Abstract

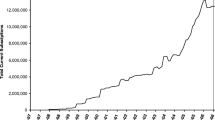

We estimate the demand for a videocalling technology in the presence of both network effects and heterogeneity. Using a unique dataset from a large multinational firm, we pose and estimate a fully dynamic model of technology adoption. We propose a novel identification strategy based on post-adoption technology usage to disentangle equilibrium beliefs concerning the evolution of the network from observed and unobserved heterogeneity in technology adoption costs and use benefits. We find that employees have significant heterogeneity in both adoption costs and network benefits, and have preferences for diverse networks. Using our estimates, we evaluate a number of counterfactual adoption policies, and find that a policy of strategically targeting the right subtype for initial adoption can lead to a faster-growing and larger network than a policy of uncoordinated or diffuse adoption.

Similar content being viewed by others

Notes

Rose and Joskow (1990) discuss how identification is important in generalized diffusion models when trying to put a causal interpretation on a variable such as firm size.

We exclude from our analysis 300 employees who left the firm during our sample period.

The Asia region also includes a small number of isolated offices in other locations.

We do not model the length of calls; low-intensity long calls can be as useful as high-intensity short calls.

Fewer than 5% of calls involved more than two people.

Discarding some of the calls may induce bias in our estimated parameters. Removing the Finance/Credit Analysis division could artificially reduce the number of agents in the network, deflating the estimates of the network’s worth at any point in time, and as a result will bias the estimates of the fixed costs of adoption downward. Due to the small number of employees who adopted and the fact that only two employees ever called another employee in this division which was focused more on retail banking, this effect is probably small. The same effect is possible with calls from employees who were fired. Though these employees who left the firm made a similar, though slightly lower number of calls to those who did not leave, we are not able to trace out their adoption as we do not have details about their title, function and location within the firm.

Tucker (2008) explores the differences between modeling calls as one-way or two-way process and presents evidence that for modeling purposes the directionality of calls is not empirically important.

Our specification does not explicitly account for intertemporal correlation in calling patterns, as in the case of two coworkers who work on the same project and who repeatedly call each other.

Our model is agnostic about the identity of agents from two subtypes who call each other. Our calling model is consistent with the notion that two different agents repeatedly call each other, but is not as efficient as an estimator which explicitly accounts for such autocorrelation in the error structure.

In principle, one would also impose a discount factor within the calling period.

This is true even if τ i is time-varying. The reason is that we can write the expected discounted stream of stand-alone benefits as \(\bar{\tau} = \sum_{t=0}^{\infty} E [ \tau_{it} ]\). Note, however, that this results in the same formulation as Eq. 7 since the stand-alone benefits are a stochastic stream of benefits that accrue to the agent regardless of the evolution of the state space or actions by the agent. Therefore, the stream of payoffs can be replaced by the expected discounted value, and it is clear from Eq. 7 that only the difference τ i − F i is identified at the point that the agent adopts the technology.

We present a two-period, two-agent model in the Appendix to illustrate analytically why agents may find it optimal to wait as uncertainty is resolved. While our model has many agents and many time periods, the intuition of the simple model extends to our more complex setting.

In earlier versions of this paper, we discussed Monte Carlo evidence that suggested this simulated sequence estimator performs well in small samples, and that joint estimation is badly biased in small samples. These results are available upon request from the authors.

To illustrate this point further, suppose we exogenously placed two observably identical agents each into one of two networks, where one network has an initially larger installed base than the other. Suppose that neither agent adopts the technology in the first period, and that both networks grow to the same size in the second period. The probability of seeing the agent in the initially smaller network adopt is now higher than the agent who did not adopt in the initially larger network, as the adoption benefits in that network were larger, and therefore the agent has revealed themselves to be of at least as high a type as the agent who did not adopt in the small network. This intuition translates into our restriction on the sign of λ 3 in the reduced-form adoption policy function.

We have experimented with several different specifications, including ones where the shock and lagged adoption variables are interacted. Unfortunately, data limitations preclude the use of more complex functions of the shock and the state variable. In all specifications we tested, the estimated coefficient on the shock was statistically insignificant.

We do not report standard errors, as the asymptotic distribution for inequality-constrained estimators with many parameters on the boundary is a frontier area of research. We note that this will bias the standard errors on the distributions of adoption costs downward, as they are functions of the adoption policy function. See Andrews and Guggenberger (2009) for a discussion of possible solutions in the case of one parameter on the boundary, and why intuitive solutions such as the bootstrap are inconsistent.

The likelihood ratio test for the hypothesis that the decay rates are all jointly zero is overwhelming rejected at the 0.001 level.

These results on decay rates rely on the assumption that the appropriate calling period is a calendar month. We have contrasted the results obtained from using a calendar month with the results of using quarters, weeks, or individual days. We found no evidence that our choice of period influenced our results.

As noted above, we do not account for statistical error in the adoption policy function. The standard errors capture variation in outcomes due to statistical error the estimated calling parameters and structural errors in the calling functions.

References

Ackerberg, D. A., & Gowrisankaran, G. (2006). Quantifying equilibrium network externalities in the ACH banking industry. RAND Journal of Economics, 37, 738–761.

Andrews, D.W.K., & Guggenberger, P. (2010). Asymptotic size and a problem with subsampling and with the m out of n bootstrap. Econometric Theory, vol. 26(02), pp. 426–468. Cambridge University Press.

Bajari, P., Benkard, C. L., & Levin, J. (2007). Estimating dynamic models of imperfect competition. Econometrica, 75, 1331–1370.

Bajari, P., Hong, H., & Ryan, S. (2010). Identification and estimation of a discrete game of compete information. Econometrica, 78(5), 1529–1568.

Baker, G., Gibbs, M., & Holmstrom, B. (1994). The internal economics of the firm: Evidence from personnel data. The Quarterly Journal of Economics, 109(4), 881–919.

Carr, N. G. (2003). It doesn’t matter. Harvard Business Review, 81(5), 41–49.

Draganska, M., Mazzeo, M., & Seim, K. (2009). Beyond plain vanilla: Modeling joint product assortment and pricing decisions. Quantitative Marketing and Economics, 7(2), 105–146.

Dubé, J.-P. H., Hitsch, G. J., & Chintagunta, P. K. (2010). Tipping and concentration in markets with indirect network effects. Marketing Science, 29(2), 216–249.

Ellickson, P., & Misra, S. (2010). Enriching interactions: Incorporating revenue and cost data into static discrete games. Mimeo, University of Rochester.

Farrell, J., & Saloner, G. (1985). Standardization, compatibility, and innovation. RAND Journal of Economics, 16, 70–83.

Garicano, L. (2000). Hierarchies and the organization of knowledge in production. Journal of Political Economy, 108(5), 874–904.

Garicano, L., & Hubbard, T. N. (2007). Managerial leverage is limited by the extent of the market: Hierarchies, specialization, and the utilization of lawyers’ human capital. Journal of Law & Economics, 50(1), 1–43.

Gordon, B. R. (2009). A dynamic model of consumer replacement cycles in the PC processor industry. Marketing Science, mksc.1080.0448.

Gowrisankaran, G., & Stavins, J. (2004). Network externalities and technology adoption: Lessons from electronic payments. RAND Journal of Economics, 35(2), 260–276.

Griliches, Z. (1957). Hybrid corn: An exploration in the economics of technological change. Econometrica, 25(4), 501–522.

Hartmann, W. R., & Nair, H. S. (2010). Retail competition and the dynamics of demand for tied goods. Marketing Science, 29(2), 366–386.

Jackson, M., & Wolinsky, A. (1996). A strategic model of social and economic networks. Journal of Economic Theory, 71, 44–74.

Katz, M. L., & Shapiro, C. (1985). Network externalities, competition, and compatibility. American Economic Review, 75(3), 424–40.

Keane, M. P., & Wolpin, K. I. (1997). The career decisions of young men. Journal of Political Economy, 105(3), 473–522.

Liebowitz, S., & Margolis, S. E. (1994). Network externality: An uncommon tragedy. Journal of Economic Perspectives, 8(2), 133–150.

Mansfield, E. (1961). Technical change and the rate of imitation. Econometrica, 29(4), 741–766.

Maskin, E., & Tirole, J. (1988). A theory of dynamic oligopoly, I: Overview and quantity competition with large fixed costs. Econometrica, 56(3), 549–69.

Maskin, E., & Tirole, J. (2001). Markov perfect equilibrium: I. Observable actions. Journal of Economic Theory, 100(2), 191–219.

Misra, S., & Nair, H. (2011). A structural model of sales-force compensation dynamics: Estimation and field implementation. Quantitative Marketing and Economics, 1–47. doi:10.1007/s11129-011-9096-1.

Nair, H., Chintagunta, P., & Dubé, J.-P. (2004). Empirical analysis of indirect network effects in the market for personal digital assistants. Quantitative Marketing and Economics, 2(1), 23–58.

Radner, R. (1992). Hierarchy: The economics of managing. Journal of Economic Literature, 30, 1382–1415.

Radner, R. (1993). The organization of decentralized information processing. Econometrica, 61, 1109–1146.

Rajan, R., & Wulf, J. (2006). The flattening firm: Evidence from panel data on the changing nature of corporate hierarchies. Review of Economics and Statistics, 88(4), 759–773.

Reiss, P. C., & Spiller, P. T. (1989). Competition and entry in small airline markets. Journal of Law & Economics, 32(2), S179–202.

Rogers, E. M. (1962). Diffusion of innovations. Perth: Free Press.

Rose, N. L., & Joskow, P. L. (1990). The diffusion of new technologies: Evidence from the electric utility industry. RAND Journal of Economics, 21(3), 354–373.

Ryan, S. P. (2011). The costs of environmental regulation in a concentrated industry. MIT Working Paper.

Rysman, M. (2004). Competition between networks: A study of the market for yellow pages. Review of Economic Studies, 71(2), 483–512.

Tucker, C. (2008). Identifying formal and informal influence in technology adoption with network externalities. Management Science, 54(12), 2024–2039.

Tucker, C. (2011). Network stability, network externalities and technology adoption. NBER Working Papers 17246, National Bureau of Economic Research, Inc.

Van Zandt, T. (1999). Real-time decentralized information processing as a model of organizations with boundedly rational agents. Review of Economic Studies, 66(3), 633–58.

Acknowledgements

Financial support from the NET Institute, is gratefully acknowledged. We would also like to thank Dan Ackerberg, Amy Finkelstein, Shane Greenstein, Thierry Magnac, Chris Snyder, Marc Reisman, Andrew Sweeting, and seminar participants at the International Industrial Organization Conference, Boston University, Central European University, Chicago GB, the University of Mannheim, the Minnesota Applied Microeconomics Conference, the Wharton School of the University of Pennsylvania, the Quantitative Marketing and Economics Conference, the Tuck Winter IO Conference, the Fourth IDEI Conference on the Economics of the Software and Internet Industries, MIT, and the NBER Winter IO Meetings.

Author information

Authors and Affiliations

Corresponding author

Appendix: Simple model of technology adoption

Appendix: Simple model of technology adoption

Consider the following simple model of technology adoption. There are two periods, t = {1, 2}. Suppose that there are two agents, each of whom receives a draw of adoption costs from a common distribution, F. If both agents have joined the network, they call each other and obtain utility U per period. At the beginning of each period, each agent can join the network and make a call to the other agent if they are also in the network. Assume there is no discounting. Let s i = 1 if agent i has adopted the technology and zero otherwise. Denote the probability that agent i joins at time t by P it .

In the second period, there are three possible configurations of agent adoption carried over from the first period: neither has adopted, one has adopted, and both have adopted. If both have adopted, then the agents call each other and obtain a payoff of U each. If one has adopted, consider the choice problem facing the other agent:

The probability that the agent will adopt in the second period conditional on the other agent adopting in the first period is given by P i2(s j = 1). The distribution that agent i projects over the agent j’s fixed costs associated with this probability is different than F, since the agent j already revealed information about their draw on F by not adopting in the first period.

If neither agent has adopted in the first period, the choice problem facing each agent is:

The probability that agent i adopts in the second period conditional on the other agent adopting in the first period is given by P i2(s j = 0). The distribution associated with this probability is also different than F for the same reason as above.

In the first period, each agent must decide whether to adopt or wait. If the agent adopts, the expected payoff is given by:

The first term is the value accruing to the agent from the possibility of the other agent adopting early, and receiving 2U as a result. The second term is the possibility that the other adopts j only in the second period, with a payout of U.

If the agent waits, the payoff is given by:

Given these two payoffs in the first period, the agent makes an optimal choice of whether to adopt or not:

Clearly the agent will never adopt if F i ≥ 2U. For the case where F i ≤ U, we have the following comparison:

The agent will adopt in the first period if and only if:

Factoring common terms, this simplifies to:

where we denote the threshold value at which the agent is indifferent to adoption as \(\bar{F}\). The associated conditional probabilities of adoption in the second period are:

and

Therefore, the potential for revelations about the distribution of F generates “learning” or “cascading” adoption behavior, where agents find it advantageous to wait to adopt until after seeing how their colleagues behave. In the model, we estimate that the fact that each of the 64 sub-types of agents have a different F increases the aggregate uncertainty within the network beyond that suggested in this simplified model.

Rights and permissions

About this article

Cite this article

Ryan, S.P., Tucker, C. Heterogeneity and the dynamics of technology adoption. Quant Mark Econ 10, 63–109 (2012). https://doi.org/10.1007/s11129-011-9109-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-011-9109-0