Abstract

The relationship between housing prices (HP) and household non-housing consumption (CON) is a key topic worldwide. By developing a panel threshold model and utilizing data from 18 provinces in central and western China from 2005 to 2020, this study investigates the impact of housing prices on household non-housing consumption given housing credit constraints. The results show that (1) housing credit constraints play a single threshold role in the impact of housing prices on household non-housing consumption; (2) the elasticity of housing price fluctuation on household non-housing consumption was negative in the western region during the entire sample period, and the elasticity of housing price fluctuation on household non-housing consumption decreased when housing credit constraints exceeded its threshold value; (3) the effects of housing price fluctuation on household non-housing consumption in the central region changed from negative to positive when housing credit constraints exceeded its threshold value. These outcomes implies that housing credit constraints are not a factor driving a low household non-housing consumption rate in the studied regions. Importantly, our findings suggest that unaffordable housing prices and homeownership linked to better public education resources in combination were a key factor leading to a low non-housing consumption rate in the studied regions. The main contribution of this paper is to supplement the current academic research on low levels of consumption in underdeveloped regions of China and the impact of housing prices on consumption.

Similar content being viewed by others

Introduction

Over the past three decades, the world economy has experienced unprecedented growth and a global redistribution of wealth and population (Grodecka, 2020; Li et al., 2022b). In the process of massive and rapid urbanization, Chinese households have been amassing a reserve of wealth (Balsa-Barreiro et al., 2019; Li and Li, 2022). Housing in China has become the most valuable type of asset, accounting for about 64% of household assets in 2019, as reported by the China Household Finance Survey. However, with extensive migration to cities, housing prices have risen dramatically. In response, households need to increase their savings rate to account for rising housing prices, often in undesirable locations (buying homes in areas that are less favorable or less convenient in terms of location), and then suffer from longer commuting times, less housing space, and worse housing conditions (Zhou and Hui, 2022). In the past 15 years, national average housing prices soared from RMB 2885 per square meter in 2005 to RMB 6626 per square meter in 2020, leading China’s housing price-to-income ratio of 29.06 in 2020 to rank seventh globallyFootnote 1. Subsequently, in China, rapidly rising housing prices have worsened existing housing unaffordability, with the housing affordability index measures declining from 0.76 in 2010 to 0.43 in 2020Footnote 2, suggesting that high house prices are putting greater pressure on residents’ lives.

In China, according to resource endowments and socio-economic development, the central government has divided the country’s 31 provinces into four economic-geographic zones, of which the central and western regions have been classified as underdeveloped regions. There has been the typical phenomenon of simultaneously occurring low income, low household non-housing consumption rate and high housing price in the central and western regions of China. In response, China’s central government has implemented policies in numerous domains, including monetary, macro-prudential, fiscal and land, to regulate the housing market and stimulate non-housing consumption (Wang et al., 2021). Nonetheless, household non-housing consumption in the central and western regions remains increasingly sluggish.

Thus, it has been widely argued that in China, the rapid rise of housing prices is a major factor inhibiting household non-housing consumption (Waxman et al., 2020; Li and Zhang, 2021; Li et al., 2022a). Further, the influence of housing wealth on household non-housing consumption in China may be a reflection of different impacts of housing wealth accumulation on household consumption, including the positive “wealth effect” and negative “crowding-out effect” (Liu et al., 2019). At the same time, numerous studies have found that the housing credit channel plays an important role in the influence of housing wealth on consumption (Cloyne et al., 2019; DeFusco, 2018), since heavy housing credit constraints were a factor inhibiting household non-housing consumption (Cheng, 2021; Justiniano et al., 2019; Greenwald and Guren, 2021). However, the response of household non-housing consumption to rising housing prices is unclear, and there is a lack of evidence to support the idea that housing credit constraints inhibit the wealth effect of higher housing prices on household non-housing consumption in China’s underdeveloped regions. Thus, in light of unaffordable housing prices, sluggish consumption, and relaxing housing credit constraints in central and western China, we raise the following theoretical and practical questions for consideration. Specifically, how housing prices combined with housing credit constraints affect household non-housing consumption, in the central and western China? What are the differences between the central and western regions in household non-housing consumption’s responses to housing prices combined with housing credit constraints?

The innovations and contributions of this study are as follows: (1) The study explores how housing prices combined with housing credit constraints affect household non-housing consumption in the underdeveloped central and western regions of China. This is a departure from most research that has focused on developed nations or developed cities in China (Dong et al., 2017; Atalay et al., 2020; Suari-Andreu, 2021). The focus here thus provides a fresh perspective to deepen the understanding of the relationship between housing affordability and residents’ welfare, particularly in underdeveloped areas. (2) Departing from Burrows (2018) and Zhao et al. (2020) with housing credit constraints set as an exogenous variable to identify credit-constrained households, we introduce housing credit constraints as a threshold variable in a varying co-efficient panel model, to investigate the link between housing prices and low household non-housing consumption, and the threshold model can automatically identify thresholds based on the intrinsic characteristics of the data, making it a more objective and unbiased approach (Huo et al., 2021).

The paper is organized as shown in Fig. 1 and the remainder is as follows. Section 2 presents a literature review. Section3 is the theoretical framework. Section 4 contains the methods and data. Model building is presented in Section 5. Section 6 put forward the results and analysis, while discussion of those results is presented in Section 7. Section 8 concludes with the conclusions and policy implications.

Literature review

Housing prices and household non-housing consumption

The relationship between housing prices and urban household non-housing consumption has been extensively discussed in the literature on economic and urban sustainable development. A substantial body of work on the relationship between the two variables has focused on developed countries where there is a broad agreement that rising housing prices play a potentially important role in promoting aggregate consumption based on the theoretical framework of the Life Cycle Hypothesis and the Permanent Income Hypothesis (Berger et al., 2018; Kaplan et al., 2020; Andersen and Leth-Petersen, 2021). Therefore, measures of household wealth and changes in housing wealth affect current consumption expenditures. Regarding China, however, the existing literature has not yet reached a consensus. Some scholars have argued that rising housing prices could squeeze out and constrain household consumption (Hu, Yuan, 2017; Waxman et al., 2020; Liu and Chen, 2021). In contrast, empirical research has also verified that higher housing prices positively affect household consumption (Chen et al., 2020). Further, a large number of studies have shown that housing affordability is what matters to households. Unaffordable housing prices are causing serious problems, such as lower quality of life, increased debt, rising inequality, and so on (Atalay et al., 2020; Zhou and Hui, 2022). As a result of urban diseconomies and processes resembling gentrification, soaring housing costs have led to a significant reduction in household non-housing consumption among low- and middle-income households, as they are compelled to allocate a larger proportion of income to rent or mortgage payments (Waxman et al., 2020; Balsa-Barreiro et al., 2021).

Effects of changes in housing price on consumption

The impact of housing prices on household consumption is the result of a combination of mechanisms (Li et al., 2022a), with the final result depending on which mechanism plays a leading role (Suari-Andreu, 2021). In recent years, scholars have classified these transmission mechanisms into two categories: the direct wealth effect and the collateral constraint effect. The direct wealth transfer mechanism means that households adjust their consumption in response to changes in housing wealth (Li and Zhang, 2021). The collateral constraint effect or liquidity constraint transmission mechanism implies that an increase in housing prices can ease liquidity constraints and thus increase household non-housing consumption by facilitating access to mortgage loans against home equity (Atalay et al., 2016; Burrows, 2018; Choi and Zhu, 2022). On the one hand, in developed countries such as the US and the UK, governments generally prefer to ease the liquidity of home equity withdrawals, which happens when homeowners use home assets as collateral for loans that can be used to fund other things (Caporale et al., 2013). In China, by contrast, home equity withdrawals are almost non-existent (Yang et al., 2018; Painter et al., 2022). On the other hand, China’s unique social norms, including the key role of housing in marriage (Wrenn et al., 2019), elderly care (Li and Zhang, 2021), high savings rates and low consumption characteristics of Chinese households (Yang et al., 2021), etc. both directly and indirectly affect the transmission of wealth effect. In addition, there is a preference for buying over renting a home among Chinese people, with “home ownership” playing a prominent role in Chinese society, in part due to its association with better public primary and secondary education resources (Gao et al., 2022). Based on China’s reality, some scholars have focused on a new channel, the home purchase channel, through which the housing market affects household non-housing spending (Yan and Zhu, 2013; Li, 2018). Rising housing prices have prompted a generation of young, non-homeowners to cut back on consumption to accumulate savings for a future home purchase. In some cases, it is not only the younger generation who do not own a home, but also parents who are saving their entire lives to finance their children’s home purchase. Due to the pressure of down payment and mortgage repayment for buying a home, potential homebuyers tend to then rein in their consumption and increase savings, which Yan and Zhu (2013) have termed the “housing slave effect”, with Li (2018) finding empirical evidence of the effect.

Housing prices, housing credit constraints and consumption

Since the US subprime mortgage crisis in 2007, the impact of credit on property wealth has received widespread attention from academics and policymakers, with a large number of studies on the relationship between property credit and housing prices, and between property credit and consumption (Cerutti et al., 2017; Kartashova and Tomlin, 2017).

Most studies have investigated the relationship between home equity and consumption considering second mortgages and the level of credit market development. In countries where the credit market is more mature, home equity can be easily obtained through second mortgages and then positively affect household consumption (Cumming and Hubert, 2022). In contrast, in an underdeveloped credit market, home equity is difficult to obtain. Hence, potential home buyers are forced to save more money for buying a home at the expense of current consumption. Most importantly, it is difficult for homeowners to enjoy the benefits of wealth appreciation by mortgaging their property. Therefore, in areas with poor credit markets, rising housing prices generally constrain household consumption (Penne and Goedemé, 2021, Dong et al., 2017).

Some research has focused on the link between housing wealth and household expenditures through the transmission mechanism of housing wealth credit. For example, Mian and Sufi (2018) pointed out that the increasing volume of household debt in the past four decades in most developed economies such as the United States has been a major driver pushing the economic cycle through the consumer demand channel. Fan and Yavas (2020) also emphasized that households with mortgages spend more current income on consumption than households without mortgages. In addition, the influence of housing wealth on household consumption through the mortgage transmission channel shows a mutual feedback loop. First, when the volume of household debt increases, households will increase the demand for housing mortgages, and then promote the housing liquidity premium and rising housing prices (Favara and Imbs, 2015; Favilukis et al., 2017; Justiniano et al., 2019). Second, household wealth added from rising housing prices will increase household non-housing consumption (Iacoviello and Neri, 2010), which in turn stimulates the expansion of household debt for increasing non-housing consumption (Ganong and Noel, 2020).

The case of underdeveloped regions in China

In China, compared with the relatively developed eastern regions, the economic development of the central and western regions is relatively lagging (Wu et al., 2021), resulting in decreasing housing affordability. Since 2003, in order to balance regional disparities, the central government has implemented a land use policy that favors the central and western regions in spatial distribution of investment, leading to a boom in the real estate industry in these areas (Fan et al., 2021). However, heavy housing burden in the central and western regions persists. For example, Li et al. (2014) found that housing is more affordable in China’s eastern cities than in its central and western cities, where urban incomes are much lower. A few scholars have begun to pay attention to the impact of housing affordability on consumption in the more developed eastern regions of China. By examining differences between the “Tiers” of cities, Liu et al. (2019) demonstrated that in less developed regions, the impact of rising housing prices on consumption is manifested in a crowding-out effect. However, given the heterogeneous financial market conditions in different regions, the impact of housing prices on consumption is unclear in these areas (Dong et al. 2017).

In sum, existing studies on the responses of household consumption to housing prices have greatly improved understanding of the crowding-out and wealth effects of housing prices on household consumption in developed and developing countries (Table 1). However, most existing studies have focused on the effectiveness of housing wealth or the relationship between housing prices and consumption, with housing credit constraints set as an exogenous variable outside of the model framework. In fact, housing credit constraints play a key role in buying a home, mortgage payments (Zhao et al., 2020; Li et al., 2022b), and the effectiveness of housing wealth (Ampudia and Mayordomo, 2018), and then affect household consumption. Thus, it is difficult to realistically describe how housing prices combined with housing credit constraints affect consumption. In addition, China’s unique housing policies have a direct impact on access to public primary and secondary education. Household registration (hukou) is a determining factor in this access. Children whose parents are school district homeowners have greater opportunities for better public educational resources compared to children of parents who rent their home. Thus, this perspective deepens our understanding of the connection between housing prices and non-housing consumption. Moreover, most research on this topic has focused on developed countries/regions, while less has focused on the underdeveloped central and western regions of urban China. Housing credit constraints vary across regions in China (Chen et al., 2021) and social-economic development also differs greatly between regions (Wu et al., 2021). It is therefore crucial to fill this gap by investigating the linkage between housing prices combined with housing credit constraints and consumption in the central and western regions of China.

Theoretical framework

Our theoretical model serves the purpose of establishing an abstract framework to comprehend the potential relationships between housing prices and household non-housing consumption. Within this theoretical modeling, we can incorporate a broader array of variables and factors to consider various potential influencers and mechanisms, without being constrained by data availability. To realistically illustrate the effects of housing prices on household non-housing consumption, we introduce housing credit constraints as a variable into the life cycle model framework within which urban residents adjust their decisions of non-housing consumption. Housing is included in the model as both consumption goods and collateral, since homebuyers can purchase housing through the form of “down payment + mortgage”, and homeowners can also obtain loans for consumption through a housing equity mortgage. Home renters need to adjust their household consumption structure between household non-housing consumption and housing consumption when they face changing housing prices.

Therefore, we propose the following hypotheses:

Hypothesis 1 (H1). Housing prices directly and indirectly affect the household consumption structure (Income allocation between household non-housing consumption and housing consumption).

Hypothesis 2 (H2). Household consumption decisions would be adjusted in response to the combination of changing housing prices and housing credit constraints.

We put more emphasis on the fact that changes in housing prices directly and indirectly affect a household’s total income (such as the residual value of housing depreciation and mortgage funds, etc.), and then lead to a change in the total amount of household expenditure. Thus, referring to the life cycle theory and the permanent income hypothesis (Friedman, 1956), where rational consumers seek to maximize their utility through the life cycle, we follow Guerrieri and Iacoviello (2017) to propose an optimal intertemporal consumption formula that is expressed as Eq. (1) and subjected to budgetary and borrowing constraints as Eq. (2).

where, E, conditional expectation operator of utility; βt, discount rate of utility in time t; CONt, household consumption without housing in time t, and Ht is housing consumption/services in time t; TCt, TIt, total amount of household expenditures and total amount of household income in time t, respectively; Pt, housing price in time t; \(P_tH_t\), housing value in time t; \(R_{t - 1}B_{t - 1}\), the last mortgage interest paid by household in time t; \(Y_t\), disposable income in time t; δ, housing depreciation rate; \(\left( {1 - \delta } \right)P_tH_{t - 1}\), the residual value of housing depreciation in period t-1; \(B_t\), total amount of mortgage funds in time t; \(\theta _t\), housing credit constraints in time t. Here, a lower value of \(\theta _t\) means stricter credit constraints faced by households to get mortgage funds from housing value.

In order to achieve their optimal consumption, a Lagrangian function is constructed from Eqs. (1) and (2), where \(\lambda _t\) and \(\gamma _t\) are the Lagrangian multipliers.

Equation (3) represents the optimal consumption choice under the constraints. Then, the first-order conditions of Eq. (3) are given by Eqs. (4)–(7), which are used to calculate utility maximization.

To simplify analysis, in this study, referring to Guerrieri and Iacoviello (2017) to simplify the utility function, we assume the utility function (\(U(CON_t{{{\mathrm{,}}}}H_t)\)) of a household as Eq. (8).

where, j represents the degree of consumer preference for housing.

Thus, by calculating Eqs. (4)–(8), we can obtain substituting utility functions of non-housing and housing consumption as the Euler Eqs. (9)–(10), respectively. An Euler equation reflects that a rational person pursues the maximization of current utility and future utility present value (total utility), with the inter-period condition characterizing the optimal consumption path (Guerrieri and Iacoviello, 2017).

Theoretical analysis of the influence of housing prices combined with housing credit constraints on non-housing consumption is based on Eqs. (9)–(10)Footnote 3.

In sum, household non-housing consumption is affected by the combination of housing credit constraints (θt), housing prices, and expected housing prices, as specified in our hypotheses (H1 and H2). Here, in Eqs. (9)–(10), when γt > 0, it means that a household cannot borrow money to maintain stable lifetime consumption during intertemporal decision-making, and therefore, households can only reduce their current consumption to maximize their life-cycle utility. Housing credit constraints do not always affect current consumption, but would affect their future consumption.

Theoretical analysis provides a simple simulation of reality, which requires data validation. In the following sections, we conduct an empirical study to verify these two hypotheses.

Methods and data

Study area and data processing

In this study, the research area includes 18 provincial-level administrative units in the underdeveloped central and western regions of China (Fig. 2). Location plays a vital role in determining housing prices and therefore housing prices vary considerably across the two regions. The central region includes 6 provinces: Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan. The western region includes 12 provinces (including some designated as municipalities and autonomous regions): Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang. According to the National Bureau of Statistics of China (NBSC), in 2020 the central region of China had an urban population of 215.18 million distributed in 1028.4 thousand square kilometers and the western region of China had an urban population of 219.25 million distributed in 6847.1 thousand square kilometers. In the central and western regions, the disposable income of urban residents per capita grew to RMB 37604 and RMB 37464, respectively, in 2020 though still far lower than China’s national average of RMB 43834Footnote 4. Furthermore, a notable trend in the central and western regions of China has been the simultaneous occurrence of low income, a low household non-housing consumption rate, and high housing wealth. For example, the average housing prices reached RMB 4757 (central) and RMB 4839 (western) per square meter in these two regions, and the average household non-housing consumption-disposable income ratio in the central and western regions decreased from 69.55% and 74.16% in 2010 to 63.19% and 60.16% in 2020, respectively. Importantly, high savings rates have persisted in the central and western regions of China with annual average savings rates reaching around 32.12% and 28.43% during 2005–2020Footnote 5, respectively. The central and western regions of China, as underdeveloped regions of China, as well as their low incomes, high house prices, and low non-housing consumption, make it an ideal research area to study house prices and household consumption.

Data sources and processing

The original data set comes mainly from China’s Statistical Yearbook, China’s Real Estate Statistical Yearbook and local statistical yearbooks (2000–2020). Taking into account data availability and model requirements, this study selects panel datasets for 18 provinces (including municipalities and autonomous regions) in the central and western regions of China from 2005 to 2020, based on urban resident liquidity of household registration restrictions (Hukou) at the provincial level. The data can comprehensively depict the real estate market in the central and western regions of China as China’s social-economic development shows obvious spatial and regional disparities. Although the use of larger datasets may provide greater statistical precision for our study, However, obtaining data representing millions of dwellings and residents can be a very daunting task, especially when dealing with sensitive areas of research or where data availability is limited. Thus, in our study, we obtain the most representative and comprehensive sample of available data from the National Bureau of Statistics of China. In addition, our study is designed with a specific research question in mind, and the sample size was determined based on statistical considerations tailored to our specific objectives. We have employed rigorous statistical methods and modeling techniques that are appropriate for the dataset’s size. Our modeling decisions were guided by statistical best practices and aimed at ensuring the validity and reliability of our findings. Here, to reflect real changes in economic development, we use each province CPI2004 (CPI2004 = 100) to eliminate nominal price effects. In addition, to reduce possible heteroscedasticity and smooth data, household consumption per urban resident and disposable income per urban resident were processed by natural logarithm.

Variable selection

In this paper, the core explanatory variable is housing price fluctuation, the explained variable is household non-housing consumption by urban residents (CON), and the threshold variable is housing credit constraints (HCC). According to the aforementioned references in the literature review, local economic development and demographics also play important roles in household consumption. Therefore, in order to more realistically explore the linkage between housing prices and household consumption, these two factors have been set as control variables. The definition of the variables is shown in Table 2.

Explanatory variable

Housing price fluctuation (HPF). In this study, due to the non-availability of macro-level housing wealth data in China, we use the ratio of changes in values in time t minus values in time t-1 to quantify housing price fluctuations as shown in Eq. (11). This is consistent with the life cycle theory and the permanent income hypothesis, in which rational consumers generally adjust their consumption decisions along with changes in housing prices to maximize their utility through their life cycle. Thus, people would maintain a constant consumption structure if housing price and other factors hold constant.

Explained variable

Household non-housing consumption (CON). Here, household non-housing consumption is the monetary value of household consumption per capita without housing expenditures, including food, tobacco and alcohol, clothing, daily necessities and services, transportation and communication, education, culture and entertainment, medical care, and other goods and services.

Threshold variable

Housing credit constraints (HCC). The prerequisite for investigating the impact of housing credit constraints on household consumption is to explore a feasible way to identify credit constraints (Li et al., 2016). Although several methods have been employed by scholars to quantify housing credit constraints, such as cash-on-hand (Chen et al., 2010), approved-expected loan amount ratio (Zhao and Barry, 2014), loan-to-income ratio (Grodecka, 2020; Chivakul and Chen, 2008), survey questionnaire (Tran et al., 2016; Lin et al., 2019), etc., these methods are directly related to household income, which is an important criterion for banks to estimate repayment capacity. Thus, referring to Chivakul and Chen (2008), we use the loan-to-income ratio to quantify housing credit constraints, which means the higher the loan-to-income ratio, the lower the housing credit constraints, as Chen et al. (2021) found that China’s real estate market has been driven by housing credit constraints.

Control variable

Urban resident disposable income (URDINC), which directly reflects the affordability of urban residents’ consumption (Eika et al., 2020), is a key factor influencing household consumption that has been verified by numerous studies. In addition, dependency ratios, including child dependency ratio (CDR) and elderly dependency ratio (EDR). Child dependency ratio is a measure of the number of dependents aged 0 to 14 compared to the total population aged 15 to 64, while elderly dependency ratio is a measure of the number of dependents over 65 compared to the total population aged 15 to 64. This demographic indicator provides insight into the number of non-working-age people compared to the number of working-age people. In a household, the number of non-working-age people significantly affects household consumption.

Panel threshold model

Hansen (1999) first proposed the threshold regression model, the application of which has contributed to the development and re-discovery of numerous data analytic methods. The threshold model is a valuable tool for estimating endogenously threshold values and examining the relationships between independent and explanatory variables in different stages to detect changes in structure (Hansen, 1999). Essentially, the model determines whether there is an inflection point between the explanatory and interpreted variables through a segmented function. For example, by introducing the innovation and environmental regulation as threshold variables, Wu et al. (2022) found that the emission reduction effect of the digital economy is different. The panel threshold regression model can be generally written as the following Eq. (12).

where \(y_{it}\) is the explained variable, \(x_{it}\) is the explanatory variable, \(q_{it}\) is the threshold variable and γ is the estimated threshold value. β1 and β2 represent the parameters of \(x_{it}\) for the cases of \(q_{it} \le \gamma\) and \(q_{it} \,>\, \gamma\), respectively. The indicator function I(\(\cdot\)), when \(q_{it} \le \gamma\), the value is 1, otherwise it is 0; The subscript i and t indicates the i region and t time.

For a given threshold γ, the ordinary least squares (OLS) estimate of β is

The vector of regression residuals is

The sum of squared residuals is then calculated using Eq. (15)

where the least squares estimators of γ is:

In Eq. (16), the optimal threshold value is obtained by minimizing the sum of squares of residuals. In the next step, the significance of the threshold effect needs to be tested. The null hypothesis of the threshold effect is:

which is tested by the likelihood ratio (LR) statistic as follows:

where S0 and S1 denote the sum of squared residual under the null hypothesis and the alternative hypothesis, respectively.

In the context of threshold effect model, the “threshold” refers to a critical or threshold value that determines a transition point for different behaviors or effects within the model. In such models, it is typically assumed that there exists a specific threshold, and when a variable or set of variables crosses or falls below this threshold, it triggers different effects or behaviors (Tong, 2012). At a significant level of α, when \(LR \le c\left( \alpha \right) = - 2\ln \left( {1 - \sqrt {1 - \alpha } } \right)\), the null hypothesis cannot be rejected, at which point the estimated threshold is consistent with the true threshold.

Model building

Data stationarity test

Non-stationarity in a panel dataset may lead to pseudo-regressions. Therefore, it is necessary to test the stationarity of panel data before calculating empirical regression (Shan et al., 2021). To avoid errors caused by a single method, both the LLC test (Levin et al., 2002) and the Fisher-ADF test were selected. And test results (Table 3) show that all variables exhibit significance at a minimum level of 10% at their original levels, and indicate that the data for the variables are all stable.

Threshold effect test

Before building a threshold effect model, the most important steps are to test whether the variable is a threshold variable; and simultaneously determine the number (as a single threshold or double threshold) and the value once the variable is confirmed as a threshold variable (Zhang and Kim, 2022). Generally, the bootstrap method is used to test whether a variable is a threshold variable and then determine the number and value of the threshold variable (Seo et al., 2019). Table 4 shows that the F-statistic test results of the single threshold in the central and western regions pass the significance level of 10%, implying that housing credit constraints is a threshold variable. Next, since the likelihood ratio (LR) test is generally used to form confidence intervals (the “no-rejection region”) (Seo et al., 2019; Tran et al., 2022), we used the LR-statistic to estimate the threshold value in a 95% confidence interval for each region. The LR test results (Table 5) verify our hypothesis that housing credit constraints acts as a threshold and plays an important role in housing prices influencing household non-housing consumption in the central and western regions of China.

Building single threshold panel models

Based on the above test results, a single threshold panel model was built to explore the relationship between housing prices and household non-housing consumption, combined with housing credit constraints. The formula can be expressed as Eq. (19).

Where, subscript i,t, province and time, respectively; μi, individual specific effect; \(Ln{{{\mathrm{CON}}}}_{it}\), \(HPF_{it}\), the indexes of household non-housing consumption and housing price fluctuation, respectively; \(HCC_{it}\), housing credit constraints, a threshold variable; γ, represents the threshold value of \(HCC_{it}\); \(\beta _{i1}\) and \(\beta _{i2}\), estimated parameters measuring the impacts of \(HPF_{it}\) on \(CON_{it}\) with the addition of housing credit constraints; \(Z_{it}\), control variables including disposable income per urban resident, child dependency ratio and elderly dependency ratio; \(\beta _{i3}\), estimated parameters measuring the impacts of \(Z_{it}\) on \(CON_{it}\).

Results and analysis

Simulation results (Table 6) show that the simulated single threshold panel model for each region can be used to discern the threshold effect of housing credit constraints in the process of housing prices affecting household consumption. All goodness of fit (R2) of the models exceeded 0.98. The simulation results (Tables 5–6) validate our hypothesis and identify that: (1) housing credit constraints plays a threshold role in the impacts of housing prices on urban household consumption, which is consistent with our hypotheses; (2) housing credit constraints threshold values differ between the studied regions; and (3) the crowding out or wealth effects of housing prices combined with housing credit constraints vary with housing credit constraints and by region. In this section, empirical results will be analyzed in relation to the data characteristics of variables, as these variables capture essential economic phenomena and regional characteristics.

Household non-housing consumption, housing prices and housing credit constraints in the studied regions

Consumption affordability and household non-housing consumption

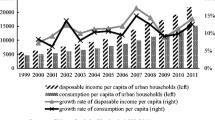

An urban household disposable income (URDINC) generally and directly represents affordability of household consumption. Increasing urban household disposable income during 2005–2020 (Figs. 3 and 4), with an annual average growth rate of 7.44% and 7.13% in the central and western regions of urban China (Fig. 5), respectively, show that affordability of households’ consumption in those two regions improved rapidly. However, household non-housing consumption slowly increased over the same period (Figs. 3 and 4), with an annual average growth rate of 6.97% and 6.24% in the central and western regions, respectively (Fig. 5), and in 2020, household non-housing consumption decreased, partly due to the COVID-19 pandemic which directly affected households’ income and non-housing consumption structure. Moreover, the non-housing consumption rate (CON-URDINC ratio) in these two regions not only steadily declined during the period 2005–2020, but also lagged behind the urban household disposable income growth rate and was well below the average value in China (Fig. 3). This implies that household non-housing consumption in the studied regions, to some extent, was insufficient, disclosing a low quality of life consistent with data from NUMBEOFootnote 6.

Housing prices, housing price fluctuation and housing credit constraints

Figures 4 and 6 show that housing prices (HP) in the central and western regions of China increased during 2005–2020, from RMB 1708 per square meter (Central) and RMB 1711.24 per square meter (Western) in 2005 to RMB 4757.47 per square meter (Central) and RMB 4839.81 per square meter (Western) in 2020, with an average annual growth rate of 8.10% (Central) and 7.78% (Western), respectively. The housing price fluctuation (Fig. 6) shows that housing prices fluctuated frequently and erratically, with the same fluctuating trend in both of the regions during the studied period. First, the housing price fluctuation values varied in the range of −2.54–21.83% (Central) and −1.22–17.37% (Western). Second, housing price fluctuation in both regions simultaneously experienced a “decreasing-increasing-decreasing-increasing” evolution during the period 2005–2020. In addition, housing price fluctuation in the western region changed more than in the whole of China after 2014.

Figure 7 shows that housing credit constraints has been trending upwards while fluctuating in the central and western regions during the sample period. Moreover, increasing housing credit constraints imply that China’s government has consistently implemented policies to relax housing credit constraints to stimulate household consumption and optimize the housing market. Further, fluctuations of housing credit constraints indicate that China’s government adjusted policies/measures to optimize the housing market. For example, in 2008, when facing the subprime mortgage crisis, housing credit constraints in the central and western regions were adjusted to 0.79% and 1.15%, respectively. Meanwhile, when housing prices grew rapidly in 2010, China’s government implemented a tight monetary policy and strict credit constraints to regulate real estate. Hence, in 2011, housing credit constraints decreased from 1.74% in 2010 to 1.39% in 2011 in the central region, and from 2.61% in 2010 to 2.17% in 2011 in the western region.

The relationship between housing price fluctuation and household non-housing consumption combined with housing credit constraints

Simulation results (Tables 5 and 6) verify our hypothesis that housing credit constraints plays a threshold role with a single threshold in the housing price fluctuation affecting consumption behaviors of urban households in the central and western regions of China. In addition, the results identify that in combination with housing credit constraints: (1) housing price fluctuation plays an important role in the household non-housing consumption of the central and western regions of China; (2) the relationship between housing price fluctuation and household non-housing consumption can be divided into two stages in the two studied regions; (3) the effects of housing price fluctuation on household non-housing consumption between these two regions show both homogenous and heterogenous characteristics.

The results of threshold estimation (Table 5) display all the p-values of the LR test below 0.05, indicating statistical significance. This reveals a significant single threshold effect of housing credit constraints, with the single threshold value of 0.0108 in the central region and 0.0015 in the western region of China. Additionally, both Figs. 3 and 5 demonstrate no significant differences in urban household disposable income, household non-housing consumption, and housing prices between the two regions during the sample period. The impacts of housing price fluctuation on housing credit constraints can be categorized into two stages for the studied regions (Table 6). In the first stage, where housing credit constraints are below their respective threshold values, the effects of housing price fluctuation on household non-housing consumption exhibit similar characteristics in both regions. Specifically, the elasticities of housing price fluctuation on household non-housing consumption are negative, −0.047 and −0.463 in the central and western regions, respectively, indicating that an increase in housing price fluctuation would diminish household non-housing consumption in both regions. In the second stage, with housing credit constraints exceeding their respective threshold values, the impacts of housing price fluctuation on household non-housing consumption show heterogeneity. The elasticity of housing price fluctuation on household non-housing consumption is positive (0.149) in the central region of China and negative (−0.015) in the western region of China. Furthermore, throughout the sample period, most housing credit constraints in both regions surpassed their threshold values (Fig. 7). In theory, as housing prices rapidly increased during the sample period, rising housing prices should have led to a decrease in household non-housing consumption in the western region of China due to decreasing elasticity, while stimulating household non-housing consumption in the central region of China. Indeed, the household non-housing consumption rate declined from 74% in 2005 to 61.61% in 2020 in the central region and from 79.14% in 2005 to 63.16% in 2020 in the western region. Integrating the above analysis, the results indicate that housing price fluctuation and housing credit constraints are joint factors affecting household non-housing consumption, but not the primary driving forces behind low household non-housing consumption rates in the central and western regions of China. Additionally, the findings suggest that relaxing housing credit constraints to some extent stimulates household non-housing consumption in the central region, aligning with our hypothesis.

Synthesis analysis

Comprehensively integrating the above analysis, the results (Fig. 1) show that: (1) Low urban household disposable income and low non-housing consumption rates occurred simultaneously in both regions during the sample period (Figs. 3, 5 and 8). (2) housing prices combined with housing credit constraints had both crowding-out and wealth effects on household household non-housing consumption. (3) housing credit constraints plays a threshold role in the impact of housing price fluctuation on household non-housing consumption, and most housing credit constraints values in the studied areas exceeded their threshold values during the sample period, as more relaxed housing credit constraints means a better financial environment to support households altering their current household non-housing consumption through the housing wealth financial channel. (4) When housing credit constraints exceed their threshold value, the effects of rising housing prices on household non-housing consumption were positive. However, the effects of rising housing prices on household non-housing consumption in the western region remained negative, implying that crowded-out effects of rising housing prices on household non-housing consumption exceeded housing wealth effects.

Discussion

Constructing a threshold panel model, we investigated how housing price fluctuation combined with housing credit constraints affected household non-housing consumption in the central and western regions of China. The results confirm our hypothesis that housing credit constraints is a threshold variable that changes the trajectories of housing price fluctuation influencing household non-housing consumption in the central and western regions. First, housing price fluctuation negatively affects the household non-housing consumption of urban households in these two regions when housing credit constraints are below their respective threshold values. Second, when housing credit constraints exceed their threshold values, housing prices increases positively influence household non-housing consumption in the central region. However, the increase in housing prices in the western region still has negative impacts on household non-housing consumption, only with a decrease in elasticity compared to the first stage. In addition, most housing credit constraints in these two regions exceeded the values, while non-housing consumption rates of households in these two regions had low growth rates relative to the urban household disposable income growth rate during the period 2005–2020. Further, low urban household disposable income, low non-housing consumption and unaffordable housing prices occurred simultaneously in the studied regions, implying that housing wealth from higher housing prices cannot be an efficient income to offset the effect of other factors that increase household non-housing consumption, even though China’s government implemented numerous policies for relaxing housing credit constraints to stimulate household non-housing consumption. The following discussion focuses on the causes of these observed phenomena.

The disparities of the housing price fluctuation combing with housing credit constraints influencing the household non-housing consumption

Housing is a dual good, characterized by serving both as a consumption and investment asset (Yang et al., 2018; He and Simmons, 2022). Consequently, according to theory, increasing housing prices would have both wealth and crowding-out effects on household non-housing consumptions. Our research findings confirm that by relaxing Housing Credit Conditions (HCC), housing wealth liquidity resulting from the surge in housing prices can be effectively alleviated, thereby stimulating consumption or reducing the net crowding-out effects on household non-housing consumption. This discovery aligns with the studies by Waxman et al. (2020), where the relaxation of housing credit constraints led to increased liquidity of housing wealth due to rising housing prices, ultimately boosting consumption.

Heterogeneities of housing price fluctuation on household non-housing consumption when housing credit constraints exceeded their threshold values between these two regions may have been caused by differing homeownership rates. According to CHFS data, the homeownership rateFootnote 7 in the western region was lower than in the central region. For instance, in 2010 and 2013, homeownership rates in the central region reached 86.23% and 78.90%, while in the western region, they were 79.27% and 76.91%, respectively. The wealth effects of increasing housing prices largely depend on household homeownership, as Mathä et al. (2017) identified homeownership as a significant determinant of wealth accumulation. Housing price appreciation can positively impact homeowners’ wealth, but it also leads to higher rents for renters, resulting in negative effects on their household non-housing consumption. The rise in housing prices elevates living costs and triggers a crowding-out effect on consumption. Furthermore, renters aspiring to become homeowners will need to borrow less and save more to meet down payment requirements (Atalay et al., 2020). Therefore, even with the continuous relaxation of housing credit constraints by China’s government, when housing credit constraints in the western region exceeded the threshold value, the crowding-out effect of increasing housing prices on household non-housing consumption remained dominant.

Low consumption rate, low urban household disposable income and housing price unaffordability

According to the absolute income hypothesis, low income generally results in a high marginal propensity to consume, leading to a high consumption rate (Cui and Chang, 2021). Our findings reveal a high marginal propensity to consume in both regions, reaching 0.901 in the central region and 0.923 in the western region (Table 6), indicating a strong sensitivity of consumption to current income. Surprisingly, we observed a simultaneous occurrence of low non-housing consumption rates and low urban household disposable income in the studied regions, which contradicts the traditional view that low urban household disposable income is typically associated with high non-housing consumption rates. For instance, in 2020, the average disposable income index per capita was approximately RMB 24,810 in the central region and RMB 24,153 in the western region, while it was RMB 34,792 in the eastern region of urban China. During the same period, the average non-housing consumption rates were 60.19% and 63.17% in the central and western regions, significantly lower than the 66.60% observed in the eastern region of China.

Moreover, our simulation results demonstrate that housing price fluctuation had a positive impact on household non-housing consumption in the central region of China during the second stage, characterized by the majority of housing credit constraints surpassing the threshold values. Conversely, in the western region, housing price fluctuation continued to negatively affect household non-housing consumption, and an increase in housing price fluctuation significantly reduced the elasticity of the crowded-out effects on household non-housing consumption. This indicates that China’s government has continuously relaxed housing credit constraints in both the central and western regions to alleviate the liquidity of housing wealth.

In theory, during the sample period in the central region of China, accompanied by rapid increases in housing prices (Fig. 6), household non-housing consumption should have experienced growth since the net and dominant effect of housing price rises on household non-housing consumption shifted from crowding-out to wealth accumulation. However, in reality, household non-housing consumption remained at a low level, and its growth rate lagged far behind the rate of disposable income growth.

Most importantly, it is interesting to find that unaffordable housing prices and high home-ownership rates have simultaneously occurred in the studied regions during the sample period. As Yan and Zhu (2013) found, continuous housing price increases/ housing unaffordability result in a house slave effect, which then suppresses household consumption for paying mortgages or saving more money to buy a home. Housing affordability is not just about the ability to buy or rent a home, but also being able to afford to live in it. If a household buys or rents a home, at the expense of life quality indicators like accessibility, such as a home that is located too far from work or school, this also is a type of housing unaffordability. Generally, housing affordability is measured using the Price-Income ratio (PIR)Footnote 8. Figure 8 shows that the PIR located in the range of 3.57–7.31 in the western region, and in the range of 4.13–7.67 in the central region. According to the widely-used standard (house prices-median income ratio equal to three), all PIRs in the 18 provinces of both studied regions show unaffordable housing prices. In contrast, the homeownership rate in the central and western regions remained high. In 2013, the homeownership rate reached 79.27% and 76.91% in the undeveloped central and western regions of urban China, far exceeding that of about 60% in the USAFootnote 9. In China, homeownership is directly related to the unique phenomenon of the “nearby enrollment” policy, in which access to public primary/secondary school is directly related to the hukou registration of homeownership. Thus, households with school-aged children generally prefer to buy a home. Moreover, in 2014 and 2015, China’s central government instructed local governments to implement an “Exam-free admission to the nearest school” policy, intensifying the linkage between homeownership and the admission qualifications for public primary schools (Gao et al., 2022). As a result, homeownership rates in the central and western regions have continuously increased to 81.8% and 75.2% in 2020, respectively. However, the rise in homeownership has also led to a worsening of housing unaffordability since 2014 (Fig. 8). According to the people’s bank of China surveys in 2019, the household debt participation rate of residents in the central and western regions reached 55.7% and 60.1% in 2019, respectively, and housing loans were the main component of debt. Hence, unaffordable housing prices and strong incentives to own a home in China have, in turn, resulted in households tightening their belts and suppressing non-housing consumption to buy a home, as Yan and Zhu (2013) and Li (2018) termed “housing slave effects”.

Above, we argued the negative marginal elasticity of housing price fluctuation on household non-housing consumption in the western region, and the low household non-housing consumption rate in the central region is driven by the combination of homeownership linked to the admission qualifications of public primary schools and housing price unaffordability. The findings are corroborated by the fact that households tighten their belts to buy a home, which results in contradictory facts of both low non-housing consumption rate and low urban household disposable income level, and also both housing price unaffordability and high home-ownership rate, which have occurred simultaneously in the studied regions. This finding differs slightly from Waxman et al. (2020) who suggested that heavy borrowing constraints and strong investment incentives in housing are a combination factor inhibiting household non-housing consumption in urban China. On the contrary, our simulation results explain the fact that housing credit constraints have been continuously relaxed in the studied regions as the people’s bank of China surveys in 2019 show that the household debt participation rate of residents in the central and western regions reached 55.7% and 60.1% in 2019, respectively, and that housing loans are the main component of debt. In addition, to some extent, looser borrowing constraints in the housing mortgage market are contributing to a housing boom, driving housing prices to rise and then increasing unaffordability. This confirms Justiniano et al. (2019), who indicated that looser lending constraints would lead to an increase in housing prices.

Conclusions and policy implications

The main contribution of this study is to provide quantitative evidence of the effects of housing price fluctuation on household non-housing consumption, using a threshold panel model. The simulation results verify that housing price fluctuation had both crowding out and wealth effects on the household non-housing consumption of urban households in the central and western regions of China during the period 2005–2020. The main findings show that: (1) housing credit constraints played a single threshold role in the impacts of housing price fluctuation on household non-housing consumption; (2) the elasticity of housing price fluctuation on household non-housing consumption was negative in the western region during the entire sample period, and the elasticity of housing price fluctuation on household non-housing consumption decreased when housing credit constraints exceeded its threshold value; (3) the effects of housing price fluctuation on household non-housing consumption in the central region changed from negative to positive when housing credit constraints exceeded its threshold value; (4) the elasticity of housing price fluctuation on household non-housing consumption decreased in the western region and was positive in the central region, which reveals that relaxing housing credit constraints can stimulate liquidity of housing wealth in the studied regions; (5) most interestingly, a low non-housing consumption rate in the studied regions was driven by the combination of unaffordable housing prices and homeownership links to admission qualifications for better public primary/secondary education resources.

The above findings contribute to the existing literature by providing new evidence and better understanding that housing credit constraints and housing price fluctuation are a combination factor affecting household non-housing consumption, but not a combination factor driving low non-housing consumption of households in the studied regions during the sample period. In addition, the findings also provide better understanding of the unique phenomena related to low URIDIN, low non-housing consumption rate, and unaffordable housing prices and high home-ownership rates occurring simultaneously. To some extent, a looser housing credit constraints in China effectively enhances the liquidity of housing assets and then causes the wealth effect on consumption, but also tends to aggravate housing unaffordability. Further, the fact that housing is closely linked to public primary/secondary school resources (school district housing) in China strongly pushes Chinese households to tighten their belts in order to buy a home.

Based on the findings, suggestions and policy implications for the housing market and low consumption in China are presented here. First, the findings suggest that policies stabilizing housing prices and consumption in China are necessary. China’s government should not depend on a booming real estate market to drive household consumption growth, but rather raise income levels and reduce income uncertainty faced by urban residents in order to ensure sustainable economic growth. Homeownership is necessary since homeownership is attached to hukou registration for most households in China, and hukou registration is a prerequisite for admission of children to primary and secondary education. Thus, relaxing housing credit constraints generally induces potential home buyers to become effective home buyers, and then relaxing housing credit constraints, in turn, stimulates potential home buyers to suppress their non-housing consumption. Thus, the Chinese government should pay more attention to stable housing prices when relaxing housing credit constraints to stimulate household non-housing consumption.

Second, in China, homeownership is closely linked to better public education resources, driving most of China’s households to buy a home at the expense of non-housing consumption. This is consistent with the contradictions of both low non-housing consumption rates and low disposable income, and that both unaffordable housing prices and high homeownership rates existed in the studied regions. Relaxing housing credit constraints cannot be an effective way to stimulate household non-housing consumption even though relaxing housing credit constraints eases the liquidity of housing price wealth in the studied regions. Thus, these findings suggest that the Chinese government should pay more attention to stabilizing housing prices and balancing public primary/secondary education resources when the government regulates housing market and consumption strategies, thereby promoting consumption and stimulating domestic demand.

In this study, we take a unique perspective on home buying driven by the availability of public education tied to the homeownership. Specifically, we discuss the difference in relationship between housing price change and household non-housing consumption across regions. The public education tied to homeownership direct affect housing prices, which subsequently induce changes in household consumption. Moreover, in our model, housing prices serve as a pivotal explanatory variable. It is of the importance of public education in China, especially in its connection to housing prices and consumption. Therefore, in future studies, we plan to delve deeper into the relationship between public education and housing prices to gain a more comprehensive understanding of this complex factor’s influence on household economic behavior. We recognize the importance of this area and intend to focus our future research efforts on enriching our understanding of it.

Data availability

The data that support the findings of this study are available from the Wenzhounese Economy Research Institute of Wenzhou University, but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are however available from authors upon reasonable request and with permission of the Wenzhounese Economy Research Institute of Wenzhou University.

Notes

National data (stats.gov.cn).

Property Prices Index by Country 2020 (numbeo.com); Asia: Property Prices Index by Country 2020 (numbeo.com).

A more detailed description of the equations is provided in the Appendix Table 1. If readers are interested in the process of deducingd equations, you can email us and we would like to provide the process.

National data (stats.gov.cn).

Quality of Life Index by Country 2020 (numbeo.com).

10 ways cities are tackling the global affordable housing crisis | World Economic Forum (weforum.org).

Homeownership Rate in the United States (RHORUSQ156N) |FRED| St. Louis Fed (stlouisfed.org).

References

Ampudia M, Mayordomo S (2018) Borrowing constraints and housing price expectations in the Euro area. Econ Model 72:410–421

Andersen HY, Leth-Petersen S (2021) Housing wealth or collateral: How home value shocks drive home equity extraction and spending. J Eur Econ Assoc 19(1):403–440

Atalay K, Whelan S, Yates J (2016) House prices, wealth and consumption: New evidence from Australia and Canada. Rev Income Wealth 62(1):69–91

Atalay K, Barrett GF, Edwards R et al. (2020) House price shocks, credit constraints and household indebtedness. Oxford Econ Pap 72(3):780–803

Balsa-Barreiro J, Li Y, Morales A (2019) Globalization and the shifting centers of gravity of world’s human dynamics: Implications for sustainability. J Clean Prod 239:117923

Balsa-Barreiro J, Morales AJ, Lois-Gonz lez RC (2021) Mapping population dynamics at local scales using spatial networks. Complexity 2021:1–14

Berger D, Guerrieri V, Lorenzoni G et al. (2018) House prices and consumer spending. Rev Econ Stud 85(3):1502–1542

Burrows V (2018) The impact of house prices on consumption in the UK: A new perspective. Economica 85(337):92–123

Caporale GM, Costantini M, Paradiso A (2013) Re-examining the decline in the US saving rate: The impact of mortgage equity withdrawal. J Int Financ Mark 26:215–225

Cerutti E, Dagher J, Dell’Ariccia G (2017) Housing finance and real-estate booms: A cross-country perspective. J Hous Econ 38:1–13

Chen J, Hardin W, Hu M (2020) Housing, wealth, income and consumption: China and homeownership heterogeneity. Real Estate Econ 48(2):373–405

Chen NK, Chen SS, Chou YH (2010) House prices, collateral constraint, and the asymmetric effect on consumption. J Hous Econ 19(1):26–37

Chen Y, Chen H, Li G et al. (2021) Time-varying effect of macro-prudential policies on household credit growth: Evidence from China. Econ Anal Policy 72:241–254

Cheng D (2021) Housing boom and non-housing consumption: evidence from urban households in China. Empir Econ 61(6):3271–3313

Chivakul MM, Chen KC (2008) What drives household borrowing and credit constraints? Evidence from Bosnia and Herzegovina 08(202):1–34

Choi JH, Zhu L (2022) Has the effect of housing wealth on household consumption been overestimated? New evidence on magnitude and allocation. Reg Sci Urban Econ 95:103801

Cloyne J, Huber K, Ilzetzki E et al. (2019) The effect of house prices on household borrowing: A new approach. Am Econ Rev 109(6):2104–2136

Cui X, Chang CT (2021) How income influences health: decomposition based on absolute income and relative income effects. Int J Env Res Public Health 18(20):10738

Cumming F, Hubert P (2022) House prices, the distribution of household debt and the refinancing channel of monetary policy. Econ Lett 212:110280

DeFusco AA (2018) Homeowner borrowing and housing collateral: new evidence from expiring price controls. J Financ 73(2):523–573

Dong Z, Hui ECM, Jia SH (2017) How does housing price affect consumption in China: wealth effect or substitution effect? Cities 64:1–8

Eika L, Mogstad M, Vestad OL (2020) What can we learn about household consumption expenditure from data on income and assets? J Public Econ 189:104163

Fan J, Zhou L, Yu X et al. (2021) Impact of land quota and land supply structure on China’s housing prices: Quasi-natural experiment based on land quota policy adjustment. Land Use Policy 106:105452

Fan Y, Yavas A (2020) How does mortgage debt affect household consumption? Micro evidence from China. Real Estate Econ 48(1):43–88

Favara G, Imbs J (2015) Credit supply and the price of housing. Am Econ Rev 105(3):958–992

Favilukis J, Ludvigson SC, Van Nieuwerburgh S (2017) The macroeconomic effects of housing wealth, housing finance, and limited risk sharing in general equilibrium. J Polit Econ 125(1):140–223

Friedman M (1956) Theory of the consumption function. Princeton University Press, Princeton

Ganong P, Noel P (2020) Liquidity versus wealth in household debt obligations: evidence from housing policy in the great recession. Am Econ Rev 110:3100–3138

Gao A, Qiu J, Yu J et al. (2022) Influence of school districts on housing prices and the effect on socio-spatial restructuring: Taking Wuchang District of Wuhan as a case. Progress Geogr 41(04):609–620

Greenwald DL, Guren A (2021) Do credit conditions move house prices?. NBER Working Papers

Grodecka A (2020) On the effectiveness of loan-to-value regulation in a multiconstraint framework. J Money Credit Banking 52:1231–1270

Guerrieri L, Iacoviello M (2017) Collateral constraints and macroeconomic asymmetries. Monetary Econ 90:28–49

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econom 93(2):345–368

He Z, Simmons P (2022) The impact of the minimum housing scale constraint on life-cycle risky asset and housing investment. J Hous Econ 55:101809

Hu Y, Yuan Y (2017) The effect of house prices on consumption in China. China Econ Q 16(2):1031–1050

Huo T, Cao R, Du H et al. (2021) Nonlinear influence of urbanization on China’s urban residential building carbon emissions: New evidence from panel threshold model. Sci Total Environ 772:145058

Iacoviello M, Neri S (2010) Housing market spillovers: evidence from an estimated DSGE model. Econ J Macroecon 2(2):125–164

Justiniano A, Primiceri GE, Tambalotti A (2019) Credit supply and the housing boom. J Polit Econ 127(3):1317–1350

Kaplan G, Mitman K, Violante GL (2020) Non-durable consumption and housing net worth in the great recession: Evidence from easily accessible data. J Public Econ 189:104176

Kartashova K, Tomlin B (2017) House prices, consumption and the role of non-Mortgage debt. J Bank Financ 83:121–134

Levin A, Lin CF, Chu CSJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24

Li C, Zhang Y (2021) How does housing wealth affect household consumption? Evidence from macro-data with special implications for China. China Econ Rev 69:101655

Li C, Lin L, Gan CEC (2016) China credit constraints and rural households’ consumption expenditure. Financ Res Lett 19:158–164

Li J (2018) Consumption inhibition for mortgage slaves in China. China Econ Q 17(01):405–430

Li J, Xu Y, Chiang Y (2014) Property prices and housing affordability in China: a regional comparison. J Comp Asian Dev 13(3):405–435

Li N, Li RYM, Nuttapong J (2022a) Factors affect the housing prices in China: a systematic review of papers indexed in Chinese Science Citation Database. Property Manag 40:780–796

Li N, Li RYM, Yao Q, Song L, Deeprasert J (2022b) Housing safety and health academic and public opinion mining from 1945 to 2021: PRISMA, cluster analysis, and natural language processing approaches. Front Public Health 10:902576

Li N, Li RYM, (2022) A bibliometric analysis of six decades of academic research on housing prices. Int J Hous Mark Anal

Lin L, Wang W, Gan C et al. (2019) Credit constraints on farm household welfare in rural China: evidence from Fujian Province. Sustainability 11(11):3221

Liu J, Chen B (2021) Do the rising housing prices expand China’s consumption inequality? China Econ Q 21(04):1253–1274

Liu L, Wang Q, Zhang A (2019) The impact of housing price on non-housing consumption of the Chinese households: a general equilibrium analysis. N Am J Econ Financ 49:152–164

Mathä TY, Porpiglia A, Ziegelmeyer M (2017) Household wealth in the euro area: the importance of intergenerational transfers, homeownership and house price dynamics. J Hous Econ 35:1–12

Mian A, Sufi A (2018) Finance and business cycles: the credit-driven household demand channel. J Econ Perspect 32(3):31–58

Painter G, Yang X, Zhong N (2022) Housing wealth as precautionary saving: evidence from urban China. J Financ Quant Anal 57:761–789

Penne T, Goedemé T (2021) Can low-income households afford a healthy diet? insufficient income as a driver of food insecurity in Europe. Food Policy 99:101978

Seo M, Kim S, Kim Y (2019) Estimation of dynamic panel threshold model using Stata. Stata J 19(3):685–697

Shan S, Ahmad M, Tan Z, Adebayo TS, Li RYM, Kirikkaleli D (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: tracking environmental sustainability. Energy 234:121243

Suari-Andreu E (2021) Housing and household consumption: an investigation of the wealth and collateral effects. J Hous Econ 54:101786

Tong H (2012) Threshold models in non-linear time series analysis, Springer Science & Business Media

Tran BL, Chen CC, Tseng WC (2022) Causality between energy consumption and economic growth in the presence of GDP threshold effect: Evidence from OECD countries. Energy 251:123902

Tran MC, Gan CEC, Hu B (2016) Credit constraints and their impact on farm household welfare: evidence from Vietnam’s North Central Coast region. Int J Soc Econ 43:782–803

Wang L, Yang W, Zhang X et al. (2021) Re-shaping global-ness by spending overseas: analysis of emerging Chinese consumption abroad. Cities 109:103034

Waxman A, Liang Y, Li S et al. (2020) Tightening belts to buy a home: consumption responses to rising housing prices in urban China. J Urban Econ 115:103190

Wrenn DH, Yi J, Zhang B (2019) House prices and marriage entry in China. Reg Sci Urban Econ 74:118–130

Wu R, Hua X, Peng L et al. (2022) Nonlinear effect of digital economy on carbon emission intensity-based on dynamic panel threshold model. Front Environ Sci 10:943177

Wu Y, Zhen H, Delang CO et al. (2021) How to build an eco-efficient city? Cases studies in Chinese urbanization over the past 20 years. Sustain Cities Soc 75:103387

Yan S, Zhu Z (2013) House slave effect or wealth effect? A theoretical analysis of the impact of rising housing prices on national consumption. Manage World 03:34–47

Yang Y, Jiang J, Yin Z (2021) Social networks, shocks, and household consumption in China. Econ Anal Policy 71:111–122

Yang Z, Fan Y, Zhao L (2018) A reexamination of housing price and household consumption in China: the dual role of housing consumption and housing investment. J Real Estate Financ 56(3):472–499

Zhang H, Kim H (2022) Institutional quality and FDI location: a threshold model. Econ Model 114:105942

Zhao D, Chen Y, Shen JH (2020) Mortgage payments and household consumption in urban China. Econ Model 93:100–111

Zhao J, Barry PJ (2014) Effects of credit constraints on rural household technical efficiency: evidence from a city in northern China. China Agric Econ Rev 6:654–668

Zhou J, Hui ECM (2022) Housing prices, migration, and self-selection of migrants in China. Habitat Int 119:102479

Funding

This work was supported by Projects of the National Natural Science Foundation of China (No. 41761112 and No. 42271007), the Second Tibetan Plateau Scientific Expedition and Research Program (Grant No. 2019QZKK040303), The National Key R&D Program of China (No. 2022YFF1302401 and No. 2022YFF1301804), Comprehensive Scientific Investigation Program of the Gaoligong Mountain National Park in Yunnan Province, Project for Wetland Ecological Processes and Impact Assessment of Wetland Birds in the Huanghe Yangqu Hydropower Station Engineering Project (No. 1161-GCJS-FY-[2022]), Theoretical Research of Launching and Receiving Hood System for Short Sleeve Without Reinforcement in Shield and Pipe Jacking (No. 13901-412312-22250), and the Research on train vibration frequency and propagation characteristics of roadbed and soil (No. 13901-412312-23183).

Author information

Authors and Affiliations

Contributions

HZ and JQ: methodology, software, writing- revised draft, data curation; GL: methodology, reviewing and editing; YW: conceptualization, writing–original draft, writing- revised draft; COD: writing-reviewing and editing; HH: supervision, resources.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zheng, H., Qian, J., Liu, G. et al. Housing prices and household consumption: a threshold effect model analysis in central and western China. Humanit Soc Sci Commun 10, 764 (2023). https://doi.org/10.1057/s41599-023-02258-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02258-w

- Springer Nature Limited