Abstract

Previous literature has explored investment efficiency in terms of executive incentives, supervisory mechanisms, information disclosure, agency conflicts, and managerial capabilities. This study focuses on analysing the power influence of executives in the context of Chinese State-Owned Enterprises (SOEs) from the two hypotheses of “economic man” and “social man”, aiming to improve the research between the power influence of executives and investment efficiency. This study adopts principal component analysis to comprehensively evaluate the power influence of executives in Chinese SOEs from four dimensions, namely, organisational position influence, personal competence influence, industry influence, and prestige influence. Using the analytical tool STATA15 to establish a regression model, the mechanism of executive power influence on investment efficiency is explored from the logic of “financing constraints” and “diversification”. It then explores the moderating effects of equity concentration and independent director oversight. The empirical results show that the greater the power influence of the executive, the lower the investment efficiency. The intermediary mechanisms of this study find that executives of Chinese SOEs can use their power influence to reduce financing constraints, obtain more resources, and make diversified investments, thus generating inefficient investments. This study also finds that equity concentration and oversight by independent directors have a positive moderating effect on executive power and investment efficiency. The results of this study are robust due to the use of the instrumental variables approach. The innovation of this study integrates the measurement of executive power influence in the particular context of SOEs and analyzes its impact on investment efficiency. It enriches the study of factors influencing executive power and corporate investment efficiency.

Similar content being viewed by others

Introduction

In the Fortune 500 list for 2022, there are ninety-nine Chinese SOEs, of which four are ranked in the top ten. Only eighty Chinese SOEs in the Fortune 500 list by 2020. Showing an increasing trend year on year. Chinese SOEs are important carriers of Chinese state-owned assets and important pillars of Chinese economic development, contributing indispensable strength to Chinese transformation from a state subject to a social subject. In 2022, at the 20th National Congress of the Communist Party of China, General Secretary Xi Jinping emphasised “deepening the reform of state-owned capital and SOEs, accelerating the optimisation of the layout and restructuring, promoting state-owned capital and SOEs to become stronger, better and larger, and enhancing the core competitiveness of enterprises.” Improving the efficiency of capital investment in SOEs is at the heart of deepening the reform of SOEs. However, because of diversified target systems, soft budget constraints, managerial appointment mechanisms, and rigid pay controls, SOEs have experienced an “efficiency paradox” of increasing operational efficiency but decreasing profitability (Lu and Peng 2015).

The role of executives in business largely depends on their performance of power (Na et al. 2022). Executive power determines the ability of enterprises to obtain and allocate resources. It is well known that executive power comes not only from within the enterprise, but also from its voice in the industry, personal prestige and the ability to obtain preferential policies and resource elements from the government (Zhai et al. 2023). Executive power is comprehensive. SOE executives in China have the status of quasi-government officials, and SOE leaders and government departments can often be interchanged. As decision-makers and senior managers of SOEs, executives decide the direction of development and investment decisions, directly impacting their investment efficiency. Existing research findings are not sufficient to reflect the power of SOE executives in the Chinese institutional context. Therefore, understanding the internal rules of the executive power’s influence on SOEs and studying their impact on corporate performance in this paper is very valuable at both theoretical and practical circles.

In modern corporate context, the relationship between executive power and investment efficiency has been studied from these two perspectives, namely, the principal-agent problem and personal characteristics of executives.

The first is the relationship between executive power and investment efficiency, based on the principal-agent problem. Executive power may increase corporate efficiency (Guo et al. 2020) or may generate non-efficient investment behaviour due to personal promotion, opportunism, etc. Lu et al. (2016) found that political promotion incentives can cause SOE executives to cater to the performance needs of local governments and implement over-investment at the expense of long-term corporate interests. Xie et al. (2023) found that due to strict performance requirements, less regulation, and less negative information interference, SOE management subject to equity incentives will increase corporate tax avoidance and improve performance. Dong and Li (2014) argues that, for personal reputation reasons, executives may tend to increase investments that enhance the short-term performance of the firm and reduce long-term investment projects that are risky and slow to yield results, leading to under-investment. For managerial defence purposes, Sia and Chen et al. (2011) argue that executives may choose projects that are good at maintaining a strong position for themselves irrespective of poor business performance, leading to under-investment.

The second is the relationship between executive power and investment efficiency, based on the personal characteristics of executives. Zhang and Jiang (2015) found that the stronger the personal ability of executives, the more they can alleviate the act of blindly following the investment decisions of other companies in the industry, reduce under-investment and over-investment, and improve capital allocation efficiency. Ullah et al. (2021) analysis from a gender perspective revealed that FCEO is more focused on curbing over-investment when making investment decisions and plays no role in improving the investment efficiency of SOEs. Studies of SOE executives found that they are civil servants dispatched by the state and government and have higher decision-making power, which can easily breed corruption and affect corporate performance. Executives of SOEs in China are civil servants dispatched by the state and government and have higher decision-making power, which can easily breed corruption and affect the performance of enterprises (Zhang et al. 2021; Zhang and Song 2021). Some scholars oppose the view that the participation of party organisations in corporate governance is an important feature of corporate governance of SOEs, and that party political governance has a restraining effect on management power and reduces the possibility of over-investment in enterprises.(Shu and Huang 2021; Yin et al. 2020).

A literature review of executive power and its relationship with investment efficiency reveals that most studies analyse the impact of executive abuse of power on corporate decision-making and firm value from the perspective of self-interest, such as executive private gains, professional reputation, and risk avoidance. However, some studies also analyse the impact of executive power on investment efficiency from the perspective of corporate free cash flow. The existing literature defines a single dimension of executive power, considering only purely executive power, without considering it in terms of the ability to deploy external resources, and without taking into account the special situation of the quasi-official status of executives of Chinese SOEs. Meanwhile, existing research mainly focused on SOE executive power itself, and the indicators measured are usually positions held, executive tenure, board independence, shareholding structure, and capital structure.

For our research, this is a central motivation, as we believe that the influence of executive power not only takes into account the administrative authority itself, but also considers the influence of executive power. The research questions addressed in the present study are as follows: (1) What is the power influence of executives in SOEs? (2)How does the power influence of executives in SOEs affect their investment efficiency? (3) Will the role of the power influence of the executive be affected by other factors?

To achieve this goal, we take the Shanghai and Shenzhen A share-listed companies as samples from 2010 to 2018. To the best of our knowledge, this study is the first attempt to explore the association between the power influence of SOE executives and corporate investment efficiency from the perspective that SOE executives have the status of quasi-officials in the context of the Chinese system. We measure the power influence of SOE executives in four aspects: organisational position influence, personal ability influence, industry influence, and prestige influence. The power influence of executives discussed in this study can more accurately reflect the ability of executives to allocate resources in investment. In addition, it more truly reflects the impact of executives on investment efficiency, and is more in line with China’s institutional background. This study also adds scientific value by revealing the impact and mechanism of executives’ power influence on investment efficiency from the perspective of SOEs. Numerous studies have been conducted to understand investment efficiency in terms of executive incentives, monitoring mechanisms, information disclosure, agency conflicts, and managerial competence. This study contributes to that body of knowledge.

The core findings of this paper are the following. First, the power influence of SOE executives can inhibit investment efficiency. Second, SOE executives can use their power to obtain more financing resources. Third, executives tend to diversify their investment operations when there are too many resources, resulting in inefficient investment. Fourth, the equity concentration of SOEs and the supervision of independent directors have a positive moderating effect on the positive relationship between the power influence of SOE executives and investment efficiency.

The remainder of this paper is organised as follows: Section 2 discusses the theory and hypotheses in the purview of extant literature; Section 3 presents the data and methodology; Section 4 illuminates the empirical results; and Section 5 concludes the findings of the research study.

Theoretical analysis and hypothesis development

Theoretical analysis: power influence of executive and investment efficiency

Based on the special holding structure of SOEs in China, the positions of SOE executives are usually tinged with administrative appointments, with some central enterprises’ chairmen, party committee (party group) secretaries, and general managers appointed by the Central Organisation Department of the Communist Party of China (CPC) and local organisation departments, similar to appointment and removal procedures for general cadres. Administrative interference by the government in corporate executives has led to a high level of non-market-based behaviour in SOEs, such as direct appointments, dismissals, and pay incentives. Therefore, combined with the special nature of property rights of SOEs, the special nature of SOEs as subjects of state-owned capital rights and the administrative overtones of management positions, SOEs take into account social benefits in addition to the pursuit of economic interests, and SOE executives are both “economic man” and “social man”.

Based on the assumption of “economic man”, the separation of ownership and management of an enterprise will give rise to a principal-agent problem. As an agent, the utility function of executives is not consistent with that of the principal, and there is a principal-agent conflict. Therefore, it is inevitable that executives of SOEs, who hold specific control and residual control of the enterprise, will take advantage of information asymmetry to seek control and private gains in business decisions. Because of principal-agent conflict and information asymmetry, SOE executives seek to maximise their personal interests, which manifests itself as inefficient investment at the expense of shareholders’ interests by extracting private profits.

Based on the assumption of “social man”, SOE executives are motivated by the desire to achieve personal fulfilment due to their special status as quasi-officials. They do so by dealing with uncertainty, assuming responsibility, establishing authority, or gaining promotion in executive rank. When the government examines candidates, performance is easily quantifiable and is the main basis for cadre promotion and selection. Corporate performance is positively related to SOE executives’ political promotion. SOE executives are not utilitarians in economics; their pursuit of social and personal motives, such as their dignity and self-worth realisation, makes them dedicated and enhances their collectivist tendencies. Driven by the motivation of collective interests, SOE executives will maximise organisational interests, tend to serve altruistically in their business decisions, exhibiting the stewardship behaviour of investing in efficiency to maximise organisational interests (Yi et al. 2022), which can simultaneously achieve personal benefits and satisfy a sense of personal achievement.

Based on agency theory, stewardship theory, and the quasi-official status characteristics of SOE executives, this study proposes competing hypotheses H1.

H1a: Other things being equal, the power influence of SOE executives is positively related to the efficiency of corporate investment, i.e. the greater the power influence of SOE executives, the greater the incentive for firms to choose efficient investment.

H1b: Other things being equal, the power influence of SOE executives is negatively related to the efficiency of firms’ investment, i.e. the greater the power influence of SOE executives, the greater the incentive for firms to make inefficient investments for personal gain.

Intermediary mechanism: financing constraints and investment diversification

The first intermediary mechanism is the financing constraints. SOEs tend to enjoy preferential interest rates and lower financing costs. The China Private Enterprise Finance Environment Report (2020) shows that private companies accounted for only 12% of SOEs in the 2018 average financing size data. From the perspective of securing external resources, SOE executives have a quasi-official status. The higher the level of SOEs executives, the more power influence they have, and the more beneficial it is for companies to seek more government grants, bank loans, and so on. In the current situation where banks in China are suspicious of small-scale enterprises and love the big-scale ones. The government is keen to create leading enterprises. The more powerful and influential the SOE executives in and out of the industry, the easier it is for companies to obtain preferential bank loans and government grants. Therefore, the more powerful and influential the executives of SOEs, the more government subsidies they can obtain, and face fewer financing constraints.

The second intermediary mechanism is diversification of investments. SOEs tend to enjoy more preferential interest rates and lower financing costs. According to Wind database and Evergrande Research Institute, the total financing scale of listed SOEs, private enterprises and public enterprises in China is 14.7 trillion, 8 trillion and 1.4 trillion respectively, with SOEs occupying the dominant position. The financing advantages created by the power influence of SOE executives and the SOE soft budget constraints provide conditions for SOE executives to diversify investments. SOE executives may be inclined to implement diversification strategies (Wu et al. 2008). Usually, SOEs, especially large SOE groups, are tasked with the important mission of “getting bigger and stronger” and improving international competitiveness. Thus, given the small financing constraints and soft budget constraints, SOE executives have the urge to diversify their investments to grow their enterprises. On the one hand, diversification can reduce investment risks and improve investment efficiency; however, on the other hand, diversification may be a speculation that deviates from the main business and is a means to expand the scale of operations, build a “corporate empire” and seek more personal gains. Excessive diversification can lead to a large organisational size and inefficient information transfer, resulting in inefficient investments that can undermine corporate value or performance (Yao et al. 2004). Therefore, in the case of SOEs with small financing constraints and soft budget constraints, the greater the power influence of SOE executives, the more funds can be mobilised and allocated for diversification, and the more serious the inefficient investment.

Based on the above analysis, hypothesis H2 is proposed.

H2a: Other things being equal, the greater the power influence of SOE executives, the smaller the financing constraints.

H2b: Other things being equal, fewer financing constraints incentivizes SOE executives’ to diversify stronger, generating more inefficient investment.

Regulating mechanisms: equity concentration and independent director oversight

High levels of equity concentration are common in both SOEs and non-SOEs. A relatively concentrated shareholding structure provides a check on senior management’s power. As equity concentration increases, the less likely it is that major shareholders will want to get out and sell their stakes, and they will monitor the operators more vigorously and rationally for their own benefit and the enterprise’s benefit, thereby improving investment efficiency (Wang et al. 2021). State-owned Assets Supervision and Administration Commissions (SASACs) act at all levels as the de facto controllers of SOEs. The higher the concentration of equity in SASACs, the greater the power influence of executives, the stronger the influence of executives on corporate investment, and the more likely they are to make inefficient investments. Based on this, hypothesis H3 is proposed.

H3: The concentration of equity in effective control of SOEs has a moderating effect on the relationship between executive power influence and investment efficiency in SOEs.

Effective corporate governance mechanisms can constrain the motivation and behaviour of SOE executives in pursuit of personal interests (Zhang 2015; Zheng et al. 2019). Among the governance structures of SOEs in China, the most characteristic is the governance of party organisations. As the subject of this study is SOEs, all samples have party governance, which is undifferentiated. The number of independent directors and their share of the board of directors are differentiated. Thus, this study focuses on whether the monitoring role of independent directors affects the relationship between the executives’ power influence and investment efficiency of SOEs. Based on this, hypothesis H4 is proposed.

H4: The monitoring role of independent directors moderates the relationship between executives’ power influence and investment efficiency in SOEs.

Data, measurement, and research methodology

Sample selection

This study uses state-owned listed companies whose actual controllers in Shanghai and Shenzhen A-shares are SASACs at all levels. The research sample is from 2010 to 2018. The reason for the sample selection from 2010 is that the Law of the People’s Republic of China on Enterprise State-owned Assets was officially implemented on 1 May 2009. The law clarified the subject position of the SASACs system among the institutions performing capitalist duties. It regulated the legal relationship between the institutions performing the duties of capital contributors and state-funded enterprises. According to the Letter of the National Bureau of Statistics on the Opinions on the Identification of State-owned Corporate Enterprises, this study distinguishes between state-owned listed companies and non-state-owned listed companies according to the nature of the actual controller. The state-owned listed companies analysed in this study are purely SOEs and state-controlled enterprises. As of 31 December 2018 there were 833 state-owned listed companies in Shanghai and Shenzhen A-shares, and to exclude the effect of outliers, the sample was processed as follows: ① excluding ST, *ST, and PT type enterprises among SOEs; ② deleting data of enterprises in the financial sector due to its own special characteristics which are significantly different from other industries; ③ excluding the data of enterprises in the financial sector during the study period where the auditor issued a rejection or negative opinions; ④ in the matching process, there were certain missing values in the databases of listed companies, so the missing values were deleted. Taking into account the impact that extreme values may have on the results of the study, this study applies a top and bottom 1% winsorizing to the main continuous variables, and 3654 company annual data of 451 state-owned listed companies were obtained. The financial data and executive information of the listed companies were obtained from the CSMAR and Wind databases, and company executives’ information was supplemented and checked through company annual reports and relevant online information.

Variable measures

Explanatory variable: power influence of SOEs executive

In the Chinese context, the power influence of SOE executive includes not only their ability to control the company internally but also their influence on the outside, such as influencing the industry, society, and government. Based on the special characteristics of SOEs and the synthesis of the existing literature, this study constructs indicators of the power influence of SOEs executive from four dimensions, as shown in Table 1.

First, the power influence of organisational position. (1) Administrative level: The power to appoint SOEs executives is largely controlled by the government. Because the roles of government officials and SOEs managers are often interchangeable in both directions, some government officials can be reappointed or promoted to SOEs executive, and SOEs executives can be promoted or reappointed to government officials(Prakash 2003). As a result, administrative levels still exist in SOEs. (2) Holding multiple positions: In the case of chief executive officer (CEO) duality, SOEs executives have a stronger ability to deploy resources within the enterprise, resulting in a greater influence of power. (3) Length of tenure: Tenure length is a measure of executive power in terms of time. The longer the tenure, the higher the prestige accumulated and the greater the influence of the executive’s personal power (Cash 2018; Kragt and Day 2020).

The second is the influence of power on personal competence. (1) Technical title: According to the existing literature, the higher the technical title of an executive, the more prominent the expertise and influence of the executive (Liu and Peng 2018). (2) Political capital: Executives with political capital can obtain policy, institutional support, and tilt by virtue of their good relationships with the government. Executive politics can lobby the government to develop and implement policies and institutions conducive to business operations, such as interest-free loans and land tenure, through their good relations with the government. Thus, political connections provide firms with more institutional and resource support and freedom to make decisions. At this point, executives with political resources have increased their power and influence. (3) Internal promotion: Due to years of accumulation, internally promoted executives have formed a mature network of power relations within the enterprise. Compared to executives parachuted into the company from outside, internally promoted executives have obvious advantages in terms of knowledge, information, experience, and internal contacts, which can enhance their power influence.

The third factor is industry influence. (1) Industry title: Executive influence represents a firm’s recognition in the industry and that society’s understanding of a firm’s business begins primarily with the perception of the executive (Graham et al. 2015). Executives who are leaders of industry associations have higher prestige and greater voice in the industry, are better able to coordinate the relationship between the company and other companies in the industry, coordinate disputes within the industry, and secure favourable policies from the government for the development of the industry. (2) Social influence: Weng and Chen (2016) found that both corporate reputation and executive reputation are beneficial to a company’s financial performance, and that the impact of executive reputation is more lasting and comprehensive. Wang et al. (2016) concluded that receiving honorary awards from professional bodies (e.g., Labour Medal, Outstanding Entrepreneur) would increase executive reputation, which has a positive effect on firm performance. Thus, the stronger the social influence of executives, the greater their power influence.

The fourth factor is the influence of prestige. The ability of executives to gain the support of their subordinates and staff internally depends not only on the power of their organisational position but also on their personal reputation. The higher the reputation of an individual, the more convincing he or she can be, and therefore, the higher the power influence(Jia et al. 2022). From an “economic human” rational point of view, the more a company’s employees earn than other companies in the same industry, the more the employees have a sense of belonging and pride in the company, and they will embrace corporate executives more often. On the contrary, the lower the income of employees in the same industry, the more frustrated the employees will be, and the more dissatisfied they will be with the management of the company. Therefore, this study selects the degree of employee support to measure the influence of executive prestige.

This study uses principal component analysis to comprehensively evaluate the power influence of SOEs executives. The weights of the four level indicators and nine secondary indicators, as shown in Table 1, in the prediction function of the power influence of SOEs executives are determined based on the contribution of each principal component. The power influence of SOEs executives can be calculated based on the weights of each indicator and the data collected for measurement. The contributions of each level and the secondary indicators are shown in Table 2.

That is, the measure of power influence of SOEs executives(Score) is expressed as:

Based on the weights of each indicator in Tables 1 and 2 and using Eq. (1), this study measured the power influence of 451 state-owned listed companies in Shanghai and Shenzhen A-shares from 2010 to 2018. Owing to space constraints, Table 3 lists only some of the measurements for 2018.

Explained variable: investment efficiency

With reference to Chen et al. (2011) and Chen and Huang (2019), we construct an expectation investment regression model to measure investment efficiency in terms of the difference between the actual investment expenditure value and the expected value obtained from the regression equation, and express the level of investment efficiency in terms of the regression residuals, as follows:

where the explained variables Invest is investment efficiency, Growth is firm growth, and NEG is a dummy variable that introduces an interaction term between NEG and sales revenue growth. The variables are listed in Table 4. The regression of Eq. (2) is estimated by year and industry, and the absolute value of the residuals is obtained and used to measure investment efficiency. Larger absolute values of the residuals indicate lower investment efficiency, whereas smaller absolute values of the residuals indicate higher investment efficiency.

Intermediate variables: diversified investments and financing constraints

The degree of diversification (Dhy) is measured by referring to Park and Kim (2016), and the Herfindel Index (HHI) for each firm’s business is chosen (Table 5). Specifically, this is the dispersion of firm size in the market, with a larger value indicating less diversification.

There are many ways to measure financing constraints (Fc), but most rely on financial indicators that are endogenous rather than directly related to financing constraints, potentially making the study’s findings biased. To avoid this shortcoming, this study refers to the method of Lu and Chen (2017), which use the absolute value of the SA index and take the logarithm to measure it. The larger the value, the greater the degree of financing constraint.

Moderating variables: equity concentration and independent director oversight

Referring to the study by Ling (2014), the sum of shareholdings of the second-largest shareholder to the tenth-largest shareholder of a company is used to measure equity concentration. The larger the indicator, the stronger the inhibitory effect of large shareholders on the influence of executive power. Independent director oversight (Sid) is measured as the ratio of the number of independent directors to the total number of board members.

Control variables

To control for the effects of other factors on investment efficiency, we select the gearing ratio (Lev), return on total assets (ROA), and cash holding level (Cash). This study controls for industry fixed effects (Industry) and time fixed effects (Year) because there may be unobservable factors that vary over time, such as policy changes.

The specific variables are defined as shown in Table 5 below.

Estimating model

Based on the theoretical analysis above, to test hypothesis H1, drawing on the study of Liu et al. (2018), and to avoid the time-varying nature of firm investment efficiency and firm heterogeneity, this study uses a control year and industry dual fixed effects model for empirical analysis and constructs the following mode.

where k is the number of control variables, ε denotes the random disturbance term, i denotes the firm, and t denotes the time.

Descriptive statistics

Table 6 presents the results of the descriptive statistics for the main variables. The mean Score was −0.008, the maximum value was 3.838, the minimum value was −0.742, and the standard deviation was 0.47, indicating that power influence varies significantly between SOE executives. Financing constraint (Fc) has a maximum value of 1.497 and a minimum value of 0.940, indicating that the degree of constraint in accessing financing varies widely across SOEs. The degree of diversification (Dyh) has a minimum value of 0.159, indicating a high degree of operational diversification, and a maximum value of 1.724 with a standard deviation of 0.469, which indicates a large variation in the way different SOEs operate and manage their businesses.

Results

Empirical regression results

To test H1, the greater the power influence of SOEs executives, the lower/higher the investment efficiency, regressions were conducted using model (1), and the results are shown in Table 7.

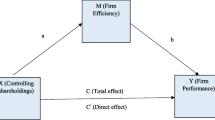

Analysis of intermediary mechanisms

A previous study shows that the greater the power influence of SOE executives, the lower the efficiency of corporate investment. To further analyse the mechanism of the power influence of SOE executives on enterprise investment efficiency and to test hypothesis H2a, models (4) and (5) are constructed based on model (3).

where Fc denotes the intensity of the firm’s financing constraint.

Columns (1) and (2) of Table 8 show the empirical results of the influence mechanism of financing constraints. The power influence of SOE executives (Score) is significantly and negatively related to the firm’s financing constraint (Fc) at the 1% level, indicating that SOE executives’ power influence reduces the firm’s financing constraint. The regression results in column (2) of Table 8 show that the coefficients of the regressions of financing constraints (Fc) and firms’ investment efficiency (Invest) are both significantly negative at the 10% level, indicating that the greater the power influence of SOE executives, the lower the financing constraints, and the more resources SOE executives can allocate using their power influence, which reduces firms’ investment efficiency. The H2a hypothesis in this study that the intermediary mechanism of financing constraints holds.

To further test the mediating mechanism of diversification in hypothesis H2b, i.e. SOE executives use their power and influence to diversify their investments, thus reducing the efficiency of corporate investments we construct models (6) and (7) based on model (3).

where Dyh denotes the degree of diversified investments.

The regression results in Column (3) of Table 8 indicate that the power influence of SOE executives (Score) is significant and positively related to the degree of diversification (Dyh), suggesting that the greater the power influence of SOE executives, the greater their investment in diversification (Dyh). Column (4) of Table 8 shows that the degree of diversification (Dyh) is significant and negatively related to the efficiency of the firm’s investment (Invest), indicating that the higher the degree of diversification, the less efficient is the firm’s investment. Therefore, the greater the power influence of SOE executives, the more inclined they are to adopt diversification, which reduces the investment efficiency of the firm. Thus, the hypothesis H2b regarding the intermediary mechanism of the degree of diversification holds true.

Analysis of regulating mechanisms

To further analyse the moderating effect of SOE equity concentration on the relationship between the power influence of SOE executives and investment efficiency, i.e. to test hypothesis H3, this study incorporates SOE equity concentration (Shr) and its interaction term with executive power influence (Score×Shr) on the basis of model (3). The regression results are presented in Column (1) of Table 9, which show that the regression coefficient of the interaction term between SOE equity concentration and power influence (Score×Shr) is significantly positive. This indicates that SOE equity concentration mitigates the positive relationship between the influence of SOE executives’ power and corporate investment efficiency. Thus, hypothesis H3 holds true.

In order to test hypothesis H4, this paper adds independent directors’ supervision (Sid) and its interaction term with executive power influence (Score×Sid) to model (3) to verify the moderating effect of independent directors’ supervision on the relationship between executive power influence and corporate investment efficiency. The regression results are shown in Column (2) of Table 9. The regression coefficient of the interaction term between independent directors’ supervision and the power influence of SOE executives (Score×Sid) is significantly positive, indicating that the higher the degree of independent directors’ supervision, the greater the influence of executive power on corporate investment efficiency in SOEs. This suggests that the relationship between independent director supervision and the power influence of SOEs executives and corporate investment efficiency has a positive moderating effect. Hypothesis H4 of this study holds true.

Robustness tests

To ensure the reliability of the results of this study, the following robustness tests were conducted:

First, we replaced the measure of enterprises’ investment efficiency. In the previous empirical analysis, this study used the difference between the actual investment expenditure value and the expected value obtained from the regression equation to portray investment efficiency. To further reflect the robustness of this result, this study uses a regression model of corporate investment on growth opportunities to estimate firms’ investment efficiency by referring to Dai and Kong (2017). The regression results show that executive power influence in SOEs is significantly and positively related to overinvestment, i.e. the greater the executive power influence, the higher the likelihood that firms will produce inefficient outcomes of overinvestment, and the previous results do not change substantially.

The second is the lagged period treatment of the key variables. This study uses a regression analysis of the current period’s executive power influence of SOEs on the investment efficiency of the next period, which is now rerun using the current period’s investment efficiency.

Third, we consider endogeneity treatment. The findings of this study suffer from some endogeneity problems because there is likely to be reverse causality in the impact of executive power influence on the investment efficiency of SOEs, i.e. SOEs with higher investment efficiency may themselves have higher executive power influence. Although this study takes the approach of using the dependent variable (firm investment efficiency) one period ahead to overcome the endogeneity problem, it may still not be able to fully overcome this problem. Given that there is no good instrumental variable to replace the power influence of SOE executives in the existing literature, in order to mitigate the endogeneity problem, this study adopts a two-stage least squares (2SLS) approach to parameter estimation of the instrumental variables, using the explanatory variables of the previous period and the mean values of the variables of other firms in the same industry and year as the instrumental variables, showing that Corollary 1’s findings remain unchanged.

The results of the above robustness tests indicate that the main findings of the previous study have not changed; therefore, the previous findings are reliable (results omitted and retained for information).

Conclusions and perspectives

Conclusion and policy implications

This study theoretically analyses the relationship between the power influence of SOE executives on corporate investment efficiency and constructs an indicator system to measure the power influence of SOE executives. To measure the power influence of SOE executives, we use a sample of state-owned listed companies in Shanghai and Shenzhen A-shares from 2010 to 2018 to empirically analyse the double fixed-effect model of the relationship between the power influence of SOE executives and investment efficiency. As a starting technique, STATA15 was used to test pooled ordinary least squares (OLS) regression on a sample of Chinese listed companies, and the panel data set was obtained from the Wind Information database and the China Stock Market and Accounting Research (CSMAR) database. Data on executive positions and awards were manually compiled. This study found that the power influence of SOE executives had a dampening effect on investment efficiency. Further analysis of the mechanism of influence found that SOE executives can use their power and influence to alleviate financing constraints and diversify their investments, thereby generating inefficient investments. Moderating effect analysis found that the concentration of equity in SOEs and the supervision of independent directors can mitigate the positive relationship between the power influence of SOE executives and efficient investment.

The relationship and impact of SOE executive both personal and social influence on performance of company is well explained as well analysed with empirical data. Based on this study’s findings, we propose the following policy recommendations.

First, we should continue to deepen the market-oriented reform of SOEs and improve the supervision and discipline mechanisms for senior executives of state-owned enterprises. The reform of SOEs is the focus and central part of the current reform of China’s economic system, and its important goal is to solve the problems of inefficient management and weak market competitiveness by resolving the problem of inactive internal mechanisms. In addition to streamlining the organisational structure, decentralisation, and empowerment of SOEs, it is necessary to strengthen the supervision system of SOE executives and establish a sound mechanism for linking the work of the expatriate supervisory board with the internal supervision force of the enterprises.

Second, the administrative level of SOEs should be completely abolished, and the influence of SOE executives’ power should be weakened from an organisational point of view. Until now, many provinces, municipalities directly under the Central Government, and autonomous regions have abolished the administrative level of SOEs, but out of inertia, the influence of executive officers and administrative level of state-owned enterprises is still very strong. For this reason, a market-oriented system of “market-based selection and recruitment” of senior executives of SOEs should be implemented. The general manager and other executives along with the chairman of the board of directors should be selected and hired through the internal market of all SOEs belonging to the same level as SASACs.

Third, we should strengthen the focus of SOEs on their main businesses and prevent blind diversification that may lead to inefficient investments. Promote the divestment of SOEs from non-main businesses and non-advantageous businesses, and prevent inefficient investments resulting from blind greed for more comprehensive and haphazard spreads.

Limitations and future research

This study has some limitations and provides additional opportunities for future research.

First, owing to data limitations, our research results may be limited to state-owned listed companies. The degree of marketisation of SOEs differs somewhat from that of non-SOEs, the selection of executives is influenced by the government management system, and their overall competence is subject to scrutiny by government departments, which may limit the generalisability of our findings. Future research could focus on the performance of SOE executives after market transformation, and on a broader group of executives.

Second, this study is confined to the Chen model to assess the investment efficiency of a firm. To find the connection between the investment results and the power influence of SOE executives, the upcoming enquiry should add better investment performance metrics.

Finally, this study examines the intermediary mechanism of diversification and financing constraints. However, we believe that there may be other ways to influence the relationship between SOE executives power influence and investment efficiency, which need to be explored in the future.

Data availability

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation, to any qualified researcher.

References

Cash JT (2018) George mason and the ambiguity of executive power. Pres Stud Q 48:741–767. https://doi.org/10.1111/psq.12483

Chen F, Hope OK, Li Q, Wang X (2011) Financial reporting quality and investment efficiency of private firms in emerging markets. Account Rev 86:1255–1288. https://doi.org/10.2308/accr-10040

Chen YS, Huang JQ (2019) Stock market liberalization and corporate investment efficiency: evidence from Shanghai-Hong Kong stock connect. J Finan Res 8:151–170. https://doi.org/10.13587/j.cnki.jieem.2020.02.008

Dai YH, Kong DM (2017) Can executives with overseas experience improve corporate investment efficiency? J World Econ 1:168–192. https://doi.org/10.19985/j.cnki.cassjwe.2017.01.009

Dong HY, Li XR (2014) The executive power of state-owned enterprise and overinvestment. Econ Manage J 10:75–87. https://doi.org/10.19616/j.cnki.bmj.2014.10.010

Graham KA, Ziegert JC, Capitano J (2015) The effect of leadership style, framing, and promotion regulatory focus on unethical pro-organizational behavior. J Bus Ethics 126:423–436. https://doi.org/10.1007/s10551-013-1952-3

Guo H, Li WL, Gao WW (2020) Political governance, managerial power and over-investment of state-owned enterprises. J Ind Eng 2:71–83. https://doi.org/10.13587/j.cnki.jieem.2020.02.008

Jia XP, Liao SD, Van der Heijden B, Li WQ (2022) Power and responsibility: How different sources of CEO power affect firms’ corporate social responsibility practices. Journal of the Florida Medical Association. Bus Ethics Environ Responsib 31:682–701. https://doi.org/10.1111/beer.12438

Kragt D, Day DV (2020) Predicting leadership competency development and promotion among high-potential executives: the role of leader identity. Front Psychol 11:1816. https://doi.org/10.3389/fpsyg.2020.01816

Ling ZH (2014) Empirical study on equity concentration, balance and operating performance. Commun Finan Account 24:44–46. https://doi.org/10.16144/j.cnki.issn1002-8072.2014.24.046

Liu GJ, Peng SB (2018) CEO power intensity, equity incentive plan and CEO explicit corruption. Collect Essays Finan Econ 6:87–95. https://doi.org/10.13762/j.cnki.cjlc.2018.06.008

Lu J, Peng X (2015) Multidimensional evaluation of Chinese SOEs’ efficiency. Res Econ Manage 6:27–36. https://doi.org/10.13502/j.cnki.issn1000-7636.2015.06.005

Lu SF, Chen SX (2017) Does governmental favoritism reduce financing constraintsof firms:a quasi-natural experiment from China. Manage World 5:51–65. https://doi.org/10.19744/j.cnki.11-1235/f.2017.05.006

Lu X, He YQ, Wu T (2016) Is SOE executives’ political promotion incentive a long-term solution? Econ Manage J 7:94–106. https://doi.org/10.19616/j.cnki.bmj.2016.07.009

Na C, Tian G, Rauf F, Naveed K (2022) Do financial performance and firm’s value affect the quality of corporate social responsibility disclosure: moderating role of chief executive officer’s power in China. Front Psychol 13: https://doi.org/10.3389/fpsyg.2022.925323

Park S, Kim S (2016) Can nonprofit enterprises lead to better revenue conditions in local government. Am Rev Publ Adm 46:700–712. https://doi.org/10.1177/0275074015573832

Prakash S (2003) The essential meaning of executive power. U Illinois Law Rev 2:701–820. https://doi.org/10.2139/SSRN.223757

Shu JP, Huang L (2021) The problem of executive compensation of state-owned enterprises and its governance under the perspective of power allocation. Manage Eng 26:13–19. https://doi.org/10.19327/j.cnki.zuaxb.1007-1199.2021.01.002

Ullah I, Majeed MA, Fang HX (2021) Female CEOs and corporate investment efficiency: evidence from China. Borsa Istanbul Rev. 21:161–174. https://doi.org/10.1016/j.bir.2020.09.010

Wang JY, Wang H, Wang D (2021) Equity concentration and investment efficiency of energy companies in China: evidence based on the shock of deregulation of QFIIs. Energy Econ 93:80–88. https://doi.org/10.1016/j.eneco.2020.105032

Wang S, Xu N, Jiang NN (2016) Intensity, effectiveness and mechanism of executive reputation incentive contract: an empirical study in the Chinese context. Theory Pract Finan Econ 3:69–76. https://doi.org/10.16339/j.cnki.hdxbcjb.2016.03.011

Weng PS, Cchen WY (2016) Doing good or choosing well? Corporate reputation, CEO reputation, and corporate financial performance. North Am J Econ Finan 39:223–240. https://doi.org/10.1016/j.najef.2016.10.008

Wu JF, He DJ, Lin W, Wang Y (2008) Political network of top managers and corporate diversification strategy: from the perspective of social capital: an empirical analysis based on panel data of listed companies in China. Manage World 8:107–118. https://doi.org/10.19744/j.cnki.11-1235/f.2008.08.012

Xie WW, Khurram MU, Qing L, Rafiq A (2023) Management equity incentives and corporate tax avoidance: moderating role of the internal control. Front. Psychol 1:14. https://doi.org/10.3389/fpsyg.2023.1096674

Yao J, Lv Y, Lan HL (2004) An empirical study on the relationship between diversification and economic performance of listed companies in China. Manage World 11:119–125+135. https://doi.org/10.19744/j.cnki.11-1235/f.2004.11.016

Yi LQ, Li T, Zhang XY, Huang QY, Ma YZ, Wang P (2022) Power and corporate green governance from the perspective of input-output efficiency. Emerging Mark Finan Trade 59:836–847. https://doi.org/10.1080/1540496X.2022.2108318

Yin LQ, Li T, Zhang T, Li A (2020) Executive power, internal control and social responsibility in state-owned enterprises. Soft Sci 34::25–29. https://doi.org/10.13956/j.ss.1001-8409.2020.08.05

Zhai D, Zhao X, Bai Y, Wu D (2023) A study of the impact of executive power and employee stock ownership plans on corporate cost stickiness: evidence from China a-share non-financial listed companies. Systems 11:238. https://doi.org/10.3390/systems11050238

Zhang DL, Jiang XF (2015) Managerial ability and the herd behavior of corporate investment:considering the moderating effect of compensation fairness. Account Res 8:41–48+96. https://doi.org/10.3969/j.issn.1003-2886.2015.08.006

Zhang LL, Liu F, Cai GL (2015) Regulatory independence, market-oriented process and the implementation of executives promotion mechanism in SOEs — based on the SOE executives turnover data from 2003 to 2012. Manage World 10:117–131. https://doi.org/10.19744/j.cnki.11-1235/f.2015.10.011

Zhang WJ, Gu FJ, Liu L (2021) Research on the effect of executive compensation incentive on enterprise performance in state-owned enterprises. Res Finan Econ Issues 10:122–129. https://doi.org/10.19654/j.cnki.cjwtyj.2021.10.013

Zhang YF, Song XY (2021) Study on the function of economic responsibility audit accountability in the governance of corruption of state-owned enterprises’ executives. Auditing Finan. 6:41–44. https://doi.org/10.19419/j.cnki.36-1264/f.2021.06.020

Zheng ZG (2019) Ways to strengthen corporate control in the era of decentralized equity. Tsinghua Finan Rev 9:41–44. https://doi.org/10.19409/j.cnki.thf-review.2019.09.010

Acknowledgements

We are grateful to Prof. Changnan Wu for his guidance on the manuscript and to the foundations for their support.

Funding

This research was supported by Science and Technology Research Project of Jiangxi Provincial Department of Education(No. GJJ2204104) and Humanities and Social Sciences Research Project of Colleges and Universities in Jiangxi Province(No. JJ22207).

Author information

Authors and Affiliations

Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work, and approved the final manuscript. YH: research ideas, concept and design, statistical analysis, and writing up. JQ: investigation, data curation, and obtaining funding.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Huang, Y., Qiu, J. The power influence of executives and corporate investment efficiency: empirical evidence from Chinese state-owned enterprises. Humanit Soc Sci Commun 10, 586 (2023). https://doi.org/10.1057/s41599-023-02107-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02107-w

- Springer Nature Limited