Abstract

The soaring compensation levels of chief executive officers (CEOs) have spurred an intense debate about its outcomes. This paper examines an understudied outcome in this regard: employee engagement. Using a dynamic panel model with data from 336 publicly listed firms across 26 countries, we find that employee engagement is generally unaffected by CEO (over)compensation. However, negative effects emerge under specific conditions. First, employee engagement declines with negative media coverage about CEO compensation. Second, employee engagement declines with greater CEO (over)compensation in the financial sector, which is a sector with extraordinary levels of CEO compensation and compensation controversies. The findings suggest that a ceiling effect exists, at which point negative effects emerge and employee engagement becomes relevant in determining CEO compensation policies, while the general insensitivity of employee engagement to CEO compensation can help explain the soaring CEO compensation levels.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Chief executive officer (CEO) compensation has been soaring over the past decades. The median total compensation among CEOs of the 500 largest US-based companies reached more than $12.3 million in 2019, which represents a 22% increase since 2015 and is 191 times more than the median salary of their employees (Equilar 2020). The growth in CEO compensation has outpaced the growth in corporate profits, economic growth, and the stagnating compensation of rank-and-file employees, thereby contributing to the widening income inequality within companies and societies (Piketty 2014).

The growth in CEO pay has sparked a long and intense debate about whether corporate leaders receive excessive compensation and enrich themselves at the cost of other stakeholders. For instance, Alan Greenspan (2002) noted as the chairman of the Federal Reserve that “an infectious greed seemed to grip much of our business community”, while Barack Obama (2009) stated in the aftermath of the financial crisis that “you [American citizens red.] deserve better than the attitude that’s prevailed from Washington to Wall Street to Detroit for too long; an attitude that valued wealth over work, selfishness over sacrifice, and greed over responsibility”. Larcker et al. (2016) showed that these quotes reflect a broader negative sentiment in society about CEO pay, with almost three-quarters of Americans believing that CEOs are not paid the correct amount relative to the average worker, while only 16% believe that they are. This negative sentiment reflects the more general dissatisfaction with increasing income inequality in our societies (Shrivastava and Ivanova 2015) and the perceived negative consequences of the greedy and selfish behavior of business executives made possible by their managerial power (Wang and Murnighan 2011). The business community often defends the current levels of CEO compensation by stating that CEOs influence firm performance much more than other employees, implying that paying high wages to attract talented CEOs is an optimal firm strategy and a byproduct of the competitive market for managerial talent (Edmans et al. 2017). Therefore, ‘greed is inevitable’ continues to be the mantra of many corporate leaders.

Ultimately, the debate about CEO compensation revolves around the question of how CEO compensation affects other stakeholders. While a sizeable finance and economics literature has focused on the implications for shareholders, little is known about the implications for employees (Edmans et al. 2017). Conversely, the (human resource) management literature has a strong focus on employee attitudes, but the role of CEO compensation remains largely unexplored. Consequently, quantitative evidence on how CEO compensation affects employees’ job attitudes and behaviors is limited to a handful of studies on employee satisfaction and employee turnover from more than a decade ago in single countries. Welsh et al. (2012) found that the change in CEO compensation, but not the level of CEO compensation, was positively related to employee satisfaction and employees’ evaluation of senior management among employees of public U.S. companies in 2002–2003. While they did not investigate CEOs specifically, Godechot and Senik (2015) found contradicting cross-sectional evidence, as they observed workers’ wage satisfaction to decrease with the gap between their own salary and that of the firm’s top 1% wage earners among a representative sample of French employees surveyed in 2009. Dittmann et al. (2018) showed that the employee turnover probability decreased with higher CEO pay in German firms between 2000 and 2011, while Godechot and Senik (2015) found no relationship between employee turnover intention and the employee wage gap with the top 1% wage earners among French employees. In contrast, CEO overcompensation and larger CEO-manager pay disparities are associated with higher managerial turnover across management levels (excluding the CEO-level) in the United States (Bloom and Michel 2002; Wade et al. 2006). In sum, findings in the scant literature on the impact of CEO (over)compensation on employees’ job attitudes and turnover are mixed and inconclusive. More evidence on how executive compensation relates to employees’ job attitudes is warranted because an engaged workforce is for many companies of strategic importance to enhance firm performance through its positive influence on the recruitment, performance, and retention of employees (Harter et al. 2002).

The objective of this paper is to provide further insight into how CEO compensation influences employee engagement. Employee engagement has become a principal HR metric in the business world that refers to the cognitive, emotional, and behavioral energy an employee directs toward positive organizational outcomes (Shuck and Wollard 2010). It is a positive, psychological state of motivation that combines the positive affectivity and activation components of various constructs in the organizational psychology and management literature, including job satisfaction, organizational commitment, job involvement, and organisational citizenship behaviour (Macey and Schneider 2008; Shuck et al. 2013). Five common indicators of this broad multi-dimensional construct are the overall evaluation of the job or organization, intent to stay, organizational pride, advocacy, and (discretionary) effort.Footnote 1

This paper intends to expand the knowledge about both the consequences of CEO compensation and the antecedents of employee engagement in five main ways. First, we expand the literature by examining the relationship between CEO (over)compensation and employees’ job attitudes using more recent panel data with a broader geographical scope and a comprehensive HR metric that has received relatively little academic attention despite its widespread use in the business world. Second, we integrate the dispersed theoretical insights from the management, finance, and economics literature on this matter. Third, we examine the moderating role of negative media coverage about CEO compensation, which is motivated by and adds to the growing literature on the sizeable consequences of negative media coverage for firms. Fourth, our examination of the moderating role of the financial sector is motivated by and adds to the literature on CEO wage premia in this sector and its consequences. Fifth, the explored within-firm dynamics add to the broader discussion on the consequences of growing income inequality in societies and the specific role of CEOs in this regard. Practically, we hope our findings will contribute to a factual debate about the consequences of soaring CEO compensation and have relevant implications for corporate boards, shareholders, labor unions, and governments in the pay-setting process.

2 Theory and hypotheses

2.1 CEO compensation and employee engagement

Higher CEO compensation may decrease employee engagement through two main channels. We refer to the first channel as a tone-at-the-top effect. The tone at the top reflects the ethical practices and expression of values of the organization’s leadership—starting with the CEO (Amernic et al. 2010). Actual CEO pay levels far exceed people’s estimated CEO pay levels and what people consider a fair or ideal CEO pay (Larcker et al. 2016; Kiatpongsan and Norton 2014). People are stunned when learning about the actual CEO pay level through published reports, the media, or peers and typically consider it outrageous. Employees often attribute high CEO pay to the immoral (greedy) behavior of the specific CEO, the firm’s leadership, or corporate leaders more generally (Haynes et al. 2015). They attribute high CEO pay to greed at the top because of their general awareness that the firm’s leadership has much power in the pay-setting process. Employee’s perception of a greedy tone at the top can signal to them that the firm’s leadership enrich themselves to the detriment of employees, particularly when employees underestimate or are unaware of the responsibilities, workload, and required talents of CEOs (Benedetti and Chen 2018). In addition, employees may perceive an incongruence between their own moral beliefs and those of the firm’s leadership. It follows that the perception of a greedy tone at the top can reduce employee perceptions of value congruence, social exchange relationships, and identification with the leader or organization (Brown and Treviño 2006), while increasing perceptions of psychological contract violation (Morrison and Robinson 1997). In turn, this can trigger various negative attitudes and emotions towards the CEO and organization such as discontent, cynicism, and resentment as well as negative behaviors such as reduced effort (Andersson and Bateman 1997; Wade et al. 2006). This negative tone-at-the-top effect is softened by many employees being unaware about the actual compensation of CEOs (Larcker et al. 2016).

The tone at the top can also affect employee engagement through a more indirect mechanism: a trickle-down effect. Upper echelons theory posits that “organizations become reflections of their top managers” (Hambrick and Mason 1984, p. 193) as CEOs serve as role models that influence follower behaviors (Judge et al. 2009). Top managers who attribute high CEO incomes to the CEO’s greed may subsequently engage in greedy or other immoral acts themselves because the CEO’s behavior signals to them that greedy or immoral behavior is acceptable (Colquitt et al. 2001; Haynes et al. 2015). The trickle-down effect can cascade down to lower organizational levels and eventually create an organizational culture of greed and immoral behavior that contaminates lower-level managers and rank-and-file employees (Judge et al. 2009). Such vicious trickle-down effects can decrease employee engagement and firm performance in the long term (Ruiz et al. 2011; Guiso et al. 2015). An important implication of this mechanism is that even if an employee is unaware of the CEO compensation level, high CEO compensation may negatively affect employees through a trickle-down effect.

The second channel relates to relative income concerns and distributive justice. Higher CEO compensation is generally associated with a larger CEO-employee wage gap because it is not fully compensated for by higher employee wages (Ditmann et al. 2018; Wade et al. 2006). Employees evaluate their inputs and outcomes relative to those of others within an organization (Clark and Senik 2010), with the CEO serving as a salient referent (Wade et al. 2006). Inequity theory (Adams 1965) posits that such comparisons involve a condition of relative deprivation when distributive justice is not realized (employee’s perceived input/outcome ratio is larger compared to that of the CEO). In turn, relative deprivation triggers feelings of inequity that could eventually lead to disengagement such as reduced satisfaction and motivation (Clark and Oswald 1996; Colquitt et al. 2001; Card et al. 2012). Given that most people believe that the growing CEO-wage gap is excessive (Larcker et al. 2016), using the CEO as a referent can result in disutility through this relative deprivation process (Akerlof and Yellen 1990; Levine 1991).

On the other hand, high CEO compensation may increase employee engagement through three main channels. First, as suggested in the business world, employees may benefit from higher CEO compensation if such higher pay leads to attracting better CEOs and incentivizing CEOs to perform at higher levels, thereby improving firm performance. However, evidence on the impact of CEO pay on firm performance is inconclusive (Frydman and Jenter 2010; Jacquart and Armstrong 2013; Haynes et al. 2017) and there is little evidence that firm performance improves employee well-being (Krekel et al. 2019).

Second, high levels of CEO compensation can be part of a firm-wide system of large pay disparities between hierarchical levels. Tournament theory posits that greater pay disparity within firms can improve employee engagement and firm performance because it incentivizes employees to exert effort to climb the ranks (Lazear and Rosen 1981). Moreover, high pay disparities can be a signal function for good career or wage prospects (Cullen and Perez-Truglia 2018). There is indeed evidence that within-firm pay inequality can improve firm performance (Faleye et al. 2013; Mueller et al. 2017). There is also evidence that employee motivation and wage satisfaction increase with the wages of higher-ranked employees within the same firm (Cullen and Perez-Truglia 2018; Godechot and Senik 2015). However, Godechot and Senik (2015) found a ceiling effect in that wage satisfaction decreases with the gap between employees’ own salaries and those of the firm’s top 1% wage earners, particularly for employees who know the wages of their top managers. One explanation is that CEO-related tournament effects do not directly incentivize most employees because they do not consider the CEO position as a realistic goal, but possibly only indirectly through trickle-down processes and as part of a firm-wide system of pay disparities.

Third, increases in CEO pay or the disclosure of CEO pay are followed by rising employee wages (Wade et al. 2006; Dittmann et al. 2018), and other managers receive higher wages when CEOs are overpaid based on market standards (Bloom and Michel 2002; Wade et al. 2006). Even if the compensatory pay raise is not proportional to that of the CEO, the absolute progress can foster employee engagement.

The opposing considerations discussed above lead to the following two competing hypotheses:

H1a

CEO compensation is negatively related to employee engagement.

H1b

CEO compensation is positively related to employee engagement.

2.2 CEO overcompensation and employee engagement

CEO overcompensation refers here to CEO compensation that exceeds objectively defined market standards (Vergne et al. 2018), which can differ from employee perceptions of CEO overcompensation.Footnote 2 We additionally consider the role of CEO overcompensation for two main reasons. First, the impact of overcompensation on employee engagement can go beyond the impact of the absolute compensation level. The tone-at-the-top effect can be expected to be more negative for relatively overpaid CEOs because they receive more attention (e.g., through media controversies), and the criticism may be more directed at the CEO’s own greedy behavior rather than the ‘broken’ system (market standards). Following a similar reasoning, the trickle-down effect may be stronger for more overpaid CEOs because employees will attribute the high compensation level more to the CEO’s greedy behavior than to market standards. Second, compared with the absolute compensation level, overcompensation better reflects employee perceptions of CEO compensation for those who rather accurately take into account market standards and the firm situation. By contrast, overcompensation reflects employee perceptions of CEO compensation less well for those not (accurately) taking into account market standards and the firm situation.Footnote 3

As suggested in the business world, overcompensating CEOs can also benefit employee engagement if it leads to better business results. Indeed, employee wages have been seen to particularly increase with increasing compensation of overcompensated CEOs (Dittman et al. 2018) and there is some evidence that CEO overcompensation has a weak positive effect on corporate reputation (Schulz and Flickinger 2020). Yet, there is mixed evidence of whether the overpayment of CEOs leads to better company performance (Brick et al. 2006; Fong et al. 2010; Haynes et al. 2017). Again, the discussion above features opposing considerations and warrants the following two competing hypotheses:

H2a

CEO overcompensation is negatively related to employee engagement.

H2b

CEO overcompensation is positively related to employee engagement.

2.3 Compensation controversies and employee engagement

Media coverage is an important information intermediary through which employees and the general public become aware of a firm’s actions and it can shape how they perceive those (Graf-Vlachy et al. 2020). The extraordinary compensation of CEOs receives much attention in the popular and business press (Core et al. 2008; Kuhnen and Niessen 2012), especially when it relates to extraordinary events such as shareholder revolts against compensation policies, pay raises in times of layoffs or corporate scandals, or abnormal compensation such as extraordinary termination payments. Compensation-related negative media coverage simultaneously raises employees’ awareness and negatively shapes their perceptions about the typically higher-than-expected CEO compensation. The greater awareness and more negative perceptions both reinforce tone-at-the-top effects, such as beliefs that the firm’s leadership enrich themselves to the detriment of employees. In addition, the increased awareness about CEO compensation can trigger upward income comparisons that cause inequity concerns and ultimately lower the subjective well-being of employees (Perez-Truglia 2020; Dittman et al. 2018). CEO compensation controversies can also affect employees through other mechanisms, such as weakened corporate reputation and performance (Graf-Vlachy et al. 2020). Therefore, the following hypothesis is suggested:

H3

Negative media coverage of CEO compensation is negatively related to employee engagement.

2.4 The moderating role of the financial sector

The relationship between CEO compensation and employee engagement may be context dependent. One contextual factor that stands out is the financial sector. Top executives in the financial sector earn a large wage premium (Philippon and Reshef 2012). In the European Union, for instance, financial sector workers make up 26% of the top 0.1% income earners in Europe, although the overall employment share of finance is only 4% (Denk 2015). In addition, the growth in executive compensation in the financial sector has far exceeded the growth in other sectors in the past decades. Bell and Van Reenen (2014) estimated, for instance, that rising bankers’ bonuses accounted for 70% of the increase in the earnings share of the top 1% in the UK between 1999 and 2011, even though they accounted for only one‐third of the top percentile of workers. Similar patterns have been shown for France (Godechot 2012) and the United States (Bakija et al. 2012; Kaplan and Rauh 2010). While financial sector employees are partly compensated for these executive wage premiums by receiving wage premiums themselves, this wage premium is more than twice as high for financial sector workers at the top of the distribution than at the bottom (Denk 2015; Philippon and Reshef 2012). Even if this income growth in the financial sector can be to some extent rationalized by increasing scale, technological change, and a competitive labor market (Gabaix and Landier 2008; Kaplan and Rauh 2010), the public uproar about CEO compensation has focused on the financial sector during the past decade as illustrated by the Occupy Wall Street demonstrations in 2011 (Shrivastava and Ivanova 2015). Accordingly, since the burst of the subprime bubble, the financial sector has been under significant media scrutiny (Roulet 2019).

These peculiarities of the financial sector can cause a more negative relationship between CEO (over)compensation and employee engagement in this sector for several reasons. First, higher levels in CEO compensation, and by extension larger CEO-employee wage gaps, may shift the balance more towards the disadvantages of high CEO (over)compensation. For instance, the CEO-employee pay ratio has reached the turning point in many financial sector firms at which tournament effects do not further increase firm performance (Crawford et al. 2014). By contrast, distributive injustice perceptions and greedy tone-at-the-top effects may become stronger with higher CEO (over)compensation. Second, the greater media scrutiny may have made employees in the financial sector more aware of CEO compensation, and combined with the stronger disadvantages, it can lead to a greater reduction in employee engagement. This effect can be reinforced by the concentration of highly publicized executive compensation controversies in the financial sector. Third, the greedy public reputation of the financial sector that was reinforced by the global financial crisis could make employees more sensitive to high CEO (over)compensation. A final reason for a more negative association relates to a selection effect. Individuals that are more strongly motivated by money are more prone to enter the finance industry (Deter and van Hoorn 2021). This suggests that they may be more sensitive to CEO (over)compensation and pay fairness.Footnote 4 Therefore, the following hypothesis is suggested:

H4

The relationship between CEO (over)compensation and employee engagement is more negative in the financial sector compared to other sectors.

3 Method

3.1 Sample construction

Our initial sample consists of the approximately 10,000 global firms in the full universe list of the Refinitiv (formerly Thomson Reuters and ASSET4) environmental, social, and governance (ESG) database in Eikon. This list includes public firms listed in various major indexes such as the S&P 500, FTSE 350, CAC 40, DAX, SMI, RUSSELL 3000, and the MSCI World Indexes. We use the Refinitiv ESG database because it is a leading ESG database in academic research (Berg et al. 2021) that provides the best available employee engagement data across firms.Footnote 5 The initial sample includes all available firm-year observations on employee engagement. Our main estimations will be based on within-firm analyses with a lagged dependent variable. Therefore, firm-year observations were included in the final sample when the following firm data were available for at least two firm-years: a valid employee engagement score in the current year (time t) and the previous year (t − 1), CEO compensation data in t − 1, and all control variables in t − 1.Footnote 6 It results in an unbalanced analysis sample comprising 1686 firm-year observations from 336 firms (374 firm series) covering a wide range of industries in 26 countries for the period 2006–2020.Footnote 7 The final sample is a fraction of the initial sample because valid and useful employee engagement data are available for 5.3% of the firms in the database. Moreover, CEO total compensation was not available for all firms in all years, with missing data being primarily from firms in non-Western countries without mandatory disclosure requirements. Online appendix A presents a detailed breakdown of how we arrived at our analysis sample.

3.2 Measures

3.2.1 Dependent variable

Many firms measure employee engagement through employee surveys, which are often administered and analyzed by external survey providers. A firm’s employee engagement score is usually reported in annual reports, sustainability reports, or corporate responsibility reports as a percentage value that is calculated as the composite score of a multi-item scale. Refinitiv extracts engagement scores from these public reports and lists them in its database if the score represents all employees who were surveyed.Footnote 8 We identified the utilized engagement measure for 83% of the firm-years in our analysis sample and observed five common facets. In our analysis sample, 77% of the indexes included an indicator of advocacy (e.g., “I would recommend this company as a great place to work”), 75% the intent to stay (e.g., “I rarely think about looking for a new job with another company”), 75% (discretionary) effort (e.g., “I am willing to go the extra mile to help the organization succeed”), 73% organizational pride (e.g., “I am proud to work for this company”), 53% an overall evaluation of the job or organization (e.g., “Taking everything into account, I would say this is a great place to work”), and 36% included another facet such as a having meaningful work or alignment with the firm’s vision and values. The answering scales are typically five-point agreement scales (1 = strongly disagree; 5 = strongly agree). Those scoring above the scale mid-point (“agree” or “strongly agree”) are typically considered engaged. Accordingly, employee engagement is operationalized as the company-reported annual percentage of employee engagement. In rare cases where a scale mean was available rather than a percentage value, Refinitiv recalculated the indicated score to a percentage score by dividing the actual score by the maximum possible score. Appendix C provides an overview of the facets covered by the most prominent survey providers. While the facets tend to have high internal consistency (Newman et al. 2010; Hewitt 2015; IBM 2014), a robustness check will be conducted to test whether the results differ between the different facets. Moreover, the heterogeneity in the exact measure of survey providers and thus firms motivates our modeling approach to focus on within-firm variation.

3.2.2 Explanatory variables

3.2.2.1 CEO compensation

CEO pay data came from Compustat’s Execucomp database for U.S. firms, Institutional Shareholder Services (ISS) for European firms, and Compustat’s People Intelligence (PI) database and Bloomberg for other firms. We hand-collected missing CEO pay data from annual reports, and we double-checked all data from ISS, PI, and Bloomberg to correct inaccuracies. CEO compensation reflects a CEO’s publicly reported total compensation. Publicly reported compensation data are used because these compensation data are also typically reported in the media and known to employees. While reporting guidelines differ by country, the reported total compensation generally consists of the sum of the salary, annual bonus, stock awards, stock option awards, non‐equity incentive plan compensation, pensions and non‐qualified deferred compensation earnings, as well as other compensation such as perquisites and severance payments.

3.2.2.2 CEO overcompensation

CEO overcompensation—the portion of the CEO’s logged total pay that exceeds what can be explained by known predictors of executive compensation—was constructed as a measure of overcompensation-based residuals from a CEO pay regression. One widely used approach is to determine CEO overcompensation based on within-company fluctuations in CEO compensation using a firm-fixed effects model (e.g., Wade et al. 2006; Haynes et al. 2017). We followed this approach by regressing logged total compensation on a set of CEO variables (age, firm-specific CEO tenure, and CEO/chairman duality), a set of firm variables in years t and t − 1 (firm size (ln), sales growth, return on assets, ln ESG controversies (ln), and firm risk), and year dummies using a firm-fixed effects regression model.Footnote 9 In this model, a positive residual means that the actual change in compensation in response to changes in the independent variables within the firm was larger than predicted. CEO overcompensation is equal to the residual if the residual was positive—reflecting the unexplained portion of executive compensation—and 0 otherwise. An alternative established approach is to compare the CEO’s compensation to the compensation of CEOs of comparable firms (e.g., Core et al. 2008; Vergne et al. 2018; Schulz and Flickinger 2020). This approach allows for identifying companies where CEOs are systematically overcompensated at the cost of higher omitted variable bias. We also present the results obtained using this alternative approach. Specifically, we calculated this alternative overcompensation variable by regressing logged total compensation on industry dummies (two-digit SIC codes), country dummies, and the same set of explanatory variables as for within-firm overcompensation. Again, positive residuals reflect CEO overcompensation.

3.2.2.3 CEO compensation controversies

Our third main explanatory variable is the number of controversies related to CEO compensation reported in the global media. Data on executive compensation controversies come from the Refinitiv ESG database. Refinitiv determines the occurrence of controversies based on source data from publicly available top editorial sources such as Reuters, the Associated Press, and the Financial Times. In some cases, multiple different compensation controversies occurred in one firm-year. The analysis sample includes 69 compensation controversies from 32 firms, of which 25 are related to total pay, 23 to variable compensation (annual bonus or long-term performance incentives), 10 to termination payments, 4 to future pay schemes, and 7 to other causes (e.g., pension payments and the CEO-employee pay ratio).Footnote 10 Shareholder revolts or firm scandals frequently precede media controversy. Examples of CEO compensation controversies in our dataset are the 2017 shareholder revolt at AstraZeneca over the CEOs excessive long-term incentive plan payment and an excessive bonus payment in 2014 to the CEO of Lloyds Banking Group.

3.2.3 Moderator

The finance industry is defined as banks, credit institutions, and financial brokers/dealers (SIC codes 6000–6299; see e.g., Kaplan and Rauh 2010). As a robustness check, we will additionally include insurance firms given that those are sometimes included in broader definitions of the finance industry, while noting that insurance firms have not seen the same kind of (growing) CEO wage premia as banks and credit institutions.

3.2.4 Controls

To avoid model misspecification, we control for six firm characteristics that have a theoretical or empirically proven relationship with both employee engagement and CEO compensation that can be attributed to reasons others than being part of the causal pathway.

3.2.4.1 Firm performance

Firm performance is a standard predictor of CEO compensation (e.g., Schulz and Flickinger 2020; Wade et al. 2006; Haynes et al. 2017) that may increase employee engagement (Harter et al. 2010). We measured firm performance using two complementary indicators: return on assets (ROA) and the percentage of sales growth.

3.2.4.2 Firm size

The natural logarithm of firm size is another standard predictor of CEO compensation (e.g., Schulz and Flickinger 2020; Wade et al. 2006) that can negatively relate to employee perceptions (Tansel and Gazîoğlu 2014). Following Haynes et al. (2017), firm size is composed of three standardized and equally weighted variables: number of employees, total annual sales, and total firm assets.

3.2.4.3 ESG controversies

Corporate wrongdoing is positively associated with managerial greed (Haynes et al. 2015) while being confronted with corporate wrongdoing is negatively associated with employee engagement (Gond et al. 2017). We use a firm’s exposure to ESG controversies in global media to assess (media attention for) corporate wrongdoing. This control variable is particularly important for testing the hypothesis on CEO compensation controversies as it tackles a possible bias arising from some firms receiving more media attention than others. The ESG controversies index from Refinitiv covers 22 controversy topics after excluding CEO compensation controversies. It is based on the same sourcing strategy as the CEO compensation controversies variable and calculated as the natural logarithm of the total number of media-reported controversies within a firm-year. Examples are controversies related to shareholder rights and employee wages or working conditions (see appendix D for the full item list).

3.2.4.4 HR policies & practices

Better working conditions are positively associated with employee engagement while also being associated with CEO compensation (Dittmann et al. 2018). We controlled for working conditions using the 29-item HR policies and practices index from the Refinitiv ESG database. It is measured as the relative score of the firm compared to other firms in the same industry on a scale from 0 to 100 and covers four dimensions: training and development, health and safety, diversity and opportunity, and general employment quality. Example items are average training hours, having a health and safety team, diversity targets, and flexible working schedules (see appendix D for the full item list).

3.2.4.5 Governance quality

Governance quality tends to be negatively associated with CEO compensation (Gabaix and Landier 2008) while it may be positively associated with employee engagement through its positive effects on firm processes/outcomes. Therefore, we included a 32-item governance quality index from the Refinitiv ESG database as a control variable. It is measured as the relative score of the firm compared to other firms in the same industry on a scale from 0 to 100 and covers three dimensions: board functions, board structure, and compensation policy. Example items are the percentage of independent board members, requirement of shareholder approval, and board size (see appendix D for the full item list).

3.2.4.6 Survey experience

Survey experience refers to the number of times a firm has publicly reported the results of an employee engagement survey prior to time t based on the database used for our dependent variable. Survey experience captures the upward trends in CEO compensation and employee engagement, which are not fully captured by year dummies in our unbalanced sample.

Other control variables used in calculating CEO overcompensation (firm risk and CEO characteristics) are excluded from our main analysis because they have no clear link with employee engagement.Footnote 11

3.3 Estimation strategy

A firm-specific model is estimated as follows:

where \(EE_{it}\) represents employee engagement in firm i in fiscal year t; \(EE_{{i\left( {t - 1} \right)}}\) is a lagged dependent variable; \( COMP_{{i\left( {t - 1} \right)}}\) is the natural logarithm of a CEO’s total compensation in firm i in fiscal year t − 1; \(X_{{i\left( {t - 1} \right)}}\) is the vector of control variables capturing firm characteristics at time t − 1; and \(\mu_{t}\) is a vector of year dummies included to capture common shocks such as market fluctuations. The main parameter of interest is \(\alpha_{2}\), which gives the relationship between employee engagement and CEO compensation. Total CEO compensation in year t − 1 will be replaced by the two alternative measures of CEO overcompensation in year t − 1 to test hypothesis 2 and by compensation controversies in year t to test hypothesis 3. Note that the total compensation of year t − 1 is publicly reported approximately three months after the fiscal year-end of year t − 1. CEO compensation controversies feature in the media upon publication of the annual report/filings or immediately after the annual shareholder meeting. For that reason, controversies about CEO compensation in year t − 1 occur in year t. Relating compensation controversies in year t to employee engagement in year t does not lead to major causality concerns because employee engagement is typically reported based on the period since the last annual report, not the fiscal year, meaning that the publicly reported compensation and compensation controversies preceded the employee engagement surveys.Footnote 12 We use a fixed-effect estimator to control for any unobserved firm-level and industry-level factors that are constant through time and to control for between-firm differences in the measurement of employee engagement. The lagged dependent variable \(EE_{{i\left( {t - 1} \right)}}\) is included to allow for adjustment dynamics, account for serial correlation, and decrease the likelihood of omitted variable bias in that it (partly) captures unobserved time-varying job characteristics that are associated with employee engagement (Wooldridge 2002).

While we tried to minimize endogeneity bias by using a fixed-effect estimator, a lagged dependent variable, and by controlling for as many relevant firm variables as we could obtain data for, we would ideally have liked to control for a richer array of microlevel factors, but high-frequency firm data related to employees are unfortunately not widely available. In addition, the presence of a lagged endogenous variable creates a potential upward endogeneity bias when estimating equations using ordinary least squares due to a correlation between the time invariant unobserved fixed effects and the explanatory variables. By contrast, fixed effects estimates tend to be biased downwards because of the so-called Nickell bias (Nickell 1981; Kiviet 1995), which is a nonnegligible correlation between the transformed residuals and the transformed error term. The Nickell bias is particularly pertinent when the time dimension of the panel is short and the number of cross-sectional units is large, which is the case in our sample with an average of approximately four observations per firm-series.

To address these two issues, we used the two-step system generalized method of moments (GMM) estimator developed by Arellano and Bover (1995) and Blundell and Bond (1998) by using the xtabond2 package in Stata (Roodman 2009a).Footnote 13 In the absence of credible external instruments to instrument CEO compensation, GMM addresses the issue of reverse causality by using the lagged levels and lagged first differences of the variables as internally generated instruments. In addition, GMM models use a first-difference estimation to address possible correlations between the time-invariant individual characteristics in the fixed-effects estimation and the other independent variables. We utilized an orthogonal-deviations transform (Arellano and Bond 1991) and Windmeijer (2005) finite sample correction for standard errors. System GMM estimations are sensitive to specification decisions, particularly to the number of instruments (Roodman 2009b). To avoid overfitting endogenous variables, we used a limited number of lags (maximum 4 years) and minimized the number of instruments in our estimations by collapsing the instrument count. In addition, we tested the sensitivity of our findings to alternative specifications.

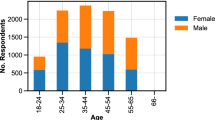

3.4 Sample descriptives

Summary statistics are reported in Table 1. The analysis sample overrepresents large firms, firms with good HR policies & practices, European firms, and firms in finance and infrastructure as compared with publicly listed firms in major stock market indexes. A correlation matrix of the study variables is provided in Table 2. The study variables generally relate to employee engagement in the expected directions. The correlation between compensation controversies and actual (over)compensation is modest because the controversies are often about specific pay components, future pay schemes, and bonuses, which are frequently waived under pressure to avoid, for instance, shareholder revolt.

4 Results

4.1 Main results

Table 3 shows the results of the system GMM regressions on how employee engagement relates to compensation (H1; Column 1), overcompensation (H2; Columns 2–3), and compensation controversies (H3; Column 4). System GMM assumes that the internally generated instruments are exogenous (tested with the Hansen J statistic) and that the error term is not serially correlated (tested with the AR(2) test). In addition, there should be no correlation between the unobserved individual fixed effects and the instruments, which can be tested with the difference-in-Hansen test. The test statistics, provided in Table 3, show that these conditions were met in our estimations.

As shown in Table 3, changes in employee engagement are not significantly related to changes in CEO compensation (Column 1) and CEO overcompensation (Columns 2–3). This finding suggests either that the advantages and disadvantages of higher CEO (over)compensation generally balance each other out or that these are not strong enough to significantly influence employee engagement. One noteworthy observation is the sign reversal of overcompensation compared with the actual compensation level, but a between-model comparison of coefficients shows that these coefficients do not significantly differ at conventional significance levels.

Turning to compensation controversies (Column 4), we find a negative and significant association between compensation controversies and employee engagement that holds when controlling for (over)compensation. This finding suggests that compensation controversies have a negative association with employee engagement on and above the impact of the level of (over)compensation. Specifically, we estimate that if a firm experiences an additional media controversy related to CEO compensation, the employee engagement score declines on average with 0.90 percentage points within the year after the controversy takes place, ceteris paribus. As a robustness check, we re-estimated the full model without the four controversies that relate to future pay schemes rather than received compensation. The negative impact of compensation controversies also holds for this alternative specification at the 95% confidence level.

Turning to the financial sector, our sample shows a consistent picture with the financial sector wage premium and overrepresentation in compensation controversies documented in the literature. In our sample, compensation levels are higher in the financial sector than in other sectors (diff = $1.04 million; p < 0.01). Estimations using the Gabaix and Landier (2008) methodology show that financial sector CEOs earn a wage premium (diff = $1.06 million; p < 0.01; see appendix F for details). In the financial sector, 21% of the firms (8% of firm-years) experienced at least one compensation controversy in the period in which they were surveyed. In the other sectors, only 7% of other firms experienced at least one compensation controversy (3% of firm-years).

Consistent with hypothesis 4, the interaction effects in Table 4 show that higher (over)compensation is more negatively associated with employee engagement in the financial sector compared to other industries. The negative main effects show that in the financial sector all three compensation measures relate negatively to employee engagement. For instance, the negative main effect in Column 1 shows that if a CEO’s compensation level increases by 1%, the employee engagement score declines by 0.0138 percentage points in the following year. We did not find statistically significant main effects of CEO (over)compensation in non-financial industries. To assess the extent to which the disproportionally large number of compensation controversies in the financial sector drives the more negative effects in this sector, we re-estimated the models of Table 4 with compensation controversies as an additional control variable. The negative effects become smaller when blocking this “controversies” channel, e.g., from − 1.38 to − 0.95 for CEO compensation (Column 1), but all negative effects remain significant at the 90% confidence level. Hence, the comparatively many CEO compensation controversies in the financial sector partially explains the more negative impact of higher CEO compensation in this sector.

4.2 Sensitivity Analyses

In a first series of sensitivity tests, we examined two alternative specifications of Table 4. One possible concern is that employee engagement relates differently to ROA and firm size in the financial sector because of higher firm assets in this sector, and consequently biases the relationships of interest. We address this concern by re-estimating model 4 with additional interactions between the industry dummy and both ROA and firm size to allow for industry-specific effects of ROA and firm size. The added interactions reduce the coefficient sizes, but do not challenge the main findings (see Appendix H). In a second alternative specification, we re-estimated Table 4 with a broader definition of the financial sector that additionally includes insurance firms (SIC codes 6300–6499). Given the smaller level and growth of CEO way premia among insurance firms, it is not surprising that the coefficients tend to be slightly smaller in this alternative specification. Yet, the associations of interest remain statistically significant (see Appendix I).

In a second series of sensitivity tests reported in Appendix J, we re-estimated Tables 3 and 4 using three alternative estimation methods: a fixed effects estimation excluding (Column 1) or including a lagged dependent variable (Column 2) and the system GMM estimator using a further reduced number of instruments (Column 3) (Roodman 2009a, b).Footnote 14 Appendix J additionally reports the results of three alternative specifications. In Column 4, the “ESG controversies” control variable is excluded because it may partially block a relevant channel through which high CEO compensation can reduce employee engagement, namely that high CEO (over)compensation can set in motion a trickle-down process that leads to a more vicious (greedy) company culture that affects employee engagement at all organizational levels (see Sect. 2.1). Column 5 reports a model including time t controls in addition to t − 1 controls for all firm controls.Footnote 15 Column 6 reports a reduced-sample model additionally controlling for the percentage of female employees to capture changes in the firm’s gender composition.Footnote 16 Several findings stand out. First, in none of the sensitivity analyses is (over)compensation significantly associated with employee engagement, which is consistent with our main models. Second, we generally find robust evidence that (over)compensation relates negatively to employee engagement in the financial sector and that this relationship is more negative than in other sectors. Third, compensation controversies remain significantly negatively correlated with employee engagement at the 90% confidence level regardless of the estimation method and specification. Fourth, the fixed effects and system GMM estimates give rather similar results, suggesting that the magnitude of the Nickell bias is relatively limited.

As a third sensitivity test, we tested how employee engagement relates to undercompensation and over/undercompensation combined. For both types of measures, we observed no statistically significant relationship with employee engagement (Appendix K). In the financial sector, undercompensation was also unrelated to employee engagement and this relationship did not differ from other sectors, suggesting an asymmetrical effect of over/undercompensation in the financial sector. Nonetheless, the combined over/undercompensation measure has a negative relationship with employee engagement.

A fourth series of sensitivity tests aims to explore the external validity of our main findings. This robustness check is particularly relevant because the analysis sample is not representative of public firms in major stock indexes and because the reported average effects may obscure differences across different kinds of firms extending beyond the sector in which the firm is operating. Appendix L shows that our main findings are not strongly contingent on firm characteristics, which suggests that, by and large, they hold in a wide variety of public firms. We do not observe contingent effects of firm size, HR policies and practices, and geographical location.Footnote 17 Yet, within-firm overcompensation relates more negatively to employee engagement in firms with higher compensation levels, worse performance, and worse governance quality. These findings are consistent with notions that negative effects increasingly outbalance positive effects at higher (over)compensation levels, good performance buffers negative overcompensation effects, and that well-governed firms overcompensate CEOs for better reasons. However, the evidence is weak because these findings do not hold for between-firm overcompensation and absolute compensation levels. Moreover, the relationships have not consistently changed over time, with the exception being that we find weak evidence that within-firm overcompensation related less negatively to employee engagement in recent years, which may be explained by the possibility that the global financial crisis triggered more negative perceptions of CEO overcompensation.

In a final sensitivity test, we explored whether the results are contingent on specific facets of employee engagement. We observed no significant differences between engagement facets, and the results also did not differ for the 17% of observations for which the exact engagement measure could not be derived (see Appendix M).

5 Discussion and conclusion

Three main findings emerge from our cross-national panel study. First, employee engagement is generally unaffected by the (over)compensation of CEOs in public firms. Second, employee engagement declines with negative media coverage about CEO compensation. Third, an important context in which higher CEO (over)compensation does negatively affect employee engagement is the financial sector.

Our study contributes to the literature and provides valuable insight into the recent debate on the soaring compensation of CEOs and its effects in the following ways. First, the generally observed null relationship suggests that the discussed positive channels (tone-at-the-top effects, trickle-down effects, and distributive justice concerns) and negative channels (motivating and attracting CEOs, tournament effects, and higher employee wages) through which CEO compensation affects employee engagement either balance each other out or have negligible effects. The null relationship sheds light on why soaring CEO compensation has not led to large-scale worker revolts and why most CEOs can get away with disproportionate pay growth (Larcker et al. 2016). This null relationship takes an intermediate position between the finding of Welsh et al. (2012) that changes in CEO compensation are positively related to employee satisfaction in the United States and the finding of Godechot and Senik (2015) that workers’ wage satisfaction decreases with the gap between their own salary and those of the firm’s top 1% wage earners in France. Given that we do not find consistent evidence that the relationship has changed over time or that it differs between Anglo-Saxon and non-Anglo-Saxon countries, methodological differences may be a core driver of these diverging results, with our dynamic panel analyses being less susceptible to endogeneity issues.

Second, the engagement-reducing effect of media controversies adds to the growing literature documenting the significant impact of media coverage about top executives on firm processes and outcomes and underscores that firms at risk of negative media coverage must consider the potential effects on employees in the pay-setting process (Graf-Vlachy et al. 2020). Moreover, it signals the importance of convincingly justifying CEO pay to avoid controversy (Benedetti and Chen 2018).

Third, while the disproportionate level and growth of CEO compensation and the concentration of public uproar and publicized controversies in the financial sector are well-documented in the financial sector literature (Philippon and Reshef 2012; Roulet 2019), the findings of this study demonstrate that these sector peculiarities can harm employees. We found supporting evidence that the more negative effect of CEO (over)compensation in the financial sector was partially driven by the concentration of media-reported compensation controversies in this sector. Another reason may be that further growth in CEO (over)compensation has marginally decreasing advantages (e.g., tournament effects) but not marginally decreasing disadvantages (distributive injustice perceptions and greedy tone-at-the-top effects).

Fourth, our findings have implications for the employee engagement literature. This literature tends to focus on the role of work characteristics as antecedents of employees’ job attitudes, probably because this is under direct influence of HR professionals (Purcell 2014). Unfortunately, the role of top management has remained largely unexplored. The findings of this study underscore the notion of upper echelons theory that the top management team is a relevant antecedent of employees’ job attitudes that warrants more attention (see, e.g., Ruiz et al. 2011).

Our findings have implications for parties who can directly or indirectly influence the pay-setting process, including corporate boards, shareholders, pay consultants, labor unions, and governments through regulations. A ceiling effect seems to exist after which higher CEO compensation starts to reduce employee engagement given that more negative effects emerge in a sector with extraordinary CEO (over)compensation and in single firms where controversial CEO compensation practices cause negative media coverage. This suggests that negative effects on employee engagement are a particularly relevant concern in determining CEO pay packages for firms in the financial sector and for firms at risk of negative media exposure. There may be a ceiling effect rather than a gradual effect of increasing compensation because we do not consistently find that CEO (over)compensation relates more negatively to employee engagement in higher-paying firms. A likely explanation is that CEO overcompensation remains largely under the radar in most firms, while tone-at-the-top effects and inequity concerns become prominent when negative publicity makes employees aware of excessive CEO compensation. This raises the question of whether the negative relationship in the financial sector could extend to other sectors in the future if CEO compensation keeps soaring.

Our empirical results do not suggest that the association between CEO compensation and employee engagement consistently changed during the 2006–2020 period, suggesting that the association has not been strongly affected by the global financial crisis of 2007/08 becoming part of the more distant past. However, we speculate that the future relationship may negatively deviate from this past relationship because of growing concerns that the social contract between richer and poorer individuals in a free market system, and by extension within firms, is no longer functioning well for those not at the top of the hierarchy (Piketty 2014).

Turning to government regulation, our findings suggest no urgent need to address the growing pay gap between CEOs and employees, although the ceiling effect reached by the financial sector and firms facing media controversies over excessive compensation suggest that more regulation may become beneficial for employees if CEO compensation keeps soaring. More generally, the revealed within-firm dynamics contribute to a better understanding of the relationship between top incomes and societal wellbeing (Powdthavee et al. 2017; Brzezinski 2019). Societal well-being can be decreased by negative effects of CEO compensation on employees in the financial sector and firms that receive negative media coverage. We caution, however, that the impact of CEO compensation on society as-a-whole may not be simply the sum of its effects on employees within individual companies.

Our study has limitations that provide directions for future research. We could not examine the roles of CEO pay ratios compared to the median employee or other firm executives, although these ratios could potentially be unique predictors of employee engagement. In addition, while this study focused on objective levels of CEO (over)compensation, future research could take a complementary approach by exploring how employee engagement relates to subjective levels or employee perceptions of CEO (over)compensation. Relatedly, our lack of subjective data did not permit the study of the discussed mediating channels, which leaves an interesting avenue for future research to better understand the processes through which CEO compensation affects employees and how employees determine what is a fair and reasonable CEO pay. One endogeneity concern is that we were not able to control for all possible variables that might influence our main variables of interest such as changes in the composition of the firm’s workforce. We addressed this issue to the extent possible by using dynamic panel models. Still, it would be interesting to see whether our findings can be replicated by experimental or small-scale longitudinal research that can control for additional microlevel factors. In addition, our results should be interpreted as conservative estimates because not having a uniform employee engagement measure across firms could upwardly bias the standard errors. Finally, while our findings were not strongly contingent on firm characteristics, it is noteworthy that our analysis sample was not representative for public firms in major stock indexes.

Availability of data and material

The data used are proprietary. Data on CEO compensation and CEO characteristics can be obtained from Compustat and Bloomberg, while data on employee engagement and firm characteristics can be obtained from the Refinitiv database in Eikon.

Code availability

The full syntax code is attached.

Notes

Employee engagement is a broader concept than work engagement (Purcell 2014). While work engagement receives more attention in the psychology discipline, employee engagement receives more attention from practitioners.

Just like the CEO-employee wage ratio, employee perceptions of CEO overcompensation cannot be explored due to data limitations. Compared with objective CEO overcompensation, employee perceptions are based on additional criteria such as their general convictions about wage inequality and CEO pay. Moreover, employees do not always have accurate knowledge of market standards and the firm situation or do not take all relevant criteria into account.

Both compensation and objective overcompensation are valuable (even if imperfect) predictors of the tone-of-the-top effect and distributive justice effect under the reasonable assumption that higher CEO (over)compensation generally diverges more from employee wages (Ditmann et al. 2018; Wade et al. 2006) and employee beliefs of a fair CEO pay (for indirect evidence, see Godechot and Senik 2015).

Another noteworthy consideration is that the financial sector has additional disclosure requirements and renumeration rules in some countries, such as the remuneration codes of the Financial Conduct Authority in the UK. The greater transparency may positively or negatively influence the relationship between CEO compensation and employee engagement depending on the specific regulations. For instance, disclosure requirements related to CEO compensation may negatively impact the relationship, but other disclosure requirements may have the opposite effect because it may draw attention away from CEO compensation.

Employee engagement is since 2017 used as an indicator of the “workforce” score in the social pillar of the Refinitiv ESG rating and is as such widely used in current academic research. It has been rarely used as a stand-alone measure because it was not part of the original ASSET4 items and most data points have become available only in the past few years (for an exception, see Ben-Nasr and Ghouma 2018).

For ease of interpretation, we refer to the top executive of a firm as the CEO while acknowledging that the top executive is sometimes referred to differently in some firms.

A firm can have multiple firm series when the engagement measure changes over time.

The specific item codes of employee engagement and all other study variables are available in Appendix B.

Firm risk is based on stock price volatility, i.e., the variance of the firm’s daily stock price over the fiscal year. Variable definitions of the other firm characteristics are reported in Sect. 3.2.4.

One controversy was excluded because it related to other executives than the CEO.

We empirically verified that those variables were no significant predictors of employee engagement in our models.

The survey date was reported by a minority of firms in our sample. We verified for compensation controversies that none of the available survey dates (29 out of 69 controversies) preceded the dates on which the CEO’s compensation was publicly reported.

We used a system GMM estimator rather than a difference GMM estimator because it gives less biased and more efficient estimates when the autoregressive parameter is moderately high and the number of time-series observations is moderately small, as is the case in our analysis (Blundell and Bond 1998).

We also re-estimated our results for a reduced sample using an additional lag for CEO compensation, overcompensation, compensation controversies and the interaction effects (t − 2). None of the additional lags were significantly associated with employee engagement, indicating that there is no delayed effect of past CEO (over)compensation and negative media exposure.

Ideally, we would have liked to additionally control for changes in other employee characteristics, such as changes in the firm’s age and location composition. However, these data are not sufficiently available.

Although corporate governance practices differ between geographical areas beyond an Anglo-Saxon vs. Rhineland model distinction, we also found no significant relationships between CEO (over)compensation and employee engagement in any of the five geographical regions distinguished in table 1. We also explored whether our main results differed by sector or by compensation component (salary, annual bonus, LTIP, or other compensation); no significant interaction effects were observed.

References

Adams JS (1965) Inequity in social exchange. In: Berkowitz L (ed) Advances in experimental social psychology. Academic Press, pp 267–299

Akerlof GA, Yellen JL (1990) The fair wage-effort hypothesis and unemployment. Q J Econ 105(2):255–283

Amernic J, Craig R, Tourish D (2010) Measuring and assessing tone at the top using annual report CEO letters. The Institute of Chartered Accountants of Scotland, Edinburgh

Andersson LM, Bateman TS (1997) Cynicism in the workplace: some causes and effects. J Organ Behav 18(5):449–469

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Bakija J, Cole A, Heim BT (2012) Jobs and income growth of top earners and the causes of changing income inequality: Evidence from U.S. tax return data. Working Paper, Williams College

Bell B, Van Reenen J (2014) Bankers and their bonuses. Econ J 124(574):F1–F21

Benedetti AH, Chen S (2018) High CEO-to-worker pay ratios negatively impact consumer and employee perceptions of companies. J Exp Soc Psychol 79:378–393

Ben-Nasr H, Ghouma H (2018) Employee welfare and stock price crash risk. J Corp Finance 48:700–725

Berg F, Fabisik K, and Sautner Z (2021) Is history repeating itself? The (un) predictable past of ESG ratings. European Corporate Governance Institute–Finance Working Paper, 708

Bloom M, Michel JG (2002) The relationships among organizational context, pay dispersion, and among managerial turnover. Acad Manag J 45(1):33–42

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Brick IE, Palmon O, Wald JK (2006) CEO compensation, director compensation, and firm performance: Evidence of cronyism? J Corp Finance 12(3):403–423

Brown ME, Treviño LK (2006) Ethical leadership: a review and future directions. Leadersh Q 17(6):595–616

Brzezinski M (2019) Top incomes and subjective well-being. J Econ Psychol 73:60–65

Capezio A, Shields J, O’Donnell M (2011) Too good to be true: board structural independence as a moderator of CEO pay-for-firm-performance. J Manag Stud 48(3):487–513

Card D, Mas A, Moretti E et al (2012) Inequality at work: the effect of peer salaries on job satisfaction. Am Econ Rev 102(6):2981–3003

Chi W, Chen Y (2021) Employee satisfaction and the cost of corporate borrowing. Finance Res Lett 40:101666

Clark AE, Oswald AJ (1996) Satisfaction and comparison income. J Public Econ 61(3):359–381

Clark AE, Senik C (2010) Who compares to whom? The anatomy of income comparisons in Europe. Econ J 120(544):573–594

Colquitt JA, Conlon DE, Wesson MJ et al (2001) Justice at the millennium: a meta-analytic review of 25 years of organizational justice research. J Appl Psychol 86(3):425–445

Core JE, Guay W, Larcker DF (2008) The power of the pen and executive compensation. J Financ Econ 88:1–25

Crawford S, Nelson KK, Rountree B (2014) The CEO-employee pay ratio. Working paper

Cullen Z, Perez-Truglia R (2018) How much does your boss make? The effects of salary comparisons (No. w24841). National Bureau of Economic Research.

Denk O (2015) Financial sector pay and labour income inequality: evidence from Europe. OECD Economics Department working paper 1225. OECD Publishing, Paris

Deter M, van Hoorn A (2021) Selection and socialization in the finance industry: longitudinal evidence on finance professionals’ preferences for money and risk. Working paper

Dittmann I, Schneider C and Zhu Y (2018) The Additional costs of CEO compensation: the effect of relative wealth concerns of employees. European Corporate Governance Institute (ECGI)-Finance Working Paper No. 559/2018

Edmans A, Gabaix X, Jenter D (2017) Executive compensation: a survey of theory and evidence. In: Hermalin B, Weisbach M (eds) The handbook of the economics of corporate governance. Elsevie, Amsterdam, pp 383–539

Equilar (2020) CEO pay trends. Available at https://info.equilar.com/4325-2020-ceo-pay

Faleye O, Reis E, Venkateswaran A (2013) The determinants and effects of CEO–employee pay ratios. J Bank Financ 37(8):3258–3272

Fong EA, Misangyi VF, Tosi HL (2010) The effect of CEO pay deviations on CEO withdrawal, firm size, and firm profits. Strateg Manag J 31(6):629–651

Frydman C, Jenter D (2010) CEO compensation. Annu Rev Financial Econ 2(1):75–102

Gabaix X, Landier A (2008) Why has CEO pay increased so much? Q J Econ 123(1):49–100

Godechot O (2012) Is finance responsible for the rise in wage inequality in France? Socioecon Rev 10(3):447–470

Godechot O, Senik C (2015) Wage comparisons in and out of the firm. evidence from a matched employer–employee French database. J Econ Behav Organ 117:395–410

Gond JP, El Akremi A, Swaen V, Babu N (2017) The psychological microfoundations of corporate social responsibility: a person-centric systematic review. J Organ Behav 38(2):225–246

Graf-Vlachy L, Oliver AG, Banfield R et al (2020) Media coverage of firms: background, integration, and directions for future research. J Manage 46(1):36–69

Greenspan A (2002) Testimony of chairman Alan Greenspan: federal reserve board’semiannual monetary policy report to the congress. Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate July 17

Guiso L, Sapienza P, Zingales L (2015) The value of corporate culture. J Financ Econ 117(1):60–76

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manage Rev 9(2):193–206

Harter J, Schmidt FL, Hayes TL (2002) Business-unit-level relationship between employee satisfaction, employee engagement, and business outcomes: a meta-analysis. J Appl Psychol 87(2):268–279

Harter JK, Schmidt FL, Asplund JW, Killham EA, Agrawal S (2010) Causal impact of employee work perceptions on the bottom line of organizations. Perspect Psychol Sci 5(4):378–389

Haynes KT, Josefy M, Hitt MA (2015) Tipping point: managers’ self-interest, greed, and altruism. J Leadersh Organ Stud 22(3):265–279

Haynes KT, Campbell JT, Hitt MA (2017) When more is not enough: executive greed and its influence on shareholder wealth. J Manage 43(2):555–584

Hewitt Aon (2015) Aon Hewitt’s model of employee engagement. Research Brief, Hewitt associates LLC

IBM (2014) Beyond engagement: The definitive guide to employee surveys and organizational performance. https://www.ibm.com/downloads/cas/JNEL5GY1. Accessed 18 July 2021

Jacquart P, Armstrong JS (2013) The ombudsman: are top executives paid enough? Evid-Based Rev Interfaces 43(6):580–589

Judge TA, Piccolo RF, Kosalka T (2009) The bright and dark sides of leader traits: a review and theoretical extension of the leader trait paradigm. Leadersh Q 20:855–875

Kaplan SN, Rauh j (2010) Wall street and main street: what contributes to the rise in the highest incomes? Rev Financ Stud 23(3):1004–1050

Kiatpongsan S, Norton MI (2014) How much (more) should CEOs make? A universal desire for more equal pay. Perspect Psychol Sci 9(6):587–593

Kiviet JF (1995) On bias, inconsistency, and efficiency of various estimators in dynamic panel data models. J Econom 68(1):53–78

Krekel C, Ward G, De Neve JE (2019) Employee well-being, productivity, and firm performance: Evidence and case studies. In: The Global Council for Happiness and Wellbeing (Ed) Global happiness and wellbeing policy report 2019, pp 73–94

Kuhnen CM, Niessen A (2012) Public opinion and executive compensation. Manage Sci 58(7):1249–1272

Larcker DF, Donatiello NE, Tayan B (2016) Americans and CEO pay: 2016 public perception survey on CEO compensation. Corporate Governance Research Initiative, Stanford Rock Center for Corporate Governance. https://www.gsb.stanford.edu/sites/default/files/publication-pdf/cgri-survey-2016-americans-ceo-pay.pdf

Lazear EP, Rosen S (1981) Rank-order tournaments as optimum labor contracts. J Polit Econ 89(5):841–864

Levine DI (1991) Cohesiveness, productivity, and wage dispersion. J Econ Behav Organ 15(2):237–255

Macey WH, Schneider B (2008) The meaning of employee engagement. Ind Organ Psychol 1(1):3–30

Morrison EW, Robinson SL (1997) When employees feel betrayed: a model of how psychological contract violation develops. Acad Manage Rev 22(1):226–256

Mueller HM, Ouimet PP, Simintzi E (2017) Within-firm pay inequality. Rev Financ Stud 30(10):3605–3635

Newman DA, Joseph DL, Hulin CL (2010) Job attitudes and employee engagement: considering the attitude “A-factor.” In: Albrecht SL (ed) The handbook of employee engagement: perspectives, issues, research, and practice. Edward Elgar Publishing, Cheltenham, pp 43–61

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426

Obama B (2009) Remarks by the president to general motors plant employees. General Motors Lordstown Assembly Plant, Warren

Perez-Truglia R (2020) The effects of income transparency on well-being: evidence from a natural experiment. Am Econ Rev 110(4):1019–1054

Philippon T, Reshef A (2012) Wages and human capital in the US finance industry: 1909–2006. Q J Econ 127(4):1551–1609

Piketty T (2014) Capital in the twenty-first century. Harvard University Press, Cambridge

Powdthavee N, Burkhauser RV, De Neve JE (2017) Top incomes and human well-being: evidence from the Gallup world poll. J Econ Psychol 62:246–257

Purcell J (2014) Disengaging from engagement. Hum Resour Manag J 24(3):241–254

Roodman D (2009a) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata J 9(1):86–136

Roodman D (2009b) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158

Roulet TJ (2019) Sins for some, virtues for others: Media coverage of investment banks’ misconduct and adherence to professional norms during the financial crisis. Hum Relat 72(9):1436–1463

Ruiz P, Ruiz C, Martínez R (2011) Improving the “leader–follower” relationship: Top manager or supervisor? The ethical leadership trickle-down effect on follower job response. J Bus Ethics 99(4):587–608

Schulz AC, Flickinger M (2020) Does CEO (over) compensation influence corporate reputation? Rev Manag Sci 14:903–927

Shrivastava P, Ivanova O (2015) Inequality, corporate legitimacy and the occupy wall street movement. Hum Relat 68(7):1209–1231

Shuck B, Wollard K (2010) Employee engagement and HRD: a seminal review of the foundations. Hum Resour Dev Rev 9(1):89–110

Shuck B, Ghosh R, Zigarmi D, Nimon K (2013) The jingle jangle of employee engagement: further exploration of the emerging construct and implications for workplace learning and performance. Hum Resour Dev Rev 12(1):11–35

Tansel A, Gazîoğlu Ş (2014) Management-employee relations, firm size and job satisfaction. Int J Manpow 35(8):1260–1275

Vergne JP, Wernicke G, Brenner S (2018) Signal incongruence and its consequences: a study of media disapproval and CEO overcompensation. Organ Sci 29(5):796–817

Wade JB, O’Reilly CA III, Pollock TG (2006) Overpaid CEOs and underpaid managers: fairness and executive compensation. Organ Sci 17(5):527–544

Wang L, Murnighan JK (2011) On Greed. Acad Manag Ann 5:279–316

Welsh ET, Ganegoda DB, Arvey RD et al (2012) Is there fire? Executive compensation and employee attitudes. Pers Rev 41(3):260–282

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT press, Cambridge

Funding

This project/publication was made possible through the support of a grant from Templeton World Charity Foundation Inc (Grant 0141). The opinions expressed in this publication are those of the author(s) and do not necessarily reflect the views of Templeton World Charity Foundation, Inc.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

Study is in compliance with ethical standards.

Informed consent

This study uses secondary data without individual identifiers. All CEO and firm data are publicly available.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Hendriks, M., Burger, M. & Commandeur, H. The influence of CEO compensation on employee engagement. Rev Manag Sci 17, 607–633 (2023). https://doi.org/10.1007/s11846-022-00538-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11846-022-00538-4