Abstract

Standard axioms of additively separable utility for choice over time and classic axioms of expected utility theory for choice under risk yield a generalized expected additively separable utility representation of risk-time preferences over probability distributions over sure streams of intertemporal outcomes. A dual approach is to use the analogues of the same axioms in a reversed order to obtain a generalized additively separable expected utility representation of time–risk preferences over intertemporal streams of probability distributions over sure outcomes. The paper proposes an additional axiom, which is called risk-time reversal, for obtaining a special case of the two representations—expected discounted utility. The axiom of risk-time reversal postulates that if a risky lottery over streams of sure intertemporal outcomes and an intertemporal stream of risky lotteries yield the same probability distribution of possible outcomes in every point in time then a decision-maker is indifferent between the two. This axiom is similar to assumption 2 “reversal of order in compound lotteries” in Anscombe and Aumann (Ann Math Stat 34(1):199–205, 1963, p. 201).

Similar content being viewed by others

Notes

Blavatskyy and Maafi (2018) compare the goodness of fit of these generalizations to experimental data.

Mathematical expectation of any convex function is greater than or equal to the value of the convex function at the mathematical mean, the result which is known as Jensen’s inequality (Jensen 1906).

Formally, xPf ~ yPf for all x, y ∈ X and all f:T\P → X.

We assume that this can be any time period so that Bernoulli utility function is time-invariant.

Cantor (1895) gives an earlier proof using slightly stronger axioms.

References

Abdellaoui, M., Kemel, E., Panin, A., & Vieider, F. (2017). Take your time or take your chance. On the impact of risk on time discounting, HEC working paper.

Anchugina, N. (2017). A simple framework for the axiomatization of exponential and quasi-hyperbolic discounting. Theory and Decision,82(2), 185–210.

Andersen, S., Harrison, G. W., Lau, M., & Rutstroem, E. E. (2018). Multiattribute utility theory, intertemporal utility, and correlation aversion. International Economic Review,59(2), 537–555.

Anscombe, F. J., & Aumann, R. J. (1963). A definition of subjective probability. Annals of Mathematical Statististics,34(1), 199–205.

Bernoulli, D. (1738). «Specimen theoriae novae de mensura sortis» Commentarii Academiae Scientiarum Imperialis Petropolitanae. Translated, Bernoulli, D., 1954. Exposition of a new theory on the measurement of risk. Econometrica22, 23–36.

Blavatskyy, P. (2013). A simple behavioral characterization of subjective expected utility. Operations Research,61(4), 932–940.

Blavatskyy, P. (2015). Intertemporal choice with different short-term and long-term discount factors. Journal of Mathematical Economics,61, 139–143.

Blavatskyy, P. (2016). A monotone model of intertemporal choice. Economic Theory,62, 785–812.

Blavatskyy, P. (2017). Probabilistic intertemporal choice. Journal of Mathematical Economics,73, 142–148.

Blavatskyy, P. (2018). Temporal dominance and relative patience in intertemporal choice. Economic Theory,65(2), 361–384.

Blavatskyy, P., & Maafi, H. (2018). Estimating representations of time preferences and models of probabilistic intertemporal choice on experimental data. Journal of Risk and Uncertainty,56(3), 259–287.

Cantor, G. (1895). Beiträge zur Begründung der transfiniten Mengenlehre §11. Mathematische Annalen,46, 481–512.

Chesson, Harrell, & Viscusi, Kip W. (2000). The heterogeneity of time-risk tradeoffs. Journal of Behavioral Decision Making,13, 251–258.

Chesson, Harrell, & Viscusi, Kip W. (2003). Commonalities in time and ambiguity aversion for long-term risk. Theory and Decision,54, 57–71.

De Jarnette, P., Dillenberger, D., Gottlieb, D., & Ortoleva, P. (2018). Time lotteries and stochastic impatience, PIER Working Paper 15-026.

Debreu, G. (1954). Representation of a preference ordering by a numerical function. In R. M. Thrall, C. H. Coombs, & R. L. Davis (Eds.), Decision processes (pp. 159–165). New York: Wiley.

Epstein, L. G. (1983). Stationary cardinal utility and optimal growth under uncertainty. Journal of Economic Theory,31(1), 133–152.

Harvey, C. M. (1986). Value functions for infinite-period planning. Management Science,32(9), 1123–1139.

Harvey, Charles, & Østerdal, Lars Peter. (2012). Discounting models for outcomes over continuous time. Journal of Mathematical Economics,48, 284–294.

Hayashi, T. (2003). Quasi-stationary cardinal utility and present bias. Journal of Economic Theory,112(3), 343–352.

Jensen, J. (1906). Sur les fonctions convexes et les inégalités entre les valeurs moyennes. Acta Mathematica,30(1), 175–193.

Kihlstrom, R. E., & Mirman, L. J. (1974). Risk aversion with many commodities. Journal of Economic Theory,8, 361–388.

Kopylov, I. (2010). Simple axioms for countably additive subjective probability. Journal of Mathematical Economics,46, 867–876.

Krantz, D. H., Luce, R. D., Suppes, P., & Tversky, A. (1971). Foundations of measurement, Vol. 1 (Additive and Polynomial Representations). New York: Academic Press.

Kreps, David M., & Porteus, Evan L. (1978). Temporal resolution of uncertainty and dynamic choice theory. Econometrica,46(1), 185–200.

Loewenstein, George, & Prelec, Drazen. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics,107, 573–597.

Onay, Selcuk, & Öncüler, Ayse. (2007). Intertemporal choice under timing risk: An experimental approach. Journal of Risk and Uncertainty,34, 99–121.

Pan, Jinrui, Webb, Craig S., & Zank, Horst. (2015). An extension of quasi-hyperbolic discounting to continuous time. Games and Economic Behavior,89, 43–55.

Phelps, E., & Pollak, R. (1968). On second-best national saving and game-equilibrium growth. The Review of Economic Studies,35, 185–199.

Samuelson, P. (1937). A note on measurement of utility. The Review of Economic Studies,4, 155–161.

Savage, L. J. (1954). The foundations of statistics. New York: Wiley.

Thaler, R. H. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters,8, 201–207.

von Neumann, J., & Morgenstern, O. (1947). Theory of games and economic behavior. Princeton: Princeton University Press.

Wakker, P. P. (1984). Cardinal coordinate independence for expected utility. Journal of Mathematical Psychology,28, 110–117.

Wakker, P. P. (1989). Additive representation of preferences, a new foundation of decision analysis. Dordrecht, Holland: Kluwer Academic Publishers.

Yaari, M. E. (1965). Uncertain lifetime, life insurance, and the theory of the consumer. The Review of Economic Studies,32(2), 137–150.

Young, E. R. (2007). Generalized quasi-geometric discounting. Economics Letters,96(3), 343–350.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Lemma 1

If Axioms 1–5 hold then the preference relation ≽ satisfies ordinal independence: xPf ≽ xPg implies yPf ≽ yPg for all \( x,\;y \in X \); f, g:T\P → X and any time period \( P \in \sum \)

Proof of Lemma 1

Step 1 If time period P ∈ \( \sum \) is null then yPf ≽ xPf and xPg ≽ yPg for all outcomes x, y ∈ X. Thus, if xPf ≽ xPg then we have yPf ≽ xPf ≽ xPg ≽ yPg and Axiom 2 (transitivity) implies that yPf ≽ yPg, i.e. Lemma 1 holds.

Step 2 Note that aPh ≻ bPh implies aPk ≻ bPk for all outcome a, b ∈ X, functions h, k :T\P → X, and a nonnull time period P ∈ \( \sum \). Otherwise, if aPk ≻ bPk does not hold, i.e. bPk ≽ aPk, we can then apply Axiom 5 (cardinal independence) as follows: bPk ≽ bPk, bPk ≽ aPk and bPh ≽ bPh imply bPh ≽ aPh; which contradicts aPh ≻ bPh.

Step 3 If x1Pg ~ xPf and xPf ≻ xPg then Axiom 2 (transitivity) implies that x1Pg ≻ xPg. By step 2, x1Pg ≻ xPg implies x1Pf ≻ xPf (set a = x1, b = x, h = g and k = f). Since x1Pf ≻ xPf and xPf ~ x1Pg then Axiom 2 (transitivity) implies that x1Pf ≻ x1Pg.

Step 4 We now prove that xPf ≻ xPg implies yPf ≻ yPg if yPf ≽ xPf and time period P ∈ \( \sum \) is nonnull.

If the set {z ∈ X: zPg ≽ xPf} is empty then yPf ≽ xPf implies yPf ≻ yPg (if yPf ≻ yPg does not hold, i.e. yPg ≽ yPf, and yPf ≽ xPf then Axiom 2 (transitivity) implies that yPg ≽ xPf, which contradicts the fact that the set {z ∈ X: zPg ≽ xPf} is empty).

If the set {z ∈ X: zPg ≽ xPf } is nonempty then there exists an outcome z ∈ X such that zPg ≽ xPf. Therefore, we have zPg ≽ xPf ≻ xPg. According to Axiom 3 (solvability), there must then exist an outcome x1 ∈ X such that x1Pg ~ xPf.

Since in step 4 we consider only preference yPf ≽ xPf and xPf ~ x1Pg by our choice of x1, Axiom 2 then implies that yPf ≽ x1Pg. Suppose that yPf ≻ yPg does not hold, i.e. yPg ≽ yPf. If yPg ≽ yPf and we just established that yPf ≽ x1Pg then Axiom 2 implies that yPg ≽ x1Pg.

If it happens to be so that x1Pf ≻ yPf then, by step 2 (set a = x1, b = y, h = f and k = g), we must have x1Pg ≻ yPg in contradiction to yPg ≽ x1Pg.

Otherwise, if yPf ≽ x1Pf (and x1Pf ≻ x1Pg by step 3) then we can repeat step 4 from the very beginning with outcome x being replaced by x1 and choosing outcome x2 ∈ X such that x2Pg ~ x1Pf. By successive iteration, we obtain a so-called standard sequence of outcomes \( \{ x_{i} \}_{{i \in {\mathbb{N}}}} \) that is recursively defined by xiPg ~ xi−1Pf (with a convention x0 ≡ x). Axiom 4 implies that the standard sequence \( \{ x_{i} \}_{{i \in {\mathbb{N}}}} \) such that yPf ≽ xiPf is finite. Thus, for some \( m \in {\mathbb{N}} \) we must have either

- (a)

xmPf ≻ yPf ≽ xm−1Pf and we arrive at contradiction by step 2 (xmPf ≻ yPf implies xmPg ≻ yPg, which contradicts yPg ≽ xmPg); or

- (b)

yPf ≽ xm−1Pf and there is no xm ∈ X such that xmPg ~ xm−1Pf. In such a case, the set {z ∈ X: zPg ≽ xm-1Pf} must be empty. Yet, if yPf ≻ yPg does not hold, i.e. yPg ≽ yPf, and yPf ≽ xm−1Pf then Axiom 2 implies that yPg ≽ xm−1Pf and the set {z ∈ X: zPg ≽ xm−1Pf} cannot be empty. Hence, we must have yPf ≻ yPg in this case as well.

Step 5 If yPg ≻ yPf and yPf ~ y−1Pg, then we must have yPg ≻ y−1Pg due to Axiom 2. By step 2, yPg ≻ y−1Pg implies yPf ≻ y−1Pf (set a = y, b = y−1, h = g and k = f). Since y−1Pg ~ yPf and yPf ≻ y−1Pf, Axiom 2 (transitivity) implies that y−1Pg ≻ y−1Pf.

Step 6 We now prove that yPg ≻ yPf implies xPg ≻ xPf if yPf ≽ xPf and P ∈ \( \sum \) is a nonnull time period.

If the set {z ∈ X: yPf ≽ zPg} is empty then we must have xPg ≻ xPf (if xPg ≻ xPf does not hold, i.e. xPf ≽ xPg, and yPf ≽ xPf then we must have yPf ≽ xPg due to Axiom 2, which contradicts the statement that the set {z ∈ X: yPf ≽ zPg} is empty).

If the set {z ∈ X: yPf ≽ zPg} is nonempty then there is z ∈ X such that yPf ≽ zPg. Thus, we have yPg ≻ yPf ≽ zPg. According to Axiom 3 there is then an outcome y−1 ∈ X such that y−1Pg ~ yPf. If y−1Pg ~ yPf and we consider only the case when yPf ≽ xPf then we must have y−1Pg ≽ xPf due to Axiom 2. Suppose that xPg ≻ xPf does not hold, i.e. xPf ≽ xPg. Since we already established that y−1Pg ≽ xPf and xPf ≽ xPg then we must have y−1Pg ≽ xPg due to Axiom 2.

If it happens to be so that xPf ≻ y−1Pf then, by step 2 (set a = x, b = y−1, h = f and k = g), we must have xPg ≻ y−1Pg in contradiction to y−1Pg ≽ xPg.

Otherwise, if y−1Pf ≽ xPf (and y−1Pg ≻ y−1Pf by step 5) then we can repeat step 6 from the very beginning with outcome y being replaced by y−1 and choosing outcome y−2 ∈ X such that y−2Pg ~ y−1Pf. By iteration, we construct another standard sequence of outcomes \( \{ y_{ - i} \}_{{i \in {\mathbb{N}}}} \). Axiom 4 implies that this standard sequence \( \{ y_{ - i} \}_{{i \in {\mathbb{N}}}} \) such that y−iPf ≽ xPf is finite. This implies that for some \( n \in {\mathbb{N}} \) we must have either

- (a)

y−nPf ≽ xPf ≻ y−n−1Pf and we arrive at contradiction by step 2 (xPf ≻ y−n−1Pf implies xPg ≻ y−n−1Pg, which contradicts y−n−1Pg ≽ xPg); or

- (b)

y−nPf ≽ xPf and there is no y−n−1 ∈ X such that y−n−1Pg ~ y−nPf. In such a case the set {z ∈ X: y−nPf ≽ zPg} must be empty. Yet, if y−nPf ≽ xPf and xPf ≽ xPg (because we assumed that xPg ≻ xPf does not hold) then we must have y−nPf ≽ xPg due to Axiom 2 and the set {z ∈ X: y−nPf ≽ zPg} cannot be empty. Hence, we must have xPg ≻ xPf in this case as well.

Summary If time period P ∈ \( \sum \) is null then Lemma 1 holds by step 1. If P ∈ \( \sum \) is nonnull then three cases are possible. First, if xPf ≻ xPg and yPf ≽ xPf, then Lemma 1 holds by step 4. Second, if xPf ~ xPg and yPf ≽ xPf, then yPf ≽ yPg (otherwise, if yPg ≻ yPf, then, by step 6, we must have xPg ≻ xPf, which contradicts xPf ~ xPg). Third, if xPf ≽ yPf, then Lemma 1 holds as well. This can be proven by contradiction: suppose that yPf ≽ yPg does not hold, i.e. yPg ≻ yPf. If xPf ≽ yPf then xPg ≽ yPg by step 2 (set a = x, b = y, h = f and k = g). If xPg ≽ yPg and yPg ≻ yPf then xPg ≻ xPf by step 4 (switching x and y as well as f and g in step 4). Yet, xPg ≻ xPf contradicts xPf ≽ xPg.\( \square \)

Proof of Proposition 1

It is relatively straightforward to show that Axioms 1–5 are necessary. We shall prove only their sufficiency. When all time periods are null, then Proposition 1 holds trivially by setting u(x) = 0 for all \( x \in X \) . In this case, constants D(t) ≥ 0 can be chosen arbitrary for all \( t \in T \). In the static case when only one time period is nonnull, Lemma II from Debreu (1954, p. 161) or Theorem 2 from Section 2.1 in Krantz et al. (1971)Footnote 5 guarantees the existence of a continuous utility function \( u:X \to {\mathbb{R}} \) that represents binary preference relation over outcomes. In this case, we set D(t) = 0 for all null time periods \( t \in T \) and D(t) can be an arbitrary positive constant for the remaining nonnull time period \( t \in T \).

When exactly two time periods are nonnull, we can set R = P and k = g in Axiom 5 to obtain a so-called Thomsen–Blaschke condition: if xPf ≽ yPg, xPg ≽ zPf, and yPh ≽ xPg then xPh ≽ zPg for all \( x,y,z \in X \); f, g, h:T\P → X; and any nonnull time period \( P \in \sum \). Preference relation ≽ also satisfies ordinal independence due to Lemma 1 above. Theorem 2 in Section 6.2.4 in Krantz et al. (1971) then establishes that the utility of a stream that yields outcomes f(t) in moments of time \( t \in T \) can be written in the weighted utility representation (4), where \( u_{t} :X \to {\mathbb{R}} \) is a continuous function that is unique up to a positive affine transformation for all nonnull moments of time t ∈ T.

If more than two time periods are nonnull, we use Lemma 1 above to establish that preference relation ≽ satisfies ordinal independence. Theorem 13 in Section 6.11.1 in Krantz et al. (1971) then guarantees that this preference relation admits the weighted utility representation (4).

If Axiom 5 holds then Theorem 15 in Krantz et al. (1971, Section 6.11.2) establishes that functions ut(.) in weighted utility representation (4) must be positive affine transformations of each other so that we can write ut(x) = D(t)u(x) for all x ∈ X, where \( D(t) \in {\mathbb{R}} \) for all \( t \in T \) and function \( u:X \to {\mathbb{R}} \) is continuous and unique up to a positive affine transformation when at least two time periods are nonnull. The constants \( D(t) \in {\mathbb{R}} \) must be either all positive or all negative (otherwise Axiom 5 is violated). In the latter case, we can define a new utility function, which is equal to − u(.).\( \square \)

Proof of Proposition 2

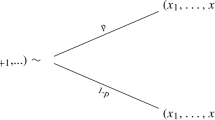

It is relatively straightforward to show that Axioms 1a, 2a, 3–7 are necessary. We shall prove only their sufficiency. If the preference relation ≽ satisfies Axioms 1a, 2a, 6 and 7 then it admits expected utility representation (von Neumann and Morgenstern 1947). In other words, the utility of a risky stream that yields sure streams of intertemporal payoffs \( f_{1} , \ldots ,f_{n} \in {\mathcal{F}} \) with respective probabilities \( p_{1} , \ldots ,p_{n} \in [0,\;1] \), \( p_{1} + \cdots + p_{n} = 1 \), \( n \in {\mathbb{N}} \), can be written in expected utility form:

where \( w:{\mathcal{F}} \to {\mathbb{R}} \). If the preference relation ≽ satisfies Axioms 1–5 then, according to Proposition 1, preferences over sure streams of intertemporal payoffs are represented by additively separable utility (2). Thus, function \( w:{\mathcal{F}} \to {\mathbb{R}} \) can be written in the form of a strictly increasing function \( v:{\mathbb{R}} \to {\mathbb{R}} \) such that

where functions \( D:T \to {\mathbb{R}}_{ + } \) and \( u:X \to {\mathbb{R}} \) are the same as in Proposition 1.\( \square \)

Proof of Proposition 3

It is relatively straightforward to show that the analogues of Axioms 1–5 from Sect. 1 on the extended domain \( \varPhi \) instead of domain \( {\mathcal{F}} \) as well as Axioms 6b and 7b are necessary. We shall prove only their sufficiency.

If a preference relation ≽ on \( \varPhi \) satisfies the analogues of Axioms 1–5 from Sect. 1 on the extended domain \( \varPhi \) instead of domain \( {\mathcal{F}} \) then, according to Proposition 1, preferences over streams of intertemporal lotteries are represented by additively separable utility (2). In other words, the utility of a stream of risky lotteries that yields lottery \( L_{t} \in {{\Delta }}(X) \) in moment of time \( t \in T \) can be written as

where D(t) ≥ 0 for all \( t \in T \) and function \( \tilde{w}:\Delta (X) \to {\mathbb{R}} \) is continuous and unique up to a positive affine transformation if at least two time periods are nonnull.

If a preference relation ≽ on \( \varPhi \) satisfies the analogues of Axioms 1, 2 from Sect. 1 on the extended domain \( \varPhi \) instead of domain \( {\mathcal{F}} \) then Axioms 1b and 2b hold as well. If the preference relation ≽ on \( {{\Delta }}(X) \) satisfies Axioms 1b, 2b, 6b and 7b then it admits expected utility representation (von Neumann and Morgenstern 1947). In other words, the utility of a static risky lottery \( L \in \Delta (X) \) can be written as \( \sum\nolimits_{x \in X } {L(x)\tilde{v}(x)} , \) where \( \tilde{v}:X \to {\mathbb{R}} \) is time-invariant Bernoulli utility function. Therefore, function \( \tilde{w}:\Delta (X) \to {\mathbb{R}} \) can be written in the form of a strictly increasing function \( \tilde{u}:{\mathbb{R}} \to {\mathbb{R}} \) such that

Proof of Proposition 4

It is relatively straightforward to show that axioms are necessary. We shall prove only their sufficiency. According to Proposition 2, if a preference relation ≽ on S satisfies Axioms 1a, 2a, 3–7 then the utility of a risky stream \( (f_{1} ,\;p_{1} ; \ldots ;f_{n} ,\,p_{n} ) \) can be written in a generalized expected additively separable form (2). According to Proposition 3, if a preference relation ≽ on \( \varPhi \) satisfies the analogues of Axioms 1–5 from Sect. 1 on the extended domain \( \varPhi \) instead of domain \( {\mathcal{F}} \) as well as Axioms 6b and 7b, then the utility of an intertemporal stream of risky lotteries \( p_{1} f_{1} + \cdots + p_{n} f_{n} \) can be written in a generalized additively separable expected utility form:

where D(t) ≥ 0 for all \( t \in T \); function \( \tilde{u}:{\mathbb{R}} \to {\mathbb{R}} \) is continuous and strictly increasing; and \( \tilde{v}:X \to {\mathbb{R}} \). If Axiom 8 holds then for all \( f_{1} ,\; \ldots ,\;f_{n} \in {\mathcal{F}} \) and \( p_{1} ,\; \ldots ,\;p_{n} \in [0,\;1] \), \( p_{1} + \cdots + p_{n} = 1 \), \( n \in {\mathbb{N}} \) the following functional equation must hold:

Setting \( p_{i} = 1 \) for any \( i \in \{ 1, \ldots ,n\} \) in functional Eq. (8) immediately implies that function \( v:{\mathbb{R}} \to {\mathbb{R}} \) is linear:

Rights and permissions

About this article

Cite this article

Blavatskyy, P. Expected discounted utility. Theory Decis 88, 297–313 (2020). https://doi.org/10.1007/s11238-019-09718-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-019-09718-3