Abstract

A measure of risk is introduced for a sequence of random incomes adapted to some filtration. This measure is formulated as the optimal net present value of a stream of adaptively planned commitments for consumption. The new measure is calculated by solving a stochastic dynamic linear optimization problem which, for finite filtrations, reduces to a deterministic linear programming problem.

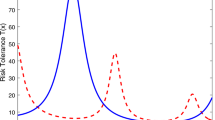

We analyze properties of the new measure by exploiting the convexity and duality structure of the stochastic dynamic linear problem. The measure depends on the full distribution of the income process (not only on its marginal distributions) as well as on the filtration, which is interpreted as the available information about the future. The features of the new approach are illustrated by a numerical example.

Similar content being viewed by others

References

F. Andersson, H. Mausser, D. Rosen, and S. Uryasev, “Credit risk optimization with conditional value-at-risk criterion,” Mathematical Programming, vol. 89, pp. 273–291, 2001.

P. Artzner, F. Delbaen, J.-M. Eber, and D. Heath, “Coherent measures of risk,” Mathematical Finance, vol. 9, pp. 203–228, 1999.

P. Artzner, F. Delbaen, J.-M. Eber, D. Heath, and H. Ku, Coherent multiperiod mesures of risk, Manuscript.

J. Birge and F. Louveaux, Introduction to Stochastic Programming, Springer Verlag, 1977.

D. Carino and W. T. Ziemba, “Formulation of the Russell–Yasuda Kasai financial planning model,” Operations Research, vol. 46, pp. 433–449, 1998.

M. Dempster and Thompson, “EVPI-based importance sampling solution procedures for multistage stochastic linear programmeson parallel MIMD architectures,” Annals of OR, vol. 90, pp. 161–184, 1999.

A.D. Ioffe and V.D. Tihomirov, Theory of Extremal Problems, North-Holland, Amsterdam, 1979.

H. Föllmer and A. Schied, “Convex measures of risk and trading constraints,” Finance and Stochastics vol. 6, no. 4, 429–447, 2002.

L.V. Kantorovich and G.P. Akilov, Functional Analysis, Pergamon Press, Oxford, 1982.

H. Konno and H. Yamazaki, “Mean-absolute deviation portfolio optimization model and its application to Tokyo stock market,” Management Science, vol. 37, pp. 519–531, 1991 .

H.M. Markowitz, “Portfolio selection,” Journal of Finance vol. 7, pp. 77–91, 1952.

H.M. Markowitz, Mean–Variance Analysis in Portfolio Choice and Capital Markets, Blackwell, Oxford, 1987.

J.M. Mulvey and A.E. Thorlacius, “The Towers Perrin global capital market scenario generation system,” in Worldwide Asset and Liability Modeling, J.M. Mulvey and W.T. Ziemba (Eds.). Cambridge University Press, 1998, pp. 286–314.

J.M. Mulvey, “Introduction to financial optimization”, Mathematical Programming, vol. 89 pp.205–216, 2001.

J.M. Mulvey and W.T. Ziemba, “Asset and liability allocation in a global environment,” in Finance, R.A. Jarrow, V. Maksimović and W.T. Ziemba (Eds.). North–Holland 1995, pp. 435–463.

W. Ogryczak and A. Ruszczyński, From stochastic dominance to mean-risk models: Semideviations as risk measures, European Journal of Operational Research, vol. 116, pp. 33–50, 1999.

W. Ogryczak and A.Ruszczyński, “On consistency of stochastic dominance and mean-semideviation models,” Mathematical Programming, vol. 89, pp. 217–232, 2001.

W. Ogryczak and A. Ruszczyński, “Dual stochastic dominance and related mean-risk models,” SIAM Journal on Optimization, vol. 13, pp. 60–78, 2002.

G. Ch. Pflug, “Some remarks on the Value-at-Risk and the Conditional Value-at-Risk,” in Probabilistic Constrained Optimization—Methodology and Applications, S. Uryasev (Ed.). Kluwer Academic Publishers, ISBN 0-7923-6644-1, 2000, pp. 272–281.

G. Ch. Pflug and A. Ruszczyński, “A risk measure for income streams, in Risk Measures for the 21st Century, G. Szegoe (Ed.). J. Wiley and Sons, 2003.

R.T. Rockafellar and S. Uryasev, “Optimization of conditional value-at-Risk,” Journal of Risk, vol. 2, pp. 21–41, 2000.

W.F. Sharpe, “A linear programming approximation for the general portfolio analysis problem,” Journal of Financial and Quantitative Analysis, vol. 6, pp. 1263–1275, 1971.

Tan Wang, “A class of dynamic risk measures,” Manuscript, University of British Columbia, http://finance.commerce.ubc.ca/research/abstracts/UBCFIN98-5.html

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pflug, G.C., Ruszczyński, A. Measuring Risk for Income Streams. Comput Optim Applic 32, 161–178 (2005). https://doi.org/10.1007/s10589-005-2058-3

Issue Date:

DOI: https://doi.org/10.1007/s10589-005-2058-3