Abstract

This paper develops a framework of innovation dynamics to appreciate observed heterogeneity of firm size distributions, in which dynamics refer to exit and entry of product varieties and variety markets of individual firms. The analysis is based on a model of variety-triplets where every such triplet in the economy is identified by a unique combination of a variety, destination and firm. New variety triplets are introduced by innovating firms in a quasi-temporal setting of monopolistic competition. Ideas for variety-triplets arrive to firms according to a firm-specific and state dependent Poisson process, whereas variety triplets exit according to a destination-specific Poisson process. The empirical analysis employs a detailed firm-level data base which provides information about all variety triplets. Firm size is measured by a firm’s number of variety triplets. The empirical results are compatible with the model predictions of (i) a persistent distribution of firm sizes, (ii) frequent events of exit and entry, and (iii) state dependent entry, where a state may be given by each firm’s composition of triplets and/or other firm attributes.

Similar content being viewed by others

Notes

A common form of growth dynamics is some form of the well-known Gibrat’s Law (Gibrat 1931), which states that the growth rate of a firm is independent of its size.

The demand framework in our model is in principle identical to those of Dixit and Stiglitz (1977) with one exception; varieties age and become obsolete. It is with regard to the assumptions about the supply structure that our model differ from previous ones.

Case (i) represents a market innovation in the sense that it generates a new variety triplet for the destination market and a new variety-destination pair to the innovating firm.

The assumption that innovation costs are zero for a novel combination of a for the firm established variety and established market is a simplification, reflecting that those cost may be lower than other innovation costs.

A question that may be raised is: what happens when a firm receives an idea which at the time of arrival cannot be turned into an innovation due to the net profit constraint? There are two options. The first option is that the idea is dropped, forgotten and may return at a later time. The alternative where firms store ideas and innovate at a later stage would require additional model details and is not considered here.

To see this, observe that V L1 ≥ 0 implies that (p o − v)x o ≥ F + G, and firm k can (due to the gap in the market) get the gross profit (p o − v)x o which is larger than the associated costs G + H < F + G for a new variety and H<F+G for a new destination market with an already existing variety.

CN is an acronym for the Combined Nomenclature. When declared to customs in the EU, goods must generally be classified according to the CN. The CN is a method for designating goods and merchandise which was established to meet, at one and the same time, the requirements both of the Common Customs Tariff and of the external trade statistics of the Community. The CN is also used in intra-Community trade statistics. The CN is composed of the Harmonized System (HS) nomenclature with further Community subdivisions. The Harmonized system is run by the World Customs Organization (WCO). Information at a finer level of disaggregation (8-digit) is accessible, but because of granularities for firms at this level of disaggregation, we opt for the 6-digit level.

This may be viewed as a form of a ‘firm-level dual’ to the well-known Armington assumption in Armington (1969), which states in its original formulation that products are distinguished by place of production. Many papers derive measures pertaining to the Armington assumption. Feenstra (1994) and Broda and Weinstein (2006), for instance, define a variety as an 8- or 10-digit variety code produced in a particular country. In these papers, each unique combination of a country and product code thus constitutes a variety.

Each transition probability, q kl , is calculated by the number of transitions from state k to state l divided by the number of times the chains leaves state k.

We are here interested in changes of the supply pattern of firms over time as evidenced by the composition of their exports and therefore exclude firms that exports temporarily over the period 1998–2004.

One may put the assumption of state-dependence in the introduction of new export varieties in relation to the literature on ‘learning-by-exporting’, which states that firms acquire knowledge from export market participation (cf. Andersson and Lööf 2009).

MNEs have high ratios of R&D relative to sales, a large number of scientific, technical and other ‘white-collar’ workers as a percentage of their workforce, high value of intangible assets and large product differentiation efforts, such as high advertising to sales ratios (van Marrewijk 2002).

A region is defined as a functional region. A functional region consists of several municipalities that together form an integrated local labor market. They are delineated based on the intensity of commuting flows between municipalities. Within such a region, time distances between places are small enough to allow for frequent face-to-face contacts. We use a spatial delineation with 81functional regions in Sweden.

References

Aitken B, Hanson G, Harrison A (1997) Spillovers, foreign investment and export behavior. J Int Econ 43:103–132

Andersson M, Johansson B (2008) Innovation ideas and regional characteristics. Growth and Change 39:193–224

Andersson M, Lööf H (2009) Learning-by-exporting revisited—the role of intensity and persistence. Scand J Econ 111(4):893–916

Andersson M, Lööf H, Johansson S (2008) Productivity and international trade—firm-level evidence from a small open economy. Rev World Econ 144:773–800

Armington PS (1969) A theory of demand for products distinguished by place of production. Int Monetary Fund Staff Pap 16:159–176

Axtell RL (2001) Zipf distributions of US firm sizes. Science 293:1818–1820

Baldwin R, Okubo T (2006) Heterogeneous firms, agglomeration and economic geography: spatial selection and sorting. J Econ Geogr 6:323–346

Bartel AP, Lichtenberg FR (1987) The comparative advantage of educated workers in implementing new technology. Rev Econ Stat 69:1–11

Bernard AB, Eaton J, Jensen JB, Kortum S (2003) Plants and productivity in international trade. Am Econ Rev 93:1268–1290

Bottazzi G, Secchi A (2006) Gibrat’s law and diversification. Ind Corp Change 15:847–875

Broda C, Weinstein DE (2006) Globalization and the gains from variety. Q J Econ 121:541–585

Cameron A, Trivedi P (1998) The analysis of count data. Cambridge University Press, New York

Clegg RG (2008) Lecture six point five, continuous Markov chains, Richard G. Clegg’s webpage, lecture notes, Dept of Electronic and Electrical Engineering, University College London, http://www.richardclegg.org/

Coad A (2010) The exponential age distribution and the Pareto firm size distribution. J Ind Compet Trade 10:389–395

Cohen W, Levinthal D (1990) Absorptive capacity—a new perspective on learning and innovation. Adm Sci Q 35:128–152

Dachs B, Ebersberger B, Lööf H (2008) The innovative performance of foreign-owned enterprises in small open economies. J Technol Transf 33:393–406

Dixit A, Stiglitz J (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Feenstra RC (1994) New product varieties and the measurement of international prices. Am Econ Rev 84:157–177

Feldman M (1999) The new economics of innovation, spillovers and agglomeration—a review of empirical studies. Econ Innov New Technol 8:5–25

Gibrat R (1931) Les Inegalites Economiques. Sirey, Paris

Glaeser E (1994) Cities, information and economic growth. Cityscape 1:9–47

Griliches Z, Mairesse J (1995) Production Functions—the search for identification, NBER Working Paper No. 5067

Haight FA (1967) Handbook of the poisson distribution. Wiley, New York

Ijiri Y, Simon H (1977) Skew distributions and the size of business firms. North-Holland, Amsterdam

Keller W (2004) International technology diffusion. J Econ Lit 42:752–782

Klette TJ, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112:896–1018

Kortum S (2008) Exploring innovation with firm-level data. The Conference Board, Economics Program, EPWP #08-11

Krugman P (1979) A model of innovation, technology transfer and the world distribution of income. J Polit Econ 89:253–266

Krugman P (1980) Scale economies, product differentiation, and the pattern of trade. Am Econ Rev 70:950–959

Krugman P (1990) Rethinking international trade. The MIT Press, Cambridge

Lööf H, Andersson M (2010) Imports, productivity and the origin markets—the role of knowledge intensive economies. World Econ 33:458–481

Matia K, Fu D, Buldyrev S, Pammolli F, Riccaboni M, Stanley E (2004) Statistical properties of business firms structure and growth. Europhys Lett 67:498–503

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Norris JR (1998) Markov chains. Cambridge University Press, Cambridge

Pfaffermayr M, Bellak C (2002) Why foreign-owned firms are different: a conceptual framework and empirical evidence for Austria. In: Jungnickel R (ed) Foreign-owned firms: are they different? Palgrave Macmillan, pp 13–57

Schumpeter JA (1934) The theory of economic development. Harvard University Press, Cambridge

Sutton J (1997) Gibrat’s legacy. J Econ Lit 35:40–59

van Marrewijk C (2002) International trade and the world economy. Oxford University Press, Oxford

Author information

Authors and Affiliations

Corresponding authors

Appendices

Appendix 1: Transforming poisson processes into a Markov process

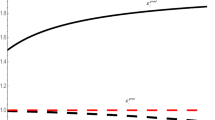

Consider that at a given point in time, t, there is a vector \( f(t) = [{f_0}(t),{f_1}(t),...] \) of probabilities or shares such that \( \sum\nolimits_k {{f_k}(t) = 1} \), where f n (t) denotes the share of firms with n distinct (i, j)-combinations. Following Clegg (2008) we shall study the Poisson arrival of innovation ideas and exit of (i, j)-combinations with the help of a continuous-time Markov chain, where σ kl denotes the flow rate between state k and l. With small discrete time steps, δt, the transition pattern can be depicted by

It is not meaningful to take the limit for δt → 0. Instead we introduce \( {q_{{kl}}}(t,t + \tau ) \) to denote the probability of a transition from state k to state l. Since there is no temporal memory (homogenous time), we may construct the following transition rates:

The transitions depicted are like a Poisson process, and then it is possible to write

Differentiating with respect to time yields the following result

Now, formula (A1.3) can be replicated in terms of q kl (t), which yields

From this we can replicate (A1.4) to obtain \( \partial {f_k}(t)/\partial t = - \sum\nolimits_{{l \ne k}} {{f_k}(t){q_{{kl}}} + } \sum\nolimits_{{l \ne k}} {{f_l}} (t){q_{{lk}}} \). Then, to make the two processes consistent, we assume that q-coefficients and σ-coefficients correspond so that q kl = σ kl for k ≠ l and that \( {q_{{kk}}} = - \sum\nolimits_{{l \ne k}} {{q_{{kl}}}} \). These q-coefficients can be arranged in a Q-matrix, Q = {q kl }, for which we have that \( df(t)/dt = f(t)Q \).

Given that the Q-matrix is irreducible to satisfy ergodicity properties, the equilibrium distribution of firms exists and can be obtained as \( f* = \mathop{{\lim }}\limits_{{t \to \infty }} f(t) \), satisfying f* Q = 0. The introduced transition rate q kl reflects the rate at which a firm with k variety-destination pairs experiences the change l − k = a k − e k , where k is the firm’s current number of variety-destination pairs, a k is the number of variety-destination pair ideas that arrive to the firm, and where e k is the number of variety-destination pairs that exit from the current stock of such varieties. All these transition rates can be derived from Poisson probabilities related to each individual firm.

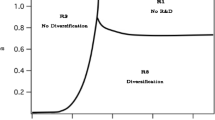

Appendix 2: Limit values of fixed costs for scope-firms

We shall consider three categories of scope firms and make precise the limit of possible effects from scope economies. An M1-firm has a strong scope effect, compared with an L1-firm. The former reduces the fixed cost (F +G + H) to half the value for the L1-firm. M-firms have always scope effects by reducing the importance of F for each destination delivery. On the other hand, as one extreme an M-firm may have many destination links for few varieties, and as the other extreme many varieties sold to few destination markets.

Consider now that we apply an average flow size \( \tilde{x} \). When all destination markets are in the neighborhood of an L1-equilibrium, we have that \( \tilde{x} \approx {x^o} \). We denote a firm’s gross profit per average delivery by \( \tilde{V} = ({p^o} - v)\tilde{x} \) Table 5 presents the break-even values for three categories of firms: M1, MH (with only one variety and many destinations), and MG (with many varieties and only one destination besides the domestic market.

The limit values in the table are obtained by simply assigning large values to H* and G*. In this way F/(H* +1) and G/(H* +1) approach zero for MH-firms, while F/2G* and H/2G* approach zero for MG-firms. Given that innovation ideas arrive according to a stochastic process, the two extreme outcomes, represented by MH and MG firms, are unlikely events.

Now, in case that F ≈ H ≈ G, then we can conclude that \( {\tilde{V}_M} \) ≈ \( {\tilde{V}_{{M1}}} \), which implies that an M1-equilibrium will be robust. This equilibrium is defined by the supply quantity x oo such that \( ({p^o} - v){x^{{oo}}} = (F + G + H)/2 \).

Rights and permissions

About this article

Cite this article

Andersson, M., Johansson, B. Heterogeneous Distributions of Firms Sustained by Innovation Dynamics—A Model with Empirical Illustrations and Analysis. J Ind Compet Trade 12, 239–263 (2012). https://doi.org/10.1007/s10842-010-0092-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-010-0092-z