Abstract

This study aims to consolidate the economic history of Quebec over the period from 1948 to 2019 with the emphasis on the period 1948–1980 for which we estimated the quarterly GDP for the province. Unlike previous economic studies relating to this period, we identify the chronology of the economic cycle of Quebec by estimating the real quarterly GDP by using the method of Ginsburgh (Appl Stat 22(3):368–374, 1973) as modified by De Carufel and Lizotte (in: Paper presented at Congrès de la Société canadienne de Science Économique, Montréal, 1982). Our analysis of the duration and intensity of recessions confirms the presence of regional cycles in Canada. Il shows also that the business cycle of Quebec is more strongly correlated with the US cycle than with the cycle in the rest of Canada for the period prior to 1980 and more correlated to the cycle of the rest of Canada onwards. We provide insights on why this trend changed over time.

Source Authors’ calculation. Episodes of potential recession are highlighted by red circles

Source Authors’ calculation. Significant deflationary deviations are highlighted by the red circles

Source Authors’ calculation in millions of dollars of 1980. Potential recessions are identified by shaded areas

Source Authors’ calculation in millions of dollars of 1980. Potential recessions are identified by shaded areas

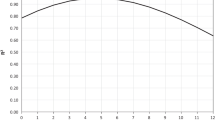

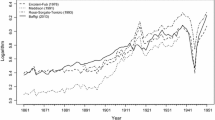

Source Authors’ calculation

Source Authors’ calculation

Source Authors’ calculation

Similar content being viewed by others

Notes

Many authors describing Quebec’s economic post WW2 history focus on the performance of two or three main periods, many the WW2 to pre quiet revolution period to the post quiet revolution (Geloso, 2017; Dean & Geloso, 2021; Fortin, 2001, 2011) and other such as Haddow (2015) focus on a comparative analysis of the evolution in Quebec and Ontario.

This would implicitly imply that the Quebec economy would have stronger links to the North American economy compared to the rest of Canada.

While their analysis is for the Canadian economy as a whole, the consequences are likely similar for the Quebec economy.

Depending on the nature of the variables, aggregation consists of either summing the quarterly data or taking the average of the quarterly values.

Data taken from https://statistique.quebec.ca/fr/document/comptes-economiques-du-quebec-trimestriels are seasonally adjusted expenditures in chained 2012 dollars. Our estimates of the real GDP for the period 1948–1980 is in 1981 real dollars. Both series can be made compatible after conversion using the ratio between the 2012 GDP deflator and the 1981 deflator.

A deflationary gap occurs when the GDP is below its potential level.

The jagged movements in the ROC's GDP are consistent with those for Canada as a whole, since Canada's real GDP in the fourth quarter of 1953 was 1.3 per cent higher than in the second quarter. Cross and Bergevin (2012) clearly considered other factors besides GDP to date the recession.

For a longer period, Kollenz (2000) found no correlation between the sovereignty movement in Quebec and economic performance compared to Ontario and the ROC. Somers and Vaillancourt (2014) also find an absence of a statistical relation between the sovereignty threat and GDP between Ontario and Quebec.

These papers mostly focus on the political reasons explaining Quebec’s strong support for NAFTA.

Explaining the rise in support for Quebec’s sovereignty in the 1970s is, however, a multifaceted topic that lies well outside the scope of the current paper.

The correlation difference test was performed on an online program offered by Lee and Preacher (2013) available at http://quantpsy.org/corrtest/corrtest2.htm.

We refer here to the explanatory power of a regression with a single explanatory variable. We do not want to suggest that we should limit ourselves to a single factor or claim that US GDP is an exogenous shock, but simply to illustrate the consequences of the degree of correlation that we measure if it were to reflect the effect of exogenous variables. This stronger correlation is, in in all likelihood not unrelated to the use of US GDP in constructing the Quebec quarterly data. But nevertheless, this should not be taken as a methodology-induced result. Indeed, Canadian GDP was initially taken as an explanatory variable before being discarded because it was not statistically significant when US GDP was included. The causality is therefore rather the opposite. It is the relative weakness of the correlation of Quebec GDP with Canadian GDP that ultimately explains why US GDP and not Canadian GDP was used, among other variables, to create the quarterly data.

Canada’s GDP is from Statistics Canada, Table 36-10-0104-01 while Quebec’s GDP is from Institut de la Statistique du Québec (2022), comptes économiques du Québec.

That said, the transmission of the cycle through foreign trade is necessarily much stronger between provinces than between a US state and a Canadian province, since crossing the international border reduces the volume of trade by a factor of at least 20 as shown by Helliwell (1996). We did not find such estimates for pre-1980 period to see how if it may have change over time. However, his model forecasted that the new NAFTA deal signed in 1988 would increase the trade between both countries.

References

Alesina, A., & Spolaore, E. (2005). The size of nations (p. 261). MIT Press.

Baldwin, J. R., & Macdonald, R. (2012). Ressources naturelles, termes de l'échange et croissance du revenu réel au Canada: 1870 à 2010, Statistics Canada, Catalogue No 11F0027M no 079.

Blain, L. (1978). Regional cyclical behavior and sensitivity in Canada, 1919–1973. The Journal of Economic History, 38(1), 271–273.

Blinder, A. S., & Rudd, J. B. (2013). The supply-shock explanation of the Great Stagflation revisited. In M. D. Bordo & A. Orphanides (Eds.), The great inflation: The rebirth of modern central banking (pp. 119–175). University of Chicago Press, Chicago.

Bonin, J. (2011). The “great” recession in Canada: Perception vs. Reality, conference at the Montréal CFA Society, March 28, 2011, https://www.bankofcanada.ca/2011/03/great-recession-canada-perception-reality/?_ga=2.95174172.141300858.1649697833-617520422.1587997601.

Burns, A. F., & Mitchell, W. C. (1946). Measuring business cycles (No. burn46-1). National Bureau of Economic Research.

Business Cycle Council (2016). Evidence mounts that 2015 downturn was no recession, Communiqué, Décembre (2016), https://www.cdhowe.org/sites/default/files/attachments/communiques/mixed/Communique_DEC212016_BCC.pdf.

Buyuksahin, B., Mo, K., & Zmitrowicz, K. (2016). Commodity price supercycles: What are they and what lies ahead? Bank of Canada Review-Autumn.

Cayemite, J. M. (2010). La trimestrialisation du GDP réel d’Haïti pour les Méthodes de Chow-Lin, Fernandez et Litterman. Working Papers ERMES, 1003, ERMES, University Paris 2.

Chow, G. C., & Lin, A. (1971). Best linear unbiased interpolation, distribution, and extrapolation of time series by related series. The Review of Economics and Statistics, 53(4), 372–375.

Cross, P., & Bergevin, P. (2012). Turning points: Business cycles in Canada since 1926, C. D. Howe Institute, Commentary 366.

Dauphin, R. (2007). La croissance économique du Québec au 20e siècle. Institut de la Statistique du Québec.

de Carufel, J., & Lizotte, S. (1982). L’approche économétrique utilisée pour la production de valeurs trimestrielles des comptes économiques du Québec. In Paper presented at Congrès de la Société canadienne de Science Économique, Montréal.

Dean, J., & Geloso, V. (2021). The linguistic wage gap in Quebec, 1901 to 1951. Cliometrica. https://doi.org/10.1007/s11698-021-00236-3

Denton, F. T. (1971). Adjustment of monthly or quarterly series to annual totals: An approach based on quadratic minimization. Journal of the American Statistical Association, 66(333), 99–102.

Dickinson, A. J., & Young, B. (1992). Brève histoire socio-économique du Québec. Les Éditions du Septentrion, ISBN 2-921114-79-8, F2911 Y6914.

Fernandez, R. B. (1981). A methodological note on the estimation of times series. Review of Economics and Statistics, 63(3), 471–476.

Fortin, P. (1980). Chômage, inflation et régularisation de la conjoncture au Québec. L’institut de recherche C. D. Howe, Montréal.

Fortin, P. (1996). The great Canadian slump. Canadian Journal of Economics, 29(4), 761–787.

Fortin, P. (2001). Has Quebec’s standard of living been catching up? In P. Grady & A. Sharpe (Eds.), The state of economics in Canada: Festschrift in honor of David Slater (pp. 381–402). Centre for the Study of Living Standards.

Fortin, P. (2011). La révolution tranquille et l’économie: Ou étions-nous, que vivions-nous et qu’avons-nous accompli? In G. Berthiaume & C. Corbo (Eds.), La révolution tranquille en héritage (pp. 87–134). Boréal.

Gagné, G. (1999). Libre-échange, souveraineté et américanité: Une nouvelle trinité pour le Québec? Politique et Sociétés, 18(1), 99–107.

Geloso, V. (2017). Rethinking Canadian economic growth and development since 1900: The Quebec case (p. 233). Springer.

Geloso, V. J., & Grier, K. B. (2022). Love on the rocks: The causal effects of separatist governments in Quebec. European Journal of Political Economy, 71, 102088.

Ginsburgh, V. A. (1973). A further note on the derivation of quarterly figures consistent with annual data. Applied Statistics, 22(3), 368–374.

Haddow, R. (2015). Comparing Quebec and Ontario: Political economy and public policy at the turn of the millennium (Vol. 47). University of Toronto Press.

Hébert, G. (1989). Les comptes économiques de 1926 à 1987. In Bureau de la Statistique du Québec (Eds.), Le Québec statistique (59th ed., pp. 45–67). Les publications du Québec, Quebec, Canada.

Helliwell, J. F. (1996). Do national borders matter for Quebec’s trade. Canadian Journal of Economics, 29(3), 507–522.

Institut de la Statistique du Québec. (2022). Comptes économiques du Québec, Produit intérieur brut selon les dépenses¹, données désaisonnalisées au taux annuel. https://statistique.quebec.ca/fr/document/compteseconomiques-du-quebec-trimestriels/tableau/produit-interieur-brut-selon-depenses-donnees-desaisonnaliseestaux-annuel-quebec.

Joseph, H. C. (1997). L’économie du Québec en ce dernier quart du 20e siècle: un survol. Écostat Québec, Gouvernement du Québec. http://www.stat.gouv.qc.ca/bul/economie/pdf/eco1_97.pdf.

Kaboré, P. (2014). Détermination du GDP réel trimestriel du Québec et analyse du cycle économique, 1948–1964, Masters thesis, Department of Economics, Université de Sherbrooke, supervised by L. Savard and M. Joanis.

Kaboré, P., Joanis, M., & Savard, L. (2014). Étude spéciale: Histoire économique du Québec depuis une soixantaine d'années. Études économiques Desjardins, November 2014.

Kneebone, R. D., & Gres, M. (2013). Trends, peaks, and troughs: National and regional employment cycles in Canada. The School of Public Policy-SSP Research Papers, 6(21), 1–26.

Kollenz, K. R. (2000). Historic roots and socio-economic consequences of the separatist movement in Quebec. PhD dissertation, Vienna, WU Vienna University of Economics and Business, available at http://epub.wu.ac.at.

Kouparitsas, M. A. (2001). Is the United States an optimum currency area? An empirical analysis of regional business cycles. Working Paper Series, WP-01-22, Federal Reserve Bank of Chicago.

Lachapelle, G. (2011). Quebec under free trade: Making public policy in North America (p. 422). Presse de l’Université du Québec.

Lamy, R., & Sabourin, P. (2001). Monitoring regional economies in Canada with new high-frequency coincident indexes. Working Paper 2001-05-Department of Finance Canada.

Lee, I. A., & Preacher, K. J. (2013). Calculation for the test of the difference between two dependent correlations with one variable in common [Computer software]. Available from http://quantpsy.org.

Lefebvre, M., & Poloz, S. S. (1996). The commodity-price cycle and regional economic performance in Canada. Bank of Canada Working Paper 96-12.

Linteau, P.-A., Durocher, R., Robert, J.-C., & Ricard, F. (1989). Histoire du Québec contemporain, New Updated Edition, Montréal, Boréal.

Litterman, R. B. (1983). A random walk, Markov model for the distribution of times series. Journal of Business & Economic Statistics, 1(2), 169–173.

Martin, P. (1995). When nationalism meets continentalism: The politics of free trade in Quebec. Regional & Federal Studies, 5(1), 1–27.

Mintz, I. (1969). Appendices and indexes to" Dating postwar business cycles: Methods and their application to Western Germany, 1950–67". (pp. 55–111). National Bureau of Economic Research.

Rashid, A., & Jehan, Z. (2013). Derivation of quarterly GDP, investment spending, and government expenditure figures from annual data: The case of Pakistan. Munich Personal Repec Archive. Paper no. 46937.

Raynauld, A. (1961). Croissance et structure économiques de la province de Québec. Ministère de l’industrie et du commerce du Québec, p. 657.

Romer, C. D., & Romer, D. H. (2002). A rehabilitation of monetary policy in the 1950’s. American Economic Review, 92(2), 121–127.

Rouillard, J. (1998). La révolution tranquille, rupture ou tournant? Journal of Canadian Studies/Revue D’études Canadiennes, 32(4), 23–51.

Schembri, L. (2008). Canada’s experience with a flexible exchange rate in the 1950s: Valuable lessons learned. Bank of Canada Review, (Spring Issue), 3–15. https://www.bankofcanada.ca/wp-content/uploads/2010/06/review_spring08.pdf

Somers, K., & Vaillancourt, F. (2014). Some economic dimensions of the sovereignty debate in Quebec: Debt, GDP, and migration. Oxford Review of Economic Policy, 30(2), 237–256.

Statistique Canada (1989). Comptes nationaux des revenus et dépenses—Estimations trimestrielles 1947–1986. Catalogue 13-533, Hors-Série.

Statistique Canada (2014). Désaisonnalisation et estimation de la tendance-cycle, (http://www.statcan.gc.ca/pub/12-539-x/2009001/seasonal-saisonnal-fra.htm).

Steiger, J. H. (1980). Tests for comparing elements of a correlation matrix. Psychological Bulletin, 87, 245–251.

Thiessen, G. (2000). Le changement au service de la stabilité: L'évolution de la politique monétaire à la Banque du Canada, de 1935 à 2000: conférence. Banque du Canada.

Wilson, T. A. (1985). Lessons of the recession. Canadian Journal of Economics, 18(4), 693–722.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Fortin, M., Joanis, M., Kabore, P. et al. Determination of Quebec's Quarterly Real GDP and Analysis of the Business Cycle, 1948–1980. J Bus Cycle Res 18, 261–288 (2022). https://doi.org/10.1007/s41549-022-00077-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41549-022-00077-7