Abstract

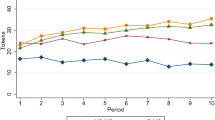

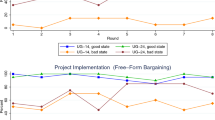

We explore the efficiency and distributive implications of a multilateral bargaining model with endogenous production of the surplus under two different timings: ex ante and ex post bargaining. Both timings are commonly observed in business partnerships and alliance formations. The theoretical predictions confirm an intuitive economic tenet: in ex post bargaining, effort is considered sunk and opportunistic bargaining behavior will dissuade players from producing. On the other hand, ex ante bargaining entails an allocation of ownership shares that induces at least certain members to invest in the common fund because their return is guaranteed. Experiments show opposite results: ex post bargaining yields almost fully efficient outcomes while the reverse timing entails near zero efficiency. The psychological theory of inequity is useful in reconciling these divergent results.

Similar content being viewed by others

Notes

In a lock-step system partners are assigned ownership shares based on their status or seniority within the firm. Such profit-sharing scheme is an example of a compensation plan in which partners know their shares of the profits prior to engaging in productive activities. This system is most widely spread in European law firms but not so common in U.S. and Canadian firms according to three surveys by Edge International (Wessman and Kerr 2015).

Another setting in which the timing of bargaining with respect to production is essential is the choice of technological standards (see Llanes and Poblete 2014). Setting a standard creates rents which are to be divided among the firms of an industry. How these rents are divided and the timing of rent-sharing with respect to the choice of the standard will likely impact the outcome of negotations to choose a standard.

See Rubinstein (1982) for bilateral bargaining and Osborne and Rubinstein (1990) for a comprehensive analysis of such games. See Baron and Ferejohn (1989), Krishna and Serrano (1996) for multilateral bargaining. Battaglini and Coate (2007, 2008) consider a dynamic model of taxing and spending in which a nation’s budget is determined endogenously through labor decisions which are a function of the taxing schemes agreed in the bargaining game. For cooperative (Nash) bargaining with an endogenous fund and subjective claims see Gächter and Riedl (2006) and Karagözoğlu and Riedl (2014).

In both models we use the solution concept of stationary subgame perfect equilibrium, a standard refinement in the bargaining literature.

For an experiment on how renegotiation (after investments) in a bilateral exchange setting can improve efficiency see Hoppe and Schmitz (2011).

In principle \(\alpha\) can be larger and this poses potential changes in the equilibrium predictions, but for our experiments this is the range that matters.

If there is no agreement, each player receives a share equal to zero.

It is commonly assumed that players only vote in favor if the offered share is greater than or equal to the continuation value of the game.

Under our parameter configuration for redistribution, any allocation may be supported as a subgame perfect Nash Equilibrium according to an off equilibrium punishment strategy described in Baron and Ferejohn (1989). Thus, one may construct an equilibrium in which shares are perfectly proportional to investments.

If no agreement is ever reached, players earn zero.

In all the surveyed literature, we could not find a single observation where players had bargained for more than 10 rounds. Our software automatically stopped in round 15. A group bargaining for 15 rounds would take approximately 30 min, which would not allow us to conclude the experiment within our time frame. Subjects were told that, if they failed to approve an allocation and too much time had passed, the experimenter would move them to the next game in order to continue with the experiment. Payoffs for that round would not count if it was selected for payment. No one reached the limit.

I also conducted a treatment in which half of the fund was negotiated ex ante, investments took place, and the remaining half was negotiated ex post. It yielded similar efficiency levels as those observed in the pre-distribution treatment and the results were omitted from the article for the sake of a concise exposition.

Mann–Whitney test using session averages as the unit of observation.

If a member receives 5% or less (equity or percentage of the fund) she is considered to be excluded. For example, the proposal (50%, 20%, 20%, 5%, 5%) is counted as a minimun winning coalition. Only 7 (of 850) investments represent 5% or less of the total group investments of which 4 receive a larger share of the fund. In 97% of the instances in which a member receives a share 5% or less of the total fund her contribution has been appropriated by others.

The p values were obtained from an OLS regression controlling for session and period effects, where none of the controls reached significance at conventional levels. Two-sided Wilcoxon signed rank tests using session averages as the pairs of observations further confirm that these differences are significant (\(p{\hbox { values}} < 0.05\)).

These results remain when performing regression analysis and controlling for whehter the allocation was a 3, 4 or 5-way split. The regression table may be found in the Online Appendix.

We can reject the null hypothesis that average payoffs for cases when subjects contribute less than 20 tokens are equal to payoffs when members contribute more (\(p{\hbox { value}} <0.001\), two-sided t test). Two-sided Wilcoxon signed rank tests using session averages as the pairs of observations further confirm that this difference is significant (\(p{\hbox { value}}=0.028\)).

A table with payoffs by contribution level is presented in the Online Appendix.

Session dummies were also included only session 5 yielded a significant. However, according to a joint test of significance we cannot reject the hypothesis that all session dummies are equal to zero (Wald test p value of 0.33). The interaction dummy for role and vote was omitted due to collinearity (all proposers vote in favor).

A Wald test for Own \({\hbox {Share}}\times {\hbox {Vote}}+{\hbox {Own Share}}=0\) yields a \(p{\hbox { value}}=0.014\).

This holds for the case when the implementation of the tax took place endogenously.

We find one proposer in the first game that assigned herself 0. The subject then voted against perhaps because this was a mistake.

See Hamman et al. (2011) for a similar result on the tyranny of the majority, where some elected leaders force contributions from a minority and implicitly distribute the benefits to a majoritarian minimal coalition. However, just like in our setting, they find that a majority of outcomes are not MWCs contrary to theoretical predictions.

MWC allocations increase from 22% in the first five games to 37% in the last five and five way split decrease from 63 to 48%. In a post experimental survey, some subjects explained that they shifted from more to less inclusive allocations as they encountered these at some point.

We reject the hypothesis that the proposer dummy and its interaction with investment are jointly equal to zero (Wald test \(p{\hbox { value}}=0.037\)).

See Cappelen et al. (2007) for a study on the pluralism of fairness ideals. One could argue that minimizing final payoff inequality or an equal split of the fund regardless of investments represent alternative fairness notions.

Another measure one may use is \(\frac{Share}{Fund}-\frac{Investment}{\sum _{j\in Group}Investment_{j}}\) and this has no major consequence on the results of our estimations.

Our data shows that subjects always vote against a proposal in their share is lower than their investment (\(OS<0\)). Thus we estimate our models in columns 2 and 4 conditioning on profitable shares.

We assume that the proposer votes in favor, thus chances of both voters voting in favor are \(0.934^{2}\approx 0.87\).

The calculation is as follows: \(\left( {\begin{array}{c}4\\ 2\end{array}}\right) (0.667)^{2} (1-0.667)^{2}+\left( {\begin{array}{c}4\\ 3\end{array}}\right) (0.667)^{3}(1-0.667)^{1}+\left( {\begin{array}{c}4\\ 4\end{array}}\right) (0.667)^{4}\) . Here, \((0.667)^{k}(1-0.667)^{m}\) is the probability that k members vote in favor and m against.

The final payoffs for a player that proposed an MWC in round 1 are on average 111 tokens and 105 tokens if a more inclusive allocation would have been proposed initially.

We have not invoked economic theories of inequality aversion such as Bolton and Ockenfels (2000) or Fehr and Schmidt (1999), because as Montero (2007) shows, these preferences predict more unequal payoffs in favor of the proposer in the Baron and Ferejohn bargaining game. Moreover, aversion to inequality would imply that redistribution would tend to more equal payoffs even when players have contributed different amounts, contrary to what we observe in redisribution.

The authors introduce a quiz in which the best performers earn the right to propose.

Based on the treatment with five members and no discounting in the last five games.

References

Adams, J. S. (1963). Towards an understanding of inequity. The Journal of Abnormal and Social Psychology, 67(5), 422–445.

Agranov, M., & Tergiman, C. (2014). Communication in multilateral bargaining. Journal of Public Economics, 118, 75–85.

Alchian, A. A., & Demsetz, H. (1972). Production, information costs, and economic organization. The American Economic Review, 62(5), 777–795.

Baranski, A. (2016). Voluntary contributions and collective redistribution. American Economic Journal: Microeconomics, 8(4), 149–73.

Baranski, A. (2017). Pre-distribution: Bargaining over property rights, mimeo. www.abarmad.com/research.html. Accessed 10 Jan 2018.

Baranski, A., & Kagel, J. H. (2015). Communication in legislative bargaining. Journal of the Economic Science Association, 1(1), 59–71.

Baron, D. P., & Ferejohn, J. A. (1989). Bargaining in legislatures. American Political Science Review, 83(4), 1181–1206.

Battaglini, M., & Stephen, C. (2007). Inefficiency in legislative policymaking: a dynamic analysis. American Economic Review, 97(1), 118–149.

Battaglini, M., & Stephen, C. (2008). A dynamic theory of public spending, taxation, and debt. American Economic Review, 98(1), 201–236.

Bolton, G. E., & Ockenfels, A. (2000). ERC: A theory of equity, reciprocity, and competition. American Economic Review, 90, 166–193.

Bradfield, A. J., & Kagel, J. H. (2015). Legislative bargaining with teams. Games and Economic Behavior, 93, 117–127.

Buckley, E., & Croson, R. (2006). Income and wealth heterogeneity in the voluntary provision of linear public goods. Journal of Public Economics, 90(4), 935–955.

Cappelen, A. W., Hole, D., Astri, S., Erik, O., & Tungodden, B. (2007). The pluralism of fairness ideals: An experimental approach. The American Economic Review, 97(3), 818–827.

Chaudhuri, A. (2011). Sustaining cooperation in laboratory public goods experiments: a selective survey of the literature. Experimental Economics, 14(1), 47–83.

Cherry, T. L., Kroll, S., & Shogren, J. F. (2005). The impact of endowment heterogeneity and origin on public good contributions: evidence from the lab. Journal of Economic Behavior & Organization, 57(3), 357–365.

Cripps, M. W. (1997). Bargaining and the timing of investment. International Economic Review, 38, 527–546.

Dal Bó, P., Foster, A., & Putterman, L. (2010). Institutions and behavior: Experimental evidence on the effects of democracy. American Economic Review, 100(5), 2205–29.

Dong, L., Falvey, R., & Luckraz, S. (2016) Fair share and social efficiency: A mechanism in which peers decide on the payoff division. Working Paper CeDEx Discussion Paper Series. ISSN: 1749-3293.

Eraslan, H. (2002). Uniqueness of stationary equilibrium payoffs in the Baron–Ferejohn model. Journal of Economic Theory, 103(1), 11–30.

Eraslan, H., & McLennan, A. (2013). Uniqueness of stationary equilibrium payoffs in coalitional bargaining. Journal of Economic Theory, 148(6), 2195–2222.

Ertan, A., Page, T., & Putterman, L. (2009). Who to punish? Individual decisions and majority rule in mitigating the free rider problem. European Economic Review, 53(5), 495–511.

Fehr, E., & Gächter, S. (2000). Cooperation and punishment in public goods experiments. The American Economic Review, 90(4), 980–994.

Fehr, E., Kremhelmer, S., & Schmidt, K. M. (2008). Fairness and the optimal allocation of ownership rights. The Economic Journal, 118(531), 1262–1284.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. The Quarterly Journal of Economics, 114(3), 817–868.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Fisher, J. R., Isaac, M., Schatzberg, J. W., & Walker, J. M. (1995). Heterogenous demand for public goods: Behavior in the voluntary contributions mechanism. Public Choice, 85(3–4), 249–266.

Frankel, D. M. (1998). Creative bargaining. Games and Economic Behavior, 23(1), 43–53.

Fréchette, G. R., Kagel, J. H., & Lehrer, S. F. (2003). Bargaining in legislatures: An experimental investigation of open versus closed amendment rules. American Political Science Review, 97(02), 221–232.

Fréchette, G. R., Kagel, J. H., & Morelli, M. (2005a). Behavioral identification in coalitional bargaining: An experimental analysis of demand bargaining and alternating offers. Econometrica, 73(6), 1893–1937.

Fréchette, G., Kagel, J. H., & Morelli, M. (2005b). Nominal bargaining power, selection protocol, and discounting in legislative bargaining. Journal of Public Economics, 89(8), 1497–1517.

Frohlich, N., Oppenheimer, J., & Kurki, A. (2004). Modeling other-regarding preferences and an experimental test. Public Choice, 119(1–2), 91–117.

Gächter, S., & Riedl, A. (2006). Dividing justly in bargaining problems with claims. Social Choice and Welfare, 27(3), 571–594.

Gantner, A., Güth, W., & Königstein, M. (2001). Equitable choices in bargaining games with joint production. Journal of Economic Behavior & Organization, 46(2), 209–225.

Gantner, A., Horn, K., & Kerschbamer, R. (2016). Fair and efficient division through unanimity bargaining when claims are subjective. Journal of Economic Psychology, 57, 56–73.

Gilson, R. J., & Mnookin, R. H. (1985). Sharing among the human capitalists: An economic inquiry into the corporate law firm and how partners split profits. Stanford Law Review, 37(2), 313–392.

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with ORSEE. Journal of the Economic Science Association, 1(1), 114–125.

Großer, J., & Reuben, E. (2013). Redistribution and market efficiency: An experimental study. Journal of Public Economics, 101, 39–52.

Hamman, J. R., Weber, R. A., & Woon, J. (2011). An experimental investigation of electoral delegation and the provision of public goods. American Journal of Political Science, 55(4), 738–752.

Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy, 98(6), 1119–1158.

Hoffman, E., McCabe, K., Shachat, K., & Smith, V. (1994). Preferences, property rights, and anonymity in bargaining games. Games and Economic Behavior, 7(3), 346–380.

Hoppe, E. I., & Schmitz, P. W. (2011). Can contracts solve the hold-up problem? Experimental evidence. Games and Economic Behavior, 73(1), 186–199.

Karagözoğlu, E., & Riedl, A. (2014). Performance information, production uncertainty, and subjective entitlements in bargaining. Management Science, 61(11), 2611–2626.

Konow, J. (2000). Fair shares: Accountability and cognitive dissonance in allocation decisions. American Economic Review, 90(4), 1072–1091.

Kosfeld, M., Okada, A., & Riedl, A. (2009). Institution formation in public goods games. American Economic Review, 99(4), 1335–1355.

Krishna, V., & Serrano, R. (1996). Multilateral bargaining. The Review of Economic Studies, 63(1), 61–80.

Lang, K., & Gordon, P.-J. (1995). Partnerships as insurance devices: Theory and evidence. The RAND Journal of Economics, 26, 614–629.

Ledyard, J. (1995). Public goods: A survey of experimental research. In J. H. Kagel & A. E. Roth (Eds.), Handbook of experimental economics (pp. 111–194). Princeton: Princeton University Press.

Llanes, G., & Poblete, J. (2014). Ex ante agreements in standard setting and patent-pool formation. Journal of Economics & Management Strategy, 23(1), 50–67.

Montero, M. (2007). Inequity aversion may increase inequity. The Economic Journal, 117(519), 192–204.

Morgan, J. (2004). Dissolving a partnership (un) fairly. Economic Theory, 23(4), 909–923.

Osborne, M. J., & Rubinstein, A. (1990). Bargaining and markets (Vol. 34). San Diego: Academic Press.

Rose, J. (2011). The distribution of law firm profits. Web log post. Law Practice Management Tip of the Week. The New York State Bar Association. February 14. http://nysbar.com/blogs/Tipoftheweek/2011/02/the_distribution_of_law_firm_p.html. Accessed March 4, 2015.

Reuben, E., & Riedl, A. (2009). Public goods provision and sanctioning in privileged groups. Journal of Conflict Resolution, 53(1), 72–93.

Reuben, E., & Riedl, A. (2013). Enforcement of contribution norms in public good games with heterogeneous populations. Games and Economic Behavior, 77(1), 122–137.

Rubinstein, A. (1982). Perfect equilibrium in a bargaining model. Econometrica, 50(1), 97–109.

Sefton, M., Shupp, R., & Walker, J. M. (2007). The effect of rewards and sanctions in provision of public goods. Economic Inquiry, 45(4), 671–690.

Selten, R. (1987). Equity and coalition bargaining in experimental three person games. In A. E. Roth (Ed.), Laboratory experimentation in economics: Six points of view (pp. 42–98). Cambridge: Cambridge University Press.

Wessman, E. & Kerr, N. J. (2015) 2015 Global partner compensation survey. Edge International. March 2. http://www.edge.ai/wp-content/uploads/2015/03/Edge-Compensation-Survey_20150302.pdf. Accessed September 5, 2015.

Author information

Authors and Affiliations

Corresponding author

Additional information

I would like to thank John H. Kagel for supporting a pilot test and useful comments in the development of the project. I benefitted greatly from conversations with Ernesto Reuben, Arno Riedl, Martin Strobel, Alexander Cappelen, Jordi Brandts, Nikos Nikiforakis, María Montero, Joerg Oechssler, Eric Van Damme, and Patrick Schmitz. Comments obtained from participants at seminars in Nottingham University, Maastricht University, Universidad Pontificia Javeriana in Bogotá, 15th TIBER Symposium on Psychology and Economics (Tilburg 2016), and the 13th Workshop on Employee Ownership and Shared Capitalism organized by the Rutgers School of Management and Labor Relations (La Jolla, 2016) are gratefully acknowledged. Two anonymous referees and the editor, Roberto Weber, provided valuable suggestions. All errors are my own.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A: Proof of Proposition 2

Starting in stage 2 after an equity agreement has been reached in round \(\tau\) we have that a member finds it optimal to invest if and only if the return of doing so is larger than the cost. Formally, the equilibrium investment strategy in any subgame is

Now we partition the set of subgames into three possible disjoint sets and show that equilibrium can only occur in one of those subsets. We define

where the \(S_{k}\) determines all equity agreements in which k members receive a share that induces investments. It is straight forward to show that the sets \(S_{k}\) are pair-wise disjoint and that \(S_{0}\cup S_{1}\cup S_{2}=[0,1]^{n}\). Moreover, \(S_{k}=\emptyset\) for \(k>2\). If \(\alpha <2\), then \(S_{2}=\emptyset\) also. This is a consequence of the equity constraint which requires that the sum of shares must add to 1.

Lemma 3

In equilibrium,\(\mathbf {s\notin }S_{0}\).

Proof

By the contrary, assume that \({{\tilde{\mathbf{s }}}\in }S_{0}\) is an equilibrium. Then, \(u({{\tilde{\mathbf{s }}}})=1\) for each player which implies that the ex ante value of the game is equal to 1 for every player. As such, a voter will vote yes for any share, because it will yield at least a payoff of 1. A proposing member can deviate to \((1,0,\ldots ,0)\) where the first entry is the proposer’s share (without loss of generality). Every player would earn \(u({\tilde{\mathbf{s }}})=\)\(u(1,0,\ldots ,0)=1\) which means they would vote in favor. The proposer who would find it profitable to invest and earn \(\alpha >1\). \(\square\)

Lemma 4

In equilibrium,\(\mathbf {s\notin }S_{2}\).

Proof

By the contrary, assume that \({{\tilde{\mathbf{s }}}\in }S_{2}\). This means that exactly 2 players are offered a share of \(s_{Inv}=0.5\). Without loss of generality, the payoff vector that arises will be \((\alpha ,\alpha ,1,\ldots ,1)\). This is, two players will earn \(\alpha\) and the \(n-2\) will earn only their endowment. Since ex ante any player can attain each payoff with equal chances, the equilibrium expected value of the game is \(V=\frac{2}{n}\alpha +\frac{n-2}{n}>1\). Here, we are imposing symmetry in the sense that what player i offers j is what j offers i. Recall that a member votes in favor if and only if her payoff resulting from the share received is greater than or equal to V. However, this proposal will never be approved, because only two players exhaust all the available equity and the proposal does not receive a majority vote. \(\square\)

Proof of Proposition 2

We now focus on the case of \(\mathbf {s\in }S_{1}\) and will show that there exists an equilibrium with one productive member. Without loss of generality, we assume that the proposer assigns herself a share \(s^{\text {prop}}\) greater than or equal to 1 / 2 which means that she invests in equilibrium. We denote by \(s^{\text {vote}}\) the positive share offered to m coalition partners. The equity feasibility constraint is given by

With probability \(\frac{m}{n}\) a member is an included voter who earns a share of the fund \(s^{\text {vote}}\) and keeps his endowment. With probability \(1-\left( \frac{1+m}{n}\right)\) a member receives zero equity and only keeps his endowment. Hence, the ex ante value of the game is given by

which is simply the payoff associated to each role weighed by its probability. Imposing the equity constraint (7) we obtain that \(V=\frac{\alpha -1}{n}+1\). As such, the proposer faces the following problem:

The objective function states that the proposer is seeking to maximize his own payoff and must choose a share for himself, a share offerd to coalition partners \(s^{\text {vote}}\), the number of shares \(s^{\text {vote}}\) that she will offer (m). Constraints (10) and (12) simply guarantee that the chosen equity scheme \({\mathbf {s}}\) is in \(S_{1}\). Conditions (11) and (14) are ensure that the proposal receives at least the required number of votes in favor. The equity constraint (7) specifies that the sum of shares have to be feasible, i.e., less than one from which we obtain that \(s^{\text {prop} }=1-m\cdot v^{\text {vote}}\). This implies that (14) binds at \(m=\frac{n-1}{2}\), namely, that minimum winning coalitions are optimal. To obtain \(s^{\text {vote}}\) we use constraint (13) which clearly binds as well because if the share was higher the proposer could decrease it and still obtain a favorable vote. Thus, we have \(s^{\text {vote}}=\frac{V-1}{\alpha }=\frac{\alpha -1}{\alpha n}\) and \(s^{\text {prop}}=1-\frac{n-1}{2}\frac{\alpha -1}{\alpha n}\). With simple computations one verifies that (11) and (10) hold. \(\square\)

Appendix B: Supplementary figures

Rights and permissions

About this article

Cite this article

Baranski, A. Endogenous claims and collective production: an experimental study on the timing of profit-sharing negotiations and production. Exp Econ 22, 857–884 (2019). https://doi.org/10.1007/s10683-018-9591-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-018-9591-2