Abstract

-

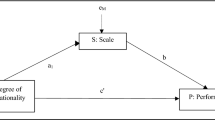

We conduct a Meta-analysis of 54 papers that study the relationship between multinationality and firm performance. The aim is to understand if any systematic relationships exist between the characteristics of each study and the reported results of linear and curvilinear regressions to examine the multinationality-performance relationship.

-

Our main finding, robust to different specifications and to different weights for each observation, is that when analysis is based on non-US data, the reported return to multinationality is higher. However, this relationship for non-US firms is usually U-shaped rather than inverted U-shaped. This indicates that US firms face lower returns to internationalization than other firms but are less likely to incur losses in the early stages of internationalization.

-

The findings also highlight the differences that are reported when comparing regression and non-regression based techniques. Our results suggest that in this area regression based analysis is more reliable than say ANOVA or other related approaches.

-

Other characteristics that influence the estimated rate of return and its shape across different studies are: the measure of multinationality used; size distribution of the sample; and the use of market-based indicators to measure firm performance. Finally, we find no evidence of publication bias.

Similar content being viewed by others

Notes

This ranking information is available in Harvey et al. (2008).

This reports the marginal effect of the outcome probability to be an inverted U-shape curve with respect to study characteristics .

It is important to emphasize that there are a group of studies used other dependent variables, such as innovation, patent and technical efficiency. However, in order to focus our analysis on comparable studies, we consider only those that use accounting/market-based performance.

References

AL-Obaidan, A. M., & Scully, G. W. (1995). The theory and measurement of the net benefits of multinationality: The case of the international petroleum industry. Applied Economics, 27(2), 231–238.

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies, 27(4), 633–653.

Andersen, J. T. (2005). The performance and risk management implication of multinationality: An industry perspective. SMG Working Paper 10.

Andersen, J. T. (2008). Multinational performance relationship and industry context. SMG Working Paper 15.

Ashenfelter, O., Harmon, C., & Oosterbeek, H. (1999). A review of estimates of the schooling/earnings relationship, with tests for publication bias. Labour Economics, 6(4), 453–470.

Autio, E., Heikki, L., & Arenius, P. (2002). Emergent “Born Globals”: Crafting early and rapid internationalization strategies in technology-based new firms. Helsinki University of Technology Working Paper Series 91-WP-2002-003.

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization-performance relationship: Evidence from meta-analysis. Management International Review, 47(3), 319–347.

Bodnar, G. M., Tang, C., & Weintrop, J. (1999). Both sides of corporate diversification: The value impacts of geographic and industrial diversification. NBER Working Paper 6224.

Brouthers, E. L., & Nakos, G (2005). The role of systematic international market selection on small firms’ export performance. Journal of Small Business Management, 43(4), 363–381.

Buckley, P. J., & Casson, M. (1976). The future of the multinational enterprise. London: Macmillan.

Buhner, C. H. (1987). Assessing international diversification of West German corporations. Strategic Management Journal, 8(1), 25–37.

Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firms. Journal of International Business Studies, 34(4), 345–355.

Card, D., & Krueger, A. B. (1995). Time-series minimum-wage studies: A meta analysis. American Economic Review, 85(2), 238–243.

Castellani, D., & Zanfei, A. (2007). Internationalisation, innovation and productivity: How do firms differ in Italy? The World Economy, 30(1), 156–176.

Christophe, S. E., & Lee, H. (2004). What matters about internationalization: A market-based assessment. Journal of Business Research, 58(5), 636–643.

Christophe, S. E., & Pfeiffer, J. R. (2002). The valuation of U.S. MNC international operations during the 1990s. Review of Quantitative Finance and Accounting, 18(2), 119–138.

Click, R. W., & Harrison, P. (2000). Does multinationality matter? Evidence of value destruction in U.S. multinational corporations. Federal Reserve Board, Working Paper 21.

Collins, J. M. (1990). A market performance comparison of US firms active in domestic, developed and developing countries. Journal of International Business Studies, 21(2), 271–287.

Contractor, F. J. (2007). Is international business good for companies? The evolutionary or multi-stage theory of internationalization vs. the transaction cost perspective. Management International Review, 47(3), 453–475.

Contractor, F. J., Kundu, S. K., & Hsu, C. C. (2003). A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34(1), 5–18.

Dastidar, P. (2002). The effect of pure multinational diversification on firm value. AIB 2002 Annual Meeting Puerto Rico.

Delios, A., & Beamish, P. W. (1999). Geographic scope, product diversification, and the corporate performance of Japanese firms. Strategic Management Journal, 20(8), 711–727.

Denis, D. J., Denis, D. K., & Yost, K. (2002). Global diversification, industrial diversification, and firm Value. The Journal of Finance, 57(5), 1951–1979.

Doukas, J., Pantzalis, C., & Kim, S. (1999). Intangible assets and the network structure of MNCs. Journal of International Financial Management Accounting, 10(1), 1–35.

Dunning, J. H. (1988). The theory of international production. International Trade Journal, 31(1), 21–46.

Geringer, J. M., Beamish, P. W., & DaCosta, R. C. (1989). Diversification strategy and internationalization: Implications for MNE performance. Strategic Management Journal, 10(2), 109–119.

Geringer, J. M., Tallman, S., & Olsen, D. M. (2000). Product and international diversification among Japanese multinational firms. Strategic Management Journal, 21(1), 51–80.

Goerzen, A., & Beamish, P. W. (2003). Geographic scope and multinational enterprise performance. Strategic Management Journal, 24(13), 1289–1306.

Gomes, L., & Ramaswamy, K. (1999). An empirical examination of the form of the relationship between multinationality and performance. Journal of International Business Studies, 30(1), 173–187.

Görg, H., & Strobl, E. (2001). Multinational companies and productivity spillovers: A meta-analysis. Economic Journal, 111(475), F723–739.

Grant, R. M. (1987). Multinationality and performance among British manufacturing companies. Journal of International Business Studies, 18(3), 79–89.

Grant, R. M., Jammine, A. P., & Thomas, H. (1988). Diversity, diversification, and profitability among British manufacturing companies. Academy of Management Journal, 31(4), 771–801.

Harvey, C., Morris, H., & Kelley, A. (2008). Academic Journal Quality Guide. http://www.the-abs.org.uk.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Export versus FDI with heterogeneous firms. American Economic Review, 94(1), 300–316.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product-diversified firms. The Academy of Management Journal, 40(4), 767–798.

Hitt, M. A., Uhlenbruck, K., & Shimizu, K. (2006). The importance of resources in the internationalization of professional service firms: The good, the bad, and the ugly. The Academy of Management Journal, 49(6), 1137–1157.

Hunter, J. E., & Schmidt, F. L (1990). Methods of meta-analysis: Correcting error and bias in research findings. Newbury Park: Sage.

Hunter, J. E., Schmidt, F. L., & Jackson, G. B. (1982). Meta-analysis: Cumulating research findings across studies. Beverly Hills: Sage.

Hughes, J. S., Logue, D. E., & Sweeney, R. J. (1975). Corporate international diversification and market assigned measures of risk and diversification. Journal of Financial and Quantitative Analysis, 10(4), 651–652.

Kim, W. J., & Lyn, E. D. (1986). Excess market value, the multinational corporation and Tobin’s q Ratio. Journal of International Business Studies, 17(1), 119–125.

Kim, W., Hwang, P., & Burgers, W. P. (1993). Multinationals’ diversification and the risk-return trade-off. Strategic Management Journal, 14(4), 275–286.

Knight, G. A., & Cavusgil, S. T. (2004). Innovation, organizational capabilities, and the born-global firm. Journal of International Business Studies, 35(2), 124–141.

Kostova, T., & Zaheer, S. (1999). Organizational legitimacy under conditions of complexity: The case of the multinational enterprises. Academy of Management Review, 24(1), 64–81.

Kotabe, M., Srinivasan, S. S., & Aulakh, P. S. (2002). Multinationality and firm performance: The moderating role of RD and marketing capabilities. Journal of International Business Studies, 33(1), 79–97.

Laeven, L., & Valencia, F. (2008). Systemic banking crises: A new database. http://www.imf.org/external/pubs/cat/longres.cfm?sk=22345.

Li, L. (2005). Is regional strategy more effective than global strategy in the US service industries? Management International Review, 45(1), 37–57.

Li, L. (2007). Multinationality and performance: A synthetic review and research agenda. International Journal of Management Reviews, 9(2), 117–139.

Li, L., & Qian, G. (2005). Dimensions of international diversification: The joint effects on firm performance. Journal of Global Marketing, 18(3/4), 7–35.

Lu, J. W., & Beamish, P. W. (2001). The internationalization and performance of SMEs. Strategic Management Journal, 22(6/7), 565–586.

Lu, J. W., & Beamish, P. W. (2004). International diversification and firm performance: The s-curve Hypothesis. The Academy of Management Journal, 47(4), 598–609.

Martins, P. S., & Yang, Y. (2009). The impact of exporting on firm productivity: A meta-analysis. Review of World Economy, 145(3), 431–445.

Michel, A., & Shaked, I. (1986). Multinational corporations vs. domestic corporations: Financial performance and characteristics. Journal of International Business Studies, 17(3), 89–100.

Mishra, C. S., & Gobeli, D. H. (1998). Managerial incentives, internalization, and market valuation of multinational firms. Journal of International Business Studies, 29(3), 583–598.

Morck, R., & Yeung, B. (1991). Why investors value multinationality. Journal of Business, 64(2), 165–187.

Moen, O., & Servais, P. (2002). Born global or gradual global? Examining the export behavior of small and medium-sized enterprises. Journal of International Marketing, 10(3), 49–72.

Pangarkar, N. (2008). Internationalization and performance of small- and medium-sized enterprises. Journal of World Business, 43(4), 475–485.

Pantzalis, C. (2001). Does location matter? An empirical analysis of geographic scope and MNC market valuation. Journal of International Business Studies, 32(1), 133–155.

Pereira, P. T., & Martins, P. S. (2004). Returns to education and wage equations. Applied Economics, 36(6), 525–531.

Qian, G. (1997). Assessing product-market diversification of U.S. firms. Management International Review, 37(2), 127–149.

Qian, G. (1998). Determinants of profit performance for the largest U.S. firms 1981–92. Multinational Business Review, 6(2), 44–51.

Qian, G. (2002). Multinationality, product diversification, and profitability of US emerging and medium-sized enterprises. Journal of Business Venturing, 17(6), 611–633.

Qian, G. M., Li, L., Li, J., & Qian, Z. M. (2008). Regional diversification and firm performance. Journal of International Business Studies, 39(2), 197–214.

Ramírez-Aleson, M., & Espitia-Escuer, M. A. (2001). The effect of international diversification strategy on the performance of Spanish-based firms during the period 1991–1995. Management International Review, 41(3), 291–315.

Rugman, A. M. (1986). New theories of the multinational enterprise: An assessment of internalization Theory. Bulletin of Economic Research, 38(2), 101–118.

Ruigrok, W., & Wagner, H. (2003). Internationalization and performance: An organizational learning perspective. Management International Review, 43(1), 63–84.

Ruigrok, W., Amann, W., & Wagner, H. (2007). The internationalization-performance relationship at Swiss firms: A test of the s-shape and extreme degree of internationalization. Management International Review, 47(3), 349–368.

Sambharya, R. B. (1995). The combined effect of international diversification and product diversification strategies on the performance of US-based multinational corporations. Management International Review, 35(3), 197–213.

Severn, A. K., & Laurence, M. M. (1974). Direct investment, research intensity, and profitability. Journal of Financial and Quantitative Analysis, 9(2), 181–190.

Shaked, I. (1986). Are multinational corporations safer? Journal of International Business Studies, 17(1), 83–106.

Siddharthan, N. S., & Lall, S. (1982). The recent growth of the largest U.S. multinationals. Oxford Bulletin of Economics and Statistics, 4(1), 1–13.

Soenen, L. A. (1990). Stock market recognition of multinationality. Akron Business and Economic Review, 21(4), 64–73.

Stanley, T., & Jarrell, S. B. (1989). Meta-regression analysis: A quantitative method of literature surveys. Journal of Economic Surveys, 3(2), 161–170.

Tallman, S., & Li, J. (1996). Effects of international diversity and product diversity on the performance of multinational firms. Academy of Management Journal, 39(1), 179–196.

Thomas, D. E., & Eden, L. (2004). What is the shape of the multinationality-performance relationship? The Multinational Business Review, 12(1), 89–110.

Zaheer, S. (1995). Overcoming the liability of foreignness. Academy of Management Journal, 38(2), 341–363.

Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance. Academy of Management Journal, 43(5), 925–950.

Acknowledgements

We are very grateful to anonymous referees of this journal for their constructive comments on an earlier version of this paper. The authors gratefully acknowledge the financial support from the ESRC under RES-062-23-0986. We also thank Stephen Tallman, Suma Athreye, Pedro Martins, Teresa da Silva Lopes, Sushanta Mallick, Richard Kneller and the anonymous referees careful reading of my paper and insightful comments and suggestions for improvement, particularly the issue of curvilinearity. We also thank Simon Mohun, Tomasz Mickiewicz, Yadong Luo, and participants at Workshop 2008 at Queen Mary, University of London and AIB 2010 conference at Rio de Janeiro, for helpful comments. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, Y., Driffield, N. Multinationality-Performance Relationship. Manag Int Rev 52, 23–47 (2012). https://doi.org/10.1007/s11575-011-0095-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-011-0095-y