Abstract

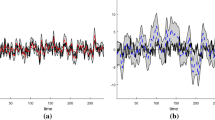

This paper presents a methodology for estimating the Brazilian GDP quarterly series in the period between 1960–1996. Firstly, an Engle–Granger’s static equation is estimated using GDP yearly data and GDP-related variables. The estimated coefficients from this regression are then used to obtain a first estimation of the quarterly GDP, with unavoidable measurement errors. The subsequent step is entirely based on benchmarking models estimated within a state space framework and consists in improving the preliminary GDP estimation in order to both eliminate as much as possible the measurement error and that the sum of the quarterly values matches the annual GDP.

Similar content being viewed by others

Notes

The reason for using the index variable is that the real revenue expressed in 1980 currency has very low values due to the monetary reforms that took place in the sample.

These results are not reported in the paper.

To confirm such statement, a clean GDP series regression was estimated in levels and differences against deterministic terms (constancy, trend and seasonal dummies) by recursive least squares. Coefficients and their confidence intervals did not show any change in 1980. That stability analysis is not presented in this paper.

Unit root tests no longer reject (as a set) the null hypothesis with the series that has integration order 1 (one).

References

Bassie, V. L. (1958). Appendix A. In V. L. Bassi (Ed.), Economic forecasting (pp. 256–269). New York, NY: McGraw-Hill.

Brazilian Central Bank. http://bcb.gov.br/.http://www.bcb.gov.br, accessed in March, 2006.

Cardoso, E. (1981). Uma Equação para a Demanda de Moeda no Brasil. Pesquisa e Planejamento Econômico, 11(3), 617–655, December.

Cholette, P. A., & Dagum, E. B. (1994). Benchmarking time series with autocorrelated survey errors. International Statistical Review, 62(3), 365–377, December.

Contador, C. R., & Santos Filho, W. A. C. (1987). Produto Interno Bruto Trimestral: Bases Metodológicas e Estimativas. Pesquisa e Planejamento Econômico, 17(3), 711–742 December.

Denton, F. T. (1971). Adjustment of monthly or quarterly series to annual totals: an approach based on quadratic minimization. Journal of the American Statistical Association, 66(333), 99–102, March.

Di Fonzo, T., & Marini, M. (2003). Benchmarking systems of seasonally adjusted time series according to Denton’s movement preservation principle, Dipartimento di ScienzeStatistiche, Università di Padova, Working Paper, September, 2003–2009.

Durbin, J., & Koopman, S. J. (2004). Time series analysis by state space methods pp. 1–154. Oxford, NY: Oxford University Press.

Durbin, J., & Queenneville, B. (1997). Benchmarking by state space models. International Statistical Review, 65(1), 21–48, April.

Engle, R. F., & Granger, C. (1991). Cointegration and error correction: Representation, estimation, and testing. In R. Engle, & C. W. J. Granger (Eds.), Long-run economic relationships: Readings in cointegration (pp. 51–76). Oxford, NY: Oxford University Press.

FGV (1977). Conjuntura Econômica, 31(4), 88–116 April.

FGV (1979). Conjuntura Econômica, 33(8), 156–167 August.

Ginsburgh, V. A. (1973). A further note on the derivation of quarterly figures consistent with annual data. Applied Statistics, 22(3), 368–374, August.

Harvey, A. C. (1990). Forecasting, structural time series and the Kalman Filter pp. 100–233. Cambridge, USA: Cambridge University Press.

Hillmer, S. C., & Trabelsi, A. (1987). Benchmarking of economic time series. Journal of the American Statistical Association, 82(400), 1064–1071, December.

IBGE. Sistema IBGE de Recuperação Automática-SIDRA, http//www.sidra.ibge.gov.br/, accessed in March, 2006.

IPEA. Ipeadata, http://www.ipeadata.gov.br/, accessed in March, 2006.

Maddala, G. S., & Kim, I.-M. (2002). Unit roots, cointegration, and structural changes pp. 45–154. Cambridge, UK: Cambridge University Press.

Mian, I. U. H., & Laniel, N. (1993). Maximum likelihood estimation of constant multiplicative Bias Benchmark Model with application. Survey Methodology, 19, 165–172, December.

Author information

Authors and Affiliations

Corresponding author

Appendix: Data Used and Unit Root Tests

Appendix: Data Used and Unit Root Tests

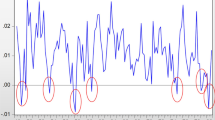

The series used in the paper were subject to consistency analysis, and when they appeared in more than one source, they were compared in such a way as to identify and correct typing or calculation errors and make precision as high as possible. Basically, this comparison was made between the series published at the following references: The Brazilian Central Bank (Banco Central), IBGE, IPEA, FGV (1977 and 1979) as well as the author’s own databank built throughout the years. As a rule, the data considered to be used are those most recently disclosed in an official publication. In this case, except for some extraordinary review, data could be considered as definitive. Figure 5 contains data in quarterly indexes (base 1980) of automobile production (IAUTO), cement production (ICIM), industrial consumption of electricity (IEES), and real tax revenue (IRTNRS).

Figure 6 shows the dirty GDP series divided by the real tax revenue series, adjusted and expressed in indexes (see text).

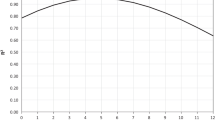

Table 4 reports the unit root test results for the annual series used in Engle–Granger’s regression for the 1960–1996 period. The first two are modifications to the ADF test, and the last shows four statistics that are modifications to the Phillips-Perron, Bhargava and ERS-PO statistics; see Maddala and Kim (2002). Considering the test results, it can be admitted that all series have integration order 1.

Rights and permissions

About this article

Cite this article

Cerqueira, L.F., Pizzinga, A. & Fernandes, C. Methodological Procedure for Estimating Brazilian Quarterly GDP Series. Int Adv Econ Res 15, 102–114 (2009). https://doi.org/10.1007/s11294-008-9187-2

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11294-008-9187-2