Abstract

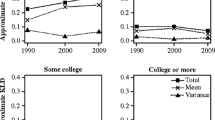

Differences in lifetime earnings by educational attainment have been of great research and policy interest. Although a large literature examines earnings differences by educational attainment, research on lifetime earnings—which refers to total accumulated earnings from entry into the labor market until retirement—remains limited because of the paucity of adequate data. Using data that match respondents in the Survey of Income and Program Participation to their longitudinal tax earnings as recorded by the Social Security Administration, we estimate the 50-year work career effects of education on lifetime earnings for men and women. By overcoming the purely synthetic cohort approach, our results provide a more realistic appraisal of actual patterns of lifetime earnings. Detailed estimates are provided for gross lifetime earnings by education; net lifetime earnings after controlling for covariates associated with the probability of obtaining a bachelor’s degree; and the net present 50-year lifetime value of education at age 20. In addition, we provide estimates that include individuals with zero earnings and disability. We also assess the adequacy of the purely synthetic cohort approach, which uses age differences in earnings observed in cross-sectional surveys to approximate lifetime earnings. Overall, our results confirm the persistent positive effects of higher education on earnings over different stages of the work career and over a lifetime, but also reveal notably smaller net effects on lifetime earnings compared with previously reported estimates. We discuss the implications of these and other findings.

Similar content being viewed by others

Notes

Specifically, we estimated a logistic regression on the likelihood of an administrative match across a range of characteristics, including age, age-squared, education, race/ethnicity, family income, and marital history. Using the results of that regression, we multiply the inverse of the match probability given the characteristics by SIPP Wave 2 person weights.

Those born in 1960 and 1961, for example, are excluded from the sample because their age-20 earnings (i.e., earnings in year 1980 and 1981) go beyond the year for which data are available.

To check whether our results are sensitive to this restriction, we varied the number of years of positive earnings to one, three, and four, finding basically the same results.

Some will argue that marriage and children are endogenous with earnings, so they should not be included as covariates. To address this concern, we additionally estimated the net 50-year lifetime earnings without controlling for the effects of marriage and children (results not shown). The difference between these estimates and the estimates reported in this article are small. This may be because the effects of marriage and childbearing are mostly associated with level of education rather than operating within the same level of education.

AP courses were not officially operational until 1955, but 62 % of men of the oldest cohort who attended college claim to have taken an AP course. Given that our analysis involves cohorts over several decades during which the educational system was evolving, various measurement issues may be associated with these control variables.

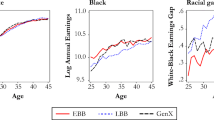

Earnings growth rates are estimated by regressing log annual earnings on time, separately by educational groups.

In computing net lifetime earnings, we set all covariates except education equal to the mean of the entire sample.

For both genders, AP courses, college preparatory classes, and type of high schools explain the virtually all the reduction in the return to college education. For example, the 98 % of the reduction in the return to BA compared with HSG is attributable to these three variables. Other covariates cancel each other out more or less when included in addition to these three variables.

We used propensity score matching techniques (PSM) to estimate cumulative earnings by education as a robustness check. We do not use PSM as our primary method because it yields results that are essentially the same as those based on median quantile regressions. When correctly specified, quantile regression is more efficient than PSM.

We omit room and board from this calculation because persons who do not attend college also need to pay those costs.

References

Avery, C., & Turner, S. (2012). Student loans: Do college students borrow too much—or not enough? Journal of Economic Perspectives, 26, 165–192.

Barrow, L., & Rouse, C. (2005). Does college still pay? Economist’s Voice, 2, 1–8.

Baum, S., & Ma, J. (2007). Education pays: The benefits of higher education for individuals and society (Trends in Higher Education Series 2007). Washington, DC: College Board. Retrieved from http://www.collegeboard.com/prod_downloads/about/news_info/trends/ed_pays_2007.pdf

Bhuller, M., Mogstad, M., & Salvanes, K. G. (2014). Life cycle earnings, education premiums, and internal rates of return (NBER Working Paper No. 20250). Cambridge, MA: National Bureau of Economic Research.

Björklund, A. (1993). A comparison between actual distributions of annual and lifetime income: Sweden 1951–89. Review of Income and Wealth, 39, 377–386.

Brand, J. E., & Davis, D. (2011). The impact of college education on fertility: Evidence for heterogeneous effects. Demography, 48, 863–887.

Brand, J. E., & Halaby, C. (2006). Regression and matching estimates of the effects of elite college attendance on educational and career achievement. Social Science Research, 35, 749–770.

Brand, J. E., & Xie, Y. (2010). Who benefits most from college? Evidence for negative selection in heterogeneous economic returns to higher education. American Sociological Review, 75, 273–302.

Card, D. (1999). The causal effect of education on earnings. In O. Ashenfelter & D. Card (Eds.), Handbook of labor economics (Vol. 3A, pp. 1801–1863). Amsterdam, The Netherlands: Elsevier-North Holland.

Carnevale, A. P., Rose, S. J., & Cheah, B. (2013). The college payoff: Education, occupation, and lifetime earnings (Report). Washington, DC: Georgetown University Center on Education and the Workforce. Retrieved from https://cew.georgetown.edu/report/the-college-payoff/

Cooke, T. J. (2003). Family migration and the relative earnings of husbands and wives. Annals of the Association of American Geographers, 93, 341–352.

Couch, K. A., Reznik, G. L., Tamborini, C. R., & Iams, H. M. (2013a). Economic and health implications of long-term unemployment: Earnings, disability benefits, and mortality. Research in Labor Economics, 38, 259–305.

Couch, K. A., Tamborini, C. R., Reznik, G., & Phillips, J. W. R. (2013b). Divorce, women’s earnings and retirement over the life course. In K. A. Couch, M. C. Daly, & J. M. Zissimopoulos (Eds.), Lifecycle events and their consequences: Job loss, family change, and declines in health (pp. 133–157). Stanford, CA: Stanford University Press.

Cristia, J. P. (2009). Rising mortality and life expectancy differentials by lifetime earnings in the United States. Journal of Health Economics, 28, 984–995.

Davis, J. M., & Mazumder, B. (2011). An analysis of sample selection and the reliability of using short-term earnings averages in SIPP-SSA matched data (CES Working Paper No. CES-WP-11-39). Washington, DC: Center for Economic Studies, U.S. Census Bureau.

Day, J. C., & Newburger, E. C. (2002). The big payoff: Educational attainment and synthetic estimates of work-life earnings. Washington, DC: Economics and Statistics Administration, U.S. Department of Commerce.

Elder, G. H., Jr., & Pavalko, E. K. (1993). Work careers in men’s later years: Transitions, trajectories, and historical change. Journal of Gerontology, 48, S180–S191.

Engen, E. M., Gale, W. G., & Uccello, C. E. (2005). Lifetime earnings, Social Security benefits, and the adequacy of retirement wealth accumulation. Social Security Bulletin, 66, 38–57.

Fischer, C. S., & Hout, M. (2006). Century of difference: How America changed in the last one hundred years. New York, NY: Russell Sage Foundation.

Flinn, C. J. (2002). Labour market structure and inequality: A comparison of Italy and the U.S. Review of Economic Studies, 69, 611–645.

Goldin, C. D., & Katz, L. F. (2009). The race between education and technology. Cambridge, MA: Harvard University Press.

Gottschalk, P., & Moffitt, R. (1994). The growth of earnings instability in the US labor market. Brookings Papers on Economic Activity, 2, 217–272.

Gouskova, E., Chiteji, N., & Stafford, F. (2010). Estimating the intergenerational persistence of lifetime earnings with life course matching: Evidence from the PSID. Labour Economics, 17, 592–597.

Haas, S. A., Glymour, M. M., & Berkman, L. F. (2011). Childhood health and labor market inequality over the life course. Journal of Health and Social Behavior, 52, 298–313.

Haider, S., & Solon, G. (2006). Life-cycle variation in the association between current and lifetime earnings. American Economic Review, 96, 1308–1320.

Hauser, R. M., & Daymont, T. N. (1977). Schooling, ability, and earnings: Cross-sectional findings 8 to 14 years after high school graduation. Sociology of Education, 50, 182–206.

Hayward, M. D., Friedman, S., & Chen, H. (1998). Career trajectories and older men’s retirement. Journals of Gerontology, Series B: Psychological Sciences and Social Sciences, 53, 91–103.

Hendricks, L. (2007). The intergenerational persistence of lifetime earnings. European Economic Review, 51, 125–144.

Hout, M. (2012). Social and economic returns to college education in the United States. Annual Review of Sociology, 38, 379–400.

Iams, H. M., Reznik, G. L., & Tamborini, C. R. (2010). Earnings sharing in the U.S. Social Security system: A microsimulation analysis of future female retirees. The Gerontologist, 50, 495–508.

Johnson, G. E., & Stafford, F. P. (1974). Lifetime earnings in a professional labor market: Academic economists. Journal of Political Economy, 82, 549–569.

Julian, T., & Kominski, R. (2011). Education and synthetic work-life earnings estimates. Washington, DC: U.S. Department of Commerce.

Kantrowitz, M. (2007). The financial value of a higher education. NASFAA Journal of Student Financial Aid, 37, 19–27.

Kim, C., & Sakamoto, A. (2008). The rise of intra-occupational wage inequality in the United States, 1983 to 2002. American Sociological Review, 73, 129–157.

Kim, C., & Tamborini, C. R. (2012). Do survey data estimate earnings inequality correctly? Measurement errors among black and white male workers. Social Forces, 90, 1157–1181.

Kim, C., & Tamborini, C. R. (2014). Response error in earnings: An analysis of the Survey of Income and Program Participation matched with administrative data. Sociological Methods & Research, 43, 39–72.

Manning, W. G. (1998). The logged dependent variable, heteroscedasticity, and the retransformation problem. Journal of Health Economics, 17, 283–295.

McNabb, J., Timmons, D., Song, J., & Puckett, C. (2009). Uses of administrative data at the Social Security Administration. Social Security Bulletin, 69, 75–84.

Mirowsky, J., & Ross, C. E. (2003). Education, social status and health. New York, NY: Transaction Publishers.

Moffitt, R. A., & Gottschalk, P. (2011). Trends in the transitory variance of male earnings in the U.S., 1970–2004 (NBER Working Paper No. 16833). Cambridge, MA: National Bureau of Economic Research.

Munnell, A. H., & Sundén, A. (2004). Coming up short: The challenge of 401(k) plans. Washington, DC: Brookings Institution Press.

Murphy, K. M., & Welch, F. (1993). Industrial change and the rising importance of skill. In S. Danziger & P. Gottschalk (Eds.), Uneven tides (pp. 101–132). New York, NY: Russell Sage Foundation.

National Center for Education Statistics (NCES). (1997). Public and private schools: How do they differ? (NCES 97-983). Washington, DC: NCES.

National Center for Education Statistics (NCES). (2012). What is the price of college? (NCES 2011-175). Washington, DC: NCES.

O’Rand, A. M. (2011). 2010 SSS presidential address: The devolution of risk and the changing life course in the United States. Social Forces, 90, 1–16.

O’Rand, A. M., Ebel, D., & Isaacs, K. (2009). Private pensions in international perspective. In P. Uhlenberg (Ed.), The international handbook of population aging (pp. 429–443). Dordrecht, The Netherlands: Springer-Verlag.

O’Rand, A. M., & Shuey, K. M. (2007). Gender and the devolution of pension risks in the US. Current Sociology, 55, 287–304.

Oreopoulos, P., & Salvanes, K. G. (2011). Priceless: The nonpecuniary benefits of schooling. Journal of Economic Perspectives, 25, 159–184.

Poterba, J., Venti, S. F., & Wise, D. A. (2007). Rise of 401(k) plans, lifetime earnings, and wealth at retirement (NBER Working Paper 13091). Cambridge, MA: National Bureau of Economic Research.

Putnam, R. D. (2001). Bowling alone. New York, NY: Simon and Schuster.

Riddell, W. C., & Song, X. (2011). The Impact of education on unemployment incidence and re-employment success: Evidence from the U.S. labour market. Labour Economics, 18, 453–463.

Ruel, E., & Hauser, R. M. (2013). Explaining the gender wealth gap. Demography, 50, 1155–1176.

Schwartz, C. R. (2010). Pathways to educational homogamy in marital and cohabitating unions. Demography, 47, 735–753.

Smith, H., & Powell, B. (1990). Great expectations: Variation in income expectations among college seniors. Sociology of Education, 63, 194–207.

Sum, A., & Khatiwada, I. (2010). The nation’s underemployed in the “Great Recession” of 2007–09. Monthly Labor Review, 11, 3–15.

Tamborini, C. R., & Iams, H. M. (2011). Are generation X’ers different than late Boomers? Family and earnings trends among recent cohorts of women at young adulthood. Population Research and Policy Review, 30, 59–79.

Tamborini, C. R., Iams, H. M., & Whitman, K. (2009). Marital history, race, and Social Security spouse and widow benefit eligibility in the United States. Research on Aging, 31, 577–605.

van der Wel, K., Dahl, E., & Birkelund, G. E. (2010). Employment inequalities through busts and booms: The changing roles of health and education in Norway 1980–2005. Acta Sociologica, 53, 355–370.

Weber, M. (1922/1978). Economy and society. G. Roth & C. Wittich (Eds.). Berkeley: University of California Press.

Yang, Y. (2008). Social inequalities in happiness in the United States, 1972 to 2004: An age-period-cohort analysis. American Sociological Review, 73, 204–226.

Acknowledgments

The findings and conclusions presented in this article are those of the authors and do not represent the views or opinions of the U.S. Social Security Administration or any agency of the federal government. The administrative data used in this article are restricted-use and undergo disclosure review before their release. For researchers with access to these data, our programs are available upon request. We thank the Editor and the anonymous reviewers of Demography for helpful comments. Thanks also to Gayle Reznik, Patrick Purcell, Kevin Whitman, and Natalie Lu for comments. All remaining errors are our own. This research was supported by the Eunice Kennedy Shriver National Institute of Child Health and Human Development of the National Institute of Health (Grant No. 1R03HD073464) and Spencer Foundation (Grant No. 201400077).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tamborini, C.R., Kim, C. & Sakamoto, A. Education and Lifetime Earnings in the United States. Demography 52, 1383–1407 (2015). https://doi.org/10.1007/s13524-015-0407-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-015-0407-0