Abstract

This paper investigates how letting people predict others’ choices under risk affects subsequent own choices. We find an improvement of strong rationality (risk neutrality) for losses in own choices, but no such improvement for gains. There is no improvement of weak rationality (avoiding preference reversals). Overall, risk aversion in own choices increases. Conversely, for the effects of own choices on predicting for others, the risk aversion predicted in others’ choices is reduced if preceded by own choices, for both gains and losses. Remarkably, we find a new probability matching paradox at the group level. Relative to preceding studies on the effects of predicting others’ choices, we added real incentives, pure framing effects, and simplicity of stimuli. Our stimuli were maximally targeted towards our research questions.

Similar content being viewed by others

1 Introduction

This paper investigates how making predictions of others’ choices prior to choosing for oneself affects one’s own subsequent choices. We similarly investigate how making one’s own choices prior to predicting for others affects these predictions. Our study is motivated by construal level theory and the findings of Faro and Rottenstreich (2006). Construal level theory entails that objects at a larger psychological distance are construed in a more abstract way, which may foster rationality (Liberman et al. 2007). Because predicting what others would do puts us at a larger psychological distance from our own decision, we will then make a more rational decision. Consistent with this theory, Faro and Rottenstreich (2006, experiment 3) found that predicting others’ choices will move one’s own subsequent choices towards risk neutrality. Under the strong rationality requirement that risk neutrality is normative for the moderate amounts considered,Footnote 1 the latter effects are desirable. There has recently been a renewed interest in procedures for debiasing and improving decisions.Footnote 2 Thus, Faro and Rottenstreich (2006) conclude: “Our work suggests one such simple procedure: when choosing for yourself, start by making predictions of what others would do.”

Our paper follows up on the suggestions made by Faro and Rottenstreich, adding the following contributions. First, we use real incentives throughout. Second, we add a clearer test of rationality, namely a reduction of preference reversals (weak rationality). In particular, our losses will concern the same final outcomes as our gains, and will only be different in terms of framing, as with the original Asian disease problem. Thus, we test pure reference dependence while ruling out income effects. Following other studies (Tversky and Kahneman 1981, p. 456, 2nd column), we use the term preference reversal to refer to such pure reference dependence.

To focus on the effect of prediction on weak and strong rationality of subsequent choices, we keep our design as simple as possible in other respects. Thus, following Hsee and Weber (1997 p. 46), we only ask simple choice questions. We use the exact choice stimuli of Vieider (2011). These stimuli test framing and reference dependence in their purest form, and use simple probabilities and moderate outcomes suited for salient real incentives. We find risk aversion for gains, risk seeking for losses, and preference reversals, as is commonly found in the literature. Regarding the effects of prediction on choice, predicting for others increases risk aversion in choices, reaching significance for losses. There it increases strong rationality by reducing risk seeking. We do not find any effect on weak rationality, and preference reversals in choice are unaffected by prior prediction. Regarding the effects of prior choice on prediction, prior choice increases predicted risk seeking.

2 Predicting others’ choices

Under construal level theory, increases in psychological distance induce a stronger focus on central, goal-related aspects of the object and a weaker focus on peripheral, goal-irrelevant aspects (Trope and Liberman 2010). Construal level theory suggests that an increase in psychological distance can increase rationality to the extent that abstract thinking fosters rationality (Liberman et al. 2007). Psychological distance can refer to remoteness in space, time, or probability. It can also refer to social distance in the sense of experiences of others rather than ourselves. If first predicting what others would do puts us at a larger psychological distance from a decision we are about to make, then we will make a more rational decision if this distance fosters rationality. Yet, other psychological theories exist that suggest otherwise, as we will see next. Therefore, testing the effect of predictions on choices contributes to an assessment of the validity of these theories.

How people predict what others will choose has been extensively studied, using models that include anchoring and adjustment, false consensus, mind-reading, similarity-contingency, social projection, and stereotyping (Ames 2004; Ball et al. 2010; Goldman 2006; Van Boven et al. 2005; Viscusi et al. 2011). How predictions of others’ choices are related to one’s own choices has also been widely studied (see Faro and Rottenstreich 2006; Hsee and Weber 1997, and their references). Our main interest concerns the effect of prior predictions on posterior choice. We also investigate the reverse effect, of prior choice on posterior prediction. We will, therefore, not seek to review all literature that studies how predictions are made and how they relate to a decision maker’s (DM) own choices. Instead, we will focus on those theories that are relevant when studying the effect of (explicit) prior predictions on posterior choices and the effect of prior choices on posterior predictions.

2.1 False consensus and false uniqueness

The false consensus effect states that people think that their own preferences are relatively common (Ross et al. 1977; Dawes 1989). This effect thereby suggests that the predictions of others’ choices suffer from an egocentric bias: they will be (too) similar to a DM’s own choices. Hence, the false consensus effect suggests that there is no strong discrepancy between own choices and predictions of others’ choices and thereby suggests that (1) first making predictions about others’ choices will not affect own choices and (2) own choices will not affect subsequent predictions about others’ choices. Alternatively, the false uniqueness effect states that people think that their own preferences are relatively uncommon (Bosveld et al. 1995). Yet, it does not say whether people think they are more or less risk averse than others. It therefore has no further implications for the effect of making predictions for others on one’s own subsequent choices in a risky context.

2.2 Stereotype hypothesis

According to the stereotype hypothesis, people base their predictions of what others will choose on their stereotype about the group the others belong to (Hsee and Weber 1997). This hypothesis implies that the comparison of choices and predictions depends on what the relevant group is. It therefore does not imply that choices will always become more rational after predictions have been made. In the experiments of Hsee and Weber (1997), the stereotype hypothesis was rejected.

2.3 Risk-as-value

Risk-as-value assumes that people find risk seeking to be an admirable characteristic and they also believe that they possess more of it than others do.Footnote 3 Risk-as-value accordingly implies that a DM’s own choices are more risk seeking than predictions. As emphasized by McCauley et al. (1971), risk-as-value has no direct predictions about the effect of prior prediction on posterior choice or vice versa, and we have to specify additional assumptions (Smith 2002).

When answering a question about a choice, if people anchor on a prior question about the same choice, then posterior choices will move closer to prior predictions, and posterior predictions will similarly move closer to prior choices. Risk-as-value combined with anchoring therefore implies that, for both gains and losses, choices will become more risk averse when preceded by predictions of others’ choices and predictions will become more risk seeking when preceded by own choices. No implications result concerning preference reversals. Conformity, whereby people want to behave as others do, leads to the same implications as anchoring.

Instead of anchoring on the first question, people may also adjust their answer on the second question—whether prediction or choice—to their answer on the first one so as to confirm that they are more risk seeking than others (Ariely et al. 2003). People then want to conform with the risk-as-value hypothesis, resulting in divergence rather than convergence between first and second answers. After making a prediction of other people’s choices, DMs will be extra risk seeking in their own choice, and after making their own choices, they will make extra risk averse predictions. Risk-as-value combined with the aforementioned adjustment gives no systematic implications for preference reversals.

2.4 Risk-as-feelings

The risk-as-feelings hypothesis states that risk attitudes are partly driven by emotional reactions to risk (Hsee and Weber 1997; Slovic 2010; Faro and Rottenstreich 2006; Loewenstein et al. 2001). Predicting risky choices for another person requires empathizing with that person. Due to an empathy gap (Loewenstein 1996; Van Boven et al. 2000), the prediction of the other’s emotions and of the impact of those emotions on choices are not accurate. People underestimate the emotional response of others to risk and therefore underestimate the emotional impact of this response on others’ choices. Thus, risk-as-feelings combined with the empathy gap suggests that predictions of others’ choices will be more risk neutral than own choices, as was indeed found by Hsee and Weber (1997). Like risk-as-value theory, risk-as feelings alone has no direct implications regarding the effect of prior prediction on posterior choice or vice versa.

Combined with anchoring, risk-as-feelings says that choices will get closer to risk neutrality when preceded by predictions of others’ choices. Because people are risk averse for gains and risk seeking for losses, fewer risk averse choices for gains and more risk averse choices for losses will result when choices are preceded by predictions. Hence, risk-as-feelings implies fewer preference reversals when choices are preceded by predictions. Similarly, the risk-as-feelings hypothesis implies that a DM’s predictions for others will be more risk averse for gains and more risk seeking for losses when the DM chooses for herself first. Thus, risk-as-feelings combined with anchoring suggests that choices will become more rational if preceded by predictions of others’ choices. Thereby, risk-as-feelings combined with anchoring is consistent with the suggestion by construal level theory that increased psychological distance, resulting from predictions, will enhance rationality of own choices. False-consensus and risk-as-value, however, suggest differently.

3 Experiment

We analyze a monetary version of the Asian disease problem. The instructions for subjects are in the Electronic Supplemental Material.

3.1 Subjects

One hundred fifteen subjects from Erasmus University Rotterdam were recruited. The average age was 21.2 years and 60% were male. The subjects were divided into nine experimental sessions with between 10 and 19 subjects.

3.2 Stimuli

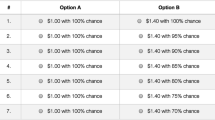

To ensure anonymity and avoid communication during the experiment, subjects were seated in sight-shielded cubicles. The experiment was conducted using paper and pencil. The experimental questions are in Figs. 1 and 2. There always is a choice between €25 for sure, or a 25% chance at gaining €40 and a 75% chance at gaining €20, in terms of final outcomes. However, the options are framed differently in the figures, with Figs. 1a/2a using a gain framing and Figs. 1b/2b using a loss framing. Fig. 1 asks for a direct choice, and Fig. 2 asks for a DM to predict the choice of another subject, randomly and anonymously selected from the other subjects in the experiment.

Preference reversals are a sign of irrationality when observed within an individual (Cherry et al. 2003; Bardsley et al. 2010 §3.4; Attema and Brouwer 2013; Luchini and Watson 2013). For a survey, see Seidl (2002). Moreover, we are interested in the effects of predictions on choices and vice versa within individuals. Therefore, all subjects answered all four questions. Subjects were randomly assigned to two different treatments.

3.3 Treatments

In the choice-prediction (CP) treatment, subjects first made choices (Fig. 1) and then predictions (Fig. 2). In the prediction-choice (PC) treatment it was the other way around. Subjects always first answered the gain question and then the loss question. Because our main interest is in the effect of choice on prediction and vice versa, we chose not to randomize the order of gain and loss questions. Etchart-Vincent and l’Haridon (2011) and Vieider et al. (2014) tested order effects for gains and losses and found none. Hence, the latter reference recommended presenting gain lotteries first: gain lotteries are easier to understand than loss lotteries, helping subjects to further familiarize themselves with the design. Because our conclusions are based on comparisons within gains and within losses, order effects, even if they were to occur, would not affect our conclusions.

The prediction questions in Fig. 2 were preceded by the following explanation:

-

“If one of these questions is later randomly selected to be played out for real money, the experimenter will randomly select another participant from the experiment. If you correctly predict the choice of the participant, you will receive €15, otherwise you will receive nothing.”

3.4 Incentives

This experiment was followed by another, unrelated, second experiment. Every subject received a €5 flat fee for participating. In each session, one of the subjects was randomly selected to play one of the questions (out of one of the two experiments) for real. The question was also randomly selected. Decision makers’ own choices were implemented as they are. In case a prediction question was selected, a correct prediction was awarded €15. The subject who was selected to play for real was paid in private, when all other subjects had left the room. For a prediction question, the subject would not know whose choice he had to predict. Thus, subjects were informed at the beginning of the experiment that their choices would be anonymous in the sense that other subjects would not observe them.

3.5 Discussion of stimuli

The stimuli in Fig. 1 were taken from Vieider (2011), using the exact same wordings. These stimuli were especially designed for tractable incentive-compatible pure tests of preference reversals, using moderate payoffs and probabilities. There are several reasons for choosing this task. First, it is easy. Second, it can be used to analyze both preference reversals and risk attitudes. Third, it has been widely studied and is well known in the literature. De Martino et al. (2006) used similar stimuli.

In Fig. 2, we let the “other” refer to an anonymously chosen single individual from the other subjects in the same session. McCauley et al. (1971) let the other refer to the average subject of a group, but subjects may easily confound the average subject with the average payment, which is why we preferred to avoid this framing. We chose a formulation (Fig. 2) that would make a DM’s predictions sufficiently different from their own choices such that prior predictions have a reasonable chance to increase rationality in subsequent choices. Faro and Rottenstreich (2006) and Hsee and Weber (1997) studied several framings of others in detail, and found that an empathy gap that generates self-other differences would disappear if the other were too familiar to the subject. Therefore, we did not let the other be a family member or friend.

4 Hypotheses

One test concerns whether preferences are moved in the direction of expected value maximization (strong rationality) by first letting DMs predict what others would choose. We cannot investigate risk neutrality at the individual level, because subjects can only answer in a risk seeking or risk averse manner, and not in a neutral (indifference) manner. We assume that risk neutrality of subjects implies a 50–50 chance of choosing risk averse or risk seeking. Accordingly, a significant move of the group percentage towards 50% is taken as an increase of risk neutrality of the individuals.

As for the second test we note that choice questions like those in Fig. 1 are monetary versions of the Asian disease problem, and have been extensively studied (Kühberger 1998; Okder 2012; Kühberger and Gradl 2013). The common finding is a preference reversal in the form of risk aversion for gains in Fig. 1a and risk seeking for losses in Fig. 1b, as implied by prospect theory (Tversky and Kahneman 1992; Dimmock et al. 2015; Vieider et al. 2015) and underlying the disposition effect (Barberis 2013, p. 183). Such a preference reversal is clearly irrational as the gain and loss questions differ only in terms of framing. We examine whether we can reduce the number of observed preference reversals by first letting people predict what others would choose. Because we did not directly ask for predictions of preference reversals, and obviously did not reward correct predictions of those, we will not consider preference reversals in predictions. Preference reversals will always concern choices. Strong rationality will overlap with weak rationality in the sense that it will reduce the aforementioned preference reversals.

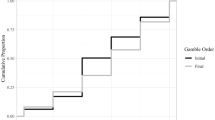

5 Results

Table 1 shows the percentages of safe choices and safe-choice predictions for every treatment and task. Table 2 shows percentages of preference reversals. Eyeballing the data suggests that we have moderate risk aversion for gains, strong risk seeking for losses, and preference reversals. These results are in agreement with common findings. In particular, for gain probabilities 0.25 choices are usually close to risk neutral (Tversky and Kahneman 1992). Further, we have anchoring, with second answers close to first answers: choices close to predictions in PC and predictions close to choices in CP. Risk aversion is always higher in PC than in CP, and preference reversals are not affected by treatment. These observations are confirmed by the following statistical analyses. All tests are two-sided unless indicated differently.

5.1 Logit regression

Table 3 shows the results of a logit regression with answer (=1 if safe) as the dependent variable, and dummy variables loss, prediction, and PC as independent variables, clustered on subjects. The standard errors were specified such that within, but not across, clusters the usual requirement of independence of observations was relaxed. The results confirm the sign (gain-loss) and treatment (PC vs. CP and vice versa) effects in Table 1. They also confirm the similarity between choices and predictions consistent with anchoring. Interaction effects between the independent variables are insignificant and are therefore omitted from the regression. All results will be confirmed by the non-parametric analyses given next.

5.2 Risk attitudes and preference reversals

For both treatments together the risk aversion for gains and risk seeking for losses, both for choices and predictions, are significant at level p < 0.01 (one-sided binomial tests; Table 4, “All”). We consider two types of preference reversals. Common preference reversals concern a safe choice for gains and a risky choice for losses, which is the common finding. Uncommon preference reversals concern the opposite choices. At least 50% of the subjects exhibit preference reversals, mostly in the common direction.

5.3 Comparison of choices and predictions

Within treatment PC, the 67% of risk averse choices for gains is not significantly different from the 72% predicted risk averse choices.Footnote 4 We similarly find no differences between the other predictions and choices within treatments. Both for PC and CP, the correlations between predictions and choices always exceed 0.3 and are significant at level p < 0.01, except for p = 0.02 for losses in CP.

5.4 Treatment effects

All observations under PC reveal more risk aversion than under CP, twice significant at p < 0.05 (one-sided) and once marginally significant (Table 1). The total number of preference reversals does not differ significantly between treatments. Common preference reversals are reduced somewhat when going from CP to PC, but uncommon preference reversals are increased.

6 Discussion

Our results on risk attitudes and preference reversals agree with common findings in the literature. Further, making predictions of what others will do before choosing for oneself does not improve weak rationality (avoiding preference reversals), and neither does it improve strong rationality (risk neutrality) for choices in gains. It does improve strong rationality for choices in losses. Huber et al. (2008) suggest that the effects will be strongest if implemented just before making the choices. Our findings support risk-as-value combined with anchoring: overall, choices become more risk averse after first making predictions.

McCauley et al. (1971) compared the risk aversion in choices that subjects make for themselves with the predicted risk attitudes of others as we did, with a CP treatment and a PC treatment. Unlike us, they did not consider losses and did not employ real incentives. Moreover, we preferred to avoid the average-other/average-payoff effects in their design. Like us, McCauley et al. (1971) found support for risk-as-value.

Hsee and Weber (1997) introduced risk-as-feelings. They found the opposite of McCauley et al. (1971), i.e., less risk aversion in predictions, supporting risk-as-feelings with an empathy gap. They found that the empathy gap becomes smaller as other people for whom you are predicting get closer. These findings were confirmed by Faro and Rottenstreich (2006). The latter paper added a refinement. They noted that less risk aversion for predictions than for choices in Hsee and Weber (1997) always coincided with more risk neutrality. Faro and Rottenstreich found that the latter effect was the general one, leading to more risk aversion for predictions than for choices whenever choices are risk seeking. Their finding was confirmed by Daruvala (2007).

Our experiment was designed to be maximally simple and hence we only measured binary choices and predictions (risk averse or risk seeking), and not indifferences as in Faro and Rottenstreich (2006 p. 539) or Hsee and Weber (1997). In the terminology of Faro and Rottenstreich (2006 p. 539), our questions concern the type of emotions (risk averse or risk seeking), and not the intensity.

At the group level, the percentages of risk aversion were close for choice and prediction in both treatments. At first sight, this result may seem to be reassuring and may suggest a consistency. However, it in fact is a paradox and there is no prior reason to expect such a consistency. If all subjects had been perfect predictors, maximizing expected payoff, then they all would have predicted the majority choices, which are risk aversion for gains and risk seeking for losses. In other words, then we would have had 100% risk aversion predictions for gains and 100% risk seeking predictions for losses. In reality, subjects’ predictions were close to their own choices within each treatment. If we treat the group of subjects in each treatment as one DM, then our finding entails probability matching: individuals not choosing best in all situations, but having their overall choice percentages match real probability distributions (Bitterman 1965; Vulkan 2002). That is, we have found a probability matching paradox at the group level.

7 Conclusion

We investigated how predictions of others’ choices prior to choosing for oneself affects one’s own subsequent choices, following up on promising results from prior research (Faro and Rottenstreich 2006; Hsee and Weber 1997). Those results suggested that first imagining what others would do may increase rationality of choice and thus provide a useful addition to modern nudging techniques. Our experiment used simple and well-known stimuli with real incentives and careful framing, all targeted towards testing the aforementioned hypothesis. We found an improvement of strong rationality (risk neutrality) for losses, but not for gains, and we found no improvement of weak rationality (avoiding framing effects and preference reversals). Choices became more risk averse (thus, more risk neutral) for losses when preceded by predictions of others’ choices, and predictions of others’ choices became more risk seeking (thus, more risk neutral) for gains when preceded by choices.

Notes

See Viscusi (1995 p. 108), Baron et al. (2001), Bleichrodt et al. (2001), Thaler and Sunstein (2003, 2008: nudge), Loewenstein and Ubel (2008 §1.2), and Infante et al. (2016). For references to early work, see Fischhoff (1982) and Arkes (1991). Lapidus and Sigot (2000 §5) discuss Bentham’s ideas on this issue.

It may be argued that the predictions in PC should be compared with the choices in CP (which are a priori choices not following after a prediction task; see Cubitt et al. 1998, p. 116). Here these differences are not significant either. The mentioned comparison does not confirm the claim of risk-as-value of more risk aversion in predictions in PC.

References

Ames, D. R. (2004). Inside the mind reader’s tool kit: Projection and stereotyping in mental state inference. Journal of Personality and Social Psychology, 87, 340–353.

Ariely, D., Loewenstein, G., & Prelec, D. (2003). “Coherent arbitrariness”: Stable demand curves without the stable preferences. Quarterly Journal of Economics, 118, 73–105.

Arkes, H. R. (1991). Costs and benefits of judgments errors: Implications for debiasing. Psychological Bulletin, 110, 486–498.

Attema, A. E., & Brouwer, W. B. F. (2013). In search of a preferred preference elicitation method: A test of the internal consistency of choice and matching tasks. Journal of Economic Psychology, 39, 126–140.

Ball, S., Eckel, C. C., & Heracleous, M. (2010). Risk aversion and physical prowess: Prediction, choice and bias. Journal of Risk and Uncertainty, 41, 167–193.

Barberis, N. (2013). Thirty years of prospect theory in economics: A review and assessment. Journal of Economic Perspectives, 27, 173–195.

Bardsley, N., Cubitt, R. P., Loomes, G., Moffat, P., Starmer, C., & Sugden, R. (2010). Experimental economics: Rethinking the rules. Princeton: Princeton University Press.

Baron, J., Wu, Z., Brennan, D. J., Weeks, C., & Ubel, P. A. (2001). Analog scale, magnitude estimation, and the person trade-off as a measure of health utility: Biases and their correction. Journal of Behavioral Decision Making, 14, 17–34.

Bitterman, M. E. (1965). Phyletic differences in learning. American Psychologist, 20, 396–410.

Bleichrodt, H., Pinto, J. L., & Wakker, P. P. (2001). Making descriptive use of prospect theory to improve the prescriptive use of expected utility. Management Science, 47, 1498–1514.

Bosveld, W., Koomen, W., van der Pligt, J., & Plaisier, J. W. (1995). Differential construal as an explanation for false consensus and false uniqueness effects. Journal of Experimental Social Psychology, 31, 518–532.

Camerer, C. F., & Hogarth, R. M. (1999). The effects of financial incentives in experiments: A review and the capital-labor-production framework. Journal of Risk and Uncertainty, 19, 7–42.

Cherry, T. L., Crocker, T. D., & Shogren, J. F. (2003). Rationality spillovers. Journal of Environmental Economics and Management, 45, 63–84.

Clark, R. D., Crockett, W. H., & Archer, R. L. (1971). Risk-as-value hypothesis: The relationship between perception of the self, of others, and of the risky shift. Journal of Personality and Social Psychology, 20, 425–429.

Cubitt, R. P., Starmer, C., & Sugden, R. (1998). On the validity of the random lottery incentive system. Experimental Economics, 1, 115–131.

Daruvala, D. (2007). Gender, risk and related stereotypes. Journal of Risk and Uncertainty, 35, 265–283.

Dawes, R. M. (1989). Statistical criteria for establishing a truly false consensus effect. Journal of Experimental Social Psychology, 25, 1–17.

de Finetti, B. (1937). La Prévision: Ses Lois Logiques, ses Sources Subjectives. Annales de l’Institut Henri Poincaré 7, 1–68. Trans. Henry E. Kyburg, Jr. (1964). Foresight: Its Logical Laws, its Subjective Sources. In H.E. Kyburg, Jr. & H.E. Smokler (Eds.), Studies in Subjective Probability, 93–158. New York: Wiley, 2nd edn. 1980 (pp. 53–118). New York: Krieger.

de Martino, B., Kumaran, D., Seymour, B., & Dolan, R. J. (2006). Frames, biases, and rational decision-making in the human brain. Science, 313(August 4), 684–687.

Dimmock, S. G., Kouwenberg, R., Mitchell, O. S., & Peijnenburg, K. (2015). Estimating ambiguity preferences and perceptions in multiple prior models: Evidence from the field. Journal of Risk and Uncertainty, 51, 219–244.

Etchart-Vincent, N., & l’Haridon, O. (2011). Monetary incentives in the loss domain and behavior toward risk: An experimental comparison of three reward schemes including real losses. Journal of Risk and Uncertainty, 42, 61–83.

Faro, D., & Rottenstreich, Y. (2006). Affect, empathy, and regressive mispredictions of others’ preferences under risk. Management Science, 52, 529–541.

Fischhoff, B. (1982). Debiasing. In D. Kahneman, P. Slovic, & A. Tversky (Eds.), Judgment under uncertainty: Heuristics and biases (pp. 422–444). Cambridge: Cambridge University Press.

Goldman, A. I. (2006). Simulating minds: The philosophy, psychology, and neuroscience of mindreading. New York: Oxford University Press.

Hansson, B. (1988). Risk aversion as a problem of conjoint measurement. In P. Gärdenfors & N.-E. Sahlin (Eds.), Decision, probability, and utility; Selected readings (pp. 136–158). Cambridge: Cambridge University Press.

Hsee, C. K., & Weber, E. U. (1997). A fundamental prediction error: Self-others discrepancies in risk preference. Journal of Experimental Psychology: General, 126, 45–53.

Huber, J., Viscusi, W. K., & Bell, J. (2008). Reference dependence in iterative choices. Organizational Behavior and Human Decision Processes, 106, 143–152.

Infante, G., Lecouteux, G., & Sugden, R. (2016). Preference purification and the inner rational agent: A critique of the conventional wisdom of behavioural welfare economics. Journal of Economic Methodology, 23, 1–25.

Kahneman, D., & Lovallo, D. (1993). Timid choices and bold forecasts: A cognitive perspective on risk taking. Management Science, 39, 17–31.

Kühberger, A. (1998). The influence of framing on risky decisions: A meta-analysis. Organizational Behavior and Human Decision Processes, 75, 23–55.

Kühberger, A., & Gradl, P. (2013). Choice, rating, and ranking: Framing effects with different response modes. Journal of Behavioral Decision Making, 26, 109–117.

Lapidus, A., & Sigot, N. (2000). Individual utility in a context of asymmetric sensitivity to pleasure and pain: An interpretation of Bentham’s felicific calculus. European Journal of the History of Economic Thought, 7, 45–78.

Levinger, G., & Schneider, D. J. (1969). Test of the “risk is a value” hypothesis. Journal of Personality and Social Psychology, 11, 165–169.

Liberman, N., Trope, Y., & Wakslak, C. (2007). Construal level theory and consumer behavior. Journal of Consumer Psychology, 17, 113–117.

Loewenstein, G. (1996). Out of control: Visceral influences on behavior. Organizational Behavior and Human Decision Processes, 65, 272–292.

Loewenstein, G. F., & Ubel, P. A. (2008). Hedonic adaptation and the role of decision and experience utility in public policy. Journal of Public Economics, 92, 1795–1810.

Loewenstein, G. F., Weber, E. U., Hsee, C. K., & Welch, E. S. (2001). Risk as feelings. Psychological Bulletin, 127, 267–286.

Luce, R. D. (2000). Utility of gains and losses: Measurement-theoretical and experimental approaches. London: Lawrence Erlbaum Publishers.

Luchini, S., & Watson, V. (2013). Uncertainty and framing in a valuation task. Journal of Economic Psychology, 39, 204–214.

Marshall, A. (1890). Principles of Economics. 8th edn. 1920 (9th edn. 1961). New York: MacMillan.

McCauley, C., Kogan, N., & Teger, A.I. (1971). Order effects in answering risk dilemmas for self and others. Journal of Personality and Social Psychology, 20, 423–424.

Okder, H. (2012). The illusion of the framing effect in risky decision making. Journal of Behavioral Decision Making, 25, 63–73.

Pigou, A. C. (1920). The Economics of Welfare. Reprint 1952. London: MacMillan.

Rabin, M. (2000). Risk aversion and expected-utility theory: A calibration theorem. Econometrica, 68, 1281–1292.

Ramsey, F. P. (1931). Truth and probability. In Richard B. Braithwaite (Ed.), The Foundations of Mathematics and other Logical Essays, 156–198. London: Routledge and Kegan Paul. Reprinted in Henry E. Kyburg, Jr. and Howard E. Smokler (Eds.), Studies in Subjective Probability, 61–92 (1964). New York: Wiley. (2nd edn. 1980, New York: Krieger.)

Ross, L., Greene, D., & House, P. (1977). The “false consensus effect”: An egocentric bias in social perception and attribution processes. Journal of Experimental Social Psychology, 13, 279–301.

Savage, Leonard J. (1954). The Foundations of Statistics. New York: Wiley. (2nd edn. 1972, Dover Publications.)

Seidl, C. (2002). Preference reversal. Journal of Economic Surveys, 16, 621–655.

Slovic, P. (2010). The feeling of risk: New perspectives on risk perception. London: Earthscan.

Smith, V. L. (2002). Method in experiment: Rhetoric and reality. Experimental Economics, 5, 91–110.

Stone, E. R., & Allgaiera, L. (2008). A social values analysis of self–other differences in decision making involving risk. Basic and Applied Social Psychology, 30, 114–129.

Thaler, R. H., & Sunstein, C. R. (2003). Libertarian paternalism. American Economic Review: Papers and Proceedings, 93, 175–179.

Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving decisions about health, wealth, and happiness. New Haven: Yale University Press.

Trope, Y., & Liberman, N. (2010). Construal-level theory of psychological distance. Psychological Review, 117(2), 440.

Tversky, A., & Kahneman, D. (1981). The framing of decisions and the psychology of choice. Science, 211, 453–458.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Van Boven, L., Dunning, D., & Loewenstein, G. (2000). Egocentric empathy gaps between owners and buyers: Misperception of the endowment effect. Journal of Personality and Social Psychology, 79, 66–76.

Van Boven, L., Loewenstein, G., & Dunning, D. (2005). The illusion of courage in social predictions: Underestimating the impact of fear of embarrassment on other people. Organizational Behavior and Human Decision Processes, 96, 130–141.

Vieider, F. M. (2011). Separating real incentives and accountability. Experimental Economics, 14, 507–518.

Vieider, Ferdinand M., Thorsten Chmura, & Peter Martinsson. (2014). Risk attitudes, development, and growth: Macroeconomic evidence from experiments in 30 countries. Mimeo.

Vieider, F. M., Lefebvre, M., Bouchouicha, R., Chmura, T., Hakimov, R., Krawczyk, M., & Martinsson, P. (2015). Common components of risk and uncertainty attitudes across contexts and domains: Evidence from 30 countries. Journal of the European Economic Association, 13, 421–452.

Viscusi, W. K. (1995). Government action, biases in risk perception, and insurance decisions. Geneva Papers in Risk and Insurance Theory, 20, 93–110.

Viscusi, W. K., Phillips, O. R., & Kroll, S. (2011). Risky investment decisions: How are individuals influenced by their groups? Journal of Risk and Uncertainty, 43, 81–106.

Vulkan, N. (2002). An economist’s perspective on probability matching. Journal of Economic Surveys, 14, 101–118.

Wallach, M. A., & Wing, C. W. (1968). Is risk a value? Journal of Personality and Social Psychology, 9, 101–106.

Willems, E. P. (1969). Risk is a value. Psychological Reports, 24, 81–82.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(PDF 497 kb)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Li, Z., Rohde, K.I.M. & Wakker, P.P. Improving one’s choices by putting oneself in others’ shoes – An experimental analysis. J Risk Uncertain 54, 1–13 (2017). https://doi.org/10.1007/s11166-017-9253-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-017-9253-3