Abstract

Housing markets display several correlations to multiple economic sectors of an economy. Their enormous impact on economies’ health, wealth, and stability is uncontroversial. Interestingly, the forms of financing residential property vary widely between the different countries in terms of both, the available product types and the institutions offering them. This research examines the implications of different financial intermediaries on housing market cycles with special emphasis on two institutional types, conventional banks and building and loan associations. Introducing a heterogeneous agent-based model, the interactions of buyers, sellers, and the two types of credit institutions are assessed. Heterogeneous economic principles and expectations of agents create endogenous market conditions which are strongly influenced by the lending practices of financial intermediaries.

Focusing primarily on collateral values to decide about lending, conventional banks may contribute to volatile housing markets which are prone to recessions. Building and loan associations, on the other hand, rely to a greater extent on endogenously created borrower information. Thus, they are able to cushion the volatility of house prices caused by procyclical mortgage lending of conventional banks and increase the stability of the housing market. Simulations show that the most stable market conditions are attained if both types of financial intermediaries serve the mortgage lending market jointly. Furthermore, transaction and homeownership rates are the highest in this market setting. These findings advocate in favor of diversified financial markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Housing is one of the few commodities that significantly affects both, social and economic concerns. The functionality of the real estate market and the prediction of housing market cycles, therefore, are of tremendous importance. This, however, is highly challenging since housing is, above all, particularly individual. Dwellings must be fitted to external factors as geographical or political conditions. On top, they are strongly determined by individual circumstances, habits, and preferences. To meet all these individual needs, it is not surprising that different financial institutions exist that offer real estate financing. Some financial systems mainly consist of privately organized establishments, focused on common banking business. Others are rather diverse, characterized by public, cooperative, or specialized financial intermediaries. Lending activities, loan granting decisions, as well as terms and conditions are significantly aligned to the organizational form, the business model, and the strategic orientation of financial institutions. It seems reasonable to assume that these disparities affect housing markets differently. Therefore, it is important to examine the effects of particular institutional forms. Though, we find no studies that assess the impact of different institutional frameworks with respect to housing finance.

Our study examines the effect of different financial intermediaries on housing market cycles. We construct a housing market model with heterogeneous buyers, sellers, and two institutional bank types, i.e., conventional banks and building and loan associations. Buyers are characterized by heterogeneous preferences of consumption and housing investment. According to their individual utilities and income constraints, they enter the market, state their reservation prices, and place bids. Sellers perceive current market conditions and form expectations about future housing prices based on the recent price history. They decide whether to offer their property in the current period or to keep it in the expectation of subsequent house price appreciations. Credit institutions finance residential property and, thus, mainly determine whether transactions take place. In order to minimize default risk, they restrict lending on credit constraints that are aligned to institutional specifications and business orientation.

The computational experiments show that conventional banks exercise procyclic lending practices. They base their mortgage granting decision on recent price trends thus exacerbating prevailing price movements to high peaks or low troughs. As a result, housing prices are unstable and volatile and face endogenously created outbreaks. If, in addition to conventional banks, building and loan associations offer mortgage financing, housing market cycles are smoothened. Excessive price booms are prevented and sharp declines are dampened. Building and loan associations align their lending practices on their special business model of serving any demand of housing financing, need to comply with the institution-specific regulations, and highly consider endogenously created customer information out of relationship lending to decide about mortgage financing. These features have stabilizing effects on housing prices, mitigate volatility and positively impact transactions and homeownership.

By elaborating the implications of varying loan granting policies of financial institutions on the housing market, our study contributes to the question of a favorable composition of the mortgage financing market with respect to stability concerns of the housing market. The model gives an implication which financial institutions should finance housing investment in order to create stable and at the same time efficient and competitive financial markets. In this context, the matter of diversity within financial systems is evaluated. We also contribute to the European Union's consideration of creating a single European market for housing finance. Footnote 1

The paper is organized as follows. In “Building and Loan Associations” section, we introduce the specialized institutions of building and loan associations. The model setup and the features of the interacting economic agents are described in “The Model” section. Section “Results” presents the results of the model. On top, the basic model is extended by introducing an equity requirement. Section “Conclusions” concludes.

Building and Loan Associations

Building and loan associations (BLs) are financial institutions specialized in satisfying any needs related to real estate financing. Driven by the overarching aim to overcome capital-market imperfections and loosen credit rationing, they are comparable to rotating savings and credit associations (Scholten, 2000) and share similarities to co-operative banks, with respect to the idea of collecting deposits from savers and lending them to borrowers. Their emergence dates back to the foundation of Ketley’s Building Society in 1775 in Birmingham, United Kingdom. Members were attracted by the idea of saving collectively in order to afford residential property. Although the former business model was unviable, the British innovation inspired the development of enduring, competitive institutions in several countries (Proettel, 2017). This also holds for Germany, where BLs evolved in the 1920s as a response to a housing shortage and hyperinflation due to World War I (Müller, 1999). Since existing institutions were unable to meet financial needs, BLs arose as demand-driven financial innovations to overcome loan-shortage. After the establishment of the first BLs in 1924,Footnote 2 the new financial intermediaries flourished over the centuries and established themselves as an integral part of the German financial market.Footnote 3

Similar to conventional banks, BLs are usually organized as publicFootnote 4 or private institutions, hold by banks or insurance companies. They are regulated by the German Banking Act and overseen by the Federal Financial Supervisory Authority. Their specificity is revealed, among others, by the separate law, they are additionally subject to. The Building Society Act (Bausparkassengesetz) and the Building Society Decree (Bausparkassenverordnung) align their business model to collect deposits and grant loans for purposes of building, buying, or modernizing residential property to those who are part of their enclosed system (sect. 1 (1) to (3) BauSparkG). To ensure this business approach and to protect customers from potential misuse of deposits (Müller, 1999), BLs are restricted in funding and investment opportunities (sect. 4 and sect. 6 BauSparkG). By allowing collateral values without risk discount in case of financing owner-occupied property, national law encourages lending and relaxes credit rationing which is further promoted by BLs, that subordinate granted mortgages (sect. 7 (1) BauSparkG, Diamond & Lea, 1992).

BLs are further characterized by their core product, contractual saving for housing (CSH) (Bausparvertrag), which establishes the underlying idea of saving unitedly to enable access to mortgages and shorten the waiting period until investment. This enables participants to achieve Pareto-improvement and satisfy their positive time preference for homeownership. The concept is based on an overlapping generation model which consists out of savers and borrowers who build a self-enclosed, collective system (Scholten, 2000). To get a part of this system, a saver contractually obliges to save a specified amount for a certain period of time and, simultaneously, receives a commitment to be granted a residential loan at a later date. During the savings period, the customer earns an interest that is lower than prevailing market interest rates. The resulting opportunity costs shall be offset by a loan interest rate which is also below market conditions. Since both, savings and debt interest rates, are locked in for the whole contract period, the customer is protected from unfavorable market developments, which is especially attractive for risk-averse borrowers. Debts are granted from the pool of savings done by all customers collectively during different generations. The length of the qualifying savings period, therefore, depends on the customer’s individual savings effort and the total volume of collected deposits. As soon as both criteria are fulfilled, the customer obtains the legal right of loan disbursement, which, according to his individual request, can be exercised immediately or at a later stage. This option grants the customer additional flexibility. At the time he decides to draw on the loan, his position changes from being a creditor to being a debtor. Instead of saving regularly, he is now required to service his loan. Following this concept, the BLs’ lending business is endogenously driven and independent from capital markets.

BLs’ business practices, as well as its core product, characterize BLs as special-purpose savings companies. In many legislations, financial intermediaries that accept deposits and in return commit to grant loans for specific purposes are prohibited in order to protect depositors. BLs, however, are explicitly exempt from this prohibition.Footnote 5 They promote residential property and thus contribute to overall economic prosperity. Following the underlying idea of saving collectively to realize housing investment and at the same time, being an economic institution that aims at profit maximization are, however, somewhat contradictory principles. In order to achieve positive effects on the real estate market and simultaneously protect customers, the regulator set up a particular framework to regulate the specialized financial institutions. This framework clearly defines their business model, their business operations as well as their organizational form. In return for the regulatory restrictions, the CSH business is reserved for BLs only.Footnote 6 This exclusivity generates a good reputation and creates customer confidence.

Although the regulatory framework significantly restricts the flexibility and the business activities of BLs, the special regulations seem to be a precondition for BLs to exist. Examples from the past have shown that financial liberalization and deregulation abandoned institutions from the market that were founded on the principles of BLs. When building societies in the U.K. and savings and loan institutions in the U.S. started to refinance loans on the capital market, their market share in housing finance significantly decreased and finally, they were forced out of the market (Diamond & Lea, 1992; Scholten, 2000). This indicates that deregulation increases the incentives for specialized financial institutions to expand business activities, resulting in a convergence of specialized institutions with conventional banks. In both nations, the elasticity of the supply of funds for housing increased, thus, the amplitude of housing cycles rose and the housing market got more volatile as a result of deregulated market environments and the disappearance of BLs (Scholten, 2000). For reasons such as different legal systems, deregulation had another scale in European countries. In Germany and Austria, for example, BLs experienced market declines but successfully defended their raison d'être.At the time of its development, CSH and the innovative financial intermediaries distributing it were important to support housing investment. Just as then, the housing and the mortgage lending market are of high economic relevance and among the most important markets in Europe. In the EU, real estate loans account for about 74% of total adjusted bank lending which is equivalent to 40% of the euro area’s GDP (Euro Area Statistics, 2020). German conditions are quite similar where housing finance makes up around 70% of total lending (German Central Bank, 2020). Nowadays, however, financing conditions have changed. Especially in developed countries with highly competitive and easily accessible financial markets, plenty of products and financial institutions are available to finance residential property. This might be one reason for BLs to loosen their focus from their former main product and expand their product range to further real estate financing products (Burghof & Gehrung, 2019), which is apparently successful. In Germany, BLs account for approximately 14,2% of today’s total financing volume for housing and, therefore, constitute an essential real estate financier. Since BLs serve any demand of housing financing, which, in addition to housing purchase also includes renovation, modernization or investments in sustainable housing, BLs are involved in one out of three private housing financings. The market penetration of CSH in Germany reaches 30% and almost every second household is CSH customer. Similar or even higher market penetration rates can be observed in other European countries. Austria records the highest market penetration of 43%. This means that almost every second citizen uses CSH. The market penetration of the Czech Republic reaches 33%, Slovakia 16%, and Hungary 8%. Smaller but stable rates can be observed in Hungary and Romania.Footnote 7 The high popularity the special institutions enjoy in these countries is also evident in Luxembourg. German BLs even service customers in China and India (Kirsch & Burghof, 2018). Similar concepts of BLs exist in UK and Ireland and even in Australia and New Zealand.Footnote 8 The continued successful existence on financial markets indicates that BLs serve a purpose beyond the distribution of CSH contracts. This purpose is to be explored within this research.

The Model

Overall Model Structure

As stated previously, housing and real estate financing markets are strongly characterized by heterogeneity. For this reason, a generally applicable, globally transferable market setting must be examined, to address the research question. In the following, a heterogeneous agent-based model is developed in which agents with deviating beliefs about future housing prices interact with each other and thus create endogenous housing market cycles. The model incorporates four types of agents: buyers, sellers, and two types of credit institutions. Buyers determine whether to buy a dwelling and therefore, state the demand in the housing market. Sellers, in contrast, provide housing units on the market. Credit institutions grant mortgages to buyers who decided to invest in housing. Those are differentiated by two types of financial institutions. On the one hand, a conventional mortgage can be granted by a conventional bank.Footnote 9 On the other hand, housing investment can be financed by a BL, using CSH. By distinguishing loan granting financial intermediaries, the model reveals the effects of different product types and institutions on the housing market.

The model incorporates the important feature of heterogeneity persistent in the housing market by considering the individual penchants of households according to consumption and housing investment. Furthermore, all agents align their actions to individual expectations about future housing prices. Since the model is set up in a multi-period framework, not only market interactions, but also the feedbacks of those are displayed.

Types and Characteristics of Economic Agents

Buyers

Buyers are assumed to be households and represent potential customers of residential property. They can enter the housing market at the beginning of each period and are restricted to buy one unit of housing each. Their individual demand is formed out of the utility they receive from owning one housing unit \(h\) and from consuming any other consumption goods \(c\). The investment choice of a buyer \(b\) is based on his preferences expressed in the form of a Cobb–Douglas utility function. Every agent has a disposal period income \({Y}_{t}\) which is fully spent in each period. Investment choices are therefore constrained by \({Y}_{t}={P}_{ct}c+{P}_{t}h\).

Utilizing Lagrangian function and solving for \({P}_{t}\) gives the highest possible periodical expenditure for housing purposes a buyer can afford under his given budget constraint. This price can be stated to be the reservation price \({P}_{res,b,t}\) of a buyer \(b\) who maximizes the utility of his preferences. \({P}_{res,b,t}\) is:

It is assumed, that an investment in residential property is fully mortgage financed. Housing expenditure, therefore, includes interest cost \({r}_{t}\) on the mortgage volume (\({P}_{t}\)) as well as a redemption on the principal \({r}_{p}\). The sum of interest cost and redemption \(r={r}_{t}+{r}_{p}\)Footnote 10 lowers the highest possible purchase price. This assumption creates a base scenario that serves as a benchmark. In chapter 4.3, the assumption of a fully mortgage financed dwelling is relaxed by introducing an equity constraint. As financiers usually demand a minimum level of equity to finance residential property, this scenario mimics reality.

Formulating a reservation price as stated in (1) follows an equilibrium approach in which all agents make optimal decisions and the market clears up completely. However, markets are dynamic systems following the interactions of market participants. The equilibrium approach serves as a good starting point for the model. To display market dynamics and set up realistic market conditions, further periods follow a disequilibrium approach.

A disequilibrium approach as formulated by Filatova et al. (2007) assumes that prices for residential properties are built by bilateral bidding. This model applies a price formation that evolves out of bilateral transaction. The reservation price in (1) represents a threshold above which a household is not able to buy a dwelling. This price level, however, must not equal the price a buyer is willing to bid when entering the market. The bid price is specified by taking current and expectations about future market conditions into account. The expected market price of an upcoming period is based on the available price information and an individual market assessment and is formed as:

where \({e}_{b}\) indicates an agent’s belief of future market performance, \({P}_{t-1}\) indicates the price level of the previous period, and \(\Delta {P}_{t-1}\) the change of the price level which has happened during this period. By considering recent price changes when determining future prices, the prevailing market condition is included. A buyer’s demand consequently depends on both, \({P}_{res,b,t}\) and \({P}_{expected,t}\), whereas he only places a bid, if

If (3) holds, the price a buyer bids is:

Sellers

Whereas buyers are assumed to be households, sellers can either be households, too, or they are residential developing firms. In the following, the term ‘seller’ designates households who sell already established properties, whereas ‘residential property firms’ produce and sell new dwellings. In both cases, they aim at profit maximization. At the beginning of each period, a potential seller decides whether to keep a house or to sell it. This decision is based on the expected profit out of the given options. By keeping a property, the earliest possible profit \(Z\) can be achieved in period \({t}_{+1}\), which would be the observed price level of \(t\). The price a seller expects in period \(t\) is \({P}_{expected,s,t}\) and follows those of buyers (see (2)). The expected profit in period \(t\) out of keeping a dwelling consequently isFootnote 11:

It is assumed that a seller leaves the housing market as soon as a sale has been conducted and the quantity of sales is restricted to \(1\). Furthermore, a seller cannot be a buyer in the same period, whereas a former seller can become a buyer in subsequent periods. Freed up liquidity out of a sale is entirely invested in an alternative investment which bears interest at the risk-free interest rate \({r}_{f}\). A seller would only offer his property for sale if \({Z}_{sell, t}\ge {Z}_{keep,t}\), respectively, if \({Z}_{sell, t}-{Z}_{keep,t}\ge 0\). The expected profit out of selling a property equals the sum of the observed price level in the previous period, \({P}_{t-1}\), and the return of the alternative investmentFootnote 12:

Since a seller uses the previously observed price level in order to decide between keeping and selling, \({P}_{t-1}\) determines the seller’s reservation price:

However, a seller can be optimistic to achieve more than his reservation price and mark it up by \(\varphi\). To determine a markup ratio, the agent consults the previous ratio of buyers and sellers in the housing market. For this purpose, he calculates:

where \(NB\) means the number of buyers and \(NS\) means the number of sellers. By doing this, he figures out whether a buyer or a seller market exists. For \(\varphi >0\), the price is adjusted upwards while for \(\varphi <0\), \({P}_{offer,t}={P}_{res,s,t}\) since \({P}_{res,s,t}\).is the lower limit of \({P}_{offer,t}\) Accordingly, the offered market price is:

If a property is not sold during \(t\), it remains on the market and can be bought in \({t}_{+1}.\) In this case, the seller must admit that his price offer was not in line with the market and thus, he reduces it by a markdown ratio of \(\sigma\). For \(\sigma ,\) \(0<\sigma <1\) applies. In the case that the dwelling is not sold in \({t}_{+1}\), despite the granted markdown, it remains on the market to be bought in \({t}_{+2}.\) This approach applies for all further periods until the dwelling is sold. A seller’s reservation price of a housing unit available for sale thus is:

where \(n\) denotes the number of periods a house remains on the market. This implies that an agent only accepts bids from potential buyers equal to or above his prevailing reservation price. Since the bid price formation of buyers is not directly dependent on sellers’ behavior, bids may exceed a reservation price.

Housing Price

After evaluating the market situation and considering individual conditions, agents place their bids and offers at the market. As soon as a bid equals or exceeds a potential seller’s reservation price, a sale takes place. Prices of conducted transactions are thus formed by agents’ valuation and interaction. The transaction price is registered as the actual price of the traded property. For building the price level of one period, we follow the approach of Sommervoll et al. (2010) and calculate the mean of all transaction prices during this period. The price level as well as its change are observable for every market participant and serve as reference points for expectations about price developments. The price index is:

where \({N}_{transactions}\) represents the number of all transactions in one period, and \({P}_{i}\) represents the price of the sold unit \(i\). The market closes when demand is satisfied, supply is exhausted, or when remaining bids and offers cannot be matched. After that, a new price index is calculated. Correspondingly, actual transaction prices affect agents’ future bids and offers.

Number of Properties

The housing stock available for sale is composed of offers from sellers and those from residential property firms.Footnote 13 In each period, potential sellers decide anew whether to keep or to sell their dwelling out of which the number of first-time sales, \({N}_{new\;sellings}\), is made up of. In addition, not sold offers of the previous period, \({N}_{left\;over}\), may remain on the market. On top, at the beginning of each period, construction firms decide whether, and if yes, how many houses to construct. This is done by consulting \(\varphi\) and, thus, by considering whether the market lacks or exceeds supply. Since residential property firms are assumed to maximize profit, the construction volume also depends on recent price developments. Accordingly, a volume of newly constructed houses, \({N}_{constructions},\) enter the market in the course of:

where \({N}_{remaining buyers,t-2}\) is the number of buyers who were not satisfied two periods before, \({\varphi }_{t-2}\) is the ratio of buyers and sellers at the market in the period \({t}_{-2}\), and \({\rho }_{t-2}\) is the change rate of the price level in the same period and is calculated by: \({\rho }_{t-2}=\left(\frac{{P}_{t-2}+\Delta {P}_{t-2}}{{P}_{t-2}}\right)\).

The construction time for new houses is assumed to be one period. Newly constructed houses available on the market in \(t\) are based on the number of houses, and the market and price situation two periods ago, since the decision how many houses to build, must be made at the beginning of \({t}_{-1}.\) At this time, however, the most recent data available is this of the period \({t}_{-2}.\) Construction starts at the beginning of \({t}_{-1}\) and is finished in \(t\). By following this approach, supply is adjusted to market conditions, and the delay of supply, resulting out of the long construction period of residential property, is considered. To determine the number of constructions, \({N}_{constructions,t}\ge 0\) holds. The total number of houses available for sale in a prevailing period consequently is:

The prices for which residential construction firms offer their houses at the market follow the Eqs. (7), (9), and (10).

Credit Institutions

Unlike other markets, the real estate market is strongly influenced by financial institutions. By approving or rejecting mortgages, they affect whether and to whom properties are sold. This model lays focus on two types of credit institutions. Type one represents a bank, herein referred to as conventional bank (CB), granting a mortgage after evaluating the financial circumstances of a potential borrower, with a fixed term and a fixed interest rate. Type two is a building and loan association (BL) as introduced in chapter two. Given their displayed specialties, the loan granting behavior of BLs differs from that of CBs.

As banks are economic enterprises, the maxim of profit maximization applies to both types of credit institutions. Since borrowing applicants are budget constraint, a bank limits a potential borrower’s mortgage volume to the amount of his highest possible expenditure for housing purposes, which is \(\frac{Y}{\left(\frac{\alpha }{\beta }+1\right)}\) (Eq. (3)), and can be stated as a first mortgage constraint for borrowers:

Following the lines of Heuson et al. (2001), credit institutions are assumed to be risk-neutral and only approve a mortgage if the expected profit \({Z}_{mortgage, t}\) exceeds this of investing the same amount in an alternative investment, which bears interest of \({r}_{AI}.\) The decision of mortgage granting, therefore, involves determining:

where \(q\) indicates a potential borrower’s probability of not defaulting, \({r}_{t}\) indicates the mortgage interest rate, \({r}_{d}\) indicates the rate of return if the borrower defaults and \(M\) indicates the mortgage sum and determining:

A bank only grants a mortgage if \({{Z}_{mortgage, t} \ge Z}_{no\ mortgage,t}\), which means:

Whereas Heuson et al. (2001) assume \({r}_{AI}>{r}_{d}\), to restrict lenders from benefiting from mortgage default, we follow the approach of Sommervoll et al. (2010), who allow for \({r}_{AI}={r}_{d}\). If this sets in, the potential lender can consider other information, too, when deciding about lending, as expected house prices or the composition of its individual investment portfolio. Solving (17) for \({r}_{t}\), the lowest mortgage interest rate a lender would accept as a function of a potential borrower’s probability of not defaulting is obtained. Those indifference rates are unequal for CBs and BLs. BLs are by law quantitatively restricted in investment opportunities. The return out of their alternative investment shall therefore be calculated as a discrete one in the sense of:

where \(w\) states the investment volume in percent of the respective investment, \({r}_{f}\) states the risk-free interest rate, and \({r}_{M}\) the capital market return. CBs, however, are not governed by any restrictions. Considering capital market theory, \({r}_{AI,CB}\) can be stated to be \({r}_{M}\). The indifference rates for mortgage granting of CBs and BLs accordingly are:

Solving (17) for \(q\) reveals the lowest probability of not defaulting of potential lenders the respective bank would accept for a given \({r}_{t}\):

The lower the value of \(q\), the higher the return of lending must be in order to be advantageous for the bank. Since \({r}_{min,CB}>{r}_{min,BL}\), the customers with lower probabilities of not defaulting will be those of BLs. Consequently, for a given \({r}_{t}\) borrowers can be assigned to the two institutional types according to their values of \(q\). All customers with \(q\) in the interval \(\left[0,{q}_{min,BL}\right]\) are rejected by both banks. Those in the range of \(\left[{q}_{min,BL},{q}_{min,CB}\right]\) are only granted a mortgage by BLs. For \(\left[{q}_{min,CB}, 1\right]\), however, both banks are willing to lend. Borrowers are assumed to have a positive time preference for housing investment. Therefore, every borrower with a value of \(q\in \left[{q}_{min,CB}, 1\right]\) who can afford the comparatively high interest rate of CBs, will decide in favor of CBs. Accordingly, customers will borrow from CBs if their disposable income equals or exceeds debt service, which is the annuity \({A}_{m,CB}=\frac{{\left(1+{r}_{min,CB}\right)}^{n}{r}_{min,CB}}{{\left(1+{r}_{min,CB}\right)}^{n}-1}M\). Customers of BLs with \(q\in \left[{q}_{min,CB}, 1\right]\) can thus be referred to as those, for which \(\frac{Y}{\left(\frac{\alpha }{\beta }+1\right)}<{A}_{m,CB}\) holds.

In our model, banks operate in a competitive financial market. Their expected profit is zero and no single institution has market power. Both institutional types are able to accurately risk price borrowers, thus, no market failure exists. In reality, however, an additional dimension of imperfect information may exist. This is where problems of adverse selection set in and a competitive market may turn out to be inefficient. In a market setting in which different financial intermediaries offer different kinds of lending contracts, agents may self-select choosing their contract (Rothschild & Stiglitz, 1978). Thus, there is some risk that unsuccessful mortgage seekers of CBs turn to BLs and hence, BLs cater to less attractive mortgagors. To counteract adverse selection, BLs would have to price mortgages higher. Instead, they provide mortgages at a lower interest rate which is induced by regulatory requirements. In our model, we comply with this fact, calculating their alternative investment return as a discrete one (18). Assumed adverse effects, however, are not dominant. Instead, it is evidenced empirically that BLs experience lower mortgage defaults than CBs (Burghof & Schairer, 2017). This may have different reasons. One might be the inherent borrower information out of relationship lending. According to these findings, the model assumption of a competitive market neglecting adverse selection seems reasonable.

Further following the approach of Sommervoll et al. (2010), it is assumed that the probability of not defaulting is oppositely associated with an applicant’s mortgage-to-income ratio, which is \(\gamma =\left(\frac{M}{Y}\right)\). The smaller the mortgage-to-income ratio, the higher the no-default probability \(q\), what leads to the expression of \(q\) as a decreasing function of \(\gamma\), \(q=q(\gamma )\). Resulting from this, the mortgage a lender would grant to an applicant \(i\) must not be higher than the opposite of his mortgage-to-income ratio times \(i\)’s income, given his probability of not defaulting:

The mortgage-to-income ratio serves as a good proxy to estimate borrower default since higher borrower income is associated with a lower probability of default (Ambrose & Capone, 2000; Hakim & Haddad, 1999; Yang et al., 1998). We restrain from modeling strategic default decisions of borrowers since, via the individual utility functions of potential borrowers, only those agents enter the housing market who positively assess owning residential property. Strategic default in contrast is a decision to abandon homeownership and its benefits.Footnote 14 Homeowners may try to avoid default as they attach a non-financial value to their homes. This point is evidenced by the fact that default among homeowners is relatively raw even if households suffer severe financial difficulties (Bhutta et al., 2017; Foote & Willen, 2017).

Existing literature identifies further default decisions arising from external factors such as falling house prices or income shocks. Negative home equity due to house price depreciation is positively correlated with borrower default (Ambrose & Capone, 2000; Ambrose et al., 2001; Deng, 1997). It is the necessary condition for failing to repay debts, however not the sufficient one (Foote et al., 2008). Borrower default usually arises from two triggers that combine negative equity with adverse life effects such as loss of employment or divorce (Ambrose & Capone, 2000; Campbell & Cocco, 2015; Deng, 1997; Foote et al., 2008). External triggers from housing or macroeconomic conditions are volatile house prices and interest rates (Ambrose et al., 2001; Schwartz & Torous, 1993). We refrain from modeling such default decisions, too, since those would affect the two investigated financial intermediaries equally and, thus, the result would be unaffected. Instead, we use the mortgage-to-income ratio to select borrowers. It reduces mortgage affordability, making borrowing constraints more likely to bind and, thus, considers borrower default.

Collateralizing the financed dwelling is common business practice in housing financing in order to lower financiers’ risk (Bester, 1985). Pledged collateral reduces the risk of moral hazard and strategic borrower default and protects creditors (Aghion & Bolton, 1992; Hart, 1995). Screening customers and creating endogenous or acquiring external customer information is costly. Collateralizing the financed dwelling is comparably cheap and a reliable way to prevent losses. This induces CBs to omit screening and to primarily focus on collateral values to decide about lending (Manove et al., 2001) Footnote 15 In this model environment, it is assumed that the whole stock of debt shall be collateralized what constrains the mortgage sum to the amount of collateral. To determine the collateral value, CBs rely on recent market information and adapt expectations. Furthermore, mortgage lending is part of strategic portfolio selection and shall always be considered for diversification reasons.

In times of favorable market conditions, CBs imply further house price appreciation. In times of previous depreciation, they determine a threshold up to which mortgage lending is advantageous because of diversification reasons. If price declines exceed this threshold, CBs imply the same decrease for future periods. If price declines are below this threshold, mortgage granting of CBs is more permissive in order to benefit from positive diversification outcomes. In this case, they do not only account for market information and collateral values, but also for a potential buyer’s affordability of housing investment. On top, they lower the collateral value by applying a risk discount. The mortgage constraints for the different scenarios are:

where \({\rho }^{+}\) represents a positive relative price change, \({\rho }^{-}\) a negative relative price change, \(\chi\) a risk discount, and \(\uppsi\) the threshold until which mortgage lending is advantageous out of diversification reasons although prices fell in previous periods. Given (14), (23) and (24), a CB approves a mortgage to applicant \(i\) in the volume of:

According to the ruling law of BLs, owner-occupied dwellings are allowed to be fully collateralized. Opposite to CBs, BLs do not primarily refer to the collateral value to determine the maximum amount of debt, since they subordinate granted mortgages. Instead, they depend the volume on information gathered during the qualifying period of the CSH. During this time, a potential borrower is contractually obliged to save regularly a specified amount of money. If the customer fulfills this obligation, he can be referred to be a good customer, represented by the proportion \(\mu\). The mortgage amount disbursed is not further limited.Footnote 16 If the customer violates his contractual obligation during the qualifying period, he reveals himself as a bad customer with the proportion \((1-\mu\)). The bad personal traits disclosed before indicate additional breaches of contract during the credit period. Therefore, the mortgage is not disbursed. This kind of endogenously created information about borrower behavior during a long-term savings contract has a high value content and is the most reliable information they can obtain. Borrower’s long-term neglect of consumption reveals reliability and creditworthiness. A third mortgage constraint holds which is \({C3}_{BL}:{M}_{max, i,3}=0\). The disbursed mortgage volume of a BL which accounts for having two customer types is:

Since this mortgage granting behavior does not account for collateral values, it is independent of expectations of future house prices. On top, it incorporates the monetary credit capacity of applicants as well as their personal creditworthiness. By following this approach, the credit approval procedure is less dependent on prevailing market conditions.Footnote 17

Results

Calibration of the Simulation Setting

A set of computational experiments of the model presented in the previous sector has been carried out. Based on numerical simulations, it shall be evaluated whether varying lending practices of financial intermediaries affect housing market cycles differently. To start the simulation, initial parameter values are defined to set a model frame that mirrors a real housing market with respect to relations and conditions. To initialize the market, 60 potential buyers and 30 potential sellers are put on the market who observe an initial market price of one unit of housing of \({P}_{t}=2500\). To let agents follow their decision-making process right from the beginning, \(\Delta {P}_{t-1}=50\) and \(\Delta {P}_{t-2}=50\). The heterogeneity of potential buyers and sellers is set by various parameters. Buyers’ preference for consumption is uniformly distributed between \(\left[0, 1\right]\). Their income ranges from \(\left[100, 1000\right]\) and the individual expectations of future market conditions are drawn from a uniform distribution, therefore allowing a deviation up to 10% around the price index expectation. Buyers’ initial burden rate for housing investment equals \(r=0.13\) which is composed of a fixed redemption rate of \({r}_{p}=0.1\)Footnote 18 per period and a mortgage interest rate of \({r}_{t}=0.03\). In subsequent periods, buyers use the average mortgage interest rate of the previous period to calculate their reservation price. If a buyer is unsuccessful for the repayment period of 10, he is assumed to be too old to buy a dwelling and stays a tenant.

As sellers are assumed to be households, too, having the same information available, their market expectation is determined as those of buyers. If a house is not sold, a seller reduces his offer price by 5% each period up to a maximum of 30 periods. If a dwelling stays unsold during this time, it is assumed to be depreciated and, therefore, removed from the market. In each subsequent period, a random number of potential buyers in a range of \(\left[30, 36\right]\) and potential sellers in a range of \(\left[10, 12\right]\) attend the market setting.

After evaluating market conditions and determining their reservation prices, potential buyers and potential sellers enter the market. Sales are conducted following a first-price-sealed-bid auction. All bidders submit their bids which are assigned to sellers’ offers in descending order. Although the model does not account for different housing features, this auction process implicitly measures quality differences. It can be assumed that more expensive houses have a higher quality standard and buyers with a higher disposable income value this by placing higher bids. The transaction price equals the mean of matched bid and offer. This incorporates a realistic negotiation range in real estate transactions and allows the seller to make an additional profit if the bid exceeds the offer.

Credit institutions are assumed to have a \({r}_{d}\) of \(0.001\) in all simulations. To determine the collateral value of a dwelling, a risk discount of \(0.2\) (\(\chi =0.8)\)Footnote 19 is applied. The price decline until which mortgage lending is advantageous for CBs out of diversification reasons is \(\uppsi =0.03\). BLs recognize a ratio of good customers in the market of \(\mu =0.8\) and they are restricted by national law to invest not more than 5% in assets on the financial market other than the risk-free interest rate (sect. 4 and sect. 6 BauSparkG).Footnote 20 Financial markets display a risk-free interest rate of 0.01 and a market return of 0.02. The initial simulation parameters are displayed in Table 1.

Analysis of Agent Interactions

To assess the effect of different financial intermediaries on housing market cycles, multiple computational simulations of the model presented in “The Model” section have been carried out. Each model run develops three scenarios that are investigated individually and compared to each other: a first, in which only CBs operate, a second, in which only BLs grant mortgages, and a third, in which CBs and BLs finance residential property. In each scenario, the banks operate on a competitive financial market and no single institution has market power. For each scenario, 100 periods are simulated.

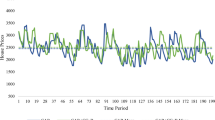

Figure 1 displays the house price dynamics which arise in the different simulation scenarios. Each of the scenarios reveals that the housing market, based on the interactions of heterogeneous agents, proceeds in cycles. As potential buyers and sellers follow their decision-making process, they perceive market conditions and make backward-looking expectations about future development. House price appreciations of previous periods spur investment motives of potential buyers. As a result, prices increase. The affordability of residential property for buyers gets more severe, while, recognizing steady positive price developments, potential sellers decide to keep their houses to generate higher profits out of future sales. The combination of a higher price level and reduced supply mitigates positive price developments, until, after reaching a peak, prices start to fall. The depreciation depresses future market expectations what pushes the market downwards until a recession sets in. Buyers recognize the decreased price level, align their actions to the new market conditions, and the fall bottoms out when bids start to pick up again. As a response to higher demand, house prices appreciate. As housing investment is fully mortgage financed in this model environment, the arising market dynamics are strongly affected by the lending policies of the loan granting financial intermediaries. Since they constrain lending on different conditions, they determine whether and in what amount residential property can be acquired and, therefore, directly influence market dynamics.

The first simulation scenario, in which only CBs finance residential property, reveals recurring upturn and downturn phases which are distinct and strongly defined. The market cycles feature high peaks and strongly pronounced troughs. Previous house price appreciations do no not only spur demand of potential buyers but also lending of CBs. Their lending decision is strongly determined by the collateral value of the financed dwelling. In times of positive market conditions, house prices are expected to continue to increase in future periods. Therefore, CBs are lending generously, further driving prices upwards. If prices declined in previous periods, CBs evaluate whether or not it is advantageous out of portfolio diversification reasons to finance residential property. If the price decline is too sharp, they refuse lending This strategic lending decision reinforces a prevailing downswing, pushing the house price into a deep low.

Table 2 provides some summary statistics of all simulation scenarios. The market in which solely CBs interact as financial intermediaries displays the lowest minimum price for residential property as well as the largest price drops in times of recessions. The difference between the minimum and maximum price exceeds those of the other simulation scenarios. Due to the sharp declines in recessions, the mean price for dwellings settles at a low level. A low transaction rateFootnote 21indicates sluggish market conditions and leads to a comparably low homeownership rate. The construction rate, in contrast, reaches a moderate level. Due to attractive alternative investment opportunities, the mortgage interest rates charged by CBs for housing investment exceed those of the other scenarios.

Table 2 also shows the standard deviation of the respective mean values (written in brackets). The standard deviation of the house prices of the CB scenario affirms what is visible in Fig. 1. House prices oscillate sharply and market dynamics are unsettled and noisy if only CBs operate as financial institutions. The imposed credit constraints lead to an overvaluation of past market periods and procyclic mortgage granting. The permissive lending in times of appreciation pushes prices upwards while in times of depreciation, decreasing house prices are further exacerbated by the restrictive lending decisions.

The second simulation scenario investigates house price dynamics in which only BLs operate to finance housing investment. Those are also shown in Fig. 1. As for the CB scenario outlined previously, cyclical market behavior is also clearly observable in the BL scenario. The market cycles, however, are less pronounced. Prevailing market phases turn earlier, troughs are not as low and the difference between the minimum and maximum price is lower than in the CB scenario. This can be seen in Table 2. The mean of the house price in the BL scenario settles at a higher level than in the case of CBs. On the one hand, this corresponds with less pronounced lows. On the other hand, this is due to the smaller mortgage interest rates imposed by BLs. Cheaper mortgage terms allow more of the disposable income to be invested in homeownership. The standard deviation of the price oscillations falls below that of the CB scenario. By putting less emphasis on previous market developments, and focusing on information out of relationship lending, BLs create a housing market which is less volatile.

The transaction, as well as the homeownership rate, exceed those of the CB scenario. Therefore, BLs enhance market transactions and promote homeownership. As mortgage interest rates are below those of CBs, BLs enable access to real estate financing for a broader share of the population. This, in turn, pushes the house prices to the highest level of all of the three scenarios.

The third simulation scenario combines CBs and BLs and creates a market setting in which both financial institutions operate on the market and grant mortgages according to their lending strategies. The effects on house price dynamics can also be seen in Fig. 1. The interactions of real estate buyers, sellers, CBs, and BLs create market cycles with the lowest peaks and higher troughs.

Figure 2 displays how the different lending practices of the CBs and BLs play out over the market cycles. In times of sharp downturns, CBs restrict lending, and, thereby, push the market further downwards. BLs, in contrast, concentrate on customer information. The mortgage lending decision, based on endogenously created information about creditworthiness and credit eligibility stops the downturn and induces a turnaround. Recognizing house price appreciation, CBs lend more generously. As CBs view mortgages as secure because of expected increases of collateral values, they reinforce the induced upswing by BLs. BLs, in contrast, still focus on borrower information and reject mortgages in case of previous breaches of contract and thereby prevent the market from enormous price increases and exorbitant peaks. Since borrowers do have a positive time preference for housing investment, they decide in favor of CBs if both institutions are willing to finance their desired dwelling. For this reason, CBs dominate the market after a previous upswing. In times of previous downturns, however, BLs grant the majority of mortgages and, thereby, push prices up again.

The lending strategies of CBs and BLs create a house price level which is between the first two scenarios (Table 2). This is the reasonable result out of the higher average mortgage interest rate when both institutions grant mortgages. The standard deviation of the mean price, stated in Table 2, reveals that a housing market in which CBs and BLs interact with potential buyers is the most stable one. On top, transaction and homeownership rate reach the highest level compared to the scenarios with a single interacting financial institution.

Table 3 summarizes some further cycle characteristics of the simulation scenarios. The average cycle length of the isolated CB scenario exceeds this of the combined scenario. Accordingly, more cycles occur in the CB and BL case. These results reveal that the market is stuck in a cycle longer if only CBs grant mortgages. Due to the large outbreaks up and down, it takes more time for the market to stabilize again. If both, CBs and BLs grant mortgages, cycles are less severe. Therefore, agents approach their personal threshold for housing investment earlier. As a result, market entry barriers are reduced. This, in turn, corresponds with the higher transaction and homeownership rates observed in the combined scenario (Table 2). On top, the combined scenario reveals the lowest number of outbreaksFootnote 22 which confirms the lowest market volatility in this setup. Furthermore, Table 3 discloses the number of mortgages granted by the different financial intermediaries in the respective scenario. The fact that CBs dominate the mortgage market in the combined case underlines the positive time preference of borrowers if they fulfill the credit constraints imposed by CBs.

The simulation experiments show that CBs exercise procyclic lending practices which intensify housing market cycles and prevent a stable housing market. The mortgage granting strategy of BLs, in contrast, generates cyclic market activities which are more stable and predictable. The third scenario, in which CBs and BLs operate jointly on the housing market, dominates the other settings. CBs spur the market in the prevailing market period while BLs, although they are less strongly represented on the market, counteract downturns and reduce housing market cycles. The combined result of the different lending strategies of the financial institutions studied reduces price volatility, maximizes transaction and homeownership (Table 2), and minimizes price outbreaks (Table 3).

Due to the heterogeneity of the interacting agents, the simulations performed rely to some extent on random variation. To ensure that the simulation runs are representative and the presented model is structurally coherent and consistent, a robustness check has been performed which is provided in the Appendix.

Model Extension

The base model presented above assumes that the desired house is fully mortgage financed. In reality, however, financiers usually demand a minimum level of equity to finance residential property. To allow for this contingency, the model is extended by an equity condition. The equity ratio demanded by a financier constitutes a fixed share of the price of the desired dwelling in the means of \(\varepsilon =\frac{E}{{P}_{i}}\). Based on this equity requirement, CBs impose a fourth credit constraint on their potential customers which is:

where \(E\) is the total equity of the potential buyer, \({P}_{i}\) the price of a housing unit an individual buyer desires to buy and \(\varepsilon\) the required equity ratio. Available equity lowers the mortgage-to-income ratio in the sense of \(\gamma =\left(\frac{M-E}{Y}\right)\). The size of the equity of potential buyers is drawn from a uniform distribution on \(\left[\mathrm{0,0.35}\right]\). As conventional banks do not have reliable customer information, they cannot infer the equity ratios of potential borrowers. Instead, they need to rely on imposed self-disclosures. The mortgage amount granted by a CB now is \({M}_{CB}=\mathrm{min}\left(C1, C2, {C3}_{CB}\right)\) while \({C4}_{CB}\) holds.

A main feature of CSH is the savings period which precedes the loan. These accumulated savings serve as equity available for housing financing.Footnote 23 Since BLs can directly observe the individual savings performance of their customers, they do not further constrain mortgage granting according to equity requirements, while still accounting for \(\mu\), the proportion of good customers. As a result, lending practices of BLs are independent of pre-existing wealth. Instead, their mortgage granting decision is based on the endogenously created information out of relationship lending.

Figure 3 displays housing market dynamics of the CB, the BL, and the CB & BL scenario with the additionally imposed equity requirement which is set to \(\varepsilon =0.2\).Footnote 24 As in the simulation scenarios presented previously, the interaction of buyers, sellers, and financial institutions leads to a housing market which moves in cycles and in which house prices oscillate around its mean. In comparison to the CB scenario without equity constraint, however, the amplitudes of the house price cycles are less severe. By additionally constraining mortgages to available equity, CBs only grant loans to potential customers who have lower mortgage-to-income ratios, since \(\gamma =\left(\frac{M-E}{Y}\right)\). Applicants who do not fulfill the equity requirement, and, therefore, feature a higher probability of default, are rejected. As a result, these customers cannot enter the housing market. These findings are in line with existing literature which provides evidence that markets are more stable and the borrower risk of default is lower if lenders require an initial down payment for mortgages (Danis & Pennington-Cross, 2008; Demyanyk, 2009; Sommervoll et al., 2010).

As BLs base their lending decision on endogenously created customer information and do not constrain lending on an additionally imposed equity requirement, the house price cycles of the BL scenario are similar to those of the base model. The house price dynamics of the two bank scenario, however, is affected by the extended lending strategy of CBs. As in the base model, market cycles show the most stable movements and less outbreaks if both banks act on the market. The equity requirement of CBs has a smoothening effect on the market. However, the procyclical mortgage lending of CBs cannot completely be compensated by requiring initial wealth for housing financing.Footnote 25 The lending strategy of BLs again counteracts the procyclical mortgage lending of CBs, and, as. a result, the volatility of house prices of the combined credit scenario with equity requirement of CBs is even lower than this of the combined base scenario.

These results are exemplified in Table 4, which provides the summary statistics for the model extension. As already revealed by Fig. 3, the equity requirement of CBs dampens the volatility of house prices. This also has a positive effect on the cycle volatility of the combined bank scenario. As BLs do not constrain for available equity, the market of this scenario stays unaffected.Footnote 26

The smoothening effect of equity is also reflected in the cycle characteristics of the market scenarios which are stated in Table 5. The average cycle length of the CB scenario shortens when CBs demand for equity. Therefore, more cycles occur. As market cycles are less severe, those applicants who fulfill all credit constraints approach their threshold for housing investment faster and can enter the market earlier. The number of market outbreaks is reduced.

This favorable circumstance coincides, however, with limited access to housing financing for those potential customers who do not fulfill the imposed equity constraint. By conditioning lending on preexisting equity, housing investment is denied to those applicants with no or too little initial wealth. Accordingly, CBs reduce lending (Table 5) and less agents can enter the market, which dampens transaction and homeownership rate in comparison to the CB base scenario (Table 4). With regard to this aspect, BLs fulfill an additional stabilizing function on the housing market as they grant mortgages independent of prior equity.

Due to the extended credit constraint of CBs, potential home buyers reallocate between the two financial institutions. Applicants, who would have been accepted by CBs in the base model, are rejected in the model extension due to lack of equity. These apply for mortgages at BLs. Since BLs do not demand for equity a priori, BLs accept the applicant if he reveals himself as a good customer. Accordingly, a customer shift sets in. The customers of BLs are those with \(\frac{E}{{P}_{i}}\in \left[0,\varepsilon \right]\). Those represent this part of potential buyers who do not meet the equity requirements set by CBs. Since clients are assumed to have a positive time preference for housing investment, wealthier clients, in the means of an equity ratio in the range of \(\left[\varepsilon ,1\right]\) are those of CBs. Evidence of the reallocation of customers is provided in Table 5. In comparison to the base model, BLs grant more credit, whereas CBs lose market shares. Furthermore, the extended lending by BLs cushions transaction, homeownership, and construction rate and ensures reasonable levels in comparison to the base model.

This observation strengthens the result that BLs expand accessibility to real estate financing within the population and serve as stabilizers for the housing market. They incorporate the smoothening nature of an equity requirement in its CSH which must be fulfilled during the savings phase in order to get a mortgage while not limiting the access to housing financing for households with little or no initial equity.

Conclusions

In a computational simulation experiment, this paper investigates whether various lending strategies of financial intermediaries affect the housing market differently. We develop a heterogeneous agent-based model in which buyers, sellers, and two types of financial intermediaries, conventional banks and building and loan associations, interact on the market. Buyers and sellers use recent price information to form expectations about future market conditions and are restricted by individual income levels. Financial intermediaries finance residential property and, therefore, mainly determine whether housing investment can be realized. CBs mainly base their lending decision on backward-looking, expectation-driven collateral values. BLs, in contrast, focus on endogenously created customer information out of relationship lending. Endogenous housing market cycles are created by the decisions and interactions of agents.

Three simulation scenarios are examined individually and compared to each other: one in which only CBs operate, a second, in which only BLs grant mortgages, and a third, in which CBs and BLs serve the mortgage market jointly. The simulations show that a residential property market in which solely CBs act as financial intermediaries tends to be the most volatile. As they focus on collateral values, they grant mortgages generously in times of previous house price appreciations, further cheering prevailing upturns. In times of downturns, applicants are rejected. This procyclic lending strategy leads to sharp oscillations of house prices, restricts transactions and homeownership, and creates a housing market, prone to recessions. As the housing market is closely correlated with other economic sectors as production, social health, and welfare, the lending practices of CBs may pose risks for an entire economy and the society at large.

A housing market, in which only BLs grant mortgages shows milder price level fluctuations and less outbreaks. BLs put less emphasis on collateral values and use information out of relationship lending what leads to less pronounced market cycles, a higher rate of property transactions, and promotes homeownership. Due to low mortgage interest rates, BLs enable lower-income households to invest in residential property, thus adding potential buyers to the real estate market.

A mortgage market that consists of both, CBs and BLs, shows less market volatility than a market with a single financial institution. BLs mitigate the procyclic lending activities of CBs and create smoothened housing market cycles. The simulations show that BLs act as stabilizers of the housing market which is consistent with empirical evidence (Molterer et al., 2017). Transactions and homeownership reach the highest level if both financial intermediaries act on the market. Less market volatility can also be achieved by constraining mortgage lending on an equity requirement. This, however, dampens transaction and homeownership rates and makes the market shrink. BLs cushion these negative effects as they do not constrain mortgage lending to equity conditions and also lend to those who do not fulfill the equity requirements if they revealed themselves as good customers. Therefore, a diversified market in which financial intermediaries with differing lending strategies, especially ones that detach lending decisions from previous market developments, finance residential property appear to have a positive effect on market stability, and, at the same time provide homeownership for a larger share of households. This market composition contributes to economic and social prosperity while at the same time preventing the housing market from crashes.

Our model assumes that CBs primarily focus on collateral values to decide about mortgage lending. This, in turn, does not imply that BLs have a monopoly on information. CBs may also create endogenous information about borrowers or acquire it from external sources. As evidenced in existing literature, however, CBs mainly use collaterals as their primary source of information to save screening costs and to prevent losses out of default. If external borrower information would be as cheap and as loss-preventing as pledged collateral, CBs may use other information, too. This might have stabilizing effects on the housing market if the information is as valuable as this generated by BLs. During the savings phase of a CSH, customers reveal their ability and willingness to steadily forgo consumption in order to acquire residential property at a later date. With regard to a long-term real estate mortgage, this information is more valuable than credit card or one-time consumer debt information from 3rd-party credit reports.Footnote 27 Non-reliable or unsuitable information, in turn, would counteract a possible stabilizing effect.

Even if CBs would also take customer information into account for some extent, BLs would still act as market stabilizers. This becomes apparent in the model extension. Their cooperative idea to bring people together to save jointly and to make housing purchase affordable grants access to the housing market to a broader share of the population. Thus, the advantageous effects of BLs are not only linked to asymmetric information regarding creditworthiness. They serve a value beyond that by not solely maximizing profits but by following their cooperative idea. This, in turn, benefits households and enhances the total public welfare.

Past experiences have shown from different perspectives that the homogenization of financial markets entails a diverse set of risks. In the 1980s, deregulation caused building societies and savings and loan institutions to disappear from the market in the U.K. and the U.S. which, as a result, led to increased housing market volatility. High volatilities, in turn, induce rising defaults (Ambrose et al., 2001; Yang et al., 1998). In addition, both countries suffered severe consequences from the latest financial crisis of 2008 while countries with BLs experienced milder downturns and thus proved to be more resilient to crises. A possible explanation of this phenomenon is the finding of Ambrose et al. (2001) who evidenced that the probability of borrower default is lower in areas in which the market interest rates exceed mortgage contract rates. This condition is integral to the business model of BLs.

Given the negative consequences of volatile housing markets, the findings of our study have important political implications and should be taken into account when making policy decisions concerning the composition and the regulation of the mortgage market. Our results can be taken as support for the presence of BLs in housing markets as they are able to dampen market oscillations. As such, this study may serve as a reference for policy implications to consider (re)introducing BLs in markets with historically high volatility, being aware that an appropriate regulatory framework is necessary to successfully establish the system.

Notes

In order to complete the European Single Market, the European Commission arguments in favor of cross-border housing financing. This is intended to decrease financing costs, facilitate access to differing financial products, and intensify competition. However, due to huge differences within the member states according to conditions and products, harmonization has not yet been achieved. For more information see Voigtländer (2010).

The first BL, Gemeinschaft der Freunde (Society of Friends), was founded by Georg Kropp in Wüstenrot.

Public building societies, called Landesbausparkassen (LBS), are part of the German Savings Banks Association (Deutscher Sparkassen- und Giroverband) and are limited in competition by regional segregation according to the federal states in which they operate.

For more information see for instance Boos, Fischer, Schulte-Mattler, and Schäfer KWG § 3 Rn. 14–18; Drescher, Fleischer, and Schmidt KWG § 3 Rn. 168–179; Erbs, Kohlhaas, and Häberle KWG § 3 Rn. 8.

For more information about the development of the German regulatory requirements of BLs see Schäfer et al. 1999.

Data is available from the Verband der deutschen Bausparkassen, EFBS and Eurostat.

The terms conventional mortgage and conventional bank are used for standardized mortgages, granted by financial institutions, others than BLs, at the time of request, characterized by a fixed term and a fixed interest rate.

If a redemption period of 10 is considered and 10 payments on the principal are made, \({r}_{p}=0.1\).

Since a cash flow would not occur until period \({t}_{+1}\), it is discounted with the risk-free interest rate \({r}_{f}.\)

Note: Because of great variations in transaction costs, they are not considered in the model.

Note: Residential property firms are not further divided into individual companies. Instead, the entire industry is represented.

Note: Mortgage disbursement is not only contingent on the individual savings effort. Instead, a minimum duration of the savings period must be fulfilled as well as a fixed threshold level that depends on the collective savings volume of the whole group of customers.

CBs may assess for personal credit worthiness of debt applicants as well. However, these information are exogenously, disclosed by the applicant himself and, therefore, less reliable than information created endogenously by relationship lending.

This corresponds to a repayment period of 10.

Loan-to-value ratios vary internationally. Conventional German banks are quite restrictive, only funding 60% of the market value when a senior loan is granted. The LTV of junior loans reaches 80% (Bienert & Brunauer, 2007). BLs, in contrast, are legally permitted to finance 100% of owner-occupied residential property by their national law. In Denmark, the LTV-level reaches 80% (Jensen et al., 2015). The same holds for Russia (Zubov, 2020) whereas in Ireland a maximum LTV of 90% is permitted (Corrigan et al., 2020).

The Bausparkassengesetz, respectively, the Building Society Act, is the national law, BLs are subject to.

Transaction, homeownership, and construction rate are calculated in every simulation period as: \(Transaction\;Rate=\frac{{N}_{transactions,t}}{\mathrm{min}\left({N}_{buyers,t}, {N}_{sellers,t}\right)}\), \(Homeownership Rate= \frac{{N}_{transactions,t}}{{N}_{potential\ buyers,t}}\), \(\mathrm{Construction\;Rate}=\frac{{N}_{constructions,t}}{({N}_{new\;sellings, t}+{N}_{left\;over})}\).

An outbreak is defined as a price movement up or below the mean, ± the lowest standard deviation of the three simulation scenarios.

The amount of regularly savings as well as the length of the savings period are determined by a BL at the beginning of the savings phase. Therefore, a BL and it’s customer know the amount of equity that will be available at the beginning of the credit phase if all savings are done properly.

Equity requirements vary internationally. However, an equity requirement of 20% is in line with those of several countries. In Germany, Denmark, and Russia 20% of equity are necessary to get a mortgage loan (Chiuri & Jappelli, 2003; Jensen et al., 2015; Zubov, 2020). In Ireland, borrowers are required to make a down payment of at least 10% (Corrigan et al., 2020). UK and US, in contrast, require comparatively low down payment rates of 5% (UK) and 11% (US) (Chiuri & Jappelli, 2003).

Note: In this model extension, CBs only account for whether potential buyers meet the imposed equity requirement or not. Impacts of a higher available equity i.e. on the mortgage interest rate are not considered.

Note: The minor variations of the parameters are due to the individuality of each simulation run.

References

Aghion, P., & Bolton, P. (1992). An incomplete contracts approach to financial contracting. The review of economic Studies, 59.3(1992), 473–494. https://doi.org/10.2307/2297860

Ambrose, B. W., & Capone, C. A. (2000). The hazard rates of first and second defaults. The Journal of Real Estate Finance and Economics, 20, 275–293. https://doi.org/10.1023/A:1007837225924

Ambrose, B. W., Capone, C. A., & Deng, Y. (2001). Optimal put exercise: An empirical examination of conditions for mortgage foreclosure. The Journal of Real Estate Finance and Economics, 23(2), 213–234. https://doi.org/10.1023/A:1011110501074

Bester, H. (1985). Screening vs. rationing in credit markets with imperfect information. The American Economic Review, 75(4), 850–855.

Bhutta, N., Dokko, J., & Shan, H. (2017). Consumer ruthlessness and mortgage default during the 2007 to 2009 housing bust. The Journal of Finance, 72(6), 2433–2466. https://doi.org/10.1111/jofi.12523

Bienert, S., & Brunauer, W. (2007). The mortgage lending value: Prospects for development within Europe. Journal of Property Investment & Finance, 25(6), 542–578. https://doi.org/10.1108/14635780710829289

Boos, K.-H.; Fischer, R.; Schulte-Mattler, H., & Schäfer, F. A. (2016). KWG § 3: Zwecksparunternehmen, Kommentar zum KWG – CRR-VO (5) Band 1: Rn. 14–18.

Burghof, H.-P., & Schairer, M. (2017). Loan Performance of Contractual Savings for Housing. Available at SSRN 2925104. https://doi.org/10.2139/ssrn.2925104

Burghof, H.-P., & Gehrung, M. (2019). Bausparen und die Kosten der privaten Immobilienfinanzierung. Immobilien Und Finanzierung, 4, 28–30.

Campbell, J. Y., & Cocco, J. F. (2015). A model of mortgage default. The Journal of Finance, 70(4), 1495–1554. https://doi.org/10.1111/jofi.12252

Chiuri, M. C., & Jappelli, T. (2003). Financial market imperfections and home ownership: A comparative study. European Economic Review, 47(5), 857–875. https://doi.org/10.1016/S0014-2921(02)00273-8

Collyns, C., & Senhadji, A. (2003). Lending booms, real estate bubbles, and the Asian crisis. Asset price bubbles: the implication for monetary, regulatory and international policies (pp. 101–25). MIT Press.

Corrigan, E., O'Toole, C., & Slaymaker, R. (2020). Credit demand in the Irish mortgage market: What is the gap and could public lending help? (No. 671). ESRI Working Paper.

Danis, M. A., & Pennington-Cross, A. (2008). The delinquency of subprime mortgages. Journal of Economics and Business, 60(1–2), 67–90. https://doi.org/10.1016/j.jeconbus.2007.08.005

Demyanyk, Y. (2009). Quick exits of subprime mortgages. Federal Reserve Bank of St. Louis Review, 2, 79–93.

Deng, Y. (1997). Mortgage termination: An empirical hazard model with a stochastic term structure. The Journal of Real Estate Finance and Economics, 14(3), 309–331. https://doi.org/10.1023/A:1007758412993

Diamond, D. B., & Lea, M. J. (1992). The decline of special circuits in developed country housing finance. Housing Policy Debate, Informa UK Limited, 3, 747–777. https://doi.org/10.1080/10511482.1992.9521107

Drescher, I., Fleischer, H., & Schmidt, K. (2019). Verbot von Zwecksparunternehmen. Münchener Kommentar zum HGB (4) Band 6: Rn. 168–179.

Erbs, G., Kohlhass, M., & Häberle, P. (2021). KWG § 3: Zwecksparunternehmen, Beck’sche Kurzkommentare Band 17: Rn. 8.

Euro Area Statistics. (2020). Growth rates in housing loans are steadily increasing in the euro area. URL https://www.euro-area-statistics.org/statistics-insights/growth-rates-in-housing-loans-are-steadily-increasing-in-the-euro-area?cr=eur&lg=en&page=0

Filatova, T., Parker, D. C., & Van der Veen (2007). Agent-based land markets: heterogeneous agents, land prices and urban landuse change, Proceedings of the 4th Conference of the European Social Simulation Association (ESSA’07).

Foote, C. L., Gerardi, K., & Willen, P. S. (2008). Negative equity and foreclosure: Theory and evidence. Journal of Urban Economics, 64(2), 234–245. https://doi.org/10.1016/j.jue.2008.07.006

Foote, C. L., & Willen, P. (2017). Mortgage-default research and the recent foreclosure crisis. Available at SSRN 3082773.

Freund, J., Curry, T., Hirsch, P., & Kelly, T. (1998). Commercial real estate and the banking crises of the 1980s and early 1990s. History of the eighties: Lessons for the future (an examination of the banking crises of the 1980s and early 1990s) 1, 137–165.

German Central Bank. (2020). Banking Supervision and Real Estate Financing: The Risks at a Glance. URL https://www.bundesbank.de/de/presse/gastbeitraege/bankenaufsicht-und-immobilienfinanzierung-die-risiken-im-blick-836218

Glaeser, E. L., & Shapiro, J. M. (2003). The benefits of the home mortgage interest deduction. Tax Policy and the Economy, 17, 37–82. https://doi.org/10.1086/tpe.17.20140504

Hakim, S. R., & Haddad, M. (1999). Borrower attributes and the risk of default of conventional mortgages. Atlantic Economic Journal, 27(2), 210–220. https://doi.org/10.1007/BF02300240

Hart, O. (1995). Firms, contracts, and financial structure. Clarendon press.

Herring, R. J., & Wachter, S. M. (1999). Real estate booms and banking busts: An international perspective. Wharton School Center for Financial Institutions, Working Paper 99–27.

Heuson, A., Passmore, W., & Sparks, R. (2001). Credit scoring and mortgage securitization: Implications for mortgage rates and credit availability. Journal of Real Estate Finance and Economics, 23(3), 337–363. https://doi.org/10.1023/A:1017952120081

Hilbers, P., Lei, Q., & Zacho, L. (2001). Real estate market developments and financial sector soundness. Working paper 01/129, IMF. https://doi.org/10.2139/ssrn.879898

Holmström, B. (1982). Managerial incentive problems - a dynamic perspective, Essays in Economics and Management in Honour of Lars Wahlbeck, Svenska Handelshogskolan, Helsinki. Reprinted 1999 in Review of Economic Studies 66(1), 169–182.

Jensen, T. L., Leth-Petersen, S., & Nanda, R. (2015). Home equity finance and entrepreneurial performance: Evidence from a mortgage reform. No. 15–020. Harvard Business School.

Kirsch, S., & Burghof, H.-P. (2018). The efficiency of savings-linked relationship lending for housing finance. Journal of Housing Economics, 42, 55–68.

Lehmann, W. (1983). Abriß der Geschichte des deutschen Bausparwesens. Domus Verlag.

Manove, M., Padilla, A. J., & Pagano, M. (2001). Collateral versus project screening: A model of lazy banks. Rand Journal of Economics, 2001, 726–744. https://doi.org/10.2307/2696390

Molterer, M., Amon, J., & Tyrell, M. (2017). Specialized Financial Intermediaries and the Impact of Savings and Loan Contracts on Real Estate Finance. Available at SSRN 2873919.

Müller, M. L. (1999). Bausparen in Deutschland zwischen Inflation und Währungsreform 1924–1948. CH Beck. https://doi.org/10.2139/ssrn.2873919