Abstract

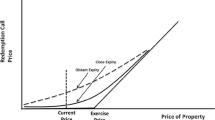

Assessment of lender and third-party bidder acquired properties at foreclosure auction is provided. Properties acquired at foreclosure auction by third-party bidders transact at a discount to lender dispositions of real estate owned (REO) properties. The discount reflects a reduction in costs associated with lender owned (REO) dispositions and uncertainty faced by third-party bidders. Moreover, there is a ranking in transaction prices among initial purchases by third-party bidders at foreclosure auction, REO sales, non-distressed property sales and the subsequent sales of third-party bidder acquired properties. Third-party bidder auction prices are below REO sale prices, which are below non-distressed property sale prices, which are below the subsequent sale prices of third-party bidder acquired properties. The price spacing by cohort is logical, intuitive and economically justified in a market with rational participants. Implications are also apparent for the measurement of price changes, net sale proceeds and returns to residential real estate.

Similar content being viewed by others

Notes

The frequency of foreclosure auction sales to third-party bidders has historically been very low.

The literature is silent on the definition of the third-party bidder acquired properties and their use in indices, return calculations or evidence of foreclosure/distressed asset discounts.

There are other mitigation strategies that end in the conveyance of property title including short sales. Cash sales at auction eliminate many disposition costs including brokerage and actual property management that comes with ownership. Concurrently, in discussions with large scale lenders and servicers, some municipalities have actually increased holding costs by implementing increased inspections, limiting conveyance of properties not at code and using liens that attach to all properties a lender or investor may own.

Public records do not capture potential “concessions” at closing related to items found in a buyer’s inspection report. It is common practice to have some of these items addressed as a concession at closing. This impacts both settlement and net proceeds, but not recorded price. Acknowledgement is made that these minor changes are also likely to not be represented in MLS data.

These sales will appear as normal transactions as the conveyor will not be a lender or collateral holder. In the present case, with a third-party bidder sale there will be no lender in the chain of title making identification as a distressed asset problematic. While it is possible to identify through required notices and deed types whether a property was under foreclosure, the public sale record such as assessor’s data will typically show as an arms-length transaction without debt. Proper filtering of the transactions is essential and studies and reports to date are generally silent on this issue. Concurrently, in a MLS database, type of sale is typically self-reported. A transaction with no financing contingency could be classified as a cash sale in this self-reported context even if a mortgage is used. In such a case, the buyer is taking additional risk as they may have to use more cash if the loan underwriting indicates a lower mortgage amount. These areas need additional research and clarification and are related but not central to this study.

The existence of direct and opportunity related costs for distressed assets are acknowledged in the literature. One approach is a model related to disposition costs and net realizable value or proceeds (Shilling et al. 1990). Third-party acquirers are likely to have different value prospects (Harding et al. 2012).

These auctions take place online allowing the lender/servicing agent to provide an expected bid.

For the lender/owner there is an implicit holding cost that includes direct expenditures along with some cost of capital.

There is no time-on-market (TOM) for a foreclosure auction related sale. The process is related to conveyance of ownership from the borrower to the lienholder. Hence, TOM is not the focus in this paper since the foreclosure auction process is not a traditional sale, but is instead the legal process whereby a lender exercises a right to acquire a property subsequent to default. Benefield and Hardin (2015) provide a review of TOM studies that highlights inconsistent empirical results and suggest that the TOM debate for typical sales remains open to debate.

We use both assessor’s data and MLS data for property attributes. The MLS provides more housing attributes than the assessor’s data. But, not all the auctions can be matched with MLS data, as auctioned properties are usually not listed in the MLS. Using assessor’s data helps us obtain more observations, due to a better matching between the two databases. When the MLS data are merged with the auctions, a portion of the observations are lost. To provide robustness checks, we report the results based on two merged samples. This means the numbers of observations in the different tables may vary.

Plaintiffs who are either individuals or service companies for mechanic’s liens by contractors are removed. The transactions with home owner associations as plaintiffs are also eliminated from the sample.

There are several typical transaction codes used by the Miami-Dade County Appraisal Office that carries out property tax assessments. For example, CTI means certificate of title, which is used for foreclosure actions only. DEE refers to transactions in which regular deed transfers are involved. QCD means quit claim deed, which is a deed type releasing a person’s interest in a property without stating the nature of the person’s interest or rights, and with no warranties of ownership.

It is noted that even in a normal market case, the lender/servicer should/will look at net transaction proceeds. Also, in the absence of a large number of third-party bidder acquisitions, the influence of these properties on repeat sale or other index measures is minimal.

For example, from Real Trends, at www.realtrends.com, the average real estate commission is 5.4 %.

We delete recorded prices less than $20,000, as those prices are less likely to reflect market value of the property. We also calculate capital gains for a pair of repeat sales for lenders based on fitted value of the properties. In other words, instead of using the recorded auction prices for the properties that went back to lenders (a book keeping entry with no cash implications), we also find a fitted value of the properties using hedonic regression with detailed property characteristics and zip code. The results based on the fitted value are qualitatively similar compared with those using recorded prices.

References

Benefield, J. D., & Hardin, W. G., III. (2015). Does time-on-market measurement matter? The Journal of Real Estate Finance and Economics, 50(1), 52–73.

Campbell, J. Y., Giglio, S., & Pathak, P. (2011). Forced sales and house prices. American Economic Review, 101(5), 2108–2131.

Carroll, T. M., Clauretie, T. M., & Neill, H. R. (1997). Effect of foreclosure status on residential selling price: comment. Journal of Real Estate Research, 13(1), 95–102.

Chang, Y., & Li, X. (2014). Distressed home sales: Temporary discount or permanent devaluation. Working paper, Freddie Mac.

Clauretie, T. M., & Daneshvary, N. (2009). Estimating the house foreclosure discount corrected for spatial price interdependence and endogeneity of marketing time. Real Estate Economics, 37(1), 43–67.

Drukker, D. M., Prucha, I. R., & Raciborski, R. (2013a). Maximum likelihood and generalized spatial two-stage least-squares estimators for a spatial-autoregressive model with spatial-autoregressive disturbances. The Stata Journal, 13(2), 221–241.

Drukker, D. M., Peng, H., Prucha, I. R., & Raciborski, R. (2013b). Creating and managing spatial-weighting matrices with the spmat command. The Stata Journal, 13(2), 242–286.

Fisher, L. M., Lambie-Hansen, L., & Willen, P. S. (2013). The role of proximity in foreclosure externalities: evidence from condominiums. Federal Reserve Bank of Boston, Public Policy Discussion Paper.

Forgey, F. A., Rutherford, R. C., & VanBurskirk, M. L. (1994). Effect of foreclosure status on residential selling price. Journal of Real Estate Research, 9(3), 313–318.

Gangel, M., Seiler, M. J., & Collins, A. (2013). Exploring the foreclosure contagion effect using agent-based modeling. Journal of Real Estate Finance and Economics, 46(2), 339–354.

Hardin III, W. G., & Wolverton, M. L. (1996). The relationship between foreclosure status and apartment price. Journal of Real Estate Research, 12(1), 101–109.

Harding, J. P., Rosenthal, S. S., & Sirmans, C. F. (2003). Estimating bargaining power in the market for existing homes. Review of Economics and Statistics, 85(1), 178–188.

Harding, J. P., Rosenblatt, E., & Yao, V. W. (2012). The foreclosure discount: myth or reality? Journal of Urban Economics, 71(2), 204–218.

Hendel, I., Nevo, A., & Ortalo-Magne, F. (2009). The relative performance of real estate marketing platforms: MLS versus FSBOMadison.com. American Economic Review, 99(5), 1878–1898.

Kelejian, H., & Prucha, R. (1998). A generalized spatial Two-stage least squares procedure for estimating a spatial autoregressive model with autoregressive disturbance. The Journal of Real Estate Finance and Economics, 17(1), 99–121.

Lin, Z., Rosenblatt, E., & Yao, V. W. (2009). Spillover effects of foreclosures on neighborhood property values. The Journal of Real Estate Finance and Economics, 38(4), 387–407.

Pennington-Cross, A. (2006). The value of foreclosed property. Journal of Real Estate Research, 28(2), 193–214.

Rajajagadeesan, R., & Hansz, A. J. (2014). The valuation impact of distressed residential transactions: anatomy of a housing price bubble. The Journal of Real Estate Finance and Economics, 49(2), 277–302.

Shilling, J. D., Benjamin, J. D., & Sirmans, C. F. (1990). Estimating net realizable value for distressed real estate. Journal of Real Estate Research, 5(1), 129–13.

Springer, T. M. (1996). Single-family housing transactions: Seller motivations, price, and marketing time. The Journal of Real Estate Finance and Economics, 13(3), 237–254.

Sumell, A. (2009). The determinants of foreclosed property values: evidence from inner-city Cleveland. Journal of Housing Research, 18(1), 45–61.

Turnbull, G. K., & Van der Vlist, A. (2014). Foreclosures and spillovers: Externality or supply effect? Working Paper 1304, University of Central Florida.

Author information

Authors and Affiliations

Corresponding author

Appendix: Definition of the Variables in the Empirical Analysis

Appendix: Definition of the Variables in the Empirical Analysis

- Banksale :

-

A dummy variable, equal to 1 if a house is sold by a lender after getting the property through foreclosure auction, and 0 otherwise

- Biddersale :

-

A dummy variable, equal to 1 if a house is acquired by a third-party bidder during the foreclosure auction, and 0 otherwise.

- Biddersubsale :

-

A dummy variable, equal to 1 if a house is sold subsequently by a third-party bidder after the bidder wins the property from foreclosure auction, and 0 otherwise

- Age :

-

Age of a house based on year of 2013

- Logsqft :

-

Log of square footage of a house

- Bath :

-

Number of bathrooms in a house

- Bedroom :

-

Number of bedrooms in a house

- Acre :

-

Acreage of a house

- Cashsale :

-

A dummy variable, equal to 1 if the transaction is a cash sale, and 0 otherwise

- Garage :

-

A dummy variable, equal to 1 if a house has at least one garage

- Closet :

-

A dummy variable, equal to 1 if a house has a walk-in closet

- Noair :

-

A dummy variable, equal to 1 if a house does not have any air conditioning system

- Central :

-

A dummy variable, equal to 1 if a house has a central air conditioning system

- Lakeview :

-

A dummy variable, equal to 1 if a house has lake view

- Pool :

-

A dummy variable, equal to 1 if a house has a pool

- Fair :

-

A dummy variable, which indicates the condition of a house to be fair

- Good :

-

A dummy variable, which indicates the condition of a house to be good

- IMR :

-

Inverse mills ratio based on “Econometric Analysis” (7th edition) by William Greene

- Zipcode :

-

A dummy variable for each zip code in Miami-Dade County

Rights and permissions

About this article

Cite this article

Chinloy, P., Hardin, W. & Wu, Z. Foreclosure, REO, and Market Sales in Residential Real Estate. J Real Estate Finan Econ 54, 188–215 (2017). https://doi.org/10.1007/s11146-015-9544-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-015-9544-x