Abstract

Our contribution to the expanding literature on the globalization of research and innovation is to investigate the extent to which sector-specific developments in an emerging technology (such as increasing interdisciplinarity and complexity) affect inventive activities developed abroad. We look at how technological diversity and scientific excellence of host countries in the field of nanotechnology affect the development of inventive activities by US multinational companies (MNCs). We identify the most active US-based MNCs in nanotechnology-related patenting and examine location decisions of these companies and their international subsidiaries. Econometric results confirm our hypothesis that the technological breadth of host countries positively influences the expected number of inventions developed abroad by US MNCs. Science capabilities of countries also have a positive impact on the decision to invent abroad, while the influence of market specific factors is less clear. We interpret these results as suggesting that host country science capabilities are important to attract innovative activities by MNCs, but as the interdisciplinary and convergent nature of nanotechnology evolves, access to a broadly diversified knowledge base becomes important in increasing the relative attractiveness of host locations.

Similar content being viewed by others

Notes

See Narula and Zanfei (2005) for a recent survey.

A distinction should be made between the terms nanoscience and nanotechnology. Nanoscience refers to the search for fundamental new knowledge to understand structures, materials, and components at the scale of roughly 1–100 nanometer (nm). Nanotechnology is a broader concept that refers to the application of that knowledge to design and use. More formally, we can say that nanotechnology consists of the creation of systems, devices, structures and materials at the 1–100 nm scale with novel properties and functions because of their small size (PCAST 2005). Whereas the growth of codified knowledge in nanoscience can be captured by examination of scientific publication, for nanotechnology the intrinsic characteristics of patents (novelty, non-obviousness, and usefulness) make them appropriate for analyzing the development and application potential of this emerging technology.

Instead of limiting the analysis to a particular country of origin of MNCs, another methodological solution could be to use dummy variables for each country of origin of MNCs. However, country comparability is problematic because there are country biases in the use of different patent offices (Schmoch 2007). As a result, our empirical model focuses on MNCs from a specific country.

In total our sample size consists of 625 observations. These observations correspond to the total number of US assignees multiplied the total number of host countries with one patent invented totally or partially abroad and assigned to those corporations. We find that the US companies in our sample invent in a total of 25 host countries. Each observation is therefore unique for each company and each location.

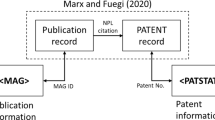

The use of patents as indicator of inventive activity has long been emphasized in the literature (see Griliches 1990, for a review). Despite the technical difficulties associated with patents and the fact that not all inventions are patentable, patent documents are rich information sources that can be used to study, among other topics, the geographic distribution of particular inventions. By limiting the analysis to a specific domain, we reduce potential differences that could emerge between fields and industries with different propensities to patent (Arundel and Kabla 1998).

Patent scopes indexes are generally computed using the International Patent Classification (IPC) class in which a patent office assigns a patent (see, for example, Cassiman et al. 2006). As explained below, we use this classification at the three-digit level.

These companies have 50 or more nanotechnology combined patents during the period under study. By industry category (using the Dow Jones Industry Classification Benchmark), the companies are: automobiles and parts: Ford Motor Company; chemicals: Dow Chemical Company, EI Du Pont de Nemours, Exxon Mobil Chemical, PPG Industries, Rohm & Haas; computer hardware: Hewlett-Packard, International Business Machines, Lucent Technologies, Seagate Technology; electronic office equipment: Xerox; general industrials: 3M, General Electric, Honeywell International; household goods: Procter & Gamble; leisure goods: Eastman Kodak; materials: Hyperion Catalysis (although not a large MNC, this is an internationally active company in the top 25 of all US nanotechnology patenting companies. We have thus included it in the analysis); personal goods: Kimberly-Clark; semiconductors: Advanced Micro Devices, Applied Materials, Intel, Micron Technology, Texas Instruments; telecommunications equipment: Corning Incorporated, Motorola.

Initially we considered all patent offices included in the dataset. However, we found out that, except for USPTO, EPO and WIPO, other patent offices did not have complete information on the location of inventor. As a result, we only used awarded patents by USPTO and EPO and granted WIPO PCTs. As we are not comparing patent activities of companies from different countries, the use of different patent offices is appropriate and desirable.

An extensive manual checking was undertaken to unify name variance of assignee firms and their subsidiaries. As noted by Griliches (1990), patent offices do not employ consistent company codes for each corporation.

The geographic address of the inventor is a more desirable indicator of the site of the inventive process than the location of the assignee, because the assignee location may be biased towards head-office administrative locations (Jaffe et al. 2002).

The main difficulty with the inventor location is that regional codes may correspond to country codes. For example, country/state code “CA” sometimes refers to Canada and other times to California, “IL” to Israel or Illinois, “IN” to India or Indiana, and “ID” to Indonesia or Idaho. To avoid misleading results regarding inventor cities and countries, inventor cities were assigned manually to correct countries/states.

References

Almeida, P., & Phene, A. (2004). Subsidiaries and knowledge creation: The influence of the MNC and host country on innovation. Strategic Management Journal, 25, 847–864.

Archibugi, D., & Michie, J. (1995). The globalisation of technology: A new taxonomy. Cambridge Journal of Economics, 19, 121–140.

Arundel, A., & Kabla, I. (1998). What percentage of innovations are patented? Empirical estimates for European firms. Research Policy, 27(2), 127–141.

Avenel, E., Favier, A. V., Maa, S., Mangematin, V., & Rieu, C. (2007). Diversification and hybridization in firm knowledge bases in nanotechnologies. Research Policy, 36, 864–870.

Barkema, H. G., Bell, J. H. J., & Pennings, J. M. (1996). Foreign entry, cultural barriers, and learning. Strategic Management Journal, 17, 151–166.

Belderbos, R. (2006). R&D activities in East Asia by Japanese, European, and US multinationals. JCER discussion paper No. 100.

Blanc, H., & Sierra, C. (1999). The internationalisation of R&D by multinationals: A trade-off between external and internal proximity. Cambridge Journal of Economics, 23, 187–206.

Birkinshaw, J., Hood, N., & Jonsson, S. (1998). Building firm-specific advantages in multinational corporations: The role of subsidiary initiative. Strategic Management Journal, 19(3), 221–242.

Branstetter, L. G., Fisman, R., & Foley, C. F. (2005). Do stronger intellectual property rights increase international technology transfer? Empirical evidence from U.S. firm-level data, NBER working paper no. W11516.

Bonaccorsi, A., & Thoma, G. (2007). Institutional complementarity and inventive performance in nano science and technology. Research Policy, 36, 813–831.

Cantwell, J. (1995). The globalisation of technology: What remains of the product cycle model? Cambridge Journal of Economics, 19, 155–174.

Cantwell, J., & Piscitello, L. (2005). Recent location of foreign-owned research and development activities by large multinational corporations in the European regions: The role of spillovers and externalities. Regional Studies, 39, 1–16.

Cassiman, B., Veugelers, R., & Zuniga, P (2006). In search of performance effects of (in) direct industry science links. FETEW Research Report MSI_0610, K.U. Leuven.

Criscuolo, P., Narula, R., & Verspagen, B. (2005). Role of home and host country innovation systems in R&D internationalisation: a patent citation analysis. Economics of Innovation & New Technology, 14, 417–433.

Dunning, J., & Narula, R. (1995). The R&D activities of foreign firms in the United States. International Studies of Management and Organisation, 25, 39–73.

Economist Intelligence Unit (EIU). (2004). Scattering the seeds of invention: The globalization of research and development. London.

Edler, J., Meyer-Krahmer, F., & Reger, G. (2002). Changes in the strategic management of technology: Results of a global benchmarking study. R&D Management, 32, 149–164.

Feinberg, S. E., & Gupta, A. K. (2004). Knowledge spillovers and the assignment of R&D responsibilities to foreign subsidiaries. Strategic Management Journal, 25, 823–845.

Fernández-Ribas, A., Shapira, P., & Youtie, J. (2006). Traditional vs decentralized innovation strategies of MNEs. Working paper, School of Public Policy, Georgia Institute of Technology.

Florida, R. (1997). The globalization of R&D: Results of a survey of foreign affiliated R&D laboratories in the USA. Research Policy, 26(1), 85–103.

Frost, T. S. (2001). The geographic sources of foreign subsidiaries’ innovations. Strategic Management Journal, 22, 101–123.

Furu, P. (2001). Drivers of competence development in different types of multinational R&D subsidiaries. Scandinavian Journal of Management, 17(1), 133–149.

Greene, W. (1994). Accounting for excess zeros and sample selection in Poisson and negative binomial regression models. Working paper, Stern School of Business, NYU EC-94-10.

Griliches, Z. (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 28, 1661–1707.

Guellec, D., & van Pottelsberghe, B. (2001). The internationalisation of technology analysed with patent data. Research Policy, 30(8), 1253–1266.

Hagedoorn, J., Cloodt, D., & van Kranenburg, H. (2005). Intellectual property rights and the governance of international R&D partnerships. Journal of International Business Studies, 36, 175–186.

Hagedoorn, J., & Narula, R. (1996). Choosing organizational modes of strategic technology partnering: International and sectoral differences. Journal of International Business Studies, 27(2), 265–284.

Ito, B., & Wakasugi, R. (2007). What factors determine the mode of overseas R&D by multinational? Empirical evidence. Research Policy, 36, 1275–1287.

Jaffe, A. B., Trajtenberg, M., & Henderson, R. (2002). Geographic localization of knowledge spillovers as evidenced by patent citations. In A. B. Jaffe & M. Trajtenberg (Eds.), Patents, citations and innovations (pp. 155–179). Cambridge, MA: The MIT Press.

Kostoff, R. N., Koytcheff, R. G., & Lau, C. G. Y. (2007). Technical structure of the global nanoscience and nanotechnology literature. Journal of Nanoparticle Research, 9, 701–724.

Kuemmerle, W. (1999). The drivers of foreign direct investment into research and development: An empirical investigation. Journal of International Business Studies, 30(1), 1–24.

Kumar, N. (2001). Determinants of location of overseas R&D activity of multinational enterprises: The case of US and Japanese corporations. Research Policy, 30, 159–174.

Lambert, D. (1992). Zero-inflated Poisson regression, with an application to defects in manufacturing. Technometrics, 34, 1–14.

Le Bas, C., & Sierra, C. (2002). “Location versus home country advantages” in R&D activities: Some further results on multinationals’ locational strategies. Research Policy, 31, 589–609.

Lerner, J. (1994). The importance of patent scope: An empirical analysis. Rand Journal of Economics, 25(2), 319–333.

Lux Research. (2004). The nanotechnology report 2004. New York: Lux Research Inc.

Mansfield, E., Teece, D., & Romeo, A. (1979). Overseas research and development by U.S.-based firms. Economica, 46, 186–196.

Narula, R., & Zanfei, A. (2005). Globalization of innovation: The role of multinational enterprises. In J. Fagerberg, D. C. Mowery, & R. Nelson (Eds.), The Oxford handbook of innovation (pp. 318–345). Oxford University Press.

National Science Board. (2002). Science and engineering indicators 2002 (vol. 1). Arlington, VA: National Science Foundation.

National Science Board. (2008). Science and engineering indicators 2008 (vol. 1). Arlington, VA: National Science Foundation.

Nordmann, A. (2004). Converging technologies—Shaping the future of European societies. Luxembourg: Office for Official Publications of the European Communities (EUR 21357).

Odagiri, H., & Yasuda, H. (1996). The determinants of overseas R&D by Japanese firms: An empirical study at the industry and company levels. Research Policy, 25, 1059–1079.

Patel, P., & Pavitt, K. (1991). Large firms in production of world’s technology. Journal of International Business Studies, 22(1), 1–22.

PCAST. (2005). The national nanotechnology initiative at five years: Assessment and recommendations of the National Nanotechnology Advisory Panel. Washington, DC: President’s Council of Advisors on Science and Technology, Executive Office of the President.

Porter, A. L., Youtie, Y., Shapira, P., & Schoneck, D. J. (2007). Refining search terms for nanotechnology. Journal of Nanoparticle Research (published online). doi:10.1007/s11051-007-9266-y.

Roco, M. C., & Bainbridge, W. S. (2003). Converging technologies for improving human performance: Nanotechnology, biotechnology, information technology and cognitive science. Dordrecht, The Netherlands: Kluwer Academic Publishers.

Rothaermel, F. T., & Thursby, M. (2007). The nanotech vs. the biotech revolution, sources of productivity in incumbent firm research. Research Policy, 36, 832–849.

Rugman, A., & Verbeke, A. (2001). Subsidiary specific advantages in multinational enterprises. Strategic Management Journal, 22(3), 237–250.

Schmoch, S. (2007). Double-boom cycles and the comeback of science-push and market-pull. Research Policy, 36(7), 1000–1015.

Sofka, W. (2006). Innovation activities abroad and the effects of liability of foreignness: Where it hurts. ZEW Discussion Papers 06-29.

Subramaniam, M., & Venkatraman, N. (2001). Determinants of transnational new product development capability: Testing the influence of transferring and deploying tacit overseas knowledge. Strategic Management Journal, 22, 359–378.

Tang, L., & Shapira, P. (2008). Research collaboration in nanotechnology research: A case study of China, paper presented at the Winter School on Emerging Nanotechnologies, PRIME and Nanodistrict, Grenoble, February 4–9.

Thursby, J., & Thursby, M. (2006). Here or there? A survey on the factors of R&D location. Washington, DC: National Academies Press.

Todo, Y., & Miyamoto, K. (2002). Knowledge diffusion from multinational enterprises: The role of domestic and foreign knowledge-enhancing activities. OECD Technical Papers No. 196.

Van Zeebroeck, N., Pottelsberghe de la Potterie, B., & Han, W. (2006). Issues in measuring the degree of technological specialization with patent data. Scientometrics, 66(3), 481–492.

Vernon, R. (1966). International investment and international trade in the product cycle. Quarterly Journal of Economics, 80, 190–207.

Vernon, R. (1979). The product cycle hypothesis in the new international environment. Oxford Bulletin of Economics and Statistics, 41, 255–267.

Wakasugi, R., & Ito, B. (2007). The effects of stronger intellectual property rights on technology transfer: evidence from Japanese firm-level data. The Journal of Technology Transfer, forthcoming.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. The MIT Press, Cambridge, Massachusetts. Chapter 9, 645–684.

Youtie, J., Shapira, P., & Porter, A. L. (2008). National publications and citations by leading countries and blocks. Journal of Nanoparticle Research (published online). doi:10.1007/s11051-008-9360-9.

Zaheer, S., & Mosakowski, E. (1997). The dynamics of the liability of foreignness: A global study of survival in financial services. Strategic Management Journal, 18, 439–464.

Zanfei, A. (2000). Transnational firms and the changing organisation of innovative activities. Cambridge Journal of Economics, 24, 515–554.

Zucker, L. G., & Darby, M. R. (2005). Socio-economic impact of nanoscale science: Initial results and nanobank. NBER working paper 11181.

Acknowledgements

Sponsorship of this research was provided by the Center for Nanotechnology in Society (CNS-ASU funded by the National Science Foundation, Award No. 0531194). We owe special thanks to Chien-Chun Liu and Sophia Randhawa for their diligent research assistance. We also wish to thank Lynne Zucker, Michael Darby, and participants at the Nanobank NBER conference (May 2-3, 2008, Boston, MA) for helpful comments and suggestions. Comments by two anonymous referees are also greatly appreciated. The findings and observations contained in this paper are those of the authors and do not necessarily reflect the views of the National Science Foundation.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fernández-Ribas, A., Shapira, P. Technological diversity, scientific excellence and the location of inventive activities abroad: the case of nanotechnology. J Technol Transf 34, 286–303 (2009). https://doi.org/10.1007/s10961-008-9090-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-008-9090-2