Abstract

The audit market is subject to ongoing regulation to ensure or improve the quality of audit services. For this reason, international research on the audit market is highly popular. As part of this discussion, pricing is considered one of the most relevant aspects of audits. However, a remarkable heterogeneity of the control variables used in empirical studies can be observed. Prior meta-analyses on audit fees already summarized and categorized them for audit fee studies covering financial periods until fiscal year 2007. We contribute to the international literature with an up-to date and systematic review approach on audit fee studies published in international relevant scientific journals (JQ3 A + , A, B). In addition to prior reviews and meta-analyses, we finally suggest a standard model for the most important fee drivers that can be used for future audit fee studies. Our unique approach is based on an EBSCO keyword search with a sample of 385 papers published in international relevant scientific journals (JQ3 A + , A, B) and is using a scoring model to assess significance of audit fee control variables. On the one hand, we enrich the literature by a new state of the art paper on pricing within audit firms. On the other hand, we contribute to the international literature on audit markets from a theoretical point of view by deriving a new testable model of audit fee determinants. Therefore, our empirical results provide several fundamental insights that can be used for further empirical and theoretical research on the pricing of audit services. Thus, the results are meaningful not only for researchers within the field of auditing but also for experts in management, pricing or European legislature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The recent financial, public debt and economic crises shook the capital markets more than ten years ago (see, e.g., Fahlenbach et al. 2012). In the eyes of the European Commission, the auditing profession played a prominent role in fueling rather than preventing economic dislocations (European Commission 2011). In particular, long-term audit engagements were criticized by the media, the public and policy makers (Quick 2004). Potentially influenced by the negative experiences from the Enron case (e.g., Culpan and Trussel 2005), it was argued that the auditor becomes increasingly blind to shortcomings in company processes the longer he or she is in charge of his client, which can be explained by DeAngelo (1981). The EU Commission took this as an opportunity to publish a specific green paper in 2010. According to the title “Audit Policy: Lessons from the Crisis” (European Commission 2010), it appears prima facie quite clear that a political change was expected that would affect the profession and the whole structure of the audit market (e.g., Humphrey et al. 2011). That supranational initiative applied to the entire European economic area. The representatives from Brussels were starting an extensive discussion concerning the improvement of audit quality. However, it took almost 4 years until the legal decisions were agreed to on 16th June 2014, by EU Regulation No. 537/2014 and Directive 2014/56/EU (European Parliament 2014a, b). Among the changes that were introduced by these reforms (Humphrey et al. 2011), the most significant one addresses limiting the maximum duration of the auditor–client relationship (Weber et al. 2016, pp. 660–661). This so-called “external rotation” means legislators would intervene in the free market. By capping the number of consecutive years that an auditing firm is allowed to provide its audit services to a particular client, the EU expects to stimulate the market with a greater number of future auditor changes (European Commission 2010, p. 11). The first time-adoption of the external rotation was set for periods beginning after 16th June 2016. Since then, public interest entities have been obliged to apply the rules. By such an external rotation, the EU hopes to increase competition in the audit market. In particular, increased auditor changes should stimulate the market.

It should be noted that an initial audit engagement raises particular questions compared to recurring engagements (Ridyard and DeBolle 1992, p. 90). At first, auditors have to address strategic considerations by finding answers to the following question: “Are we able to, are we allowed to and are we actually willing to submit a proposal to serve the possible client?” Quite intuitively, one would like to answer these questions with a convincing “Yes, we can”.

However, before being assigned as an auditor, a proper analysis of the company’s risk structure is required (D’Aquila et al. 2010) before the terms of engagement are fixed. Additionally, auditors need to double-check if they have adequate capacity and capability to perform the necessary procedures. Once the risk structure is clear and the necessary resources are verified, the auditor can come up with a proposal and an adequate audit fee.

The number of publications that focus on audit fees is remarkable. Nevertheless, there is not even a handful of comprehensive literature reviews that provide an overview of current key findings and insights in a nutshell. The most significant papers are those from Hay et al. (2006) and Hay (2013). Their meta-analyses covered audit fee studies that were using data collected prior to the 2007 financial period.

Therefore, we provide a more recent literature review of the determinants of audit fees and consider the future dynamic in the audit market that was kicked off by the EU. Following Widmann (2019), we assume that regulatory intervention in the auditing market will have a lasting impact on the design of audit fees. It is the aim of this paper to contribute to the literature concerning audit fees in two ways.

-

At first, by presenting the up-to date state of the art within this demanding scientific field.

-

At second, by aggregating the empirical results of previous studies to a fundamental scoring model of audit fee control variables.

To contribute to a better understanding of the determinants of audit fees, it is necessary to systematically examine the influencing factors of audit fees that have already been examined, which we provide with the study at hand.

The remainder of this review is structured as follows. In Sect. 2, we provide a theoretical background based on the results of prior research. Section 3 will present the research design concerning the data sample and empirical approach to our analysis. Section 4 will present key results before we finally discuss the findings in Sect. 5.

Based on our unique and recent data we contribute to the international literature in two ways. First, we provide the current state of the art within the pricing practice of audit firms by presenting a systematic literature review. Second, we go further than a literature review by developing a new testable model for the calculation of audit fees based on 121 quantitative studies with 137 regression outputs. We provide crucial implications for the management of audit firms; researchers within the fields of auditing, pricing and management; policy makers; and lobbyists.

2 Theoretical background

One of the first studies that offered an economic analysis of the audit market was that of Simunic (1980), who focused on the competition within that market. Simunic (1980) found that there is a relation between the complexity of the audit, the risk and the audit fee. From this starting point, in the following 20 years, Cobbin (2002) found 56 studies concerning the determinants of audit fees, most of them with data from the United States (15). Research on auditing markets is currently one of the most prominent fields of scientific contribution to auditing (see, e.g., Nikkinen and Sahlström 2004 for further literature).

One of the critical aspects within the negotiation between a client and a potential auditor—spoken in legal terms as “essentialia negotii”—is the audit fee, which can be understood as the price for the services provided by the audit firm (Pong and Whittington 1994). Before a negotiation, a client will calculate its willingness to pay based on a calculation between benefits and costs. The auditor will do similar considerations, in particular concerning the relation between its costs and the price that the client will pay (DeAngelo 1981).

In addition, we need to focus on the role of the auditor itself. We are not living in a perfect world. Auditors may differ in terms of their size, their level of experience, their competences and thus their quality. Therefore, there might be specific factors that affect the audit fee as well. From the perspective of the supply side, there are different factors that influence the price an audit firm will demand, e.g., the auditor’s size (e.g., Palmrose 1986; Taylor and Simon 1999). For example, Pong and Witthington (1994) found that the “BIG-8” audit firms (now “BIG-4”) are more expensive than smaller companies, so they emphasize a premium for big audit firms. Finally, there might be specific factors affecting the audit fee that are probably just due to engagement.

From the client’s perspective, we can consider that the audit fee itself is also part of the monitoring costs (Nikkinen and Sahlström 2004). The close relationship between agency theory and the explanation of international audit fees was empirically tested by Nikkinen and Sahlström (2004). They provided evidence for the negative relationship between audit fees and ownership by management and a positive correlation between audit fees and free cash flow. Moreover, the size and complexity of the auditee determines the audit fee because a large company requires a higher workload (Pong and Whittington 1994).

We suggest that all actions taken by the auditor are driven by an economic point of view due to an assumed effectiveness of these regulations. Consequently, the auditor wants—similar to a stereotypical entrepreneur—to make a profit. Considering that the common audit approach is based on the idea of mitigating all relevant risks before issuing the opinion as a final delivery (e.g., Marten et al. 2015), it becomes obvious that personnel expenses for highly qualified staff are one of the key drivers for the costs of the auditor. Following Agrawal and Jayaraman (1994), Gul and Tsui (2001) and Nikkinen and Sahlström (2004), we assume that the agency between management and shareholders influences the monitoring costs in general and therefore audit fees in particular. The more agency conflicts the auditor is identifying, the more risks the client seems to incorporate. Consequently, in such cases, audit fees should be higher, thus making audit fees a promising proxy for the client’s risk situation (at least, the auditor’s perception of the client’s risk).

In this respect, there will certainly be client-specific determinants on the one hand and auditors’ specific determinants that affect audit fees. Furthermore, we summarize all other effects, e.g., the bargaining power under “engagement specifics”. Additionally, an auditor change may be an important determinant of the fees, which was investigated in an agency context by Marten (1994, 1995) and Stefani (1999) before the EU came up with the external rotation.

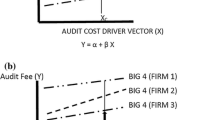

In more technical terms, we can state that audit fees are a function of client specifics, auditor specifics and engagement specifics. Following the approach by Hay et al. (2006), we assume the following regression model (see Eq. (1)):

where

\({LN(AF}_{it})\) is the \(Nat.\; Log. \;of \;the \;audit \;fee \;at \;the\; time \; t\), \({\beta }_{0}\) is the \(Constant, {\beta }_{j}, {\beta}_{k}, {\beta}_{l}\) is the \(Regressions\; coefficient\; at \;the \;time \; t\), \({\varepsilon }_{t}\) is the \(error\; term \;at \;the \;time \; t.\)

Our objective is to finally fill these categories with those control variables that have proven to be most significant in explaining audit fees. To do so, we first identify all variables that were used in prior audit fee studies. Second, we put the respective variable into the categories that are presented in Eq. (1). We further extracted their significance level (1%, 5% or 10%-level or no significance) and their sign ( ±) to analyze the aggregated impact in prior studies. Based on these results, we conclude on the adequateness and suggest an improved model that could be used for future audit fee studies. Finally, we compute a score that is based on a coding of each regression output, as follows:

-

If the respective variable was highly significant (1%) and positive (negative), we set the value as 4 (− 4).

-

If the respective variable was significant (5%) and positive (negative), we set the value as 3 (− 3).

-

If the respective variable was significant (10%) and positive (negative), we set the value as 2 (− 2).

-

If the respective variable was not significant but positive (negative), we set the value as 1 (− 1).

3 Research design and descriptive results

3.1 Literature identification process

Concerning the fundamental steps of writing a systematic literature review, we based our procedure on the recommendations by Fisch and Block (2018). The term “audit fee” was used as the basis for the search strategy within the database of EBSCO, which included all papers that were published prior to the end of 2019. This search initially produced 516 results. We then eliminated all papers that were not for academic purposes by using the corresponding filter function offered by the database. A total of 299 studies remained after having eliminated all papers that were statements by and for practitioners.

To ensure a certain quality of papers, only A + , A and B VHB-JQ3 ranked papers were analyzed. Therefore, 235 studies preliminarily remained in our set. As a next step, each paper was carefully reviewed to determine whether it was a quantitative study. For this systematic literature review, we purely focus on quantitative studies with audit fees as the dependent variable. That criterion reduced the sample to 189 publications. Then, 68 studies were removed from the list due to missing data or due to focusing on banks, insurance or real estate companies, as these companies have particular audit requirements and therefore particular audit fee model/determinants. Finally, we obtained 121 comparable studies with 137 different regression outputs as a basis for the analysis.

3.2 Journals

“Auditing: A Journal of Practice and Theory” is the most relevant journal in the field of auditing research when focusing on audit fees. A total of 21 out of the 121 analyzed studies (17% of the sample) were published in this journal. Hay et al. (2006) and Hay (2013) found similar results.

The journals are divided as follows according to the filtration technique used to ensure the quality of the journal and the validity of the research contributions in accordance with the German VHB-JQ3 rating.

Table 1 shows that 13.0% of the papers were published in A + -ranked journals, which means that auditing is relevant in leading journals worldwide in the field of accounting (Table 2).

3.3 Studies’ characteristics

Studies that analyzed data from the US and Anglo-Saxon areas play the most important role within auditing research in terms of pricing (Fig. 1), which is consistent with the prominence of the US within the scientific community in the field of accounting (e.g., Brinn et al. 2001).

The earliest studies analyzed data from the 1980s (Fig. 2). Due to missing information about the audit fee within the financial statements at this time, the authors had to send questionnaires in order to receive their data (as performed by Chung and Lindsay 1988; Gist 1992; Behn et al. 1999; Ahmed and Goyal 2005; Knechel and Willekens 2006; Ho and Hutchinson 2010). Figure 3 presents a quite intuitive curve over time. The stable lines within the first years are due to missing and hard-to-obtain information. Only peer-reviewed journals were included in the scope of our review. Therefore, the decline in recent years is not surprising at all, considering the long-lasting review process in place at the journals. Therefore, the curve continuously declines after the peak in 2007. The last available datasets belong to the financial year 2016.

First, the number of independent variables in the studies was simply counted. On average, 13 different independent variables were included in the regressions of the 86 studies. The number of independent variables ranges from 5 (Che-Ahmad and Houghton 1996; Ahmed and Goyal 2005) to 29 in the study of Bills et al. (2017). Hay et al. (2006) noted that since the initial model of Simunic (1980), the number of independent variables has increased considerably (Fig. 4). Our results support this statement for upcoming periods as well, as shown in Fig. 5.

The mean of the adj. R2 was 0.75. Even if the number of attached control variables increased over time, that value remained quite constant, as shown in Fig. 6. The highest adj. R2 was provided by a study of the Australian audit market for the financial years 2003–2010. They examined 19 control variables and achieved an adj. R2 of 93% (Goodwin and Wu 2014). Obviously, a higher amount of available data leads to a greater number of control variables, but this relationship is not reflected by a higher explanatory value.

The total firm year observations depend on the size of the market but also on the methodology used. Two studies of the Belgian audit market had the smallest analysis, as they analyzed 48 firm-year observations. (Knechel and Willekens 2006; Willekens and Achmadi 2003). In contrast, the largest analysis is from a cross-country comparison of the years 1996–2012. That study provides 136,209 firm-year observations from 34 different countries within a single audit fee model (Kuo and Lee 2016).

In particular, our review examined more recent publications. In total, 101 out of our 137 regression outputs were extracted from studies that were not included in the previous meta-analyses by Hay et al. (2006) and Hay (2013).

The meta-analysis carried out by Hay et al. considered 147 regression outputs, leading to a total of 186 control variables that were used (Hay et al. 2006). Generally, aggregation leads to a loss of explanatory value. Therefore, we carefully transferred every control variable used in those studies, even with slight differences within the definition.Footnote 1

However, to reduce the complexity of this paper, we will present only the most frequently used variables, i.e., those that were used at least five times across all studies. To guarantee high intercoder reliability, each coauthor of this paper first analyzed the variables independently before discussing the findings together to reach a consensus. Our systematic literature analysis identified 421 different control variables from 137 regression outputs. However, this difference is due to slight variations in the identification process. We assigned all control variables to the corresponding categories we mentioned. Based on this categorization, we discuss these categories and their results in the following chapter.

4 Findings

4.1 Client specifics

4.1.1 Size

Larger companies generally require a more time-consuming audit than smaller ones. However, Simunic (1980) noted that there is a nonlinear relationship between the size of the client and the audit fee. He argued that the pure number of account balances, classes of transactions or disclosure items to be tested will not simply increase as the size of the client increases. Moreover, auditing a client that is becoming larger does not necessarily lead to the involvement of higher-qualified and higher-paid staff. Following O’Keefe et al. (1994), we assume that the cost structure of the audit firm becomes more optimized as the size of the client increases.

The results of our literature analysis show that the logarithmic balance sheet total of the client represents the dominant determinant for the size of the company to be audited. In 93% of all studies analyzed (n = 128), total assets were integrated in the audit fee model. That fee driver has a score of 3.99 in terms of significance with a standard deviation (s) of 0.09. Therefore, the results for total assets strongly indicate a positive relationship between size and the audit fee, where all but one has a significant effect at the 1% level. Thus, our results are strongly in line with those of prior studies (Hay et al. 2006; Hay 2013).

The second most commonly used variable for size is the total number of business segments (n = 66). That determinant is especially used in recent studies instead of the total number of subsidiaries, which is the third most commonly used variable (n = 45). Comparing both, the total number of business segments is better than the total number of subsidiaries, as the score is slightly higher and the standard deviation is slightly smaller. Three studies were identified that regress the audit fee on both variables (Goodwin and Wu 2014; Carcello et al. 2002; Behn et al. 1999).

All size variables presented in Fig. 5 are absolute values, apart from the ratio of total sales by the client compared to all total sales in the industry. That ratio was used seven times and indicates a negative relationship with the audit fee. A higher ratio indicates that the relevance of the client is increasing. Therefore, auditors could be willing to accept a lower audit fee when auditing industry leaders, as indicated by our score of 3.00 (s = 1.00).

Other size variables, such as total revenues or total number of employees, are overwhelmingly positive as well. Total sales even indicate a higher score (3.85) and a smaller standard deviation (0.55) than the total number of business segments. However, using an additional size variable based on accounting data next to the most dominant of total assets should be discussed critically with respect to potential multicollinearity problems (Firth 1997).

The size of a firm can typically explain approximately 70% of the variance in audit fees (Hay et al. 2006). However, it is suggested that this may be significantly lower when the client decreases.

4.1.2 Complexity

In addition to the pure size of the company, a measure of the level of complexity is usually included in audit fee models. As complexity increases, it is expected that it becomes more difficult to audit the client (e.g., Simunic 1980; Hackenbrack and Knechel 1997). Consequently, our literature review seeks to examine the positive relationship between complexity and audit fees.

We identified 64 variables that address the complexity of the client in the audit fee models, 15 of which were used at least 5 times. Some of these variables were absolute (3 times), some were ratios (4 times), and some were dummy variables (8 times). The most frequently used variable was the market-to-book ratio of equity (MTB) or the book-to-market value of equity; this variable was especially common in more recent studies. Often, it is argued that the higher the MTB, the higher the audit fee should be. Although MTB is mostly used in terms of complexity, the variable was not significant in 44.7% of the studies and only yielded a score of − 0.74 with a high standard deviation of 2.34. Consequently, the sign of MTB remains unclear.

Our results show that the number of days between the end of the audit and the signature of the audit opinion has the highest score in this category (3.70). This variable was used 20 times (s = 1.34). It is argued that the more complex the client is, the longer it takes before the audit opinion is signed. Therefore, the auditor increases his audit fee as a reaction to an overrun of his budget.

The dummy variables (“client had an M&A deal in the audited period?” or “client is reporting extraordinary items?”) are also quite commonly used to examine complexity. Comparing both variables, the former is used more frequently, has a better score (3.46 vs 3.04) and has a smaller standard deviation (1.03 vs 1.70).

In addition, the results suggest that the level of foreign activities of the client is also a standard variable in audit fee models. The most frequently used variable in of this subcategory is a dummy variable assessing whether the client has foreign operations or subsidiaries at all. This variable was used 19 times and has a score of 3.58 with a small standard deviation of 0.96. However, the variable with the highest score and lowest standard deviation is the dummy variable “client is reporting foreign income taxes?” with a score of 3.67 and a standard deviation of 0.82.

4.1.3 Additional categories

The meta-analysis by Hay et al. (2006) separates the categories “inherent risk”, “profitability” and "”everage” to categorize additional audit fee drivers (Hay et al. 2006, p. 159). However, factors of inherent risk can affect all levels of the economic situation (Quick 1996, p. 255). Consequently, we suggest a structure that is based on the auditor’s risk assessment leading to variables such as the client’s net assets, financial position, profitability and other aspects that impact the inherent risk of the whole engagement.

4.1.3.1 Net assets

An assessment of the client’s economic situation is of central importance for the auditor (Quick 1996, p. 236). Therefore, it should be noted which balance sheet ratios the auditor typically focuses on when assessing the client’s risk situation. Auditors are mitigating risks by their audit procedures, but before performing relevant procedures, they need to identify risks and plan the design of their procedures to address these risks.

We find that current asset ratios are used more commonly than any fixed asset ratio (Fig. 7). This finding is in line with Hay et al. (2006) and Hay (2013). In total, we only identified a handful of studies using fixed asset ratios for determining audit fees. For example, Yang et al. (2018) use fixed assets to total assets, and the variable was nonsignificant. Huang et al. (2017) use intangible assets/total assets, which was significant and showed a positive relation at the 5% level.

The variable used the most for net assets is the proportion of the total receivables and inventories to total assets (InvRec). This factor was used 62 times and has a score of 2.79 and a standard deviation of 2.07. The second most used variable was the total sum of current assets to total assets, as the sum of inventory and receivable is only a part of the total of current assets. That ratio is nearly comparable to InvRec but has a slightly better score (2.86) and a marginally higher standard deviation (2.14). Because InvRec already accounts for the majority of current assets, using both variables could lead to potential multicollinearity problems. Nevertheless, we identified four studies that put both variables in their audit fee model (Hardies et al. 2015; Jiang and Zhou 2017; Bryan et al. 2018; Boland et al. 2019).

However, we find that the ratio of receivables to total assets is better than InvRec. This ratio achieved a better score by 3.10 points and has a smaller standard deviation by 1.48 points. Only the results from the study by Behn et al. (1999) show a contradictory negative (and significant) effect at the 10% level from. No study used both the ratio of total receivables to total assets and InvRec in an audit fee model. We also assume that the auditor give stronger consideration to the ratio of receivables to total assets than to the ratio of inventories to total assets. We notice that the ratio of inventories to total assets is not significant in 50% of the cases. Furthermore, that ratio only has a score of − 0.06 with a standard deviation of 2.13.

4.1.3.2 Financial position

Audit fee determinants that are based on the financial position of the client suggest that a deterioration in financial position leads to higher audit fees. Therefore, it seems consistent to assess the debt-equity ratio as an appropriate fee driver that follows this argumentation. In fact, we identified nine studies that took this ratio into account (Fig. 8). Our analysis suggests a score of 2.22 with a standard deviation of 1.72 for the debt-equity ratio. However, the fact that this (typically) important ratio is not the most frequently used factor for determining audit fees could be based on the difficulty of calculating the ratio. Usually, it is assumed that a decrease in debt equity would lead to a more stable financial position and that the auditor would react by decreasing audit fees. However, there is a logical break in this assumption if the value of the entire term becomes negative. In this case, the client is indebted and equity is less than zero, but the ratio would assume that the financial position is even better than before. As a consequence, the ratio of total debt/total assets was the most frequently used audit fee variable in terms of describing financial position. That variable was used 62 times and has a score of 2.31, which is the best in that category, and a standard deviation of 2.10. However, the variable is not significant in 30.6% of the cases. Furthermore, we identified four studies that indicate a negative relation between the ratio of total debt/total assets and audit fees (Bronson et al. 2017; Lesage et al. 2017; Gong et al. 2018; Hoitash and Hoitash 2018), in contrast to the assumption that an increase in this ratio leads to higher audit fees.

In 36 studies, the assessment of financial position only takes long-term debt into consideration instead of all debt positions by using the ratio of long-term debt to total assets. Although the standard deviation of this indicator is slightly better (s = 1.96), its score is much worse (1.22), and it is not significant.

Another approach to assess the financial position is that of addressing the client’s shareholding structure. We identified six studies that use a dummy variable to check whether government is the major shareholder. That variable has a score of − 2.17. This leads to the assumption that involvement by the government leads to fewer audit fees. However, the standard deviation is 2.79. Tee et al. (2017) find a completely contradictory result. The estimated influence of this variable in their study is highly significant and positive. The last variable with regard to the shareholding structure assesses the percentage of institutional investors as shareholders of the company. It is expected that a larger share of institutional investors will lead to lower audit fees. That variable was first used by Gotti et al. (2012) and was highly significant in only two of the five studies we investigated (Tee et al. 2017; Gul et al. 2018). Our results support this assumption. This variable has a score of 2.20 and a standard deviation of 1.64.

4.1.3.3 Profitability

Profitability is usually the ratio of a profit figure to the corresponding capital base. Depending on which reference value is in the foreground, there are a couple of different ratios that are used in audit fee studies (Fig. 9). We identified 33 different variables to assess the profitability of the client, and 7 of them were used at least 5 times. With regard to the risk assessment by the auditor, it is expected that better profitability leads to lower audit fees. However, the most frequently used variable is not a ratio but a dummy variable question assessing whether the client was reporting a loss in the current period. This variable has the highest score in the category (2.80) and a standard deviation of 1.97. Therefore, we can support the assumption that the auditor will increase the audit fees when the client is not making profits. Nonetheless, there are some studies with conflicting results (Vafeas and Waegelein 2007; Ittonen and Peni 2012; Barua et al. 2019). In addition, we identified different studies that use a proxy for audit fees if (not only) the profit of the actual period or prior periods is negative. However, our results suggest that auditors take more of the actual values into account than values from prior periods. For all of these variables, the score is less compared to the dummy “loss in the period?”.

We further identified five studies that use the dummy variable “EBIT is negative?” to address profitability instead of income. EBIT is a key figure and is of central importance for the operative earning power of a company. Our result shows that EBIT is actually a better proxy for profitability than income. The respective variable clearly dominates the most frequently used income variable by achieving a score of 3.40. The standard deviation of the EBIT check is smaller as well (s = 0.89). The same finding appears when comparing the respective ratios in that section. The ratio of EBIT to total assets is better than the ratio of income to total assets in all matters and is used more often.

4.1.3.4 Other aspects

In addition to the specifics already discussed, we identified 132 variables that were used in audit fee studies that we categorized as “other aspects” (Fig. 10). The majority of these variables were only used in few studies or even in just one research design. However, we identified 12 variables that were used at least 5 times. These variables address liquidity aspects, growth potential, regulatory aspects and governance aspects. The variable that was used most frequently is the ratio of current assets to current liabilities. It is expected that a higher ratio leads to lower audit fees as the risk situation of the client improves. Our results support this assumption. This variable has a score of − 2.71, and the standard deviation is 2.09. Only the studies from Basioudis (2007), Ho and Hutchinson (2010), Willekens and Achmadi (2003) and Baatwah et al. (2019) show contradictory results. In addition, 24 studies decided to deduct inventories from the numerator of this ratio. That variable reaches a score of − 2.42 and has a higher standard deviation compared to the initial quick ratio. We therefore suggest using the quick ratio for estimating audit fees. With respect to the growth of a company, auditors could react by decreasing audit fees when their client is growing. Eighteen studies put a variable into their model that assessed the change in sales compared to prior year. In fact, we found that the score is − 1.78, and it has a standard deviation of 2.29. For financial stability, the Altman Z-score is used 13 times across the audit fee models. A higher Altman Z-score indicates a lower audit fee. We determined that the Altman Z-score achieves a score of 1.92. The value is positive but not significant at all and has a standard deviation of 2.66. A better proxy for financial stability could be the ratio of operating cashflow to total assets. We find that there is an average score of − 2.00, meaning this variable could be negatively and significantly related to audit fees, and the standard deviation is 1.50.

Additionally, we identified some company-related variables that were usually used in audit fee models. One variable is a dummy variable assessing whether the company is recording any restructuring expenses leading to future corporate events that might be of higher importance to the auditor. That dummy variable has a score of 3.43 and indeed indicates that auditors are increasing audit fees when the client is recording any such expenses (s = 1.13).

A (cross-)listed company needs to fulfill more regulatory aspects, and the public is more aware of any corporate event that takes place. Therefore, it is expected that the audit fee should be higher in these cases. Our analysis notes that for all variables questioning (cross-)listings, a positive and significant score is to be found.

Furthermore, our analysis notes that the age of a client seems to have no effect on audit fees. We identified five studies that were using that figure. The respective score only reached a level of 1.40 and a standard deviation of 2.88.

Finally, our results show that the number of boards of director meetings in the period could have a significant effect on audit fees. That variable has a score of 3.00 (s = 1.83). It is expected that the more meetings within a period, the better the usual monitoring function itself and the less audit work that needs to be covered by audit fees.

4.2 Auditor specifics

4.2.1 BIG-N Premium

It is assumed that an auditor with a higher market power can enforce a higher fee compared to other audit firms. Such a “fee premium” is based on the consideration that a larger audit firm is a proxy for better audit quality. (Simunic 1980, p. 175). The majority of the studies integrate such a dummy variable (Fig. 11). A total of 84 studies included BIG-4, BIG-5, BIG-6, BIG-8 and BIG-N variables (e.g., Turpen 1990; Gist 1992; Chan et al. 1993; Yang et al. 2017; Fleischer and Goettsche 2012; DeFond et al. 2016). Our results indeed indicate a highly significant effect of market power on audit fees. We can also see that such a BIG-4 premium has a higher score and a smaller standard deviation than previous dummy variables with a lower market concentration. The effect on audit fees potentially increased over time when the market power increased to BIG-4. In fact, we identified no study that presented a negative effect of the BIG-4 variable on audit fees, but a handful of studies presented nonsignificant effects (Krauß et al. 2014; Gotti et al. 2012; Ettredge et al. 2018; Chung et al. 2015; Ittonen and Peni 2012; Huang et al. 2017; Reid et al. 2019). More recent studies even break down their fee models to the level of the individual audit firm (Kim and Fukukawa 2013; Köhler and Ratzinger-Sakel 2012; Kacer et al. 2018). For complexity reasons, we decided not to present these data, as the limit of five studies was not reached in any cases.

4.2.2 Auditor specialization

Having an auditor that is a specialist within a certain industry has a positive influence on the audit fee. This assumption is supported by results from various studies (e.g., Chung et al. 2015; Bills et al. 2017; Riccardi et al. 2018). In total, we identified 37 different dummy variables assessing whether the respective auditor in charge is an industry expert. In our systematic literature analysis, we identified two different types of variances when answering that question. At first, there are different benchmarks when assessing auditor specialization. Some studies used audit fees as benchmarks and assessed the auditor as a specialist if he or she received the most audit fees within an industry. Other studies use the ratio of total assets audited by the audit firm to the total sum of all total assets in the same industry. The results may differ in terms of specialization. Furthermore, the respective basis differs as well. Some studies focus on city-level industry specialists, other studies use a country-based approach, and others focus on a global worldwide level. There is only one variable that was used five times across all studies. The variable of total assets in a country comparison has a score of 1.83 (s = 2.56). We therefore assume that auditor specialization might not have a significant effect on audit fees at all.

4.3 Engagement specifics

4.3.1 End of fiscal year

The end of the fiscal year is not prescribed by law. Therefore, studies include indicator variables to control for the effect of the fiscal year being in line with the “busy season”. In the lower season, competition is high due to the small amount of remaining engagements, which could be an argument for price reductions (e.g., Hay et al. 2006, p. 177). A total of 53 studies included such a dummy variable in the regression model (Fig. 12). In 81.13% of the cases, a positive relationship between this variable and audit fees was observed. However, the variable was only significant in 45.28% of the cases. The score was only 1.98 (s = 1.74). However, it should be noted that the result is largely determined by the final definition of the critical time period.

4.3.2 Auditor tenure

As a consequence of the fee-cutting phenomenon, the dummy variable of whether an auditor change took place in the audit year is also integrated into the model. Simon and Francis (1988) demonstrate, on the basis of the Australian audit market, that there are also indications of fee-cutting in the three financial years following an initial audit (Simon and Francis 1988, p. 258). However, Wolz et al. (2015) evaluated the fee development after an auditor change and in the following years, and their results did not indicate fee-cutting in the German audit market (Wolz et al. 2015, p. 626).

International audit market research has also often discussed the influence of the duration of the audit relationship on audit fees since the first publication by Chung and Lindsay (1988), and this variable has been included in an increasing number of studies in recent years. The analysis of the duration of an audit relationship does not, however, appear to be a unique European feature of the Brussels regulators; all of the studies considered herein relate to economic areas outside the EU. In this respect, the discussion on the duration of an audit relationship may well bear the current stamp of (worldwide) audit market research.

First, however, it must be acknowledged that the majority of the results of the international studies indicate that there is no significant relationship between the duration of the audit relationship and the audit fee. In 17 of the 22 studies considered, the corresponding variable remained nonsignificant. It should also be noted that even the presumption at the beginning of the studies is quite divided. Felix et al. (2001), Huang et al. (2007) and Tanyi and Litt (2017) expect a positive influence of the duration of the study on the audit fee. This contrasts with Chung and Lindsay (1988), Chung et al. (2015) and Kwon and Yi (2017), who assume lower examination fees over time due to an assumed learning curve effect. Against this background, it should come as no surprise that Ettredge et al. (2018), Wang et al. (2009), Wang and Zhou (2012) and Bentley et al. (2013) completely dispense with an assumed effect direction. In more recent studies, the tenure of audit engagement is calculated by the total logarithm of the number of years (Huang et al. 2017; Gul et al. 2018; Hanlon et al. 2019; Mohrmann et al. 2019). We decided to use this as a new variable for calculation reasons. The score of this variable only reaches − 0.25 (s = 0.96) and is not presented due to only being used in a small number of studies.

4.3.3 Providing non-audit services

The practice among auditing firms of offering non-audit services is controversial. In the course of the presentation of the EU reforms, parallel advisory services were discussed against the background of a possible impairment of the auditor’s independence, which suggests a possible synergy potential from the auditor’s perspective. Such a benefit is described by the vocabulary knowledge spillover and describes the coincidence that information on the business and system environment as well as on certain processes only has to be obtained once and thus is available to both service lines of the audit firm. If the profit margin were to remain the same, such an efficiency gain would have to affect the audit fee as a discount (Umlauf 2013, pp. 179–185). There are some studies that confirm a corresponding negative influence of the amount of the consulting fee on the examination fee (Kwon and Yi 2018; Ittonen and Peni 2012). In fact, however, the majority of empirical results indicate exactly the opposite (e.g., Turpen 1990; Yang et al. 2017; Thinggaard and Kiertzner 2008; Köhler and Ratzinger-Sakel 2012; Vafeas and Waegelein 2007; Carson et al. 2004). A total of 29 of the analyzed studies use variables that assess the examiner's parallel advisory offer in the course of an examination. In addition to the abovementioned studies, individual studies also make use of a dummy variable that assesses whether the auditor in question also provides parallel advisory services. The amount is not further evaluated (Chung et al. 2015; Abbott et al. 2012). All of these studies report significantly positive results. The results suggest a positive overall relationship between non-audit fees and the audit fee. The amount of non-audit fees has a score of 3.03 (s = 1.94) and indicates a strong effect on audit fees. These findings indicate that extensive consulting services are causal for restructuring within the group structure and new implementations of the software environment, which ultimately justifies an increased audit effort for the period (Palmrose 1986, p. 408; Davis et al. 1993, p. 138; Umlauf 2013, p. 187).

4.3.4 Audit opinion

It is expected that the auditors increase the audit fees if they assume that the going concern assumption is impaired. We identified 40 studies that used such a dummy variable to assess whether this was the case. Indeed, the score of 2.45 (s = 1.52) indicates a significant effect on this dummy variable on audit fees. The second most frequently used opinion-related variable is a dummy variable that assesses whether the auditor issued an unqualified audit opinion. Assuming such a scenario, it is suggested that this leads to a process of ongoing discussion with management and finally results in a higher fee. Our results support this assumption. This variable has a score of 2.24 (s = 2.13). Conversely, there are some studies that are putting the opposite variable in their model, i.e., they use using dummy variables to assess whether the auditor is issuing clean opinions. Not surprisingly, the influence of this variable appears to mirror the variable regarding unqualified audit opinions, with a score of -1.38 (s = 2.20).

In the US, jurisdiction auditors need to report internal control weaknesses for PIEs. We found that such a dummy variable (“Reporting of an internal control weakness?”) was used 25 times. The score nearly reached the maximum of 3.96 (s = 0.20) and indicates that this variable has a strong influence on audit fees. Finally, a dummy variable assessing whether the clients need to restate their annual report was used 16 times. The score of 2.88 (s = 1.93) also indicates a significant effect of this variable on audit fees.

4.4 Summary of findings

In addition to the scope of the audit, the audit fee is another important determinant of the contractual relationship between the auditor and the client. To contribute to a deeper understanding of audit fee calculation, we present a systematic literature review concerning the relevant determinants of audit pricing. Our research findings extend the existing international literature on audit pricing by summarizing the empirical results of 121 quantitative studies with 137 different regression outputs in international scientific journals. We derive for the first time an evidence-based audit fee model that takes variables from all categories into consideration. As a limit value, we take a score of ± 2 and a standard deviation of 2.5. Following that approach, our audit fee model is based on the following composition (for variable description, we refer to Table 3).

After our substantial analysis, we suggest filling the model proposed by Hay et al. (2006) as follows:

where \({LN(AF}_{it})\) is the \(Nat. \;Log. \;of\; the\; audit\; fee\; at \;the\; time \;t,\; {\beta }_{0}\) is the \(Constant, \;{\beta }_{j}, \;{\beta }_{k},\; {\beta }_{l}\) is the \(Regressions\; coefficient \;at \;the\; time t\), \({\varepsilon }_{t}\) is the \(error \;term \;at \;the \;time \;t.\)

5 Concluding remarks

Like any empirical study, our analysis has some limitations. There are limitations with respect to the collection and evaluation of the data. With regard to data collection, it must be taken into account that we applied a keyword search with only one word. We did this because from our point of view, the marginal utility of an advanced search was considered low. Nevertheless, it is conceivable some relevant studies were not analyzed. Furthermore, it is possible that relevant studies were not examined due to the focus on VHB-JQ3 ranked A + -, A- and B-journals. With regard to data evaluation, it should be noted that each study uses slightly modified control variables and defines them differently. We did not perform aggregation and instead decided not to report variables that were used fewer than five times. However, we are aware that other variables can also have a high explanatory value, such as shareholder structure (Cassel et al. 2018) or the effect of ongoing digitalization. Furthermore, we did not check the comparability of the studies per se (legal background, country specific), and we cannot give a statement about the influence strength of different parameters.

Some of our limitations offer new perspectives for further research, e.g., through meta-analytic approaches by measuring the influence strength of the different parameters. Given the fact that internal data auditors are not available to the public, other research approaches could also bring case studies more into play. Moreover, it is possible that there are country specific differences that could also be addressed by future works. Against the background of European regulation of the audit market, it is also unclear how auditor rotation affects pricing. It is possible that the limitations of the term lead to a loss of quasi-rents within the DeAngelo (1981) model, so this should be taken into account in the fee structure. The goal of future research efforts should be to develop an improved empirical-evidence-based fee model that can possibly be used for individual pricing purposes in the future.

Our study is an important contribution to the international literature on audit markets. On the one hand, we provide a systematic literature review of 121 studies in leading international journals and give an overview on the current state of the art within this field of research. By analyzing 137 regression outputs we are able to derive a testable model of audit fees based on empirical evidence. Therefore, our paper could influence further research projects on audit fee determinants in two different ways. First, future research could test our final model based on current data. Second, other researchers could refine the presented model, e.g. by adding market conditions, legal environment or country specifics.

Notes

E.g. EBIT/Total Assets vs. EBT/Total Assets, cf. Hay et al (2006).

References

Abbott L, Parker S, Peters G (2012) Audit Fee Reductions from internal audit-provided assistance: the incremental impact of internal audit characteristics. Contemp Account Res 29(1):94–118

Agrawal A, Jayaraman N (1994) The dividend policies of all-equity firms: a direct test of the free cash flow theory. Manage Decis Econ 15(2):139–148

Ahmed K, Goyal M (2005) A comparative study of pricing of audit services in emerging economies. Int J Audit 9(2):103–116

Baatwah S, Al-Ebel A, Amrah M (2019) Is the type of outsourced internal audit function provider associated with audit efficiency? Empirical evidence from Oman. Int J Audit 23(3):424–443

Barua A, Hossain MdSm Rana D (2019) Financial versus operating liability leverage and audit fees. Int J Audit 23(2):231–244

Basioudis I (2007) Auditor’s Engagement Risk and Audit Fees: The Role of Audit Firm Alumni. J Bus Finance Account 34(9–10):1393–1422

Behn B, Carcello J, Hermanson D, Hermanson R (1999) Client Satisfaction and Big 6 Audit Fees. Contemp Account Res 16(4):587–608

Bentley K, Omer T, Sharp N (2013) Business strategy, financial reporting irregularities, and audit effort. Contemp Account Res 30(2):780–817

Bills K, Cunningham L, Myers L (2016) Small audit firm membership in associations, networks, and alliances: Implications for audit quality and audit fees. Account Rev 91(3):767–792

Bills K, Lisic LL, Seidel T (2017) Do CEO succession and succession planning affect stakeholders’ perceptions of financial reporting risk? Evidence from audit fees. Account Rev 92(4):27–52

Boland M, Daugherty B, Dickins D (2019) Evidence of the relationship between PCAOB inspection outcomes and the use of structured audit technologies. Audit J Pract Th 38(2):57–77

Brinn T, Jones M, Pendlebury M (2001) Why do UK accounting and finance academics not publish in top US journals? Brit Account Rev 33(2):223–232

Bronson S, Ghosh A, Hogan C (2017) Audit fee differential, audit effort, and litigation risk: an examination of ADR firms. Contemp Account Res 34(1):83–117

Bryan D, Mason T, Reynolds K (2018) Earnings autocorrelation, earnings volatility, and audit fees. Audit J Pract Th 37(3):47–69

Carcello J, Hermanson D, Neal T, Riley JRR (2002) Board characteristics and audit fees. Contemp Account Res 19(3):365–384

Carson E, Fargher N, Simon D, Taylor M (2004) Audit fees and market segmentation – further evidence on how client size matters within the context of audit fee models. Int J Audit 8(1):79–91

Cassel C, Drake M, Dyer T (2018) Auditor litigation risk and the number of institutional investors. Audit J Pract Th 37(3):71–90

Chan P, Ezzamel M, Gwilliam D (1993) Determinants of audit fees for quoted UK companies. J Bus Finance Account 20(6):765–786

Che-Ahmad A, Houghton K (1996) Audit fee premiums of big eight firms: evidence from the market for medium-size UK auditees. J Int Audit Account Tax 5(1):53–72

Chung H, Hillegeist S, Wynn J (2015) Directors’ and officers’ legal liability insurance and audit pricing. J Account Public Policy 34(6):551–577

Chung D, Lindsay D (1988) The pricing of audit services: the Canadian perspective. Contemp Account Res 5(1):19–46

Cobbin P (2002) International dimensions of the audit fee determinants literature. Int J Audit 6(1):53–77

Collier P, Gregory A (1999) Audit committee activity and agency costs. J Account Public Policy 18(4–5):311–332

Culpan R, Trussel J (2005) Applying the agency and stakeholder theories to the Enron debacle: an ethical perspective. Bus Soc Rev 110(1):59–76

Davis L, Ricchiute D, Trompeter G (1993) Audit effort, audit fees and the provision of nonaudit services to audit clients. Account Rev 68(1):135–150

DeAngelo L (1981) Auditor independence, ‘low balling’, and disclosure regulation. JAE 3(2):113–127

DeFond M, Lim CY, Zang Y (2016) Client conservatism and auditor-client contracting. Account Rev 91(1):69–98

Du L, Masli A, Meschke F (2018) Credit default swaps on corporate debt and the pricing of audit services. Audit J Pract Th 37(1):117–144

D’Aquila JM, Capriotti K, Boylan R, O’Keefe R (2010) Guidance on auditing high-risk clients. CPA J 80(10):32–37

Ettredge M, Sherwood M, Sun L (2018) Effects of SOX 404(b) implementation on audit fees by SEC filer size category. J Account Public Policy 37(1):21–38

European Commission (2010) Green paper – Audit policy: Lessons from the crisis. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52010DC0561&from=DE. Accessed 12 Dec 2019

European Commission (2011) Restoring confidence in financial statements: the European Commission aims at a higher quality, dynamic and open audit market. https://europa.eu/rapid/press-release_IP-11-1480_en.htm. Accessed 08 Dec 2019

European Parliament (2014a) Regulation (EU) No 537/2014 of the European Parliament and of the Council on specific requirements regarding statutory audit of public-interest entities and repealing Commission Decision 2005/909/EC. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014R0537&from=de. Accessed 12 Dec 2019

European Parliament (2014b) Directive 2014/56/EU of the European Parliament and of the Council of 16 April 2014 amending Directive 2006/43/EC on statutory audits of annual accounts and consolidated accounts. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014L0056&from=DE. Accessed 08 Dec 2019

Ewert R, Stefani U (2001). Wirtschaftsprüfung. In: Jost, Peter-J. (ed.), Die Prinzipal-Agenten-Theorie in der Betriebswirtschaftslehre, Stuttgart: 147–182

Fahlenbach R, Prilmeier R, Stulz RM (2012) This time is the same: using bank performance during the recent financial crisis. J Fin 67(6):2139–2185

Felix W Jr, Gramling A, Maletta M (2001) The contribution of internal audit as a determinant of external audit fees and factors influencing this contribution. J Account Res 39(3):513–534

Firth M (1997) The provision of non-audit services and the pricing of audit fees. J Bus Finance Account 24(3):511–525

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106

Fleischer R, Goettsche M (2012) Size effects and audit pricing: evidence from Germany. J Int Account Audit Tax 21(2):156–168

Gist W (1992) Explaining variability in external audit fees. Account Bus Res 23(89):79–84

Gong SX, Gul F, Shan L (2018) Do auditors respond to media coverage? Evidence from China. Account Horiz 32(3):169–194

Goodwin J, Wu D (2014) Is the effect of industry expertise on audit pricing an office-level or a partner-level phenomenon? Rev Account Stud 19:1532–1578

Gotti G, Han S, Higgs J, Kang T (2012) Managerial stock ownership, analyst coverage, and audit fee. J Account Audit Finance 27(3):412–437

Gul FA, Khednati M, Lim EKY, Navissi F (2018) Managerial ability, financial distress, and audit fees. Account Horiz 32(1):29–51

Gul FA, Tsui JSL (2001) Free cash flow, debt monitoring, and audit pricing: further evidence on the role of director equity ownership. Audit J Pract Th 20(2):71–84

Hackenbrack K, Knechel WR (1997) Resource allocation decision in audit engagements. Contemp Account Res 14(3):481–499

Hanlon D, Khedmati M, Lim EKY (2019) Boardroom backscratching and audit fees. Audit J Pract Th 38(2):179–206

Hardies K, Beeesch D, Branson J (2015) The female audit fee premium. Audit J Pract Th 34(4):171–195

Hay D (2013) Further evidence from meta-analysis of audit fee research. Int J Audit 17(2):162–176

Hay D, Knechel R, Wong N (2006) Audit fees: a meta-analysis of the effect of supply and demand attributes. Contemp Account Res 23(1):141–191

Ho S, Hutchinson M (2010) Internal audit department characteristics/activities and audit fees: Some evidence from Hong Kong firms. J Int Account Audit Tax 19(2):121–136

Hoitash R, Hoitash U (2018) Measuring accounting reporting complexity with XBRL. Account Rev 93(1):259–287

Huang HW, Liu LL, Raghunandan K, Rama D (2007) Auditor industry specialization, client bargaining power, and audit fees: further evidence. Audit J Pract Th 26(1):147–158

Huang M, Masli A, Meschke F, Guthrie JP (2017) Clients’ workplace environment and corporate audits. Audit J Pract Th 36(4):89–113

Humphrey C, Kausar A, Loft A, Woods M (2011) Regulating audit beyond the crisis: a critical discussion of the EU green paper. Eur Account Rev 20(3):431–457

Ittonen K, Peni E (2012) Auditor’s gender and audit fees. Int J Audit 16(1):1–18

Jiang L, Zhou H (2017) The role of audit verification in debt contracting: evidence from covenant violations. Rev Account St 22:469–501

Kacer M, Peel D, Peel M, Wilson N (2018) On the persistence and dynamics of Big 4 real audit fees: evidence from the UK. J Bus Finance Account 45(5–6):714–727

Kim H, Fukukawa H (2013) Japan’s big 3 firms’ responses to clients’ business risk: greater audit effort or higher audit fees? Int J Audit 17(2):190–212

Knechel R, Willekens M (2006) The role of risk management and governance in determining audit demand. J Bus Finance Account 33(9–10):1344–1367

Krauß P, Quosigk B, Zülch H (2014) Effects of initial audit fee discounts on audit quality: evidence from Germany. Int J Audit 18(1):40–56

Kuo NT, Lee CF (2016) A potential benefit of increasing book-tax conformity: evidence from the reduction in audit fees. Rev Account Stud 21:1287–1326

Kwon SY, Yi H (2018) Do social ties between CEOs and engagement audit partners affect audit quality and audit fees? Audit J Pract Th 37(2):139–161

Köhler A, Ratzinger-Sakel N (2012) Audit and non-audit fees in Germany – the impact of audit market characteristics. Schmalenbach Bus Rev 64:281–307

Lesage C, Ratzinger-Sakel N, Kettunen J (2017) Consequences of the abandonment of mandatory joint audit: an empiricial study of audit costs and audit quality effects. Eur Account Rev 26(2):311–339

Marten KU (1994) Auditor change: results of an empirical study of the auditing market in the context of agency theory. Eur Account Rev 3(1):168–171

Marten KU (1995) Empirische analyse des Prüferwechsels im Kontext der Agency- und Signalling-Theorie. ZfB 65(7):703–727

Marten KU, Quick R, Ruhnke K (2015) Wirtschaftsprüfung 5th edn. Stuttgart

Mohrmann U, Riepe J, Stefani U (2019) Fool’s gold or value for money? The link between abnormal audit fees, audit firm type, fair-value disclosure, and market valuation. Int J Audit 23(2):181–203

Ng HY, Tronnes PC, Wong L (2018) Audit seasonality and pricing of audit services: theory and evidence from a meta-analysis. J Account Lit 40:16–28

Nikkinen J, Sahlström P (2004) Does agency theory provide a general framework for audit pricing? Int J Audit 8(3):253–262

O’Keefe T, Simunic D, Stein M (1994) The production of audit services: evidence from a major public accounting firm. J Account R 32(2):241–261

Palmrose ZV (1986) The effect of nonaudit services on the pricing of audit services: further evidence. J Account Res 24(2):405–411

Piot C (2001) Agency costs and audit quality: evidence from France. Eur Account Rev 10(3):461–499

Pong CM, Whittington G (1994) The determinants of audit fees: some empirical models. J Bus Finance Account 21(8):1071–1095

Quick R (2004) Externe Pflichtrotation – Eine adäquate Maßnahme zur Stärkung der Unabhän-gigkeit des Abschlussprüfers? DBW 64(4):487–508

Quick R (1996) Die Risiken der Jahresabschlussprüfung. Düsseldorf

Reid L, Carcello J, Li C, Neal T (2019) Impact of auditor report changes on financial reporting quality and audit costs: evidence from the United Kingdom. Contemp Account Res 36(3):1501–1539

Riccardi W, Rama D, Raghunandan K (2018) Regulatory quality and global specialist auditor fee premiums. Audit J Pract Th 37(3):191–210

Ridyard D, De Bolle J (1992) Competition and the regulation of auditor independence in the EC. J Fin Reg Comp 1(2):163–169

Simon D, Francis J (1988) The effects of auditor change on audit fees: test of price cutting and price recovery. Account Rev 63(2):255–269

Simunic D (1980) The pricing of audit services: theory and evidence. J Account Res 18(1):161–190

Stefani U (1999). Quasirenten, Prüferwechsel und rationale adressaten. Working Paper Series: Finance & Accounting, No. 39, Johann Wolfgang Goethe-Universität, Frankfurt/Main

Tanyi P, Litt B (2017) The unintended consequences of the frequency of PCAOB inspection. J Bus Finance Account 44(1–2):116–153

Taylor M, Simon D (1999) Determinants of audit fees: the importance of litigation, disclosure, and regulatory burdens in audit engagement in 20 countries. Int J Account 34(3):375–388

Tee C, Gul F, Foo YB, Teh C (2017) Institutional monitoring, political connections and audit fees: evidence from Malaysian firms. Int J Audit 21(2):164–176

Thinggaard F, Kiertzner L (2008) Determinants of audit fees: evidence from a small capital market with a joint audit requirement. Int J Audit 12(2):141–158

Tsui J, Jaggi B, Gul F (2001) CEO domination, growth opportunities, and their impact on audit fees. J Account Audit Finance 16(3):198–208

Turpen R (1990) Differential pricing on auditors’ initial engagements: further evidence. Audit J Pract Th 9(2):60–76

Umlauf S (2013) Prüfungs- und Beratungshonorare von Konzernabschlussprüfern. Hamburg

Vafeas N, Waegelein J (2007) The association between audit committees, compensation incentives, and corporate audit fees. Rev Quant Finance Account 28:241–255

Wang K, Sewon O, Iqbal Z (2009) Audit pricing and auditor industry specialization in an emerging market: evidence from China. J Int Account Aud Tax 18(1):60–72

Wang D, Zhou J (2012) The impact of PCAOB auditing standard No.5 on audit fees and audit quality. Account Horiz 26(3):493–511

Weber S, Velte P, Storck M (2016) Wie wirkt sich die externe Pflichtrotation auf den deutschen Prüfungsmarkt aus? WPg 69(12):660–708

Widmann M (2019) Das Prüfungshonorar des Abschlussprüfers. Hamburg

Willekens M, Achmadi C (2003) Pricing and supplier concentration in the private client segment of the audit market: Market power or competition? Int J Account 38(4):431–455

Wolz M, Henrich T, Widmann M (2015) Die externe Rotationspflicht – Fluch oder Segen? KoR 15(12):622–628

Yang R, Yu Y, Liu M, Wu K (2018) Corporate risk disclosure and audit fee: a text mining approach. Eur Account Rev 27(3):583–594

Acknowledgements

Open Access funding provided by Projekt DEAL. We thank an anonymous reviewer for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Widmann, M., Follert, F. & Wolz, M. What is it going to cost? Empirical evidence from a systematic literature review of audit fee determinants. Manag Rev Q 71, 455–489 (2021). https://doi.org/10.1007/s11301-020-00190-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11301-020-00190-w