Abstract

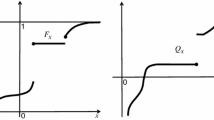

Multivariate Value at Risk, or MVaR, is defined as the quantile set of a multivariate probability distribution. It has already been introduced and used in the literature under the name of p-Level Efficient Points, or pLEP’s, or briefly p-efficient points. Some of the topics connected with it are surveyed: discrete convexity, algorithmic generation, relation to logconcavity. A related notion: Multivariate Conditional Value at Risk, or MCVaR, is also introduced and some of its properties are explored. Finally, optimization problems, based on these notions, are presented and discussed, from the point of view of convexity and algorithmic solution.

Similar content being viewed by others

References

Beraldi, P., & Ruszczynski, A. (2002). The probabilistic set-covering problem. Operations Research, 50, 956–967.

Borell, C. (1975). Convex set-functions in d-space. Periodica Mathematica Hungarica, 6, 111–136.

Boros, E., Elbassioni, K., Gurvich, V., Khachiyan, L., & Makino, K. (2003). In Lecture notes in computer science : Vol. 2719. An intersection inequality for discrete distributions and related generation problems (pp. 543–555). Berlin: Springer.

Dentcheva, D., Prékopa, A., & Ruszczynski, A. (2000). Concavity and efficient points of discrete distributions in probabilistic programming. Mathematical Programming Series A, 89, 55–77.

Föllmer, H., & Schied, A. (2002). Stochastic finance. Berlin: de Gruyter.

Fredman, M. L., & Khachiyan, L. (1996). On the complexity of dualization of monotone disjunctive normal forms. Journal of Algorithms, 21, 618–628.

Klein Haneveld, W. K. (1986). Lecture notes in economics and mathematical systems : Vol. 274. Duality in stochastic linear and dynamic programming. New York: Springer.

Komáromi, É. (1986). Duality in probabilistic constrained linear programming. In A. Prékopa, J. Szelezsán, & B. Strazicky (Eds.), Lecture notes in control and information sciences : Vol. 84. System modelling and optimization, Proceeding of the 12th IFIP conference, Budapest, Hungary (pp. 423–429). Berlin: Springer.

Liu, T., & Prékopa, A. (2005). Solution of a probabilistic constrained stochastic programming problem with Poisson, binomial and geometric random variables. RUTCOR Research Reports 29-2005.

Pflug, G. Ch. (2000). Some remarks on the value-at-risk and conditional value-at-risk. In S. P. Uryasev (Ed.), Probabilistic constrained optimization (pp. 272–281). Kluwer: Dordrecht.

Pflug, G. C., & Römisch, W. (2007). Modeling, measuring and managing risk. Hackensack: World Scientific.

Pflug, G. Ch., & Ruszczyński, A. (2005). Measuring risk for income streams. Computational Optimization and Applications, 32, 161–178.

Prékopa, A. (1971). Logarithmic concave measures with application to stochastic programming. Acta Scientiarum Mathematicarum (Szeged), 32, 301–316.

Prékopa, A. (1973a). On logarithmic concave measures and functions. Acta Scientiarum Mathematicarum (Szeged), 34, 335–343.

Prékopa, A. (1973b). Contribution to the theory of stochastic programming. Mathematical Programming, 4, 202–221.

Prékopa, A. (1980a). Logarithmic concave measures and related topics. In M. A. H. Dempster (Ed.), Stochastic programming (pp. 63–82). London: Academic Press.

Prékopa, A. (1980b). Network planning using two-stage programming under uncertainty. In P. Kall & A. Prékopa (Eds.), Lecture notes in economics and mathematical systems : Vol. 179. Recent results in stochastic programming (pp. 216–237). Berlin: Springer.

Prékopa, A. (1990). Dual method for a one-stage stochastic programming problem with random RHS, obeying a discrete probability distribution. Zeitschrift für Operations Research, 34, 441–461.

Prékopa, A. (1995). Stochastic programming. Dordrecht: Kluwer Scientific.

Prékopa, A. (2007a). On the relationship between probabilistic constrained, disjunctive and multiobjective programming. RUTCOR Research Reports 7-2007.

Prékopa, A. (2007b). Conditional mean-conditional variance portfolio selection models. RUTCOR Research Reports 34-2007.

Prékopa, A., Ganczer, S., Deák, I., & Patyi, K. (1980). The STABIL stochastic programming model and its experimental application to the electrical energy sector of the Hungarian economy. In M. A. H. Dempster (Ed.), Stochastic programming (pp. 369–385). London: Academic Press.

Prékopa, A., & Kelle, P. (1978). Reliability-type inventory models based on stochastic programming. Mathematical Programming Study, 9, 43–58.

Prékopa, A., & Szántai, T. (1978). Flood control reservoir system design using stochastic programming. Mathematical Programming Study, 9, 138–151.

Prékopa, A., Vizvári, B., & Badics, T. (1998). Programming under probabilistic constraint with discrete random variable. In F. Giannessi et al. (Ed.), New trends in mathematical programming (pp. 235–255). Dordrecht: Kluwer Academic.

Uryasev, S. (2000). Conditional value at risk: optimization algorithms and applications. Financial Engineering News, 14.

Uryasev, S., & Rockafellar, R. T. (2000). Optimization of conditional value at risk. The Journal of Risk, 2, 21–41.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Prékopa, A. Multivariate value at risk and related topics. Ann Oper Res 193, 49–69 (2012). https://doi.org/10.1007/s10479-010-0790-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-010-0790-2