Abstract

This paper examines default outcomes for subprime first lien loans during the recent subprime mortgage boom. It conducts this investigation in two phases. The paper first examines factors associated with pre-foreclosure outcomes for subprime mortgages in default. It then examines factors associated with different outcomes for loans that enter foreclosure. These factors include less understood elements such as mortgage product features and borrower demographics. The analysis is based on detailed loan-level data and employs multinomial logit models in a hazard framework. Results show that default resolutions vary with product features and borrower demographics. Adjustable rate and interest-only mortgages, and loans with low- or no-documentation are more likely to enter foreclosure proceedings, and, once in foreclosure, are more likely to become REO. The existence of junior liens increases the probability of the loan remaining in default. Owner-occupancy is associated with lower likelihood of foreclosure initiation and REO, and greater likelihood of curing default. Additionally, default outcomes are impacted by local legal, economic and housing market conditions, and the equity in the home.

Similar content being viewed by others

Notes

In February 2009, the Obama administration announced the Homeowner Affordability and Stability Plan, which aims to help a large number of at-risk homeowners avoid foreclosure. The main components of the plan include facilitating low-cost refinancing and boosting loan modifications through a variety of financial incentives provided to servicers, lenders, and borrowers.

Defaults are defined as 90+ day delinquencies in which acceleration has been initiated.

Servicers are the principal agents with whom borrowers interact throughout the lifetime of their mortgages. In some cases, servicers may also be the owners of whole loans or investors in securitized loans that they service, but typically owners and investors in loans are different institutions than the servicer. Although servicers are contractually required to act in the best interests of the investors, they may have different incentives from the investor(s) with regard to loss mitigation actions. Servicers may also have some discretion with regard to loss mitigation decisions.

Pennington-Cross ( 2010 ) finds that, for the majority of loans, foreclosure is not profitable for lenders [here meaning the owners of the loans], and, as a result, lenders try to postpone or forgo foreclosure and find alternative, less costly outcomes.

For example, nonforeclosure outcomes are especially attractive to lenders in the subprime market, where borrowers tend to remain in delinquency for longer periods of time and losses on foreclosures tend to be higher (Capozza and Thomson 2005, 2006; Pennington-Cross 2010). In addition, given the relatively high interest rates of the subprime loans, any ongoing payments made by borrowers, even if sporadic, may generate more income for lenders than foreclosures (Pennington-Cross 2010).

Haughwout et al. ( 2008 ) provide empirical evidence on the asymmetry of the effects of house price increases and decreases on the probability of an early default for subprime loans.

These studies have used the First American LoanPerformance data and a similar database called LPS Analytics.

To control for unobserved heterogeneity and possible dependence among observations for the same loan, we use a cluster-robust variance estimator that allows for clustering by loan. The independence of irrelevant alternatives (IIA) assumption (the odds ratio of a pair of outcomes is independent of any of the alternative outcomes)—a key but typically hard to satisfy requirement of the multinomial logit model—is not a concern in our case, because the Small-Hsiao test cannot reject the IIA assumption for our data.

Pennington-Cross (2010) notes that borrowers have little incentive to maintain the property, because they likely will no longer own it. Supporting this scenario, Harding et al. (2000) provide empirical evidence that homeowners with little equity in their homes spend less on maintenance than other homeowners.

We eliminate subordinate loans because servicers’ ability to recover anything from a subordinate lien on a property with a defaulted first mortgage is extremely limited and as a result the incentives may be substantially different than for the first lien.

We assume that a junior lien exists on the property at the time of the first lien loan origination if the combined loan-to-value at origination is greater than the loan-to-value.

EQUITY is computed for each month following default as the difference between the estimated house value and the outstanding principal balance for the first lien loan in the given month. The (time-variant) house value estimate is computed based on the house value at the time of loan origination (which is available in our loan performance data) and the SMSA-level average rate of house price appreciation since origination, which is derived from the Federal Housing Finance Agency’s repeat-sale index.

While we can identify the existence of junior liens at the time of the origination of the first lien loan (see footnote 12 above), we cannot compute the monthly outstanding balance for these subordinate liens. Moreover we do not know whether there were subordinate liens that were originated subsequent to the first mortgage. Thus, our equity variable likely overstates the true equity. For example, using the combined loan-to-value at origination, the initial equity for properties with a junior lien in existence at the time of the first lien loan origination is about ten times lower than that for properties without a junior lien.

We use Fair Isaac Corporation’s FICO score at origination.

Supporting this hypothesis, Danis and Pennington-Cross (2005) find that borrowers with higher credit scores are much more likely to stay current and less likely to enter delinquency or default.

Ong and Pfeiffer (2008) suggest that, in Los Angeles, language problems may be particularly serious for Asians and Hispanics, due to the high percentage of foreign-born residents in these groups. Hendricks (2009) points out that “language is a huge issue” among the Hispanic and Asian homeowners of the San Francisco Bay Area; it prevented them from understanding the initial loan terms and now it prevents them from obtaining effective help in avoiding foreclosure. And, exacerbating the importance of language barriers is the lack of non-profit agencies that provide foreclosure prevention counseling in foreign languages (according to Hendricks (2009), only one of five counseling agencies certified by the US Department of Housing and Urban Development in San Francisco offer all services in both Spanish and English).

Following Chomsisengphet and Pennington-Cross (2006), INTEREST_RATE_CHANGE is based on the national average contract mortgage rate which is derived from the Federal Housing Finance Board’s Monthly Interest Rate Survey (MIRS) and is reported by the Federal Housing Finance Agency (FHFA) on a monthly basis. HP_APPREC is the SMSA-level average rate of house price appreciation over the year preceding the quarter in which the loan performance is observed and is computed based on the repeat-sale index produced by the FHFA. INC_GROWTH is calculated at the SMSA level as the percentage change in median per capita income during the calendar year preceding the month when the loan performance is observed. UNEMP_RATE used is the state unemployment rate in the month when the loan performance is observed.

This measure is drawn from Jankowski (1999) and reflects Freddie Mac’s guidelines as to the expected length of time of a foreclosure, measured approximately from the time of the initial default to the time of the foreclosure sale. According to estimates, a foreclosure without any complications would take between 37 days (in Georgia) and 303 days (in New York).

Ideally, we would like to examine and present the association between individual servicers and default outcomes. Unfortunately, our level of access to the data does not permit us to execute this type of examination. A future paper by researchers able to access these data in this manner would be a useful contribution to the field.

HMDA requires financial institutions to publicly report detailed data on their home mortgage lending activity. In addition to such details as property type and location, loan amount, and purpose, HMDA includes information on race, ethnicity, and gender of loan applicants and co-applicants.

We matched the LoanPerformance and HMDA loans in two steps. In the first step, we matched the two datasets on the basis of six “mandatory” criteria: (1) the HMDA action year matches the LoanPerformance origination year; (2) the LoanPerformance loan number is contained in the HMDA application number; (3) the Federal Information Process Standard (FIPS) states codes match; (4) the loan amounts match; (5) the lien status matches; and (6) the LoanPerformance origination date is later than the HMDA application date. We found multiple HMDA matches for some LoanPerformance loans. In the second step, we used six additional criteria to select one HMDA match for each LoanPerformance loan, the one satisfying most of these additional criteria. The additional criteria are: (1) occupancy; (2) loan purpose; (3) loan type; (4) originator name; (5) date (if LoanPerformance origination date is within 30 days of the HMDA action date); and (6) zip code (based on identifying zip codes associated with the census tract for the HMDA loans). For (6), we used a dataset provided by HUD that matches census tracts with up to 5 zip codes. If the zip code in the LoanPerformance dataset matched up with any of the potential 5 HMDA zip codes, then it was treated as having matched on the zip code.

While the percentage difference in the percent of paid-off loans is also large, the absolute difference is very small due to the very small proportion of loans that reach this outcome.

The regression results on which these comparisons are based are available upon request from the authors.

In preliminary work, we also graphically investigated the variation of marginal effects over the full range of observed values for DEFAULT_TIME. Although the magnitudes of the effects typically vary with DEFAULT_TIME, the variations are relatively small, especially when excluding the more extreme values of DEFAULT_TIME. Additionally, the signs of the effects reported in the paper apply for all the observed values of DEFAULT_TIME. Since these results do not provide significant additional insights, we exclude them from the paper; however, they are available upon request from the authors.

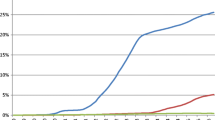

The conditional monthly probability is conditioned on having “survived” in default until the beginning of the month.

The statistical significance of the sum of the coefficients on EQUITY and EQUITY*JUNIOR_LIEN is lower than that of the EQUITY coefficient for all outcomes, and for the cure and partial cure outcomes it becomes statistically insignificant.

References

Allison, P. D. (1995). Survival analysis using the SAS system: A practical guide. Cary: SAS Institute Inc.

Ambrose, B. W., Buttimer, J., Jr., & Capone, C. A. (1997). Pricing mortgage default and foreclosure delay. Journal of Money, Credit and Banking, 29(3), 314–325.

Ambrose, B. W., & Capone, C. A. (1996). Do lenders discriminate in processing defaults? CityScape, 2(1), 89–98.

Ambrose, B. W., & Capone, C. A. (1998). Modeling the conditional probability of foreclosure in the context of single-family mortgage default resolutions. Real Estate Economics, 26(3), 391–429.

Ambrose, B. W., & Capone, C. A. (2000). The hazard rates of first and second defaults. The Journal of Real Estate Finance and Economics, 20(3), 275–293.

Capozza, D. R., & Thomson, T. A. (2005). Optimal stopping and losses on subprime mortgages. The Journal of Real Estate Finance and Economics, 30(2), 115–131.

Capozza, D. R., & Thomson, T. A. (2006). Subprime transitions: lingering or malingering in default. The Journal of Real Estate Finance and Economics, 33(3), 241–258.

Chomsisengphet, S., & Pennington-Cross, A. (2006). Subprime refinancing: Equity extraction and mortgage termination. Federal Reserve Bank of St. Louis Working Paper 2006–023A.

Danis, M. A., & Pennington-Cross, A. (2005). The delinquency of subprime mortgages. Federal Reserve Bank of St. Louis Working Paper 2005–022A.

Demyanyk, Y. S. (2009). Quick exits of subprime mortgages. Federal Reserve Bank of St. Louis Review, 91(2), 79–93.

Foote, C., Gerardi, K., Goette, L., & Willen, P. (2009). Reducing foreclosures: No easy answers. Federal Reserve Bank of Atlanta Working Paper 2009–15.

Haughwout, A., Peach, R., & Tracy, J. (2008). Juvenile delinquent mortgages: Bad credit or bad economy? Federal Reserve Bank of New York Staff Report No. 341.

Harding, J. P., Miceli, T. J., & Sirmans, C. F. (2000). Deficiency judgments and borrower maintenance: theory and evidence. Journal of Housing Economics, 9(4), 267–285.

Hendricks, T. (2009). Pre-purchase help for home buyers lessens risk. San Francisco Chronical, January 3.

Ho, G., & Pennington-Cross, A. (2006). The impact of local predatory lending laws on the flow of subprime credit. Journal of Urban Economics, 60(2), 210–228.

Jankowski, D. (1999). National mortgage servicers reference directory (16th ed.). Perry Hall: Vernon Enterprises.

Ong, P., & Pfeiffer, D. (2008). Spatial variation in foreclosures in Los Angeles. Ziman Center, Working Paper, 2008–22.

Pennington-Cross, A. (2010). The duration of foreclosures in the subprime mortgage market: a competing risks model with mixing. The Journal of Real Estate Finance and Economics, 40(2), 109–129.

Phillips, R. A., & Rosenblatt, E. (1997). The legal environment and the choice of default resolution alternatives: an empirical analysis. The Journal of Real Estate Research, 13(2), 145–154.

Phillips, R. A., & VanderHoff, J. (2004). The conditional probability of foreclosure: an empirical analysis of conventional mortgage loan defaults. Real Estate Economics, 32(4), 571–587.

Acknowledgements

The views expressed in this paper are those of the authors alone and do not necessarily reflect those of the Office of the Comptroller of the Currency (OCC), the U.S. Department of the Treasury, or Citigroup Inc. The analysis in the paper was done while Irene Fang was employed by the OCC. We thank Gary Whalen, Jason Dietrich, Kostas Tzioumis, Souphala Chomsisengphet, Feng Li, and participants at the OCC Economics Seminar and at the ARES (American Real Estate Society) 2009 Annual Meeting for their comments and suggestions. We are especially grateful to two anonymous referees for their many helpful suggestions on an earlier draft. We are also grateful to Souphala Chomsisengphet, Regina Villasmil, Matthew Gee, and Mark Pocock for providing us with the LoanPerformance-HMDA merged dataset, and to Elizabeth Kaplan, Jared Kassan, David Lo, and Aimee Martin for excellent research assistance. We thank Lily Chin, Emily Gold and Morey Rothberg for extensive assistance with editing. The authors take responsibility for any errors.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Voicu, I., Jacob, M., Rengert, K. et al. Subprime Loan Default Resolutions: Do They Vary Across Mortgage Products and Borrower Demographic Groups?. J Real Estate Finan Econ 45, 939–964 (2012). https://doi.org/10.1007/s11146-011-9305-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9305-4