Abstract

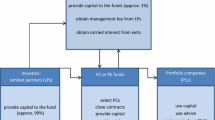

In this paper we analyse the changes in the patterns of investments for venture capital (VC) investors with different governance structures. We distinguish independent, corporate, bank-affiliated and governmental VC investors. Focusing on a sample of VC investments made in the period 1998–2014 in 28 EU-member countries and Israel, we compute specialization indexes for each investor type along five dimensions (age and industry of target, geographical distance; cross-border and syndicated investments) and compare their evolution across four time periods (booming internet bubble: 1998–2001, bursting post-bubble: 2002–2004, post bubble recovery: 2005–2007, global financial crisis: 2008–2010, and post global financial crisis 2011–2014). We find interesting trends in how investors with different governance structures changed their patterns of investment across time, highlighting the importance of considering the dynamic nature of the VC ecosystem.

Similar content being viewed by others

Notes

Macroeconomic conditions during the post-GFC period varies across countries. Northern European countries and Israel experienced a recovery from the crisis, similarly to the U.S. Conversely, in Southern European countries this period was marked by the sovereign debt crisis, peaking in 2011. The few studies that compare the VC industry before and after the global crisis detect several important differences. For example, Block and Sander (2009) formally compare the average investment choices before and after the global crisis in the U.S., finding that in the latter period target companies were older, later stage investments were smaller and done in larger syndicates, while early stage investments were less attractive to CVC. However, because of the different macroeconomic conditions in different countries, whether these results are generalizable is questionable.

References

Abrardi, L., Croce, A., & Ughetto, E. (2018). The dynamics of switching between governmental and independent venture capitalists: theory and evidence. Small Business Economics, 1–24.

Aernoudt, R. (1999). European policy towards venture capital: Myth or reality? Venture Capital: An International Journal of Entrepreneurial Finance, 1(1), 47–58. https://doi.org/10.1080/136910699295983.

Alperovych, Y., Hübner, G., & Lobet, F. (2015). How does governmental versus private venture capital backing affect a firm’s efficiency? Evidence from Belgium. Journal of Business Venturing, 30(4), 508–525. https://doi.org/10.1016/j.jbusvent.2014.11.001.

Alperovych, Y., Quas, A., & Standaert, T. (2018). Direct and indirect government venture capital investments in Europe. Economics Bullettin, 38(2), 1219–1230.

Andrieu, G., & Groh, A. P. (2012). Entrepreneurs’ financing choice between independent and bank-affiliated venture capital firms. Journal of Corporate Finance, 18(5), 1143–1167. https://doi.org/10.1016/j.jcorpfin.2012.07.001.

Archibugi, D., & Pianta, M. (1992). The technological specialization of advanced countries: A report to the EEC on international science and technology activities. Dordrecht: Kluver Academic. https://doi.org/10.1007/978-94-015-7999-5.

Balassa, B. (1965). Trade liberalization and “revealed” comparative advantage. Manchester School, 33, 99–123. https://doi.org/10.1111/j.1467-9957.1965.tb00050.x.

Bertoni, F., Colombo, M. G., & Quas, A. (2015). The patterns of venture capital investment in Europe. Small Business Economics, 45(3), 543–560. https://doi.org/10.1007/s11187-015-9662-0.

Bertoni, F., Colombo, M. G., & Quas, A. (2018). The role of governmental venture capital in the venture capital ecosystem: An organizational ecology perspective. Entrepreneurship: Theory and Practice. https://doi.org/10.1177/1042258717735303. (in press).

Block, J. H., & Sandner, P. (2009). What is the effect of the financial crisis on venture capital financing? Empirical evidence from US Internet start-ups. Venture Capital: An International Journal of Entrepreneurial Finance, 11(4), 295–309. https://doi.org/10.1080/13691060903184803.

Bottazzi, L., Da Rin, M., & Hellmann, T. F. (2004). The changing face of the European venture capital industry facts and analysis. The Journal of Private Equity, 7(2), 26–53. https://doi.org/10.3905/jpe.2004.391048.

Buzzacchi, L., Scellato, G., & Ughetto, E. (2013). The investment strategies of publicly sponsored venture capital funds. Journal of Banking and Finance, 37(3), 707–716. https://doi.org/10.1016/j.jbankfin.2012.10.018.

Cantwell, J. A. (1989). Technological innovation and multinational corporations. Oxford: Blackwell.

Colombo, M. G., Cumming, D. J., & Vismara, S. (2016). Governmental venture capital for innovative young firms. Journal of Technology Transfer, 41(1), 10–24. https://doi.org/10.1007/s10961-014-9380-9.

Croce, A., D’Adda, D., & Ughetto, E. (2015). Venture capital financing and the financial distress risk of portfolio firms: How independent and bank-affiliated investors differ. Small Business Economics, 44(1), 189–206. https://doi.org/10.1007/s11187-014-9582-4.

Cumming, D. J., & Dai, N. (2010). Local bias in venture capital investments. Journal of Empirical Finance, 17(3), 362–380. https://doi.org/10.1016/j.jempfin.2009.11.001.

Cumming, D. J., Fleming, G., & Schwienbacher, A. (2008). Financial intermediaries, ownership structure and the provision of venture capital to SMEs: Evidence from Japan. Small Business Economics, 31(1), 59–92. https://doi.org/10.1007/s11187-008-9106-1.

Da Rin, M., Hellmann, T. F., & Puri, M. (2013). A survey of venture capital research. Handbook of the Economics of Finance, 2(PA), 573–648. https://doi.org/10.1016/b978-0-44-453594-8.00008-2.

Da Rin, M., Nicodano, G., & Sembenelli, A. (2006). Public policy and the creation of active venture capital markets. Journal of Public Economics, 90(8–9), 1699–1723. https://doi.org/10.1016/j.jpubeco.2005.09.013.

Dalum, B., Laursen, K., & Villumsen, G. (1998). Structural change in OECD export specialisation patterns: De-specialisation and “stickiness”. International Review of Applied Economics, 12(3), 423–443. https://doi.org/10.1080/02692179800000017.

Deardorff, A. V. (1994). Exploring the limits of comparative advantage. Review of World Economics, 130(1), 1–19. https://doi.org/10.1007/BF02706007.

Dimov, D. P., & Gedajlovic, E. (2010). A property rights perspective on venture capital investment decisions. Journal of Management Studies, 47(7), 1248–1271. https://doi.org/10.1111/j.1467-6486.2009.00905.x.

Drover, W., Busenitz, L. W., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A review and road map of entrepreneurial equity financing research: Venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of Management, 43(6), 1820–1853. https://doi.org/10.1177/0149206317690584.

Erkens, D., Hung, M., & Matos, P. (2012). Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), 389–411. https://doi.org/10.1016/j.jcorpfin.2012.01.005.

European Commission. (2009). Cross-border venture capital in the European Union: Summary report of the European Commission work on removing obstacles.

Ferrary, M. (2010). Syndication of venture capital investment: The art of resource pooling. Entrepreneurship: Theory and Practice, 34(5), 885–907. https://doi.org/10.1111/j.1540-6520.2009.00356.x.

Gompers, P. A., & Lerner, J. (2003). Boom and bust in the venture capital industry and the impact on innovation. Innovation policy and the economy (Vol. 3). Chicago: The University of Chicago Press. https://doi.org/10.2139/ssrn.366041.

Green, J. (2004). Venture capital at a new crossroads: Lessons from the Bubble. Journal of Management Development, 23(10), 972–976. https://doi.org/10.1108/02621710410566883.

Hellmann, T. F. (2002). A theory of strategic venture investing. Journal of Financial Economics, 64(2), 285–314. https://doi.org/10.1016/S0304-405X(02)00078-8.

Hellmann, T. F., Lindsey, L., & Puri, M. (2008). Building relationships early: Banks in venture capital. Review of Financial Studies, 21(2), 513–541. https://doi.org/10.1093/rfs/hhm080.

Hillman, A. L. (1980). Observations on the relation between “revealed comparative advantage” and comparative advantage as indicated by pre-trade relative prices. Review of World Economics, 116(2), 315–321. https://doi.org/10.1007/BF02696859.

Hoen, A. R., & Oosterhaven, J. (2006). On the measurement of comparative advantage. The Annals of Regional Science, 40(3), 667–691. https://doi.org/10.1007/s00168-006-0076-4.

Mayer, C., Schoors, K., & Yafeh, Y. (2005). Sources of funds and investment activities of venture capital funds: Evidence from Germany, Israel, Japan and the United Kingdom. Journal of Corporate Finance, 11(3), 586–608. https://doi.org/10.1016/j.jcorpfin.2004.02.003.

Sahlman, W. A. (1990). The structure and governance of venture-capital organizations. Journal of Financial Economics, 27(2), 473–521. https://doi.org/10.1016/0304-405X(90)90065-8.

Soete, L. G., & Wyatt, S. M. E. (1983). The use of foreign patenting as an internationally comparable science and technology output indicator. Scientometrics, 5(1), 31–54. https://doi.org/10.1007/BF02097176.

van Essen, M., Engelen, P., & Carney, M. (2013). Does “good” corporate governance help in a crisis? The impact of country- and firm-level governance mechanisms in the European financial crisis. Corporate Governance: An International Review, 21(3), 201–224. https://doi.org/10.1111/corg.12010.

Yeats, A. J. (1985). On the appropriate interpretation of the revealed comparative advantage index: Implications of a methodology based on industry sector analysis. Review of World Economics, 121(1), 61–73. https://doi.org/10.1007/BF02705840.

Yoshikawa, T., Phan, P. H., & Linton, J. (2004). The relationship between governance structure and risk management approaches in Japanese venture capital firms. Journal of Business Venturing, 19(6), 831–849. https://doi.org/10.1016/j.jbusvent.2003.06.004.

Yu, R., Cai, J., & Leung, P. S. (2009). The normalized revealed comparative advantage index. Annals of Regional Science, 43(1), 267–282. https://doi.org/10.1007/s00168-008-0213-3.

Acknowledgements

This work was supported by RISIS2—funded by the European Union’s Horizon2020 Research and innovation programme under grant number 824091.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Bertoni, F., Colombo, M.G., Quas, A. et al. The changing patterns of venture capital investments in Europe. J. Ind. Bus. Econ. 46, 229–250 (2019). https://doi.org/10.1007/s40812-019-00113-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-019-00113-1

Keywords

- Venture capital

- Relative specialization index

- Europe

- Venture capital firm governance

- High-tech start-ups