Abstract

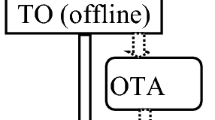

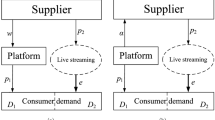

This paper examines the selling mode choice and information sharing in an online tourism supply chain with an online travel platform (OTP) that holds private demand information and a tourism service provider under demand uncertainty. By developing a game-theoretic model, we examine the OTP’s information sharing incentive under different selling modes (i.e. agency mode, reselling mode or hybrid mode), then study the OTP’s selling mode preference. Our analysis shows that the OTP may share information even if the double marginalization of information sharing exists under the hybrid mode. The OTP’s selling mode choice changes in response to the channel competition intensity and the commission rate, and is also critically affected by the demand fluctuation and forecast accuracy under certain conditions. In particular, although the channel competition is intense under the hybrid mode, the OTP may choose the hybrid mode rather than the agency/reselling mode without channel competition.

Similar content being viewed by others

Notes

Available at https://www.chinatravelnews.com/article/131335.

Available at https://jipiao.jd.com/.

Available at https://flight.qunar.com/.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Du, F., Yang, F., Liang, L., & Yang, M. (2016). Do service providers adopting market segmentation need cooperation with third parties? An application to hotels. International Journal of Contemporary Hospitality Management, 28(1), 136–155.

Fu, F., Chen, S., & Yan, W. (2021). Implications of e-tailers’ transition from reselling to the combined reselling and agency selling. Electronic Commerce Research. https://doi.org/10.1007/s10660-021-09520-w

Geng, X., Tan, Y., & Wei, L. (2018). How add-on pricing interacts with distribution contracts. Production and Operations Management, 27(4), 605–623.

Guo, X., Dong, Y., & Ling, L. (2016). Customer perspective on overbooking: The failure of customers to enjoy their reserved services, accidental or intended? Journal of Air Transport Management, 53, 65–72.

Guo, X., Ling, L., Dong, Y., & Liang, L. (2013). Cooperation contract in tourism supply chains: The optimal pricing strategy of hotels for cooperative third party strategic websites. Annals of Tourism Research, 41, 20–41.

Guo, X., Zheng, X., Ling, L., & Yang, C. (2014). Online coopetition between hotels and online travel agencies: From the perspective of cash back after stay. Tourism Management Perspectives, 12, 104–112.

Ha, A. Y., Luo, H., & Shang, W. (2022). Supplier encroachment, information sharing and channel structure in online retail platforms. Production and Operations Management, 31(3), 1235–1251.

Ha, A. Y., Tong, S., & Wang, Y. (2022). Channel structures of online retail platforms. Manufacturing & Service Operations Management, 24(3), 1547–1561.

Ha, A. Y., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Management Science, 54(4), 701–715.

He, P., He, Y., Xu, H., & Zhou, L. (2019). Online selling mode choice and pricing in an O2O tourism supply chain considering corporate social responsibility. Electronic Commerce Research and Applications, 38, 100894.

Huang, S., Guan, X., & Chen, Y. J. (2018). Retailer information sharing with supplier encroachment. Production and Operations Management, 27(6), 1133–1147.

Jain, A., Seshadri, S., & Sohoni, M. (2011). Differential pricing for information sharing under competition. Production and Operations Management, 20(2), 235–252.

Jiang, B., Tian, L., Xu, Y., & Zhang, F. (2016). To share or not to share: Demand forecast sharing in a distribution channel. Marketing Science, 35(5), 800–809.

Jiang, L., & Hao, Z. (2016). Incentive-driven information dissemination in two-tier supply chains. Manufacturing & Service Operations Management, 18(3), 393–413.

Ke, H., Ye, S., & Mo, Y. (2022). A comparison between the wholesale model and the agency model with different launch strategies in the book supply chain. Electronic Commerce Research, 22, 1491–1513.

Li, G., Zheng, H., & Liu, M. (2020). Reselling or drop shipping: Strategic analysis of E-commerce dual-channel structures. Electronic Commerce Research, 20(3), 475–508.

Li, L. (2002). Information sharing in a supply chain with horizontal competition. Management Science, 48(9), 1196–1212.

Li, L., & Zhang, H. (2008). Confidentiality and information sharing in supply chain coordination. Management Science, 54(8), 1467–1481.

Li, Y., & Cui, Q. (2019). Official website or online travel agencies? The online ticket booking strategies of low-cost carriers. Transportmetrica B: Transport Dynamics, 7(1), 1743–1757.

Li, G., Tian, L., & Zheng, H. (2021). Information sharing in an online marketplace with co-opetitive sellers. Production and Operations Management, 30(10), 3713–3734.

Li, X., & Ai, X. (2021). A choice of selling format in the online marketplace with cross-sales supply chain: Platform selling or traditional reselling? Electronic Commerce Research, 21, 393–422.

Liao, P., Ye, F., & Wu, X. (2019). A comparison of the merchant and agency modes in the hotel industry. International Transactions in Operational Research, 26(3), 1052–1073.

Liao, P., Ye, F., Tayi, G. K., & Zhao, X. (2015). Competition and coordination in online and offline hotel distribution channels under commission override model. International Journal of Revenue Management, 8(2), 193–217.

Ling, L., Guo, X., & Liang, L. (2011). Optimal pricing strategy of a small or medium-sized hotel in cooperation with a web site. Journal of China Tourism Research, 7(1), 20–41.

Liu, Y., Zhang, X., Zhang, H., & Zha, X. (2021). Competing tourism service provider introduction strategy for an online travel platform with demand information sharing. Electronic Commerce Research and Applications, 49, 101084.

Liu, Z., Zhang, D. J., & Zhang, F. (2021). Information sharing on retail platforms. Manufacturing & Service Operations Management, 23(3), 606–619.

Long, Y., & Shi, P. (2017). Pricing strategies of tour operator and online travel agency based on cooperation to achieve O2O model. Tourism Management, 62, 302–311.

Ma, S., He, Y., & Gu, R. (2021). Joint service, pricing and advertising strategies with tourists’ green tourism experience in a tourism supply chain. Journal of Retailing and Consumer Services, 61, 102563.

Niu, B., Wang, J., Lee, C. K., & Chen, L. (2019). “Product+ logistics” bundling sale and co-delivery in cross-border e-commerce. Electronic Commerce Research, 19(4), 915–941.

Shamir, N., & Shin, H. (2018). The perils of sharing information in a trade association under a strategic wholesale price. Production and Operations Management, 27(11), 1978–1995.

Tsunoda, Y., & Zennyo, Y. (2021). Platform information transparency and effects on third-party suppliers and offline retailers. Production and Operations Management, 30(11), 4219–4235.

Wang, Q., Zhao, N., & Ji, X. (2022). Reselling or agency selling? The strategic role of live streaming commerce in distribution contract selection. Electronic Commerce Research. https://doi.org/10.1007/s10660-022-09581-5

Yang, M., Zhang, T., & Wang, C. X. (2021). The optimal e-commerce sales mode selection and information sharing strategy under demand uncertainty. Computers & Industrial Engineering, 162, 107718.

Ye, F., Lu, M., & Li, Y. (2019). Optimal overbooking decision for a “Hotel+OTA” dual-channel supply chain. International Transactions in Operational Research, 26(3), 999–1024.

Ye, F., Yan, H., & Wu, Y. (2019). Optimal online channel strategies for a hotel considering direct booking and cooperation with an online travel agent. International Transactions in Operational Research, 26(3), 968–998.

Ye, F., Yan, H., & Xie, W. (2022). Optimal contract selection for an online travel agent and two hotels under price competition. International Transactions in Operational Research, 29(2), 1274–1307.

Ye, F., Zhang, L., & Li, Y. (2018). Strategic choice of sales channel and business model for the hotel supply chain. Journal of Retailing, 94(1), 33–44.

Zhang, S., & Zhang, J. (2020). Agency selling or reselling: E-tailer information sharing with supplier offline entry. European Journal of Operational Research, 280(1), 134–151.

Zhang, X., Liu, Y., & Dan, B. (2021). Cooperation strategy for an online travel platform with value-added service provision under demand uncertainty. International Transactions in Operational Research, 28(6), 3416–3436.

Zhang, X., Zha, X., Zhang, H., & Dan, B. (2022). Information sharing in a cross-border e-commerce supply chain under tax uncertainty. International Journal of Electronic Commerce, 26(1), 123–146.

Zhong, B., Shen, H., Zhang, J., & Gao, X. (2022). Agency or wholesale? Retail selling format in the presence of new manufacturer introduction. Electronic Commerce Research. https://doi.org/10.1007/s10660-022-09535-x

Acknowledgements

This research was supported by the National Natural Science Foundation of China (Grant number 72072016) and the Fundamental Research Funds for the Central Universities (Grant number 2021CDSKXYJG007).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflicts in our paper.

Appendix

Appendix

Proof of Theorem 1

Under \(AN\) strategy, as \(\partial^{2} E[\pi_{TSP}^{AN} ]/\partial^{2} p_{A}^{AN} = - 2 + 2\lambda < 0\), \(E[\pi_{TSP}^{AN} ]\) is concave in \(p_{A}^{AN}\). Then, by solving \(\partial E[\pi_{TSP}^{AN} ]/\partial p_{A}^{AN} = (1 - \lambda )(\overline{a} - 2p_{A}^{AN} ) = 0\), we get \(p_{A}^{AN} = \overline{a}/2\). Similarly, under \(AI\) strategy, we derive \(p_{A}^{AI} = E[a\left| {Y]} \right./2\). Finally, substituting optimal prices into Eqs. (6), (7) and (8), we get \(E[\pi_{TSP}^{AX} ]\) and \(E[\pi_{OTP}^{AX} ]\).

Proof of Theorem 2

Under \(RN\) strategy, \(E[\pi_{OTP}^{RN} ]\) is concave in \(p_{R}^{RN}\) since \(\partial^{2} E[\pi_{OTP}^{RN} ]/\partial^{2} p_{R}^{RN} = - 2 < 0\). Then, by solving \(\partial E[\pi_{OTP}^{RN} ]/\partial p_{R}^{RN} = E[a\left| {Y]} \right. - 2p_{R}^{RN} + w^{RN} = 0\), we can easily get \(p_{R}^{RN} (w^{RN} ) = (E[a\left| {Y]} \right. + w^{RN} )/2\). Substituting \(p_{R}^{RN} (w^{RN} )\) into the TSP’s expected profits function, we obtain \(E[\pi_{TSP}^{RN} ] = w^{RN} (E[a] - w^{RN} )/2\). From \(\partial^{2} E[\pi_{TSP}^{RN} ]/\partial^{2} w^{RN} = - 1 < 0\), we know that \(E[\pi_{TSP}^{RN} ]\) is concave in \(w^{RN}\). Accordingly, we get \(w^{RN} = \overline{a}/2\) based on the first order condition \(\partial E[\pi_{TSP}^{RN} ]/\partial w^{RN} = (\overline{a} - 2w^{RN} )/2 = 0\). Substituting \(w^{RN} = \overline{a}/2\) into \(p_{R}^{RN} (w^{RN} )\), we derive \(p_{R}^{RN} = (\overline{a} + 2E[a\left| {Y]} \right.)/4\). Following the similar argument, we get the optimal pricings under \(RI\) strategy. Finally, substituting optimal pricings into Eqs. (9), (10) and (11), we get \(E[\pi_{TSP}^{RX} ]\) and \(E[\pi_{OTP}^{RX} ]\).

Proof of Theorem 3

Under \(CN\) strategy, since \(\partial^{2} E[\pi_{OTP}^{CN} ]/\partial^{2} p_{R}^{CN} = - 2/(1 + \gamma )(1 - \gamma ) < 0\), we get that \(E[\pi_{OTP}^{CN} ]\) is concave in \(p_{R}^{CN}\). Then, we derive \(p_{R}^{CN} (p_{A}^{CN} ,w^{CN} ) = ((1 - \gamma )E[a\left| {Y]} \right. + (1 + \lambda )\gamma p_{A}^{CN} + w^{CN} )/2\). Substituting it into Eq. (12), we find that \(E[\pi_{TSP}^{CN} ]\) is joint concave in \(p_{A}^{CN}\) and \(w^{CN}\). Hence, \(p_{A}^{CN} = \overline{a}/2\) and \(w^{CN} = (1 - \lambda \gamma )\overline{a}/2\) are derived based on the first order condition. Substituting \(p_{A}^{CN} = \overline{a}/2\) and \(w^{CN} = (1 - \lambda \gamma )\overline{a}/2\) into \(p_{R}^{CN} (p_{A}^{CN} ,w^{CN} )\), we obtain \(p_{R}^{CN} = ((1 + \gamma )\overline{a} + 2(1 - \gamma )E[a\left| {Y]} \right.)/4\). Similarly, we can easily obtain the optimal pricings under \(CI\) strategy. Finally, substituting optimal pricings into Eqs. (12), (13) and (14), we get \(E[\pi_{TSP}^{CX} ]\) and \(E[\pi_{OTP}^{CX} ]\).

Proof of Proposition 1

Under the agency mode, we have \(V_{OTP}^{AI} = \lambda \rho^{2} \Delta^{2} \overline{a}^{2} /4 > 0\) from Theorem 1.

Under the reselling mode, we get \(V_{OTP}^{RI} = - 3\rho^{2} \Delta^{2} \overline{a}^{2} /16 < 0\) from Theorem 2.

Under the hybird mode, the OTP’s information shairng profits are \(V_{OTP}^{CI} = (3(\gamma - 1) + 4\lambda (1 + \gamma ))\rho^{2} \Delta^{2} \overline{a}^{2} /16(1 + \gamma )\). There is a unique \(\lambda_{1}\) making \(3(\gamma - 1) + 4\lambda_{1} (1 + \gamma ) = 0\), and then \(V_{OTP}^{CI} < 0\) when \(0 < \lambda < \lambda_{1}\); \(V_{OTP}^{CI} > 0\) when \(\lambda_{1} < \lambda < 1\).

Proof of Proposition 2

Firstly, the agency mode are compared with the hybrid mode. From Proposition 1, we know that when \(0 < \lambda < \lambda_{1}\), we only need to compare \(AI\) and \(CN\) strategies. On the one hand, as for the risk-free profits, we have \(\overline{\pi }_{OTP}^{C} - \overline{\pi }_{OTP}^{A} = (1 - \gamma )\overline{a}^{2} /16(1 + \gamma ) > 0\). As for risky profits, we get \(F_{OTP}^{C} - V_{OTP}^{AI} = (1 - \gamma - \lambda - \lambda \gamma )\rho^{2} \Delta^{2} \overline{a}^{2} /4(1 + \gamma )\). It is obvious that \(F_{OTP}^{C} - V_{OTP}^{AI} > 0\) when \(0 < \lambda < \lambda_{1}\). As a result, when \(0 < \lambda < \lambda_{1}\), \(CN\) strategy always dominates \(AI\) strategy. When \(\lambda_{1} < \lambda < 1\), we need to compare \(AI\) and \(CI\) strategies. We can easily get that \(\overline{\pi }_{OTP}^{C} - \overline{\pi }_{OTP}^{A} = (1 - \gamma )\overline{a}^{2} /16(1 + \gamma ) > 0\) and \(F_{OTP}^{C} + V_{OTP}^{CI} - V_{OTP}^{AI} = (1 - \gamma )\rho^{2} \Delta^{2} \overline{a}^{2} /16(1 + \gamma ) > 0\). Hence, \(CI\) strategy also dominates \(AI\) strategy when \(\lambda_{1} < \lambda < 1\). Combining the above comparison results, we derive that the hybrid mode is more profitable than the agency mode.

Next, we compare the reselling mode and the hybrid mode. From Proposition 1, when \(0 < \lambda < \lambda_{1}\), we only need to compare \(WN\) and \(CN\) strategies. For the risk-free profits, we have \(\overline{\pi }_{OTP}^{C} - \overline{\pi }_{OTP}^{R} = (2\lambda - \gamma + 2\lambda \gamma )\overline{a}^{2} /8(1 + \gamma )\). Its sign depends on the sign of \(2\lambda - \gamma + 2\lambda \gamma\). There is a unique \(\lambda_{2} = \gamma /2(1 + \gamma )\), which satisfies \(2\lambda - \gamma + 2\lambda \gamma = 0\), such that \(\overline{\pi }_{OTP}^{C} < \overline{\pi }_{OTP}^{R}\) when \(0 < \lambda < \min \{ \lambda_{1} ,\lambda_{2} \}\); \(\overline{\pi }_{OTP}^{C} > \overline{\pi }_{OTP}^{R}\) when \(\lambda_{2} < \lambda < \lambda_{1}\). For the risky profits, we get \(F_{OTP}^{C} - F_{OTP}^{R} = - \gamma \rho^{2} \Delta^{2} \overline{a}^{2} /2(1 + \gamma ) < 0\). Based on the above comparison results, we find that when \(0 < \lambda < \min \{ \lambda_{1} ,\lambda_{2} \}\), \(\overline{\pi }_{OTP}^{C} < \overline{\pi }_{OTP}^{R}\) and \(F_{OTP}^{C} < F_{OTP}^{R}\). Therefore, \(RN\) strategy dominates \(CN\) strategy when \(0 < \lambda < \min \{ \lambda_{1} ,\lambda_{2} \}\). In addition, we also obtain that \(\overline{\pi }_{OTP}^{C} > \overline{\pi }_{OTP}^{R}\) and \(F_{OTP}^{C} < F_{OTP}^{R}\) when \(\lambda_{2} < \lambda < \lambda_{1}\), and thus the forecast variability affects choices in this case. We have \(\partial \left( {E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ]} \right)/\partial (\rho \Delta )^{2} < 0\), and \(\max \left( {E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ]} \right) > 0\) when \((\rho \Delta )^{2} = 0\). When \((\rho \Delta )^{2} = 1\), there exists a unique \(\lambda_{3}\), which makes \(\min \left( {E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ]} \right) = 0\). Then, when \(\lambda_{3} < \lambda < \lambda_{1}\) (i.e. in R2), \(\min \left( {E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ]} \right) > 0\), and \(CN\) strategy is optimal. When \(\lambda_{2} < \lambda < \min \{ \lambda_{1} ,\lambda_{3} \}\) (i.e. in R3), \(\min \left( {E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ]} \right) < 0\). Obviously, there exists a unique \(\tau_{1}\), which makes \(E[\pi_{OTP}^{CN} ] - E[\pi_{OTP}^{RN} ] = 0\), such that \(CN\) strategy is optimal when \(0 < \rho \Delta < \tau_{1}\); otherwise, when \(\tau_{1} < \rho \Delta < 1\), \(RN\) strategy is optimal.

When \(\lambda_{1} < \lambda < 1\), we need to compare \(RN\) and \(CI\) strategies. For the risk-free profits, we have \(\overline{\pi }_{OTP}^{C} - \overline{\pi }_{OTP}^{R} = (2\lambda - \gamma + 2\lambda \gamma )\overline{a}^{2} /8(1 + \gamma )\). Its sign is the same as the previous case when \(0 < \lambda < \lambda_{1}\). Hence, when \(\lambda_{1} < \lambda < \lambda_{2}\), we have \(\overline{\pi }_{OTP}^{C} < \overline{\pi }_{OTP}^{R}\); when \(\max \{ \lambda_{1} ,\lambda_{2} \} < \lambda < 1\), we get \(\overline{\pi }_{OTP}^{C} > \overline{\pi }_{OTP}^{R}\). As for the risky profits, we get \(F_{OTP}^{C} + V_{OTP}^{CI} - F_{OTP}^{R} = ((4\gamma + 4)\lambda - 5\gamma - 3)\rho^{2} \Delta^{2} \overline{a}^{2} /16(1 + \gamma )\). Its sign depends on the sign of \((4\gamma + 4)\lambda - 5\gamma - 3\). There exists a unique \(\overline{\lambda } = (3 + 5\gamma )/4(1 + \gamma )\) making \(F_{OTP}^{C} + V_{OTP}^{CI} - F_{OTP}^{R} = 0\). Then, when \(\lambda_{1} < \lambda < \overline{\lambda }\), we have \(F_{OTP}^{C} + V_{OTP}^{CI} < F_{OTP}^{R}\); when \(\overline{\lambda } < \lambda < 1\), we get \(F_{OTP}^{C} + V_{OTP}^{CI} > F_{OTP}^{R}\). Based on the above comparison results, we find that when \(\lambda_{1} < \lambda < \lambda_{2}\), we have \(\overline{\pi }_{OTP}^{C} < \overline{\pi }_{OTP}^{R}\) and \(F_{OTP}^{C} + V_{OTP}^{CI} < F_{OTP}^{R}\), and thus \(RN\) is the optimal strategy for the OTP. When \(\overline{\lambda } < \lambda < 1\), we get \(\overline{\pi }_{OTP}^{C} > \overline{\pi }_{OTP}^{R}\) and \(F_{OTP}^{C} + V_{OTP}^{CI} > F_{OTP}^{R}\); therefore \(CI\) is the optimal strategy for the OTP. However, when \(\max \{ \lambda_{1} ,\lambda_{2} \} < \lambda < \overline{\lambda }\), we have \(\overline{\pi }_{OTP}^{C} > \overline{\pi }_{OTP}^{R}\) and \(F_{OTP}^{C} + V_{OTP}^{CI} < F_{OTP}^{R}\), and thus the forecast variability affects selection in this case. Then, we have \(\partial (E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ])/\partial (\rho \Delta )^{2} < 0\), and when \((\rho \Delta )^{2} = 0\), we have \(\max \left( {E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ]} \right) > 0\). When \((\rho \Delta )^{2} = 1\), there is a unique \(\lambda_{4} = (3 + 7\gamma )/8(1 + \gamma )\), which satisfies \(\min \left( {E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ]} \right) = 0\). Accordingly, when \(\lambda_{4} < \lambda < \overline{\lambda }\), we get \(\min \left( {E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ]} \right) > 0\), and the OTP prefers \(CI\) strategy. When \(\max \{ \lambda_{1} ,\lambda_{2} \} < \lambda < \lambda_{4}\)(i.e. in R4), we have \(\min \left( {E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ]} \right) < 0\). It indicates that in R4, there is a unique \(\tau_{2}\), which satisfies \(E[\pi_{OTP}^{CI} ] - E[\pi_{OTP}^{RN} ] = 0\). Therefore, in R4, when \(0 < \rho \Delta < \tau_{2}\), \(CI\) is the optimal strategy; when \(\tau_{2} < \rho \Delta < 1\), \(RN\) is the optimal strategy.

Proof of Proposition 3

Firstly, we derive the TSP’s optimal strategy. For the information sharing profits, we have \(V_{TSP}^{AI} = (1 - \lambda )\rho^{2} \Delta^{2} \overline{a}^{2} /4 > 0\), \(V_{TSP}^{RI} = \rho^{2} \Delta^{2} \overline{a}^{2} /8 > 0\) and \(V_{TSP}^{CI} = (3 + \gamma - 2\lambda (1 + \gamma ))\rho^{2} \Delta^{2} \overline{a}^{2} /8(1 + \gamma ) > 0\). That is, regardless of the selling mode, the TSP always prefers information sharing. Next, we analyze the TSP’s optimal selling mode. Comparing \(AI\) and \(CI\) strategies, we get \(E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{AI} ] = (1 - \gamma )(1 + \rho^{2} \Delta^{2} )\overline{a}^{2} /8(1 + \gamma ) > 0\), and thus \(CI\) strategy dominates \(AI\) strategy. Next, comparing the TSP’s expected profits under \(RI\) and \(CI\) strategies, we get \(E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RI} ] = (1 - (1 + \gamma )\lambda )(1 + \rho^{2} \Delta^{2} )\overline{a}^{2} /4(1 + \gamma )\). Its sign depends on the sign of \(1 - (1 + \gamma )\lambda\). Therefore, there exists a unique \(\lambda_{5} = 1/(1 + \gamma )\), which satisfies \(1 - (1 + \gamma )\lambda { = }0\). When \(0 < \lambda < \lambda_{5}\), we have \(E[\pi_{TSP}^{CI} ] > E[\pi_{TSP}^{RI} ]\), and thus \(CI\) strategy is optimal; when \(\lambda_{5} < \lambda < 1\), we get \(E[\pi_{TSP}^{CI} ] < E[\pi_{TSP}^{RI} ]\), and thus \(RI\) strategy is optimal.

For the TSC, we have \(V_{TSC}^{AI} = \rho^{2} \Delta^{2} \overline{a}^{2} /4 > 0\), \(V_{TSC}^{RI} = - \rho^{2} \Delta^{2} \overline{a}^{2} /16 < 0\) and \(V_{TSC}^{CI} = (3 + 5\gamma )\rho^{2} \Delta^{2} \overline{a}^{2} /16(1 + \gamma ) > 0\). As for the optimal selling mode, comparing \(AI\) and \(CI\) strategies, we get \(E[\pi_{TSC}^{CI} ] - E[\pi_{TSC}^{AI} ] = 3(1 - \gamma )(1 + \rho^{2} \Delta^{2} )\overline{a}^{2} /16(1 + \gamma ) > 0\), so \(CI\) strategy dominates \(AI\) strategy. Then, we compare \(RN\) and \(CI\) strategies. For the risk-free profits, we have \(\overline{\pi }_{TSC}^{C} - \overline{\pi }_{TSC}^{R} = (2 - \gamma )\overline{a}^{2} /8(1 + \gamma ) > 0\). For the risky profits, we get \(F_{TSC}^{C} + V_{TSC}^{CI} - F_{TSC}^{R} = 3(1 - \gamma )\rho^{2} \Delta^{2} \overline{a}^{2} /16(1 + \gamma ) > 0\). As a result, \(CI\) strategy also dominates \(RN\) strategy.

Proof of Proposition 4

One can easily identify the Pareto improvement regions by comparing Propositions 2 and 3. To achieve Pareto improvement, the fixed fee charged to the TSP should at least make up for the loss suffered by the OTP because of the strategy adjustment (i.e., \(T_{\min } = \pi_{OTP}^{ZB} - \pi_{OTP}^{ZA}\)), whereas it cannot be higher than the TSP’s benefits from adopting the Pareto improvement strategy (i.e., \(T_{\max } = \pi_{TSP}^{ZA} - \pi_{TSP}^{ZB}\)).

Proof of Proposition 5

When \(0 < \lambda < \lambda_{1}\), we only need to compare \(CN\), \(RN\) and \(AI\) strategies. Firstly, we compare \(CN\) and \(RN\) strategies. The TSP only gains the risk-free profits under \(CN\) and \(RN\) strategies, and then we have \(\overline{\pi }_{TSP}^{C} - \overline{\pi }_{TSP}^{R} = (1 - (1 + \gamma )\lambda )\overline{a}^{2} /4(1 + \gamma )\). One can easily derive that when \(0 < \lambda < \lambda_{1}\), \(\overline{\pi }_{TSP}^{C} > \overline{\pi }_{TSP}^{R}\). That is, \(CN\) strategy dominates \(RN\) strategy. Then, comparing \(CN\) and \(AI\) strategies, we have \(\overline{\pi }_{TSP}^{C} - \overline{\pi }_{TSP}^{A} = (1 - \gamma )\overline{a}^{2} /8(1 + \gamma ) > 0\). For the risky profits, the OTP shares (withholds) information under the agency mode (hybrid mode). Hence, the TSP possesses risky profits advantage under the agency mode. When \(0 < \lambda < \lambda_{1}\), we have \(\overline{\pi }_{TSP}^{C} > \overline{\pi }_{TSP}^{A}\) and \(V_{TSP}^{AI} > 0\). So, the TSP’s preference depends on the forecast variability. It is easy to identify that \(\partial (E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ])/\partial (\rho \Delta )^{2} < 0\), and when \((\rho \Delta )^{2} = 0\), we have \(\max \left( {E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ]} \right) > 0\). When \((\rho \Delta )^{2} = 1\), there exists a unique \(\lambda_{6} = (1 + 3\gamma )/2(1 + \gamma )\), which makes \(\min \left( {E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ]} \right) = 0\). Therefore, when \(\lambda_{6} < \lambda < \lambda_{1}\) (in R7), we get \(\min \left( {E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ]} \right) > 0\), and thus the TSP prefers \(CN\) strategy. When \(0 < \lambda < \min \{ \lambda_{1} ,\lambda_{6} \}\) (i.e. in R6), we have \(\min \left( {E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{WN} ]} \right) < 0\). It indicates that in R6, there is a unique \(\tau_{3}\) making \(E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ] = 0\). As a result, when \(0 < \rho \Delta < \tau_{3}\), the TSP prefers \(CN\) strategy; when \(\tau_{3} < \rho \Delta < 1\), the TSP chooses \(AI\) strategy.

Next, when \(\lambda_{1} < \lambda < 1\), we only need to compare \(CI\), \(RN\) and \(AI\) strategies. Firstly, we compare \(CI\) and \(AI\) strategies. We have \(E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{AI} ] = (1 - \gamma )(1 + \rho^{2} \Delta^{2} )\overline{a}^{2} /8(1 + \gamma ) > 0\), and thus \(CI\) strategy is optimal. Then, we compare \(CI\) and \(RN\) strategies. We have \(\overline{\pi }_{TSP}^{C} - \overline{\pi }_{TSP}^{R} = (1 - (1 + \gamma )\lambda )\overline{a}^{2} /4(1 + \gamma )\) for the risk-free profits. Its sign depends on the sign of \(1 - (1 + \gamma )\lambda\). We can easily derive that when \(\lambda_{1} < \lambda < \lambda_{5}\) (i.e. in R8), \(\overline{\pi }_{TSP}^{C} > \overline{\pi }_{TSP}^{R}\); when \(\lambda_{5} < \lambda < 1\), \(\overline{\pi }_{TSP}^{C} < \overline{\pi }_{TSP}^{R}\). For the risky profits, the OTP shares information under the hybrid mode, but withholds information under the reselling mode. Therefore, the TSP possesses the risky profits advantage under the hybrid mode when compared with the reselling mode. Based on the above comparison results, inR8, we have \(\overline{\pi }_{TSP}^{C} > \overline{\pi }_{TSP}^{R}\) and \(V_{TSP}^{CI} > 0\), and thus the TSP prefers \(CI\) strategy. When \(\lambda_{5} < \lambda < 1\), we have \(\overline{\pi }_{TSP}^{C} < \overline{\pi }_{TSP}^{R}\) and \(V_{TSP}^{CI} > 0\); therefore, the forecast variability affects choice. We verify that \(\partial (E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RN} ])/\partial (\rho \Delta )^{2} > 0\), and when \((\rho \Delta )^{2} = 0\), \(\min \left( {E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RN} ]} \right) < 0\). When \((\rho \Delta )^{2} = 1\), there exists a unique \(\lambda_{7} = (5 + \gamma )/4(1 + \gamma )\), which satisfies \(\max \left( {E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RN} ]} \right) = 0\). Accordingly, when \(\lambda_{7} < \lambda < 1\) (i.e. in R10), we have \(\max \left( {E[\pi_{TSP}^{CN} ] - E[\pi_{TSP}^{AI} ]} \right) < 0\), and thus the TSP prefers \(RN\) strategy. While when \(\lambda_{5} < \lambda < \min \{ \lambda_{7} ,1\}\)(i.e. in R9), \(\max \left( {E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RN} ]} \right) > 0\). Therefore, there exists a unique \(\tau_{4}\), which satisfies \(E[\pi_{TSP}^{CI} ] - E[\pi_{TSP}^{RN} ] = 0\) in R9, such that when \(0 < \rho \Delta < \tau_{4}\), the TSP prefers \(RN\) strategy; otherwise, when \(\tau_{4} < \rho \Delta < 1\), the TSP prefers \(AI\) strategy.

Proof of Proposition 6

One can easily identify the Pareto improvement regions by comparing Propositions 5 and 3.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhang, X., Liu, Y., Dan, B. et al. Selling mode choice and information sharing in an online tourism supply chain under channel competition. Electron Commer Res (2023). https://doi.org/10.1007/s10660-023-09671-y

Accepted:

Published:

DOI: https://doi.org/10.1007/s10660-023-09671-y