Abstract

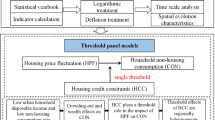

Home-purchase limits, introduced by China’s central government in April 2010 and afterward implemented by the local governments of major cities successively, were usually regarded as the most stringent policy instruments regulating over-heated Chinese housing markets over recent years. Our study attempts to investigate the effects of the home-purchase limits based on the micro data of resale housing transactions between January 2008 and December 2011 in Guangzhou city, one of the largest cities in mainland China. Our regression results show that, while the central government’s notice negatively affects housing prices, the localized home-purchase limit measures have positive effects on housing prices in Guangzhou, which deviate far from the expectations the policy makers might have. We also find that the effects of the policies are significantly stronger for the housing units of high-rise building (or with big size) relative to those without elevators (or with small size). We provide the explanation from the aspects of policy uncertainty and redevelopment option embodied in the housing.

Similar content being viewed by others

Notes

Although numerous studies have addressed housing policies in mainland China, the overwhelming majority of these studies focus only on the introduction and changes of these policies, such as Wang and Murie (1999), Wu (1996), Wang (2000), Huang and Clark (2002), Deng et al. (2011), and Zou (2014). Zou (2014) also provides a recent review on these papers.

Data source: Guangzhou Statistic Yearbook 2013.

Data source: Guangzhou Statistic Yearbook 2013.

Data sources: The average price of newly built homes in 2012 is from the official website of National Bureau of Statistics of the People’s Republic of China, while the average price of resale housing is from Wind Information Company.

Data source: Wind Information Company.

According to Beijing’s HPL, households with a Beijing local Hukou are only allowed to buy a housing unit if they had not owned a home in Beijing. If they have already owned a housing unit, they can buy an additional housing unit only under certain special conditions. Household who have already owned two or more housing units, and non-local-Hukou households were prohibited from buying any home in Beijing (Zheng et al. 2013).

There are two advantages of making use of data from real estate agents. On one hand, in the data the transaction dates recorded are the actual transaction dates and not the official registered transfer dates that will be at least one month later. On the other hand, the recorded housing prices are accurate as they are the actual purchase prices of the homebuyers. For resale housing transactions in China, their sellers and buyers might register housing prices lower than their actual transaction prices in their official transfer registration in order to decrease the relevant tax costs.

In Guangzhou, multi-storied buildings usually have six floors. There are only a small number of buildings without elevators whose heights are more than six floors. But the maximum building height for this type of buildings does not exceed nine floors.

References

An, H., Chen, Y., Luo, D., & Zhang, T. (2016). Political uncertainty and corporate investment: Evidence from China. Journal of Corporate Finance, 36, 174–189.

Childs, P., Riddiough, T., & Triantis, A. (1996). Mixed uses and the redevelopment option. Real Estate Economics, 24(3), 317–339.

Clapp, J. M., Bardos, K. S., & Wong, S. K. (2012a). Empirical estimation of the option premium for residential redevelopment. Regional Science and Urban Economics, 42, 240–256.

Clapp, J. M., Jou, J.-B., & Lee, T. (2012b). Hedonic models with redevelopment options under uncertainty. Real Estate Economics, 40(2), 197–216.

Clapp, J. M., & Salavei, K. (2010). Hedonic pricing with redevelopment options: A new approach to estimating depreciation effects. Journal of Urban Economics, 67, 362–377.

Deng, D. H., & Cao, G. Z. (2012). Non-rational consumption behavior in real estate market under strict new regulations. Academic Exploration, 9, 52–56 (in Chinese).

Deng, L., Shen, Q., & Wang, L. (2011). The emerging housing policy framework in China. Journal of Planning Literature, 26(2), 168–183.

Ding, W. J., Zheng, S. Q., & Guo, X. Y. (2010). Value of access to jobs and amenities: Evidence from new residential properties in Beijing. Tsinghua Science and Technology, 15(5), 595–603.

Du, Z., & Zhang, L. (2015). Home-purchase restriction, property tax and housing price in China: A counterfactual analysis. Journal of Econometrics, 188, 558–568.

Gao, J. B., Zhou, C. S., Wang, Y. M., & Jiang, H. Y. (2011). Spatial analysis on urban public service facilities of Guangzhou City during the economy system transformation. Geographical Research, 30(3), 424–436 (in Chinese).

Hassett, K. A., & Metcalf, G. E. (1999). Investment with uncertain tax policy: Does random tax policy discourage investment? The Economic Journal, 109, 372–393.

He, C. G., Wang, Z., Guo, H. C., Sheng, H., Zhou, R., & Yang, Y. H. (2010). Driving forces analysis for residential housing price in Beijing. Procedia Environmental Sciences, 2, 925–936.

Huang, Y., & Clark, W. A. (2002). Housing tenure choice in transitional urban China: A multilevel analysis. Urban Studies, 39(1), 7–32.

Hui, E. C. M., & Wang, Z. Y. (2014). Price anomalies and effectiveness of macro control policies: Evidence from Chinese housing markets. Land Use Policy, 39, 96–109.

Jens, C. E. (2017). Political uncertainty and investment: Causal evidence from U.S. gubernatorial elections. Journal of Financial Economics, 124, 563–579.

Jim, C. Y., & Chen, W. Y. (2007). Consumption preferences and environmental externalities: A hedonic analysis of the housing market in Guangzhou. Geoforum, 38(2), 414–431.

Julio, B., & Yook, Y. (2012). Political uncertainty and corporate investment cycles. Journal of Finance, 67, 45–83.

Krueger, A. B., & Schkade, D. A. (2008). The reliability of subjective well-being measures. Journal of Public Economics, 92, 1833–1845.

Lee, B. S., Chung, E. C., & Kim, Y. H. (2005). Dwelling age, Redevelopment, and housing prices: The case of apartment complexes in Seoul. Journal of Real Estate Finance and Economics, 30(1), 55–80.

Leung, C. K. Y., Cheung, P. W. Y., & Tang, E. C. H. (2013). Financial crisis and the comovements of housing sub-markets: Do relationships change after a crisis? International Real Estate Review, 16(1), 68–118.

Leung, C. K. Y., Ma, W. Y., & Zhang, J. (2014). The market valuation of interior design and developers strategies: a simple theory and some evidence. International Real Estate Review, 17(1), 63–107.

Liao, W.-C., & Wang, X. (2012). Hedonic house price and spatial quantile regression. Journal of Housing Economics, 21, 16–27.

McDonald, R., & Siegel, D. (1986). The value of waiting to invest. Quarterly Journal of Economics, 101, 707–727.

Mok, H., Chan, P., & Cho, Y.-S. (1995). A hedonic price model for private properties in Hong Kong. Journal of Real Estate Finance and Economics, 10, 37–48.

Pastor, L., & Veronesi, P. (2012). Uncertainty about government policy and stock prices. The Journal of Finance, 67(4), 1219–1264.

Pindyck, R., & Solimano, A. (1993). Economic instability and aggregate investment. NBER Macroeconomics Annual, 8, 259–303.

Poor, P. J., Boyle, K. J., Taylor, L. O., & Bouchard, R. (2001). Objective versus subjective measures of water clarity in hedonic property value models. Land Economics, 77(4), 482–493.

Ren, Y., Xiong, C., & Yuan, Y. F. (2012). House price bubbles in China. China Economic Review, 23, 786–800.

Rodrik, D. (1991). Policy uncertainty and private investment in developing countries. Journal of Development Economics, 36, 229–242.

Rosen, S. (1974). Hedonic prices and implicit markets: product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Titman, S. (1985). Urban land prices under uncertainty. American Economic Review, 75, 505–514.

Tse, R. (2002). Estimating neighbourhood effects in house prices: Towards a new hedonic model approach. Urban Studies, 39(7), 1165–1180.

Yang, H. H., & Hu, G. (2012). Analysis on the internal movement orientation of Guangzhou’s population in the background of residential suburbanization. Journal of Guangzhou City Polytechnic, 6(2), 18–23 (in Chinese).

Wang, Y. P. (2000). Housing reform and its impacts on the urban poor in China. Housing Studies, 15(6), 845–864.

Wang, Y. P., & Murie, A. (1999). Housing Policy and Practice in China. New York: St. Martin’s Press.

Wang, Y. Z., Chen, C. R., & Huang, Y. S. (2014). Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance Journal, 26, 227–243.

Williams, J. (1997). Redevelopment of real assets. Real Estate Economics, 25(3), 387–407.

Wu, F. (1996). Changes in the structure of public housing provision in urban China. Urban Studies, 33(9), 1601–1627.

Wu, J., Gyourko, J., & Deng, Y. H. (2012). Evaluating conditions in major Chinese housing markets. Regional Science and Urban Economics, 42, 531–543.

Xu, C. (2011). The fundamental institutions of China’s reforms and development. Journal of Economic Literature, 49(4), 1076–1151.

Zheng, S. Q., & Kahn, M. E. (2008). Land and residential property markets in a booming economy: New evidence from Beijing. Journal of Urban Economics, 63, 743–757.

Zheng, S. Q., & Kahn, M. E. (2012). Does government investment in local public goods spur gentrification? Evidence from Beijing. Real Estate Economics, 41, 1–28.

Zheng, S. Q., Sun, W. Z., Geltner, D., & Wang, R. (2013). The housing market effects of a local home purchase restriction: Evidence from Beijing, Tsinghua University, Working paper.

Zou, Y. H. (2014). Contradictions in China’s affordable housing policy: Goals vs. Structure. Habitat International, 41, 8–16.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jia, S., Wang, Y. & Fan, GZ. Home-Purchase Limits and Housing Prices: Evidence from China. J Real Estate Finan Econ 56, 386–409 (2018). https://doi.org/10.1007/s11146-017-9615-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-017-9615-2