperation with OEMs), and (8) other criteria (market behavior, liabilities, patents, intellectual property rights). Other relevant arguments were provided in e.g., Hammond et al. [7], Guide and Van Wassenhove [22], Ijomah et al. [19], Subramoniam et al. [23, 24], and Matsumoto [25].

This study highlights three factors raised by Geyer and Jackson [26] and Lundmark et al. [20]. According to these authors, the remanufacturing system consists of three parts--collection, the remanufacturing process itself, and redistribution--each having its distinct challenges. For a company to undertake remanufacturing, it must (1) develop a collection system for used products, (2) develop efficient remanufacturing processes, and (3) cultivate demand for remanufactured products. This study investigates companies' efforts to meet these requirements.

In some cases, legislation is indispensable in enabling companies to operate as remanufacturers, and in other cases it creates barriers to remanufacturing. Hammond et al. [8] found that in auto parts remanufacturing, increased part proliferation and new governmental regulations in the United States caused major changes within the industry. Webster and Mitra [27] analyzed the effects of governmental subsidies on sustainable operations and found that they encourage remanufacturing activities. Zuidwijk and Krikke [28] analyzed the strategic response of the industry to the Waste Electric and Electronic Equipment Directive (WEEE Directive) in the European Union (EU). Gerrard and Kandlikar [29] assessed the impact of the End-of-Live Vehicles Directive (ELV Directive) in the EU and found that while it led car OEMs to take steps toward recycling and disassembly, progress in designing the process for reuse and remanufacturing was limited. This study introduces relevant legislation in Japan--the Home Appliance Recycling Law and the End-of-Life Vehicles Recycling Law--and discusses their influences on remanufacturing.

Methods and results: Case studies of remanufacturing businesses in Japan

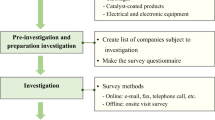

Methods

Following discussions and interviews with Japanese companies engaged in remanufacturing, the authors focused on case studies related to four types of products: photocopiers, single-use cameras, auto parts, and ink and toner cartridges for printers.

These product areas were selected for the following reasons. Photocopiers and single-use cameras were selected because they are the two most successful cases of OEM remanufacturing in Japan. Studying these cases provides insights into OEMs' remanufacturing practices.

Remanufactured auto parts are prevalent worldwide [3]. In Japan, as in other countries, the main remanufacturers are IRs rather than OEMs. This case study is helpful to learn IRs' remanufacturing practices, and OEMs incentives and disincentives to remanufacture. In addition, since auto parts remanufacturing in Japan is less prevalent than in the United States and EU, the reasons, obstacles, and companies' efforts to overcome the obstacles are investigated.

The printer cartridge case exemplifies the conflict between profits on OEMs' sales of new products and IRs' sales of remanufactured products. The share of remanufactured products in Japan's printer ink cartridge market has increased rapidly since early 2000s. The efforts of the successful IRs are studied.

The case studies are based on the authors' discussions and interviews with major Japanese OEMs and IRs in the targeted product areas. The authors have occasions for discussions and interviews with OEMs in the countrya. To interview IRs, the authors visited their companies and interviewed the managers on site. Case studies involving IRs derive from the authors' interviews with the presidents of five companies and executive directors of two companies. Interviews were semi-structured and lasted from one to several hours. Table 1 lists the companies on which case studies are based.

In the discussions and interviews, the questions asked were as follows. First, we asked about the basic features of the companies' businesses. The topics included the companies' profiles, remanufacturing practices, market size, market shares, businesses strategies, and areas of competence. Then, we inquired about the companies' motives and incentives for remanufacturing. Moreover, we asked about their major motives for remanufacturing. To IRs, in addition to these questions, we asked about the attitudes of OEMs (whose products they remanufacture) toward remanufacturing. Next, we asked what measures the companies take to meet the following three requirements for remanufacturing [20, 26]:

-

1)

Collection of used products

-

2)

Development of efficient remanufacturing processes

-

3)

Cultivation of demand for remanufactured products.

Interview data was supplemented with observations and secondary data. The IR participants' views of OEMs' attitudes toward remanufacturing were supplemented by the authors' interpretations because some interviewees talked implicitly. The results of the case studies follow.

Case studies

Photocopier machines

The remanufacturing of photocopy machines is a well-known example of remanufacturing. Three major OEMs of photocopy machines in Japan--Fuji Xerox, Ricoh, and Canon--have been undertaking remanufacturing activities [30–32]. Practices in other countries have also been studied [33–35].

Fuji Xerox, Ricoh, and Canon, account for about 90% of Japan's photocopier market. Until the 1970s, photocopiers were so expensive that they generally were rented by their users; however, after prices fell, sellouts and leasing became commonplace. Fuji Xerox started remanufacturing in 1990s, and Ricoh and Canon began selling remanufactured machines in the 2000s. Ricoh's and Canon's remanufactured products are made of reused components. According to Ricoh, 93% by weight of a typical remanufactured photocopy machine is composed of reused parts, its price is 50% to 70% less than prices of new products, and profits from remanufactured machines are larger than those from newly produced machines.

In Fuji Xerox's remanufacturing process, reused components are incorporated in new products. Thus, all products may include reused components and there is no distinction between new and remanufactured products. As far as the authors know, Xerox in the United States and Europe is not remanufacturing in this fashion. In Xerox's remanufacturing, as with Ricoh and Canon, remanufactured products are distinguished from new products, which are made exclusively from new components. The merit of the Fuji Xerox approach is that demand for reused components is not restricted by customers' product selection. On the contrary, when reused components are used solely in remanufacturing, if many customers prefer new products and avoid remanufactured products, components are not reused. Moreover, Fuji Xerox is said to have the highest ratio of reused components among the three companies.

The companies' motives for remanufacturing came from concerns about the environment and from corporate social responsibility. In addition, these companies are convinced that component reuse brings economic benefits. However, the benefits they expect are long-term. Fuji Xerox, for example, made a large investment to renovate and adapt to remanufacturing that it took more than 10 years to recoup.

Photocopiers need frequent maintenances, which makes it easier for OEMs to manage product life cycles and thus to collect used products. Many products are leased to customers. OEMs take return delivery of leased products from the leasing companies in abundance. In case of sellout products, since in general, customers buy a new product in replacement of the old one, OEMs can reclaim their discarded product. The three OEMs form partnerships to collect and return each other's used products. However, third party intermediaries also buy used products, and as a result OEMs cannot re-acquire all used products. The ratios of take-back among OEMs vary.

The companies implement design for remanufacturing (DfReman) of products to facilitate remanufacturing, which substantially enhances the efficiencies of their remanufacturing processes. The companies have also been renovating remanufacturing processes and accumulating know-how. For example, Fuji Xerox developed a subparts cleaning method using chilled carbon dioxide gas. It is used to clean the frames of the photocopier machines and it substantially shortened cleaning time in remanufacturing.

Photocopiers are business equipments, and customers' aversion to remanufactured products in business equipment is generally lower than that in consumer products. In addition, product leasing could lower customers' aversion to remanufactured products. Ricoh and Canon offer remanufactured products with prices lower than those of new products. Fuji Xerox installs reused components in all products and there is no distinction between new and remanufactured products. Thus, demand for reused components is not restricted by customers' product selection. The companies' thorough quality controls have earned trust from customers, who show little dissatisfaction regarding products with reused components.

In sum, the following points were observed.

-

Motive: long-term economic and environmental incentives

-

Collection of used products: Companies accept returns from leasing companies in abundance and companies collaborate in collecting returns.

-

Efficiency of remanufacturing processes: Efficiency has been achieved through DfReman, process renovation, and know-how accumulation.

-

Cultivation of demand: Companies provide products to business and leasing customers, and they more readily accept remanufactured products than individual and sellout customers. Companies provide remanufactured products with lower prices (Ricoh and Canon). Reused components are installed in all products, and thus demand for used components is not restricted by customers' product selection (Fuji Xerox). Thorough quality controls have been carried out.

Single-use cameras

Remanufacturing of single-use cameras is another often-studied example of remanufacturing [11, 36–38]. Single-use cameras began to appear in 1986, and three OEMs--Fuji Film, Kodak, and Konica--have dominated the Japanese market. In 1987, OEMs began to collect used products and recycle them. Fuji Film developed an automated production line for single-use cameras in 1992 and launched research and development into product designs that facilitated recycling and remanufacturing (Figure 1). In 1998, it developed a remanufacturing line that fully automated all processes--product disassembly, parts cleaning, parts inspection, parts replenishment, reassembly, and final testing. The parts--flash, battery, plastic, mechanical parts--are reused, and if parts wear out, new parts are replenished. The company reports that more than 82% by weight of all camera components are reused or recycled.

Modular design (DfReman) of single-use cameras (Source: [42]).

Economic and environmental incentives are Fuji Film's motive to remanufacture. Before the company began remanufacturing, the waste disposal costs at film developing centers had been expensive. The economic incentive is long-term, as with photocopiers, and it took approximately 10 years to recoup its investment. Before OEMs undertook product remanufacturing, Japanese consumers had criticized them for wasting materials. Concerns about the environment and its customer image motivated Fuji Film to remanufacture. A conflict between sales of new and remanufactured products for the company never occurred because used parts are incorporated in all products and there is no distinction between new and remanufactured products.

Fuji Film's customers bring about 90% of single-use cameras to its centers to have their film developed. To transport the cameras back to its remanufacturing factory in Ashigara, Kanagawa Prefecture, Japan, the company simply reversed its pre-existing logistics for distributing supplies and chemicals from Ashigara to its development centers. The reverse logistics system was key to remanufacturing. The OEMs formed partnerships to collect and return each other's used products.

Fully automated remanufacturing is ideal for quality assurance and high efficiencies. DfReman of products was a prerequisite for the automation. Some parts are used only once, whereas others are used up to five times.

Consumers accepted remanufactured products well. The company carries out thorough quality control, and there have been few complaints regarding reused components. In addition, consumers' aversion to remanufactured products did not occur because there is not distinction between new products and remanufactured products, and the company could avoid demand cultivation problems.

The case is summarized as follows.

-

Motive: long-term economic and environmental incentives

-

Collection of used products: Fuji Film reversed the flow of its pre-existing forward logistics system

-

Efficiency of remanufacturing process: The company developed a fully-automated remanufacturing process. DfReman was essential in developing the line.

-

Cultivation of demand: Thorough quality controls were carried out. Used components are incorporated in all products, consumers' aversion to remanufactured products did not occur.

Auto parts

Auto parts are the most prevalent target of remanufacturing in the world. Up to two-thirds of remanufacturing businesses globally is estimated to involve auto parts [3]. In Japan, however, remanufacturing of auto parts is less common than in other developed countries. One reason is that the prevalence of automobiles in Japan is more recent compared with the United States and many European countries and thus auto parts remanufacturing has a briefer history. Auto parts remanufacturing saves material and energy. Manufacturing a new starter, for example, requires more than nine times the quantity of new material and about seven times more energy than remanufacturing a starter [3].

Japan's auto parts remanufacturers are primarily IRs. OEMs are generally reluctant remanufacturers because remanufacturing conflicts with sales of new parts. Profit margins on new auto parts are high--in some cases over 90%--whereas margins on remanufactured parts are lower.

In Japan, as in other countries, the remanufactured auto parts primarily include engines, turbo chargers, alternators, starters, compressors, transmissions, and steering units. The case study of Shin-Etsu Denso, one of the largest auto parts remanufacturers in Japan, shows the importance of assuring collection of used products, efficient remanufacturing processes, and demand for remanufactured products. This company remanufactures alternators and starters and ships about 100,000 of each annually.

To collect used products, the company supplies car maintenance shops with remanufactured products in exchange with used products. In addition, the company continually purchases and stocks used products from car dismantling companies. It stocks about 300,000 used products, which are essential for its business. Figure 2 shows the flow of the company's remanufacturing processes. Although the company has developed and accumulated know-how involving each of its processes, its president indicated that know-how in cleaning and surface treatment of subparts is primarily important. His estimate reinforces previous studies showing that cleaning process is the most costly and knowledge-intensive process in auto parts remanufacturing [8]. Products can be remanufactured two to four times.

Until the early 1990s, there had been little demand for remanufactured auto parts in Japan, and Shin-Etsu Denso shipped most of its remanufactured products to the United States and Europe. However, since the late 1990s, the Japanese demand has increased, and today about 45% of its shipments (measured in yen) are for the domestic market. The company's thorough quality control (Figure 2) has enhanced users' confidence in remanufactured products and has helped to stimulate demand. Auto parts remanufacturers are cooperating with suppliers of reused auto parts, i.e., the car dismantling companies. The companies are forming networks to share information about inventories [14]. Car maintenance shops--the main buyers of reused and remanufactured parts--pass orders to member companies in the network. So partnerships with reused auto parts suppliers help remanufacturers to stimulate demand. The Japanese end-users' low recognition of remanufactured products is problematic for increasing demand further; an author's previous study found that nearly 60% of Japanese drivers know little about reused (including remanufactured) auto parts [39].

The auto parts case study presents the following observations:

-

Motive: IRs' motives primarily come from economic incentives. Regarding OEMs, they face profit conflicts between remanufacturing and selling new auto parts and are reluctant to remanufacture.

-

Collection of used products: Shin-Etsu Denso collects used products from car maintenance shops (by shipping remanufactured products in exchange with used products) and from car dismantling companies.

-

Efficiency of remanufacturing processes: Companies have been developing and accumulating know-how about processes, especially the cleaning and surface treatment of subparts.

-

Cultivation of demand: Companies have emphasized quality control in order to build users' trust in and demand for remanufactured products. Remanufacturers cooperate with reused parts suppliers to fetch orders from car maintenance companies. Publicizing remanufactured auto parts is significant to further increase demand in Japan.

Printer ink cartridges and toner cartridges

In Japan, 200 million ink cartridges are sold annually, primarily for use in personal printers. Remanufactured cartridges account for 15 million in sales. Ecorica, an IR founded in 2003, is Japan's largest ink cartridge remanufacturer, shipping approximately 10 million remanufactured products annually (other 5 million products are provided by other IRs). Ecorica collects used cartridges from end-users, and remanufactures and sells them. Of the 30 million toner cartridges sold annually in Japan, mainly for office printers, 5 to 6 million are remanufactured. There are a number of independent toner cartridge remanufactures; 33 IRs formed the Association of Japan Cartridge Remanufacturers, and member companies account for 90% of remanufactured toner cartridges sold in Japan.

Some OEMs do remanufacturing of printer cartridges. But most of remanufacturing in the product areas is done by IRs, and OEMs generally respond negatively to such activities by IRs. In their normal business model, companies sell printers at low prices and earn most of their profit from selling ink and toner cartridges. In 2004, soon after Ecorica began to remanufacture ink cartridges, Epson, Japan's second-highest-share OEM of printers, sued Ecorica for intellectual property infringement, but Epson lost the case in 2008. Recently, OEMs began to recover used ink cartridges. Six OEMs--Epson, Canon, Hewlett-Packard, Brother, Dell, and Lexmark--collaborated to collect used ink cartridges. However, since remanufacturing ink cartridges costs more than manufacturing new cartridges, OMEs are unenthusiastic about remanufacturing. These companies are not active remanufacturers and merely recycle the collected cartridges. According to an IR interviewee, even an OEM which remanufactures cartridges is unenthusiastic about remanufacturing because it sells only on internet sites, not in shops, and at prices similar to that of new cartridges. It is possible that OEMs collect used ink cartridges to discourage IRs from remanufacturing. The executive director of Ecorica maintains that in recent years OEMs have designed products to make the remanufacturing process more difficult.

To collect used ink cartridges, Ecorica had placed 6,000 collection boxes in electronics retail stores nationwide in 2008. That year the company recovered 20 million used ink cartridges (5% of the ink cartridges sold in Japan). It remanufactured 15 million cartridges and sold 10 million of them (5 million was backlogged). Although OEMs efforts to collect used ink cartridges have had limited influence on IRs' business, their efforts to collect used toner cartridges have been more significant. It is no longer easy for IRs to collect used cartridges, which restricts growth of the remaining market.

The five processes of remanufacturing--inspection, disassembly, reconditioning, reassembly, and final testing--are labor-intensive. Ecorica has invested in the development of ink, the quality of which is crucial to its business, and in developing techniques to decode IC chips in cartridges.

Ecorica sells remanufactured ink cartridges at 20% to 30% below new product prices. It is attempting to increase consumers' recognition and demand by enhancing quality control and after-sales services. According to the executive director, to achieve further growth in the market requires increased collection of used cartridges alongside increasing demand for remanufactured ink cartridges.

The case is summarized as follows:

-

Motive: IRs' motives for remanufacturing primarily come from economic incentives. OEMs derive profits on their printer products from the sale of ink and toner cartridges. Since profits on remanufactured cartridges are less than those on new cartridges, OEMs are indifferent remanufacturers and are hostile toward IRs' remanufacturing.

-

Collection of used products: Ecorica (IR) opened a new collection channel, placing boxes in retail stores to collect used ink cartridges. Collection of toner cartridges is an effort to increase sales has been difficult.

-

Efficiency of processes: IRs have invested in remanufacturing and have accumulated know-how such as developing ink and techniques to decode IC chips in cartridges.

-

Cultivation of demand: Ecorica is attempting to increase consumers' recognition and demand by enhancing quality control and after-sales services.

Summary of case study results

OEMs' incentives to remanufacture and remanufacturers' efforts to meet the requirements of remanufacturing are summarized in Table 2 for each of the four types of products.

Review and results: Relevant Japanese legislation and its influence on remanufacturing

In Japan, legislations relevant to recycling of products are the Home Appliance Recycling Law and the End-of-Life Vehicle Recycling Law. Enacted in 2001, the former provides rules for collection and recycling of air conditioners, television sets, refrigerators, freezers, and washing machines. In effect since 2005, Japan's End-of-Life Vehicle Recycling Law requires OEMs to be responsible for collecting and recycling chlorofluorocarbons, airbags, and shredder dust for EOL vehicles. OEMs have a contract with car dismantling, shredding, and collecting companies, which handle take-back and recycling. Car owners pay the recycling fees when they buy the car.

These two laws have promoted material recycling and have helped mitigate Japan's landfill shortage. In discussions with OEMs, the authors found that the laws have motivated OEMs to implement environmentally conscious product designs that facilitate material recycling. For example, OEMs have designed products to facilitate product disassemblies and have attempted to decrease the variety of materials used in products. However, it was expected that the laws also would encourage OEMs to undertake remanufacturing as well as product servicing, and they seem not to have had that effect.

The Home Appliance Recycling Law requires consumers to pay the feesb when they dispose off products, not at the time of purchase. Although an expected increase in illegal dumping never materialized following the law's enactment, exports of end-of-life (EOL) products to foreign countries, primarily developing countries, have increased because consumers avoid recycling fees by handing EOL products to exporters rather than to retailers and OEMs. Japan generates about 20 million units of EOL home appliances. About one-third of these units are exported to foreign countriesc, and about half are returned to OEMs [40].

The End-of-Life Vehicle Recycling Law requires car owners to pay EOL recycling fees at the time of purchase, but the fees are refunded if owners sell cars to secondhand dealers (including exporters) rather than deliver them to car dismantling companies. Again, the law increased exports of EOL autos. In Japan, about 5 million cars are discarded annually. About 3.5 million are disposed of by domestic car dismantling companies, and 1.5 million are exported. Car dismantling companies are increasingly active in dealing with reused auto parts. However, during interviews with the authors, these companies indicated that increased exports of EOL autos impedes their collecting EOL products and is a significant obstacle in their reuse businesses.

Regarding reuse and remanufacturing operations in the worldwide scope, although both laws have increased exports of EOL products from Japan and have impeded remanufacturing within the country, most of the products exported are reused at the destined countries after being repaired there [41]. In other words, the laws could have stimulated reuse and remanufacturing in other countries. Further arguments are needed regarding EOL product exports and product reuse and remanufacturing in developing countries.

Discussion

In the case studies, we first examined Japan's major remanufacturers, particularly OEMs, and their motives for remanufacturing. OEMs remanufacturing photocopiers and single-use cameras, whereas IRs focus on remanufacturing auto parts and printer cartridges. Previous studies have indicated that OEMs have advantages over IRs in remanufacturing. However, OEMs face unique obstacles. For example, sales of remanufactured products may reduce their sales of new products, which customarily yield higher profit margins than remanufactured products. In such instances, OEMs have little incentive or have a negative attitude toward remanufacturing, as shown in the auto parts and printer cartridge case studies. Moreover, even though photocopiers and single-use cameras are successful examples of OEM remanufacturing, establishing remanufacturing systems required OEMs to make large initial investments; it took over 10 years for Fuji Xerox and Fuji Film to recoup their initial investments. IRs might not need to make initial investments as large as OEMs. In general, OEMs pursue higher quality control levels than IRs for products from the initial stage of the business. This makes OEMs' initial investment expensive.

OEMs lack of incentive to remanufacture presents IRs with an opportunity, and IRs are expected to lead Japanese remanufacturing business. If IRs successfully create a market for remanufactured goods and stimulate consumers' demand, OEMs could be forced to become remanufacturers despite their reservations. Auto parts remanufacturing, for example, is more prevalent in the United States and Europe than in Japan, and some OEMs in these countries are active remanufacturers. The same could occur in Japan if end-users demand more remanufactured products, and demand could be cultivated through IRs' remanufacturing practices. This is expected to happen for many products worldwide.

Regarding the effects of relevant Japanese legislation on remanufacturing, Japan's Home Appliance Recycling Law and End-of-Life Vehicle Recycling Law have promoted material recycling, but have failed to stimulate remanufacturing. Even worse, both laws have increased exports of EOL products and have impeded IRs' remanufacturing operations in the country. Thus, there is a pressing need for institutional measures that stimulate remanufacturing. An important point in designing institutional measures is that, because IRs could lead remanufacturing even if OEMs are reluctant to remanufacture, and counteracting IRs' remanufacturing drives OEMs to begin remanufacturing [16], policy-making to encourage appropriate competition between OEMs and IRs could effectively stimulate remanufacturing. It is expected that remanufacturing will be stimulated through OEMs' and IRs' competition and through consumers' acceptance of remanufactured products.

Regarding the perspectives of remanufacturing in Japan, the markets for remanufactured products and reused products (i.e., secondhand products) have grown steadily in the last 10 to 20 years. This growth indicates that Japanese consumers have increasingly accepted remanufactured products. This Japanese market trend of remanufacturing growth seems destined to continue, at least in the product areas where remanufacturing already occurs. One possible obstructive factor for continued growth is the decreasing price of new products, particularly those imported from newly developing countries such as China. Remanufactured products often have to face competition from such products, and if consumers prefer cheaper new products to remanufactured products, the remanufactured market will shrink. To date, in auto parts and printer ink cartridge products, remanufactured products have been accepted by consumers more than the cheap, new, imported products. However, we need to monitor the direction of the market. To extend the scope of products remanufactured, it would be effective to refer to and consider adopting other countries' remanufacturing practices.

Conclusion

This study has analyzed cases of selected remanufacturing operations in Japan. We focused on remanufacturing in four product areas: photocopiers, single-use cameras, auto parts, and ink and toner cartridges for printers.

The study investigated companies' motives and incentives for remanufacturing. OEMs' motives are long-term economic and environmental incentives. However, OEMs often shun remanufacturing, fearing to cannibalize new product sales.

We highlighted three requirements for successful remanufacturing: (1) develop collection systems for used products; (2) develop efficient remanufacturing processes; and (3) cultivate demand for remanufactured products. Companies' efforts to meet these requirements were observed: (1) establishing a new collection channel, (2) developing reverse logistics to collect used products, (3) designing products for remanufacturing (DfReman), (4) accumulating know-how to establish remanufacturing processes, and (5) controlling product quality to stimulate demand for remanufactured products. Another important implication of this study is that (6) incorporating used components into new products increases the demand for remanufactured products. In Fuji Xerox's photocopier and Fuji Film's single-use camera businesses, used components are incorporated in all new products, with no distinction made between remanufactured and new products. The advantage of this mode of remanufacturing is that (1) the supply of remanufactured products is not restricted by the timing of returns of used products, (2) reuse ratios for components are not dictated by customer demand, and (3) OEMs avoid conflict between sales of new and remanufactured products.

Endnotes

aOne of the occasions for the discussions and interviews with OEMs was the Inverse Manufacturing Forum, a Japanese industry-government-academia forum of which the authors are committee members and many OEMs are, or once were, the member companies.

bThe law requires consumers to pay for collection and recycling; retailers collect the used appliances, and OEMs are responsible for recycling them. Under the law, OEMs determine the recycling fees, which currently are ¥2,500 for air conditioners, ¥2,700 for televisions, ¥4,600 for refrigerators, and ¥2,400 for washing machines (¥110 = €1).

cThe main destination of the exports was once mainland China via Hong Kong, and today many are exported to Vietnam and the Philippines [41]. The exported EOL products are used in the destinations, but after use, many are processed in informal sectors and it partially causes the e-waste problem.

Abbreviations

- DfReman:

-

design for remanufacturing

- EOL:

-

end-of-life

- IR:

-

independent remanufacturer

- OEM:

-

original equipment manufacturer

References

Ijomah W: Addressing decision making for remanufacturing operations and design-for-remanufacture. International Journal of Sustainable Engineering 2009,2(2):91–102. 10.1080/19397030902953080

Ijomah W, Bennett J, Pearce J: Remanufacturing evidence of environmentally conscious business practices in the UK. Proceedings of the 1st International Symposium on Environmentally Conscious Design and Inverse Manufacturing (EcoDesign 99), Tokyo 1999.

Steinhilper R: Remanufacturing: The Ultimate Form of Recycling. Stuttgart: Fraunhofer IRB. Verlag; 1998.

Lund R: The Remanufacturing Industry: Hidden Giant. Boston. Boston University. final report of Argonne National Laboratory study; 1996.

Lund R, Skeels F: Guidelines for an original equipment manufacturer starting a remanufacturing operation. Government Report, DOE/CS/40192, CPA-83.8. Cambridge, MA: Massachusetts Institute of Technology, Center for Policy Alternatives; 1983.

Lund R: Remanufacturing. Technology Review 1984,87(2):19–23.

Haynsworth H, Lyons R: Remanufacturing by design, the missing link. Production and Inventory Management 1987,28(2):24–29.

Hammond R, Amezquita T, Bras B: Issues in the automotive parts remanufacturing industry e a discussion of results from surveys performed among remanufacturers. International Journal of Engineering Design and Automation 1998,4(1):27–46.

Guide VDR, Harrson T, Van Wassenhove LN: The challenge of closed loop supply chains. Interfaces 2003,33(6):3–6. 10.1287/inte.33.6.3.25182

Bras B, McIntosh M: Product, process, and organizational design for remanufacture - an overview of research. Robotics and Computer Integrated Manufacturing 1999, 15: 167–178. 10.1016/S0736-5845(99)00021-6

Toffel MW: Strategic management of product recovery. California Management Review 2004,46(2):120–141.

Ferguson M, Toktay L: The effect of competition on recovery strategies. Production & Operations Management 2006,15(3):351–368.

Linton J: Assessing the economic rationality of remanufacturing products. Journal of Product Innovation Management 2008,25(3):287–302. 10.1111/j.1540-5885.2008.00301.x

Matsumoto M: Business frameworks for sustainable society: A case study on reuse industries in Japan. Journal of Cleaner Production 2009,17(17):1547–1555. 10.1016/j.jclepro.2009.07.011

Ostlin J, Sundin E, Bjorkman M: Business drivers for remanufacturing. Proceedings of 15th CIRP International Conference on Life Cycle Engineering. Sydney 2008.

de Brito M, Dekker R: A framework for reverse logistics. Reverse Logistics Quantitative Models for Closed-loop Supply Chains. Edited by: Dekker R, Fleischmann M, Inderfurth K, Van Wassenhove NL. Springer, Berlin; 2004.

Seitz MA: A critical assessment of motives for product recovery: the case of engine remanufacturing. Journal of Cleaner Production 2007,15(11&12):1147–1157.

Pagell M, Wu Z, Murthy NN: The supply chain implications of recycling. Business Horizons 2007, 50: 133–143. 10.1016/j.bushor.2006.08.007

Ijomah W, McMahon C, Hammond G, Newman S: Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. International Journal of Production Research 2007,45(18&19):4513–4536.

Lundmark P, Sundin E, Bjorrkman M: Industrial challenges within the remanufacturing system. Proceedings of Swedish Production Symposium. Stockholm 2009, 132–139.

Steinhilper R: Recent trends and benefits of remanufacturing: from closed loop businesses to synergetic networks. Proceedings of 2nd International Symposium on Environmentally Conscious Design and Inverse Manufacturing (EcoDesign 2001). Tokyo 2001.

Guide VDR, Van Wassenhove LN: Business aspects of closed-loop supply chains. Business Aspects of Closed-loop Supply Chains: Exploring the Issues. Edited by: Guide VDR, Van Wassenhove LN. Carnegie Bosch Institute, Pittsburgh, Pennsylvania; 2003:17–42.

Subramoniam R, Huisingh D, Chinnam RB: Remanufacturing for the automotive aftermarket-strategic factors: literature review and future research needs. Journal of Cleaner Production 2009,17(13):1163–1174. 10.1016/j.jclepro.2009.03.004

Subramoniam R, Huisingh D, Chinnam RB: Aftermarket remanufacturing strategic planning decision-making framework: theory & practice. Journal of Cleaner Production 2010, 18: 1575–1586. 10.1016/j.jclepro.2010.07.022

Matsumoto M: Development of a simulation model for reuse businesses and case studies in Japan. Journal of Cleaner Production 2010,18(13):1284–1299. 10.1016/j.jclepro.2010.04.008

Geyer R, Jackson T: Supply loops and their constraints: the industrial ecology of recycling and reuse. California Management Review 2004,46(2):55–73.

Webster S, Mitra S: Competitive strategy in remanufacturing and the impact of take-back laws. Journal of Operations Management 2007, 25: 1123–1140. 10.1016/j.jom.2007.01.014

Zuidwijk R, Krikke H: Strategic response to EEE returns - product ecodesign or new recovery processes. European Journal of Operations Research 2007.

Gerrard J, Kandlikar M: Is European end-of-life vehicle legislation living up to expectations? Assessing the impact of the ELV Directive on 'green' innovation and vehicle recovery. Journal of Cleaner Production 2007, 15: 17–27. 10.1016/j.jclepro.2005.06.004

Tani T: Product development and recycle system for closed substance cycle society. Proceedings of International Symposium on Environmentally Conscious Design and Inverse Manufacturing (EcoDesign 1999). Tokyo 1999.

Tanaka H: Research and development of environmentally conscious components: Photocopiers. Proceedings of International Symposium on Environmentally Conscious Design and Inverse Manufacturing (EcoDesign 1999). Tokyo 1999.

Suzuki M, Subramanian R, Watanabe T, Hasegawa H: The application of the international resource recycling system to encouragement of electronic waste recycling - The case of Fuji Xerox. Proceedings of IEEE International Symposium on Electronics and the Environment. San Francisco 2008.

Berko-Boateng V, Azar J, de Jong E, Yander G: Asset recycle management: a total approach to product design for the environment. Proceedings of IEEE International Symposium on Electronics and the Environment. Arlington 1993, 19–31.

Azar J, Berko-Boateng V, Calkins P, de Jong E, George J, Hilbert H: Agent of change: xerox design for the environment program. Proceedings of IEEE International Symposium on Electronics and the Environment. Orlando 1995, 89–94.

Kerr W, Ryan C: Eco-efficiency gains from remanufacturing: a case study of photocopier remanufacturing at Fuji Xerox Australia. Journal of Cleaner Production 2005,13(9):913–925. 10.1016/j.jclepro.2004.04.006

Guide VDR, Van Wassenhove LN: The reverse supply chain: smart manufacturers are designing efficient processes for reusing their products. Harvard Business Review 2002,80(2):25–26.

Sundin E, Lindahl M: Rethinking design for remanufacturing to facilitate integrated product service offerings. Proceedings of IEEE International Symposium on Electronics and the Environment. San Francisco 2008.

Duflou JR, Seliger G, Kara S, Umeda Y, Ometto A, Willems B: Efficiency and feasibility of product disassembly: A case-based study. CIRP Annals - Manufacturing Technology 2008, 57: 583–600. 10.1016/j.cirp.2008.09.009

Matsumoto M, Nakamura N, Takenaka T: Business constraints in reuse services. IEEE Technology and Society Magazine 2010,29(3):55–63.

Joint meeting of Central Environment Council and Industrial Structure Council WGs: Results of actual condition survey of the flow of particular home appliances on their waste generation, take-back and disposals. 2006. [http://www.env.go.jp/council/03haiki/y0311–05/mat02_1–1.pdf]

Yoshida A, Terazono A: Reuse of secondhand TVs exported from Japan to the Philippines. Waste Management 2010, 50: 1063–1072.

Fukano Edited by: Umeda Y. Inverse Manufacturing. Kogyochosakai, Tokyo; 1998.

Acknowledgements

This research is partially financially supported by Grant-in-Aid for Scientific Research (No. 20246130), JSPS, Japan.

Author information

Authors and Affiliations

Corresponding author

Additional information

Competing interests

The authors declare that they have no competing interests.

Authors' contributions

MM and YU carried out discussions and interviews with photocopier OEMs, single-use camera OEM, and auto parts remanufacturer. MM independently carried out interviews with reused auto parts suppliers, and printer and toner cartridge remanufacturers for printers. Case analyses and the discussion section are based on the authors' discussion. MM drafted the manuscript.

Authors’ original submitted files for images

Below are the links to the authors’ original submitted files for images.

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Matsumoto, M., Umeda, Y. An analysis of remanufacturing practices in Japan. Jnl Remanufactur 1, 2 (2011). https://doi.org/10.1186/2210-4690-1-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/2210-4690-1-2