Abstract

The current research is a systematic review of 54 empirical papers from 1996 to 2022 which aim to investigate whether board member age diversity influences a firm’s financial and non-financial outcomes. Analysis of the extant research reveals board member age diversity to be an inconsistent predictor of both the financial and non-financial performance of a firm. Apart from CSR performance, which was found to more consistently be positively associated with age diversity, most studies included in the review failed to identify age diversity as a significant predictor of firm outcomes, however several positive, negative and curvilinear relationships were found by some studies. The lack of a consistent trend of significant associations may indicate that age diverse boards perform no better or worse than non-diverse boards or, more likely, given the inconsistent pattern of results, this research highlights that there may be other factors, such as team processes or task characteristics, which differentially impact whether age diversity has a positive, negative, curvilinear or no effect on outcomes. The current work is the first to systematically evaluate the available data on board age diversity and provides a clear account of what is known and what is not known about the relationship between board member age diversity and financial and non-financial outcomes. This study offers important insights and practical recommendations to researchers, HRM practitioners and policy makers interested in understanding how board composition factors influence the performance of corporate boards.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Boards are tasked with setting the strategic direction of a firm as well as the overall management and governance of the firm. Much of the recent attention and public debate on board and TMT composition has focused on gender (e.g., Nguyen et al. 2020) or national diversity (e.g., Schmid and Mitterreiter 2020). Boards around the world comprise of individuals mostly between the ages of 50 to 70 and a great deal of research has focused on identifying how ‘young’ and ‘old’ board members approach and perform their director duties (e.g., Mustafa et al. 2018). While this research is useful to the broader debate on age diversity, it does not actually provide insight into the specific way that a collection of board members of different ages interacts and collectively problem solve to guide firm performance.

Understanding the impact of board member age diversity on performance is important because there is currently a strong trend towards actively encouraging age diverse membership on boards (Kang et al. 2007; Zhang and Luo 2021). Some researchers have even suggested that age diversity be integrated into investment standards (i.e., Xia et al. 2022). Research on the impact of board age diversity is discrepant, with some research reporting a positive association between board age diversity and outcomes and other research reporting a negative association (i.e., Kagzi and Guha 2018a). The evidence base does not state whether board member age diversity has a positive, negative, curvilinear or no effect on firm outcomes.

Unfortunately, the broader research on age diversity and team performance shed’s little light on how board member age diversity might link to outcomes. Team age diversity has been found to be unrelated (i.e., Bell 2007; Bell et al. 2011; Schneid et al. 2016) as well as positively related (i.e., Syakhroza et al. 2021) to team performance. However, most studies tend to report team age diversity as detrimental to team performance (see Wegge et al. 2012). Without further clarity on this issue, it is difficult for boards to determine whether effort should be committed to achieving diversity. At best, the commitment of material resources might lead to some benefit–but how much? At worst, age diversity might be associated with poorer outcomes. Together these points highlight that there is good reason to expect age diversity to be associated with firm outcomes, but the strength and direction of such an association is unknown.

1.1 Research aims

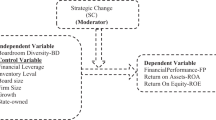

The current research aims to review the extant evidence to determine whether age diversity has a positive, negative, curvilinear or no effect on financial and non-financial firm outcomes. To answer this research question, a Systematic Quantitative Literature Review (SQLR) methodology is adopted. The outcomes of the current research will provide some practical guidance to researchers, boards and professionals interested in understanding the impact of age diversity on board effectiveness.

We note that two recent reviews have been published relevant to board diversity. The most recent is by Åberg et al.’ (2019) who conduct a narrative review focusing on board service tasks (rather than firm performance), and only incidentally mention prior studies which discuss TMT diversity broadly, but not age diversity specifically. In contrast, Kagzi and Guha’s (2018a) review looks more closely at board demographic diversity, of which age diversity is one of four types of diversity examined. The findings of Kagzi and Guha’s (2018a) study in relation to age diversity is discrepant, perhaps because of the small sample of studies that included age as a variable and a lack of uniform outcome variables. Unlike the current research, Kagzi and Guha’s (2018a) review is not systematic, includes papers which do not measure heterogeneous age diversity and is prone to publication bias including only research published in leading management journals and ignoring grey literature. Our review is quite distinct and more advanced than both reviews, such that our review systematically assesses all of the available quantitative literature and focuses specifically on the important and specific question of how board member age diversity is associated with financial and non-financial outcomes.

1.2 Types of diversity

Diversity is broadly defined as the distribution of one or more individual attributes amongst individuals, and there are three specific conceptualisations of diversity, namely, separation, disparity and variety (Harrison and Klein 2007). These types of diversity differ with respect to how they impact group outcomes and how they are operationalised. Separation diversity captures diversity that is bimodally distributed within a group such that members are similar to only half of the group. This form of diversity is conceptualised as negatively impacting group outcomes through reducing cohesiveness, increasing interpersonal conflict and facilitating similarity-attraction amongst like members. Disparity diversity reflects a distribution of diversity where only one or few members are likely to be diverse on that attribute, creating more within-group competition and reduced member input. Lastly, variety diversity represents diversity that is uniformly distributed within a group and of the three categories, it is the only one that is hypothesised to positively influence group outcomes. Groups that experience variety diversity are predicted to experience greater creativity and higher decision-making quality.

1.3 Theories of diversity

In addition to the types of diversity, there are several theories of diversity that attempt to model the nature of the relationship between diversity and outcomes. Table 1 lists popular theories employed to explain how board member age diversity is likely to influence firm performance. As can be seen in the table, theories can be further categorised into theories that view diversity optimistically or pessimistically (See Mannix and Neale 2005). Theories that view diversity optimistically typically argue that diversity supports performance through the provision of more resources, human capital or rigorous debate. In contrast, theories that view diversity pessimistically typically point to high transaction costs associated with heterogeneous groups with respect to poor fit between group members.

An example of an optimistic theory is Resource Dependency Theory (Pfeffer and Salancik 1978) which contends that the human resources of a firm can be effectively managed to secure high performance and a competitive advantage. Applied to age diversity, the appointment of age diverse board members allows the firm to gain new essential resources, such as knowledge, skills and linkages with a wider range of external stakeholders—all resources which can be used to benefit the growth and performance of the firm. Another example of an optimistic theory is the Information Processing Theory, which argues that group members with different backgrounds, networks, information and skills will be better able to problem solve as a result of their diversity (Gruenfeld et al. 1996). Although it might be more difficult to coordinate diverse groups, the overall performance of the group will be enhanced by the variety of talents and information possessed by the group. Linking to boards, this theoretical perspective contends that age diversity amongst board members would result in better performance because of the knowledge, skills, abilities, and professional network differences between younger and older board members.

One example of a pessimistic theory is Similarity-Attraction Theory (Byrne 1971) which suggests that individuals will be more attracted to individuals who are similar to themselves, enjoying higher levels of cohesion and social integration with these individuals in comparison to dissimilar individuals. In terms of board member age diversity, the similarity-attraction paradigm theorises that older board members will be less attracted to younger board members, resulting in low levels of affiliation and poor-quality social interactions. Self-Categorizing Theory (Turner 1982, 1985; Turner and Oakes 1989) is similar to Similarity-Attraction theory and also views diversity pessimistically. According to this theory, individuals label themselves and others based on salient social categories, such as gender, age or race. Categorising according to these social categories makes stereotypes of out-group members more salient to individuals, creating a ‘them vs. us’ view. Applying this theoretical perspective to board member age diversity would suggest that age differences amongst board members would have the potential to create tension such that new younger members would be seen as out-group members by the older long-serving board members.

Reconciling these competing theories, some researchers prefer to conceptualise diversity as occurring at either an optimal or sub-optimal level (e.g., Ali and Ayoko 2020). The ‘optimal’ level is thought to be the peak of an inverted U-shape curve, such that too little or too much diversity will have a negative impact on group outcomes and the positive effects of diversity will be experienced at moderate amounts. Research with 288 Australian firms found a significant curvilinear relationship between board of director age diversity and ROA, but only a negative linear relationship between board of director age diversity and employee productivity (Ali et al. 2014). Testing for curvilinear relationships may provide some insights into which theories best model the diversity-outcome relationship; however, consideration of what outcome is tested is also likely to matter.

2 Methods

The current research complies with Pickering and Byrne’s (2014) 15-step framework for performing a systematic quantitative literature review (SQLR) and the Preferred Reporting Items for Systematic Reviews and Meta-Analyses Statement (Moher et al. 2009). The SQLR methodology, which involves systematically identifying relevant empirical research studies related to key research terms and evaluating the body of work to answer a specific research question, is well suited to the current research aims and provides a framework for the systematic, quantitative, comprehensive and structured mapping of diverse combinations of heterogeneous variables (Pickering and Byrne 2014). This methodology has been employed in several recent studies investigating related topics of corporate governance (e.g., Alhossini 2020) and older workers (e.g., Chen and Gardiner 2019). This methodology has advantages over other methodologies in terms of rigour and replicability (Pickering and Bryne 2014) and is more appropriate for the current topic than meta-analytic methods, which require precise uniformity in the operationalisation of variables across studies to allow statistical comparison. Using the SQRL methodology, a broader range of diverse studies, accommodating differences in sample, methodology, design and operationalisation of constructs, can be examined to identify what is known and unknown about this field. The use of pre-specified eligibility criteria to identify, synthesise and evaluate the literature reduces the potential of bias in sample selection (Higgins and Green 2011).

2.1 Data collection

Data collection was conducted in two stages, the first in June 2019 involving a search of all papers up until May 2019, and then an update in May 2022, involving a search of papers from January 2019 up until April 2022. The same search strategy was used in both stages. After several iterations of trialling search terms, the following search terms were used: board diversity, corporate governance and board of directors. These search terms were entered in the same order each time to minimise the chances of search results being confounded. For example, board divers* OR corporate gover* OR board of directors was the search string used consistently across all databases. The following databases were searched: Scopus (yielding 24,307 items, 515 extracted); ProQuest (yielding 26,434 items, 920 extracted); Google Scholar (yielding 4,081,720 items, 1039 extracted); and EBSCOhost (yielding 25,006 items, 1835 extracted). In consultation with an expert librarian, these databases were chosen as they are frequently cited in other review papers and have the most comprehensive collection of topic relevant journals.

2.2 Inclusion/exclusion criteria

Studies were included if they met the following criteria: (a) primary/original quantitative empirical research; (b) the study assessed (either directly or incidentally) the association between board member age diversity and board performance (i.e., papers where age diversity was measured as a control variable were included); (c) age diversity must be operationalised using a metric of heterogeneity (i.e., not average board age or youthfulness of board); (d) full-text articles; and (e) English only articles. The role of theory is critical to the current work, in terms of identifying why board diversity might impact firm outcomes, and what form of diversity (i.e., separation, disparity or variety) is likely to yield positive outcomes. However, the primary research question under investigation is whether age diversity has a positive, negative, curvilinear or no effect on firm outcomes. This is an empirical question and can only be answered by analysing empirical studies. Therefore, literature reviews, and theoretical and conceptual papers were excluded from the review.

3 Results

3.1 Data selection

To identify appropriate articles, returned items from each database were screened by reading the title and abstract. All relevant articles were exported to EndNote reference management library and duplicates removed. Titles and abstracts of the articles in EndNote were re-screened, and articles that did not meet the eligibility criteria were excluded. Finally, the entire content of the articles was reviewed in greater detail. A total of 54 studies met all the eligibility criteria. Papers were excluded for several reasons. One common reason for exclusion was that age diversity was not operationalised as diversity but rather as the mean age of board of directors (e.g., Letting et al. 2012). Studies that used a broader ‘diversity index’ where the unique effects of age diversity were not partialled out from other forms of diversity, such as education or gender diversity, were also excluded.

Although small, the final sample size is in line with recommendations by Pickering and Bryne (2014) as well as other published systematic reviews on related topics (e.g., Buljac-Samardzic et al. 2010; Chen and Gardiner 2019). Of the 54 studies selected, 51 were published in peer-review journals, one was published in an academic edited book and three were postgraduate dissertations. All included papers were reviewed by an experienced and independent researcher for external verification. The independent researcher holds a PhD in psychology, is a published academic with over 14 years of research experience. After sampling 30 papers as part of an independent review, the independent researcher agreed that the 30 sample papers met the inclusion criteria. The screening process is summarised in Fig. 1.

3.2 Data abstraction

The content of the articles was extracted in accordance with Pickering and Byrne’s (2014) recommendations, where an Excel spreadsheet was used to detail the extracted information. The relationship between the predictor variables (i.e., age diversity of board members) and the outcome variables (i.e., firm performance) were determined using the significance test tables, as well as interpreting conclusions drawn by the authors. For quantitative research, if the significant test tables were not published, quantitative results reported in the paper were then used to ascertain the effect of predictor variables on outcome variables. The number of positive, negative, curvilinear and non-significant associations between the predictor and outcome variables were recorded. The associations between age diversity and the various outcome variables were then tabulated and stratified. The data is stratified by economy type (i.e., developed vs. developing) and type of outcome measure (i.e., financial performance vs. non-financial performance). The decision to stratify according to economy type is based on evidence that there are marked differences between developed and developing economies with respect to business environment and corporate governance standards (Young et al. 2008). Classification of studies as either developing or developed was made in accordance with the United Nation’s World Situation and Prospects Report (2020). Evidence that there may be different drivers of financial and non-financial performance (Judge et al. 2010) and that these drivers either directly or indirectly relate to overall firm performance (Fullerton and Wempe 2009) supports the decision to analyse this data separately.

3.3 Descriptives

Fifty-four empirical studies published between 1996 and 2022 were identified. More than half of all research on this topic has been published within the last five years (54.5%), indicating that board member age diversity is a contemporary and growing topic of research.

Tables 2 and 3 present the descriptives of the studies. Viewing these tables reveals several interesting observations. First, there is notable representation of developing economies from Asia (19 studies) Africa (7 studies) and South America (2 studies), as well as developed economies from Europe (13 studies) and North America (9 studies). This suggests that board member age diversity is a topic of interest around the world.

Second, most studies utilised publicly available secondary data spanning several years (81.4%). Data was primary retrieved via scanning firms’ annual reports and/or accessing databases (96.3%). Studies 14 and 42, both which included primary data collection of survey responses, are notable exceptions.

Third, the four most common operationalisations are: Coefficient of Variation (40.8%); Blau’s Index (36.7%); the Standard Deviation of Board of Directors Age (12.2%); and number of age bands within a board (10.2%). These conceptualisations of age diversity are in line with the suggestions of Harrison and Klein (2007), indicating an established methodology and relative agreement with respect to how to best measure age diversity. In terms of types of diversity, disparity and variety (44.6%) were equally commonly measured with fewer studies enlisting a measure of separation (10.1%). The use of diversity metric does not appear to be impacted by geographic location or economy type as the various metrics appear to be evenly spread across the regions.

Fourth, Table 2 also shows the distribution of studies according to SJR impact factor and Quartile Ranking. While 31.2% of the studies are unranked, 40.7% were published in journals with a Q1 ranking.

Table 3 shows that all sectors of the economy have been investigated in this collection of studies in terms of financial firms (11.1%); non-financial firms (38.9%); and not-for profits (5.6%). Several studies investigated board member age diversity across multiple industries (44.5%). Table 3 also details that over 20 theoretical frameworks were mentioned. Resource Dependency Theory (57.4%); Agency Theory (48.1%); Stakeholder Theory (22.2%); Social Identity Theory (18.5%) and Upper Echelons Theory (18.5%) were the most cited.

3.4 Main analyses

3.4.1 Financial performance

Table 4 presents associations between age diversity and all outcome measures investigated. ROA, an accounting-based measure of a firm’s current effectiveness of management in generating returns to ordinary shareholders with its available assets, and ROE, a measure of how well a company is managing the capital that shareholders have invested in it, are the two most popularly measured outcomes. Both ROA and ROE are well-known indicators of a firm’s profitability, and while there are slight differences between the two metrics, both provide an estimate of the amount of income earned in relation to the resources used to generate the income. Concentrating first on ROA, the balance of evidence indicates a negative linear or non-significant association between profitability and board member age diversity. Seventeen studies tested the relationship between ROA and board member age diversity, some multiple times with different diversity measures (i.e., Blau’s Index and CoV). In total, 21 analyses were run, and a negative association was found in 33.3% of studies, a positive association was found in 23.8% of studies, a curvilinear association was found in 9.5% and 33.3% studies failed to find a significant association between the two variables.

Similarly, of the 10 sets of analyses conducted with ROE, there was a similar proportion of negative (30.0%) and non-significant (30%) results, therefore, it is unclear whether age diversity has a negative, positive or no effect on ROE. Positive associations were reported in 40.0% of studies. Combining the results of ROA with ROE reveals a pattern where the incidence of negative (32.3%), positive (29.0%) and non-significant results (32.3%) are roughly equivalent. Although the generalizability of this pattern of results is limited given that no tests with ROE were run in developing economies, together, this finding does not support the idea that diversity will have a positive impact on financial outcome. Age diversity seems to be just as likely to have a negative or no effect at all on the financial gains of a firm.

Tobin’s Q, a market-based measure of a firm’s value in terms of the intrinsic value of its physical assets in relation to its replacement costs, was the third most studied financial outcome variable. Six studies, three in developing economies and three in developed economies, tested for an association between age diversity and Tobin’s Q. The overall pattern of results indicates a non-significant association between Tobin’s Q and board member age diversity (66.7%), that is, board member age diversity does not have an impact on the estimated growth prospects of the firm.

Looking more broadly at the remaining financial outcomes listed in Table 3, excluding the associations with ROA, ROE and Tobin’s Q, most of the reported associations show a non-significant relationship between board member age diversity and financial outcomes (40.0%). Fewer curvilinear (12.0%), positive (28.0%) and negative (20.0%) associations are reported. This finding is in line with the pattern revealed for Tobin’s Q, which is that the financial performance of a firm is unrelated to the age diversity of its board. Overall, the findings with the various financial metrics indicate that age diversity is not a robust or consistent predictor of a firm’s financial performance.

3.4.2 Non-financial performance

Examining the non-financial performance indicators in Table 4 illustrates the wide range of outcomes investigated by the studies in this review. CSR was investigated in eight studies, making it the most commonly tested non-financial outcome. Of the analyses run, a positive association (62.5%) was most reported, with fewer negative (25.0%) and non-significant (12.5%) associations detected. Although more studies looking at CSR were run in developing economies (i.e., 5 studies in developing economies vs. 3 in developed economies), the higher prevalence of positive associations between CSR and age diversity was common to both economy types. This pattern suggests that firms that adopt management practices which integrate social, ethical, and environmental concerns are likely to have more age diverse boards.

Apart from CSR, the disparate spread of associations shows, as a field, a lack of focus on any single or cluster of firm performance indicators. This lack of critical mass makes it difficult to draw firm conclusions as to the nature of the relationship between board age diversity and non-financial outcomes. Excluding the results of CSR, of the 21 associations reported, a positive relationship is found in 23.4% of studies, a negative relationship is found in 19.0% of studies, a curvilinear relationship in 4.7%, and no relationship is found in 52.4%. The pattern does suggest that on balance, diversity is likely to have either a positive or no effect on a firm’s non-financial performance. Therefore, while a firm may not reliably benefit from diversity, firms are unlikely to experience a decline in performance.

Comparing the associations reported for developing economies demonstrates a notable lack of empirical investigation of board member age diversity and non-financial outcomes in developing economies. Given the heavy reliance by almost all the study authors on publicly available secondary data, it is unsurprising that there are fewer studies conducted in developing economies due to weaker informational links, fewer business reporting requirements (UN 2012), and a comparative lack of databases with comprehensive financial, statistical and local market information.

3.4.3 Measures of age diversity

Table 4 details how the studies operationalised age diversity (as a measure of separation diversity, variety diversity or disparity diversity) and the associations between these indices and firm outcomes. Focusing first on financial outcomes, disparity and separation measures shared a similar pattern of associations, with a slightly higher incidence of negative associations detected, but overall negligible differences in the number of negative, positive and non-significant associations. Collapsing across economy type and type of financial performance, of the 38 associations for disparity, where diversity is skewed with one member at one point and the remaining members at another point: 34.2% were negative; 31.6% were positive; 28.9% were non-significant; and 5.3% were significantly curvilinear. Similarly, of the nine associations reported between separation measures of board member age diversity and firm performance: 44.5% were negative; 22.2% were positive; and 33.3% were non-significant. No curvilinear relationships were detected using separation measures of diversity. The percentages for separation measures are a little misleading, because there are so few studies, only six, which enlisted a separation diversity measure. When the data is reanalysed considering that multiple outcome variables were tested within a single study (i.e., Study 6 tested ROA, ROE and Leverage outcomes and Study 46 tested ROA and ROE outcomes), the same pattern of a slightly higher incidence of negative associations, followed closely by a higher number of non-significant associations is found.

The higher prevalence of negative associations for both disparity and separation types are in line with Harrison and Klein’s (2007) theoretical reasoning that disparity and separation forms of diversity lead to negative outcomes. However, because the incidence of non-significant and positive associations is only slightly less than the incidence of negative associations, the current work does not demonstrate clear support for the assertion that disparity diversity within groups is likely to increase within-unit competition, resentful deviance and withdrawal or that separation diversity is likely to reduce group cohesion, task performance and increase interpersonal conflict. Overall, the pattern of results reveals that disparity and separation types of diversity are inconsistent predictors of firm outcomes. A recent longitudinal Belgian study finding that separation measures of diversity were predictive of both increased and reduced turnover for different aged workers provides some convergent support that separation measures need not necessarily be detrimental (De Meulenaere et al. 2022a).

Interpreting this pattern further, it may be that other factors, such as team or task variables, impact group performance outcomes. For example, although group cohesiveness is an important predictor of performance, Mullen and Copper’s (1994) seminal research shows that: the effect of group cohesion on performance is stronger for smaller groups; less cohesion in groups with high performance norms is likely to result in moderate (rather than low) group performance; and good present performance will result in increased future group cohesion. Board features, such as being generally large with high performance norms, may buffer the hypothesized negative impact of poor group cohesion resulting from separation forms of diversity. It might be possible that although separation diversity may initially dull high firm performance to moderate levels, over time good (moderate or high) performance will lead to improvements in group cohesion, which will in turn reinforce future good performance. While this is only one potential interpretation, it does go some way to reconcile the observed trend with Harrison and Klein’s (2007) work as well as Mullen and Copper’s (1994) view of group cohesion and performance.

Studies that operationalise diversity as variety appear to consistently report a non-significant association between age diversity and outcome variables. Of the 40 associations reported between variety measures and firm performance: 47.5% were non-significant; 25.0% were positive; 17.5% were negative; and 10.0% were curvilinear. This result indicates that the variety type of board age diversity, where the age composition of the board is evenly spread across its members, is unrelated to firm outcomes. That is, age diverse boards are unlikely to perform differently from firms with low or moderate levels of board diversity. The low number of significant negative associations is of note, and when compared with the comparably higher incidence of positive (including curvilinear) associations, it seems that while variety measures do not appear to predict positive outcomes as suggested by Harrison and Klein (2007), such as higher decision quality, greater innovation and creativity, this form of diversity measure is less likely to produce negative outcomes.

4 Discussion

One key finding is that age diverse boards were found to be associated with better CSR related outcomes for most studies in the review. This finding is in line with the optimistic theoretical perspective of resource dependency theory, stakeholder theory, social/human capital, information processing theory and agency theory and corroborates recent qualitative empirical research findings that board age diversity enhances CSR investment and approach decisions, which in turn, enhance CSR performance (Islam et al. 2022). Knowing that most boards tend to comprise of individuals in their 50 s, 60 s and 70 s aged (Barrett 2014), ‘younger’ (diverse) boards may be less conservative and have more awareness of environmental and sustainability issues (Xia et al. 2022). Interpreting this positive association between age diversity and CSR through these theoretical lenses suggests that diverse boards may be better equipped to secure essential resources through their varied external networks; more likely to accurately represent a diversified group of stakeholders; and the integration of different views, perspectives, and values may be an asset in building a firm's social capital and making decisions about how to be a good corporate citizen.

However, the positive association between firms’ CSR reporting and performance is the only notable exception, overall, board age diversity is an inconsistent and poor predictor of firm outcomes. A key finding of the current work is the lack of compelling evidence that board member age diversity predicts performance. After reviewing the last 26 years of quantitative research on board member age diversity and firm outcomes across both developed and developing economies, most researchers failed to find a significant association between the age diversity of the board and the firm's financial and non-financial performance. The lack of a significant result—that is, a clear pattern of age diversity as either a positive, negative or curvilinear—is interesting and important to understand.

On the face of it, the current research suggests that there is no material advantage to having an age diverse board, in terms of financial or non-financial outcomes. However, such an interpretation oversimplifies the pattern of results, and fails to consider the number of studies which found significant positive, negative and curvilinear relationships. Though the main effect of board member age diversity on firm outcomes may be inconsistent, such inconsistency may be ameliorated when age diversity is considered as part of a broader moderation or mediation model (McIntyre et al. 2007; Song et al. 2020). Van Knippenberg et al. (2004) categorization-elaboration model (CEM) may provide a useful theoretical framework for researchers to test potential moderating and mediating factors. According to CEM, diversity can impact outcomes via two interacting routes—one via information/decision making processes and the other via intergroup biases resulting from social categorization processes—and the nature of diversity, as either positive or negative will depend on the salience of demographic variables, presence of intergroup bias and extent of information-elaboration. The growing evidence in the broader teams’ literature which demonstrates the utility of interactive models in clarifying the role of age diversity on team (Hoch et al. 2010; Schippers Den Hartgog et al. 2003) and organisational outcomes (Guillaume et al. 2017; Li et al. 2021; Ries et al. 2013), provides further evidence that the effects of age diversity might be better understood when investigated in relation to other team or task relevant variables.

Another key finding of the review is the strong theoretical grounding of this area of literature. Although it is surprising that after reviewing 54 papers no clear pattern of associations emerges, such inconsistency is precisely in line with theoretical perspectives of diversity. The diversity literature provides compelling theoretical arguments for the costs and benefits of age diversity. Indeed, there are several theoretical frameworks, such as resource dependency theory and information-processing theories, which promote diversity to create linkages with important stakeholders and a solution to groupthink. In contrast, pessimistic theories, such as social identity theory and self-categorization theory, warn that having members from diverse groups can diminish group cohesion, decision-making and performance. That is, theories of diversity explain not only why diversity should relate to outcomes (e.g., according to stakeholder theory, diverse groups have access to greater and diverse resources), but they also predict the differential impacts of diversity on outcomes (i.e., pessimistic vs. optimistic views; see Table 1). While the current review does not provide powerful evidence in favour of one theory or group of theories (i.e., pessimistic or optimistic theories) over another, the theoretical perspectives offered by researchers does provide a theoretical explanation for why we uncover discrepant results. The presence of negative (as per self-categorization theory for example), positive (as per information processing theory for example) and curvilinear relationships is to be expected and is well explained using existing diversity theories.

One other key finding of the current work is the identification of a bias towards investigating financial firm performance rather than non-financial firm performance. Financial data is quantifiable and can be used to easily compare performance between firms irrespective of firm attributes, industry characteristics and economy type. Financial data is also generally more readily available via publicly available databases in comparison to non-financial data. There is also established methodology with respect to the calculation of financial indices. In contrast, there seems to be a notable lack of consensus on what non-financial outcomes to investigate, and there is no agreement on how to operationalise these constructs. Understandably, these factors make research using non-financial performance indicators unattractive. This collection of variables is difficult to measure, collect and compare across heterogeneous firms. While the challenges of investigating the relationship between board member age diversity and non-financial performance outcomes are pronounced, it is vital that such work take place to advance the field’s understanding the linkage between age diversity and non-financial outcomes, as well as how non-financial outcomes are related to financial outcomes.

4.1 Implications and future directions

The current review clearly illustrates the multiple ways in which age diversity can be operationalised. The results are somewhat supportive of Harrison and Klein’s (2007) conceptualisation of diversity types, but the pattern of results also highlight some departures. The current work endorses the calls by De Meulenaere et al. (2022b) for more accurate measurement of age diversity, ensuring that the metric used is a true measure of heterogeneity.

Despite the strong theoretical linkages specifying a non-linear association between board member age diversity and firm outcomes, few studies in the review explicitly tested for a curvilinear relationship between the board member age diversity and outcome variables (notable exceptions include studies 7, 21, 26, 43, 51). Curvilinear relationships can be difficult to detect because non-linearity can be masked by Pearson’s r (Warner 2008) and is likely to reduce the statistical power of univariate (i.e., ANCOVA) and multivariate tests (linear regression) (Tabachnick and Fidell 2013). As well as testing for moderated and mediated models as mentioned previously, future research should also be directed at explicitly testing for curvilinear relationships between board member age diversity and firm outcomes.

Importantly, the current review demonstrates a clear understanding by researchers of the time-lagged impact of board of directors on firm outcomes. Most studies enlisted data from multiple years and several (e.g., studies 10, 20 and 27) also explicitly analysed the data in a comprehensive longitudinal format. Given the public availability of multi-year secondary data, future research should continue to focus on adopting a longitudinal design. Longitudinal studies are particularly important to understanding the impact of board member diversity because the decisions and actions taken by a board may take years, rather than months, to influence organisational outcomes such as firm value or performance (see Bednell 2014). Longitudinal research designs do require a more sophisticated understanding of research design and data analysis; however, the lasting impact of age diversity can only be assessed using this methodology.

The findings of the current research provide some practical guidance to boards and those who advise boards. The relationship between board age diversity and firm outcomes is not straightforward. While it is most likely that age diversity will not directly affect outcomes, there is still potential for diversity to positively or negatively impact performance. So how can boards best manage the age diversity of its board to ensure that any effects are positive at best and negligible at worst? Being aware that diversity may threaten group cohesion, boards may find it useful to proactively employ strategies to protect and promote group cohesion. One strategy may involve educating board members on both how to harness the anticipated advantages of group diversity and reduce the costs. For instance, highlighting to board members that diverse groups tend to make better quality decisions but that these decisions may take longer to make, and are only likely to result when task conflict is high and relationship conflict is low (De Drue 2008), may increase their self-awareness when interacting with each other. Complementing this strategy, diverse boards may find it useful to meet more regularly to support more deliberated and constructive discussion and debate as well as facilitate the reduction of perceptions of surface level diversity (such as age, sex and race) which are known to diminish over time (Harrison et al. 1998). Another strategy may involve engaging in activities which reinforce membership of the board and promote respect and trust (Ely and Thomas 2001). A code of conduct, and/or open and explicit discussion about how board members are to conduct themselves should increase feelings of justice and reduce the potential for in-group and out-group groups to develop.

Despite reviewing in detail 54 empirical studies testing for associations between board member age diversity and firm performance, there was a notable lack of discussion on how policy could enhance or support board diversity. Omission of the role that policy can play in driving age diversity may indicate, as suggested by the current work, that there is not yet a critical mass of evidence in favour of board member age diversity. Absence of policy debate, and consideration of the current social climate, may also signal an unwillingness of policy makers to address board member age diversity, given that there is still so much current debate on gender diversity and boards. Despite the lack of advocacy for policies supporting board member age diversity (an exception is Xia et al. 2022), there is a strong need for policy makers to mandate the publication of board member demographic information. For more and better-quality longitudinal research testing for curvilinear relationships between board member age diversity and firm performance to be conducted, researchers need to have access to board member demographic data. Making reporting of such data mandatory would be a small but important step to improving the quality and quantity of research which would in turn have a material impact on corporate governance and firm performance.

4.2 Limitations

While the systematic quantitative literature review methodology employed has several strengths, one limitation of the current research is a lack of opportunity to make direct comparisons on more nuanced contextual variables likely to influence the relationship between board member age diversity and firm outcomes. For instance, boards operating in single-tier environments (e.g., US), may be impacted differently by age diversity than those in two-tier (e.g., Belgium) or other types (e.g., France) of board structures (i.e., Jouber 2020).

5 Conclusion

The results of this systematic review demonstrate the inconsistent nature in which board member age diversity predicts financial and non-financial outcomes. While most studies failed to find any significant performance differences between diverse and non-diverse boards, significant positive, negative and curvilinear relationships were reported. There is a clear need for more research. There are strong theoretical reasons for why age diversity may have differential effects on outcomes, and future research should be focused on empirically investigating under what conditions age diversity is likely to yield beneficial or detrimental results. Prioritising research which is longitudinal, explicitly testing for curvilinear, moderated and mediated relationships and looks at age diversity in relation to financial and non-financial outcomes will help to directly test, build, and reconcile competing diversity and measurement theory. Advancement of research in this space will facilitate policy and practice which is evidence based and effective.

Data availability

Data is available with in the article. The authors confirm that the data supporting the findings within the article is present within the published tables and figures.

References

Åberg C, Bankewitz M, Knockaert M (2019) Service tasks of board of directors: a literature review and research agenda in an era of new governance practices. Eur Manag J 37(5):648–663

Akpan EO, Amran NA (2014) Board characteristics and company performance: evidence from Nigeria. J Field Act 2:81–89

Alhossini MA, Ntim CG, Zalata AM (2020) Corporate board committees and corporate outcomes: an international systematic literature review and agenda for future research. Int J Acc 56:2150001

Ali M, Ayoko OB (2020) The impact of board size on board demographic faultlines. Corp Gov Int J Bus Soc 20(7):1205–1222

Ali M, Ng YL, Kulik CT (2014) Board age and gender diversity: a test of competing linear and curvilinear predictions. J Bus Ethics 125:497–512

Almashaqbeh A, Shaari H, Abdul-Jabbar H (2019) The effect of board diversity on real earnings management: empirical evidence from Jordan. Int J Financ Res 10(5):495–508

Alshabibi B (2021) Improving board diversity around the world: the role of institutional investors. J Financ Rep Acc 20(2):297–333

Arenas-Torres F, Bustamante-Ubilla M, Campos-Troncoso R (2021) Diversity of the board of directors and financial performance of the firms. Sustainability 13(21):11687

Arioglu E (2021) Board age and value diversity: evidence from a collectivistic and paternalistic culture. Borsa Istanb Rev 21(3):209–226

Arnaboldi F, Casu B, Kalotychou E, Sarkisyan A (2020) The performance effects of board heterogeneity: What works for EU banks? Eur J Finance 26:897–924

Barrett A (2014) Age diversity within board of directors of the S&P 500 companies (technical report). Board Governance Research, San Diego

Bednell TC (2014) Chapter 5 Longitudinal research. In: Sanders K, Cogin JA, Bainbridg HTJ (eds) Research methods for human resource management. Routledge, London, pp 74–95

Beji R, Ouidad Y, Loukil N, Abdelwahed O (2021) Board diversity and corporate social responsibility: empirical evidence from France. J Bus Ethics 173(1):133–155

Belkacemi R, Papadopoulos A, Bouzinab K (2021) Board of directors’ surface level diversity and innovation performance. J Leadersh Acc Ethics 18(2):131–151

Bell ST (2007) Deep-level composition variables as predictors of tem performance: a meta-analysis. J Appl Psychol 92:595–615

Bell ST, Villado AJ, Lukasik MA, Belau L, Briggs AL (2011) Getting specific about demographic diversity variable and team performance relationships: a meta-analysis. J Manag 37(3):709–743

Berthelot S, Coulmont M, Gosselin AM (2019) Do investors take directors’s age, tenure, and their homogeneity into account? Int J Bus Acc Finance 13:86–100

Bin Khidmat W, Ayub Khan M, Ullah H (2020) The effect of board diversity on firm performance: evidence from Chinese Listed Companies. Indian J Corp Gov 13(1):9–33

Branco APC, Bianchi MT, Branco MC (2020) Board demographic diversity and human rights reporting in Western Europe. PSU Research Review, pp 2399–1747

Bukalska E, Wawryszuk-Misztal A (2021) Does the board of directors’ characteristics affect the amount of capital raised in IPO? Int J Econ Policy Emerg Econ 14(2):121–135

Buljac-Samardzic M, Doekhie KD, van Wijngaarden JD (2020) Interventions to improve team effectiveness within health care: a systematic review of the past decade. Hum Resour Health 18(1):1–42

Buse K, Bernstein RS, Bilimoria D (2016) The influence of board diversity, board diversity policies and practices, and board inclusion behaviors on nonprofit governance practices. J Bus Ethics 133:179–191

Byrne D (1971) The attraction paradigm. Academic Press, New York

Calabrese GG, Manello A (2021) Board diversity and performance in a masculine, aged and glocal supply chain: new empirical evidence. Corp Gov 21(7):1440–1459

Chen MKL, Gardiner E (2019) Supporting older workers to work: a systematic review. Pers Rev 48:1318–1335

Cheuk S, Nichol EO, Tinggi M, Hla DT (2018) Board diversity and financial sustainability in charities: a Malaysian perspective. Glob Bus Manag Res 10:87–95

Dagsson S, Larsson E (2011) How age diversity on the board of directors affects firm performance. Unpublished master's dissertation, Blekinge Institute of Technology, Karlskrona

Darmadi S (2011) Board diversity and firm performance: the Indonesian evidence. Corp Ownersh Control J 8:66

De Meulenaere K, Allen DG, Kunze F (2022a) Age separation and voluntary turnover: asymmeric effects for collective turnover rates and individual turnover intentions depending on age. Pers Psychol 66:1–30

De Meulenaere K, Biemann T, Boone C (2022b) The (mis)use of SD as age diversity measure: introducing the mean SD, Work, Aging and Retirement

De Drue C (2008) The virtue and vice of workplace conflict: food for (pessimistic) thought. J Organ Behav 29(1):5–18

Ely RJ, Thomas DA (2001) Cultural diversity at work: the effects of diversity perspectives on work group processes and outcomes. Adm Sci Q 46:229–273

Engelen PJ, Van Den Berg A, Van Der Laan G (2012) Board diversity as a shield during the financial crisis. In: Boubaker S, Nguyen BD, Nguyen DK (eds) Corporate governance: recent developments and new trends. Springer, Berlin, pp 259–285

Eulerich M, Velte P, van Uum C (2014) The impact of management board diversity on corporate performance. An empirical analysis for the German two-tier system. Probl Perspect Manag 12:25–39

Ferrero-Ferrero I, Fernández-Izquierdo MÁ, Muñoz-Torres MJ (2015) Integrating sustainability into corporate governance: an empirical study on board diversity. Corp Soc Responsib Environ Manag 22:193–207

Freeman RE (1984) Strategic management: a stakeholder approach. Pitman Publishing, Boston

Fullerton RR, Wempe WF (2009) Lean manufacturing, non-financial performance measures, and financial performance. Int J Oper Prod Manag 29:214–240

Galia F, Zenou E (2012) Board composition and forms of innovation: Does diversity make a difference? Eur J Int Manag 6:630–650

Gruenfeld DH, Mannix EA, Williams KY, Neale MA (1996) Group composition and decision making: how member familiarity and information distribution affect process and performance. Organ Behav Hum Decis Process 67:1–15

Guillaume YR, Dawson JF, Otaye-Ebede L, Woods SA, West MA (2017) Harnessing demographic differences in organizations: What moderates the effects of workplace diversity? J Organ Behav 38(2):276–303

Hagendorff J, Keasey K (2012) The value of board diversity in banking: evidence from the market for corporate control. Eur J Finance 18:41–58

Harrison DA, Klein KJ (2007) What’s the difference? Diversity constructs as separation, variety, or disparity in organizations. Acad Manag Rev 32:1199–1228

Harrison DA, Price KH, Bell MP (1998) Beyond relational demography: time and the effects of surface- and deep-level diversity on work group cohesion. Acad Manag 41(1):96–107

Higgins JP, Green S (2011) Cochrane handbook for systematic reviews of interventions. Wiley, Chichester

Hoch JE, Pearce CL, Welzel L (2010) Is the most effective team leadership shared? The impact of shared leadership, age diversity, and coordination on team performance. J Pers Psychol 9(3):105

Ibrahim AH, Hanefah MM (2016) Board diversity and corporate social responsibility in Jordan. J Financ Rep Acc 14:279–298

Islam R, French E, Ali M (2022) Evaluating board diversity and its importance in the environmental and social performance of organizations. Corp Soc Responsib Environ Manag 6:66

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ 3:305–360

Jirásek M (2021) Corporate boards’ and firms’ R&D responses to performance feedback. J Strategy Manag 6:66

Jouber H (2020) Is the effect of board diversity on CSR diverse? New insights from one-tier vs two-tier corporate board models. Corp Gov Int J Bus Soc 6:66

Judge WQ, Gaur A, Muller-Kahle MI (2010) Antecedents of shareholder activism in target firms: evidence from a multi-country study. Corp Gov Int Rev 18:258–273

Kagzi M, Guha M (2018a) Board demographic diversity: a review of literature. J Strateg Manag 11:33–51

Kagzi M, Guha M (2018b) Does board demographic diversity influence firm performance? Evidence from Indian-knowledge intensive firms. Benchmark Int J 25:1028–1058

Katmon N, Mohamad ZZ, Norwani NM, Al Farooque O (2019) Comprehensive board diversity and quality of corporate social responsibility disclosure: evidence from an emerging market. J Bus Ethics 157:447–481

Kang H, Cheng M, Gray SJ (2007) Corporate governance and board composition: diversity and independence of Australian boards. Corp Gov Int Rev 15:194–207

Khan A, Baker HK (2022) How board diversity and ownership structure shape sustainable corporate performance. Manag Decis Econ 6:66

Khan I, Khan I, Senturk I (2019) Board diversity and quality of CSR disclosure: evidence from Pakistan. Corp Gov 19(6):1187–1203

Letting D, Nicholas K, Aosa E, Machuki V (2012) Board diversity and performance of companies listed in Nairobi Stock Exchange. Int J Humanit Soc Sci 2:172–182

Li N, Wahid AS (2018) Director tenure diversity and board monitoring effectiveness. Contemp Acc Res 35:1363–1394

Li Y, Gong Y, Burmeister A, Wang M, Alterman V, Alonso A, Robinson S (2021) Leveraging age diversity for organizational performance: an intellectual capital perspective. J Appl Psychol 106(1):71

Limbasiya N, Shukla H (2019) Effect of board diversity, promoter’s presence and multiple directorships on firm performance. Indian J Corp Gov 12(2):169–186

Mahadeo JD, Soobaroyen T, Hanuman VO (2012) Board composition and financial performance: uncovering the effects of diversity in an emerging economy. J Bus Ethics 105:375–388

Mannix E, Neale MA (2005) What differences make a difference? The promise and reality of diverse teams in organizations. Psychol Sci Public Interest 6:31–55

McIntyre ML, Murphy SA, Mitchell P (2007) The top team: examining board composition and firm performance. Corp Gov Int J Bus Soc 7:547–561

Midavaine J, Dolfsma W, Aalbers R (2016) Board diversity and R&D investment. Manag Decis 54:558–569

Moher D, Liberati A, Tetzlaff J, Altman DG (2009) Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Ann Intern Med 151:264–269

Mullen B, Copper C (1994) The relation between group cohesiveness and performance: an integration. Psychol Bull 115:210–227

Mustafa AS, Che-Ahmad A, Chandren S (2018) Board diversity, audit committee characteristics and audit quality: the moderating role of control-ownership wedge. Bus Econ Horizons 14:587–614

Nel G, Scholtz H, Engelbrecht W (2020) Relationship between online corporate governance and transparency disclosures and board composition: evidence from JSE listed companies. J Afr Bus 23(2):304–325

Nguyen THH, Ntim CG, Malagila JK (2020) Women on corporate boards and corporate financial and non-financial performance: a systematic literature review and future research agenda. Int Rev Financ Anal 71:101554

Ntim CG, Soobaroyen T (2013) Black economic empowerment disclosures by South African listed corporations: the influence of ownership and board characteristics. J Bus Ethics 116(1):121–138

Onuorah AC, Osuji CC, Ozurumba BA (2019) Board composition, diversity index and performance: evidence from four major Nigerian banks. J Manag Inf Decis Sci 22(4):342–359

Pfeffer J, Salancik GR (1978) The external control of organizations: a resource dependence perspective. Harper and Row, New York

Pickering C, Byrne J (2014) The benefits of publishing systematic quantitative literature reviews for PhD candidates and other early-career researchers. High Educ Res Dev 33:534–548

Prudêncio P, Forte H, Crisóstomo V, Vasconcelos A (2021) Effect of diversity in the board of directors and top management team on corporate social responsibility. Braz Bus Rev 18(2):118–139

Ries BC, Diestel S, Shemla M, Liebermann SC, Jungmann F, Wegge J, Schmidt KH (2013) Age diversity and team effectiveness. In: Age-differentiated work systems. Springer, Berlin, pp 89–118

Schmid S, Mitterreiter S (2020) International top managers on corporate boards: dissimilarity and tenure. Manag Int Rev 60:787–825

Schneid M, Isidor R, Steinmetz H, Kabst R (2016) Age diversity and team outcomes: a quantitative review. J Manag Psychol 31:2–17

Shehata N, Salhin A, El-Helaly M (2017) Board diversity and firm performance: evidence from the UK SMEs. Appl Econ 49:4817–4832

Shoukat A, Ramiz Ur R, Muhammad Ishfaq A, Ueng J (2021) Does board diversity attract foreign institutional ownership? Insights from the Chinese Equity Market. J Risk Financ Manag 14(11):507

Siciliano JI (1996) The relationship of board member diversity to organizational performance. J Bus Ethics 15:1313–1320

Singh V (2007) Ethnic diversity on top corporate boards: a resource dependency perspective. Int J Hum Resour Manag 18(12):2128–2146

Sitthipongpanich T, Polsiri P (2013) Who’s on board? Influence of diversity and network of Thai boards of directors on firm value. J Appl Bus Res 29:1763–1780

Sitthipongpanich T, Polsiri P (2014) Board diversity, network and firm value. J Econ Soc Dev 1:184–198

Song HJ, Yoon YN, Kang KH (2020) The relationship between board diversity and firm performance in the lodging industry: the moderating role of internationalization. Int J Hosp Manag 86, Article 102461

Syakhroza A, Diyanty V, Dewo SA (2021) Top management team (TMT) age diversity and firm performance: the moderating role of the effectiveness of TMT meetings. Team Perform Manag Int J 27:486–503

Tabachnick BG, Fidell LS (2013) Using multivariate statistics, 6th edn. Pearson Education, Boston

Tajfel H (1981) Human groups and social categories: studies in social psychology. Cambridge University Press, Cambridge

Talavera O, Yin S, Zhang M (2018) Age diversity, directors’ personal values, and bank performance. Int Rev Financ Anal 55:60–79

Tarus DK, Aime F (2014) Board demographic diversity, firm performance and strategic change. Manag Res Rev 37:1110–1136

Turner JC (1985) Social categorization and the self-concept: a social cognitive theory of group behaviour. In: Lawler EJ (ed) Advances in group processes. JAI Press, Greenwich, pp 77–122

Turner JC, Oakes PJ (1989) Self-categorization theory and social influence. In: Paulus PB (ed) The psychology of group influence. Erlbaum, Hillsdale, pp 233–275

Turner JC (1982) Towards a cognitive redefinition of the social group. In: Tajfel H (ed) Social identity and intergroup relations, pp 15–40. Cambridge University Press and Paris: Editions de la Maison des Sciences de l’Homme, Cambridge

United Nations (2020) World economic situation and prospects 2020, pp 162–200

United Nations Conference on Trade and Development (2012) Global accounting standards move forward; developing countries left behind? https://unctad.org/en/pages/PressRelease.aspx?OriginalVersionID=54. 22 April 2012. Accessed 3 June 2019

Van Knippenberg D, De Dreu CKW, Homan AC (2004) Work group diversity and group performance: an integrative model and research agenda. J Appl Psychol 89:1008–1022

Velez-Castrillon S (2012) The strategic fit between Board of Directors characteristics and the external environment, and its effect on firm reputation. Unpublished doctoral dissertation, University of Houston, Houston

Wambui K (2018) Influence of board diversity on the financial performance of commercial banks in Kenya. Unpublished doctoral dissertation, Strathmore University, Nairobi

Warner RM (2008) Applied statistics: from bivariate through multivariate techniques. SAGE, Los Angeles

Wegge J, Jungmann F, Liebermann S, Shemla M, Ries BC, Diestel S, Schmidt KH (2012) What makes age diverse teams effective? Results from a six-year research program. Work 41(Suppl 1):5145–5151

Wellalage NH, Locke S (2013) Corporate governance, board diversity and firm financial performance: New evidence from Sri Lanka. Int J Bus Gov Ethics 8:116–136

Xia L, Gao S, Wei J, Ding Q (2022) Government subsidy and corporate green innovation—Does board governance play a role? Energy Policy 161:Article 112720

Xu Y, Zhang L, Chen H (2018) Board age and corporate financial fraud: an interactionist view. Long Range Plan 51:815–830

Yaseen H, Iskandrani M, Ajina A, Hamad A (2019) Investigating the relationship between board diversity & corporate social responsibility (CSR) performance: evidence from France. Acad Acc Financ Stud J 23(4):66

Young MN, Peng MW, Ahlstrom D, Bruton GD, Jiang Y (2008) Corporate governance in emerging economies: a review of the principal–principal perspective. J Manag Stud 45:196–220

Zhang C, Luo L (2021) Board diversity and risk-taking of family firms: evidence from China. Int Entrep Manag J 17(4):1569–1590

Acknowledgements

The author would like to thank Professor Ian Ramsay, Melbourne Law School, University of Melbourne, and Associate Professor Jonas Debrulle, IESEG School of Management, for their insightful comments on an earlier draft of this manuscript and Ms Katrina Henderson, Academic Services Librarian, Griffith University, for her technical advice in conducting the systematic search of literature.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions. This research did not receive any specific grant from funding agencies in the public, commercial or non-for-profit sectors.

Author information

Authors and Affiliations

Contributions

The work is entirely that of the listed author.

Corresponding author

Ethics declarations

Conflict of interest

None to report.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gardiner, E. What’s age got to do with it? The effect of board member age diversity: a systematic review. Manag Rev Q 74, 65–92 (2024). https://doi.org/10.1007/s11301-022-00294-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-022-00294-5

Keywords

- Corporate governance

- Board of directors

- Board diversity

- Firm performance

- Age diversity

- Corporate board

- Systematic review