Abstract

In recent years, the impact of chief executive officers (CEOs) power on corporate strategies has attracted significant public debate in the academic milieu. In this study, we comprehensively review the academic literature on CEO power in relation to different corporate policies. We conduct a comprehensive review by dividing the literature into four streams: CEO power and firm performance, CEO power and executive compensation, CEO power and firm risk-taking, and finally, CEO power on other corporate strategies. Our review shows that the findings are mixed in relation to the effects of CEO power on firm strategies. Overall, the negative impact of CEO power on firm performance is attributed to agency theory, where CEOs pursue their own vested interests, thereby leading to weak corporate governance. The review reveals that the positive impact of CEO power on corporate outcomes is due to effective board monitoring, a powerful board, and high market competition. Our study also shows that most of the studies have adopted Finkelstein’s (1992) four sources of CEO power but have taken different proxies to measure these powers. We have also identified several gaps in the current studies and recommend avenues for further research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

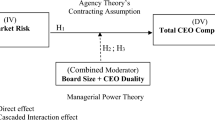

Power is defined as the “capacity of individual actors to exert their will” (Finkelstein 1992, p. 506). CEOs are deemed to be the chief organizers and designers of an organization’s long-term strategy, and their position is considered a source of power (Sheikh 2019a). Management scholars unanimously support that CEOs are the most powerful players in every organization. However, corporate governance literature is divided on the consequences of CEO power on corporate governance. One strand of literature is grounded in the agency theory and maintains that CEOs are risk averse, self-serving, and pursue policies that render their own personal goals (Combs et al. 2007; Bebchuk and Fried 2003; Bigley and Wiersema 2002). These studies support the view that conferring power to CEOs could lead to managerial entrenchment and poor corporate governance (Bebchuk et al. 2011). Adams et al. (2005) assert that powerful CEOs are overconfident, which could lead them to make costly strategic mistakes. This strand of literature shows that CEO power is detrimental to firm performance. The other strand of literature argues that CEOs are the most powerful members of a business (Daily and Johnson 1997; Jaroenjitrkam et al. 2020) and they “set the tone for the entire corporation” (Wheelen and Hunger 1990, p. 69). CEO power could also alleviate information asymmetry costs and improve operational efficiency. Some studies advance that even though the corporate board might play a dominant role during a corporate crisis, in normal times, the board plays a passive role, and the decision-making power rests on the CEOs (Elhagrasey et al. 1999). Social psychology theory specifies that powerful CEOs are more optimistic about corporate strategies (Anderson and Galinsky 2006). CEO power could improve operational efficiency, remove information asymmetry, enhance bargaining power, increase firm value through CSR practices, and increase firm value by managing organizational capital (Ahsan et al. 2022; Chiu et al. 2022; Graham et al. 2020). Given the importance of powerful CEOs in defining corporate strategies, a review of empirical evidence on CEO power and corporate governance outcome is warranted. This study addresses this gap by reviewing the literature on CEO power and firm strategies.

This topic is of interest for two main reasons. First, in recent years there has been increased attention from regulatory bodies and investors towards the composition of corporate boards. This is because CEO power is an essential aspect of board dynamism, as weak CEOs with powerful boards could lead to excessive monitoring that could constrain firm performance and risk-taking. On the other hand, powerful CEOs could also lead to entrenched boards. Hence this review highlights the theories and empirical evidence on CEO power that would have significant policy implications for corporate boards and regulatory bodies. Second, in the last few years, there has been a steady increase in research papers on CEO power in Finance, Management, Economics, and Accounting journals. In the last five years alone, we have found 61 research papers on CEO power. This increased attention on CEO power literature could be attributed to the powerful dynamics played by the CEOs on the corporate boards. In addition, research databases like Boardex have made it possible to readily obtain data on CEO characteristics like CEO pay, CEO share ownership, CEO educational background, CEO age, network size, and others. This valuable data on CEO characteristics has opened new avenues for research on CEO power and thus led to a plethora of studies on CEO power. This rising tide of empirical research on CEO power calls for a thorough review of the literature in this area. Hence, in this study, we aim to comprehensively review all the theoretical and empirical research on CEO power.

In his seminal paper, Finkelstein (1992) classifies four types of CEO power. These are structural power, ownership power, expert power, and prestige power. Extant studies have used different variants of these four sources of power. The most popular indicators of CEO power are CEO duality (structural), CEO tenure (expert), CEO stock ownership (ownership), CEO founder (ownership), CEO pay slice (structural), CEO network or directors in other organizations (prestige), CEO education (prestige), and CEO triality or plurality (structural). Pfeffer and Salancik (1978) contend that CEO power could emanate from several formal and informal sources, and hence, the four sources named by Finkelstein (1992) may not be unequivocal. In this study, we have found and reviewed 131 papers from 1995 to 2023 to study powerful CEOs’ influence on different corporate strategies. Figure 1 shows the distribution of studies across different subject areas. As shown in Fig. 1, the most popular studies on CEO power are published in the field of Finance (59), followed by General Management, Ethics and Social Responsibility (34), Economics (11), Accounting (10), Strategy (9), International Business and Area Studies (3), Social Science (2) and the rest of the fields have less than two studies on CEO power. We divide these studies into four different streams.

Stream 1: This stream reviews the studies associated with CEO power and firm performance. A review of studies on CEO power and firm performance shows mixed evidence. For instance, several studies report that CEO tenure (Simsek 2007; Tien et al. 2013; Ting et al. 2017), CEO duality (Chiu et al. 2021), and founder CEOs (Adams et al. 2005; Fahlenbrach 2009) improve firm performance. Some studies describe that CEO tenure (Veprauskaite and Adams 2013) and CEO duality (Duru et al. 2016; Tien et al. 2013; Veprauskaitė and Adams 2013) adversely affect firm performance. Others report that CEO power improves firm outcomes in the mature stage of firms’ life cycle (Harjoto and Jo 2009), low to moderate strategic change (Zhang and Rajagopalan 2010), with powerful boards (Tang et al. 2011), only in markets with high competition (Sheikh 2018b), earnings management (Le et al. 2022), and CEO self-discipline in power (Tang 2021). Few studies document that CEO power reduces firm performance (Bebchuk et al. 2011; Cormier et al. 2016; Haynes et al. 2019; Park et al. 2018; Colak and Liljeblom 2022). Daily and Johnson (1997) report mixed evidence of CEO power on firm performance.

Stream 2: Several studies sought to understand whether CEO power could influence executive compensation. A review of studies on CEO power and CEO compensation also shows mixed results. Some studies report that CEO power positively affects compensation (Choe et al. 2014; Elhagrasey et al. 1999; Hill et al. 2016; Luo 2015; Tian and Yang 2014), while others report negative consequence of CEO power on compensation (Zhu et al. 2021). Other studies on CEO power and compensation find that financial markets assist CEOs in earning higher compensation through stock options (Boyer 2005), powerful CEOs reprice executive stock options (Pollock et al. 2002), or adopt performance-vested stock options (PVSO) (Abernethy et al. 2015).

Stream 3: Several studies examine whether CEO power affects corporate risk-taking. The majority of papers report that CEO power has a favorable outcome on firm risk-taking (Altunbas et al. 2020; Chintrakarn et al. 2015; Korkeamäki et al. 2017; Lewellyn and Muller-Kahle 2012; Sheikh 2019b). Other studies report that CEO power positively impacts bank risk (Pour et al. 2023; Shabir et al. 2023). Few studies find that CEO power adversely impacts firm risk-taking (Haider and Fang 2018; Pathan 2009; Tan and Liu 2016), and CEO power strengthens the negative impact of ESG disclosure on firm risk-taking (Menla Ali et al. 2023; Zhao et al. 2023). Chintrakarn et al. (2015) find that the relation between CEO power and firm risk-taking is non-monotonic, while Zou et al. (2021) show that CEO formal power (informal power) has a positive (negative) effect on firm risk.

Stream 4: We have reviewed all the other studies on CEO power and corporate strategies in this category. The review shows that higher CEO power helps firms in the internationalization process (Sanders and Carpenter 1998), focuses on the same line of business (Bigley and Wiersema 2002), reduces audit committee effectiveness (Lisic et al. 2016), impedes the hiring of accounting experts in audit committee (Kim et al. 2017), brings unity of command in smaller boards (Dowell et al. 2011). CEO power also leads to hiring of directors with similar demography (Westphal and Zajac 1995; Zajac and Westphal 1996a, b), hiring fewer independent directors and tend to nominate monitor heavy boards (Baldenius et al. 2014), laying off senior non-executives who have lengthier tenure than the CEOs (Zhang et al. 2011), and powerful incumbent CEOs thwart the CEO-Chair dual roles of incoming CEOs (Horner and Valenti 2012). Several studies find that CEO power leads to lower bid premiums for acquisitions (Fralich and Papadopoulos 2008), more focused mergers generating higher returns (Fahlenbrach 2009), superior information of target firms during mergers (Balmaceda 2009), higher propensity to complete takeover deals (Chikh and Filbien 2011), higher bond yield (Liu and Jiraporn 2010), and lower dividend payout (Onali et al. 2016). Studies also report that CEO power improves firm innovation (Sariol and Abebe 2017; Sheikh 2018a), negatively affect corporate social responsibility (CSR) (Muttakin et al. 2018; Sheikh 2019a), positively impact CSR (Pucheta-Martínez and Gallego-Álvarez 2021). CEO power is increased by board gender diversity (Usman et al. 2018; Brodmann et al. 2022) and reduced by increased product market competition (Jaroenjitrkam et al. 2020).

This paper makes several important contributions. First, this study identifies and presents all the different measures of CEO power. Second, this literature review has helped to distinguish all the theories about CEO power, and we have ascertained the empirical studies that supported or refuted them. Third, this review has helped to recognize the methodological challenges faced in CEO power research and how empirical studies have addressed those challenges. Finally, this review also presents the key research areas in CEO power and has categorized the studies into various streams, as mentioned earlier. To the best of our knowledge, this is the first comprehensive review of CEO power and corporate strategies. The rest of the paper is structured as follows. Section 2 reviews different measures of CEO power adopted by extant studies. Section 3 presents the theories related to CEO power literature. Section 4 presents the methodology adopted by the empirical studies. Sections 5, 6, 7, 8 review the literature categorized under streams 1, 2, 3, and 4, respectively. Finally, Sect. 9 concludes.

2 Indicators and theories of CEO power

In this section, we discuss the various measures of CEO power, starting with the four areas originally identified by Finkelstein (1992) and followed by other measures of CEO power.

2.1 Structural power

CEOs’ structural power emanates from their formal organizational composition and hierarchical command through exercising their legislative rights (Finkelstein 1992; Finkelstein and D’aveni 1994). Most empirical studies have recognized CEO-Chair duality (see Daily and Johnson 1997; Deboskey et al. 2019; Haynes and Hillman 2010; Joseph et al. 2014; Korkeamäki et al. 2017) as the measure of structural power. This is measured as a dummy variable 1 if the CEO is also the board chair. From the organization perspective, CEO-Chair duality brings unity of command through unequivocal and explicit power over the company and proclaiming a definite line of influence (Finkelstein and D’Aveni 1994). Studies on strategy development suggest that organizations spearheaded by formidable leaders can provide strategic directions that can be possible when the same individual is both the CEO and the Chair of the board.

Finkelstein and D’Aveni (1994) argue that vigilant boards characterized by greater independent directors tend to support nonduality as they perceive that duality weakens the supervising mechanism of the board. Fralich and Papadopoulos (2018) document that CEO-Chair duality exerts its power over the board through information asymmetry, thereby preventing the board from making informed decisions. Finkelstein and D’Aveni (1994) report that CEO-Chair duality impedes the board’s power to successfully supervise and control the board’s agenda and directs the board’s focus to fulfill the CEO’s agenda.

A second indicator of CEO structural power pioneered by Bebchuk et al. (2009) and later by Bebchuk et al. (2011) is the CEO pay slice (CPS). This is taken as the ratio of CEO compensation to the total compensation of the top five executives on the board. Bebchuk et al. (2011) assert that CPS is a more objective measure as it accounts for different attributes of the CEO concerning its skills, influence, or power. In addition, CPS indicates the CEO’s power relative to other board members. Sheikh (2018a) measures CPS as a dummy variable 1 if the firm’s CPS is higher than the industry median CPS and 0 otherwise. CPS as a proxy of structural CEO power has been subsequently expended by several studies (see Jiraporn et al. 2012; Li et al. 2016; Liu and Jiraporn 2010; Ntim et al. 2019; Shahab et al. 2020; Sheikh 2019a, 2019b, 2018a, 2018b; Tian and Yang 2014; Usman et al. 2018). Zagonov and Salganik-Shoshan (2018) examine the validity of CPS as an effective measure of CEO power. They advance that CPS wrongly estimates CEO power as it does not control the allocation of pay amongst the top five executives. This is because CPS overlooks the vital evidence enclosed in the compensation data of top executives.

Few studies have also used CEO triality as a measure of structural power. This is a dummy variable of 1 if the same individual is the CEO, the Chair, and the firm’s President (see Adams et al. 2005; Han et al. 2016; Sheikh 2018a, 2018b, 2019a). Harjoto and Jo (2009) has used CEO plurality by taking a categorial variable with value 1 to capture CEO-Chair duality and triality. Tang et al. (2011) and Tang and Crossan (2017) have taken a similar measure that they coined as “percentage of higher titles”. They have applied a reverse coded indicator variable coded as zero implying lower CEO power if the top management team (TMT) has an executive vice president (VP), senior VP, and two VPs.

Several studies have taken board independence to gauge structural power (Abernethy et al. 2015; Choe et al. 2014; Gunasekarage et al. 2020; Han et al. 2016; Kalyta 2009; Kalyta and Magnan 2008; Sheikh 2018b; Zhu et al. 2021). The strength of independent directors to monitor the board is adversely affected by CEO power; hence a powerful CEO leads to a less diligent board (Sheikh 2018b). On the contrary, Abernethy et al. (2015) and Gunasekarage et al. (2020) assert that independent directors would also have fewer disagreements with the CEO due to their prior detachment from firms’ decision-making. Board independence is evaluated by taking the proportion of unrelated directors (Kalyta and Magnan 2008), outside directors (Coles et al. 2001; Kalyta 2009), the proportion of executive directors on the board (Choe et al. 2014), the proportion of independent directors (Abernethy et al. 2015; Gunasekarage et al. 2020), and dependent directors (Han et al. 2016). Sheikh (2018b) has adopted an indicator variable as 1 if the proportion of independent directors is below the median proportion of independent directors.

Several studies have also implemented CEO compensation to measure structural power. Higher CEO compensation indicates that the CEO could influence the board (Bigley and Wiersema 2002; Daily and Johnson 1997; Finkelstein 1992; Westphal and Zajac 1995). Pay differential between the CEOs and other board members indicates CEOs exerting power over top managers (Bigley and Wiersema 2002). Agency theory envisages that powerful CEOs could persuade the remuneration committee to settle substantial compensation not tied to financial performance (Veprauskaitė and Adams 2013). Different studies have used variants of CEOs’ compensation. CEO compensation is measured as CEOs’ total compensation out of the total cash compensation of the next highest-paid officer in the firm (Bigley and Wiersema 2002; Daily and Johnson 1997; Gunasekarage et al. 2020; Lisic et al. 2016); annual total compensation (cash, salary, and bonuses) (Fang et al. 2020; Tang et al. 2011; Tang and Crossan 2017; Veprauskaitė and Adams 2013); average CEO cash compensation by average TMT cash compensation (Abebe et al. 2011).

CEO being the only insider has been taken to evaluate structural power by few studies (Adams et al. 2005; Chiu et al. 2021; Ting 2013), while Lewellyn and Fainshmidt (2017) recognize this measure as a prestige power as it bestows heightened status. Agency theory perceives that the CEO being the only insider will reduce CEO power as this would increase board independence and, thereby, effective board monitoring (Adams et al. 2005; Lewellyn and Fainshmidt 2017). On the other hand, insider CEOs have higher knowledge capital (Chiu et al. 2021), and as the only insider, the CEO would have the power to curb information shared with other directors (Adams et al. 2005; Lewellyn and Fainshmidt 2017). A dummy variable of value 1 captures this if the CEO is an insider and zero otherwise (Adams et al. 2005; Chiu et al. 2021; Ting 2013).

Other structural CEO powers used by a few studies are the CEO pay gap (Jaroenjitrkam et al. 2020; Sheikh 2019a, 2018b; Li 2016) and performance-related bonuses (Veprauskaitė and Adams 2013). The CEO pay gap is the difference between CEO’s total compensation and second highest director’s compensation over CEO’s total compensation (Li 2016). CEO bonus pay is determined by a categorical variable 1 if the CEO gets a performance-related bonus and zero otherwise.

2.2 Ownership power

Finkelstein (1992) observes that ownership grants CEOs to implement higher authority to make strategic decisions. The two most popular ownership power measures adopted by extant studies are CEO stock ownership and the CEO as the firm’s founder. Stock ownership has been recognized as a vital measure of upper-echelon power (Bigley and Wiersema 2002; Daily and Johnson 1997; Finkelstein 1992). Morck et al. (1988) document that CEO stock ownership would increase their voting rights, which could give them substantial control in director nomination. Ownership over 5 percent could lead to CEO entrenchment (Morck et al. 1988) and could guard them against internal monitoring mechanisms. A higher ownership stake could also give CEOs legitimate rights to decide on firms’ investment policies (Dowell et al. 2011), and increased CEO stock ownership could diminish the chances of involuntary turnover (Sheikh 2019a). CEO stock ownership is proxied by the percentage of stocks obtained by CEOs. Haynes and Hillman (2010) have taken a slightly different measure of ownership power: the proportion of CEOs to board equity holdings.

The second measure of ownership power that many studies have used is founder-CEO or CEO from the founding family. Founder-CEO maintains a level of formal power (equity ownership) and informal power (founder or relative of founder) that allows proclaiming strategic changes within the firm (Buyl et al. 2011; Daily and Johnson 1997; Dowell et al. 2011; Sheikh 2018a). Fahlenbrach (2009) observes that founder CEOs lower agency costs because they consider the firm as their life’s work and are driven to maximize its value. CEO founder or from the founding family possess substantial authority over the business’s strategy, culture, and aspirations (Le et al. 2022). Founder CEOs are perceived as internally hired and have a different type of motivation than other CEOs (Adams et al. 2005), have substantial sway on the board of directors (Sheikh 2018a; Walls and Berrone 2017), are unlikely to be removed from their position and may have a different perception of risk than other CEOs (Fahlenbrach 2009). Several studies have used categorical variable, one for founder CEOs and zero otherwise (Abebe et al. 2011; Adams et al. 2005; Buyl et al. 2011; Cormier et al. 2016). Cormier et al. (2016) and Jaroenjitrkam et al. (2020) adopt a different version of the founder CEO measure: the CEO’s family owns more than a 5% share. Daily and Johnson (1997) have also used a CEO with the same last name as the third category of founder measure in addition to the above two.

A third measure of ownership power that has been used by a few studies is institutional ownership (Abernethy et al. 2015). Outside investors with significant stock ownership are expected to retrieve internal and external firm information, tend not to be influenced by the board of directors and enable the transfer of power from management to the shareholders (Lewellyn and Muller-Kahle 2012). Higher institutional ownership implies higher voting rights to nominate board members and greater supervision of executive compensation (Lewellyn and Muller-Kahle 2012) and, thereby, a more rigorous inspection of managers’ power (Haider and Fang 2018). This is the percentage of shares obtained by an individual other than the CEO (Abernethy et al. 2015; Lewellyn and Muller-Kahle 2012; Pollock et al. 2002).

Other measures of ownership power that few studies have used are outside stock ownership (Kalyta 2009; Kalyta and Magnan 2008) or top outsider ownership (Lewellyn and Muller-Kahle 2012); CEO blockholdersFootnote 1 (Kalyta 2009; Kalyta and Magnan 2008); high CEO ownershipFootnote 2 (Jaroenjitrkam et al. 2020). Increased ownership of outside directors would make them more watchful of CEOs’ behaviors. Outside directors are also expected to possess superior internal and external information. Therefore, they are unlikely to be swayed by the CEO (Lewellyn and Muller-Kahle 2012) and would have higher voting rights (Finkelstein and D’Aveni 1994). Chen (2014) has taken this as the ratio of shares owned by the CEO to outside directors.

2.3 Expert power

CEO’s ability to tackle business contingencies increases with their time on the board as they can develop more excellent contacts and relationships with different stakeholders (Finkelstein 1992). CEOs are also likely to amass social capital and knowledge with longer tenure, which could be a source of informal power (Finkelstein and D’aveni 1994; Greve and Mitsuhashi 2007). Increased tenure would lead CEOs to have greater knowledge of company information, and they could limit the board’s accessibility of this information (Daily and Johnson 1997; Combs et al. 2007). Simsek (2007) also observes that increased CEO tenure could lead to increased social gathering with directors, other firm managers, and constituents that brings legitimacy to engage in risky ventures. CEO tenure could also alleviate board monitoring (Graham et al. 2020; Ryan and Wiggins 2004) and heighten managerial entrenchment leading to divergence of corporate resources (Sheikh 2019a). Most studies that have used CEO tenure to gauge CEO expert power have measured it in terms of the CEO length (in years) in the post (see Abernethy et al. 2015; Buyl et al. 2011; Chiu et al. 2021; Fang et al. 2020; Gunasekarage et al. 2020; Park et al. 2018). In contrast, Han et al. (2016) and Sheikh (2018a) use a dummy variable of value 1 if the CEO tenure is more than the industry median or CEO tenure is more than the median tenure of the whole sample (Mollah and Liljeblom 2016). Huang and Gao (2022) have considered CEO tenure as structural power.

Expert power could emanate from in-depth knowledge and familiarity with the salient elements of the firm (Finkelstein 1992). Few studies have used the number of years worked in the firm in different roles (Finkelstein and D’aveni 1994; Daily and Johnson 1997; Fralich and Papadopoulos 2018; Kalyta 2009; Kalyta and Magnan 2008) or number of years worked in the board (Walls and Berrone 2017) or CEOs’ holding executive positions (Gunasekarage et al. 2020) or CEOs’ holding roles in board committees (Abernethy et al. 2015) as measures of expert power. They assert that when CEOs serve the board in other roles, they have a stronger bond with the board to control and mobilize resources. Le et al. (2022) affirm that CEOs with financial expertise can manage earnings and have taken a categorical variable as 1 if the CEO has financial expertise and zero otherwise. Zhang and Rajagopalan (2010) adopt different categoriesFootnote 3 of functional background to capture expert power. Kalyta and Magnan (2008) use the unrelated director’s tenure as another measure of CEO power, while Haider and Fang (2018) take CEO professional certificates as a measure of expert power. Finkelstein and D’aveni (1994) have taken another measure of expert power to represent CEOs’ unique skills and expertise, and this is measured as the difference between the functional backgrounds of the TMT and the CEO weighted by the size of the board.

Buyl et al. (2011) identify two more sources of expert power: CEO generalist and CEO as a marketing specialist. Generalist CEOs are likely to have shared perception and trust with the TMT, and CEOs as marketing specialists are particularly useful for sectors with frequent product innovation. These are used as categorical variables. Lewellyn and Muller-Kahle (2012) use another measure of CEO expert power: outside directors’ tenure. This study affirms that the long tenure of outside directors would give them enhanced information about the firm, and so they can have a better assessment of CEO decisions. This is evaluated by the number of years each outside director was a board member.

2.4 Prestige powers

CEO prestige is an informal power that emanates from the institutional environment and the CEO’s interaction with individuals in other organizations holding similar authority (Finkelstein 1992; Finkelstein and D’Aveni 1994). Lewellyn and Muller-Kahle (2012) advance that CEOs with prestige power will face less scrutiny from outside directors as their prestige power will measure their successful leadership. Most extant studies have measured CEO prestige power by taking the number of directors’ positions held by the CEO in other organizations (see Abebe et al. 2011; Altunbas et al. 2020; Bigley and Wiersema 2002; Daily and Johnson 1997; Finkelstein and D’Aveni 1994; Fralich and Papadopoulos 2018; Gunasekarage et al. 2020; Haynes et al. 2019; Lewellyn and Muller-Kahle 2012; Ting 2013) or as a dichotomous variable (Haider and Fang 2018). Fralich and Papadopoulos (2018) and Lewellyn and Fainshmidt (2017) have taken another indicator of prestige power: the number of non-profit board directorships. Fralich and Papadopoulos (2018) use a third measure, the relative prestige of the firm where the CEO holds office. This is possibly because outside directorship is viewed as CEO’s networking ties and embeddedness within the business elites (Lewellyn and Muller-Kahle 2012). CEOs could expand their network through their outside directorship, allowing them to gain access to strategic information and hence reduce asymmetric information (Fralich and Papadopoulos 2018). Finkelstien and D’Adeni (1994) assert that CEO prestige power could increase entrenchment leading to centralized structures like CEO duality. Increased CEO prestige power could lead vigilant boards to appoint an independent chairperson to counter or balance the supremacy of the CEO.

Another source of prestige power is CEO’s attendance in prestigious or elite universities for their undergraduate and postgraduate degrees. Some studies have taken this as a categorical variable (Finketsien and D’aveni 1994; Bigley and Wiersema 2002; Chikh and Filbien 2011; Daily and Johnson 1997; Dowell et al. 2011; Fang et al. 2020; Haider and Fang 2018; Ting et al. 2017; Zhang and Rajagopalam 2010; Zhu et al. 2021) or as the number of elite universities the CEO has attended (Gunasekarage et al. 2020; Haynes et al. 2019) or if CEO’s qualification is more than the median qualification (Mollah and Liljeblom 2016).

Several extant studies have also taken CEO age as a gauge of prestige power since, with age, CEOs are likely to gather more skill and knowledge (Haider and Fang 2018; Mollah and Liljeblom 2016; Ntim et al. 2019; Zhang and Rajagopalam 2010). Haider and Fang (2018) consider CEO age and gender as CEO demographic power.

2.5 Other measures of CEO power

Kalyta and Magnan (2008) and Abernethy et al. (2015) have taken board size to measure CEO power, as large boards could lead to a fall in the board’s efficiency in controlling CEO power. Other determinants of CEO power are CEO acquisition experience (Chikh and Filbien 2011); CEO unforced turnover (Onali et al. 2016); ownership concentration (Abernethy et al. 2015); CEO reputation (Ntim et al. 2019); political connection (Zhu et al. 2021); CEO is CFO (Tan and Liu 2016); staggered board (Pollock et al. 2002); CEO duality and nomination committee and CEO plurality (chair and nomination committee) (Harjoto and Jo 2009).

3 Summary of CEO power indicators

From the literature review under different streams, as shown in Tables 3, 4, 5, 6, most studies have used the four dimensions of CEO power originally coined by Finkelstein (1992). However, these studies have taken different proxies of CEO power. Figure 2 shows the distribution of studies across various measures of CEO power reviewed above. This figure has omitted those CEO power measures used by three or less than three studies listed in the previous paragraph.

The review reveals that 64 studiesFootnote 4 have used the CEO power index to measure CEO power. These indexes consider various proxies of the four CEO power dimensions coined by Finkelstein (1992) as discussed in Sect. 2. Figure 2 shows the measures of CEO power adopted by all the studies that have either used CEO power index or individual measures of CEO power. As Fig. 2 shows, the most popular measure of CEO structural power is CEO-Chair duality, which 90 studies have adopted. CEO tenure is the most popular source of expert power, and it has been used by 75 studies, CEO stock ownership is the most popular measure of ownership power, and 53 studies have used it. Other popular measures are CEO founder (40), CEO pay slice (33), CEO outside directorship or CEO network size (16), CEO education (14), board independence (12), CEO is the only insider (13), CEO triality/plurality (13), successor CEO is an insider (9), CEO cash compensation (9), number of years worked in the firm in different roles (8), directors appointed after CEO took office (8), CEO age (6), CEO functional background (4), CEO pay gap (4), top outside ownership (4). From Tables 3, 4, 5, 6, where we have reviewed all the studies under various streams, it is apparent that researchers favor no single measure of CEO power under any of the research streams. However, CEO duality stands out as the most popular measure of CEO power, as shown above, with 90 studies that have adopted this measure.

4 Theories related to CEO power literature

We have identified twenty-six theories pertaining to CEO power literature. A summary of all the studies linked to these theories is shown in Table 1. The definitions of all these theories are shown in the first column of Table 1. Some of these theories have received mixed support from empirical studies. These are shown in Panel A. Some theories have received unanimous support from empirical studies, which are reported in Panel B, and some theories have been refuted by empirical literature, and these are shown in Panel C.

4.1 Theories that have received mixed support

The most widely referred theory about CEO power literature is agency theory. Based on this theory, studies have found that CEO power leads to lower firm value and performance (Bebchuk et al. 2011; Veprauskaitė and Adams 2013; Duru et al. 2016); needs increased monitoring by outside directors (Combs et al. 2007), could lead to entrenchment (Finkelstein and D’Aveni 1994); lower leverage (Jiraporn et al. 2012; Chintrakarn et al. 2014); poor credit rating and higher bond yields (Liu and Jiraporn 2010); lower bank risk-taking (Pathan 2009); moderates the positive relation between board strength and firm strategy (Tuwey and Tarus 2016); lower dividend payout (Chintrakarn et al. 2018); use less equity-based compensation that weakens board monitoring (Ryan and Wiggins; 2004); lower CSR exposure and alleviates the positive effect of board capital on CSR exposure (Muttakin et al. 2018); reduces the effect of ESG disclosure on market-based risk than accounting-based risk (Menla Ali et al. 2023); positively influences earnings management (Le et al. 2022); lower R&D investment (Naaman and Sun 2022); lower entrepreneurial orientation (Saiyed et al. 2023); lower idiosyncratic volatility (Tan and Liu 2016); positively related to CSR (Pucheta-Martínez and Gallego-Álvarez 2021); lower corporate sexual orientation policies (Brodmann et al. 2021).

On the other hand, some studies have refuted agency theory. Some of these studies advance that agency problems through CEO power could be mitigated by board monitoring (Haynes et al. 2019); longer-term CEO pay, bigger TMT, and CEO non-duality (Sanders and Carpenter 1998); CEO ownership power (Pollock et al. 2002); market discipline (Jaroenjitrkam et al. 2020). Shui et al. (2022) contend that CEO power in weak boards should be complemented with institutional ownership to increase environmental innovation. Agency theory is refuted by some studies, which find that powerful CEOs have lower CSR engagement (Sheikh 2019a; Maswadi and Amran 2023), take more risk in the presence of discipline through increased market competition and strong corporate governance (Sheikh 2019b), no significant effect on pay performance (Luo 2015), positive effect on firm performance (Mollah and Liljeblom 2016), engage in more exploitative innovation (Sariol and Abebe 2017; Sheikh 2018a), increases firm value (Sheikh 2018b), positively affects firm performance and institutional ownership (Saleh et al. 2022), CEO directorship improves firm performance (Tien et al. 2013). Boards with concentrated ownership have higher second-tier agency problems (board power and vested interests of other directors) than first-tier agency problems (CEO power and their vested interests) (Ntim et al. 2019).

The second most popular theory is managerial power or rent extraction theory. In support of this theory, some studies have found that CEO managerial power is positively related to CPS, and where there is a cap in salary, CEO power causes rent extraction through stock-based compensation (Choe et al. 2014), leads to positive but relatively small pay-for-performance support (PPS) (Ntim et al. 2019), lesser decrease in bonus compensation, increase in equity compensation and greater chances of getting bonus when there are layoffs in their firms (Henderson et al. 2010), positively related to stock price crash (Shahab et al. 2020), positively related to bank CEO incentive pay (Tian and Yang 2014), causes CSR decoupling (Shahab et al. 2022), takes lesser environmental initiatives (Al-Shaer et al. 2023), increases CEO compensation and the gap between CEO and other executives’ pay (Zhu et al. 2021; Joura et al. 2022) and is positively related to long term pay (Tien et al. 2013). Others have reported that economic terms could not explain powerful CEOs’ excessive compensations but could be attributed to their power over the board (Hill et al. 2016) and rent extraction is contingent on the extent of transparency of management compensation (Kalyta and Magnan 2008). Refuting this theory, some studies show that CEO power does not lead to an increase in executive compensation in Chinese banks (Luo 2015); does not increase CPS overtime for newly appointed CEOs (Bugeja et al. 2017), is positively related to firm risk (Zou et al. 2021), and negatively affects CEOs’ long term and short term pays (Tien et al. 2013).

Another theory pertaining to CEO power literature, particularly on CEO power and executive compensation literature, is grounded in optimal contract theory and dynamic bargaining theory. In support of this theory, studies find that pay for performance sensitivity improves in companies with powerful founding and shareholding CEOs (Ntim et al. 2019). CEO-chair age dissimilarity could restrain CEOs’ rent-seeking behavior (Zhu et al. 2021), and firms tend to reduce excess CPS (Bugeja et al. (2017). Refuting this theory, Boyer (2005) argues that this theory is likely to fail as powerful managers use their power to convert stock options into financial market incentives.

The fourth theory is the upper echelon theory. Grounded in this theory, studies find that CEO long tenure indirectly leads to positive risk-taking through CEO power on TMT risk-taking tendencies (Simsek 2007), CEO equity ownership has a positive effect on CSR initiatives (Jia et al. 2022), CEO heir apparent experience influence the cognitive orientation that leads them to take decisions that maintain the organization’s status quo instead of corporate refocusing (Bigley and Wiersema 2002), and firms’ strategic choices are swayed by CEO and TMT attributes (Byun and Al-Shammari 2021 and Sun and Skousen 2022). Refuting this theory, Tan and Liu (2016) find that CEO experience measured by long tenure could lead to entrenchment.

Another theory related to CEO power is the approach/inhibition theory of power. This theory suggests that power could trigger an individual’s neurobiological approach to focus on positive outcomes and ignore the negative consequences. Based on this theory, Lewellyn and Muller-Kahle (2012) find that CEO power leads to excessive risk-taking, and Zhang et al. (2022) find that CEO power promotes environmental innovation. Refuting this theory, Zhou et al. (2021) find that CEO power disinhibition could thwart strategic change, and Saiyed et al. (2023) show that CEO power reduces the effect of entrepreneurial orientation on firm performance.

The next related theory is organization theory, and based on this theory, studies find that powerful CEOs are more confident in their decision-making and undertake risky decisions that could enhance firm performance (Sheikh 2018a), significantly impacts on firms’ CSR policies (Breuer et al. 2022), powerful CEOs take more extreme decisions whereas decisions taken by a larger group is more moderate (Adams et al. 2005 and Haider and Fang 2018), powerful CEOs with strong boards improves firm performance (Shabir et al. 2023). On the other hand, Zou et al. (2021) find mixed evidence on CEO power and firm risk.

In support of the stakeholder theory, Pucheta-Martínez and Gallego-Álvarez (2021) and Al-Shaer et al. (2023) find that CEO compensation is linked to CSR initiatives, and Li et al. (2018) report that Environmental, Social, and Governance (ESG) score is more value enhancing in the presence of powerful CEOs. Refuting this theory, Li et al. (2016), Muttakin et al. (2018), Harper and Sun (2019), Maswadi and Amran (2023) find that powerful CEOs have lesser engagement in CSR activities. Jia et al. (2022) find mixed evidence between CEO power and CSR disclosure.

4.2 Theories that have received unanimous support from empirical studies

In support of the compensation transparency theory in Panel B, Kalyta (2009) suggests that CEO power determines the supplemental executive retirement plan (SERP) benefits whereas transparency in compensation is driven by economic factors. In support of resource dependence theory, studies find that powerful CEOs could strengthen the effect of board power on R&D investment (Haynes and Hillman 2010; Chen 2014), CEO power is required in firms that aim to cater to customers’ needs and firms operating in competitive product markets with higher cultural power distance (Krause et al. 2016), CEO power moderates the effect of board director attributes on CSR disclosure. Ting (2013) finds support for common-sense theory and finds that when successor CEOs have similar power as predecessors, turnover announcements generate positive abnormal returns.

In support of director reputation theory, studies find that powerful CEOs show aggressiveness and optimism in their earnings announcement tone (DeBoskey et al. 2019), tend to hire successor CEOs who have similar demography as them (Zajac and Westphal 1996a, b), and attract directors from boards with governance change (Zajac and Westphal 1996b). Colak and Liljeblom (2022) find that CEOs’ long tenure could be detrimental to firm performance even after the long-tenured CEO is replaced. Chiu et al. (2021) find support for efficiency theory and show that powerful CEOs with knowledge capital lead to an increase in firm value. Lewellyn and Fainshmidt (2017) show that discretion arising from CEO duality could complement with firm and industry discretions to enhance firm value, thus supporting governance theory. Based on human capital theory, Huang and Gao (2022) show that CEO power leads to reduced debt policy persistence. In support of impression management theory, Sun et al. (2022) find that the positive association between CEO power and reading difficulty is due to bad operating performance. Harjoto and Jo (2009) report that CEO power favors firm performance in the initial stages of the business and is detrimental to firm performance in more advanced or mature stages of business, thus supporting life-cycle theory. Grounded on managerial discretion theory, Schopohl et al. (2021) find that lower-powered CEOs and diverse boards could lead female CFOs to reduce leverage in organizations.

Managerial entrenchment theory finds support from Park et al. (2018), who show that the negative relation between CEO hubris and firm performance is aggravated by CEO power. Grounded in power circulation theory, Combs et al. (2007) find that powerful CEOs could maintain a dominant coalition in the board and the strategic decisions taken by weaker CEOs result in poor outcome (Adams et al. 2005; Brahmana et al. 2021). Based on prospect theory, Tang and Crossan (2017) and Tang et al. (2011) find that troubled firms might take recourse to risky strategies by hiring dominant CEOs.

Several studies have found support for self-categorization or social categorization theory. Based on this theory, studies report that powerful CEOs are less likely to promote the heir apparent (Cannella and Shen 2001), less likely to share information with TMT (Buyl et al. 2011), prefer to hire directors of the same demography (Westphal and Zajac 1995), and non-CEO executives tend to exit firms where there is demographic dissimilarity (Zhang et al. 2011).

In support of the social capital theory, Greve and Mitsuhashi (2007) advance that powerful CEOs’ social capital helps them to make strategic decisions without reliance on their subordinates. Based on structural elaboration theory, Joseph et al. (2014) show that a CEO-only board might embrace board independence but could cause CEO entrenchment.

4.3 Theories that are refuted by empirical studies

Lewellyn and Fainshmidt (2017) find partial support for stewardship theory and show that only when CEO duality is linked to certain other CEO powers this outcome is accomplished. Shareholder theory is refuted by Ahsan et al. (2022) as they report that powerful CEOs could create firm value through CSR activities when CSR practices align with firms’ objectives.

4.4 Studies not related to any of the theories on CEO power

We have found the following studies unrelated to any of the theories discussed in Sect. 3. We have presented all these studies in Tables 3, 4, 5, 6. Table 3 discusses the following studies under CEO power and firm performance that are not related to any theory—Abebe et al. (2011), Ahsan et al. (2022), Cormier et al. (2016), Daily and Johnson (1997), Fang et al. (2020), Gunasekarage et al. (2020), Han et al. (2016), Li (2016), Tang (2021), Ting et al. (2017), Usman et al. (2018) and Table 4 shows the following studies under CEO power and executive compensation that are not related to any theory–Al-Dhamari et al. (2022), Joura et al. (2022). Table 5 presents the following studies on CEO power and firm risk-taking that are not related to any theory—Chintrakarn et al. (2015), Huang and Gao (2022), Korkeamaki et al. (2017), Pour et al. (2023), Zhao et al. (2023). Table 6 reports the following studies under CEO power and corporate strategies that are not related to any theory—Al-Shaer et al. (2023), Bristy et al. (2022), Brodmann et al. (2022), Dowell et al. (2011), Dutta et al. (2011), Fahlenbrach (2009), Fralich and Papadopoulos (2018), Harper et al. (2020), Kim et al. (2017), Lo and Shiah-Hou (2022), Onali et al. (2016), Urban (2019), Walls and Berrone (2017), Zajac and Westphal (1996a, b), Zagonov and Salganik-Shoshan (2018).

5 Methodology

In Table 2, we have provided a summary of all the models used by different studies to examine the various aspects of CEO power, like firm performance, executive compensation, firm risk-taking, and other corporate strategies. Table 2 shows that the four most popular regression models are fixed effect (FE), ordinary least square (OLS), generalized method of moments (GMM), and two-stage least square (2SLS) regressions. One of the challenges researchers face in corporate governance studies is the issue of endogeneity. The problem of endogeneity in econometrics is caused when there is a correlation between explanatory variables and error terms, and this could be caused by reverse causality, omission of variables, or errors in the variables. In many studies, the issue of reverse causality or simultaneity in the variables has been addressed by 2SLS or 2SLS-IV regressions. Several studies have adopted GMM regression to address dynamic endogeneity bias in panel data. Other studies have addressed endogeneity concerns by adopting Heckman’s two-stage regression to address sample selection bias and IV regression to address endogenous treatment effects. Several studies have also adopted lagged independent variables and subsample analysis to address endogeneity. FE regression that controls for firm characteristics is also adopted by several studies to address endogeneity. Other studies have used 3SLS and difference in difference (DiD) regression to address endogeneity. Few studies have applied the propensity score matching method (PSM) to randomize the endogenous treatment variables in the absence of reliable IV instruments. These studies are all listed in Table 2. Li (2016) extensively addresses the endogeneity issue to empirically investigate CEO power on corporate governance factors and recommends GMM, IV, and FE models as the top models to address this issue. This study also recommends including meaningful control variables in addition to firm fixed-effects and year fixed-effects. However, not all the studies reported in Tables 3, 4, 5, 6 have tackled endogeneity. Endogeneity concern is a prominent issue of corporate governance research models. Hence, research related to CEO power literature should adopt one or two of the above-mentioned models that address endogeneity. Results of the studies that have not adopted any of these models to tackle endogeneity should be considered with some skepticism. These studies can be identified by observing the methodology columns in Tables 3, 4, 5, 6.

6 CEO power and firm performance

Several studies examine how CEO power affects firm performance by considering Finkelstein’s (1992) four categories of CEO power discussed in the previous section. Table 3 reviews all the studies that examine CEO power and firm performance.

Simsek (2007) advances that CEO tenure has a favorable effect on firm performance by directly impacting TMT’s risk-taking initiatives. Tien et al. (2013) examine the four categories of CEO power and find that CEO duality adversely affects while CEO tenure increases long-term pay and leverage. They also find that CEO directorship and total pay positively influence firm performance. Ting et al. (2017) observe that CEO tenure has a favorable impact on bank performance, whereas CEO duality negatively impacts firm performance. They also find evidence suggesting that strong political connections could be forged through CEO expert or prestige power. Chiu et al. (2021) report that CEO founders and CEO duality with more knowledge capital are more effective than insider CEOs in improving productivity and resource deployment, which is more pronounced during the global financial crisis. Ahsan et al. (2022) also identify that powerful CEOs (proxied by CEO duality) could create firm value through CSR by aligning the CSR practices with the long-run firm objectives. Veprauskaitė and Adams (2013) examine all four categories of CEO power on the UK firms’ performance and show that CEO duality, tenure, ownership, and ownership concentration all adversely impact on firm performance. So, overall, the empirical evidence about the consequence of the distinct types of CEO power on firm performance is varied. In a related study, Li (2016) reports that CEO power decreases firm performance, and Li et al., (2018) find that the positive effect of firms’ ESG initiatives on firm value is enhanced by powerful CEOs.

Other studies of CEO power on bank performance observe a significant positive impact on bank profitability, asset quality, and insolvency risk in the context of the credit and sovereign debt crises (Mollah and Liljeblom 2016). In a similar vein, using a sample of different Chinese banks in terms of ownership structure, Fang et al. (2020) report that CEO power improves bank performance in terms of profitability, lending quality, and risk-taking ability. This study also shows that board strength measured by the percentage of foreign directors and board independence could curb the favorable impact of CEO power on these bank performance indicators. Within the same context of firm ownership, Le et al. (2022) demonstrate that firms with high foreign ownership have witnessed a positive and significant effect of CEO power on earnings management.

As mentioned in Sect. 2, Bebchuk et al. (2011) use CPS to measure CEO power and report that CPS can explain a range of corporate performance indicators. Specifically, CPS is linked to lower Tobin’s Q, reduced accounting profitability, lower stock return after the acquisition announcement, inferior performance to CEO turnover, and a drop-in stock returns following proxy statement filings in periods of high CPS. As shown in Sect. 2, subsequently, several studies have adopted CPS as the proxy of CEO power.

In an earlier study, Adams et al. (2005) show that CEO power leads to more variability in firm performances measured by stock price variability in terms of best and worst performances, and this is prominent in firms where the CEO is also the founder. This study also suggests that dilution of CEO power, as advocated by governance literature, would be costly and reduce the chances of remarkable performances. In a comparable study, Ting (2013) also notice that volatility is lower for firms with less successor power and higher announcement period abnormal returns are generated when the power level is the same between these successors and predecessors. In a related study, Tang et al. (2011) find that dominant CEOs bring varied strategies that lead to extreme performances. They also show that dominant CEOs with powerful boards could positively affect firm performance, while with less powerful boards, it could lead to negative effects. Using data from US publicly traded firms, Tang and Crossan (2017) observe that distressed firms have a higher likelihood of hiring dominant CEOs, and these dominant CEOs have a lower likelihood of initiating strategic changes during distressed conditions but bringing additional strategic changes in normal state. Taking a similar dataset, Tang (2021) suggests a novel proxy of CEO self-discipline in power useFootnote 5 and shows that this measure leads to the favorable consequence of CEO power on firm performance. Saleh et al. (2022) find that the positive relation between institutional ownership and firm value is more pronounced in the presence of powerful CEOs. Buyl et al. (2011) find that CEOs with higher shared experience would assist TMT functional diversity in improving performance compared to CEO power stemming from their founder status. In a similar vein, Park et al. (2018) examine a sample of big Korean firms and report that CEO power worsened the adverse impact of CEO hubris on firms’ outcome, whereas vigilant board moderated this effect. Chiu et al. (2022) examine the impact of CEO power on the relationship between operational efficiency and organization capital. The authors report that when the firm’s CEO is also the founder, a higher level of investment in organization capital will increase firm value. On the contrary, when the firm’s CEO is the only insider on the board, a higher level of investment in organization capital to protect their position could reduce firm value. In firms with even more powerful CEOs (who combine CEO founder, CEO-only insider, and CEO duality), the negative effect of a higher level of investment in organization capital on future firm value is even larger. Taken together, these studies suggest that CEO power measured by different measures may not always lead to agency costs and could actually improve firm performance under certain conditions.

Some studies have examined whether the influence of CEO power on firm performance could be mediated by corporate governance mechanisms. For instance, using a sample from Fortune 500 firms, Daily and Johnson (1997) observe that CEO power and firm performance are intertwined and find that the number of independent directors does not increase firm performance. Harjoto and Jo (2009) report that CEO power has an unfavorable influence on firm value and operating performance in the early stage of firms’ life cycle and positive effect in the mature stage of firms’ life cycle, thereby lending support to life cycle theory. This study also indicates that external monitoring by institutional investors could curb the negative effect of CEO power in comparison to internal monitoring through board independence and blockholder ownership. Cormier et al. (2016) document that strong CEO power could lead to financial misreporting, and corporate governance mechanisms in terms of board independence proved ineffective in curbing this. However, Duru et al. (2016) observe that CEO duality adversely affects firm performance because of entrenchment, but independent directors could moderate this. In a related study, Haynes et al. (2019) show that CEO power has an adverse consequence on firm performance regarding the functioning of internal and external corporate governance processes. This study also shows that this negative influence is moderated by board monitoring and Sarbanes Oxley (SOX) statute. Colak and Liljeblom (2022) examine the impact of CEOs’ tenure on firm performance after the replacement of the CEO. Their results indicate that preceding CEOs’ tenure negatively impacts operating performance and stock returns and is associated with higher restructuring costs, larger asset write-offs, and slower firm recovery. Moreover, weaker corporate governance, along with a long tenure of preceding CEOs with lower skills, intensifies the reported effects.

Few studies have shown the influence of board gender diversity on CEO power and find contrasting results. Harper et al. (2020) report that CEO power is alleviated after a firm undergoes a stock price crash, and female CEO power is curbed after the crash compared to male CEOs. Saiyed et al. (2023) attempt to examine the effect of CEO power on entrepreneurial orientation (EO) and find a U-shaped association between EO and firm performance. However, this is negatively moderated by CEO power. This suggests that CEO power has a favorable impact only at lower levels of EO. Shahab et al. (2020) note a reverse causal effect as they report that CEO power aggravates stock price crashes. However, this effect is alleviated in a gender-diverse board characterized by a critical mass of three or more directors and with high ownership by blockholders and institutions.

Conversely, Usman et al. (2018) and Brodmann et al. (2022) observe that CEO power increases with board gender diversity as female directors are weak monitors and suggest legislative gender quotas on boards could be implemented on ethical and social grounds but not from the perspective of economic advantage. Brodmann et al. (2022) further observe that the positive effect of CEO power on gender diversity is higher in younger and larger boards and the presence of a higher level of institutional ownership. Brodmann et al. (2021) show that CEO power has an adverse effect on corporate sexual orientation and equality policies measured by corporate equality index score.

Several studies have examined CEO power on firm performance in the context of different environmental factors. For instance, Abebe et al. (2011) show that CEO power leads to increased corporate turnaround for firms in a stable environment but negative turnaround for firms in a dynamic environment. Sheikh (2018b) examines whether CEO power has a different consequence on firm performance depending on whether firms are driven by high and low product market competition. This study reveals that CEO power has a favorable impact on firm performance only in markets with high competition. Conversely, Han et al. (2016) report the unfavorable impact of CEO power on firm performance during exogenous shocks characterized by industry downturns and recommend a dispersed decision-making structure during such exogenous shocks. In a similar vein, Gunasekarage et al. (2020) report that CEO power has a varying influence on firm performances for different firms categorized by the Boston Consulting Group (BCG) matrix. Specifically, this study reports that CEO power has a favorable and substantial influence on firm performance for firms characterized by high growth and high market share and for firms with high growth and low market share and has an adverse effect in the low growth/ high market share category. The results are insignificant for the low growth/low market share category.

Other studies of CEO power and firm performance look into corporate divestiture (Brahmana et al. 2021), outside versus inside CEOs (Zhang and Rajagopalan 2010) and endogeneity issues (Li 2016). Brahmana et al. (2021) report that CEO power could curb the adverse effect of corporate divestiture on firm performance and lends support to the entrenchment hypothesis of agency theory and suggests that incentives and bargaining power of CEOs are plausible reasons behind this result. Zhang and Rajagopalan (2010) observe that the effect of CEO power on firm strategic change is positive when this change is from low to moderate and negative when this change is from moderate to high, and this is more prominent for firms with outside CEOs.

7 CEO power and executive compensation

Table 4 reviews all the studies on CEO power and executive compensation.

Westphal and Zajac (1995) find that when CEOs and boards have similar demography, it increases CEO compensation. Choe et al. (2014) observe that CEO power leads to a rise in CEO salary, and in the absence of salary constraint, CEO stock-based compensation is not related to CEO power. CEO power leads to a rise in stock-based compensation in cases with a salary cap. These results hold only when CEO power is gauged by CPS, thereby supporting managerial power theory. In a related study, Tian and Yang (2014) report that CEO power is linked to CEO incentives over a reasonable portion. They also find that although bank CEO compensation fell during the 2008 financial crisis, it was better than firm performance. Similarly, using the CEO power index, Hill et al. (2016) find that powerful CEOs could cause excessive CEO compensation. In related research, Elhagrasey et al. (1999) aim to examine whether CEOs use political power to sway boards’ compensation choices and show that there is indeed a favorable influence of CEO power proxied by CEO tenure, CEO duality, and CEO compensation. Specifically, this study finds that CEO tenure strongly influences CEO compensation for large and high-performing firms. At the same time, CEO duality has a more substantial impact on smaller and low-performing firms. They also report multiple determinants of CEO compensation, thereby suggesting legitimacy in the compensation obtained by CEOs. Joura et al. (2022) find that shareholder voice could help to reduce the pay gap between CEOs and other executives, but CPS tends to increase the pay gap whereas duality has no direct impact on the pay gap, but it indirectly affects the pay gap through enhancing the effectiveness of shareholders’ say on pay. This study also finds that older or female CEOs tend to reduce the pay gap. Bugeja et al. (2017) find that the CPS of successor CEOs is like that of outgoing CEOs, and most firms are efficient in reducing excess CPS, thus refuting managerial power theory and supporting optimal contract theory.

Luo (2015) shows that CEO power did not cause an increase in executive compensation in Chinese banks. In addition, this study reveals that ownership structure substantially affects executive compensation and attributes this to the distinct corporate governance mechanism of Chinese banks. Zhu et al. (2021) show that CEO power causes a reduction in the CEO-Chair pay gap; however, this relation is moderated by the Chair-CEO age gap. They also find that the dampened impact of Chair-CEO age disparity is weakened with the rise in working time between the CEO and Chair. In addition, their result also supports the view that powerful CEOs would negate the Chair-CEO age disparity on Chair-CEO pay gap. This study provides crucial corporate governance implications on the board supervisory role through the cognitive conflict of Chair-CEO age disparity.

Boyer (2005) attempt to analyze the puzzling paradox of high CEO compensation at a time when shareholders’ value creation should be the norm. This study provides an alternative rationalization of this paradox by showing that financial markets that are supposed to discipline managers are instead conspiring with opportunistic CEOs to provide higher compensation through stock options. Another research on public outrage regarding executive compensation reports that powerful CEOs use performance-vested stock options (PVSO) early when there is public outrage over executive compensation, albeit this could be detrimental to shareholder value creation (Abernethy et al. 2015). Pollock et al. (2002) study the consequence of CEO power on the repricing of executive stock options and find that CEO duality boosts the chances of repricing when the spread between strike price and stock price is higher. In comparison, the other pointers of CEO power used in the study, which are the number of board members hired by the CEO, staggered board, percentage of voting shares by CEO, and institutional investors, reduce the likelihood of repricing. Ryan and Wiggins (2004) show that directors’ equity-based compensation is reduced by CEO power, whereas board independence tends to increase this.

Kalyta and Magnan (2008) find that supplemental executive retirement plans (SERP) benefits are widespread and considerable across CEOs, and CEO power significantly augments the SERP benefits. They also report that CEO SERP benefits increase significantly in the last year before CEOs’ retirement. Kalyta (2009) extends this research by taking eight proxies of CEO power and reports that greater CEO power is associated with higher CEO compensation via SERPs, thereby supporting managerial theory. Moreover, CEOs reduce R&D expenditures for the years before retirement when SERP benefits depend on firm performance.

Henderson et al. (2010) show that when firms undergo layoffs, powerful CEOs face lower cuts in bonuses and more equity-based compensation than less powerful CEOs. They also document that CEO power does not lead to a substantial difference in post-layoff performance. Ntim et al. (2019) examine whether CEO power and corporate governance mechanism moderate PPS and find that PPS increases in firms with robust governance, thus supporting the optimal contract theory. Mainly their evidence shows that firms with reputable founder CEOs and CEOs with high ownership with independently appointed nomination and remuneration committees have higher PPS than firms with powerful CEOs, long tenure, and larger board size. They also find support for the managerial power hypothesis as their results show a direct causal link between executive pay and performance, albeit comparatively small PPS.

8 CEO power and firm risk-taking

Few studies have examined the consequence of CEO power on firm risk-taking. Table 5 reviews all the studies that examine CEO power and firm risk-taking.

Chintrakarn et al. (2015) show that the relationship between firm risk-taking is nonmonotonic. This study finds that at low levels of CEO power, firm risk-taking is minimal, and firm risk-taking increases only when CEO power is above the 75th percentile of CPS. Lewellyn and Muller-Kahle (2012) show that CEO power positively impacts firm excessive risk-taking. They attribute this to a corporate governance mechanism guided by agency theory that drives managers to take excessive risks. Sheikh (2019b) also shows that CEO power positively influences firm total and idiosyncratic risk when the firms have robust corporate governance mechanisms and strong external discipline through increased product market competition. In a similar vein, it has been reported that bank risk-taking increases with powerful CEO, and this effect is strengthened by institutional investors and poor balance sheets (Altunbas et al. 2020). This study suggests that when it comes to bank risk-taking, the goals of the powerful CEOs are aligned with those of the institutional investors. This study does not find corporate governance characteristics like board size and board independence to moderate this effect. Shabir et al. (2023) report that powerful CEO with a strong board alleviates the negative impact of economic and geopolitical uncertainty on bank risk. However, this result is true for large banks with higher liquidity and profitability. Pour et al. (2023) show that CEO power positively affects bank risk-taking in the presence of individualism and uncertainty avoidance. Zhao et al. (2023) show that firms’ ESG performance alleviates firm risk, and this relationship is stronger with CEO power and lower institutional investor holdings. In a related study, Menla Ali et al. (2023) show that ESG disclosure negatively impacts firm risk, which is more pronounced for market-based risk rather than accounting-based risk in the presence of powerful CEOs. This study also reports that firms’ reputation, information transparency, and internal control are channels by which ESG performance affects firm risk. Korkeamäki et al. (2017) examine whether CEO personal leverage leads to heightened firm leverage, and they find the result to be affirmative for higher CEO power characterized by long-tenured CEOs and CEO-Chair duality. However, they find that this result does not hold for those CEOs whose significant percentage of wealth is linked to the firm and also in the presence of blockholders.

Zou et al. (2021) distinguish between formal and informal CEO power when testing their relationship with firm risk. They find that CEO ownership and CEO founder status (formal power) positively relate to firm risk. In contrast, CEO’s expertise captured by CEO tenure (informal power) has a negative relationship with firm risk. CEO duality, CEO social ties, and CEO educational level do not display statistically significant results. Moreover, corporate social responsibility has a mediating role in the relationship between CEO power and firm risk.

In contrast, Pathan (2009) reports that CEO power adversely impacts bank risk-taking. This study also shows that bank risk-taking is positive, with strong boards characterized by reduced board size and fewer restrictions. Tan and Liu (2016) construct a CEO power index and show an inverse relation between managerial power and idiosyncratic volatility. This study further suggests that powerful managers undertake their vested interests under market limitations at the cost of shareholder wealth creation since shareholders cannot gauge managerial endeavors. Drawing from the organizational and behavioral theory perspective that individual choices are radical, Haider and Fang (2018) also report that CEO power adversely influences firm risk-taking, proxied by total risk and idiosyncratic risk. This result is moderated by the presence of large shareholders, thereby supporting the agency theory that large shareholders can supervise and sway management. However, CEO power and firm risk-taking differ across state-owned and non-state-owned enterprises.

Using data from US firms, Liu and Jiraporn (2010) document that bondholders find CEO power to be crucial in determining bond financing. Particularly they perceive that powerful CEOs create an opaque information situation, demanding higher bond yields. In a related study, Huang and Gao (2022) find that CEOs formal power led to a rise in firms’ debt policy persistence while CEOs’ informal power has the opposite effect, and this is more pronounced for CEOs’ formal ownership power and CEOs’ informal financial expert power.

9 CEO power and other corporate strategies

This section reviews all the other literature on CEO power and corporate strategies. The review of all these studies is shown in Table 6.

9.1 CEO power and governance structure

Sanders and Carpenter (1998) report that long-tenure CEO pay, CEO non-duality and large boards help firms to deal with information-processing demands and agency problems stemming from the internationalization process. Bigley and Wiersema (2002) attempt to integrate corporate governance research with upper echelon theory and shows that powerful CEOs maintain the status quo instead of refocusing firms’ business portfolio as heir apparent experience increases. However, when CEO power is measured by CEOs’ prestige power, that is, the number of outside directorships held by the CEO, this result is negated. Deriving from resource dependence theory, Haynes and Hillman (2010) explore how the breadth and depth of board capital impact firms’ strategic change and whether CEO power curbed this. The results partially support that CEO power moderates the consequence of board capital breadth and has no impact on board capital depth. Specifically, CEO power curbs the influence of board heterogeneity on strategic divergence.

In another study of CEO power and governance structure, by constructing a CEO power index using ten distinctive characteristics, Lisic et al. (2016) show that the effectiveness of audit committee decreases with CEO power, and this is more pronounced when CEOs extract more rent from the firm through insider trading. In a similar vein, Kim et al. (2017) looks into the post-Sarbanes–Oxley period and find that having an accounting expert on the audit committee could improve the auditing process as it leads to a comprehensive audit process. However, CEO power acts as an impediment to this process. Extending this line of research, Al-Dhamari et al. (2022) advance that powerful CEOs weaken the favorable impact of the overlap between audit and remuneration committees on the cost of debt.

Combs et al. (2007) adopt event study methodology to measure the interaction of board composition and CEO power in the event of CEO deaths. They report that in the event of deaths of high (low) powered CEOs, the market reacted favorably (unfavorably) when the boards were governed by inside directors and unfavorably (favorably) when outside directors governed the boards. Overall, their results suggest that although regulation favors board independence, it may not be favorable to shareholders. Hence, the level of CEO power should be considered while determining board independence. In a related study, Dowell et al. (2011) advance that one size fits all governance structure is unsuccessful in the context of examining the collapse of publicly traded internet firms. Specifically, this study conducts event history analysis and shows that CEO power and smaller boards create a unity of command which is advantageous for fast decision-making for firms facing financial distress. Deriving from theories of institutional logic and structural elaboration, Joseph et al. (2014) assert that CEO-only structure is prevalent among firms with more insiders in the board. This study further contends that although a CEO-only structure is in line with the shareholder value logic, it is favored by powerful CEO to remove insiders who are voices of dissent.

Another study on CEO power and board leadership suggests that CEO power diminishes the positive influence of board leadership on firm strategy (Tuwey and Tarus 2016). Graham et al. (2020) investigate CEO power and board dynamics and report that when performance is weak, powerful CEOs are unlikely to be removed, and in the event of the death of powerful CEOs, market reaction is positive. This study also finds that board independence increases with the hiring of a new CEO, as new CEOs are likely to have a lower power to bargain, and board independence decreases with an increase in CEO tenure. Lewellyn and Fainshmidt (2017) suggest that CEO duality or non-duality is strengthened or counterbalanced by other types of power embedded in the CEO. They show that CEO duality bundled with information power provides effective corporate governance when it is moderated by high organizational and industry discretion. Conversely, CEO non-duality is effective when high organizational and industry discretion is absent. Graham et al. (2020) show that CEO power measured by tenure is inversely linked to board independence, and this gets weaker during uncertainty. They also find that higher CEO tenure increases the likelihood of CEO duality and reduces the chance of the CEO getting replaced in the event of poor firm performance. In addition, they show that stock market reaction is positive when powerful CEOs die, consistent with the results of Combs et al. (2007) discussed above.

Krause et al. (2016) investigate cultural power distance and CEO power and advance that shareholders determine firms’ legitimacy, and customers also have a crucial role. In this context, they argue that customers of firms competing in a high-power-distance culture view increased CEO power as legitimate, and this is more prevalent for firms that rely on their customers. Another study on CEO and culture investigates hand-collected data from 37 countries and observes that CEO retention is higher in hierarchical countries (Urban 2019). These CEOs have idiosyncratic management styles, and their greater power reduces firm governance.

Bristy et al. (2022) examine the impact of CEO power on labor-friendly policy. According to their findings, CEO power, captured by a CEO power index, is negatively related to labor-friendly policy without affecting firm value. However, powerful CEOs invest more in labor-friendly programs in the cases of a competitive market, innovation-intensive firms, and union-intensive industries, resulting in higher firm value.

9.2 CEO power and CEO succession

Some of the earlier studies by Westphal and Zajac (1995) and Zajac and Westphal (1996a, b) report that when CEOs are more (less) powerful than the board, new directors are hired with similar demographic similarities as the CEOs (board). This supports the social psychological perception that CEOs and boards use their power to hire directors with similar philosophies to avoid the chances of dissent. However, this result is at odds from a political standpoint as studies on corporate governance attribute political motives only to CEOs and not to board members. Another study finds that in firms with inferior performance, outside directors facilitate the exit of an heir apparent to restrict the sway of incumbent CEOs. In contrast, outside directors protect the heir apparent for firms with high performance and prevent the incumbent CEOs from abusing power (Cannella and Shen 2001). Horner and Valenti (2012) show that incoming and outgoing CEOs are the strongest players in the CEO nomination process. Firms looking to have CEO-Chair duality would hire CEOs with prior Chair experience, and outgoing CEOs with long tenure reduce the chance of CEO-Chair duality for incoming CEOs, suggesting that powerful CEOs can manipulate the succession process. Zajac and Westphal (1996b) show that powerful directors who enjoyed significant control over the board would like to move to companies where they can exert similar control. In addition, this study finds that directors who have faced governance changes prefer to move to firms with powerful CEOs and weaker boards.

Using a model of project appraisal, Baldenius et al. (2014) find that shareholders tend to nominate more advisors to the board to curb CEO entrenchment. In contrast, powerful CEOs could dictate the nomination process and create a monitor-heavy board to prevent information cascading to shareholders. This study reports that board monitoring negatively affects firm performance. However, the relationship is driven by firm attributes like agency issues. Zhang et al. (2011) report that non-CEO executives are expected to be dismissed and exit from TMT if they have higher age and tenure than CEOs, and this is exacerbated by firms with founder CEOs and poor performance and alleviated by CEO ownership.

9.3 CEO power, investments, and acquisitions