Abstract

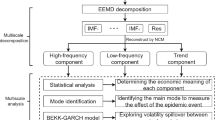

Exploring the effect of an economic crisis on the carbon market can be propitious to understand the formation mechanisms of carbon pricing, and prompt the healthy development of the carbon market. Through the ensemble empirical mode decomposition (EEMD), a multiscale event analysis approach is proposed for exploring the effect of an economic crisis on the European carbon market. Firstly, we determine the appropriate carbon price data of the estimation and event windows to embody the impact of the interested economic crisis on carbon market. Secondly, we use the EEMD to decompose the carbon price into simple modes. Hilbert spectra are adopted to identify the main mode, which is then used to estimate the strength of an extreme event on the carbon price. Thirdly, we perform a multiscale analysis that the composition of the low-frequency modes and residue is identifying as the main mode to capture the strength of the interested economic crisis on the carbon market, and the high-frequency modes are identifying as the normal market fluctuations with a little short-term effect on the carbon market. Finally, taking the 2007–2009 global financial crisis and 2009–2013 European debt crisis as two cases, the empirical results show that contrasted with the traditional intervention analysis and event analysis with the principle of “one divides into two”, the proposed method can capture the influences of an economic crisis on the carbon market at various timescales in a nonlinear framework.

Similar content being viewed by others

Change history

31 March 2017

An erratum to this article has been published.

References

Alberola, E., Chevallier, J., & Cheze, B. (2008). Price drives and structural breaks in European carbon prices 2005–2007. Energy Policy, 36(2), 787–797.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Bel, G., & Joseph, S. (2015). Emission abatement: Untangling the impacts of the EU ETS and the economic crisis. Energy Economics, 49, 531–539.

Box, G. E. P., & Tiao, G. C. (1975). Intervention analysis with applications to economic and environmental problems. Journal of the American Statistical Association, 70(349), 70–79.

Brouwers, R., Schoubben, F., Hulle, C. V., & Uytbergen, S. V. (2016). The initial impact of EUETS verification events on stock prices. Energy Policy, 94, 138–149.

Huang, N. E., Shen, Z., & Long, S. R. (1998). The empirical mode decomposition and the Hilbert spectrum for non-linear and non-stationary time series analysis. Proceedings of the Royal Society of London, 454, 903–995.

Jia, J. J., Xu, J. H., & Fan, Y. (2016). The impact of verified emissions announcements on the European Union emissions trading scheme: A bilaterally modified dummy variable modelling analysis. Applied Energy, 173, 567–577.

Lepone, A., Rahman, R. T., & Yang, J. Y. (2011). The impact of European Union Emissions Trading Scheme (EU ETS) National Allocation Plans (NAP) on Carbon Markets. Low Carbon Economy, 2, 71–90.

Lin, D. C., Guo, Z. L., An, F. G., & Zeng, F. L. (2012). Elimination of end effects in empirical mode decomposition by mirror image coupled with support vector regression. Mechanical Systems and Signal Processing, 1(31), 13–28.

MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39.

Wu, Z. H., & Huang, N. E. (2009). Ensemble empirical mode decomposition: A noise-assisted data analysis method. Advances in Adaptive Data Analysis, 1(1), 1–41.

Yu, L., Li, J. J., Tang, L., & Wang, S. (2015). Linear and nonlinear Granger causality investigation between carbon market and crude oil market: A multi-scale approach. Energy Economics, 51, 300–311.

Zhang, X., Lai, K. K., & Wang, S. Y. (2008). A new approach for crude oil price analysis based on Empirical Mode Decomposition. Energy Economics, 30, 905–918.

Zhang, Y. J., & Wei, Y. M. (2010). An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Applied Energy, 87(6), 1804–1814.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2014). Modelling the dynamics of European carbon futures price: A Zipf analysis. Economic Modelling, 38, 372–380.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2015). Examining the structural changes of European carbon futures price 2005–2012. Applied Economics Letters, 22(5), 335–342.

Zhu, B. Z., Shi, S. T., Chevallier, J., Wang, P., & Wei, Y. M. (2016). An adaptive multiscale ensemble learning paradigm for nonstationary and nonlinear energy price time series forecasting. Journal of Forecasting, 35(7), 633–651.

Zhu, B. Z., Wang, P., Chevallier, J., & Wei, Y. M. (2015). Carbon price analysis using empirical mode decomposition. Computational Economics, 45(2), 195–206.

Zhu, B. Z., & Wei, Y. M. (2013). Carbon price prediction with a hybrid ARIMA and least squares support vector machines methodology. Omega, 41(3), 517–524.

Acknowledgements

We express our gratitude to the National Natural Science Foundation of China (71473180, 71201010 and 71303174), National Philosophy and Social Science Foundation of China (14AZD068, 15ZDA054), Natural Science Foundation for Distinguished Young Talents of Guangdong (2014A030306031), Guangdong Young Zhujiang Scholar (Yue Jiaoshi [2016]95), Department of Education of Guangdong ([2013]246, [2014]145), Guangdong key base of humanities and social science: Enterprise Development Research Institute and Institute of Resource, Environment and Sustainable Development Research, and Guangzhou key base of humanities and social science: Centre for Low Carbon Economic Research for funding supports.

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Zhu, B., Ma, S., Xie, R. et al. Hilbert Spectra and Empirical Mode Decomposition: A Multiscale Event Analysis Method to Detect the Impact of Economic Crises on the European Carbon Market. Comput Econ 52, 105–121 (2018). https://doi.org/10.1007/s10614-017-9664-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9664-x

Keywords

- European carbon market

- Economic crisis

- Ensemble empirical mode decomposition

- Event analysis

- Hilbert transform