Abstract

The primary objective of this study was to measure the influence of the current account balance (CAB) on foreign direct investment (FDI) in India’s economy by considering gross domestic product (GDP). As a result, India adopted economic liberalization in 1991 with the new policy support, and there appeared to be an increase in foreign direct investment in the country. The augmented Dickey–Fuller (ADF) test suggests the quantile regression (QR) method using time series data from 1975 to 2021. Moreover, the results indicate that gross domestic product and the current account balance have a positive impact on FDI. Because of the large volume of trade in India, the government should focus on the balance of payments and current account as a determinant of FDI. However, this study added value to existing literature with the best magnitude on foreign direct investment and international trade policy.

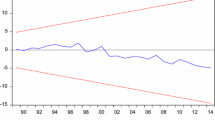

Source: WDI (2021)

Similar content being viewed by others

Data availability

The annual time series data from 1975 to 2021 has been collected by the World Development Indicators (WDI) published by the World Bank. However, the data availability statement (repository) has been covered by the following doi number: https://doi.org/10.17632/gk7538pfcx.1

References

Agrawal G, Khan MA (2011) Impact of FDI on GDP: a comparative study of China and India. Int J Bus Manage 6(10):71–79

Alam A, Shah SZA (2013) Determinants of foreign direct investment in OECD member countries. J Econ Stud 40:515–527

Aluko OA, Ibrahim M, Vo XV (2021) On the foreign direct investment–economic growth relationship in Africa: does economic freedom mediate this relationship? Int J Emerg Markets. https://doi.org/10.1108/IJOEM-04-2021-0568

Arabi AMK (2014) The impact of foreign direct investment FDI and real GDP on current account: empirical evidence from Sudan 1972–2011. Int J Bus Soc Sci 5(8):109–116

Asongu S, Akpan US, Isihak SR (2018) Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries. Fin Innov 4(1):1–17

Bansal S, Sharma GD, Rahman MM, Yadav A, Garg I (2021) Nexus between environmental, social and economic development in South Asia: evidence from econometric models. Heliyon 7(1):e05965

Buchinsky M (1994) Changes in the US wage structure 1963–1987: application of quantile regression. Econometr J Econometr Soc 62(2):405–458

Buckley PJ, Casson M (2020) The internalization theory of the multinational enterprise: past, present, and future. Br J Manage 31(2):239–252

Cecen A, Xiao L (2014) Capital flows and current account dynamics in Turkey: A nonlinear time series analysis. Econ Model 39:240–246

Dang VC, Nguyen QK (2021) Determinants of FDI attractiveness: Evidence from ASEAN-7 countries. Cogent Social Sciences 7(1):2004676

Dawid H, Greiner A, Zou B (2010) Optimal foreign investment dynamics in the presence of technological spillovers. J Econ Dyn Control 34(3):296–313

Dunning JH (1977) Trade, location of economic activity and the MNE: a search for an eclectic approach. In: The international allocation of economic activity: proceedings of a nobel symposium held at Stockholm. Palgrave Macmillan, UK, pp 395–418

Dunning WF, Curtis MR (1958) The Role of Indole in Incidence of 2-Acetylaminofluorene-Induced Bladder Cancer in Rats. Proc Soc Exp Biol Med 99(1):91–95

Esquivias MA, Harianto SK (2020) Does competition and foreign investment spur industrial efficiency?: firm-level evidence from Indonesia. Heliyon 6(8):e04494

Falki N (2009) Impact of foreign direct investment on economic growth in Pakistan. Int Rev Bus Res Pap 5(5):110–120

Fernandes AM, Paunov C (2012) Foreign direct investment in services and manufacturing productivity: evidence for Chile. J Dev Econ 97(2):305–321

Goyal A, Sharma V (2019) Estimating the relationship between the current account, the capital account, and investment for India. Foreign Trade Rev 54(1):29–45

Gupta S, Yadav SS, Jain PK (2022) Absorptive capacities, FDI and economic growth in a developing economy: a study in the Indian context. J Adv Manage Res 19:741

Hamid I, Jena PK (2020) Linear and non-linear Granger casuality between foreign direct investment and economic growth: evidence from India. Copernican J Fin Account 9(2):25–44

Hamid I, Jena PK (2022) Is democracy necessary for foreign direct investment inflows in India? Indian Econ J 70(1):88–111

Handoyo RD, Erlando A, Astutik NT (2020) Analysis of twin deficits hypothesis in Indonesia and its impact on financial crisis. Heliyon 6(1):e03248

Hennart JFMA (1982) A theory of multinational enterprise. The University of Michigan, Michigan

Hintošová AB (2021) Inward FDI: characterizations and evaluation. Encyclopedia 1(4):1026–1037

Holmes MJ, Panagiotidis T, Sharma A (2011) The sustainability of India’s current account. Appl Econ 43(2):219–229

Hossain MR (2021) Inward foreign direct investment in Bangladesh: do we need to rethink about some of the macro-level quantitative determinants? SN Bus Econ 1(3):1–23

Hymer SH (1976) International operations of national firms. MIT Press, Cambridge

Iqbal BA, Rahman MN, Yusuf N (2018) Determinants of FDI in India and Sri Lanka. Foreign Trade Rev 53(2):116–123

Itagaki T (1981) The theory of the multinational firm under exchange rate uncertainty. Can J Econ 14(2):276–297

Jaffri AA, Asghar NABILA, Ali MM, Asjed R (2012) Foreign direct investment and current account balance of Pakistan. Pakistan Econ Soc Rev 50:207–222

Joshua U, Adedoyin FF, Sarkodie SA (2020) Examining the external-factors-led growth hypothesis for the South African economy. Heliyon 6(5):e04009

Kathuria K, Kumar N (2022) Are exports and imports of India’s trading partners cointegrated? Evidence from Fourier bootstrap ARDL procedure. Empir Econ 62(3):1177–1191

Kaur M, Yadav SS, Gautam V (2012) Foreign direct investment and current account deficit-a causality analysis in context of India. J Int Bus Econ 13(2):85–106

Kirti R, Prasad S (2016) FDI impact on employment generation and GDP growth in India. Asian J Econ Empir Res 3(1):40–48

Kumari R, Shabbir MS, Saleem S, Khan GY, Abbasi BA, Lopez LB (2021) An empirical analysis among foreign direct investment, trade openness and economic growth: evidence from the Indian economy. South Asian J Bus Stud 3:27–37

Majumder SC, Rahman MH (2020) Impact of Foreign Direct Investment on Economic Growth of China after Economic Reform. J Entrepreneur Bus Econ 8(2):120–153

Majumder SC, Rahman MH, Martial AAA (2022) The effects of foreign direct investment on export processing zones in Bangladesh using generalized method of moments approach. Soc Sci Human Open 6(1):100277

Morshed N, Hossain MR (2022) Causality analysis of the determinants of FDI in Bangladesh: fresh evidence from VAR, VECM and Granger causality approach. SN Bus Econ 2(7):1–28

Mundell RA (1961) A theory of optimum currency areas. Am Econ Rev 51(4):657–665

Obasaju BO, Olayiwola WK, Okodua H, Adediran OS, Lawal AI (2021) Regional economic integration and economic upgrading in global value chains: selected cases in Africa. Heliyon 7(2):e06112

Padhi SP (2022) Determinants of foreign direct investment: employment status and potential of food processing industry in India. Int J Emerg Mark. https://doi.org/10.1108/IJOEM-09-2021-1481

Paruchuru M, Mavuri S, Jyothsna M (2020) Challenges for economic growth in India—a critique. J Crit Rev 7(7):169–175

Pečarić M, Kusanović T, Jakovac P (2021) The determinants of FDI sectoral structure in the Central and East European EU countries. Economies 9(2):66

Pennings E (2005) How to maximize domestic benefits from foreign investments: the effect of irreversibility and uncertainty. J Econ Dyn Control 29(5):873–889

Polat B (2015) Determinants of FDI into Central and Eastern European Countries: Pull or Push Effect? Eurasian J Econ Fin 3(4):39–47

Rahman MM, Alam K (2021) Exploring the driving factors of economic growth in the world’s largest economies. Heliyon 7(5):e07109

Rahman MH, Dilanchiev A (2021) Does current account increase the economic growth in Bangladesh? The analysis of GMM technique. Eur Online J Nat Soc Sci 10(1):52–69

Ray S (2012) Impact of foreign direct investment on economic growth in India: a co integration analysis. Adv Inf Technol Manage 2(1):187–201

Ricardo D (1821) On the principles of political economy. J. Murray, London

Roeger W, Welfens PJ (2022) The macroeconomic effects of import tariffs in a model with multinational firms and foreign direct investment. IEEP 19(2):245–266

Sadaf BH, Amin SB (2018) Causal relationship between current account deficit and foreign direct investment: an empirical analysis of Bangladesh. World Rev Bus Res 8(3):52–60

Sahoo P (2006) Foreign direct investment in South Asia: policy, trends, impact and determinants. ADB Institute Discussion Paper No. 56

Saluja D, Singh M, Bhatia NK, Patel N (2013) A Cointegration and VECM approach in explaining the relationship of FDI with current and capital account of India. Int J Adv Res Comput Sci Manage Stud 1(6):1–6

Sarode S (2012) Effects of FDI on capital account and GDP: empirical evidence from India. Int J Bus Manage 7(8):102–107

Schaufelbuehl JM (2021) “The advantage of being inside the wall when it is built.” US multinationals’ direct investments in the Common Market, the balance of payments deficit and Bretton Woods (1958–74). J Eur Integr 43(6):667–682

Sengupta P, Puri R (2020) Exploration of relationship between FDI and GDP: a comparison between India and its neighbouring countries. Glob Bus Rev 21(2):473–489

Shahbaz M, Mateev M, Abosedra S, Nasir MA, Jiao Z (2021) Determinants of FDI in France: role of transport infrastructure, education, financial development and energy consumption. Int J Financ Econ 26(1):1351–1374

Shahbaz M, Gyamfi BA, Bekun FV, Agozie DQ (2022) Toward the fourth industrial revolution among E7 economies: assessment of the combined impact of institutional quality, bank funding, and foreign direct investment. Eval Rev 46(6):779–803

Shahzad A, Al-Swidi AK (2013) Effect of macroeconomic variables on the FDI inflows: the moderating role of political stability: an evidence from Pakistan. Asian Soc Sci 9(9):270

Singh S (2019) Foreign direct investment (FDI) inflows in India. J Gen Manage Res 6(1):41–53

Singh U (2021) An analysis of trends and determinants of FDI inflows in India. IASSI Q 40(2):267–286

Sinha M, Sengupta PP (2022) FDI inflow, ICT expansion and economic growth: an empirical study on Asia-pacific developing countries. Glob Bus Rev 23(3):804–821

Smith A (1950) An inquiry into the nature and causes of the wealth of nations (1776). University of Chicago Press, Chicago

Suyanto S, Sugiarti Y, Setyaningrum I (2021) Clustering and firm productivity spillovers in Indonesian manufacturing. Heliyon 7(3):e06504

Uddin H, Rahman M, Majumder SC (2022) The impact of agricultural production and remittance inflows on economic growth in Bangladesh using ARDL technique. SN Bus Econ 2(4):1–25

UNCTAD (2019) Fact sheet, 9: foreign direct investment. Available at https://unctad.org/en/PublicationChapters/tdstat44_FS09_en.pdf

Vernon R (1979) The product cycle hypothesis in a new international environment. Oxford Bull Econ Stat 41(4):255–267

World Bank (2020) World development indicators. World Bank, Washington

World Development Indicators (2020) Published by World Bank Group. https://datatopics.worldbank.org/worlddevelopment-indicators/

Ylmaz EG (2021) Determinants of current account balance: evidence from Turkey. İnsan Toplum Bilimleri Araştırmaları Dergisi 11(3):1302–1322

Zafir CZ, Sezgin FH (2012) Analysis of the effects of foreign direct investment on the financing of current account deficits in Turkey. Int J Bus Soc Sci 3(10):68–78

Zaman M, Pinglu C, Hussain SI, Ullah A, Qian N (2021) Does regional integration matter for sustainable economic growth? Fostering the role of FDI, trade openness, IT exports, and capital formation in BRI countries. Heliyon 7(12):e08559

Acknowledgements

N/A.

Funding

There is no institutional funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declare that he has no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethical approval

This research has no critical ethical issues.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rahman, M.H. Does the current account balance influence foreign direct investment in the Indian economy? Application of quantile regression model. SN Bus Econ 3, 94 (2023). https://doi.org/10.1007/s43546-023-00471-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43546-023-00471-y