Abstract

In a widely acclaimed contribution to Management International Review, Hennart (2007) challenged one of the mainstream theories of International Business, the S-curve relationship between multinationality and performance, by arguing that there is no positive impact on performance aside from the scale enhancing effect resulting from increasing multinationality. We examine his arguments by analyzing 3876 firms from Canada, Germany, Japan, the UK and the US over the period from 2002 to 2016. We find that the empirical evidence for a direct positive impact of multinationality on performance is not convincing. However, increasing multinationality leads to a significantly higher firm performance via the economies of scale-channel. Multinationality seems to be more important as a means to increase scale for firms from small home markets compared to firms from large domestic markets. Intangible assets appear to amplify the impact of scale on performance much more than the impact of multinationality on performance. In the end, it's size that matters.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The question of whether and how multinationality (M) influences the performance (P) of a firm is a topic of vivid discussion in International Business (IB) (e.g., Contractor, 2012; Hennart, 2011; Kirca et al., 2012; Marano et al., 2016; Pisani et al., 2020). Academic scholars have developed many theoretical arguments to explain the conditions under which multinationality might be beneficial or detrimental to firm performance, ranging from the internalization of intangible assets (Morck & Yeung, 1991, 1992) to the flexibility advantages of a geographically dispersed network of activities (Pantzalis, 2001) to the liabilities of operating in an alien environment (Zaheer, 1995; Zaheer & Mosakowski, 1997). Empirical contributions examining the M-P relationship have provided a wide range of outcomes that are not always consistent. Whereas some scholars claim to have discovered a linear-positive impact of multinationality on performance, others suggest that the impact is linear-negative (Click & Harrison, 2000; Kotabe et al., 2002). In attempts to reconcile these divergent views, some scholars combined certain theoretical arguments in order to develop non-linear performance functions (Contractor et al., 2003; Lu & Beamish, 2004; Ruigrok et al., 2007). Unfortunately, again contradictory findings emerged (Capar & Kotabe, 2003; Lu & Beamish, 2004; Oesterle & Richta, 2013). The variety of empirical outcomes concerning the relationship between multinationality and performance appears to be confusing. Overall, previous findings seem far from robust; they are characterized as inconsistent or even contradictory (Hennart, 2007, 2011; Nguyen, 2016).

In view of these findings, Hennart (2007) challenges conventional M-P research in a widely noticed contribution in Management International Review (MIR) by arguing that the positive effects of multinationality on performance stated in the literature, for the most part, appear to be questionable or at least cannot be expected to occur generally. One exception regarding this is the performance effect of economies of scale. However, Hennart (2007) argues with regard to the economies of scale-argumentation that multinationality only plays an indirect role as it is one channel that provides opportunities to realize economies of scale. These possibilities to expand beyond the national borders in order to reap economies of scale may be necessary for firms from small countries, whereas they may be less or even not at all necessary for firms with a large home market.

With regard to the relevance of economies of scale for the performance impact of multinationality much attention has been given to the role of intangible assets. Intangible assets are firm-specific resources that behave as public goods, i.e., in theory, the marginal costs of their exploitation abroad tend to be zero (Buckley & Casson, 1976). Prominent theoretical reasoning in the literature, which is often related to internalization theory (Morck and Young, 1991, 1992; Kirca et al., 2011) and the imperfect competition theory (Hymer, 1976) maintains that the performance impact of multinationality depends on the amount of intangibles that a firm possesses (Kirca et al., 2011). In his MIR contribution, Hennart (2007) highlights the subtle distinctions concerning the role of intangible assets from the viewpoint of transaction cost theory (TCT) and the imperfect competition theory (IMT). According to Hymer (1976), intangible assets constitute competitive advantages in final output markets and enable the generation of super-normal profits. Hennart (2007), in contrast, following TCT, views intangible assets as firm resources that are – in many cases – most efficiently exploited through internalization due to inefficiencies in intermediate markets. However, these specific governance structures (internalization of intermediate input markets) do not necessarily enable a firm to generate super-normal profits.

This paper aims to clarify the role of scale with regard to the M-P relationship and examine the impact of intangible assets on the interplay between multinationality, scale, and performance. Based on a sample of multinational firms from Canada, Germany, Japan, the UK and the US, we compare the direct impact of M on P vs the indirect impact, i.e., we analyze the empirical relevance of the mediating effect of scale concerning the relationship between multinationality and performance. Furthermore, we analyze the role of intangible assets in the interplay of multinationality, scale and performance. Our paper can be considered a significant contribution to the ongoing academic debate on the relationship between multinationality and performance. Up to now, there are only very few academic studies that have explicitly addressed the effect of economies of scale on the M-P relationship (Abdi & Aulakh, 2018; Fisch & Zschoche, 2011; Richter, 2014). Our study can therefore be considered to be one of the few studies so far to explicitly test the relevance of scale concerning the performance impact of multinationality. Moreover, we contribute to the academic debate by providing a comparison between the indirect effect of multinationality on performance via the economies of scale channel versus the direct effect of multinationality on performance. Furthermore, our study is one of the few research contributions to shed light on the role of intangible assets with regard to the interplay of multinationality, scale, and performance. Our paper is organized as follows. In the next section, we will give a brief overview of the theoretical background and extant research and develop our hypotheses. After that, we will present our methodology. The empirical results are presented and discussed in light of previous research. The paper closes with a view on limitations and implications of our results for managerial practice and future research.

2 Theoretical Considerations

2.1 The Performance Impact of Multinationality in the Academic Discussion

With regard to the performance impact of multinationality, different theoretical arguments are proposed in the literature. Many IB scholars base their argumentation on the assumption that multinationality implies certain costs that a firm restraining itself to its domestic market might not incur. Such additional costs of multinationality may arise from the liabilities of foreignness and newness (Hymer, 1976; Zaheer, 1995; Zaheer & Mosakowski, 1997).

Furthermore, increasing multinationality often goes hand in hand with increasing geographical fragmentation of the value chain as well as with a multiplication of specific value chain activities of the MNC at different locations. As a result, the costs of coordinating and controlling may rise with increasing multinationality (Lu & Beamish, 2004).

On the other hand, proponents of M-P research argue that multinationality may exert positive effects on firm performance. One argument is that firms may be able to reduce the fluctuation of revenues (and hence the variance of profitability) by geographical diversification (Rugman, 1976).

Furthermore, it is argued that multinational firms have access to better and cheaper resources (including knowledge) and have the advantage of being more flexible regarding the use of these resources (Allen & Pantzalis, 1996). According to this argument, they are able to combine and exploit the advantages of different locations. MNCs may utilize differences in prices and qualities on the various national product, factor and capital markets (Kogut, 1985). Moreover, due to the multiplication of value chain activities, MNCs may react more flexibly to changes in their business environments than their purely domestic competitors. Operating in many countries simultaneously, a multinational network has substantially more real options than a purely domestic firm (Lee & Makhija, 2009).

One of the most prominent arguments why multinationality might be beneficial refers to reaping economies of scale through internationalization (Contractor, 2012; Hitt et al., 1997). By expanding beyond their home market, MNCs are able to generate larger amounts of output.Footnote 1 In the case of economies of scale, increasing output is associated, ceteris paribus, with a reduction in average costs per unit. This reduction in costs per unit implies, ceteris paribus, a higher amount of profit per unit and hence a higher amount of total profits.

Unfortunately, hitherto the empirical results regarding the effect of multinationality on performance are characterized as inconsistent or even contradictory. M-P Scholars have reacted to these confusing findings by suggesting non-linear relationships such as U-shaped, inverted-U-shaped, S-shaped or inverted S-shaped (Contractor et al., 2003; Lu & Beamish, 2004; Ruigrok et al., 2007). However, these proposed relationships did not really prove to be empirically more convincing and more valid than their linear predecessors (Berry & Kaul, 2016; Pisani et al., 2020).

In the light of these results, Hennart (2007) casts doubt on the validity of the results of extant research and argues that most of the theoretical arguments why multinationality should lead to a positive impact on performance have to be questioned and cannot be taken for granted. With one exception: the economies of scale argument.

The usage of this argument is prevalent in academic literature when it comes to explaining a positive relationship between multinationality and performance (e.g., Contractor, 2012; Hennart, 2007). However, quite surprising, the empirical relevance of scale effects regarding the performance impact of multinationality has rarely been empirically analyzed explicitly (Abdi & Aulakh, 2018; Fisch & Zschoche, 2011; Richter, 2014). In most cases, the economies of scale argument is used to explain the general idea of a positive relationship between multinationality and performance, usually among other arguments. However, the concept of economies of scale is not explicitly integrated into the empirical model. Instead, a test of the relationship between multinationality measured through a proxy like the ratio of foreign sales to total sales (FSTS) and performance, e.g., measured by return on assets (ROA), is carried out. For example, Lu and Beamish (2004) argue in the introduction of their seminal paper:

"Geographic diversification provides exploration and exploitation benefits. It enables a firm to realize economies of scale and scope" (p. 599).

However, the authors do not explicitly analyze the influence of scale on the performance impact of multinationality. Instead, they assume implicitly that if they were able to discover a positive performance impact of multinationality, this impact would be at least partly due to the effect of economies of scale.

On the other hand, the economies of scale argument is frequently used as one of several simple and straightforward ad hoc explanations for a positive relationship between multinationality and performance without having raised this argument in theoretical considerations explicitly. E.g., Dastidar (2009) interprets a positive relationship between multinationality (measured by differentiating between multinational vs domestic firms) (inter alia) as evidence of the impact of economies of scale (Dastidar, 2009, p. 81).

What about the few studies where authors claim to have explicitly analyzed the effect of economies of scale? Fisch and Zschoche (2011), as well as Richter (2014), rely on the volume of foreign sales as a measure of the relevance of economies of scale. However, economies of scale depend on the total volume of output. Foreign sales may contribute to total scale, but as they are only a part of the absolute amount of output, they appear to be a debatable proxy for economies of scale. Hennart (2007, p. 433) argues that "what matters is the total size of the market, not the size of its foreign component". Abdi and Aulakh (2018) provide sophisticated evidence of the scale-related benefits of internationalization. However, the authors did not explicitly compare the direct effect of multinationality on performance versus its impact via the economies of scale-channel.

Following Hennart's argument, multinationality foremost exerts a positive impact on performance through the mediating channel of total scale. In an attempt to contrast the empirical relevance of the economies of scale-channel via other mechanisms for multinationality to affect performance, we compare these different effects empirically and hypothesize:

H1: The indirect impact of multinationality on performance via the economies of scale-channel is stronger and more positive than the direct impact of multinationality on performance.

In his seminal paper, Hennart (2007) takes the view of the impact of multinationality on scale being by far the most important source of a positive performance effect of multinationality. He assumes the relationship between scale and performance to be inverted-U-shaped. Firms are seeking to expand their output until they reach the minimum of the average cost function. This optimum point of efficient scale depends on industry-specific characteristics and firm-specific attributes and can therefore be considered idiosyncratic. Nevertheless, the size of the home market may play a role for firms seeking to reach their individual firm-specific optimum point of efficient scale: A small home market may not provide the necessary capacity for firms to realize their optimum point of efficient scale by selling their products solely at home. Firms from small countries have to internationalize in order to achieve their optimal degree of output (Glaum & Oesterle, 2007). However, in the case of firms from large home markets, domestic market size leaves a higher chance to provide them with a sufficiently large market to exploit economies of scale without having the necessity to expand abroad. Firms from countries with a large home market may experience no necessity to internationalize in order to reap economies of scale (more often, compared to comparable firms from small home markets) as they might realize their optimum point of efficient scale on the home market already. In these cases, the marginal performance effect of multinationality should be expected to be zero or even negative. These assumptions are in line with arguments emphasized by Glaum and Oesterle (2007) as well as empirical findings from Yang and Driffield (2012), who provide evidence that the returns from multinationality are lower for firms from the US compared to firms from outside of the US arguing that "[f]irms from outside the USA are less likely to enjoy such scale economies from their domestic markets" (p. 26). They also correspond with findings from Elango and Sethi (2007), who find a positive linear relationship between multinationality and performance in the case of firms from small open economies. According to Hennart (2007), differences in home market size are one reason why the performance impact of multinationality is not universal. The rationale behind this country-specific impact lies in the fact that firms from different countries need different doses of multinationality to increase their output to a sufficient degree. We expect that the impact of multinationality on total scale varies between firms from different countries, with firms from small home markets exhibiting a larger degree of multinationality compared to firms from large home markets. Following this, we propose:

H2: The impact of multinationality on scale is moderated by the MNC's home country so that the effect of multinationality on scale gets stronger with decreasing size of the MNC's home market.

2.2 The Role of Intangible Assets

The term "economies of scale" refers to a relatively broad theoretical concept, which implies that increases in a firm's output lead to reductions in average costs per unit (e.g., Contractor, 2012; Hennart, 2007). These reductions in costs per unit through increased output can, on the one hand, be the consequence of spreading fixed costs over a larger amount of units sold. However, they can also be the consequence of reductions in variable costs due to learning effects or increased bargaining power. They can even be the outcome of a switch in technology facilitated by an increase in product demand. One specific channel to realize economies of scale relates to the exploitation of intangible assets. Intangible assets are information-intensive firm-specific resources. In many cases, these intangible assets have the characteristics of a public good in that they are non-rival in their use (Buckley & Casson, 1976). If these intangible assets are non-location bound but transferable across borders, they may be exploited not only in the domestic market but simultaneously in foreign markets.

During the last thirty years, MP scholars have analyzed the moderating effect of intangible assets on the relationship between multinationality and performance (Bausch & Krist, 2007; Kirca et al., 2011; Morck & Yeung, 1991). The implicit reasoning behind this presumed relationship is based on the idea that the development of intangible assets is associated with an increase in fixed costs. That means, all other things being equal, that the optimum point of efficient scale is higher for firms with a high amount of intangible assets compared to firms with lower amounts of intangible assets (Hennart, 2007). Moreover, due to the non-rival nature of intangible assets, output expansion (at home or abroad) provides the firm with additional returns for the exploitation of these intangible assets (Buckley & Casson, 1976). In this regard, intangible assets perform the function of a lever: The more valuable the intangible assets are, which are going to be exploited, the higher the additional returns of increasing output (Morck & Yeung, 1991). To sum up, intangible assets can be expected to influence the impact of scale on performance. As internationalization is (more or less implicitly) equated with an increase in scale in most of the literature, intangible assets are expected to positively affect the performance impact of multinationality (Kirca et al., 2011; Thomas & Eden, 2004). The consequences of these (implicit) assumptions are reflected in the empirical models of extant research analyzing the relationship between intangible assets, multinationality and performance: during the last thirty years, in order to test the moderating effect of intangible assets, these models included an interaction term combining intangible assets and multinationality and (according to our knowledge) never an interaction term combining intangible assets and scale (e.g. Berry & Kaul, 2016; Eckert et al., 2010; Lu & Beamish, 2004).

Hennart (2011) has emphasized that a higher degree of internationalization does not necessarily imply higher sales volumes. Furthermore, he argued that compared to a purely domestic company or a less internationalized company, a highly internationalized company bears a higher amount of costs: "What matters for the optimal exploitation of intangibles is a total market that is big enough to reach MES [minimum efficient scale], not any given ratio of foreign to total sales. Indeed, if a sufficiently large market can be found at home, the firm will be better off with an FSTS of zero since selling to foreign customers almost always requires some adaptations of the marketing mix (..) and this hinders the exploitation of plant- and firm-level scale economies." (p. 143–144).

Following this logic, our theoretical argumentation rests on the assumption that a positive moderating impact of intangible assets is primarily directed at the scale-performance relationship and not on the multinationality-performance relationship itself. Having controlled for scale, there seems to be no theoretical argument to justify why the moderating effect of intangible assets on the relationship between multinationality and performance should still be positive. Even though in an ideal world, the marginal costs of transferring intangible assets across country borders and exploiting them in foreign markets would be insignificant, in reality, the costs of transferring these intangible assets abroad may be quite substantial due to necessary country-specific adaptations and modifications as well as transaction costs due to cultural distance and institutional voids. Therefore, when it comes to exploiting intangible assets, domestic firms (operating at their point of optimum scale) can (ceteris paribus) be expected to outperform multinational firms (Hennart, 2007, p. 434). There is no theoretical argument why the performance impact of an increase in multinationality should be positively levered through the value of intangible assets which are going to be exploited abroad, except for one: the effect of enhancing scale. Following this argumentation, we hypothesize:

H3: The moderating impact of intangible assets on the relationship between scale and performance is stronger and more positive than the moderating impact of intangible assets on the relationship between multinationality and performance.

Our findings regarding hypothesis 3 also implicitly include an assessment of the validity of the IMT: According to the IMT, product markets are not sufficiently efficient to eradicate a quasi-monopolistic advantage that intangible assets may provide for MNCs. In contrast, Hennart (2007) suggests that intangible assets do not necessarily lead to a competitive advantage over rivals. Following the argumentation of TCT, intangible assets are firm resources that are – in many cases – most efficiently exploited through internalization due to inefficiencies in intermediate markets. However, internalizing the exploitation of intangible assets does not necessarily enable a firm to generate super-normal profits as the internalization of intangible assets may as well occur in industries with competitive product markets. The output produced by exploiting these intangible assets may have substitutes that erode super-normal profits, and the complementary resources needed for the exploitation of these intangible assets may absorb any excess return (Hennart, 2007, p. 429). In a meta-analysis, Kirca et al. (2011) contrast the diverging views of TCT and IMT and provide evidence that intangible assets related to research and development (R&D) are able to enhance the positive impact of multinationality on performance. In principle, according to the IMT, intangible assets can be seen as strategic resources which embody a competitive advantage. Their value increases when exploiting them in foreign markets through internalization. This increase in value is a consequence of the scale enhancement of international expansion. Therefore, if the moderating effect of intangible assets on the performance impact of scale turns out to be positive, we interpret this result as support of the IMT.

3 Methods and Data

Our initial sample consisted of publicly traded firms from the world's seven leading industrial economies in 2016 (IMF, 2019), i.e., Canada, France, Germany, Great Britain, Italy, Japan and the US. We refrained from considering firms from emerging economies like Brazil, China and India since extant research indicates that the MP-relationship appears to differ between firms from developed countries and firms from developing countries (Kim et al., 2020; Kirca et al., 2016). For the period of analysis, we chose the time interval between 2002 and 2016. 2002 was chosen as the starting point in order to avoid biases in companies' financial statements that might have occurred due to the necessary conversion of different European currencies before the introduction of the Euro. Due to concerns regarding insufficient representativeness for data of companies from France and Italy, we decided to remove firms from these countries from our final sample. Our final dataset contained 26,619 complete firm-year-observations of 3,876 firms from Thomson Reuters' Datastream database, where we selected all firms available from Datastreams' equities category for the remaining countries for the time period from 2002 to 2016 except firms from the financial sector. Using only complete cases allowed for the mediation procedure, which is conducted over two models, to use the same subset of data and reduce possible estimation biases. Due to better availability of complete data for Japan and the USA, the cases in the final sample are skewed towards these countries (Table 1).

3.1 Dependent Variables

Firm Performance was measured by return on equity (ROE). In order to substantiate our results, we further employ return on assets (ROA) as an alternative measure of performance.

Scale was measured through the natural logarithm of a firm's net sales (Abdi & Aulakh, 2018; Lu & Beamish, 2004). This is in line with Reuber et al. (2021), who argue that output volume typically refers to net sales in scaling operations. Prior to transforming with the natural logarithm, net sales of non-US firms were converted into million US$ and then deflated using the OECD yearly country-specific producer price indices (Abdi & Aulakh, 2018; OECD, 2020) in order to correct for sales increases due to rising product prices.

3.2 Independent Variables

Multinationality was measured by the ratio of foreign assets to total assets (FATA) (Bowen, 2007). The robustness of our findings was additionally assessed by using the foreign sales ratio (FSTS) as a further proxy for multinationality (Bowen, 2007; Nguyen, 2016; Nguyen & Kim, 2020; Ruigrok et al., 2007).

Previous research relies almost exclusively on the ratio of research and development expenses to net sales (RDS) and the ratio of selling, general and administrative expenses to net sales (SGAS) as proxies for intangible assets. However, there is substantial criticism regarding these proxies in the literature (Nguyen, 2016). Therefore, we employ a market-based measure of intangible assets (MIA) instead of using the conventional accounting-based measures of intangible assets:

With total assets being the book value of assets, intangible assets (reported on the balance sheet) being the book value of intangible assets.

The difference between both is the sum of the book value of tangible assets. In correspondence to Hirschey (1985), we use the book value of tangible assets as a proxy for the market value of tangible assets (Chung & Pruitt, 1994, Hirschey, 1985). Enterprise Value is defined as market capitalization at fiscal year-end plus preferred stock plus minority interest plus total debt minus cash. Therefore, the quotient represents a proxy for the share of tangible assets to total enterprise value. Since enterprise value is composed of tangibles and intangibles, subtracting this quotient from 1 leads to the share of a market-based evaluation of intangible assets to total enterprise value. In order to check the robustness of our results, we also follow the recommendation of Nguyen (2016) by measuring intangible assets using the amount of intangible assets reported in the balance sheet divided by net sales (IAS).

3.3 Control Variables and Descriptive Statistics

Because a firm's financial structure can impact output and performance, we included the ratio of total debt to total assets (TDTA) as a control variable. The investment structure as an indicator for a firm's growth options (Bodnar et al., 2003) was also taken into consideration and was measured by the ratio of capital expenditures to net sales (CapExS) (Abdi & Aulakh, 2018). We included research and development per sales (RDS) to control for research intensity and selling and general administrative expenses per sales (SGAS) to control for marketing intensity. We controlled for related product diversification (Rel. Div.) by counting the reported number of SIC codes belonging to the same first two digits category. The respective maximum number was considered as a measure of related product diversification. We also controlled for unrelated product diversification (Unrel. Div.) based on the number of different SIC codes at the first two digits level. Using a dummy variable, we differentiated between companies primarily active in the manufacturing sector and those primarily active in the service sector (Sector Dummy). The gross domestic product (GDP) of a MNC's home country (in trillion US$) (IMF, 2019) was used as a proxy for domestic market size.

Descriptive statistics and correlations are shown in Table 2. 26.7% of our sample exhibit a foreign asset ratio of zero, whereas the mean of FATA equals 16.79%, indicating that the majority of firms in our sample is quite internationalized. Overall, the two-sided correlations are rather low.

3.4 Modeling Procedures

In order to analyze the complex underlying relationships and concepts in this study, we used Conditional Process Analysis to acquire nuanced findings with assumed causal inference (Hayes, 2018).Footnote 2 Conditional Process Analysis is also known as moderated mediation as it is used to analyze conditional (moderated) direct and indirect (mediated) effects of independent variables on dependent variables (Hayes, 2018, p. 402). As such, this method is comparable to partial least squares structural equation modeling (PLS-SEM). Further, we applied GLS regression with time-fixed effects. The statistical significance of the unstandardized indirect effects in PROCESS was tested with bias-corrected and accelerated (BCa) bootstrapping using 1,000 bootstrapping samples. Each mediation in Conditional Process Analysis is tested with at least two models where the direct and indirect effects are estimated respectively. We created several statistical diagrams to visualize the examined relationships and the implied causal inference in our hypotheses (Fig. 1 for H1, Fig. 2 for H2, Fig. 3 for H3). Model 1 tested the effect of an independent focal variable (M: multinationality) on the mediator (S: scale). Model 2 includes home market size as the moderator W of that relationship. Model 7 tested the interaction effects of both M and S with intangible assets on firm performance as the dependent variable P. Based on these models, the conditional direct effect (M → P), as well as the conditional indirect effect (M → S → P), was computed.

Statistical diagram of models 1 & 4. Notes: Only focal variables are shown, control variables are included in both the scale and performance regression models; e shows residuals; Path to S shows model 1; Paths from M to P and S to P show model 4; Diagram based on Hayes’ PROCESS Model 4 (Hayes, 2018).

Statistical diagram of models 2 & 4. Notes: Only focal variables are shown, control variables are included in both the scale and performance regression models; e shows residuals; moderator and interaction effects in dotted lines; Paths to S show model 2; Paths from M to P and S to P show model 4; Diagram based on Hayes’ PROCESS Model 7 (Hayes, 2018)

Statistical diagram of models 3 & 7. Notes: Only focal variables are shown, control variables are included in both the scale and performance regression models; coefficients correspond to equations 1 & 2; e shows residuals; moderator and interaction effects in dotted lines; Paths to S show Model 3; Paths from M to P and S to P show model 7; Diagram based on Hayes’ PROCESS Model 59 (Hayes, 2018)

The effects are conditional since they differ depending on the value of the moderator. The conditional indirect effect, in this case, can be defined as \({a}_{1}b+{a}_{3}bW\) (Hayes, 2018, p. 405). To show corresponding conditional effects for low, medium and high values of W, the values of the moderator W for the mean and ± 1 standard deviation (SD) were selected. In a model containing a moderator on both relationships of the indirect path – see Fig. 3 – the conditional indirect effect was defined as \(({a}_{1}+{a}_{3}W)({b}_{1}+{b}_{3}W)\).

Due to the prevalence of the S-curve model in IB studies, we tested the quadratic and cubic effects of FATA on ROE in our models. But, consistent with recent findings from Pisani et al. (2020), the regression coefficients of the different components of multinationality (i.e., linear, squared and cubed) do not prove to be consistently significant across the different models. Therefore, we decided to refrain from incorporating S-curve analysis in this paper. Respective tables can be found in the appendix (Table 9, models 4–7). This notwithstanding, for the effect of FATA on scale we chose a non-linear function, because including the quadratic function of FATA into the regression appeared to describe the relationship best, leading to significantly higher values in the adjusted coefficient of determination.

With this configuration the regression functions for the M-S and M-P relationships in models 3 & 7 can be formulated as:

The desired degree of multinationality of MNCs is self-selected, which leads to endogeneity bias if not accounted for (Abdi & Aulakh, 2018). To remedy this, we applied propensity score weighting using generalized boosted models (GBM) in R with the mnps package (Cefalu et al., 2021; McCaffrey et al., 2013; Burgette et al., 2020). Propensity score correction is a method to preprocess a sample in order to infer causality from observational data to alleviate the non-random treatment problem (Reeb et al., 2012). This is done by recreating a pseudo-experimental environment in which the sample is split up into a control group (domestic companies) and one or more treatment groups (degree of multinationality) with the goal of achieving balance on all covariates (Spreeuwenberg et al., 2010). The method computes a propensity score for each observation based on selected pretreatment variables, indicating the probability of being assigned to each level of the treatment variable (Spreeuwenberg et al., 2010).

To analyze different doses of multinationality, we categorized the companies into five levels of multinationality using the quintiles of the distribution for FATA (excluding domestic companies, i.e. the reference group) (Abdi & Aulakh, 2018). To model the selection of the degree of multinationality, we integrated every available control variable into the GBM. Then, based on the propensity score, a weight for each observation was computed and integrated into the regression models. Propensity score weighting was chosen over matching, as propensity score matching can lead to problems with multiple treatment groups due to the difficulty of finding a balanced match for each observation.

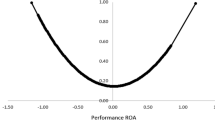

To assess the effectiveness of the propensity score correction, the propensity score covariate balance after the correction has to be analyzed. This is tested in Table 10 in the annex by comparing the absolute standardized mean difference (standardized effect size) of the covariates before and after the propensity score weighting (Burgette et al., 2020). The correction lowered the standardized effect size considerably for all covariates, with only net sales being above the 0.2 value commended by Burgette et al. (2020). The second step is to check the positivity assumption of propensity score correction. The positivity assumption states that each subject has to have a non-zero probability of being assigned to each treatment group. The results can be seen in Fig. 6. For subjects from all treatment groups, the propensity scores assigned to any other group are about 5 to 15 percent which is sufficient for the positivity assumption. The propensity score correction was also conducted based on FSTS as a treatment variable. The results were in line with the findings based on FATA.

4 Results

According to hypothesis 1, we assumed that the indirect impact of multinationality on performance via the economies of scale-channel is stronger and more positive than the direct impact of multinationality on performance. In Table 3, the empirical results of the regression models for scale and performance are exhibited. In Table 4, the respective direct and indirect conditional effects of multinationality on performance are shown. In the regression model, the impact of multinationality (FATA) on performance (ROE) turns out to be insignificant (Table 3, models 4–7). On the contrary, multinationality has a positive and significant effect on scale throughout the different model variations (Table 3, models 1–3). As the coefficient of determination proved to be much higher in the case of a quadratic function of multinationality, we decided to use this non-linear kind of relationship to explain scale. Scale, again, exerts a significant and positive effect on performance.

Further relevant insights concerning hypothesis 1 can be found in Table 4. There, the results from the Conditional Process Analysis are laid out: the direct effect of multinationality is always insignificant, whereas the indirect effect (via scale) always turns out to be positive and significant throughout all model variations (Table 4). Overall, the findings support our hypothesis that multinationality foremost has a positive effect on performance through the economies of scale channel.

In hypothesis 2, we assumed that the impact of multinationality on scale is reliant on the size of the MNC's home market in such a way that smaller home markets lead to a higher impact of multinationality on scale. The interaction term of multinationality and GDP turns out to be negative and significant (Table 3, model 2), indicating that the impact of multinationality on scale decreases with an increase in home market size. This finding is further corroborated by the fact that the conditional indirect effect of multinationality on performance tends to be lower with increasing home country market size (Table 4). In sum, we interpret our results as support of hypothesis 2.

For hypothesis 3, we compared the moderating impact of intangible assets on the relationship between scale and performance and the moderating impact of intangible assets on the relationship between multinationality and performance. In our regression, the interaction term of multinationality (FATA) and intangibles (MIA) turns out to be positive and significant (Table 3, model 5 and 7). However, the interaction term between scale (net sales) and intangible assets (MIA) is also significant and positive and turns out to be much more pronounced (Table 3, models 6 and 7). We compare the explanatory contribution of the different interaction terms based on Akaike's Information Criterion (AIC). A comparison of the performance models reveals that including the interaction term of FATA with MIA in the performance regression leads to an improvement of AIC of 27.9. However, including the interaction term of net sales with MIA instead leads to an improvement of AIC of 189.4, which appears to be much more pronounced. Including both interactions leads to an improvement of AIC of 209.2. All in all, we consider these results to support hypothesis 3.

5 Robustness Checks

In order to further substantiate our findings, we conducted several robustness checks. First, we substituted our measure of intangible assets MIA through the amount of intangible assets reported in the annual report per sales (IAS). In this case, the effect of FATA on ROE turns out to be positive and significant (Table 5). However, as Table 4 shows, when comparing the conditional direct effect of FATA on ROE and the conditional indirect effect, only the indirect effect is significant. Hence, hypothesis 1 is further supported. The interaction effect of FATA with GDP on net sales remains negative and significant (Table 5, model 2). Furthermore, the conditional indirect effect of FATA on ROE decreases with an increase in GDP (Table 6). Taken together, these findings can be considered as support of hypothesis 2. Finally, the interaction of FATA and IAS on ROE turns out to be insignificant, whereas the interaction term of net sales and IAS on ROE is positive and significant (Table 5). According to AIC, the model only including the interaction between net sales and intangible assets appears to be preferable (Table 5, models 4–7). This can be taken as further support for hypothesis 3.

Second, in order to further substantiate our results, we used the foreign sales ratio (FSTS) – by far the most common measure of multinationality (e.g., Nguyen, 2016) – as a benchmark measure for multinationality and return on assets (ROA) as an alternative measure of performance. We then compared our initial findings regarding the direct and indirect impact of multinationality on performance based on these alternative measures of multinationality and performance. In Table 7, the respective results are shown. In most cases, the direct effect of multinationality is insignificant – only in the case of using FSTS and ROA, the direct effect turns out to be positive and significant. On the other hand, the indirect effect is always positive and significant (in the case of FSTS and ROA, where the direct effect is also significant, the indirect effect is more than three times stronger). We interpret these results as further support for hypothesis 1.

We also checked the interaction effect of multinationality and intangible assets on performance by comparing it to the interaction effect of scale and intangible assets for different proxies of intangible assets and different proxies of performance (Table 8). Our results remain unchanged: the interaction effect of multinationality and intangible assets on performance is either insignificant or less pronounced than the (always significant) impact of scale and intangibles. We consider this as further support of hypothesis 3.

6 Discussion

In his seminal paper, Hennart (2007) questioned the efforts of forty years of MP-research by challenging the validity of the S-curve theory (Contractor et al., 2003; Lu & Beamish, 2004; Thomas & Eden, 2004) and by stating that there is no systematic positive impact of multinationality on performance apart from its scale enhancing effect. Although radical in its criticism and innovative with regard to its viewpoint, the propositions of Hennart have never been empirically tested up to now. According to our knowledge, we are the first to provide empirical support regarding these assumptions.

Our results tend to support the conjecture that the impact of multinationality on performance is relatively weak after controlling for the economies of scale effect. Multinationality seems to be primarily a possibility for firms to grow and thus realize economies of scale. Our research supports the argumentation of Hennart (2007) and challenges conventional MP-research (Contractor et al., 2003; Kirca et al., 2012; Lu & Beamish, 2004; Ruigrok et al., 2007). After controlling for the economies of scale-channel, the remaining direct impact of multinationality on performance vanishes. These findings are consistent with the argumentation of Hennart (2007), who doubts that multinationality should have a positive impact on performance apart from its impact on scale. They are supported by recent research from Abdi and Aulakh (2018), who plead for considering the mediating role of scale in MP-research.

Moreover, scholars like Hennart (2007) and Glaum and Oesterle (2007) claim that the (indirect) impact of multinationality on performance depends on the size of the home market. Our findings support this assumption. The smaller the firm's home market, the more critical is multinationality as a channel for increasing output. Therefore, our results provide an explanation for the differences regarding the MP-relationship of firms from different countries that have been found in many studies (Dittfeld, 2017; Elango & Sethi, 2007; Li & Yue, 2008; Marano et al., 2016; Yang & Driffield, 2012).

Our findings shed light on the role of intangible assets with regard to the relationship between multinationality, scale, and performance: They provide support for the positive interaction between intangible assets and scale, as firms in charge of high amounts of intangible assets seem to be able to generate higher increases in profitability through scale increases compared to firms with a lower amount of intangible assets. In short: intangible assets amplify the effect of scale on performance (Fig. 4).

In a way, our results provide empirical support for the IMT: Product markets appear to be sufficiently imperfect to generate super-normal profits for firms in charge of higher amounts of intangible assets. However, this leveraging effect of intangible assets has only insofar to do with multinationality as the latter may be a way to increase scale.

Our results are not apt to convincingly support the idea of intangible assets as amplifiers of a direct impact of multinationality on performance. They are in contradiction to extant findings regarding the interpretation of internalization theory followed by some IB scholars that multinationality combined with intangibles assets leads to a positive performance impact, an argument that traces back to Morck and Yeung (1991, 1992) and continues to be applied as an explanation of the MP-enigma until today (Kirca et al., 2011, 2016). However, our findings are in line with recent research from Berry and Kaul (2016), who could not provide empirical evidence of a significant performance impact of the interaction between intangible assets related to R&D and multinationality.

When it comes to exploiting intangible assets, it's not multinationality but simply size that matters. Multinationality can be a way of enhancing scale, and scale enhancements lead to performance improvements in exploiting intangible assets. However, multinationality itself does not seem to be the decisive lever that enhances the performance effect of intangible assets. Due to aspects like cultural distance and institutional voids after controlling for scale, multinationality itself may exert detrimental effects regarding the exploitation of intangible assets that may at least partially counteract the positive scale effects of expanding abroad.

Therefore, our results point to potential improvements regarding modelling the relationship between multinationality, performance, scale, and intangible assets. According to our findings, it is imperative to differentiate between the interaction of intangible assets and scale and the interaction of intangible assets and multinationality. Further research should pay attention to this in order to distinguish the different effects.

7 Theoretical Contribution, Managerial Implications, and Limitations

This contribution has been inspired by a provocative publication of Hennart (2007), published in MIR, in which he challenges important assumptions of traditional MP-research by arguing that there is no positive performance effect of multinationality except its scale enhancing effect. We aimed to contribute to an understanding of the complex nature of the relationship between multinationality, scale, and performance laid out in Hennart's paper (2007). We provide empirical evidence on the relevance of the indirect effect of multinationality via the economies of scale-channel. In our model, scale acts as a mediator between multinationality and performance. According to our findings, the effect of multinationality on performance primarily takes place via the economies of scale-channel. In this regard, our contribution works as a reminder for managers that multinationality is, first and foremost, an opportunity to increase output. Furthermore, our findings put scale as a variable more into the spotlight of attention. In the context of MP-research, scale should not just be treated as some kind of control but as an effect closely intertwined with multinationality. Hence, considering scale in regression models when considering the performance effects of multinationality seems inevitable. Nevertheless, our findings also show that it is essential to differentiate between the impact of scale and the impact of multinationality. An issue that has been mostly neglected in previous research.

Furthermore, our findings help to clarify the relationship between multinationality, scale, performance, and the moderating effect of intangible assets. We show that after controlling for the interaction between intangibles and scale, the interaction between intangible assets and multinationality tends to be relatively weak. In correspondence to Hennart's argument (2007), it is not multinationality that increases the value of intangible assets but scale. Transferring intangible assets across borders may be quite costly. Therefore, multinationality per se is not a decisive lever for intangible assets. Nevertheless, when internationalization goes along with scale enhancement, the net impact of intangible assets on performance may still be positive as the positive moderating impact between intangibles and scale appears to compensate for the weak or even negative moderating effect of intangibles and multinationality. Therefore, a certain amount of intangible assets given, multinationality in principle, can be beneficial as long as it provides sufficient scale enhancement.

On the other hand, our findings show that the benefits of a scale enhancing internationalization can be levered by increasing the value of intangible assets. Hence, managers considering internationalization as part of their strategy are well-advised to check the value of their firm's intangible resources and their international transferability. Moreover, the development of intangible resources could be a recommendable preliminary stage of the internationalization of a company in order to secure its success.

There is one caveat regarding the interpretation of our results. In our study, we have compared the impact of scale against a catchall of all other effects of multinationality. As the aggregate effect of this catchall did not consistently show significance in our models, we interpreted this as empirical support that there is no positive effect of multinationality besides the scale induced performance impact. However, as we did not isolate other effects of multinationality, we are not able to completely rule out the possibility that countervailing effects of multinationality level each other off. In particular, these concerns relate to the geographic economies of scope. Due to a lack of data availability concerning the geographic scope of the companies in our sample, we were not able to measure the impact of geographical scope on the relationship between multinationality, scale and performance. Since the turn of the millennium, more and more MNCs from different countries are disclosing their worldwide activities differentiated by regional segments. Using regional segment information may be a promising avenue in analyzing the role of economies of scope for the MP relationship in the future. However, since the formation of regional segments is subject to company-specific considerations and is therefore highly idiosyncratic, the comparability of data between different companies still appears to be a not entirely unproblematic issue.

Another limitation regards the measurement of scale. We employ deflated sales in million US$ as a proxy for scale. However, changes of this measure may not fully reflect changes in scale due to distortions caused by exchange rate changes or changes in idiosyncratic firm-specific prices. Identifying a better measure for scale should be a challenge for future studies in this area.

A further limitation concerns the sample of our study. We included firms from the world’s leading developed economies. Therefore, it is questionable whether our findings are transferable to emerging market multinationals. The relationship between multinationality, scale and performance for emerging market multinationals is a topic to be addressed in future research.

Another point of limitation regards our focus on a firm's internationalization in output markets. Internationalization processes can also be driven by the motivation to receive access to input factors such as natural resources or labor force in foreign markets (e.g., relocation of production plants). We did not explicitly analyze the performance impact of these kinds of internationalization activities.

Even if the performance impact of multinationality results from scale economies (as we interpret our findings), we would still expect sectoral differences to exist. In our sample, a wide variety of industrial sectors are included in order to find a rather general relationship. Distinguishing between more fine-grained sectoral differences might shed more light on the relationship between multinationality, scale effects and performance. To identify the significance of these differences is undoubtedly a concern that needs to be addressed in studies to come.

Notes

The term output is defined as the quantity of products and/or services that are transferred (in economic terms) by a company to its customers within a specified time interval.

The classical step-wise approach to mediation by Baron and Kenny (1986) was dismissed, as several valid critiques have accumulated over time.

References

Abdi, M., & Aulakh, P. S. (2018). Internationalization and performance: Degree, duration, and scale of operations. Journal of International Business Studies, 49(7), 832–857. https://doi.org/10.1057/s41267-018-0146-8

Allen, L., & Pantzalis, C. (1996). Valuation of the operating flexibility of multinational corporations. Journal of International Business Studies, 27(4), 633–653. https://doi.org/10.1057/palgrave.jibs.8490147

Baron, R. M., & Kenny, D. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization-performance relationship: Evidence from meta-analysis. Management International Review, 47(3), 319–347. https://doi.org/10.1007/s11575-007-0019-z

Berry, H., & Kaul, A. (2016). Replicating the multinationality-performance relationship: Is there an S-curve? Strategic Management Journal, 37(11), 2275–2290. https://doi.org/10.1002/smj.2567

Bodnar, G. M., Tang, C., & Weintrop, J. (2003). The value of corporate international diversification. Working paper. Johns Hopkins University. Baltimore. MD.

Bowen, H. P. (2007). The empirics of multinationality and performance. In A.M. Rugman (Ed.), Regional aspects of multinationality and performance. Bingley: Emerald Group Publishing Limited, 113–142. https://doi.org/10.1016/S1064-4857(07)13006-0

Buckley, P. J., & Casson, M. C. (1976). The future of the multinational enterprise. Macmillan. https://doi.org/10.1007/978-1-349-21204-0

Burgette, L. F., Griffin, B. A., & McCaffrey, D. (2020). Propensity scores for multiple treatments: A tutorial for the mnps function in the twang package. Retrieved January 17, 2021 from https://cran.r-project.org/web/packages/twang/vignettes/mnps.pdf

Capar, N., & Kotabe, M. (2003). The relationship between international diversification and performance in service firms. Journal of International Business Studies, 34(4), 345–355. https://doi.org/10.1057/palgrave.jibs.8400036

Cefalu, M., Ridgeway, G., McCaffrey, D, Morral, A., Griffin, B. A., & Burgette, L. (2021). Twang: Toolkit for weighting and analysis of nonequivalent groups. Retrieved August 23, 2021, from https://CRAN.R-project.org/package=twang

Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s Q. Financial Management, 23(3), 70–94. https://doi.org/10.2307/3665623

Click, R. W., & Harrison, P. (2000). Does multinationality matter? Evidence of value destruction in U.S. multinational corporations. Working Paper, Federal Reserve Board.

Contractor, F. J., Kundu, S. K., & Hsu, C. (2003). A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34(1), 5–18. https://doi.org/10.1057/palgrave.jibs.8400003

Contractor, F. J. (2012). Why do multinational firms exist? A theory note about the effect of multinational expansion on performance and recent methodological critiques. Global Strategy Journal, 2(4), 318–331. https://doi.org/10.1111/j.2042-5805.2012.01045.x

Dastidar, P. (2009). International corporate diversification and performance: Does firm self-selection matter? Journal of International Business Studies, 40(1), 71–85. https://doi.org/10.1057/palgrave.jibs.2008.57

Dittfeld, M. (2017). Multinationality and performance: A context-specific analysis for German firms. Management International Review, 57(1), 1–35. https://doi.org/10.1007/s11575-016-0286-7

Eckert, S., Dittfeld, M., Muche, T., & Rässler, S. (2010). Does multinationality lead to value enhancement? An empirical examination of publicly listed corporations from Germany. International Business Review, 19(6), 562–574. https://doi.org/10.1016/j.ibusrev.2010.04.001

Elango, B., & Sethi, S. P. (2007). An exploration of the relationship between country of origin (COE) and the internationalization-performance paradigm. Management International Review, 47(3), 369–392. https://doi.org/10.1007/s11575-007-0021-5

Fisch, J. H., & Zschoche, M. (2011). The effects of liabilities of foreignness, economies of scale, and multinationality on firm performance—an information cost view. Schmalenbach Business Review, 63(3), 51–68. https://doi.org/10.1007/BF03396831

Glaum, M., & Oesterle, M.-J. (2007). 40 years of research on internationalization and firm performance: More questions than answers? Management International Review, 47(3), 307–317. https://doi.org/10.1007/s11575-007-0018-0

Hayes, A. F. (2018). Introduction to mediation, moderation and Conditional Process Analysis. A regression-based approach. New York: The Guilford Press.

Hennart, J. F. (2007). The theoretical rationale for a multinationality-performance relationship. Management International Review, 47(3), 423–452. https://doi.org/10.1007/s11575-007-0023-3

Hennart, J. F. (2011). A theoretical assessment of the empirical literature on the impact of multinationality on performance. Global Strategy Journal, 1(1–2), 135–151. https://doi.org/10.1002/gsj.8

Hirschey, M. (1985). Market structure and market value. Journal of Business, 58(1), 89–98.

Hitt, M. A., Hoskisson, R. E., & Kim, H. (1997). International diversification: Effects on innovation and firm performance in product diversified firms. Academy of Management Journal, 40(4), 767–798.

Hymer, S. H. (1976). The international operations of national firms, a study of direct foreign investment. MIT Press.

IMF (2019). World Economic Outlook Database. Retrieved July 30, 2020, from https://www.imf.org/external/pubs/ft/weo/2019/02/weodata/index.aspx.

Kim, H., Wu, J., Schuler, D. A., & Hoskisson, R. E. (2020). Chinese multinationals’ fast internationalization: Financial performance advantage in one region, disadvantage in another. Journal of International Business Studies, 51(7), 1076–1106. https://doi.org/10.1057/s41267-019-00279-9

Kirca, A. H., Hult, G. T., Roth, K., Cavusgil, S. T., Perryy, M., Akdeniz, M. B., Deligonul, S., Mena, J. A., Pollitte, W. A., Hoppner, J. J., Miller, J. C., & White, R. C. (2011). Firm-specific assets, multinationality, and financial performance: A meta-analytic review and theoretical integration. Academy of Management, 54(1), 47–72. https://doi.org/10.5465/amj.2011.59215090

Kirca, A. H., Roth, K., Hult, G. T. M., & Cavusgil, S. T. (2012). The role of context in the multinationality-performance relationship: A meta-analytic review. Global Strategy Journal, 2(2), 108–121. https://doi.org/10.1002/gsj.1032

Kirca, A. H., Fernandez, W. D., & Kundu, S. K. (2016). An empirical analysis and extension of internalization theory in emerging markets: The role of firm-specific assets and asset dispersion in the multinationality-performance relationship. Journal of World Business, 51(4), 628–640. https://doi.org/10.1016/j.jwb.2016.03.003

Kogut, B. (1985). Designing global Strategies: Comparative and competitive value-added chains. Sloan Management Review, 26(4), 15–28.

Kotabe, M., Srinivasan, S., & Aulakh, S. P. (2002). Multinationality and firm performance: The moderating role of R&D and marketing capabilities. Journal of International Business Studies, 33(1), 79–97. https://doi.org/10.1057/palgrave.jibs.8491006

Lee, S. H., & Makhija, M. (2009). The effect of domestic uncertainty on the real options value of international investments. Journal of International Business Studies, 40(3), 405–420. https://doi.org/10.1057/jibs.2008.79

Li, J., & Yue, D. (2008). Market size, legal institutions, and international diversification strategies: Implications for the performance of multinational firms. Management International Review, 48(6), 667–688. https://doi.org/10.1007/s11575-008-0102-0

Lu, J. W., & Beamish, P. W. (2004). International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal, 47(4), 598–609. https://doi.org/10.2307/20159604

Marano, V., Arregle, J. L., Hitt, M. A., Spadafora, E., & van Essen, M. (2016). Home country institutions and the internationalization-performance relationship: A meta-analytic review. Journal of Management, 42(5), 1075–1110. https://doi.org/10.1177/0149206315624963

McCaffrey, D., Griffin, B. A., Almirall, D., Slaughter, M. E., Ramchand, R., & Burgette, L. F. (2013). A tutorial on propensity score estimation for multiple treatments using generalized boosted models. Statistics in Medicine, 32(19), 3388–3414. https://doi.org/10.1002/sim.5753

Morck, R., & Yeung, B. (1991). Why investors value multinationality? The Journal of Business, 64(2), 165–187. https://doi.org/10.1086/296532

Morck, R., & Yeung, B. (1992). Internalization: An event study test. Journal of International Economics, 63(2), 41–56. https://doi.org/10.1016/0022-1996(92)90049-P

Nguyen, Q. T. K. (2016). Multinationality and performance literature: A critical review and future research agenda. Management International Review, 57(3), 311–347. https://doi.org/10.1007/s11575-016-0290-y

Nguyen, Q. T. K., & Kim, S. (2020). The multinationality and performance relationship: Revisiting the literature and exploring the implications. International Business Review, 29(2), 1–15. https://doi.org/10.1016/j.ibusrev.2020.101670

OECD (2020). Producer price indices (PPI). Retrieved July 30, 2020, from https://data.oecd.org/price/producer-price-indices-ppi.htm

Oesterle, M. J., & Richta, H. N. (2013). Internationalisation and firm performance: State of empirical research efforts and need for improved approaches. European Journal of International Management, 7(2), 204–224. https://doi.org/10.1504/EJIM.2013.052834

Pantzalis, C. (2001). Does location matter? An empirical analysis of geographic scope and MNC market valuation. Journal of International Business Studies, 32(1), 133–155. https://doi.org/10.1057/palgrave.jibs.8490942

Pisani, N., Garcia-Bernardo, J., & Heemskerk, E. (2020). Does it pay to be a multinational? A large-sample, cross-national replication assessing the multinationality-performance relationship. Strategic Management Journal, 41(1), 152–172. https://doi.org/10.1002/smj.3087

Reeb, D., Sakakibara, M., & Mahmood, I. P. (2012). From the editors: Endogeneity in international business research. Journal of International Business Studies, 43(2), 211–218. https://doi.org/10.1057/jibs.2011.60

Reuber, R. A., Tippmann, E., & Monaghan, S. (2021). Global scaling as a logic of multinationalization. Journal of International Business Studies, 52(6), 1031–1046. https://doi.org/10.1057/s41267-021-00417-2

Richter, N. F. (2014). Information costs in international business: Analyzing the effects of economies of scale, cultural diversity and decentralization. Management International Review, 54(2), 171–193. https://doi.org/10.1007/s11575-013-0187-y

Rugman, A. M. (1976). Risk reduction by international diversification. Journal of International Business Studies, 7(2), 75–80. https://doi.org/10.1057/palgrave.jibs.8490702

Ruigrok, W., Amann, W., & Wagner, H. (2007). The internationalization-performance relationship at Swiss firms: A test of the S-shape and extreme degrees of internationalization. Management International Review, 47(3), 349–368. https://doi.org/10.1007/s11575-007-0020-6

Spreeuwenberg, M., Bartak, A., Croon, M., Hagenaars, J., Busschbach, J., Andrea, H., Twisk, J., & Stijnen, T. (2010). The multiple propensity score as control for bias in the comparison of more than two treatment arms: An introduction from a case study in mental health. Medical Care, 48(2), 166–174. https://doi.org/10.1097/MLR.0b013e3181c1328f

Thomas, D. E., & Eden, L. (2004). What is the shape of the multinationality–performance relationship? Multinational Business Review, 12(1), 89–110. https://doi.org/10.1108/1525383X200400005

Yang, Y., & Driffield, N. (2012). Multinationality-performance relationship: A meta-analysis. Management International Review, 52(1), 23–47. https://doi.org/10.1007/s11575-011-0095-y

Zaheer, S. (1995). Overcoming the liability of foreignness. Academy of Management Journal, 38(2), 341–363.

Zaheer, S., & Mosakowski, E. (1997). The dynamics of the liability of foreignness: A global study of survival in financial services. Strategic Management Journal, 18(6), 439–463. https://doi.org/10.1002/(SICI)1097-0266(199706)18:6%3c439::AID-SMJ884%3e3.0.CO;2-Y

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Figs. 5, 6 and Tables 5, 6, 7, 8, 9 , 10

Visualization of balance before and after weighting (see Table 10)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Eckert, S., Koppe, M., Burkatzki, E. et al. Economies of Scale: The Rationale Behind the Multinationality-Performance Enigma. Manag Int Rev 62, 681–710 (2022). https://doi.org/10.1007/s11575-022-00473-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11575-022-00473-2