Abstract

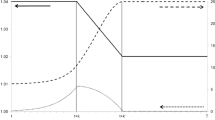

We argue that major changes in economic policy have resulted in a more market driven demand for housing investment in Sweden, due to policy changes at the end of the 1980s and the beginning of the 1990s. Tobin’s transparent Q theory is the investment theory used. For the last period of the sample (1993–2003 quarterly data), our results indicate that there exists a high degree of correlation between the Q ratio and the (logarithm of) two different variables for housing investment. An error correction regression model, controlling for structural breaks, also indicates that a stable long-run relationship could be detected for the logarithm of building starts and the Q ratio between 1993–2003, but not between 1981–1992.

Similar content being viewed by others

References

Agell, J., & Berg, L. (1996). Does financial deregulation cause the Swedish consumption boom? Scandinavian Journal of Economics, 98(4), 579–601.

Agell, J., Englund, P., & Södersten, J. (1998). Incentives and the redistribution in the welfare state. London: Macmillan.

Barrot, B. (2003). Empirical studies in consumption, house prices and the accuracy of European growth and inflation, Economic Studies 77. Department of Economics, Uppsala University.

Berg, L. (2002). Prices on the second-hand market for Swedish family houses—Correlation, causation and determinants. European Journal of Housing Policy, 2(1), 1–24.

Berg, L. (2005). Price indexes for multi-dwelling buildings in Sweden. Journal of Real Estate Research, 27(1), 47–81.

Berger, T. (1998). Priser på egenskaper hos småhus, Arbetsrapport 14, Institutet för bostads- och urbanforskning, Gävle.

Berger, T. (2000). Tobins q på småhusmarknaden. In T. Lindh (Ed.), Prisbildning och värdering av fastigheter. Institutet för bostads- och urbanforskning, Gävle.

Berger, T., Englund, P., Hendershott, P. H., & Turner, B. (2000). The capitalization of interest subsidies: Evidence from Sweden. Journal of Money, Credit, and Banking, 32(2), 199–218.

Brown, R., Durbin, J., & Evans, J. (1975). Techniques for testing the constancy of regression relationship over time. Journal of the Royal Statistical Society series B, 37, 149–172.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55, 251–276.

Englund, P. (1999). The Swedish banking crisis: Roots and consequences. Oxford Review of Economic Policy, 15(3), 80–97.

Englund, P., Hendershott, P. H., & Turner, B. (1995). The tax reform and the housing market. Swedish Economic Policy Review, 2(3), 19–56.

EViews 5 User Guide (2004). Quantitative Micro Software, LLC.

Green, W. H. (1997). Econometric analysis, third edition. Prentice-Hall.

Hayashi, F. (1982). Tobin’s marginal q and average q: A neoclassical interpretation. Econometrica, 50, 213–224.

Jaffee, D. M. (1994). Den svenska fastighetskrisen (The Swedish Real Estate Crisis). Stockholm: SNS Förlag.

Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12, 231–254.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Oxford: Oxford University Press.

Johansen, S., Mosconi, R., & Nielsen, B. (2000). Cointegration analysis in the presence of structural breaks in the deterministic trend. Econometric Journal, 3, 216–249.

Jud, G. D., & Winkler, D. T. (2003). The Q theory of housing investment. Journal of Real Estate Finance and Economics, 27(3), 379–392.

Petterson, K. (2000). An introduction to applied econometrics: A time series approach. London: MacMillan.

Stock, J. H., & Watson, M. (1988). Variable trends in economic time series. Journal of Economic Perspectives, 2, 147–174.

Takala, K., & Tuomala, M. (1990). Housing investment in Finland. Finnish Economic Papers, 3(1), 41–53.

Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money Credit, and Banking, 3(1), 15–29.

Turner, B., & Whitehead, M. E. (2002). Reducing housing subsidy: Swedish housing policy in an international context. Urban Studies, 39(2), 201–217.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Berg, L., Berger, T. The Q Theory and the Swedish Housing Market—An Empirical Test. J Real Estate Finan Econ 33, 329–344 (2006). https://doi.org/10.1007/s11146-006-0336-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-006-0336-1