Abstract

We analyze the financial planning problems of young households whose main decisions are how to finance the purchase of a house (liabilities) and how to allocate investments in pension savings schemes (assets). The problems are solved using a multi-stage stochastic programming model where the uncertainty is described by a scenario tree generated from a vector auto-regressive process for equity returns and interest rate evolution. We find strong evidence of the importance of taking into account the multi-stage nature of the problem, as well as the need to consider the asset and liability sides jointly.

Similar content being viewed by others

Notes

Formerly known as the C20 or the KFX index.

Further descriptions are given in Bechmann (2004) and at https://indexes.nasdaqomx.com/docs/methodology_OMXC20.pdf.

In a one-factor model, such a one-to-one correspondence is indeed theoretically correct.

The lower right part of the forked expression on page 1276 defining f 30 should read “x≥c+(ab)1/(1−b)”.

To be fair, the “post-Lehman” period does post problems. And one could contemplate adding an idiosyncratic noise factor. But we leave those issues for future work.

Stationarity refers to time-invariant expected values, variances, and covariances.

In Denmark, almost all stocks pay yearly dividends. And almost all pay in April or May. This may be the reason we are unable to detect any (short-term) predictive effects.

For our numerical example in Sect. 4 we use a constant branching factor of ten.

The difference to \(\operatorname{\boldsymbol{\xi}}\) is given by first row, see (9). While in \(\operatorname{\boldsymbol{\xi}}\) equity returns are on a monthly basis, ζ τ cumulates τ monthly equity returns. The Nelson/Siegel parameter vector is the same in both cases.

Given the yearly decision stages in our numerical exhibition of Sect. 4, to calculate annual returns of the bonds in our asset menu we set Δt equal to one year.

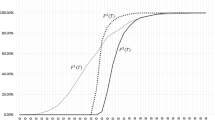

The correlation is not perfect or constant across maturity for two reasons; firstly, we use a three-factor model, and secondly the callable bond prices are non-linearly related to prices of non-callable bonds, as Fig. 2 demonstrates.

Because there are cashflows multiple dates, we take “fixed-mix strategy” to mean the following: All pension payments must be invested according to a fixed mix (e.g. 60 % in stocks, 40 % in 1Y bonds), debt can’t be called, and switching between fixed and floating rate loans is not allowed.

With Table 5 in mind it seems plain wrong that even the completely risk-neutral agent does not have stocks in her portfolio. But that is because Table 5 gives comparative statistics for returns of buy-and-hold strategies, while this agents’ pension portfolio has (annuity-like) cash-inflows over time. With the equity premium as small as it is in the estimation period, this may have an effect in-sample. The reason the risk-neutral, dynamically adjusting agent does use stock initially is that there is an element of predictability in bonds returns, so she can and will only alter her portfolio later.

The x’s do not fall on vertical lines because our risk-aversion is parametrized via in-sample CVaR.

References

Ang, A., Bekaert, G., & Wei, M. (2007). Do macro variables, asset markets, or surveys forecast inflation better? Journal of Monetary Economics, 54, 1163–1212.

Barberis, N. C. (2000). Investing for the long run when returns are predictable. Journal of Finance, 55, 225–264.

Bechmann, K. L. (2004). Price and volume effects associated with changes in the Danish blue-chips index—the KFX index. Multinational Finance Journal, 8, 3–34.

Belter, K., Engsted, T., & Tanggaard, C. (2005). A new daily dividend-adjusted index for the Danish stock market, 1985–2002: construction, statistical properties, and return predictability. Research in International Business and Finance, 19, 53–70.

Boender, G., Dert, C., Heemskerk, F., & Hoek, H. (2005). A scenario approach of ALM. In Handbook of asset and liability management (pp. 829–861). Amsterdam: Elsevier. Chapter 18.

Brandt, M. W., Goyal, A., Santa-Clara, P., & Stroud, J. R. (2005). A simulation approach to dynamic portfolio choice with an application to learning about return predictability. The Review of Financial Studies, 18, 831–873.

Campbell, J. Y., Chan, Y. L., & Viceira, L. M. (2003). A multivariate model of strategic asset allocation. Journal of Financial Economics, 67, 41–80.

Campbell, J. Y., Lo, A. W., & MacKinlay, A. C. (1997). The econometrics of financial markets. Princeton: Princeton University Press.

Cocco, J. F., Gomes, F. J., & Maenhout, P. J. (2005). Consumption and portfolio choice over the life cycle. The Review of Financial Studies, 18, 491–533.

Consiglio, A., Cocco, F., & Zenios, S. A. (2004). www.personal_asset_allocation. Interfaces, 34, 287–302.

Consiglio, A., Cocco, F., & Zenios, S. A. (2007). Scenario optimization asset and liability modeling for individual investors. Annals of Operations Research, 152, 167–191.

Consiglio, A., Cocco, F., & Zenios, S. A. (2008). Asset and liability modeling for participating policies. European Journal of Operational Research, 186, 380–404.

Diebold, F. X., & Li, C. (2006). Forecasting the term structure of government bond yields. Journal of Econometrics, 130, 337–364.

Drijver, S. (2005 July). Asset liability management for pension funds using multistage mixed-integer stochastic programming. Ph.D. thesis, University of Groningen.

Ferstl, R., & Weissensteiner, A. (2011). Asset-liability management under time-varying investment opportunities. Journal of Banking & Finance, 35, 182–192.

Frankel, A., Gyntelberg, J., Kjeldsen, K., & Persson, M. (2004 March). The Danish mortgage market. BIS Quarterly Review, 95–109.

Geyer, A., Hanke, M., & Weissensteiner, A. (2009). Life-cycle asset allocation and optimal consumption using stochastic linear programming. Journal of Computational Finance, 12, 29–50.

Geyer, A., Hanke, M., & Weissensteiner, A. (2010). No-arbitrage conditions, scenario trees, and multi-asset financial optimization. European Journal of Operational Research, 206, 609–613.

Goyal, A., & Welch, I. (2008). A comprehensive look at the empirical performance of equity premium prediction. The Review of Financial Studies, 21, 1455–1508.

Høyland, K., Kaut, M., & Wallace, S. W. (2003). A heuristic for moment-matching scenario generation. Computational Optimization and Applications, 24, 169–185.

Høyland, K., & Wallace, S. W. (2001). Generating scenario trees for multistage decision problems. Management Science, 47, 295–307.

Kaut, M., Vladimirou, H., Wallace, S. W., & Zenios, S. A. (2007). Stability analysis of portfolio management with conditional value-at-risk. Quantitative Finance, 7(4), 397–408.

Klaassen, P. (2002). Comment on “generating scenario trees for multistage decision problems”. Management Science, 48, 1512–1516.

Klein Haneveld, W. K., Streutker, M. H., & van der Vlerk, M. H. (2010). An ALM model for pension funds using integrated chance constraints. Annals of Operations Research, 177, 47–63.

Kraft, H., & Munk, C. (2011). Optimal housing, consumption, and investment decisions over the life cycle. Management Science, 57, 1025–1041.

Lütkepohl, H. (2005). Introduction to multiple time series analysis. Berlin: Springer.

Medova, A., Murphy, J. K., Owen, A. P., & Rehman, K. (2008 September). Individual asset liability management. Quantitative Finance, 8, 547–560.

Nielsen, S. S., & Poulsen, R. (2004). A two-factor, stochastic programming model of Danish mortgage–backed securities. Journal of Economic Dynamics & Control, 28, 1267–1289.

Ogryczak, W., & Ruszczynski, A. (1999). From stochastic dominance to mean-risk models: semideviations as risk measures. European Journal of Operational Research, 116, 33–50.

Pedersen, A. M. B., Rasmussen, K. M., Vladimirou, H., & Clausen, J. (2010). Integrated mortgage loan and pension planning (Working paper).

Rasmussen, K. M., & Clausen, J. (2007). Mortgage loan portfolio optimization using multi-stage stochastic programming. Journal of Economic Dynamics & Control, 31, 742–766.

Rasmussen, K. M., & Zenios, S. A. (2007). Well armed and firm: diversification of mortgage loans for homeowners. The Journal of Risk, 10, 67–84.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. The Journal of Risk, 2, 21–41.

Rogers, L. C. G. (1995). Which model for term-structure of interest rates should one use? In M. Davis (Ed.), IMA: Vol. 65. Mathematical finance (pp. 93–116). Berlin: Springer.

Schwartz, E. S., & Torous, W. N. (1989). Prepayment and the valuation of mortgage-backed securities. Journal of Finance, 44, 375–392.

Stanton, R. (1995). Rational prepayment and the valuation of mortgage-backed securities. The Review of Financial Studies, 8, 677–708.

Svenstrup, M., & Willemann, S. (2006). Reforming housing finance—perspectives from Denmark. Journal of Real Estate Research, 28, 105–130.

Acknowledgements

Pedersen and Poulsen were partially supported by the Danish Strategic Research Council, Program Committee for Strategic Growth Technologies, for the research centre “HIPERFIT: Functional High Performance Computing for Financial Information Technology” (hiperfit.dk) under contract number 10-092299. Weissensteiner benefitted from the support of Free University of Bozen-Bolzano, School of Economics and Management, via the project “Arbitrage-Free Scenario Trees”. We thank two anonymous referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: The full stochastic programming formulation

Appendix: The full stochastic programming formulation

The following parameters and variables are used in the stochastic programming problem. (A “parameter” is something that can be specified/calculated/makes sense independently of any agent’s optimization problem. A “variable” is something that is chosen by the agent—however trivially—as part of the optimization problem.)

1.1 A.1 Parameters

minCVaR: the minimal conditional value-at-risk the agent is willing to accept;

p n : probability of being at node n;

d t : discount factor for time t viewed from time 0;

r in : coupon rate for loan i at node n,

PP in : the net present value of prepayments from one unit of loan i at node n including any retirement of the debt at prevailing market prices;

r jtn : annual return on asset instrument j at node n, time t;

K in : price of prepaying loan i at node n. We have that K in =min{1,k in } for FRMs and K in =k in for ARMs where k in is the market price for the bond underlying loan i at node n;

I t : the investor’s gross income at time t;

IA: the cost of buying the house;

P in : price of loan i at node n;

c: variable transaction cost for issuing a loan;

c l : fixed transaction cost for issuing a loan;

c f : fixed cost associated with the mortgage origination;

admC: administration fee rates given as a percentage of outstanding debt for bond i;

γ: tax reduction rate from interest payments;

tx l : low-bracket tax rate;

tx h : high-bracket tax rate;

ba h : basic allowance in high-bracket tax;

α: confidence (quantile) level for VaR and CVaR (∼5 % worst cases in our applications);

M: large constant (the big M);

cmin: minimum amount used for consumption;

tax pal : tax rate on earnings from retirement investments;

β: fixed percentage of the household’s income that is used for contribution to retirement savings;

rd tn : interest rate on savings in the bank account at time t and node n.

1.2 A.2 Variables

y itn : units sold of loan i at node n, time t;

x itn : units bought of loan i at node n, time t;

Z itn : \(\left\{ \begin{array}{@{}l@{\quad }l} 1 & \mbox{if any amount of loan } i \mbox{ is issued/sold},\\ 0 & \mbox{otherwise}; \end{array} \right.\)

cref tn : total costs of refinancing the loans at node n, time t;

LP tn : \(\left\{ \begin{array}{@{}l@{\quad }l} 1 & \mbox{if a loan is refinanced},\\ 0 & \mbox{otherwise}; \end{array} \right.\)

A itn : principal payment of loan i at node n, time t;

BT tn : total payments on all loans at node n, time t, including interest and principal payments and price of prepaying the loans at horizon;

κ jtn : percentage of income used to invest in instrument j at node n, time t;

VP n : value of retirement investments before tax;

VH n : horizon value of retirement savings after tax;

W n : total wealth at horizon at node n;

C tn : amount needed for consumption at node n, time t;

x1 tn : part of gross income which is taxed with low-bracket tax rate;

x2 tn : part of gross income which is taxed with high-bracket tax rate;

OD itn : outstanding mortgage debt of loan i at node n, time t;

\(\mathit{IR}^{+}_{tn}\): interest payments at node n, time t;

\(\mathit{IR}^{-}_{tn}\): interest earnings at node n, time t;

\(v^{+}_{tn}\): part of interest earnings taxed as income;

\(v^{-}_{tn}\): part of interest payments deducted in tax;

CD tn : deposit (or withdrawal) in the savings bank account at node n, time t;

CF tn : balance of the savings bank account at node n, time t;

VaR: value-at-risk;

CVaR: conditional value-at-risk.

1.3 A.3 The liability (or mortgage) side

1.4 A.4 The asset (or pension) side

1.5 A.5 Taxes etc.

Rights and permissions

About this article

Cite this article

Pedersen, A.M.B., Weissensteiner, A. & Poulsen, R. Financial planning for young households. Ann Oper Res 205, 55–76 (2013). https://doi.org/10.1007/s10479-012-1205-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1205-3