Abstract

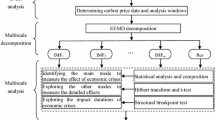

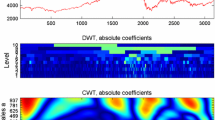

The existing literature primarily examined the impact of unexpected events on the stock market at a single scale, posing the challenge of a lack of multiscale analysis. This paper investigates the impact of COVID-19 on stock markets (China, the U.S., and Hong Kong) from a multiscale perspective using an improved ensemble empirical mode decomposition (EEMD)-based event analysis method. First, the stock price series is decomposed into several independent intrinsic mode functions (IMFs) and a residue. Second, a novel composition method is proposed to reconstruct the IMFs into three components: high-frequency, low-frequency, and long-term trend. We find that the composition of low-frequency and long-term trend components is dominant, which is used to estimate the strength of COVID-19 impact on the stock markets. In addition, the outbreak of COVID-19 significantly increased the intensity of short-term fluctuations in stock prices. Finally, the high-frequency component is analyzed to capture the volatility spillover effects among the three stock markets by the BEKK(Baba-Engle-Kraft-Kroner)-GARCH model. The results show that before the outbreak, there are two-way volatility spillovers between any two of the three markets. After the outbreak, there is no spillover effect between China and Hong Kong, and Hong Kong has no spillover effect on the U.S. However, volatility in the U.S. market still has a significant spillover effect on the other two markets, implying that a mature market can absorb new information more quickly.

Similar content being viewed by others

Notes

The news comes from the People’s Daily, one of the largest official media in China. http://en.people.cn/n3/2020/0123/c90000-9651334.html.

Thanks for the referee’s helpful advice.

References

Ali, M., Alam, N., & Rizvi, S. A. R. (2020). Coronavirus (COVID-19)-an epidemic or pandemic for financial markets. Journal of Behavioral and Experimental Finance, 27, 100341.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bollerslev, T., Chou, R. Y., & Kroner, K. F. (1992). Arch modeling in finance: A review of the theory and empirical evidence. Journal of Econometrics, 52(1–2), 5–59.

Bonham, C. S., & Gangnes, B. (1996). Intervention analysis with cointegrated time series: the case of the hawaii hotel room tax. Applied Economics, 28(10), 1281–1293.

Bouoiyour, J., Selmi, R., & Wohar, M. E. (2019). Safe havens in the face of presidential election uncertainty: A comparison between bitcoin, oil and precious metals. Applied Economics, 51(57), 6076–6088.

Box, G. E., & Tiao, G. C. (1975). Intervention analysis with applications to economic and environmental problems. Journal of the American Statistical Association, 70(349), 70–79.

Chevallier, J., Zhu, B., & Zhang, L. (2021). Forecasting inflection points: Hybrid methods with multiscale machine learning algorithms. Computational Economics, 57(2), 537–575.

Da Silva, T. T., Francisquini, R., & Nascimento, M. C. (2021). Meteorological and human mobility data on predicting COVID-19 cases by a novel hybrid decomposition method with anomaly detection analysis: a case study in the capitals of brazil. Expert Systems with Applications, 182, 115190.

Engle, R., & Kroner, K. (1995). Multivariate simultaneous generalized arch. Econometric Theory, 11, 122–150.

Fan, X., Chen, B., Wang, S., et al. (2021). An improved typical meteorological year based on outdoor climate comprehensive description method. Building and Environment, 206, 108366.

Gaci, S. (2016). A new ensemble empirical mode decomposition (eemd) denoising method for seismic signals. Energy Procedia, 97, 84–91.

He, P., Sun, Y., Zhang, Y., et al. (2020). COVID-19’s impact on stock prices across different sectors-an event study based on the Chinese stock market. Emerging Markets Finance and Trade, 56(10), 2198–2212.

Heyden, K. J., & Heyden, T. (2021). Market reactions to the arrival and containment of COVID-19: An event study. Finance Research Letters, 38, 101745.

Huang, N., Shen, Z., Long, S., et al. (1998). The empirical mode decomposition and the hilbert spectrum for nonlinear and non-stationary time series analysis. Proceedings of the Royal Society of London Series A: Mathematical, Physical and Engineering Sciences, 454, 903–995.

Jin, X., Zhu, K., Yang, X., et al. (2021). Estimating the reaction of bitcoin prices to the uncertainty of fiat currency. Research in International Business and Finance, 58, 101451.

Liu, H., Manzoor, A., Wang, C., et al. (2020). The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), 2800.

Liu, L., Wang, E. Z., & Lee, C. C. (2020). Impact of the COVID-19 pandemic on the crude oil and stock markets in the us: A time-varying analysis. Energy Research Letters, 1(1), 13154.

Liu, M., Choo, W. C., & Lee, C. C. (2020). The response of the stock market to the announcement of global pandemic. Emerging Markets Finance and Trade, 56(15), 3562–3577.

MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39.

Narayan, P. K., Devpura, N., & Wang, H. (2020). Japanese currency and stock market-what happened during the COVID-19 pandemic? Economic Analysis and Policy, 68, 191–198.

Qin, Q., He, H., Li, L., et al. (2020). A novel decomposition-ensemble based carbon price forecasting model integrated with local polynomial prediction. Computational Economics, 55(4), 1249–1273.

Wu, Z., & Huang, N. (2004). A study of the characteristics of white noise using the empirical mode decomposition method. Proceedings of the Royal Society of London Series A: Mathematical, Physical and Engineering Sciences, 460, 1597–1611.

Wu, Z., & Huang, N. E. (2009). Ensemble empirical mode decomposition: A noise-assisted data analysis method. Advances in Adaptive Data Analysis, 1(01), 1–41.

Zhang, X., Lai, K., & Wang, S. (2008). A new approach for crude oil price analysis based on empirical mode decomposition. Energy Economics, 30, 905–918.

Zhang, X., Yu, L., Wang, S., et al. (2009). Estimating the impact of extreme events on crude oil price: An emd-based event analysis method. Energy Economics, 31(5), 768–778.

Zhou, Z., Lin, L., & Li, S. (2018). International stock market contagion: A ceemdan wavelet analysis. Economic Modelling, 72, 333–352.

Zhu, B., Ma, S., Xie, R., et al. (2018). Hilbert spectra and empirical mode decomposition: A multiscale event analysis method to detect the impact of economic crises on the european carbon market. Computational Economics, 52(1), 105–121.

Acknowledgements

This research is supported by the Key project of the National Social Science Fund (22AZD039), the Guangzhou Philosophy and Social Science Planning project (2022GZYB08), the Fundamental Research Funds for the Central Universities (ZDPY202209). We would like to thank Editor-in-chief Hans Amman and the anonymous reviewers for their valuable suggestions and feedback.

Funding

This research is supported by the Key project of the National Social Science Fund (22AZD039), the Guangzhou Philosophy and Social Science Planning project (2022GZYB08), the Fundamental Research Funds for the Central Universities (ZDPY202209).

Author information

Authors and Affiliations

Contributions

HL designed the algorithms, wrote the paper. GX wrote the code and carried out the experiments. Material preparation, data collection and analysis were performed by QH, RR. WZ is responsible for ensuring that the descriptions are accurate and agreed by all authors. All authors discussed the results and contributed to the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, H., Xu, G., Huang, Q. et al. COVID-19 Impact on Stock Markets: A Multiscale Event Analysis Perspective. Comput Econ 63, 1191–1212 (2024). https://doi.org/10.1007/s10614-023-10448-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-023-10448-6