Abstract

This study examines the dynamic causality between the carbon emission market and the clean energy market, using an information flow-based, quantitative Liang causality analysis which is firmly grounded on physics and derived from first principles. The dynamic causal relationships between European Union Allowance (EUA) prices and clean energy index allow us to explore whether the causality in return or in variance from CO2 emission allowances to the clean energy index is time-varying. The results show that the causal relationships in return and in variance between EUA and Clean Energy Index (CEI) are drastically time-varying. For the causality in return, a significant unidirectional long-term and stable causality from CEI to EUA is identified after March 2020. For that in variance, a bidirectional causality is found after March 2020, but values after 2020 are opposite to those in return. It seems when fluctuations in the clean energy market are low, the clean energy market has a weak causal effect on the carbon emission market but when volatility in the clean energy market is increasing, causalities between the two markets are significantly strengthened. These results obtained through this rigorous causality analysis can serve as a reference for academics, market participants, and policymakers to understand the underlying links between EUA prices and clean energy index.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Extreme weather caused a fire in Australia that lasted for one half of a year; torrential rain battered central China’s Zhengzhou City and killed dozens of people; and the worst drought in the past 67 years is ongoing in Taiwan. These disastrous weather and climate phenomena are frequenting our daily lives and incurring huge losses to the economy and human life around the world. Climate change has become an issue that needs urgent societal attention and continuing efforts need to be invested to provide remedial solutions, so as to accomplish a sustainable, low-carbon lifestyle (Hammoudeh et al. 2020). The global greenhouse gas (GHG) emissions from human activities such as burning fossil energy sources, deforestation, and land clearing for agriculture are recognized as the most remarkable driver of the observed climate change events since the mid-twentieth century (IPCC (Intergovernmental Panel on Climate Change) 2013). The potential solution to mitigate climate change is to reduce expenditure and to increase revenue to reach the global climate neutrality—an economy with net-zero GHG emissions (Fawzy et al. 2020). The so-called reduce expenditure is to cut down carbon dioxide emissions by combining economic means with administrative means, while the so-called increase revenue means to vigorously develop the environment-friendly clean or renewable energy sources to alleviate the damage to the environment due to consumption of the traditional fossil energies.

Under the cap and trade principle, the European Union Emissions Trading System (EU ETS), as a financial instrument and emission control mechanism, is significantly effective in curbing GHG emissions and beneficial to combat climate change (Bayer and Aklin 2020; Wen et al. 2020a, b). As the first and biggest CO2 emission trading scheme worldwide, it has been the flagship of EU energy policy initiative to achieve its climate targets under the Kyoto Protocol, such as the intermediate target of at least 55% net reduction in GHG emissions in the EU by 2030 compared to 1990 and the long-term target of climate neutrality in the EU by 2050. This scheme results in that the energy-consuming installations are regulated in accordance with the annex of 2003/87/EC Directive, making them pay for the consequences of their emitting activities by integrating a price for carbon dioxide emissions into their investment and operational strategies (Keppler and Mansanet-Bataller 2010). The EU ETS facilitates the trade-in allowances, viz., the European Union Allowances (EUAs), within a certain period, between individual companies or installations. The emission allowance means the climate credit (or carbon credit), giving the holder the right to emit one ton of CO2 equivalent during a specified period. The total number of EUAs is limited under the cap and trade principle, and therefore can encourage companies participating in the scheme to trade future expected emissions to optimize compliance over their entire planning horizon. Furthermore, it is helpful for the EU to pursue ambitious emission reduction targets.

The correlation between carbon emission and energy markets has been enhanced under the EU ETS by motivating installations or companies to reduce consumption of traditional fossil energies and improve investment in environment-friendly clean energies. Thus, the scheme has emerged as one of the most important measures for reduction of GHG emission (Ji et al. 2018). Since its launch in 2005, there have been a large body of recent works that have grown exponentially, highlighting the growing interest in the EUA on the EU ETS to encourage GHG reduction and decarbonization of economic actors (Hu et al. 2015; Bayer and Aklin 2020). Actually, by having high liquidity and analogous characteristics of financial assets, EUA has become an attractive investment instrument that is capable of continuous contribution to the realization of a low-carbon lifestyle. European carbon allowance prices have languished in the single digits for years, but not any longer. The price for carbon allowances on the EU ETS has surged by 60% this year, recently crossing the €50-per-ton threshold for the first time. The rally marks a dramatic reversal from just a couple of years ago: EUA sold for less than €10 a ton as recently as in 2018. The higher prices of EUA will accelerate innovations of low-carbon energies that are needed for the European Union to achieve climate neutrality by 2050 and to impose a more important influence on the clean or renewable energy market. Subsequently, as governments around the world are accelerating the transition to low-carbon economies and mitigating climate change risk, clean energy market is becoming a greater focus for global market participants (Hammoudeh et al. 2014; Teixidó et al. 2019; Wen et al. 2020a, b; Hanif et al. 2021). EUA and clean energy innovations share the common goal of mitigating global warming and fighting against climate change by reducing GHG emission.

From a financial point of view, carbon emission and clean energy markets are collectively receiving close attention from market participants concerned about climate change and environment improvements. Naturally, price information of the two markets influences each other. For these reasons, investigating the underlying information transmission between the EUA prices and clean energy stock prices can provide significant reference for economic actors making decisions on decarbonization and clean energy development. There have been abundant investigations of information transmission between the two price series. These can be roughly classified into three categories. First, the causality between carbon emission market and clean energy market is explored by using the traditional econometric models, e.g., Granger causality test and its variants, vector autoregressive (VAR) analysis, and multiple linear regression model (Fezzi and Bunn 2009; Nazifi and Milunovich 2010; Kumar et al. 2012; Zhu and Kong 2016; Dutta et al. 2018; Adams and Acheampong 2019; Chang et al. 2020; Hammoudeh et al. 2020). Second, the dependence and spillovers between the two markets are studied according to correlation analysis and/or spillover index, such as dependence based on copulas by Gronwald et al. (2011) and Chevallier et al. (2019); Diebold and Yilmaz (DY) spillover index by Wang and Guo (2018) and Ji et al. (2018); Baruník and Křehlík (BK) spillover index by Hanif et al. (2021); BEKK model by Mansanet-Bataller and Soriano (2009) and Chen et al. (2019); and DCC-Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) model by Balcilar et al. (2016) and Gargallo et al. (2021), among others. In the third category, the information transmission between carbon emission market and clean energy market is examined using transfer entropy (Gao et al. 2020; Hung 2021). Although mixed results have been reported in literature, due to the different data and methodologies used, the general agreement has been that carbon emission market and clean energy market are related, constituting a complex system.

Although previous empirical researches have provided an important reference for comprehending the information transmission between markets of carbon emissions and clean energies, the dynamic causality between the price of EUA and the index of clean energy stocks remains elusive and has rarely been investigated using information flow analysis, a natural tool for understanding information transmission. Information flow (or information transfer as it may appear in the literature) is a fundamental physics concept which is logically associated with causality: while a causal relation entails a flow of information, the latter provides a measure of the strength of entailing causality (Liang and Kleeman 2005; Pereda et al 2005) and has been successful in many applications and generalized to multivariate data and nonlinear time series causal analysis (Kyrtsou et al 2019; Li and Liu 2019; Liang 2019; Zhang et al 2022). Recently, causality in terms of information flow has been realized as a real physical notion that can be rigorously formulated from first principles (Liang 2008, 2016). This is in contrast to the traditional axiomatically proposed methods. Because market participants, who are concerned about climate change and environment improvements, pay close attention to the carbon emission market as well as the clean energy market from the perspective of financial investment, it is understandable that the information flow between the prices of the two markets is important for them to make reasonable investment decisions. It is hence intriguing to use this more sophisticated theory and the subsequent analysis tools to explore the causality between the price of EUA and the index of clean energy stocks. It merits mentioning that this causality analysis can be easily and very efficiently fulfilled with time series in a quantitative sense (Liang 2014, 2021). Since its advent, many applications have been carried out with remarkable success for diverse problems in different disciplines, such as global warming vs. CO2 emissions, weather pattern formation, ocean eddy shedding, brain’s neural networks, financial markets, and so on (Liang 2015, 2016, 2019; Stips et al. 2016; Lu et al. 2020; Tao et al. 2021).

In addition, studies in recent literature further show that as information transmission between stock markets increases, an unpredictable event in one market causes changes in not only return but also volatility (or variance) in other markets (Balcilar et al. 2021). As documented in Pantelidis and Pittis (2004), causality between two variables can be divided into two types: one is causality in return; the other is causality in variance. Furthermore, all causality-in-return influences should be extracted from some parametric model before the causality in variance is examined. It is therefore tempting to employ the aforementioned rigorously formulated information flow and causality analysis to gain a reliable and deeper understanding of the fundamental process of information transmission, both in return and in variance or volatility, between EUA prices and clean energy index. This can provide leverage for participants in financial markets to construct better portfolios and hedging strategies and for policymakers at macro- as well as microlevel to take decisions about carbon emission, clean energy innovations, and risk management.

Also, it is worth noting that the hypothesis invoked in these researches with a conventional method that the causality between different financial variables is constant over a sample period is usually rejected (Hammoudeh et al. 2020). Thus, it is necessary to take into account the dynamic causality between EUA prices and clean energy index to figure out how the underlying information transmission between the two series changes over time. In this context, this paper aims to examine whether the causality in return and in variance from the EUA prices to the clean energy index is significantly time-varying, or vice versa. This will be important for price prediction, portfolio optimization, and risk management. Methodologically, unlike previous studies in the literature, this study employs a novel time-varying causality approach with a running window algorithm developed by Liang (2014) based on the rigorously established information flow (Liang 2016) to investigate whether the bidirectional causalities in return and in variance between EUA prices and clean energy index could change over the study period and then exhibit a different dynamic feature.

In comparison with existing studies, the potential contribution of this study is twofold. On one hand, the dynamic causalities in return and in variance between prices of EUAs and clean energy index are investigated. Specifically speaking, the time-varying significant causalities in return and in variance are examined. Significant causal relationships are detected at certain intervals in the whole sample period: a significant unidirectional long-term and stable causality in return from the clean energy index to EUA prices exists after March 2020. But the causality in variance between the two shows a different scenario; there exists a sporadic causality in variance before February 2020, and a bidirectional stable causality in variance after 2020, but the sign of the causality is opposite to that of causality in return. (A positive/negative sign in Liang’s formalism corresponds to the excitatory/inhibitory mechanism of the information flow within a neural network. This property is not seen in the traditional methods.) The significant causalities in return and in variance can improve the predictive powers of the clean energy market on the carbon emission market, and vice versa. This helps market participants to better adjust their decisions and allocate funds to appropriate portfolios.

On the other hand, a novel time-varying causality analysis with a rolling window algorithm developed by Liang (2014, 2016) is employed to examine the causal information transmission between EUA prices and clean energy index. As mentioned above, the resulting causality is not only quantitative, but it can also be further differentiated with a positive or negative sign, which is not the case in the traditional methods. It hence facilitates the revealing of more fundamental characteristics of the influence of carbon emission market on clean energy market. Our results show that EUA prices exhibit a negative causality in variance after March 2020, while the clean energy index has the opposite causality in return and in variance after March 2020. The causality between the two series is more significant as the increase of EUA prices and the clean energy index, which might imply that the turmoil in market situation strengthens the interaction between the carbon emission and clean energy markets. These results will make important references for academics, market participants, and policymakers to understand the underlying linkages between EUA prices and clean energy index. For example, financial investors can use these findings to obtain better risk-adjusted returns from their well-diversified portfolios, and to improve the portfolio performance, while policymakers could adopt effective measures to properly promote prices of the EUA so that the carbon emission allowance market can provide stimuli to shift from the traditional fossil resources to renewable energy resources.

The rest of this study is organized as follows. The “Literature review” section briefly reviews the related literature. The “Materials and methods” section depicts the data used in our empirical research and introduces the theoretical methods. The “Results” section presents and discusses the obtained results. Finally, the “Conclusion” section closes this study with general conclusions.

Literature review

It is widely accepted that CO2 emission allowance prices are correlated with energy prices, especially clean energy prices, but it is not clear whether the carbon emission market has a significant influence on the clean energy market. The traditional econometric models have been extensively used to explore the potential causality between the two markets. For instance, Hammoudeh et al. (2020) examine the real-time Granger causality between green bonds and CO2 emission allowances, and find that CO2 emission allowance price Granger causes green bond prices unidirectionally. Chang et al. (2020) find that the significant causalities are unidirectional from the stock markets to CO2 emission market, but not the other way around. Adams and Acheampong (2019) examine the impact of clean energy on carbon emissions using a multiple linear regression model and report that the use of clean energy reduces carbon emissions. Dutta et al. (2018) use the bivariate VAR-GARCH model to investigate the correlations of the return and volatility between CO2 allowances and renewable energy prices, and document that fluctuations in returns of EUA positively affect returns of clean energy stocks. Zhu and Kong (2016) analyze, using a VAR model, the correlation between the stock prices of companies related to low-carbon economy and prices of carbon emission allowances; they reveal a positive influence of Shenzhen carbon emission prices on prices of stocks of companies of low-carbon economy. Kumar et al. (2012) investigate the dependence between renewable energy companies’ stocks and carbon markets with VAR model and find it insignificant. Nazifi and Milunovich (2010) explore the causalities between the EU carbon allowance and natural gas, which is often viewed as a clean energy alternative, using the Granger causality test, and find no long-run relationship between them. Fezzi and Bunn (2009) measure the structural interactions of electricity, natural gas, and carbon prices applying a structural, co-integrated VECM model and report a bidirectional interaction between natural gas prices and carbon emission allowance prices in phase I of the EU ETS. Mansanet-Bataller et al. (2007) highlight positive impacts of natural gas on EUA forward in phase I of the EU ETS using a multiple linear regression model. Zhao et al. (2020) investigate the nonlinear Granger causality in China’s carbon emission trading markets by using the Hiemstra and Jones test and Diks and Panchenko test; they demonstrate a significant bidirectional nonlinear Granger cause in China’s major carbon emission trading markets.

In addition, the conditional vine copula is used to study the relationship between the carbon emission market and energy markets, including natural gas, coal, and electricity; a weak and negative correlation between carbon prices and natural gas prices is found (Chevallier et al. 2019). Also, different copulas are applied to explore the complex dependence structure between EUA futures and natural gas futures, and a positive dependence structure between them is discovered (Gronwald et al. 2011). Hanif et al. (2021) examine the spillovers between the prices of EUA and the indices of clean energies by using the BK spillover index and find a dominance of short-run spillovers between the two series over their long-run counterpart. Wang and Guo (2018) and Ji et al. (2018) investigate the spillovers between the carbon emission and energy markets using the DY spillover index and reveal that the dynamic spillover effects between the carbon and natural gas/clean energy markets exist. Chen et al. (2019) and Mansanet-Bataller and Soriano (2009) explore the volatility transmission in the carbon emission and energy markets with a BEKK model and show a positive correlation between the EUA and natural gas. Gargallo et al. (2021) use the DCC-GARCH model to analyze the co-movements between the carbon emission and energy markets, and find bidirectional spillover effects between EUA and natural gas. Similarly, Balcilar et al. (2016) detect the risk spillovers between prices of energy futures and Europe-based carbon futures with the DCC-GARCH model and find dynamic risk transmission from energy markets, including natural gas, to the carbon market.

Since “information transmission” is essentially about the flow of information, a few researchers have adopted the concept of information flow to examine whether carbon emission information is transmitted to the clean energy market. Their attempt is to approximate the “information flow” to the real physical notion using some empirical measures. For instance, Hung (2021) investigates with transfer entropy the causal association between green bonds and clean energy/CO2 emission allowances and finds a unidirectional connection from green bonds to the prices of CO2 emission allowances. Gao et al. (2020) studied the “information flows” from the CO2 emission market to the renewable energy stock market and highlight that EUA price “information flows” to the S&P GCE clean energy prices vary at different scales.

It merits mentioning that as of today, the important concept of information flow has been rigorously derived from the first principles. This forms our motivation to reconsider the above problem based on this newly established systematic theory. Besides, the aforementioned studies have allowed for influence of the carbon emission market on the clean energy markets, while the dynamic causality in return and in variance between the prices of EUA and the index of clean energies remains unexplored. For these reasons, this study extends the related literature.

Materials and methods

Data

The main variables considered in this paper are the S&P GSCI Carbon Emission Allowances (EUA) and the S&P Global Clean Energy Index (CEI), which are obtained from S&P Global (https://www.spglobal.com/en/). The S&P GSCI EUA closely tracks the trend of actual EU ETS permit prices, which is the most influential carbon trading asset in the world. More importantly, it provides market participants with a reliable and publicly available investment performance benchmark for European Carbon Emission Allowances and facilitates them to express a specific view on the price of carbon, or combine carbon emissions with other assets to create low-carbon strategies while promoting the transition to the global climate neutrality. Thus, it can be an appropriate proxy of the global carbon emission market quotations. The S&P Global Clean Energy Index is designed to measure the performance of top companies in global clean energy-related businesses from both developed and emerging markets which broadens the financial instruments available to market participants concerned about climate change and environment improvements. As of March 2022, market cap of European companies accounts for 52.45% of the total market cap of the S&P Global CEI. Because it tracks the largest and most liquid stocks worldwide which are involved in clean energy business, we follow the majority of the recent literature (Asl et al. 2021; Dawar et al. 2021; Liu et al. 2021) and use it as an appropriate proxy of the global clean energy market quotations. Allowing for 57% of the total amount of the general carbon emission allowances auctioned in phase III (2013–2020) and phase IV (2021–2030), which are different from the previous two phases (https://ec.europa.eu/clima/policies/ets/auctioning_en#tab-0-0), the start date of the analyzed period is 2 January 2013, the beginning of the third phase of the EU ETS. Because the fourth phase has just begun, and has adopted a new and revised legislative proposal of the EU ETS, which sets a binding EU target of a net GHG reduction by at least 55% by 2030, and aims to strengthen the EU ETS as an investment driver by increasing the pace of annual reductions in carbon emission allowances to 2.2% from 2021 onwards compared to 1.74% previously, the ending date of the analyzed period is 31 December 2020, the end of the third phase of the EU ETS. After matching the timestamps of both time series, a total of 2016 daily observations are included in the sample period.

We denote \({R}_{t}^{EUA}=\mathrm{log}\left({P}_{t}^{EUA}\right)-\mathrm{log}\left({P}_{t-1}^{EUA}\right)\) and \(R_{t}^{CEI} = \log \left( {P_{t}^{CEI} } \right) - \log \left( {P_{t - 1}^{CEI} } \right)\) as the log returns of EUA and CEI, respectively, where \(P^{EUA}\) and \(P^{CEI}\) are the prices of EUA and CEI. The descriptive statistics of the data are provided in Table 1.

As shown in Table 1, log returns of the EUA have a higher average value than the clean energy index, meaning that the carbon emission market is more favorable for financial participants, while the standard deviation of the former is larger than that of the latter, indicating that the carbon emission market is more volatile. The two log return series are skewed to the left and show high excess kurtosis, indicating that they have non-normal distribution. The Jarque–Bera (JB) statistics also indicate a significant absence of normality for log returns of EUA and CEI. The augmented Dickey-Fuller (ADF) tests for the two log return series undoubtedly reject the null hypothesis of having the unit root at a 1% significance level, indicating that they are stationary and turn out to be integrated in the same order of 0 lag. Therefore, analysis of the causality between the EUA and CEI can be conducted. The statistics of Ljung-Box test are significant and show the existence of serial correlation. Further, the LM ARCH test significantly rejects the null of homoscedasticity at a 1% significance level, implying that the heteroscedastic model, i.e., Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) model (Bollerslev 1986), is suitable to capture their conditional variances.

Figure 1 shows that lower market fluctuations in EUA prices are observed from 2013 to 2018. Then the latest reforms on the withdrawal of excess supply of carbon emission allowances caused a significant rebound in the price. EUA prices soared after that until the beginning of 2020, when the COVID-19 pandemic caused stagnation in global production and some concern and uncertainty in the recovery of certain key sectors in energy demand, leading to a turmoil in financial markets. After that, EUA prices follow a rising trend as the economy picks up. The evolution of the CEI prices is similar to that of the EUA, although a relatively steady movement is displayed from 2013 to the beginning of 2020. It seems that the increase of the EUA prices encourages production and use of clean energies, and further exerts a more important influence on stock prices of clean energy companies. Log returns of both EUA and CEI show stationarity and obvious volatility clustering. The log returns of the EUA are clearly more volatile from the beginning of the sample period until the middle of 2014 than those of the CEI. In addition, high volatility of EUA and CEI is observed during the outbreak of the COVID-19 pandemic.

Methodology

To examine the dynamic causal relationship in return and in variance between CO2 emission allowance prices and the clean energy index, we follow the recently developed causality analysis with a rolling window algorithm developed by Liang (2014, 2016). In order to fit the autoregression and conditional variances of log returns of EUA and CEI, the autoregression with the GJR-GARCH (ARMA-GJR-GARCH) model introduced by Glosten et al. (1993) is employed. This is one of the most popular models ever proposed to represent conditional heteroscedasticity with volatility clustering and leverage effect in financial markets.

The rigorously derived quantitative causality analysis

Causal inference is of central importance for researchers in various disciplines. Recently, in terms of information flow, Liang (2008, 2014, 2016) found that causality is actually a real physical notion (not just something in statistics) which can be rigorously derived from first principles, initially motivated by a discovery in a two-dimensional dynamic system (Liang and Kleeman 2005). Because of the formalism ab initio, it is universally applicable, quite different from other empirical/half-empirical formalisms. In the following, a brief introduction of the part pertaining to this study is presented.

Consider a stochastic dynamic system

where \({\mathbf{X}}\) and \({\mathbf{F}}\) are n-dimensional vectors, \({\mathbf{B}}\) is a perturbation coefficient matrix with n rows and m columns, and \({\mathbf{W}}\) is a standard Wiener process vector with m elements. Throughout the paper, \({\mathbf{F}}\) and \({\mathbf{B}}\) are supposed to be differentiable in \({\mathbf{X}}\) and time t. The rate of information flowing (RIF) from \(X_{j}\) to \(X_{i}\) (in nats per unit time) proves to be (Liang 2016)

where \(E\) denotes mathematical expectation, and \(\rho_{i} = \rho_{i} (x_{i} )\) and \(\rho_{{\tilde{j}}} = \int_{\Re } {\rho ({\mathbf{x}})dx_{j} }\) are the marginal probability of density function of \(X_{i}\) and the joint probability of density function of \({\mathbf{X}}\) with \(X_{j}\) removed, respectively; \(g_{ii} = \sum\limits_{k = 1}^{m} {b_{ik} b_{ik} }\); \(d{\mathbf{x}}_{{\tilde{i}\tilde{j}}}\) stands for \(d{\mathbf{x}}\) but with \(d{\mathbf{x}}_{i}\) and \(d{\mathbf{x}}_{j}\) removed. Ideally, if \(T_{j \to i} = 0\), then \(X_{j}\) is NOT causal to \(X_{i}\); otherwise, it is causal (for either positive or negative information flow). But in practice, significance test must be performed.

Equation (2) has many nice properties, one of which is the “principle of nil causality”: if the evolution of an event is independent of another event, then the causality (or the RIF) from the latter to the former is zero. This is the only quantitatively stated observational fact in causal inference; it has defied the classical formalism under numerous circumstances, but within Liang’s framework, it turns out to be a theorem. In addition, \(T_{j \to i}\) is invariant upon nonlinear coordinate transformation.

Let \(X_{1}\) and \(X_{2}\) be two time series, and the maximum likelihood estimator of the RIF from \(X_{2}\) to \(X_{1}\), under the assumption of a linear model with additive noise, is proved by Liang (2014) to bear a very concise form:

where \(C_{ij}\) is the sample covariance matrix between \(X_{i}\) and \(X_{j}\), and \(C_{i,dj}\) is the sample covariance between \(X_{i}\) and a series derived from \(X_{j}\) using Euler forward differencing scheme:

\(\Delta t\) being the time step size. This concise formula has had remarkable success in resolving a variety of real-world problems, for example, global climate change (Stips et al. 2016), meteorology (Yang et al. 2021), neuroscience (Hristopulos et al. 2019), and financial markets (Liang 2015; Lu et al. 2020), to name a few. A direct corollary is that causation, in linear sense, implies correlation, but correlation does not imply causation.

The above formula does not need to be applicable for the whole duration; the dynamic causality—from \(X_{2}\) to \(X_{1}\), which in general varies in time, can be obtained by applying the formula window by window with a rolling window algorithm.

ARMA-GJR-GARCH model

GARCH models have the power of investigating conditional heteroscedasticity with volatility clustering and leverage effect in financial markets (see Agnolucci 2009; Dyhrberg 2016; Lin 2018; among others). Specifically, the ARMA-GJR-GARCH model of Glosten et al. (1993) is suitable for our case, as it allows one to study the volatility features of carbon emission prices and clean energy stock index (Benz and Trück 2009). The standard \(ARMA\left( {m,n} \right) - GJR - GARCH\left( {p,q} \right)\) model is presented as follows:

where \(x_{t}\) is a stationary time series, such as \(R_{t}^{EUA}\) or \(R_{t}^{CEI}\), \(\mu\) and \(\omega\) are constants, \(\varepsilon_{t}\) are residuals, \(h_{t}\) are the conditional variance of \(\varepsilon_{t}\), and \(\eta_{t}\) belongs to a normal or Student’s t distribution. Due to rejection of the normal distribution according to the Jarque–Bera (JB) statistics of log returns of EUA and CEI (Table 1), the Student t distribution is chosen for \(\eta_{t}\). \(I_{t - 1} = 1\) if \(\varepsilon_{t - 1} < 0\), and \(0\) otherwise. \(\delta\) measures the leverage effect, that is, asset return volatility rises more following bad news than following good news. \(\omega > 0\), \(\alpha_{i} \ge 0\), \(\beta_{j} \ge 0\), and \(\sum\limits_{i = 1}^{{\max \left( {p,q} \right)}} {\left( {\alpha_{i} + \beta_{i} } \right)} < 1\).

Results

In line with most of the classical literature, in this section, we first investigate the static causality in return to identify the information flow between the carbon emission market and the clean energy market over the full sample period. Specifically, the traditional Granger causality test (Granger 1969) and the Liang formalism (Liang 2014, 2016) are employed to detect the causal relationship between EUA and CEI in the full sample. The results are listed in Table 2.

As shown in Table 2, the T value estimated with Eq. (3) for the causality from EUA to CEI is 0.0052. The corresponding confidence interval at the 90% probability level is [− 0.0005, 0.0109], inclusive of 0. Therefore, the null hypothesis that the EUA log returns do not cause the CEI log returns cannot be rejected at the 10% significance level, indicating that the T value of 0.0052 is not significantly different from 0 at the 10% level. In the other way, the T value for the causality from CEI to EUA is − 0.0073. Its corresponding confidence interval at the 90% probability level is [− 0.013, − 0.0016], which is exclusive of 0, indicating that there is a statistically significant causality from the CEI log returns to the EUA log returns at the 10% significance level.

The Granger causality test between EUA and CEI is developed from vector autoregressive (VAR) model, and the smallest BIC (− 15.4258) means that the optimum lag order of the Granger causality test is 1. The results out of the two methods are generally in accord with each other. The F statistics show that the null hypothesis of no causality running from CEI to EUA is rejected at the 10% significance level over the full sample period, but not the reverse, indicating the existence of a significant and unidirectional causality running from the clean energy market to the carbon emission market on the conditional mean and a clear directional statement regarding temporal predictability of the former to the latter.

Although consistent results are obtained from the Liang causality analysis and the Granger causality test, it is worth noting that the Granger causality test could not be robust because spurious Granger causality in mean may arise due to unobserved variables that influence the system dynamics, such as variances of variables (Liang 2014, 2016), and due to observational noise. Besides, the Granger causality test cannot provide time-varying causalities between variables, which are more important for market participants to make real-time decisions. Another problem about the Granger causality test is that it only tests the time-lag relationship between variables and the contemporaneous causality is hard to infer (Xu and Zhang 2022), which means it cannot detect the contemporaneous information flow between different variables. Therefore, the following content in this section explores the dynamic causality in return and that in variance between EUA and CEI, with a rolling window algorithm developed by Liang (2014, 2016) based on information flow.

By and large, both the Granger causality test and the Liang method (Table 2) yield similar results; that is, there is a static and unidirectional causality in mean running from the clean energy market to the carbon emission market over the full sample period, but not the reverse. Outcomes of the causality tests imply the significant information flow from the clean energy market to the carbon emission market, indicating the former can improve the prediction of the latter based on the conditional mean.

Next, the dynamic causality in return between the two variables is firstly examined. Then, we use the \(ARMA\left( {m,n} \right) - GJR - GARCH\left( {p,q} \right)\) model to obtain the conditional variances of EUA and CEI. The Liang causality analysis is then used to detect the potential dynamic causal relationship in variance between EUA and CEI.

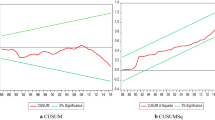

Causality in return

In Fig. 2, the blue line is the dynamic T value estimated with Eq. (3) using the rolling window algorithm developed by Liang (2014, 2016) with two red lines marking the confidence interval at a 90% probability level. If the confidence interval does not include 0, the null hypothesis of no causality or RIF in that period is rejected at the 10% significance level, and the T value is significantly different from 0 at the 10% significance level. On the contrary, if the confidence interval includes 0, the null hypothesis cannot be rejected at the 10% significance level, indicating that the T value is not significantly different from 0 at the 10% significance level. Without loss of generality, we choose a rolling window length of 250 trading days for the estimation purpose.

Figure 2 clearly shows that at the 90% probability level, confidence intervals of the T values that measure the causalities between EUA and CEI almost entirely include 0 from the beginning of the chosen rolling window until February 2020. This implies that the null hypothesis of no causality in return between EUA and CEI cannot be rejected at the 10% significance level, and hence, the EUA does not significantly cause CEI and vice versa. It is worth noting that, after March 2020, the causal relationship in return between EUA and CEI becomes obviously stronger. Especially, T values of the causalities running from CEI to EUA are significantly different from 0, indicating that the change in the clean energy market significantly affects fluctuations of the carbon emission market at the 10% significance level during that period. In contrast, T values of the causalities running from CEI to EUA are not always significantly different from 0 after March 2020. There are several short periods when causalities from the carbon emission market to the clean energy market are significant at the 10% level. It can be seen in Fig. 1 that, after March 2020, carbon emission allowances and the clean energy index experienced a dramatic increase. It appears as if, under the lower fluctuations of the clean energy market, it has a weak predictive power on the carbon emission market, and vice versa, while under its bull market condition, it has a strong predictive power on the carbon emission market and the predictive powers of the carbon emission market on the clean energy market also obtain a certain improvement.

In general, the dynamic T values show that the carbon emission and clean energy markets interact with each other in a complex fashion. Under the normal market condition, there exist fewer causalities in return between the two markets. Under the bull market condition of the clean energy market, causalities in return between the two markets become stronger. Therefore, market participants concerned about climate change and environment improvements need to adjust decisions according to market conditions. For example, the significant causalities in return running from the clean energy market to the carbon emission market indicate that for investors, the EUA plays a strong hedging role against the clean energy index variations during these periods. That is to say, it is profitable for investors to include the EUA into their portfolios in the increasing phase of the CEI.

Estimation of ARMA-GJR-GARCH model

According to the Ljung-Box test and LM ARCH test as shown in Table 1, serial correlation and heteroscedasticity exist in log returns of EUA and CEI. We hence use the ARMA-GARCH model to capture their stylized features. In light of BIC criterion, the ARMA-GJR-GARCH with Student t distribution is chosen. The estimated results of the parameters in the model are listed in Table 3.

The tabulated results show that the \(ARMA\left( {\left( {1,4} \right),\left( 4 \right)} \right) - GARCH\left( {1,1} \right) - t\) model and the \(AR\left( 1 \right) - GJR - GARCH\left( {1,1} \right) - t\) model are suitable to fit the log returns of EUA and CEI, respectively, according to the BIC criterion. The coefficients in the ARMA models are all statistically significant, indicating the present log returns of the two series are impacted by the corresponding previous log returns, with lags of orders 1 and 4 for EUA and lag of order 1 for CEI. The Ljung-Box test for the first ten lags of the sample autocorrelation function of residuals exhibits no significant series correlation for EUA and CEI. Thus, the ARMA models can preserve the residuals of the EUA and CEI log returns at a conventional level. In terms of GJR-GARCH model, the ARCH and GARCH items are always significant. These outcomes mean that the present variances of the two log return series are easily impacted by the information in the previous period. The asymmetric term \(\delta\) is statistically significant and positive for CEI at the 1% level, which means the leverage effect exists for CEI, the impact of shocks is asymmetric, and negative shocks increase the conditional variances of CEI log returns. However, the asymmetric term \(\delta\) of EUA is not statistically significant, which implies that the impact of shocks on EUA log returns is symmetric. The degrees of freedom reject the null hypothesis, indicating that the Student t distribution of standardized residuals is more appropriate than the normal distribution and can capture the fat tails and kurtosis of the two log return series. The LM ARCH test statistics for the two log return series indicate no ARCH effect remaining in the residuals of the models.

The time-varying conditional variances of EUA and CEI are displayed in Fig. 3. It can be observed that the maximum of the conditional variances of EUA took place in 2013, while that of CEI took place in 2020. In 2013, the first year of the third stage of EU ETS, policy changes resulted in the price of EUA going up. In 2020, the clean energy index had a great growth, so the CEI experienced much volatility.

Causality in variance

To investigate the causality in variance between EUA and CEI, the time-varying conditional variances for the two series from the ARMA-GJR-GARCH model are input into Eq. (3) to compute the causality. The results are shown in Fig. 4. It can be seen that this figure starts with a very low level of T values, similar to those in Fig. 2. This implies that the carbon emission and clean markets are not integrated, and variances of EUA do not influence those of CEI, and vice versa. However, if we go over the confidence intervals of the T values at the 90% probability level from the beginning of the chosen rolling window to February 2020, we can find that there are several periods that do not include 0, indicating that there exist significant causalities at the 10% significance level between variances of EUA and CEI. Regarding significant causalities in variance from CEI to EUA, the sporadic periods are January through June 2016, October through December 2016, and July through September 2018, while in the other way around, the significant periods are May 2014, June 2015, and December 2016. Particularly, larger absolute T values show up after March 2020 in Fig. 4, indicating EUA and CEI are bidirectionally causal in variance after March 2020. As a note, the T values switch their signs (+ / −). This means the causalities in variance between EUA and CEI are different from those in return. The causal relationship from CEI to EUA in return is negative, indicating that the increase in \(R_{t}^{CEI}\) will cause decrease in \(R_{t}^{EUA}\). However, the causal relationship in variance from CEI to EUA is positive, which means that increase in conditional variances of CEI will cause the increase in conditional variances of EUA. On the other hand, the causal relationship from EUA to CEI in return is positive and not so significant, indicating that the increase in \(R_{t}^{CEI}\) may cause increase in \(R_{t}^{EUA}\). Nevertheless, the causal relationship from EUA to CEI in variance is significantly negative, which means that the increase in conditional variances of CEI will cause decrease in conditional variances of EUA.

By examining variances of EUA and CEI in Fig. 3, it can be found that the significant and bidirectional causalities in variance happens during the dramatic volatilities of the variances of EUA and CEI, especially the latter. The results generally reveal stronger causalities in variance between EUA and CEI under the market turmoil. This suggests that the change in variances of the clean energy market can provide better predictive powers for variances of the carbon emission market, and vice versa. It also suggests that the importance of identifying the causalities in variance between EUA and CEI in a dynamic way is crucial for market participants to efficiently manage the investment portfolios and to implement optimal risk decisions.

Conclusions

An understanding of the causal relationship between the carbon emission market and the clean energy market is essential for probing the interaction between the CO2 emission allowance prices and clean energy asset prices. It is beneficial for financial participants to obtain better risk-adjusted returns from their well-diversified portfolios and to improve the portfolio performance; it is also beneficial for policymakers to adopt effective measures to properly promote the prices of EUA so that the carbon emission market could provide stimuli to transfer traditional resources to clean resources. Based on the CEI and EUA data during the period spanning from 2 January 2013 to 31 December 2020, this paper studies the causal relationships in return and in variance between CO2 emission allowance prices and the clean energy index, using a novel time-varying causality analysis with a rolling window algorithm developed by Liang (2014, 2016).

Our results reveal that the causal relationships in return and in variance between EUA and CEI are time-varying. Regarding the causality in return, most of the time in the considered period, no significant causality has been identified between CO2 allowance prices and clean energy index; a unidirectional long-term and stable causality in return from CEI to EUA is identified after March 2020. For the causality in variance, EUA and CEI have bidirectional causality after March 2020, but T values of causality, i.e., the rate of information flow, after 2020 are opposite to those in return. It seems that under lower fluctuations of the clean energy market, the clean energy market has a weak causality on the carbon emission market, while under the increasing situation of the clean energy market, causalities between the two markets have been significantly strengthened. Moreover, there are some sporadic periods when causalities in variance between the two markets are significant at the 10% level before February 2020, indicating that the carbon emission and clean energy markets interact in a complex way.

Our results have several important implications for investors as well as for policymakers. With high liquidity and similar financial asset characteristics, EUA has become an interesting financial investment tool to continue to contribute to realization of a low-carbon economy. Financial investors can benefit from the causality running from the carbon emission market to the clean energy market, or vice versa, when they allow for EUA and CEI in their diversified portfolios. For example, Tu et al. (2019, 2021) highlighted that the high trading price of carbon emissions may increase the revenues of the clean energy investment from the carbon abatement and then improve the performance of the clean energy-related companies. Hence, portfolios including the carbon emissions and clean energy-related companies are probably considered by the financial participants concerned about climate change and environment improvements. In addition, policymakers can use EUA to put certain pressure on enterprises with high emission and high pollution to move on, energy-mix transformation, and development of clean energy-related industries. For example, implementing appropriate carbon price and auction ration of carbon permits is able to accelerate the phase-out of operating coal power plants and reduce the implied risk for newly built coal plants to become stranded asset (Mo et al. 2021a, 2021b). Moreover, the results imply that policymakers should consider not only the causality in return, but also the causality in variance, between EUA and CEI, in attempt to implement their policies regarding the global climate neutrality.

Data availability

The datasets generated and/or analyzed during the current study are available in the S&P Global official website: https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-carbon-emission-allowances-eua/#overview for Carbon Emission Allowances and https://www.spglobal.com/spdji/en/indices/esg/sp-global-clean-energy-index/#overview for Clean Energy Index.

References

Adams S, Acheampong AO (2019) Reducing carbon emissions: the role of renewable energy and democracy. J Clean Prod 240:118245. https://doi.org/10.1016/j.jclepro.2019.118245

Agnolucci P (2009) Volatility in crude oil futures: a comparison of the predictive ability of GARCH and implied volatility models. Energ Econ 31(2):316–321. https://doi.org/10.1016/j.eneco.2008.11.001

Asl MG, Canarella G, Miller SM (2021) Dynamic asymmetric optimal portfolio allocation between energy stocks and energy commodities: evidence from clean energy and oil and gas companies. Resour Policy 71:101982. https://doi.org/10.1016/j.resourpol.2020.101982

Balcilar M, Demirer R, Hammoudeh S, Nguyen DK (2016) Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energ Econ 54:159–172. https://doi.org/10.1016/j.eneco.2015.11.003

Balcilar M, Ozdemir ZA, Ozdemir H (2021) Dynamic return and volatility spillovers among S&P 500, crude oil, and gold. Int J Financ Econ 26:153–170 (https://www.doi.org/10.1002/ijfe.1782)

Bayer P, Aklin M (2020) The European Union emissions trading system reduced CO2 emissions despite low prices. P Natl Acad Sci USA 117(16):8804–8812. https://doi.org/10.1073/pnas.1918128117

Benz E, Trück S (2009) Modeling the price dynamics of CO2 emission allowances. Energ Econ 31(1):4–15. https://doi.org/10.1016/j.eneco.2008.07.003

Bollerslev T (1986) Generalized Autoregressive Conditional Heteroskedasticity. J Econometrics 31(3):307–327. https://doi.org/10.1016/0304-4076(86)90063-1

Chang C-L, Ilomäki J, Laurila H, McAleer M (2020) Causality between CO2 emissions and stock markets. Energies 13:2893. https://doi.org/10.3390/en13112893

Chen Y, Qu F, Li W, Chen M (2019) Volatility spillover and dynamic correlation between the carbon market and energy markets. J Bus Econ Manag 20:979–999. https://doi.org/10.3846/jbem.2019.10762

Chevallier J, Nguyen DK, Reboredo JC (2019) A conditional dependence approach to CO2-energy price relationships. Energ Econ 81:812–821. https://doi.org/10.1016/j.eneco.2019.05.010

Dawar I, Dutta A, Bouri E, Saeed E (2021) Crude oil prices and clean energy stock indices: lagged and asymmetric effects with quantile regression. Renew Energ 163:288–299. https://doi.org/10.1016/j.renene.2020.08.162

Dutta A, Bouri E, Noor MH (2018) Return and volatility linkages between CO2 emission and clean energy stock prices. Energy 164:803–810. https://doi.org/10.1016/j.energy.2018.09.055

Dyhrberg UC (2016) Bitcoin, gold and the dollar – a GARCH volatility analysis. Financ Res Lett 16:85–92. https://doi.org/10.1016/j.frl.2015.10.008

Fawzy S, Osman AI, Doran J, Rooney DW (2020) Strategies for mitigation of climate change: a review. Environ Chem Lett 18:2069–2094. https://doi.org/10.1007/s10311-020-01059-w

Fezzi C, Bunn DW (2009) Structural interactions of European carbon trading and energy markets. J Energ Mark 2(4):53–69 (https://www.doi.org/10.21314/JEM.2009.034)

Gao A, Sun M, Han D, Shen C (2020) Multiresolution analysis of information flows from international carbon trading market to the clean energy stock market. J Renew Sustain Ener 12:055901. https://doi.org/10.1063/5.0022046

Gargallo P, Lample L, Miguel JA, Salvador M (2021) Co-movements between EU ETS and the energy markets: a VAR-DCC-GARCH approach. Mathematics 9:1787. https://doi.org/10.3390/math9151787

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and the volatility on the nominal excess returns on stocks. J Financ 48:1779–1801. https://doi.org/10.1111/j.1540-6261.1993.tb05128.x

Granger CWJ (1969) Investigating casual relations by econometric models and cross-spectral methods. Econometrica 37(3):424–438. https://doi.org/10.2307/1912791

Gronwald M, Ketterer J, Trück S (2011) The relationship between carbon, commodity and financial markets: a copula analysis. Econ Rec 87:105–124. https://doi.org/10.1111/j.1475-4932.2011.00748.x

Hammoudeh S, Ajmi AN, Mokni K (2020) Relationship between green bonds and financial and environmental variables: a novel time-varying causality. Energ Econ 92:104941. https://doi.org/10.1016/j.eneco.2020.104941

Hammoudeh S, Nguyen DK, Sousa RM (2014) Energy prices and CO2 emission allowance prices: a quantile regression approach. Energ Policy 70:201–206. https://doi.org/10.1016/j.enpol.2014.03.026

Hanif W, Hernandez JA, Mensi W, Kang SH, Uddin GS, Yoon S-M (2021) Nonlinear dependence and connectedness between clean/renewable energy sector equity and European emission allowance prices. Energ Econ 101:105409. https://doi.org/10.1016/j.eneco.2021.105409

Hristopulos DT, Babul A, Babul S, Brucar LR, Virji-Babul N (2019) Disrupted information flow in resting-state in adolescents with sports related concussion. Front Hum Neurosci 13:419. https://doi.org/10.3389/fnhum.2019.00419

Hu J, Crijns-Graus W, Lam L, Gilbert A (2015) Ex-ante evaluation of EU ETS during 2013–2030: EU-internal abatement. Energ Policy 77:152–163. https://doi.org/10.1016/j.enpol.2014.11.023

Hung NT (2021) Nexus between green bonds, financial and environmental indicators. Econ Bus Lett 10(3):191–199 (https://reunido.uniovi.es/index.php/EBL/article/view/1585)

IPCC (Intergovernmental Panel on Climate Change) (2013) Climate change 2013: The physical science basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Stocker TF, Qin D, Plattner G-K, Tignor M, Allen SK, Boschung J, Nauels A, Xia Y, Bex V, Midgley PM (eds.)]. Cambridge University Press, Cambridge, UK. https://www.ipcc.ch/site/assets/uploads/2018/02/WG1AR5_all_final.pdf

Ji Q, Zhang D, Geng J (2018) Information linkage, dynamic spillovers in prices and volatility between the carbon and energy markets. J Clean Prod 198:972–978. https://doi.org/10.1016/j.jclepro.2018.07.126

Keppler JH, Mansanet-Bataller M (2010) Causalities between CO2, electricity, and other energy variables during phase I and phase II of the EU ETS. Energ Policy 38(7):3329–3341. https://doi.org/10.1016/j.enpol.2010.02.004

Kumar S, Managi S, Matsuda A (2012) Stock prices of clean energy firms, oil and carbon markets: a vector autoregressive analysis. Energ Econ 34(1):215–226. https://doi.org/10.1016/j.eneco.2011.03.002

Kyrtsou C, Kugiumtzis D, Papana A (2019) Further insights on the relationship between SP500, VIX and volume: a new asymmetric causality test. Eur J Financ 25(15):1402–1419. https://doi.org/10.1080/1351847X.2019.1599406

Li M, Liu K (2019) Causality-based attribute weighting via information flow and genetic algorithm for naive Bayes classifier. IEEE Access 7:150630–150641. https://doi.org/10.1109/ACCESS.2019.2947568

Liang XS (2008) Information flow within stochastic dynamical systems. Phys Rev E 78:031113. https://doi.org/10.1103/PhysRevE.78.031113

Liang XS (2014) Unraveling the cause–effect relation between time series. Phys Rev E 90:052150. https://doi.org/10.1103/PhysRevE.90.052150

Liang XS (2015) Normalizing the causality between time series. Phys Rev E 92:022126. https://doi.org/10.1103/PhysRevE.92.022126

Liang XS (2016) Information flow and causality as rigorous notions ab initio. Phys Rev E 94:052201. https://doi.org/10.1103/PhysRevE.94.052201

Liang XS (2019) A study of the cross-scale causation and information flow in a stormy model mid-latitude atmosphere. Entropy 21(2):149. https://doi.org/10.3390/e21020149

Liang XS (2021) Normalized multivariate time series causality analysis and causal graph reconstruction. Entropy 23(6):679. https://doi.org/10.3390/e23060679

Liang XS, Kleeman R (2005) Information transfer between dynamical system components. Phys Rev E 95:244101. https://doi.org/10.1103/PhysRevLett.95.244101

Lin Z (2018) Modelling and forecasting the stock market volatility of SSE composite index using GARCH models. Future Gener Comp Sy 79:960–972. https://doi.org/10.1016/j.future.2017.08.033

Liu N, Liu C, Da B, Zhang T, Guan F (2021) Dependence and risk spillovers between green bonds and clean energy markets. J Clean Prod 279:123595. https://doi.org/10.1016/j.jclepro.2020.123595

Lu X, Liu K, Liang XS, Zhang Z, Cui H (2020) The break point-dependent causality between the cryptocurrency and emerging stock markets. Econ Comput Econ Cyb 54:203–216 (https://www.doi.org/10.24818/18423264/54.4.20.13)

Mansanet-Bataller M, Pardo A, Valor E (2007) CO2 prices, energy, and weather. Energ J 28:73–92 (https://doi.org/10.5547/ISSN0195-6574-EJ-Vol28-No3-5)

Mansanet-Bataller M, Soriano P (2009, May) Volatility transmission in the CO2 and energy markets. In the 6th International Conference on the European Energy Market, Leuven. https://www.doi.org/10.1109/EEM.2009.5207131. Accessed 10 June 2022

Mo J, Cui L, Duan H (2021a) Quantifying the implied risk for newly-built coal plant to become stranded asset by carbon pricing. Energ Econ 99:105286. https://doi.org/10.1016/j.eneco.2021.105286

Mo J, Zhang W, Tu Q, Yuan J, Duan H, Fan Y, Pan J, Zhang J, Meng Z (2021) The role of national carbon pricing in phasing out China’s coal power. iScience 24:102655. https://doi.org/10.1016/j.isci.2021b.102655

Nazifi F, Milunovich G (2010) Measuring the impact of carbon allowance trading on energy prices. Energ Envir 21:367–383. https://doi.org/10.1260/0958-305X.21.5.367

Pantelidis T, Pittis N (2004) Testing for Granger causality in variance in the presence of causality in mean. Econ Lett 85(2):201–207. https://doi.org/10.1016/j.econlet.2004.04.006

Pereda E, Quiroga RQ, Bhattacharya J (2005) Nonlinear multivariate analysis of neurophysiological signals. Prog Neurobiol 77(1–2):1–37. https://doi.org/10.1016/j.pneurobio.2005.10.003

Stips A, Macias D, Coughlan C, Garcia-Gorriz E, Liang XS (2016) On the causal structure between CO2 and global temperature. Sci Rep 6:21691. https://doi.org/10.1038/srep21691

Tao L, Liang XS, Cai L, Zhao J, Zhang M (2021) Relative contributions of global warming, AMO and IPO to the land precipitation variabilities since 1930s. Clim Dynam 56:2225–2243. https://doi.org/10.1007/s00382-020-05584-w

Teixidó J, Verde SF, Nicolli F (2019) The impact of the EU emissions trading system on low-carbon technological change: the empirical evidence. Ecol Econ 164:106347. https://doi.org/10.1016/j.ecolecon.2019.06.002

Tu Q, Betz R, Mo J, Fan Y, Liu Y (2019) Achieving grid parity of wind power in China - present levelized cost of electricity and future evolution. Appl Energ 250:1053–1064. https://doi.org/10.1016/j.apenergy.2019.05.039

Tu Q, Mo J, Liu Z, Gong C, Fan Y (2021) Using green finance to counteract the adverse effects of COVID-19 pandemic on renewable energy investment - the case of offshore wind power in China. Energ Policy 158:112542. https://doi.org/10.1016/j.enpol.2021.112542

Wang Y, Guo Z (2018) The dynamic spillover between carbon and energy markets: new evidence. Energy 149:24–33. https://doi.org/10.1016/j.energy.2018.01.145

Wen F, Wu N, Gong X (2020a) China’s carbon emissions trading and stock returns. Energ Econ 86:104627. https://doi.org/10.1016/j.eneco.2019.104627

Wen F, Zhao L, He S, Yang G (2020b) Asymmetric relationship between carbon emission trading market and stock market: evidences from China. Energ Econ 91:104850. https://doi.org/10.1016/j.eneco.2020.104850

Xu X, Zhang Y (2022) Contemporaneous causality among one hundred Chinese cities. Empir Econ Forthcoming. https://doi.org/10.1007/s00181-021-02190-5

Yang M, Luo D, Li C, Yao Y, Li X, Chen X (2021) Influence of atmospheric blocking on storm track activity over the North Pacific during boreal winter. Geophys Res Lett 48(17):e2021GL093863. https://doi.org/10.1029/2021GL093863

Zhang X, Hu W, Yang F (2022) Detection of cause-effect relations based on information granulation and transfer entropy. Entropy 24:212. https://doi.org/10.3390/e24020212

Zhao L, Wen F, Wang X (2020) Interaction among China carbon emission trading markets: nonlinear granger causality and time-varying effect. Energ Econ 91:104901. https://doi.org/10.1016/j.eneco.2020.104901

Zhu D, Kong Y (2016) A study on the relationship between stock prices of companies of low carbon economy & new energy and the price of carbon allowances. Ecol Ec 32(1):52–57. https://www.cnki.com.cn/Article/CJFDTotal-STJJ201601011.htm (in Chinese with English abstract). Accessed 10 June 2022

Funding

This work was financially supported by the National Natural Science Foundation of China [71701104]; the MOE Project of Humanities and Social Sciences [17YJC790102]; and the Social Science Fund of Jiangsu Province [20GLB008].

Author information

Authors and Affiliations

Contributions

XL: conceptualization, formal analysis, funding acquisition, investigation, methodology, software, supervision, validation, writing—original draft, writing—review and editing; KL: data curation, formal analysis, resources, software, writing—original draft; XSL: software; writing—review and editing. KKL: writing—review; HC: writing—review and editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lu, X., Liu, K., Liang, X.S. et al. The dynamic causality in sporadic bursts between CO2 emission allowance prices and clean energy index. Environ Sci Pollut Res 29, 77724–77736 (2022). https://doi.org/10.1007/s11356-022-21316-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21316-5