Abstract

The paper draws on network theory to employ concepts of homophily and heterophily to investigate whether the presence of familiar, unfamiliar or a mix of actors in an entrepreneurial ecosystem is related to start-up rates. The empirical focus of this study is on 81 UK university entrepreneurial ecosystems and their outputs in terms of academic spinoff companies. The paper finds that university entrepreneurial ecosystems with access to actors of predominantly heterophilious character are associated with higher spinoff start-up rates. It is concluded that in stimulating the development of successful entrepreneurial ecosystems there is a clear need to focus on their openness to heterophilious actors, inclusive of other ecosystems. This is especially important in the context of network lock-in that may arise from dependence on homophilious ties.

Plain English Summary

Entrepreneurial ecosystems characterised by openness to diverse actors generate more firms, as shown in a study focusing on 81 UK university entrepreneurial ecosystems. The paper studies network character of actors in entrepreneurial ecosystems and whether this character is associated with start-up rates. Specifically, it focuses on the familiarity of actors, inspecting whether it is related to greater venture formations. In so doing, the study examines 81 UK university entrepreneurial ecosystems. It finds that university entrepreneurial ecosystems that generate more ventures are associated with having a presence of actors of unfamiliar character, drawing attention to the openness of ecosystems’ networks. The key implication of the study is in recognising the link between the ecosystem’s openness to diverse actors and its entrepreneurial performance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The rise of the entrepreneurial ecosystem concept and its ability to make connections between entrepreneurship activity and the environment in which it takes place has been a major development in the field (Acs et al., 2018; Audretsch et al., 2019; Cao & Shi, 2021; Cho et al., 2021; Spigel, 2017; Spigel & Harrison, 2018; Volkmann et al., 2021). This is specifically related to problems in conceptualising the multitude of actors that are important to entrepreneurship activity, especially with the recognition of the role played by networks (Fernandes & Ferreira, 2021; Lux et al., 2020; Scott et al., 2021; Van Rijnsoever, 2020). These networks contribute to the institutional dynamics (Stam, 2015) of ecosystems where they either stimulate or hinder the formation and growth of firms.

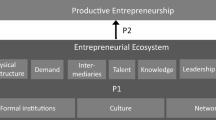

An important part of these networks are actors forming the entrepreneurial ecosystems. Whilst previous studies identified a range of different elements (Fernandes & Ferreira, 2021; Spigel, 2017), the recent work of Stam and Van de Ven (2021), building on Stam (2015), is particularly illuminating in its approach to defining the concept by offering their typology: physical infrastructure, demand, intermediaries, talent, knowledge, leadership, finance. Whilst having access to these elements is critical for entrepreneurship to take place, there is a limited understanding of the importance of network-based dynamics to entrepreneurial rates, or ecosystem performance (Spigel et al., 2020), resulting in recent calls for stronger engagement with network theory (Alvedalen & Boschma, 2017), specifically trying to explain performance of ecosystems (Wurth et al., 2021). The networks are typically regarded as reflecting the coherence of ecosystem actors (Colombelli et al., 2019; Nordling, 2019; Roundy et al., 2018), its strengthening expressing the development of an ecosystem, where connections between actors densify. At the same time, there is increasing recognition of diverse connections in ecosystems (Schäfer & Henn, 2018; Spigel & Harrison, 2018) that are responsible for either bringing new resources into ecosystems or connecting otherwise disparate ecosystems. However, the intricate issue is how this coherence or network building is achieved and, in particular, how it explains entrepreneurial performance of ecosystems, when considering the presence of actors that share similar characteristics, typically inducing faster tie formation, or actors that are dissimilar, signifying a more difficult tie formation process. As such, it is important to understand whether familiar actors or unfamiliar ones should be the focus of networking activities of entrepreneurs and how the governance of entrepreneurial ecosystems should direct efforts at configuring the ecosystems for optimal outcomes (Acs et al., 2016).

Therefore, this paper, drawing on the social network theory’s concepts of homophily (similarity/familiarity of actors) and heterophily (dissimilarity/unfamiliarity) (Lazarsfeld & Merton, 1954; McPherson et al. 2001), asks the following research question: is the presence of homophilious, heterophilious, or a mix of actors important to start-up rates? The empirical approach employs university entrepreneurial ecosystems in its focus, as these offer more defined and smaller ecosystem units (or subsystems), and have more identifiable actors and characteristics. University entrepreneurial ecosystems have emerged quite recently (Hayter et al., 2018), although similarly aimed concepts have been around for some time (Degroof & Roberts, 2004; Harrison & Leitch, 2010), and the literature on their nature has been growing in strength, identifying the role of the university in the entrepreneurial ecosystems (Miller & Acs, 2017), their governance (Cunningham et al., 2019), or their configuration and entrepreneurial outcomes (Prokop, 2021a). This paper studies 81 UK university entrepreneurial ecosystems responsible for the formation of 870 unique academic spinoffs. The key contribution of the paper is in identifying that entrepreneurial ecosystems with access to heterophilious actors are characterised by higher start-up rates.

2 Networks and entrepreneurship

This section connects key strands of literature that focus on the network heterophily and entrepreneurship, and introduces the specific context of academic spinoff companies and university entrepreneurial ecosystems.

2.1 Network properties and entrepreneurship

The formation of a firm is importantly related to the entrepreneur’s network characteristics (Greve, 1995), which dynamically change across the foundation process (Greve & Salaff, 2003). Networks of ventures show non-linear dynamism (Hollow, 2020; Rasmussen et al., 2015) and are most intensive at the early development stages (Huggins et al., 2015). The actors an entrepreneur has access to provide the sounding board for the initial business ideas (Greve & Salaff, 2003), and later enable the entrepreneur to access the resources essential for founding and building the firm (Elfring & Hulsink, 2003), such as finance or knowledge. Jack (2005) finds that these resource-based relations typically have a strong tie character (Granovetter, 1973). Such networks are also typically the determining factors for the location of the new venture, where entrepreneur’s previous place attachment, either through education, growing up, or industrial experience influences location decision – one based on proximity to established connections (Sorenson, 2018). Moreover, there is a tendency among the small business owners towards local network embeddedness at the cost of building non-proximate relations (Sharafizad & Brown, 2020), suggesting a tendency for network lock-in effect, where new opportunities have no route to enter the network. This is especially evident in Batjargal’s (2003) study which finds that having more close friends in a network limits company’s development (i.e. the lock-in effect), whilst having weak ties to actors that enable access to separate set of connections is positive for firm development. Contrastingly, Elfring and Hulsink (2003) find that the strong ties enable ventures to access resources and build legitimacy, but weak ties lead to new opportunities.

The entrepreneurship literature has developed another nuanced understanding related to the concepts of homophily and heterophily. In short, homophily signifies relationships based on a range of characteristics that are shared between actors in a network (Lazarsfeld & Merton, 1954; McPherson et al. 2001), which could include gender, age, ethnicity, occupation, etc. Heterophily, on the other hand, is the opposite concept, capturing the dissimilarity or unfamiliarity between actors. Although, these concepts tend to be treated as the opposites, Barranco et al. (2019) present heterophily as complementary to homophily, since actors are both familiar and different across a range of factors. In fact, it is rarely possible to observe a full dissimilarity (heterophily) or similarity (homophily) among network actors, but what appears important is to delineate the basis for homophily or heterophily observed, i.e. the key characteristics that are either shared or not.

In their theorisations of entrepreneurship Leyden et al. (2014) indicate the importance of heterogeneous connections being critical to firm formation, enabling the entrepreneurs to access diverse knowledge and perspectives essential to crystallising their entrepreneurial ideas. Studies of entrepreneurial intentions in academia find that heterophilious ties—formed with the industry—are positively related to research commercialisation (Bienkowska & Klofsten, 2012), specifically through engagement in entrepreneurial activities (Bourelos et al., 2012; Goethner et al., 2012; Krabel & Mueller, 2009), such as forming spinoff companies. In entrepreneurial team formation studies, homophily is a driving force for partner selection (Ruef et al., 2003); however, this may not always be based on the typical socio-demographic characteristics (McPherson et al. 2001), but also along the cognitive and value-based ones (Ben-Hafaiedh-Dridi, 2010), suggesting early stages of venture founding to be characterised by the exploitation of the familiar ties. In fact, Healey et al. (2021) find that team formation is only based on homophily if there is a shared knowledge of the entrepreneurial opportunity, otherwise the team building tendency is for increasing the heterogeneity in the team.

Whilst the dynamism of the entrepreneurial networks may indicate that in later stages the entrepreneur may need to either abandon the homophilious ties or add heterophilious ones, the evidence is not conclusive. For example, in early post-formation firm development stages, Batjargal (2003) did not find that heterophilious actors, defined as those from other industries than the entrepreneur’s, have a relationship with firm performance. Interestingly, the use of heterophilious ties is related to the aspirations of an actor holding brokerage position within a network (Shipilov et al. 2011), with those that perform above own aspirations more likely to add heterophilious ties, whilst those underperforming more likely to resort to homophily. As such, there is limited evidence on the disambiguation between the roles played by homophilious and heterophilious actors in entrepreneurship, especially as the evidence suggests context-specific understandings.

Within any particular entrepreneurial ecosystem there may exist disconnected clusters of entrepreneurs (Neumeyer et al., 2019) who do not participate in accessing the same entrepreneurial support structures, indicating potential inequality in outcomes at a local level. This is especially important given the varied entrepreneurial cultures persisting across regions (Fritsch & Wyrwich, 2017, 2018) and cities (Audretsch et al., 2021). As networks enable entrepreneurs to navigate through environments with institutional voids by creating own norms and connecting them to supportive individuals (Ivy & Perényi, 2020), this sub-ecosystem disconnect may indicate the existence of varying parallel institutional contexts within any local ecosystem, suggesting a complex picture of entrepreneurship outcomes. Consequently, it is unknown whether the ecosystems based on homophilious or heterophilious (or both) relations perform better in terms of firm formation.

Stam and Van de Ven’s (2021) framework enables identification of key resources important for entrepreneurs in ecosystems: physical infrastructure, demand, intermediaries, talent, knowledge, leadership, finance. Whilst some of these resources may be already available to entrepreneurs through their extant networks, many of them may require developing new connections to access these (Greve & Salaff, 2003). The focus of the paper is on the nature of these network links, their homophilious or heterophilious character.

The following section introduces the paper’s empirical focus on the academic entrepreneurship phenomenon to draw the contextual boundaries for this study.

2.2 Entrepreneurial ecosystems and academic spinoff companies

Entrepreneurial ecosystems concept offers a reconfigured understanding of the regional innovation systems (Cooke, 1992, 2001), where the entrepreneur is a central actor, and the entrepreneur’s local context or environment influence her/his actions (Stam, 2015). Whilst further influences can be clearly drawn from Marshall’s agglomeration economies, Jacob’s urbanisation ones, or Schumpeter’s focus on the entrepreneur-innovator, the ecosystem metaphor is agile and comprehensive in capturing and connecting a number of theoretical developments. The importance of the local is expressed through the role played by networks (Feld, 2012; Spigel, 2017), which are a reinforcing structure of the entrepreneurial ecosystem. Whilst the previous section clearly outlined the geographically local character of entrepreneurial networks, non-local connections are possible (Huggins & Prokop, 2017) and there are clear instances where they contribute to successful ecosystem performance (Prokop, 2021a). However, these spatial and relational dimensions of the ecosystem’s definition still require further theorisation (Alvedalen & Boschma, 2017; Audretsch et al., 2019; Cho et al., 2021).

As entrepreneurial ecosystems focus on larger local constructs, for the purposes of this paper, a smaller unit is needed—a sub-ecosystem, such as university entrepreneurial ecosystem. The emerging literature on university entrepreneurial ecosystems recognises that these may exist as individual ecosystems (Miller & Acs, 2017; Cunningham et al., 2019), even though they clearly cross boundaries of place-based entrepreneurial ecosystems (Prokop, 2021a), sharing many actors. The literature discussing university entrepreneurial ecosystems tends to focus on student (Breznitz et al., 2019) and academic entrepreneurs (Hayter et al., 2018), the infrastructure developed by the university for entrepreneurial purposes (Johnson et al., 2019), the importance of university knowledge to performance of entrepreneurial firms (Link & Sarala, 2019), the governance of universities in relation to spinoff formations (Meoli et al., 2019), or the problems in emergence of such ecosystems (Lahikainen et al., 2019). It is proposed here that a university entrepreneurial ecosystem is a subsystem of a wider entrepreneurial ecosystem which embraces a diverse set of firms (Spigel & Harrison, 2018), pointing to a nested character of ecosystems (Lô & Theodoraki, 2021; Wurth et al., 2021). Entrepreneurial sub-ecosystems are useful delineation tools in theorising entrepreneurial ecosystems, with important contributions on social capital (Theodoraki et al., 2018), entrepreneurial ecosystems emergence (Thompson et al., 2018) or governance (Cunningham et al. 2019) being good examples of this utility.

As such, university entrepreneurial ecosystem (Hayter et al., 2018) enables a clearer delineation of network boundaries and at the same time presents the possibility of multiple disconnected sub-ecosystems coexisting in the same locality. For example, university entrepreneurial ecosystems of the Imperial College London and of London Metropolitan University are disconnected, but present in the same entrepreneurial ecosystem of London. Through multiple network connections, these may finally share some distant ties, but crucially belong to different clusters/subnetworks or sub-ecosystems. Whilst it is well established that university entrepreneurial ecosystems where university actors have a stronger research character manifested either through publications, disclosures or patents (Bourelos et al., 2012; Di Gregorio & Shane, 2003; Fini et al., 2011; Gonzalez-Pernia et al., 2013), are characterised by stronger eminence (Fini et al., 2017), or have strong science departments (Shane, 2004), generate more spinoff companies, there is a dearth of evidence on the network properties and how these relate to spinoff numbers.

In particular, a number of university entrepreneurial ecosystem actors are identified (Hayter et al., 2018; Prokop, 2022): business incubators (on and off campus), science parks, technology transfer offices (TTO), investors (seed funds and venture capitalists), management team, and universities, corresponding with Stam and Van de Ven’s (2021) resources/elements: physical infrastructure, intermediaries, finance, talent, and leadership, respectively. The academic entrepreneurship literature also highlights the role of industry networks (Djokovic & Souitaris, 2008; Goethner et al., 2012; Hoye & Pries, 2009), which are typically used for research funding (O’Shea et al., 2005; D’Este et al., 2012) or opportunity recognition (Fini et al., 2011) by the academic founder, representing a form of knowledge. Figure 1 presents a conceptual framework that reflects the realities of university entrepreneurial ecosystems. Each of these network elements is discussed in detail below.

2.2.1 Homophilious ties

The relations that can be characterised as homophilious would concern actors where the university has greater involvement, either by originally founding the function of that ecosystem component or playing some major role in it, sharing the higher education sphere as depicted in academic spinoff theory (Prokop, 2021b). In other words, these are extensions of the parent university, which itself can be considered the most homophilious actor in any university entrepreneurial ecosystem. As such these extended functions include technology transfer offices, business incubators, seed fund investors typically accessible through university challenge funds or proof-of-concept funds), and the university itself. Technology transfer offices have been previously found to have no influence over academic entrepreneurial intentions (Clarysse et al., 2011) or spinoff formation (Belitski et al., 2019) and instead playing later stage roles that aid spinoff survival (Prokop et al., 2019). Whilst business incubators are expected to be related to spinoff numbers given the extant literature (Grimaldi & Grandi, 2005), academic spinoff companies are not found to use such facilities (Hewitt-Dundas, 2015). Instead, they tend to “incubate” in academic departments informally. Science parks play a similar role to business incubators (Tamasy, 2007), listed as important components of the university entrepreneurial ecosystem (Hayter et al., 2018), however there is limited evidence of their effect on spinoff rates with studies typically not modelling other ecosystem actors (Audretsch & Belitski, 2019; Salvador & Rolfo, 2011).

2.2.2 Heterophilious ties

The university entrepreneurial ecosystem actors that have a heterophilious character tend to be outside of the university’s influence, theorised as external to university sector (Prokop, 2021b). External management team is recruited into a spinoff company from the local or regional entrepreneurial networks, as experienced entrepreneurs bring in their own connections (Franklin et al., 2001) and commercial skills (Wennberg et al., 2011). As such, they have been previously found to be associated with spinoff formation (Vohora et al., 2004) and growth (Lundqvist, 2014). At the same time, academic entrepreneurship literature underlines the importance of venture capital investors (Politis et al., 2012), who provide the funding needed for developing the spinoff company. However, this type of financing is mainly available at the post-proof-of-concept stage (Wright et al., 2006), and often after the company is formed, when much of the initial knowledge asymmetry is resolved. It is also found that some spinoff companies are formed by more than one parent university (Prokop et al., 2019), in such cases connecting independent universities would link up multiple network clusters, increasing access to university resources. Much of the academic literature also highlights the importance of industry networks (Bourelos et al., 2012; Mustar, 1997) as critical influencing factors particularly in forming academic spinoff companies (Fini et al., 2011).

The actors forming the university entrepreneurial ecosystem have been previously considered independently in terms of spinoff company creation or through a network centrality-based measure of composition of university entrepreneurial ecosystems (Prokop, 2022); however, limited effort has been devoted to explore their relationship through the ecosystem framework, specifically focused on their network character: homophilious or heterophilious. The next section outlines the methodological approach employed to do so.

3 Methodology

3.1 Data collection and variables

The sample used in the study focuses on 81 university entrepreneurial ecosystems, which together formed 2350 spinoff companies between 1959 and 2021. The sample was sourced from multiple sources that allowed for cross-checking of records, these included the portal dedicated to university entrepreneurship activity—www.spinoutsuk.co.uk, university websites and FAME (Financial Analysis Made Easy) database that enabled access to company information. Similar data collection approach was previously employed in Hewitt-Dundas (2015) and Bagchi-Sen et al. (2020). Additional data to describe the characteristics of the university entrepreneurial ecosystems was gathered from Higher Education Funding Council England’s Higher Education Business and Community Interaction survey (HEBCIS), Higher Education Statistics Agency (HESA), Research Assessment Exercise (RAE), Research Excellence Framework (REF), and Office for National Statistics (ONS). Definitions of the variables presented below are available in Table 1.

3.1.1 Dependent variable

The dependent variable employed describes the number of spinoff companies formed within 2014/15–2020/21. There are 876 firms in the sample recorded across 81 universities. The use of spinoff counts is common in academic entrepreneurship literature (e.g. Gonzales-Pernia et al. 2013). The data was obtained from HEBCIS.

3.1.2 Homophilious ties

The role of TTO (TTO Experience) is measured through its age at 1st May 2014. The age of TTO is not an ideal measure, as resources (e.g. employees) available to TTO could perhaps better define its purpose and productivity. Unfortunately, such data is not collected by HEBCIS, nor is it easily accessible from university websites. All universities in the sample have a TTO.

There are three business incubation measures explored here: On-Campus Incubator, Off-Campus Incubator, and Science Park. Business incubators and science parks have a very similar role in the spinoff’s lifetime (Tamasy, 2007). All measures represent a proportion of a 12-year period between 2002/3 and 2013/14 when access to particular incubation services was available at the university.

In order to account for typically internal start-up funding for university spinoffs a Seed Fund measure is adopted. It indicates a proportion of a 12-year period between 2002/3 and 2013/14, when seed funding was accessible at the university. It is important to note that seed funding was available at all universities at some point within the timeframe considered in this study.

3.1.3 Heterophilious ties

University spinoff companies are often associated with receipt of external investment from institutional investors, captured here with Venture Capital, which is measured as a proportion of a 12-year period between 2002/3 and 2013/14 when venture capital funding was available at the university.

It is very difficult to measure the presence of Management Teams in spinoffs, and even more challenging to identify which universities have access to, or networks of, such individuals. As a result, the measure used here is an ex-post type variable, which shows an average of university spinoffs’ directors' average numbers of directorship positions held at 1st May 2014 or at spinoff’s deregistration date (i.e. last available date) covering spinoffs formed between 2002 and 2013. The data was collected from company information on its directors. It is expected that the measure will take the lowest value if the directors are academics with no previous entrepreneurial experience, and highest for spinoffs with directors with the greatest entrepreneurial experience.

In order to explore the effect of industry networks on spinoff company formation, a proxy for such links is used in the form of change in university’s industry research income (Δ Industry Income) over 2002/3–2013/14. The data was obtained from HESA. The variable measures the university's orientation towards development of networks with industry, where greater development is depicted with a higher growth rate of industry research income, whilst lower or negative growth represents divestment from or reduced focus on such network investment.

Universities that are more open to other parties being involved in spinoff formation were found to be responsible for greater numbers of spinoffs in the UK (Franklin et al., 2001). It is clear that such a collective is better positioned to form spinoff companies considering greater resources available to them, spanning multiple university entrepreneurial ecosystems. The variable Ecosystem Openness expresses counts of spinoff companies formed jointly with one or more institutions between 2002 and 2013. It is important to add that certain spinoffs were founded collaboratively with overseas institutions and UK PROs, whose data on available resources would not be captured by any other measure used in control variables in the multivariate analysis.

3.1.4 Control variables

In order to control for the ecosystem’s potential to generate spinoffs, a number of measures are employed that define locational conditions through pertinent university and regional characteristics. To control for the University Size effect, associated with resource endowment of universities, a sum of total university income over 2002/3–2013/14 is used. The variable is expressed in natural logarithms to correct positive skew for regression analysis.

The Disclosures variable captures university-generated knowledge of commercial potential, essentially a pre-requisite for spinoff opportunity identification. It is constructed as a sum of annual disclosures between 2002/3 and 2013/14, and expressed in natural logarithms. A disclosure is knowledge identified by a university TTO to have commercial potential and has been used in studies of spinoff company formation (e.g. Di Gregorio & Shane, 2003).

University Science Bias, which expresses university standing (Di Gregorio & Shane, 2003), is used here to control for a bias towards science-oriented disciplines being more prone to knowledge commercialisation through spinoff companies (Shane, 2004). In particular, the variable focuses on the top scientific outputs which may have a stronger commercialisation potential. Based on UK’s Research Assessment Exercise 2008 and the Research Excellence Framework 2014, it reflects university’s focus on high-quality scientific research. RAE 2008 measured outputs from 2001 to 2007 (www.rae.ac.uk), whilst REF 2014 covered outputs produced from 2008 to 2013 (www.ref.ac.uk). The metric used in this study focuses on the traditional science fields captured in REF’s (and respective fields in RAE 2008) Panels AFootnote 1 and B.Footnote 2 The variable is a proportion of total outputs rated as 4* across the science fields out of all 4* outputs submitted by each university, and is averaged then across both assessments (RAE 2008 and REF 2014).

In order to control for regional economic development, which could proxy Stam and Van de Ven’s (2021) demand factor, two simple weighted measures of GVA (gross value added) per capita are used: (1) Δ Regional GVA capturing per capita change from 2002 to 2014, and (2) 2002 Regional GVA controlling for the value of economic activities per capita in 2002.

The 2014 Stock of Spinoffs controls for the past rate of spinoff formation, as used in previous studies (Fini et al., 2011), which may suggest entrepreneurial propensity or culture responsible for greater number of spinoff companies, especially if some university entrepreneurial ecosystems had a history of generating larger numbers than others. The variable represents a stock of spinoff companies formed between 1959 and 2014.

The descriptive statistics for the variables depicted above are available in Table 2.

3.2 Method

The relationships between variables are depicted in Table 3 through Pearson’s correlations. All independent variables have positive relationships with the dependent variable. However, only two of these relationships are statistically significant and include Venture Capital and Ecosystem Openness. Some of the very strong correlations between explanatory variables are a cause for multicollinearity concerns, specifically: University Size and Disclosures (r = 0.75), Δ Regional GVA and 2002 Regional GVA (r = 0.60), University Size and 2014 Stock of Spinoffs (r = 0.71), Seed Fund and Venture Capital (r = 0.58), University Size and Ecosystem Openness (r = 0.60) and 2014 Stock of Spinoffs and Ecosystem Openness (r = 0.57). To test these, the models were first fitted using OLS regressions to compute collinearity diagnostic tests, with a particular interest in VIF (variance inflation factor) measures. Whilst VIF values are below 5 (highest 4.25 for University Size), to remain cautious about the combined effect of these variables (Johnston et al., 2018), we model 2014 Stock of Spinoffs and Ecosystem Openness both separately and together, with the latter potentially suffering from multicollinearity issues.

As the dependent variable is of a counts type—i.e. it represents the numbers of spinoff companies generated by each of the 81 universities, with each observation taking a positive value between 0 and 118, this implies the use of counts-type regression models, primarily a Poisson-based distribution model. As assumptions of Poisson distribution are not met by the dependent variable, where the mean (10.81) is not equal (or near equal) to its variance (304.85), we employ a negative binomial model that deals with overdispersion (Cameron & Trivedi, 2013), similarly used in previous studies of this nature (Fini et al., 2017). It takes the following notation:

where \({SF}_{i}\) represents the counts of spinoff companies generated within university entrepreneurial ecosystem \(i\) between 2015 and 2021, \({C}_{i}\) corresponds to a vector of control variables describing university entrepreneurial ecosystem environment measured between 2002 and 2014 with the stock of spinoffs measured between 1959 and 2014, \({HO}_{i}\) represents the vector of variables that describe homophilious ties in university entrepreneurial ecosystem \(i\) between 2002 and 2014, \({HE}_{i}\) reflects the heterophilious ties measured between 2002 and 2014, whilst \({\varepsilon }_{i}\) is an error term. The identity link function in the model is logarithmic.

4 Results

Table 4 presents results of regressions fitted to explain spinoff company formation. All models are an improvement over an intercept-only model as indicated by log likelihood and pseudo-R2 measures, with the full models (14 and 15) an improvement over the base model (1).

Model 1 is the base model with control variables only. Three of the controls enter the equation significantly at conventional levels and with positive coefficients, except for demand proxies: 2002 Regional GVA and Δ Regional GVA, which are statistically insignificant. Clearly, in absence of other covariates, university size, its stock of commercialisable knowledge, and greater orientation of research towards traditional scientific disciplines explain spinoff formation between 2014 and 2021. When 2014 Stock of Spinoffs is added to the base model Science Bias loses significance, with the past spinoff formation performance entering the equation significantly.

Models 3–7 regress homophilious ties, expressed by TTO Experience, On-Campus Incubator, Off-Campus Incubator, Science Park and Seed Fund, individually. None of such ties register statistically significant results. However, University Size, Disclosures and 2014 Stock of Spinoffs continue to explain future spinoff formation, suggesting that with presence of homophilious network connections the performance of university entrepreneurial ecosystem is related to resource endowment, ability to produce knowledge of commercialisable potential, and past performance of the ecosystem. This result is further strengthened in model 8 that fits all homophilious ties together, where 2014 Stock of Spinoffs drops significance level from 1 to 5%.

Heterophilious ties are entered individually in models 8–12, with none of them showing a statistically significant result. In model 9 we observe University Size dropping significance level to 10% with Venture Capital in the equation, whilst in model 12 losing statistical significance when Ecosystem Openness is entered. 2014 Stock of Spinoffs drops significance from 1 to 5% between models 9–10 and 11–12 respectively. The results suggest that individually, none of the heterophilious connections explains ecosystem performance, with the exception of past performance, levels of commercialisable knowledge, and (predominantly) resources available. When all heterophilious ties enter model 13, Ecosystem Openness registers a weak but statistically significant (at 10% level) and positive coefficient, suggesting that entrepreneurial ecosystem’s performance is related to presence of heterophilious connections that augment the available resources, expressed in links with other ecosystems.

When both homophilious and heterophilious connections enter a single model (14 and 15) we observe a number of interesting findings. First, homophilious ties do not show any statistical significance, indicating their limited importance in explaining performance of entrepreneurial ecosystems. Instead, we observe statistically significant results among the heterophilious ties. The key element explaining spinoff formation is Ecosystem Openness, indicating the importance of connections with other ecosystems. In model 14, that drops 2014 Stock of Spinouts to limit the influence of multicollinearity, Δ Industry Income also shows a weak but positive and significant coefficient, suggesting the importance of developing connections with industry. Whilst model 15 does not observe the same result for industry ties, when the 2014 Stock of Spinouts is present, we continue to see the importance of Disclosures among the control variables and the past ecosystem performance.

Clearly, there are two important aspects observed here: (1) the openness of university entrepreneurial ecosystems is related to forming greater numbers of spinoff companies, as characterised by the type of actors involved, specifically interconnected university entrepreneurial ecosystems (Ecosystem Openness); (2) the main endowments for academic entrepreneurship are predominantly composed of heterophilious ties and locational conditions, highlighting the critical role of dissimilar actors in entrepreneurship activity.

5 Robustness tests

In this section, the analysis is repeated with a different modelling specification to examine the robustness of results. We regress a log-transformed dependent variable with a linear ordinary least squares approach. The results are presented in Table 5. All models enter significantly and show an improvement over the intercept only model as visible in F-test and R2 results.

Whilst models 1–13 show mostly the same results, where Ecosystem Openness registers a statistically significant relationship as the only independent variable, we observe University Size maintaining statistical significance in models 12–13. In the subsequent two full models 14 and 15 we see broadly similar results with a unique change to some of the variables.

In model 14, we also observe Off-Campus Incubator entering the equation significantly (at a 5% level) and negatively, suggesting that homophilious ties expressed through this incubation route are related to lower levels of spinoff companies. This is an interesting finding, especially as the model further confirms the importance of heterophilious ties, namely connections with industry and to other ecosystems. Δ Industry Income and Ecosystem Openness enter this model at stronger significance levels (5% and 1%, respectively). Another change can be observed with the Science Bias control, which registers a weak but positive statistically significant result. This indicates that greater spinoff generation is related to more traditional science fields.

Model 15 here differs from the negative binomial specification in two ways. One, the results for Ecosystem Openness are stronger (at 5% level), a similar story is visible with past performance of ecosystems. Two, University Size enters the equation significantly, albeit at a 10% level.

Overall, the results of the alternative specification presented here broadly confirm the results of the negative binomial models, showing the importance of heterophilious ties.

6 Discussion

The results add a number of important aspects in further defining the theory of entrepreneurial ecosystems. First, by finding positive relationship between academic spinoff formation rates and engagement of multiple university parents, the role of inter-ecosystem linkages are highlighted. Previous research identified interregional connections (Prokop, 2021a; Spigel & Harrison, 2018), but limited advancement in theorising these has been attempted thus far, with Schäfer & Henn (2018) focusing predominantly on migrant human capital and entrepreneurs being such connections. Here, more formal connections between ecosystems are related to greater entrepreneurial outcomes, potentially through offering access to a greater level of ecosystem resources.

Second, industry networks are important. These could indicate the role of mentors to potential entrepreneurs (Spigel, 2017), but also act as sources of knowledge about the market conditions, and feedback about the entrepreneur’s business ideas, as such they play a critical role in entrepreneurship overall, not just academic (Goethner et al., 2012; Krabel & Mueller, 2009). These actors are not dealmakers (Feldman & Zoller, 2012), but assist in opportunity recognition through their insider knowledge.

Third, we find no evidence for entrepreneurial talent to be essential to academic entrepreneurship (Vohora et al., 2004), an element that plays a role in ecosystem’s recycling (Mason & Harrison, 2006). It is important to note that recycling may not always result in serial entrepreneurs, but may contribute higher quality human capital for future technology-based ventures (Spigel & Vinodrai, 2021).

Access to funding, whether of heterophilious (i.e. venture capital) or homophilious (i.e. seed funding) source, is not found to be related to ecosystem performance, contrary to previous studies (e.g. Fini et al., 2011; Wright et al., 2006). This finding suggests that access to finance at best plays a limited filtration role in an ecosystem (Prokop, 2021a), especially in relation to formation of new firms. However, its importance may manifest itself with other ecosystem performance measures that capture post-formation development of firms (e.g. Prokop et al., 2019) or be related to ecosystem’s evolution, where different resource demands may manifest themselves at different stages of development (Scott et al., 2021).

On-campus, off-campus incubators or science parks were found insignificant to spinoff formation (with a significant and negative effect for off-campus incubators observed only in the OLS specification), confirming previous studies of spinoff generation (Di Gregorio & Shane, 2003; Gonzalez-Pernia et al., 2013; Hewitt-Dundas, 2015). This is not a surprising finding given studies suggesting no such effect (Lockett & Wright, 2005). It is also essential to note the diversity of business incubators and science parks, with their heterogenous natures potentially contributing to different ecosystem outcomes (Theodoraki et al., 2018).

Although literature finds TTOs critical in the process of disclosure identification (Macho-Stadler et al., 2007) and more importantly creation of spinoff companies (Alexander & Martin, 2013), no support for this was found here in relation to the levels of experience of TTOs. In fact, TTOs’ impact on faculty's intentions to disclose knowledge of commercial potential is very limited (Clarysse et al., 2011), and therefore the role of TTOs’ experience could be related to facilitation of spinoff foundation, which has no association with the numbers of firms formed. Given that the entrepreneurial ecosystems outputs are more varied than merely forming new ventures (Stam, 2015), the role of TTOs may manifest itself through other ecosystem activity, for example contributing to success of firms (Prokop et al., 2019).

The picture of local ecosystem environment is mixed. The total income universities receive (i.e. university size) is generally found to be related to spinoff formation rates, confirming previous studies measuring size of lab (Haeussler & Colyvas, 2011) and department (D'Este et al., 2012). Furthermore, there is weak evidence that scientific bias, where universities that generate more research in traditional science fields are associated with creating more spinoff companies (Shane, 2004), is linked to university entrepreneurial ecosystem performance. It may suggest that ecosystems may show some level of sectoral specialisation or at least specialisation expressed in the type of knowledge, potentially challenging the notion of ecosystems embracing sectoral diversity (Spigel & Harrison, 2018). The ecosystem’s economic development conditions do not exert influence on spinoff formation. Whilst at first look this may prove contradictory to previous studies (Vedula & Kim, 2019), this may also be related to the scale at which level of economic development is measured, with local rather than regional measures potentially being better at capturing the effect. Alternatively, it could be that performance of sub-ecosystems may be less strictly related to local economic conditions, given their specialist character, where multiple locally co-existing sub-ecosystems may reveal variable evolutionary paths (Cloutier & Messenghem 2022). The past rates of spinoff companies explain future performance, confirming previous studies of academic entrepreneurship (Fini et al., 2011).

Given the results described above the paper offers a theoretical framework for entrepreneurial ecosystems in Fig. 2.

7 Conclusions

This study set out to investigate whether the presence of homophilious, heterophilious or a mix of ties is important to start-up rates. The question is especially important given a need to strengthen the theorising of entrepreneurial ecosystems concept (Alvedalen & Boschma, 2017; Audretsch et al., 2019; Cho et al., 2021) where networks are recognised as its critical component (Scott et al., 2021; Spigel et al., 2020; Stam, 2015). In answering the research question the paper examined a sub-ecosystem, university entrepreneurial ecosystem, with a focus on 81 such sub-ecosystems in the UK. The findings present a number of important contributions to the understanding of entrepreneurial ecosystems.

First, the findings draw attention to considerations of sub-ecosystems as unique entrepreneurial architectures. Here, the university entrepreneurial ecosystem is recognised as such sub-ecosystem, with its boundaries defined through the actors forming it. Recently, a nested structure of ecosystems has been recognised (Spigel et al., 2020), and it is important to acknowledge that these sub-ecosystems are important ecosystemic units, which contribute to entrepreneurial outcomes of broader place-based entrepreneurial ecosystems. Here, specifically, this is achieved through academic spinoffs.

Second, the connections between entrepreneurial ecosystems or sub-ecosystems are important, but often overlooked in the literature where the ecosystems are principally perceived as self-contained units (e.g. Stam and Van de Ven 2021; Spigel & Harrison, 2018). These inter-ecosystem connections offer additional pools of resources and access to actors not available locally. As Stam and Van de Ven (2021) argued, it is important to study the context of entrepreneurial activity, and such links cannot be omitted. This study evidenced how such openness of university entrepreneurial ecosystems is linked to greater academic spinoff generation. Whilst this complicates the study of university and broader entrepreneurial ecosystems and understanding of their performance, it is a critical characteristic to recognise and include in future studies.

Third, spinoff rates are related to predominantly heterophilious ties, confirming the importance of diverse actors and knowledge flowing within ecosystem’s networks. As such the findings add to the entrepreneurship literature confirming the important role played by networks of heterophilious nature (Leyden et al., 2014). It is critical to recognise not just the role played by particular university entrepreneurial ecosystem actors, but also their network character, indicative of opportunities.

Fourth, it is essential to recognise the importance of entrepreneurial context (Stam, 2015; Welter, 2011; Zahra et al., 2014), here depicted through ecosystem characteristics such as resources, knowledge, science bias, local economic development conditions, but also a unique form of entrepreneurship (Welter et al., 2019)—academic spinoffs. Whilst this analysis is unable to comment on the institutional environment of university entrepreneurial ecosystems, context plays a critical role in the study of both university entrepreneurial ecosystems, and more broadly entrepreneurial ecosystems. Following Stam and Van de Ven (2021), it is essential not to dismiss local environment, but instead incorporate it into analytical models.

Finally, the theorisation of the entrepreneurial ecosystem concept needs to disambiguate between the network character of actors in the ecosystem. Whilst networks underpin entrepreneurial ecosystems (Spigel, 2017; Stam, 2015), they lack sufficient theoretical development in the field. Consequently, the proposed theoretical framing (Fig. 2) builds on the existing models by recognising that networks are more important than just a background structure or institution. In fact, the network character of actors clearly relates to outcomes in an entrepreneurial ecosystem, or, as presented here, its sub-ecosystem. This has implications for the study of entrepreneurial ecosystems, where more attention should be devoted to defining networks and their actors.

The role for policymakers needs to be in recognising that entrepreneurial ecosystems are not isolated local systems, but interconnected ecosystems and sub-ecosystems, as such policy initiatives need to be inclusive of this character. In fact, it is informative to learn from the clusters literature (Huggins, 2008), where such connections have been noted especially for the successful Silicon Valley. These interconnections may have a critical role in shaping the configuration and performance of entrepreneurial ecosystems (Prokop, 2021a). As such, local policymakers where entrepreneurial ecosystems deliver sub-optimal outcomes should consider the need to connect beyond the locale, in effect investing away from purely intra-ecosystem strategy and recognising the spillover benefits of open ecosystem approach. At the same time, the policymakers governing entrepreneurial ecosystems characterised by at least optimal performance should seek to build and maintain connections with other ecosystems. In part to bring talent in, but also to identify opportunities for ecosystem evolution (Huggins, 2008; Spigel & Harrison, 2018).

The entrepreneurial ecosystems are difficult to capture, and whilst this study included 81 university entrepreneurial ecosystems, it is in no way reflective of all types of sub-ecosystems, or broader ecosystems. Whilst this may limit the ability to reflect similar ecosystem actors, their network character remains important. It is also essential to stress that there are more actors in the entrepreneurial ecosystems than identified here (e.g. Hayter et al., 2018; Spigel, 2017). As such, it is hypothesised that the association of the omitted actors/elements with ecosystem performance will reflect findings presented here. Furthermore, there is a possibility of reverse causality, where heterophilious actors could be attracted to an ecosystem because of its past performance. Evolutionary models of entrepreneurial ecosystems suggest that greater firm formation takes place during growth phase of ecosystems (Mack & Mayer, 2016), which tends to be characterised by greater connectivity between ecosystem actors (Roundy et al., 2018; Spigel & Harrison, 2018). This connectivity develops a level of self-organisation or coherence (Colombelli et al., 2019). As such it would represent a level of homophily development, at which point the ecosystem actors may be looking towards more diverse connections to avoid network lock-in and sustain greater entrepreneurial creation performance. Whilst our lagged modelling offers a partial solution to this, data restrictions do not allow for a sophisticated empirical identification strategy of instrumental variable approach, especially as for many universities forming spinoff companies is still a relatively recent phenomenon. We acknowledge that scholars studying networks of entrepreneurial ecosystems should take a cautious approach in dealing with potential endogeneity issues. The paper did not capture the institutional environment, which plays a critical role in performance of entrepreneurial ecosystems (Stam, 2015), inclusion of which may have strengthened the reported findings. It is also recognised here, that a panel approach would have been preferable, however, the data availability (specifically Management Team variable) restricted the modelling potential.

Future studies should focus on understanding the linkage between entrepreneurial ecosystems by studying the interconnectivity of actors and how this spills-over support across the ecosystems. This is especially critical, as this interconnectivity may lead to asymmetric benefits across ecosystems, with some sharing their resources, and other (especially peripheral) ecosystems being excluded from forming these inter-ecosystem ties. Whilst sub-ecosystems were studied, and multiple sub-ecosystems could be present in a locality, no spatial boundaries were considered. Entrepreneurial ecosystem scholars should focus on delineating the spatiality of ecosystems and sub-ecosystems, and how these boundaries stay separate or overlapping, and how this influences their performance. At the same time, it appears increasingly important to recognise and theorise the sub-ecosystems, their nature—whether sectoral, technological, university or other, and their positioning in relation to each other and a broader place-based entrepreneurial ecosystem.

Notes

Clinical medicine; public health, health services and primary care; allied health professions, dentistry, nursing and pharmacy; psychology, psychiatry and neuroscience; biological sciences; agriculture, veterinary and food science.

Earth systems and environmental sciences; chemistry; physics; mathematical sciences; computer science and informatics; aeronautical, mechanical, chemical and manufacturing engineering; electrical and electronic engineering, metallurgy and materials; civil and construction engineering, general engineering.

References

Acs, Z., Åstebro, T., Audretsch, D., & Robinson, D. T. (2016). Public policy to promote entrepreneurship: A call to arms. Small Business Economics, 47, 35–51.

Acs, Z., Estrin, S., Mickiewicz, T., & Szerb, L. (2018). Entrepreneurship, institutional economics, and economic growth: An ecosystem perspective. Small Business Economics, 51, 501–514.

Alexander, A. T., & Martin, D. P. (2013). Intermediaries for open innovation: A competence-based comparison of knowledge transfer offices practices. Technological Forecasting and Social Change, 80(1), 38–49.

Alvedalen, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies, 25(6), 887–903.

Audretsch, D. B., & Belitski, M. (2019). Science parks and business incubation in the United Kingdom: Evidence from university spin-offs and staff start-ups. In S. Amoroso, A. Link, & M. Wright (Eds.), Science and Technology Parks and Regional Economic Development Palgrave Advances in the Economics of Innovation and Technology. Palgrave Macmillan.

Audretsch, D. B., Cunningham, J. A., Kuratko, D. F., Lehmann, E. E., & Menter, M. (2019). Entrepreneurial ecosystems: Economic, technological, and societal impacts. The Journal of Technology Transfer, 44, 313–325.

Audretsch, D. B., Belitski, M., & Cherkas, N. (2021). Entrepreneurial ecosystems in cities: The role of institutions. PLoS ONE, 16(3), e0247609.

Bagchi-Sen, S., Baines, N., & Lawton Smith, H. (2020). Characteristics and outputs of university spin-offs in the United Kingdom. International Regional Science Review, 45(6), 606–635.

Barranco, O., Lozares, C., & Muntanyola-Saura, D. (2019). Heterophily in social groups formation: A social network analysis. Quality and Quantity, 53, 599–619.

Batjargal, B. (2003). Social capital and entrepreneurial performance in Russia: A longitudinal study. Organization Studies, 24(4), 535–556.

Belitski, M., Aginskaja, A., & Marozau, R. (2019). Commercializing university research in transition economies: Technology transfer offices or direct industrial funding? Research Policy, 48(3), 601–615.

Ben-Hafaiedh-Dridi, C. (2010). Entrepreneurial team formation: Any rationality? Frontiers of Entrepreneurship Research, 30(10), 1–15.

Bienkowska, D., & Klofsten, M. (2012). Creating entrepreneurial networks: Academic entrepreneurship, mobility and collaboration during PhD education. Higher Education, 64, 207–222.

Bourelos, E., Magnusson, M., & McKelvey, M. (2012). Investigating the complexity facing academic entrepreneurs in science and engineering: The complementarities of research performance, networks and support structures in commercialisation. Cambridge Journal of Economics, 36(3), 751–780.

Cameron, A. C., & Trivedi, P. K. (2013). Regression analysis of count data (2nd ed.). Cambridge University Press.

Cao, Z., & Shi, X. (2021). A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics, 57, 75–110.

Cho, D. S., Ryan, P., & Buciuni, G. (2021). Evolutionary entrepreneurial ecosystems: A research pathway. Small Business Economics. https://doi.org/10.1007/s11187-021-00487-4

Clarysse, B., Tartari, V., & Salter, A. (2011). The impact of entrepreneurial capacity, experience and organizational support on academic entrepreneurship. Research Policy, 40(8), 1084–1093.

Cloutier, L., & Messeghem, K. (2022). Whirlwind model of entrepreneurial ecosystem path dependence. Small Business Economics, 59, 611–625.

Colombelli, A., Paolucci, E., & Ughetto, E. (2019). Hierarchical and relational governance and the life cycle of entrepreneurial ecosystems. Small Business Economics, 52, 505–521.

Cooke, P. (1992). Regional innovation systems: Competitive regulation in the new Europe. Geoforum, 23(3), 365–382.

Cooke, P. (2001). Regional innovation systems, clusters, and the knowledge economy. Industrial and Corporate Change, 10(4), 945–974.

Cunnigham, J. A., Menter, M., & Wirsching, K. (2019). Entrepreneurial ecosystem governance: A principal investigator-centered governance framework. Small Business Economics, 52, 545–562.

Degroof, J.-J., & Roberts, E. B. (2004). Overcoming weak entrepreneurial infrastructures for academic spin-off ventures. Journal of Technology Transfer, 29(3–4), 327–352.

D’Este, P., Mahdi, S., Neely, A., & Rentocchini, F. (2012). Inventors and entrepreneurs in academia: What types of skills and experience matter? Technovation, 32(5), 293–303.

Di Gregorio, D., & Shane, S. (2003). Why do some universities generate more start-ups than others? Research Policy, 32, 209–227.

Djokovic, D., & Souitaris, V. (2008). Spinouts from academic institutions: A literature review with suggestions for further research. The Journal of Technology Transfer, 33(3), 225–247.

Elfring, T., & Hulsink, W. (2003). Networks in entrepreneurship: The case of high-technology firms. Small Business Economics, 21, 409–422.

Feld, B. (2012). Startup communities: Building an entrepreneurial ecosystem in your city. Wiley.

Feldman, M., & Zoller, T. D. (2012). Dealmakers in place: Social capital connections in regional entrepreneurial economies. Regional Studies, 46(1), 23–37.

Fernandes, A. J., & Ferreira, J. J. (2021). Entrepreneurial ecosystems and networks: Literature review and research agenda. Review of Managerial Science, 16(1), 189–247. https://doi.org/10.1007/s11846-020-00437-6

Fini, R., Grimaldi, R., Santoni, S., & Sobrero, M. (2011). Complements or substitutes? The role of universities and local context in supporting the creation of academic spin-offs. Research Policy, 40(8), 1113–1127.

Fini, R., Fu, K., Mathisen, M. T., Rasmussen, E., & Wright, M. (2017). Institutional determinants of university spin-off quantity and quality: A longitudinal, multilevel, cross-country study. Small Business Economics, 48(2), 361–391.

Franklin, S. J., Wright, M., & Lockett, A. (2001). Academic and surrogate entrepreneurs in university spin-out companies. Journal of Technology Transfer, 26, 127–141.

Fritsch, M., & Wyrwich, M. (2017). The effect of entrepreneurship on economic development—An empirical analysis using regional entrepreneurship culture. Journal of Economics Geography, 17(1), 157–189.

Fritsch, M., & Wyrwich, M. (2018). Regional knowledge, entrepreneurial culture, and innovative start-ups over time and space-An empirical investigation. Small Business Economics, 51, 337–353.

Goethner, M., Obschonka, M., Silbereisen, R. K., & Cantner, U. (2012). Scientists’ transition to academic entrepreneurship: Economic and psychological determinants. Journal of Economic Psychology, 33(3), 628–641.

Gonzalez-Pernia, J. L., Kuechle, G., & Peña-Legazkue, I. (2013). An assessment of the determinants of university technology transfer. Economic Development Quarterly, 27(1), 6–17.

Granovetter, M. S. (1973). The strength of weak ties. American Journal of Sociology, 78(6), 1360–1380.

Greve, A. (1995). Networks and entrepreneurship – An analysis of social relations, occupational background, and use of contacts during the establishment process. Scandinavian Journal of Management, 11(1), 1–24.

Greve, A., & Salaff, J. W. (2003). Social networks and entrepreneurship. Entrepreneurship Theory and Practice, 28(1), 1–22.

Grimaldi, R., & Grandi, A. (2005). Business incubators and new venture creation: An assessment of incubating models. Technovation, 25(2), 111–121.

Haeussler, C., & Colyvas, J. A. (2011). Breaking the Ivory Tower: Academic entrepreneurship in the life sciences in UK and Germany. Research Policy, 40(1), 41–54.

Harrison, R. T., & Leitch, C. (2010). Voodoo institution or entrepreneurial university? Spin-off companies, the entrepreneurial system and regional development in the UK. Regional Studies, 44(9), 1241–1262.

Hayter, C. S., Nelson, A. J., Zayed, S., & O’Connor, A. C. (2018). Conceptualizing academic entrepreneurship ecosystems: A review, analysis and extension of the literature. The Journal of Technology Transfer, 43, 1039–1082.

Healey, M. P., Bleda, M., & Querbes, A. (2021). Opportunity evaluation in teams: A social cognitive model. Journal of Business Venturing, 36(4), 106128. forthcoming.

Hewitt-Dundas, N. (2015). Profiling UK university spin-outs. ERC Research Paper No.35. Enterprise Research Centre, 35, 1–72.

Hollow, M. (2020). Historicizing Entrepreneurial Networks. Strategic Entrepreneurship Journal, 14, 66–88.

Hoye, K., & Pries, F. (2009). ‘Repeat commercializers’, the ‘habitual entrepreneurs’ of university–industry technology transfer. Technovation, 29(10), 682–689.

Huggins, R. (2008). The evolution of knowledge clusters: Progress and policy. Economic Development Quarterly, 22(4), 277–289.

Huggins, R., & Prokop, D. (2017). Network structure and regional innovation: A study of university-industry ties. Urban Studies, 54(4), 931–952.

Huggins, R., Izushi, H., Prokop, D., & Thompson, P. (2015). Network evolution and the spatiotemporal dynamics of knowledge sourcing. Entrepreneurship & Regional Development, 27(7–8), 474–499.

Ivy, J., & Perényi, Á. (2020). Entrepreneurial networks as informal institutions in transitional economies. Entrepreneurship & Regional Development, 32(9–10), 706–736.

Jack, S. L. (2005). The role, use and activation of strong and weak network ties: A qualitative analysis. Journal of management studies, 42(6), 1233–1259.

Johnston, R., Jones, K., & Manley, D. (2018). Confounding and collinearity in regression analysis: A cautionary tale and an alternative procedure, illustrated by studies of British voting behaviour. Quality & Quantity, 52, 1957–1976.

Johnson, D., Bock, A. J., & George, G. (2019). Entrepreneurial dynamism and the built environment in the evolution of university entrepreneurial ecosystems. Industrial and Corporate Change, 28(4), 941–959.

Krabel, S., & Mueller, P. (2009). What drives scientists to start their own company? Research Policy, 38(6), 947–956.

Lahikainen, K., Kolhinen, J., Ruskovaara, E., & Pihkala, T. (2019). Challenges to the development of an entrepreneurial university ecosystem: The case of a Finnish university campus. Industry and Higher Education, 33(2), 96–107.

Lazarsfeld, P., & Merton, R. K. (1954). Friendship as a social process: A substantive and methodological analysis. In T. A. Berger & C. H. Page (Eds.), Freedom and Control in Modern Society (pp. 18–66). Octagon Books.

Leyden, D. P., Link, A. N., & Siegel, D. S. (2014). A theoretical analysis of the role of social networks in entrepreneurship. Research Policy, 43, 1157–1163.

Link, A. N., & Sarala, R. M. (2019). Advancing conceptualisation of university entrepreneurial ecosystems: The role of knowledge-intensive entrepreneurial firms. International Small Business Journal, 37(3), 289–310.

Lô, A., & Theodoraki, C. (2021). Achieving interorganizational ambidexterity through a nested entrepreneurial ecosystem. IEE Transactions on Engineering Management, 68(2), 418–429.

Lockett, A., & Wright, M. (2005). Resources, capabilities, risk capital and the creation of university spin-out companies. Research Policy, 34(7), 1043–1057.

Lundqvist, M. A. (2014). The importance of surrogate entrepreneurship for incubated Swedish technology ventures. Technovation, 34, 93–100.

Lux, A. A., Macau, F. R., & Brown, K. A. (2020). Putting the entrepreneur back into entrepreneurial ecosystems. International Journal of Entrepreneurial Behaviour & Research, 26(5), 1011–1041.

Macho-Stadler, I., Pérez-Castrillo, D., & Veugelers, R. (2007). Licensing of university inventions: The role of a technology transfer office. International Journal of Industrial Organization, 25(3), 483–510.

Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118–2133.

Mason, C. M., & Harrison, R. T. (2006). After the exit: Acquisitions, entrepreneurial recycling and regional economic development. Regional Studies, 40(1), 55–73.

McPherson, J. M., Smith-Lovin, L., & Cook, J. (2001). Birds of a feather: Homophily in social networks. Annual Review of Sociology, 27, 415–444.

Meoli, M., Paleari, S., & Vismara, S. (2019). The governance of universities and the establishment of academic spinoffs. Small Business Economics, 52, 485–504.

Miller, D. J., & Acs, Z. J. (2017). The campus as entrepreneurial ecosystem: The University of Chicago. Small Business Economics, 49(1), 75–95.

Mustar, P. (1997). How French academics create hi-tech companies: The conditions for success or failure. Science and Public Policy, 24(1), 37–43.

Neumeyer, X., Santos, S. C., Caetano, A., & Kalbfleisch, P. (2019). Entrepreneurship ecosystems and women entrepreneurs: A social capital and network approach. Small Business Economics, 53, 475–489.

Nordling, N. (2019). Public policy’s role and capability in fostering the emergence and evolution of entrepreneurial ecosystems: A case of ecosystem-based policy in Finland. Local Economy, 34(8), 807–824.

O’Shea, R. P., Allen, T. J., Chevalier, A., & Roche, F. (2005). Entrepreneurial orientation, technology transfer and spinoff performance of U.S. universities. Research Policy, 34(7), 994–1009.

Politis, D., Gabrielsson, J., & Shveykina, O. (2012). Early-stage finance and the role of external entrepreneurs in the commercialization of university-generated knowledge. Venture Capital, 14(2–3), 175–198.

Prokop, D. (2021). University entrepreneurial ecosystems and spinoff companies: Configurations, developments and outcomes. Technovation, 107, 102286. https://doi.org/10.1016/j.technovation.2021.102286

Prokop, D. (2022). The composition of university entrepreneurial ecosystems and academic entrepreneurship: A UK study. International Journal of Innovation and Technology Management, 19(6), 1–23.

Prokop, D., Huggins, R., & Bristow, G. (2019). The survival of academic spinoff companies: An empirical study of key determinants. International Small Business Journal, 37(5), 502–535.

Prokop, D. (2021b) The academic spinoff theory of the firm. The International Journal of Entrepreneurship and Innovation, 1–11. https://doi.org/10.1177/14657503211066013.

Rasmussen, E., Mosey, S., & Wright, M. (2015). The transformation of network ties to develop entrepreneurial competencies for university spin-offs. Entrepreneurship & Regional Development, 27(7–8), 430–457.

Roundy, P. T., Bradshaw, M., & Brockman, B. K. (2018). The emergence of entrepreneurial ecosystems: A complex adaptive systems approach. Journal of Business Research, 86, 1–10.

Ruef, M., Aldrich, H. E., & Carter, N. M. (2003). The structure of founding teams: homophily, strong ties, and isolation among U.S. entrepreneurs. American Sociological Review, 68(2), 195–222.

Salvador, E., & Rolfo, S. (2011). Are incubators and science parks effective for research spin-offs? Evidence from Italy. Science and Public Policy, 38(3), 170–184.

Schäfer, S., & Henn, S. (2018). The evolution of entrepreneurial ecosystems and the critical role of migrants. A phase-model based on a study of IT startups in the Greater Tel Aviv area. Cambridge Journal of Regions, Economy and Society, 11(317), 333.

Scott, S., Hughes, M., & Ribeiro-Soriano, D. (2021). Towards a network-based view of effective entrepreneurial ecosystems. Review of Managerial Science, 16(1), 157–187. https://doi.org/10.1007/s11846-021-00440-5

Shane, S. (2004). Academic Entrepreneurship. University Spinoffs and Wealth Creation. Edward Elgar.

Sharafizad, J., & Brown, K. (2020). Regional small business’ personal and inter-firm networks. Journal of Business & Industrial Marketing, 35(12), 1957–1969.

Shipilov, A. V., Li, S. X., & Greve, H. R. (2011). The prince and the pauper: Search and brokerage in the initiation of status-heterophilous ties. Organization Science, 22(6), 1418–1434.

Sorenson, O. (2018). Social networks and the geography of entrepreneurship. Small Business Economics, 51, 527–537.

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory & Practice, 41(1), 49–72.

Spigel, B., & Harrison, R. (2018). Towards a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12, 151–168.

Spigel, B., & Vinodrai, T. (2021). Meeting its waterloo? Recycling in entrepreneurial ecosystems after anchor firm collapse. Entrepreneurship & Regional Development, 33(7–8), 599–620.

Spigel, B., Kitagawa, F., & Mason, C. (2020). A manifesto for researching entrepreneurial ecosystems. Local Economy, 35(5), 482–495.

Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769.

Stam, E., & Van de Ven, A. (2021). Entrepreneurial ecosystem elements. Small Business Economics, 56, 809–832.

Tamasy, C. (2007). Rethinking technology-oriented business incubators: Developing a robust policy instrument for entrepreneurship, innovation, and regional development? Growth and Change, 38(3), 460–473.

Theodoraki, C., Messeghem, K., & Rice, M. P. (2018). A social capital approach to the development of sustainable entrepreneurial ecosystems: An explorative study. Small Business Economics, 51, 153–170.

Thompson, T. A., Purdy, J. M., & Ventrasca, M. J. (2018). How entrepreneurial ecosystems take form: Evidence from social impact initiatives in Seattle. Strategic Entrepreneurship Journal, 12(1), 96–116.

Van Rijnsoever, F. J. (2020). Meeting, mating, and intermediating: How incubators can overcome weak network problems in entrepreneurial ecosystems. Research Policy, 49, 103884.

Vedula, S., & Kim, P. H. (2019). Gimme shelter or fade away: The impact of regional entrepreneurial ecosystem quality on venture survival. Industrial and Corporate Change, 28(4), 827–854.

Vohora, A., Wright, M., & Lockett, A. (2004). Critical junctures in the development of university high-tech spinout companies. Research Policy, 33(1), 147–175.

Volkmann, C., Fichter, K., Klofsten, M., & Audretsch, D. B. (2021). Sustainable entrepreneurial ecosystems: An emerging field or research. Small Business Economics, 56, 1047–1055.

Welter, F. (2011). Contextualizing Entrepreneurship – Conceptual Challenges and Ways Forward. Entrepreneurship Theory and Practice, 35(1), 165–184.

Welter, F., Baker, T., & Wirsching, K. (2019). Three waves and counting: The rising tide of contextualization in entrepreneurship research. Small Business Economics, 52, 319–330.

Wennberg, K., Wiklund, J., & Wright, M. (2011). The effectiveness of university knowledge spillovers: Performance differences between university spinoffs and corporate spinoffs. Research Policy, 40(8), 1128–1143.

Wright, M., Lockett, A., Clarysse, B., & Binks, M. (2006). University spin-out companies and venture capital. Research Policy, 35(4), 481–501.

Wurth, B., Stam, E., & Spigel, B. (2021). Toward an entrepreneurial ecosystem research program. Entrepreneurship Theory and Practice, 00, 1–50. https://doi.org/10.1177/1042258721998948

Zahra, S. A., Wright, M., & Abdelgawad, S. G. (2014). Contextualization and the advancement of entrepreneurship research. International Small Business Journal, 32(5), 479–500.

Acknowledgements

The research behind this study was funded by Economic and Social Research Council with a reference number of 1231191. We are grateful to the comments received from the editor and the two anonymous reviewers, as well as to Andrej Mrvar in assisting with earlier versions of the paper. The support is greatly appreciated. Information on the data underpinning the results presented here, including how to access them, can be found in the Cardiff University data catalogue at https://doi.org/10.17035/d.2022.0233929619.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Prokop, D., Thompson, P. Defining networks in entrepreneurial ecosystems: the openness of ecosystems. Small Bus Econ 61, 517–538 (2023). https://doi.org/10.1007/s11187-022-00710-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00710-w