Abstract

The widespread usage of machine learning in different mainstream contexts has made deep learning the technique of choice in various domains, including finance. This systematic survey explores various scenarios employing deep learning in financial markets, especially the stock market. A key requirement for our methodology is its focus on research papers involving backtesting. That is, we consider whether the experimentation mode is sufficient for market practitioners to consider the work in a real-world use case. Works meeting this requirement are distributed across seven distinct specializations. Most studies focus on trade strategy, price prediction, and portfolio management, with a limited number considering market simulation, stock selection, hedging strategy, and risk management. We also recognize that domain-specific metrics such as “returns” and “volatility” appear most important for accurately representing model performance across specializations. Our study demonstrates that, although there have been some improvements in reproducibility, substantial work remains to be done regarding model explainability. Accordingly, we suggest several future directions, such as improving trust by creating reproducible, explainable, and accountable models and emphasizing prediction of longer-term horizons—potentially via the utilization of supplementary data—which continues to represent a significant unresolved challenge.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Technology has long substantially enabled financial innovation (Seese et al. 2008). In Insights (2019), Deloitte surveyed over 200 US financial services executives to determine their use of Artificial Intelligence (AI) and its impact on their business. A total of 70% of respondents indicated that they use general-purpose Machine Learning (ML), with 52% indicating that they use Deep Learning (DL). For these respondents, the most common uses of DL are reading claims documents for triage, providing data analytics to users through intuitive dashboards, and developing innovative trading and investment strategies.

The Institute for Ethical AI & Machine Learning (EAIML) has developed eight principles for responsible ML development; these include pertinent topics such as explainability, reproducibility, and practical accuracy (The Institute for Ethical AI & Machine Learning 2020). Recent research has emphasized the issue of Explainable AI (XAI) and Reproducible AI (Gundersen et al. 2018) in numerous application domains. In a survey on XAI, the need for interpretable AI was identified as a major step toward artificial general intelligence (Adadi and Berrada 2018). However, more work is needed to ensure domain-specific metrics and considerations are used to assess applicability and usability across diverse ML domains.

Paleyes et al. (2020) suggest practical consideration in deploying ML for production use: “The ability to interpret the output of a model into understandable business domain terms often plays a critical role in model selection, and can even outweigh performance consideration.” For example, Nascita et al. (2021) fully embraces XAI paradigms of trustworthiness and interpretability to classify data generated by mobile devices using DL approaches.

In the domain of financial analysis using stock market data, a key tool for achieving explainability and giving research a good chance at real-world adoption is backtesting (de Prado 2018; Arnott et al. 2018). This refers to using historical data to retrospectively assess a model’s viability and instill the confidence to employ it moving forward. This is based on the intuitive notion that any strategy that worked well in the past is likely to work well in the future, and vice versa (de Prado 2018).

Numerous surveys have considered applications of DL to financial markets (Jiang 2021; Zhang et al. 2021; Hu et al. 2021; Li and Bastos 2020; Ozbayoglu et al. 2020), with (Ozbayoglu et al. 2020) considering numerous financial applications to demonstrate that applications involving stock market data, such as algorithmic trading and portfolio management, present the most interesting cases for researchers. Elsewhere, (Jiang 2021) focuses on DL research in the stock market, especially research concerning reproducibility; however, despite presenting financial metrics, there is no indication of backtesting or practicality. Meanwhile, (Hu et al. 2021) presents an analysis based on evaluation results such as bins of accuracy results and ranges of returns that, nonetheless, offers no clear explanation for different kinds of metrics and does not consider XAI.

The authors of Li and Bastos (2020) emphasize the importance of evaluations using financial metrics but limit their focus to profitability as a financial evaluation. Although they do discuss volatility, this is not considered for evaluation because it can result in poor financial returns despite its high level of accuracy. This survey explores the strategies that various researchers have employed to understand DL in the stock market, focusing on studies addressing explainability, reproducibility, and practicality. To the best of our knowledge, this work represents the first study to adopt backtesting and domain-specific evaluation metrics as primary criteria. This is represented by the following specific questions:

Question 1

What current research methods based on deep learning are used in the stock market context?

Question 2

Are the research methods consistent with real-world applications, i.e., have they been backtested?

Question 3

Is this research easily reproducible?

To answer question 2, we focus on works that were backtested as part of the research methodology. Proper backtesting provides assurance that the algorithm has been tested in different time horizons, consistent with domain-specific considerations, which improves investor confidence and makes its application in a real-world trading scenario more likely (Arnott et al. 2018). This serves as the primary criteria for the literature reviewed. For question 3, we consider not only works where the source data and code are provided but also on works the research could be reproduced. Section 4 further explains the approach employed and the search criteria.

Section 2 explains the characteristics, types, and representations of stock market data. Then, Sect. 3 discusses applications of DL in the stock market. We begin the section by summarizing the different DL techniques currently used in the stock market context and conclude by itemizing the specific ways these techniques are applied to stock market data. In Sect. 4, we elaborate on our research questions, answering the research questions by summarizing our survey findings. Section 5 presents challenges remaining to be unresolved and future research directions, and Sect. 6 concludes the survey.

2 Understanding stock market data

Not unlike other ML applications, data represents a crucial component of the stock market learning process (de Prado 2018). Understanding the different forms of data that are employed to utilize DL for the stock market substantially contributes to enabling proper identification of our data requirements in accordance with the task in question. This section considers the different characteristics, types, and representations of data that are relevant to mining stock market data using DL. Notably, as will become evident, some of these data forms are quite specific to stock market data.

2.1 Data characteristics

2.1.1 Source

Although trading venues such as stock exchanges are often perceived as the main source of stock market data, in recent years, other data sources, including news articles and social media, have been explored as data sources for ML processes (Day and Lee 2016; Haibe-Kains et al. 2020; Yang et al. 2018; Adosoglou et al. 2020). There is a direct correlation between data source and data type, as Sect. 2.2 demonstrates. Data source also largely depends on the intended type of analytics. If the goal is a simple regression task using purely historical market data, then the primary or only source could be trading data from the trading venue. For more complicated tasks, such as studying the effect of user sentiments on stock movement, it is common to combine trading data with data obtained from social media services or comments on relevant news articles. Irrespective of complications associated with the task at hand, it is rare to not use the trading venue as a source because literal data is always integral. Although several of the studies considered do not incorporate trading data—e.g., (Bao and Liu 2019; Ferguson and Green 2018)—these are generally theoretical studies that utilize simulated data.

2.1.2 Frequency

Data frequency concerns the number of data points within a specific unit of time (de Prado 2018). What any particular data point captures can be reported in different ways, from being represented as an aggregate (e.g., min, max, average) to using actual values. Data granularity can range from a daily snapshot (typically the closing value for trading data) to a fraction of a second for high-frequency market data. A more established representation of stock market data as bars (Sect. 2.3.1) refers to presenting multiple data points as an understandable aggregate of the highlights within that time interval.

For non-traditional data sources, such as news or social media, it is quite common to combine and summarize multiple individual items within the same time interval. For example, (Day and Lee 2016) uses multiple daily news headlines as part of the training data. Elsewhere, using a sentence encoder (Conneau et al. 2017) generates equal length vectors from differently sized sets of words representing different sentences. The literature reviewed commonly uses a snapshot or aggregated data to summarize a data point within a time interval. This could be due to the data’s granularity being directly proportional to its volume. Consequently, more parameters will be required in neural networks comprising highly granular data.

2.1.3 Volume

Although the volume of the data closely relates to the frequency of the data and the specific unit of data (de Prado 2018), we should differentiate volume from frequency because, while a high frequency typically translates to a relatively high volume, volume size might not directly correlate to data frequency. This becomes more apparent when we consider seasonality or holidays for the same time interval. We can also recognize that, based on the time of day, the volume of data generated for the same subject of interest within the same period could be vastly different, suggesting a differential occurrence rate. This is particularly relevant for non-conventional data types, such as news and social media data, where high volume (i.e., the size of the volume) might not be directly correlated to data frequency. This becomes more apparent when we consider seasonality or holidays for the same time interval. We can also notice that based on the time of day, the volume of data generated for the same subject of interest within the same period could be vastly different, suggesting a different rate of occurrence. This is particularly relevant for non-conventional data types, such as news or social media data.

Using Apple Inc. as an example (Investing.com 2013), a day marking a product announcement produces a substantially larger volume of news articles and relevant social media content than other days. Although this content might not affect the volume of the trading data—which depends more heavily on market data frequency—such instances might produce noticeable differences in the rate of change in market values. An increased rate warrants a different level of attention compared to a typical market day. The relationship between market data frequency and alternative data volume itself represents an interesting area of research that deserves a special level of attention.

Understanding data volume and data frequency is critical to designing infrastructure for processing data. As data volume approaches the realm of big data, precluding efficient computation in memory, it is necessary to consider alternative ways of processing data while utilizing relevant components of that data. Here, we begin considering ways of parallelizing the learning process without losing relationships between parallel batches. Data processing at such a scale requires parallel processing tools, such as those described by Zaharia et al. (2010).

2.2 Data types

2.2.1 Market data

Market data are trading activities data generated by trading venues such as stock exchanges and investment firms. They are typically provided via streaming data feeds or Application Programming Interface (API) used within protocols such as the Financial Information eXchange (FIX) and the GPRS Tunnelling Protocol (GTP) (Wikipedia 2020d) (accessed 19-Aug-2020). A typical trade message concerning stock market data comprises a ticker symbol (representing a particular company), bid price, ask price, time of last quote, and size of the sale (Table 1).

For messages with quote data, we should expect to see both the bid price & volume and the ask price & volume. These represent how much people are willing to buy and sell the asset at a given volume. Market data represent the core data type used by ML research in the stock market context and typically provide a detailed representation of trading activities regarding market assets such as equities/shares, currencies, derivatives, commodities, and digital assets. Derivatives can be further broken down into futures, forwards, options, and swaps (Derivative 2020).

Market data can be either real-time or historical (de Prado 2018). Real-time data are used to make real-time trading decisions about buying and selling market instruments. Historical data are used to analyze historical trends and make informed decisions regarding future investments. Typically, historical data can contain intraday or end-of-day data summaries. The granularity of real-time data can be as detailed as a fraction of a second, with some tolerance for short delays. Comparing data for the same period, the frequency of a real-time data feed is expected to be much higher than historical data.

We can further separate market data, based on the details it contains, into Level I and Level II market data. Level II data contains more information and provides detailed information on bids and offers at prices other than the highest price (Zhang et al. 2019). Level I data generally contain the basic trading data discussed thus far. Level II data are also referred to as order book or depth of book because they show details of orders that have been placed but not yet filled. These data also show the number of contracts available at different bid and ask prices.

2.2.2 Fundamental data

Unlike market data, where data directly relate to trading activity on the asset of interest, fundamental data are based on information about the company the asset is attached to Christina Majaski (2020). Such data depict the company’s standing using information such as cash flow, assets, liabilities, profit history, and growth projections. These kinds of information can be obtained from corporate documentation such as regulatory filings and quarterly reports. Care has to be taken to confirm whether fundamental data points are publicly available because these are typically reported with a lapse. This means that analyzing the data must align properly with the date it became publicly available and not necessarily the date the report was filed or indexed.

Notably, some fundamental data are reported with some data yet to be made available, becoming backfilled upon availability. When fundamental data are published before source data becomes available, placeholder values are used during the interim period. Furthermore, given companies can issue revisions or corrections to sources multiple times, these will need to be corrected in the fundamental data, which suggests the need to incorporate a backfilling technique into the data consumption design. By definition, the frequency of this kind of data is very low compared to market data. This might explain why limited DL literature employs fundamental data. However, this also indicates the existence of a gap in research utilizing this kind of data, which would ideally be filled by considering fundamental data alongside other data types to provide a significant learning signal that remains to be fully exploited.

2.2.3 Alternative data

Alternative data represents any other unconventional data type that can add value to already-established sources and types (de Prado 2018). This can range from user-generated data (e.g., social media posts, financial news, and comments) to Internet-of-Things data (e.g., data from different sensors and devices). Alternative data typically complement the aforementioned data types, especially market data. Given the nature of alternative data, they are typically much larger, hence requiring a sophisticated processing technique.

Notably, alternative data includes a vast amount of data that is open to interpretation because the signal might not be immediately obvious. For example, a market participant interested in Apple Inc. stocks might choose to observe different news articles related to the company. Although there might be no direct reports about the company releasing a new product line, news reports about key meetings or large component purchases can indicate the plausibility of action. Accordingly, stock market professionals and researchers have become attentive to such indirect signals, and now consider alternative data essential to their data pipeline. Numerous researchers now combine traditional data types with either or both news article and social media content to make market predictions. Social media especially has become a very popular alternative data type, primarily due to its position in the mainstream.

Table 3 presents certain representative attributes of the different data types. All of the attributes associated with market data and fundamental data are numerical and aggregated based on the available time series. For example, the intraday market data entry in row 1 of Table 2 shows the open and close prices for a one-hour time window that begins at 10 am and ends at 10:59 am. It also includes the maximum and minimum price and the total volume traded within the same window (Table 3).

A fourth data type known as Analytics data (de Prado 2018), describes data derived from any of the other three types. Attributes of analytics data are earnings projections or sentiments from news or tweets that are combined with trade volume. We have chosen not to include this category because it does not clearly represent a direct source, and it is usually unclear what heuristics have been used to obtain the derived data points. Furthermore, given the objective of academic research is to make the metrics explicit, it is counter-intuitive to consider them useable input.

Table 4 presents the characteristics of the data employed by the literature reviewed, including the aforementioned data types. It is apparent that market data represents the most common type, with actual trading prices and volumes often paired with fundamental data to compute technical indicators (Soleymani and Paquet 2020; Wang et al. 2019b). Table 5 presents a more complete representation of freely or publicly available data sources that fully itemizes attributes.

Sources including investing.com, finance.yahoo.com and kaggle.com utilize either API or libraries, facilitating interactions with them and unlocking better integration with the ML system. Sources without any programmatic interface usually make data available as manual downloadable files.

The other major factor that affects the preferred data source is the frequency of availability, for example, whether the data is available multiple times a day (intraday data) or once a day (interday data). Given the potential volume and size of historical data, it is common for intraday data to remain available for a shorter timeframe than interday data, especially for freely available data sets. However, in most cases, it is possible to pay for intraday data for a longer timeframe if required for lower latency projects.

2.3 Data representation

Data generated from the stock market are typically represented as Bars and Charts. It is worth discussing these representations because they represent the most typical forms of representing data either numerically (bars) or graphically (charts).

2.3.1 Bars

Bars enable extraction of valuable information from market data in a regularized manner (de Prado 2018). They categorize futures into standard and more advanced types, with the advanced types comprising derivative computation from standard types. However, standard types are more common and also form the basis of chart representation.

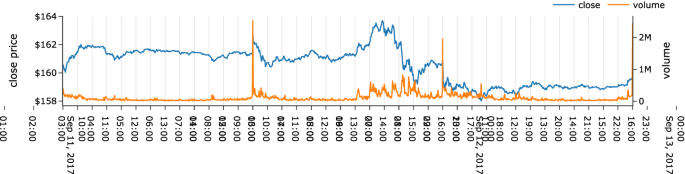

Standard bars help to summarize market data into equivalent intervals and can be used with both intraday and historical data (Fig. 1). The different types of standard bars all typically contain certain basic information for the specified interval, including the timestamp, Volume-Weighted Average Price (VWAP), open price, close price, high price, low price, and traded volume, all within the specified interval. The VWAP is based on the total traded for the day, irrespective of the time interval, and is computed as \(\sum price \cdot volume/\sum volume\). The different standard bars are described in the following paragraphs.

Intraday tick time series showing trade price and volume within the trading hours, across 2 days (Investing.com 2013)

Time bars This is the most common bar type and derives from summarizing data into an equivalent time interval that includes all of the aforementioned standard bar information. Intraday hourly time bars feature hourly standard bar information for every hour of the day. For historical data, it is common to obtain details for each day. Table 2 exemplifies intraday time bars that can capture information.

The VWAP assists by demonstrating the trend for the price of a traded item during a given day. This single-day indicator is reset at the start of each trading day and should not be used in the context of daily historical data.

Tick bars Unlike time bars that capture information at regular time intervals, tick bars capture the same information at a regular number of transactions or ticks. Ticks are trades in the stock market that can be used to represent the movement of price in trading data (i.e., the uptick and downtick). Ticks are commonly used for different stages of modeling market data, as in the case of backtesting. However, historical stock market data are not as freely accessible in the form of tick bars, especially for academic research purposes. For this purpose, most of the literature reviewed uses time bars, despite its statistical inferiority for predictive purposes.

Volume bars Although tick bars exhibit better statistical properties than time bars (i.e., they are closer to independent distribution), they still feature the shortcoming of uneven distribution and propensity for outliers (de Prado 2018). This can be because a large volume of trade is placed together from accumulated bids in the order book, which gets reported as a single tick, or because orders are equally recorded as a unit, irrespective of size. That is, an order for 10 shares of a security and an order for 10,000 shares are both recorded as a single tick. Volume bars help to mitigate this issue by capturing information at every predefined volume of securities. Although volume bars feature better statistical properties than tick bars (Easley et al. 2012), they are similarly seldom used in academic research.

Range bars Range bars involve information being captured when a predefined monetary range is traded. They are also referred to as dollar bars (de Prado 2018). Range bars are particularly useful because, by nature, securities appreciate or depreciate constantly over a given period. Consider a security that has depreciated by 50% over a certain period; by the end of that period, it is possible to purchase twice as much as at the beginning. For instance, consider a security that has depreciated from $100 to $50 over a given period. A capital investment of $1000 would only have obtained 10 units at the start of the depreciation period; however, at the end of the period, that investment can obtain 20 units. Furthermore, corporate actions (e.g., splits, reverse splits, and buy-backs) do not impact range bars to the extent that they impact ticks and volume bars.

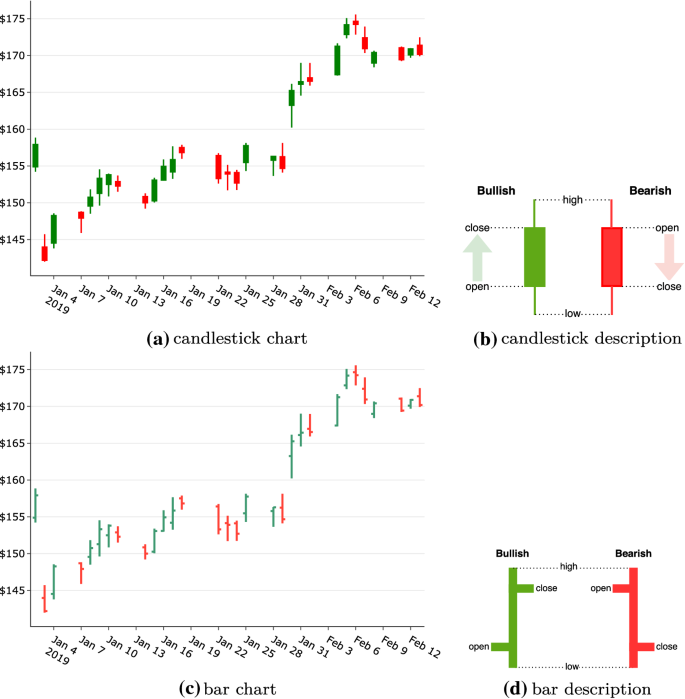

2.3.2 Charts

Charts visually represent the aforementioned bars, especially time bars. It might not be clear how these are relevant to a survey of DL applications in the stock market context, given it is possible to use the actual data that the charts are based on. However, various novel applications have used charts as training data. For example, (Kusuma et al. 2019) uses the candlestick plot chart as the input image for a Convolutional Neural Network (CNN) algorithm. The charts most commonly used to visually represent stock market data are line, area, bar, and candlestick charts. Of interest here, however, are the candlestick and bar charts, which visually encode valuable information that can be used as input for DL algorithms.

Candlestick and bar charts can visually represent Open-High-Low-Close (OHLC) data, as Figure 3 shows. These two types of charts are optionally color-coded, with red indicating bearish (closing lower than it opened) and green indicating bullish (closing higher than it opened). By properly encoding this information into these charts, an algorithm such as CNN can interpret numerous signals to generate an intelligent model.

2.4 Lessons learned

The distinctive structure and differential representations of stock market data cannot be overestimated. This section considers some of these differences, especially those used in stock-market implementations of ML algorithms using DL. Understanding data characteristics based on specific use cases can determine a given data set’s suitability for the intended use case. By understanding the different types of data used in the stock market, we can refer to the data types needed, which closely relate to their characteristics. For example, given the nature of alternative data, we can expect it to feature significant volume, especially in comparison to fundamental data.

The frequency of data also varies significantly by type. Understanding the granularity of the intended task enables determination of the frequency of the data to be obtained. For example, intraday market data will be required for modeling tasks requiring minute- or hour-level data. This also affects the volume of data required. It is interesting to note data representation, especially market data. The required frequency guides data representation as summarized time bars rather than tick-by-tick data.

Chart representations of market data also provide novel ways of learning from visual representations. Candlestick and bar charts convey information at a rich and detailed level worthy of exploitation as a learning source. Nonetheless, this is accompanied by the complex task of consuming the image rather than the data that it is based upon and, although (Kusuma et al. 2019) used a candlestick chart for this purpose, the authors failed to compare the performance with the performance using the raw data. It would be interesting to observe comparisons of results for raw data and visual representations of that same data.

3 Deep learning for stock market applications

3.1 What is deep learning?

Deep learning describes an ML technique based on networks of simple concepts and featuring different arrangements or architecture that allows computers to learn complicated concepts from simple nodes that are graphically connected using multiple layers (Goodfellow et al. 2016). The resurgence of DL was led by probabilistic or Bayesian models such as Deep Belief Networks (DBN) (Hu et al. 2021; Goodfellow et al. 2016), which comprise nodes representing random variables with probabilistic relationships to each other. More recently, however, Artificial Neural Networks (ANN) that comprise nodes representing neurons that are generated by the training process have witnessed increasing popularity. All of the architectures we encounter in this survey are based on ANN; this section details these architectures.

Generally speaking, ANN are information processing systems with designs based on the human nervous system, specifically the brain, and that emphasize problem-solving (Castro 2006). Typically, they comprise many simple processing elements with adaptive capabilities that can process a massive amount of information in tandem. Given neurons are the basic units for information processing in the brain, their simplified abstraction forms the foundation of ANN. The features and performance characteristics that ANN share with the human nervous system are (Castro 2006):

-

1.

The initial information processing unit occurs in elements known as neurons, nodes or units.

-

2.

Neurons can send and receive information from both each other and the environment.

-

3.

Neurons can be connected, forming a connection of neurons that can be described as neural networks.

-

4.

Information is transmitted between neurons via connection links called synapses.

-

5.

The efficiency of synapses, represented by an associated weight value or strength, corresponds, in aggregate, to the information stored in the neural network.

-

6.

To acquire knowledge, connective strengths (aggregated weight values) are adapted to the environmental stimuli, a process known as learning.

Patterns are created by the information stored between neurons, which represents their synaptic or connective strength (Goodfellow et al. 2016). Knowledge is represented to influence the course of processing, which becomes a part of the process itself. This invariably means that learning becomes a matter of finding the appropriate connective strength to produce satisfactory activation patterns. This generates the possibility that an information processing mechanism can learn by tuning its connective strength during the processing course. This representation also reveals that knowledge is distributed over the connections between numerous nodes, meaning no single unit is reserved for any particular pattern.

Thus, an ANN can be summarized according to these three key features:

-

1.

A set of artificial neurons, also known as nodes, units, or neurons.

-

2.

A method for determining weight values, known as training or learning techniques.

-

3.

A pattern of connectivity, known as the network architecture or structure.

The following sections detail these three features.

3.1.1 Artificial neurons

A biological neuron primarily comprises a nucleus (or soma) in a cell body and neurites (axons and dendrites) (Wikipedia 2020b). The axons send output signals to other neurons, and the dendrites receive input signals from other neurons. The sending and receiving of signals take place at the synapses, where the sending (or presynaptic) neuron contacts the receiving (or postsynaptic) neuron. The synaptic junction can be at either the cell body or the dendrites. This means that the synapses are responsible for signal/information processing in the neuron, a feature that allows them to alter the state of a postsynaptic neuron, triggering an electric pulse (known as action potential) in that neuron. The spikes cause the release of neurotransmitters at the axon terminals, which form synapses with the dendrites of other neurons. The action potential only occurs when the neuron’s intrinsic electric potential (known as membrane potential) surpasses a threshold value.

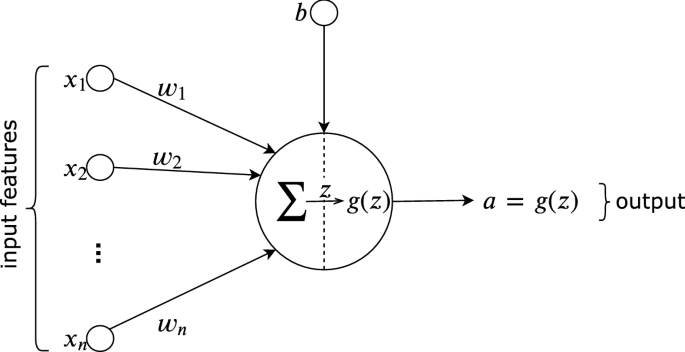

An artificial neuron attempts to emulate these biological processes. In an artificial neuron, the synapse that connects the input to the rest of the neuron is known as a weight, characterized by synaptic strength, synaptic efficiency, connection strength, or weight value. Figure 4 show a typical artificial neuron.

Model of a typical neuron (Castro 2006)

As each input connects to the neuron, it is individually multiplied by the synaptic weight at each of the connections, which are aggregated in the summing junction. The summing junction adds the product of all of the weighted inputs with the neuron’s bias value, i.e., \(z = \sum \mathbf {wx}+ b\). The images essentially represent this. The activation function (also referred to as the squashing function) is represented as \(g(z)\) and has the primary role of limiting the permissible value of the summation to some finite value. It determines a neuron’s output relative to its net input, representing the summing junction’s output. Thus, the neuron’s consequent output, also known as the activation (\(a\)), becomes:

During the learning process, it is common to randomly initialize the weights and biases. These parameters are used by the activation to compute the neuron’s output. In this simple representation of one neuron, we can imagine that the output (prediction) of the neuron is compared with the input (true value) using a loss function to generate the error rate. Through an optimization method called Stochastic Gradient Descent, the error rate is propagated back to the network, a process called backpropagation (Rumelhart et al. 1986). This process is repeated over multiple iterations or epochs until a defined number of iterations is achieved or the error rate falls below a satisfactory threshold.

Multiple types of activation functions (Wikipedia 2020b) are used across different neural network architectures. The Rectified Linear Unit (ReLU) activation function has been more popular in recent applications of Feed-Forward Neural Networks (FFNN) because it is not susceptible to the vanishing gradient issue (Wikipedia 2020c), which impacts use of the sigmoid function across multiple layers. It is also more computationally efficient. Other ReLU generalizations, such as Leaky ReL or Parametric ReLU (PReLU) are also commonly used. However, sigmoid continues to be used as a gating function in recurrent networks to maintain values between 0 and 1, hence controlling what passes through a node (Goodfellow et al. 2016). The hyperbolic tangent (tanh) activation function is also commonly used in recurrent networks, keeping the values that pass through a node between − 1 and 1 (Goodfellow et al. 2016).

3.1.2 Learning techniques

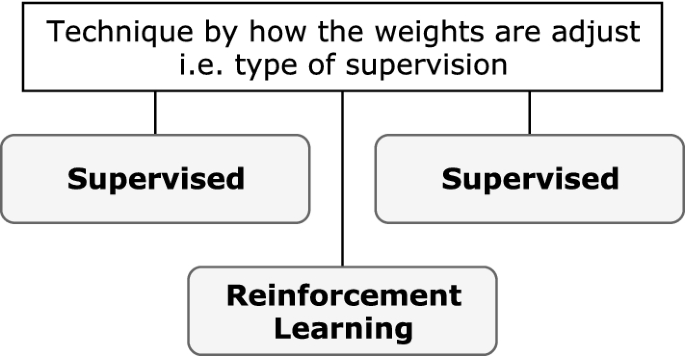

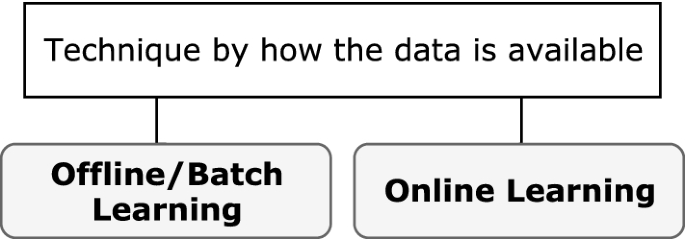

In the ANN context, learning refers to the way a network’s parameters adapt according to the input data. Typically, the learning technique is based on how weights are adjusted in the network and how data is made available to the network (Figs. 5, 6).

-

Technique based on weight adjustment: The most common learning technique category, this technique is based solely on how weights are adjusted across an iterative process and is dependent on the type of supervision available to the network during the training process. The different types are supervised, unsupervised (or self-organized), and reinforcement learning.

-

Technique based on data availability: When categorized according to how data is presented to the network, the learning technique can be considered offline or online. This technique might be chosen because the complete data are not available for training in one batch. This could be because either data are streaming or a concept in the data changes at intervals, requiring the data to be processed in specific time windows. Another reason could be that the data are too large to fit into the memory, demanding processing in multiple smaller batches.

Techniques based on supervision are most common for DL (and indeed DL), with increasing studies adopting batch learning approaches. Nonetheless, the primary architecture of DL networks is not exclusive to one technique category; instead, it is typical to find a mix of both, i.e., offline supervised learning and online reinforcement learning. Unless otherwise specified, it can be assumed that the technique is offline/batch learning. For example, supervised learning refers to offline supervised learning unless it is specified as online. The key point is that each supervision-based technique can be further categorized according to data availability.

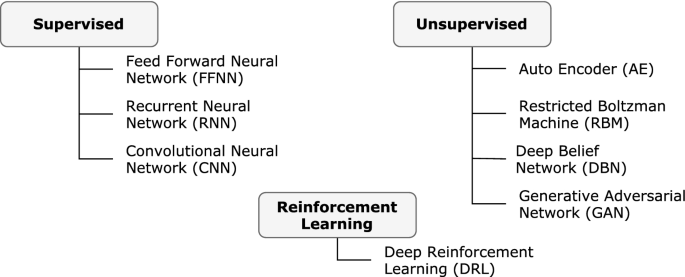

3.1.3 Network architecture

The architecture of an ANN importantly contributes to the ways that it is organized. Network inputs depend solely on training data, and, for the most part, the output represents a function of the expected output. The layers between the input and output are mostly a design decision that depends largely on the network architecture, which is based on a typical neural network’s system of multiple connections. Numerous ANN architectures exist across various domains, including communication systems and healthcare (Aceto et al. 2019; O’Shea and Hoydis 2017; Xiao 2021), with the stock market applications this survey considers adopting even more derivative architectures with easily identifiable and well-known foundations. Figure 7 presents these architectures and their common categorizations based on how they learn weight parameters). The following section describes their differences.

The learning techniques based on these architectures can be either discriminative or generative. A discriminative model discriminates between different data classes by learning the boundaries between them or the conditional probability distribution \(p(y|x)\); meanwhile, a generative model learns the distribution of individual classes or joint probability distribution \(p(x,y)\) (Hinton 2017). Although most traditional ANN architectures are discriminative, autoencoders and BoltzMann machine are considered generative. In a Generative Adversarial Network (Hinton 2017), the two techniques are combined in a novel adversarial manner.

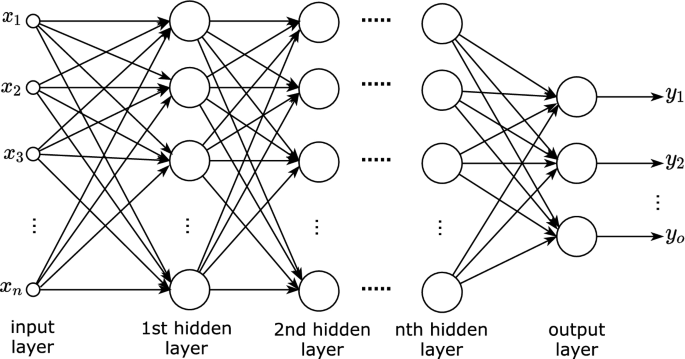

3.1.3.1 Feed-forward neural networks

Comprising multiple neurons connected in layers, DL architectures use FFNN widely. Figure 8 presents the architecture of an FFNN. It comprises an input layer, representing the input example, one or more hidden layers, and an output layer (Goodfellow et al. 2016).

n-layer feed-forward neural network (Castro 2006)

Although Goodfellow et al. (2016) suggest that “a single layer is sufficient to represent a function”, hey also recommend deeper layers for better generalization. Ideally, the number of hidden layers should be decided for the specific task via experimentation. The input layer comprises a feature vector representing the input example that is fed to the first hidden layer. The hidden layer(s) and the output layer comprise multiple neurons, each with a vector of weights of the same size as the input, as well as a bias value. Within the layers, each neuron’s output becomes the input for the next layer, until, finally, the output layer uses the final activation to represent the model’s prediction.

Broadly, this process aims to derive a generalization about the weights and biases associated with each neuron in the network, that is, derive generalizable values of \({\mathbf {w}}, b\) to compute \(z = \sum \mathbf {wx}+ b\) for each neuron (with input \({\mathbf {x}}\)) in the network. Using an iterative training process of forward and backward propagation over multiple examples (training data), each layer’s activations are propagated forward across the network, and the error rate is propagated back to the first hidden layer. Following the learning process, the network (model) can then be used to predict unseen/untested examples.

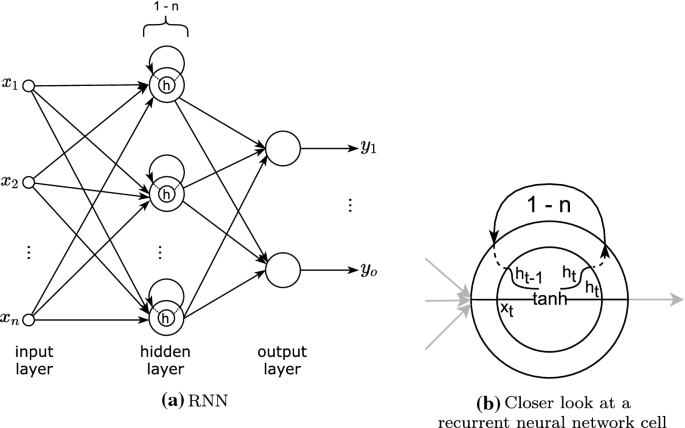

3.1.3.2 Recurrent neural network

Recurrent Neural Network (RNN) are a special type of neural network that keeps a representation of the previously seen input data. These networks are ideal for processes where the temporal or sequential order of the input example is relevant (Goodfellow et al. 2016).

RNN (Goodfellow et al. 2016)

The recurrence is represented as a loop in each neuron, as Fig. 9 shows, allowing one or more passes of the same input, with the network maintaining a state representation of each pass. Following the specified number of passes, the final state is transmitted as output parameters. This means that RNN allow the possibility of inputs and outputs of variable length. That is, given the loop’s flexibility, the architecture can be constructed to be one-to-one, one-to-many, many-to-one, or many-to-many.

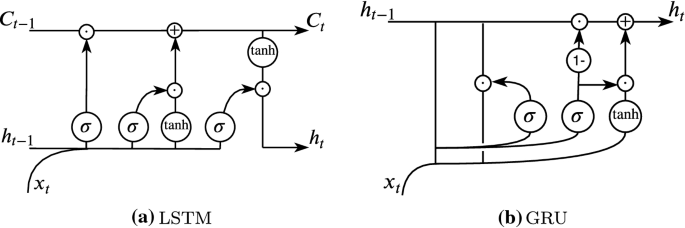

However, typical RNN, make it difficult for the hidden state to retain information over a long period. That is, they have a short memory due to the gradient becoming smaller and smaller as it is propagated backward in time steps across the recurring loop, a phenomenon known as vanishing gradient. This means that for temporal data, in which the relevant relationship between data points occurs over a lengthy period, a typical RNN model is not ideal. Thus, other versions of RNN have been formulated, with the most frequently used approaches being Long Short-term Memory (LSTM) lstm and Gated Recurrent Unit (GRU) (Goodfellow et al. 2016). The architectures discussed can largely reduce the vanishing gradient effect by maintaining a cell state via additive updates rather than just the RNN hidden state with product updates (Fig. 10).

LSTM & GRU (Goodfellow et al. 2016)

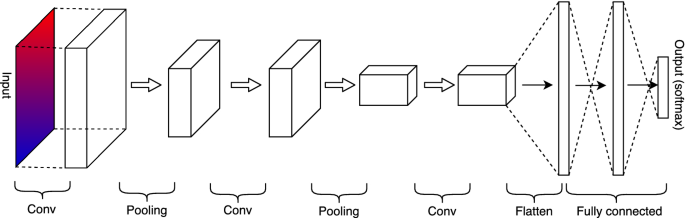

3.1.3.3 Convolutional neural networks

Another network architecture type that has gained substantial popularity, especially for analyzing digital images, is CNN (Goodfellow et al. 2016). The reason is that CNN can simplify large amounts of pixel density, vastly reducing the number of parameters to work with, making the ANN highly efficient. Unlike more conventional ANN, in which the input is represented as a feature vector, CNN represent the input as a matrix, which they use to generate the first convolutional layer.

Architecture of a convolutional neural network (Goodfellow et al. 2016)

A typical CNN will contain one or more convolutional layers, each connected to its respective pooling layer. Figure 11 provides a simple representation of such a network.

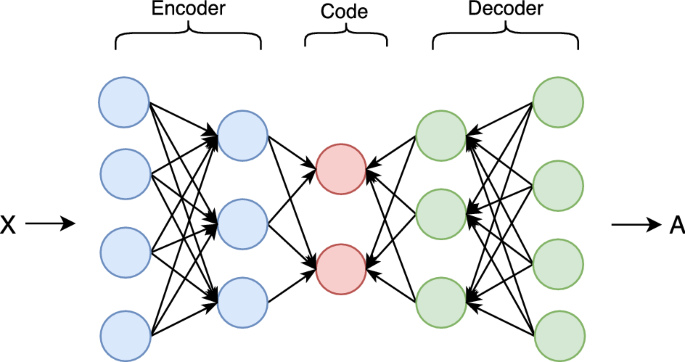

3.1.3.4 Autoencoder

Autoencoders are unsupervised ANN that efficiently encode input data, a process known as latent representation or encoding. This process involves using input data as a feature vector and attempting to reconstruct the same data using fewer nodes than the input (Goodfellow et al. 2016). As such, autoencoders are frequently used for dimensionality reduction.

A simple Autoencoder (Goodfellow et al. 2016)

As Fig. 12, shows, an autoencoder’s architecture imposes a bottleneck for encoding the input representation. A decoder layer subsequently reproduces an output to represent the reconstructed input. In so doing, it learns a representation of the input data while ignoring the input noise. The encoder’s representation of the transformed input is referred to as the emphcode, code, and it is the internal or hidden layer of the autoencoder. The decoder subsequently generates the output from the code.

Autoencoders are commonly used in stock market data for their dimension reduction functionality (Chen et al. 2018a; Chong et al. 2017) to avoid dimensionality curse (Soleymani and Paquet 2020). This is an important consideration for stock market data, where there is value in network simplicity without losing important features. In Soleymani and Paquet (2020), a restricted stacked autoencoder network reduces an 11 feature set to a three feature set before it is fed into a CNN architecture in a deep reinforcement learning framework called DeepBreath. This enables an efficient approach to a portfolio management problem in a setting that combines offline and online learning. Elsewhere, (Hu et al. 2018a) combines CNN and autoencoder architectures in its Convoluted Autoencoder (CAE) to reduce candlestick charts to numerical representations to improve stock similarity.

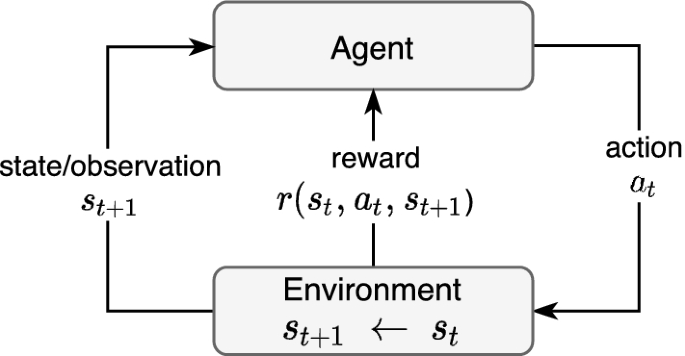

3.1.3.5 Deep Reinforcement Learning

Unlike supervised and unsupervised learning, in which all learning occurs within the training dataset, a Reinforcement Learning (RL) problem is formulated as a discrete-time stochastic process. The learning process interacts with the environment via an iterative sequence of actions, state transitions, and rewards, in a bid to maximize the cumulative reward (François-Lavet et al. 2018). The future state depends only on the current state and action, meaning it learns using a trial-and-error reinforcement process in which an agent incrementally obtains experience from its environment, thereby updating its current state (Fig. 13). The action to take (from the action space) by the agent is defined by a policy.

Reinforcement Learning (François-Lavet et al. 2018)

It is common to see a RL system formulated as a Markov decision process Markov decision process (MDP) in which the system is fully observable, i.e., the state of the environment is the same as the observation that the agent perceives (François-Lavet et al. 2018). Furthermore, RL can be categorized as model-based or model-free (Russell and Norvig 2010).

-

Model-based reinforcement learning The agent retains a transition model of the environment to enable it to select actions that maximize the cumulative utility. The agent learns a utility function that is based on the total rewards from a starting state. It can either start with a known model (i.e., chess) or learn by observing the effects of its actions.

-

Model-free reinforcement learning The agent does not retain a model of the environment, instead focusing on directly learning how to act in different states. This could be via either an action-utility function (Q-learning) that learns the utility of taking an action in a given state or a policy-search in which a reflex agent directly learns to map policy, \(\pi (s)\), from different states to corresponding actions.

Deep Reinforcement Learning (DRL) is a deep representation of RL that can be model-based, model-free, or a combination of the two (Ivanov and D’yakonov 2019). The stock market can be considered to feature an DRL characteristic, with past states well-encapsulated in current states and events and the only requirement for future states being the current state. For this reason, DRL is a particularly popular approach for modern quantitative analysis of the stock market. Applications of DRL in these scenarios vary from profitable/value stock selection or portfolio allocation strategy (Wang et al. 2019b; Li et al. 2019) to simulating market trades in a bid to develop optimal liquidation strategy (Bao and Liu 2019).

3.2 Using deep learning in the stock market

In Section 3.1, we considered what DL is and discussed certain specific DL architectures that are commonly used in stock market applications. Although we referred to certain specific uses of these network types that are employed in the stock market, it is important to note that all of the architectures mentioned are also commonly used for other applications. However, some specific considerations must be kept in mind when the stock market is the target. These range from the model’s composition to backtesting and evaluation requirements and criteria. Some of these items do not correspond to a traditional ML toolbox but are crucial to stock market models and cannot be ignored, especially given the monetary risks involved.

This section first discusses the specifics of modeling considerations for stock market applications. It also discusses backtesting as an integral part of the process, and details some backtesting methodology. This is followed by a review of the different evaluation criteria and evaluation types.

3.2.1 Modeling considerations

When training an ML model for most applications, we consider how bias and variance affect the model’s performance, and we focus on establishing the tradeoffs between the two. Bias measures how much average model predictions differ from actual values, and variance measures the model’s generalizability and its sensitivity to changes in the training data. High degrees of bias suggest underfit, and high levels of variance suggest overfit. It is typical to aim to balance bias and variance for an appropriate model fit that can be then applied to any unseen dataset, and most ML applications are tuned and focused accordingly.

However, in financial applications, we must exceed these to avoid some of the following pitfalls, which are specific to financial data.

3.2.1.1 Sampling intervals

Online ML applications typically feature sampling windows in consistent chronological order. While this is practical for most streaming data, it is not suitable for stock market data and can produce substantial irregularities in model performance. As Fig. 2 demonstrates, the volume of trade in the opening and closing period is much higher than the rest of the day for most publicly available time-based market data. This could result from pre-market or after-hours trading and suggests that sampling at a consistent time will inadvertently undersample the market data during high-activity periods and undersample during low-activity periods, especially when modeling for intraday activities.

A possible solution is using data that has been provided in ticks, but these are not always readily available for stock market data without significant fees, potentially hindering academic study. Tick data can also make it possible to generate data in alternative bars, such as tick or volume bars, significantly enhancing the model performance. Notably, (Easley et al. 2012) uses the term volume clock to formulate volume bars to align data sampling to volume-wise market activities. This enables high-frequency trading to have an advantage over low-frequency trading.

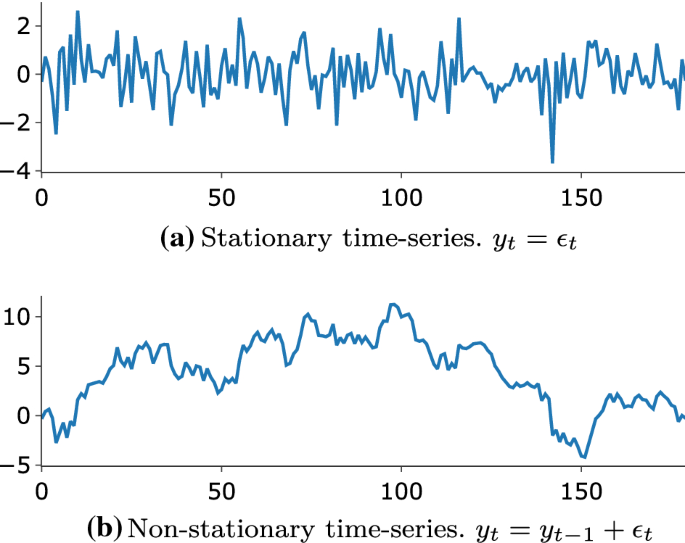

3.2.1.2 Stationarity

Time-series data are either stationary or non-stationary. Stationary time-series data preserve the statistical properties of the data (i.e., mean, variance, covariance) over time, making them ideal for forecasting purposes (de Prado 2018). This implies that spikes are consistent in the time series, and the distribution of data across different windows or sets of data within the same series remains the same. However, because stock market data are non-stationary, statistical properties change over time and within the same time series. Also, trends and spikes in non-stationary time series are not consistent. By definition, such data are difficult to model because of their unpredictability. Before any work on such data, it is necessary to render them as stationary time series (Fig. 14).

A common approach to converting non-stationary time series to stationary time series involves differencing. This can involve either computing the difference between conservative observations or, for seasonal time series, the difference between previous observations of the same season. This approach is known as integral differencing, with (de Prado 2018) discussing fraction differencing as a memory-preserving alternative that produces better results.

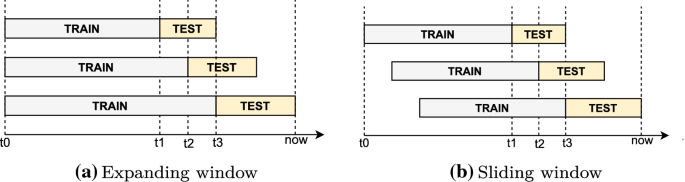

3.2.1.3 Backtesting

In ML, it is common to split data into training and testing sets during the modeling process. Given the goal of this exercise is to determine the accuracy or evaluate performance in some other way, it follows that adhering to such a conventional approach is appropriate. However, when modeling for the financial market, performance is measured by the model’s profitability or volatility of the model. According to Arnott et al. (2018), there should be a checklist or Protocol that mandates that ML research include the goal of presenting proof of positive outcomes through backtesting.

Opacity and bias in AI systems represent two of the overarching debates in AI ethics (Müller 2020). Although a significant part of the conversation concerns the civil construct, it is clear that the same reasoning applies to other economic and financial AI applications. For example, (Müller 2020) raises concerns about statistical bias and the lack of due process and auditing surrounding using ML for decision-making. This relates to conversations about honesty in backtesting reports and the selection bias that typically affects academic research in the financial domain (Fabozzi and De Prado 2018).

In the context of DL in the stock market, backtesting involves building models that simulate trading strategy using historical data. This serves to consider the model’s performance and, by implication, helps to discard unsuitable models or strategies, preventing selection bias. To properly backtest, we must test on unbiased and sufficiently representative data, preferably across different sample periods or over a sufficiently long period. This positions backtesting among the most essential tools for modeling financial data. However, it also means it is among the least understood in research (de Prado 2018).

When a backtested result is presented as part of a study, it demonstrates the consistency of the approach across various time instances. Recall that overfitting in ML describes a model performing well on training data but poorly on test or unseen data, indicating a large gap between the training error and the test error (de Prado 2018). Thus, when backtesting a model on historical data, one should consider the issue of backtest overfitting, especially during walk-forward backtesting (de Prado 2018).

Walk-forward is the more common backtesting approach and refers to simulating trading actions using historical market data—with all of the actions and reactions that might have been part of that—in chronological time. Although this does not guarantee future performance on unseen data/events, it does allow us to evaluate the system according to how it would have performed in the past. Figure 15 shows two common ways of formulating data for backtesting purposes. Formulating the testing process in this manner removes the need for cross-validation because training and testing would have been evaluated across different sets. Notably, traditional K-fold cross-validation is not recommended in time series experiments such as this, especially when the data is not Independent and Identically Distributed (IID) (Bergmeir and Benítez 2012; Zaharia et al. 2010).

Backtesting must be conducted in good faith. For example, given backtest overfitting means that a model is overfitted to specific historical patterns, if favorable results are not observed, researchers might return to the model’s foundations to improve generalizability. That is, researchers are not expected to fine-tune an algorithm in response to specific events that might affect its performance. For example, consider overfitting a model to perform favorably in the context of the 1998 recession, and then consider how such a model might perform in response to the 2020 COVID-19 market crash. By backtesting using various historical data or over a relatively long period, we modify our assumptions to avoid misinterpretations.

3.2.1.4 Assessing feature importance

In discussing backtesting, we have discussed why we shouldn’t selectively “tune” a model to specific historical scenarios to achieve a favorable performance to challenge the usefulness of the knowledge gained from the model’s performance in such experiments. Feature Importance becomes relevant here. Feature importance enables the measurement of the contribution of input features to a model’s performance. Given neural networks are typically considered “black-box” algorithms, the movement around explanation AI contributes to the interpretation of the output of the network and understanding of the importance of the constituent features, as observed in the important role of Feature Importance Ranking in Samek et al. (2017), Wojtas and Chen (2020). Unlike traditional ML algorithms, this is a difficult feat for ANN models, typically requiring a separate network for the feature ranking.

3.2.2 Model evaluation

Machine learning algorithms use evaluation metrics such as accuracy and precision. This is because we are trying to measure the algorithm’s predictive ability. Although the same remains relevant for ML algorithms for financial market purposes, what is ultimately measured is the algorithm’s performance with respect to returns or volatility. The works reviewed include various performance metrics that are commonly used to evaluate an algorithm’s performance in the financial market context.

Recall that in Sect. 3.2.1 emphasized the importance of avoiding overfitting when backtesting. It is crucial to be consistent with backtesting different periods and to be able to demonstrate consistency across different financial evaluations of models and strategies. Returns represents the most common financial evaluation metric for obvious reasons. Namely, it measures the profitability of a model or strategy (Kenton 2020). It is commonly measured in terms of rate during a specific window of time, such as day, month, or year. It is also common to see returns annualized over various years, which is known as Compound Annual Growth Rate (CAGR). When evaluating different models across different time windows, higher returns indicate a better model performance.

However, it is also important to consider Volatility because returns alone do not relay the full story regarding a model’s performance. Volatility measures the variance or how much the price of an asset can increase or decrease within a given timeframe (Investopedia 2016). Similar to returns, it is common to report on daily, monthly, or yearly volatility. However, contrary to returns, lower volatility indicates a better model performance. The The Volatility Index (VIX), a real-time index from the Chicago Board Options Exchange (CBOE), is commonly used to estimate the volatility of the US financial market at any given point in time (Chow et al. 2021). The VIX measures the US stock market volatility based on its relative strength compared to the S &P 500 index, with measures between 0 and 12 considered low, measures between 13 and 19 considered normal, and measures above 20 considered high.

Building on the information derived from returns and volatility, the Sharpe ratio enables investors to identify little-to-no-risk investments by comparing investment returns with risk-free assets such as treasury bonds (Hargrave 2019). It measures average returns after accounting for risk-free assets per volatility unit. The higher the Sharpe ratio, the better the model’s performance. However, the Sharpe ratio features the shortcoming of assuming the data’s normal distribution due to the upward price movement. TheSortino ratio can mitigate against this, differing by using only the standard deviation of the downward price movement rather than the full swing that the Sharpe ratio employs.

Other commonly used financial metrics are MDD and the Calmar ratio, both of which are used to assess the risk involved in an investment strategy. Maximum drawdown describes the difference between the highest and lowest values between the start of a decline in peak value to the achievement of a new peak value, which indicates losses from past investments (Hayes 2020). The lower the MDD, the better the strategy, with zero value suggesting zero loss in investment capital. The Calmar ratio measures the MDD adjusted returns on capital to gauge the performance of an investment strategy. The higher the Calmar ratio, the better the strategy.

Another metric considered important by the works reviewed was VaR, which measures risk exposure by estimating the maximum loss of an investment over time using historical performance (Harper 2016).

Meanwhile, other well-known non-financial ML metrics commonly used are based on the accuracy of a model’s prediction. These metrics are calculated in terms of either the following confusion matrix or in terms of the difference between the derived and observed target values.

Predicted | ||||

|---|---|---|---|---|

Positive | Negative | Total | ||

Actual | Positive | TP | FP | P |

Negative | FN | TN | N | |

Total | \(P'\) | \(N'\) | \(P+N\) | |

True Positive (TP) and True Negative (TN) are the correctly predicted positive and negative classes respectively. Subsequently, False Positive (FP) and False Negative (FN) are the incorrectly predicted positive and negative classes (Han et al. 2012).

The evaluation metrics in Table 7 are expected to be used as complementary metrics to the primary and more specific financial metrics in Table 6. This is because the financial metrics can evaluate various investment strategies in the context of backtested data, which the ML metrics are not designed for. Section 4 demonstrates how these different evaluation metrics are combined across the works of literature that we reviewed (Table 7).

3.2.3 Lessons learned

This section has reviewed different types of deep ANN architectures that are commonly used in the stock market literature considering DL. The ANN landscape in this context is vast and evolving. We have focused on summarizing these architectures on the basis of their recurrence across different areas of specialization within the stock market. Explicitly recalling the architectures used should assist explanations of their usage as we proceed to our findings in Sect. 4.

We have similarly detailed the expectations of modeling for the financial market and how these differ from the traditional ML approach, an important consideration for the rest of the survey. That is, although it is worthwhile applying methodologies and strategies across different areas of a discipline to advance scientific practice, we should endeavor to also attend to established practice and the reasoning behind that practice. This includes also understanding the kinds of metrics that should be used. In conducting this survey, we identified several works that used only ML metrics, such as accuracy and F-score, as evaluation metrics (Ntakaris et al. 2019; Lee and Yoo 2019; Kim and Kang 2019; Passalis et al. 2019; Ganesh and Rakheja 2018). Although this might be ideal for complementary metrics, the performance of an algorithm or algorithmic strategy must ultimately be relevant to the study domain. By more deeply exploring intra-disciplinary research in the computer science field, we begin to understand the space we open up and the value we confer in the context of established processes.

By highlighting various considerations and relevant metrics, we trust that we have facilitated computer science research’s exploration of ideas using stock market data and indeed contributed to the research in the broader econometric space. The next section presents this survey’s culmination, discussing how the findings relate to the previously discussed background and attempting to answer the study’s research questions and demonstrating the criteria employed to shortlist the literature reviewed.

4 Survey findings

4.1 Research methodology

This research work set out to investigate applications of DL in the stock market context by answering three overarching research questions:

Question 1

What current research methods based on deep learning are used in the stock market context?

Question 2

Are the research methods consistent with real-world applications, i.e., have they been backtested?

Question 3

Is this research easily reproducible?

Although many research works have used stock market data with DL in some form, we quickly discovered that many are not easily applicable in practice due to how the research has been conducted. Although we retrieved over 10,000 worksFootnote 1, by not being directly applicable, most of the experiments are not formulated to provide insight for financial purposes, with the most common formulation being as a traditional ML problem that assumes that it is sufficient to break the data into training and test sets.

Recall that we categorized learning techniques by data availability in Sect. 3.1.2. When the complete data are available to train the algorithm, it is defined as offline or batch learning. When that is not the case, and it is necessary to process the data in smaller, sequential phases, as in streaming scenarios or due to changes in data characteristics, we categorize the learning technique as online. Although ML applications in the stock market context are better classified as online learning problems, surprisingly, very few research papers approach the problem accordingly, instead mostly approaching it as an offline learning problem, a flawed approach (de Prado 2018).

To apply this approach to financial ML research for the benefit of market practitioners, the provided insight must be consistent with established domain norms. One generally accepted approach to achieving this is backtesting the algorithm or strategy using historical data, preferably across different periods (Bergmeir and Benítez 2012; Institute 2020). Although Sect. 3.2.1 discussed backtesting, we should re-iterate that backtesting does not constitute a “silver bullet” or a method of evaluating results. However, it does assist evaluation of the performance of an algorithm across different periods. Financial time-series data are not IID, meaning the data distribution differs across different independent sets. This also means that there is no expectation that results across a particular period will produce similar performances in different periods, no matter the quality of the presented result. Meanwhile, the relevant performance evaluation criteria are those that are financially specific, as discussed in Sect. 3.2.2. To this end, we ensured that the papers reviewed provide some indication of consideration of backtesting. An ordinary reference sufficed, even if the backtested results are not presented.

We used Google Scholar (Google 2020) as the search engine to find papers matching our research criteria. The ability to search across different publications and the sophistication of the query syntax (Ahrefs 2020) was invaluable to this process. While we also conducted spot searches of different publications and websites to validate that nothing was missed by our chosen approach, the query results from Google Scholar proved sufficient, notably even identifying articles that were missing from the results of direct searches on publication websites. We used the following query to conduct our searches:

“deep learning” AND “stock market” AND (“backtest” OR “back test” OR “back-test”)

This query searches for publications including the phrases “deep learning”, “stock market”, and any one of “backtest”, “back test” or “back-test”. We observed these three different spellings of “backtest” in different publications, suggesting the importance of catching all of these alternatives. This produced 185 resultsFootnote 2, which include several irrelevant papers. For validation, we searched using Semantic Scholar (Scholar 2020), obtaining approximately the same number of journal and conference publications. We chose to proceed with Google Scholar because Semantic Scholar does not feature such algebraic query syntax, requiring that we search for the different combinations of “backtest” individually with the rest of the search query.

The search query construct provided us with the starting point for answering research questions (1) and (2). Then, we evaluated the relevance to the research objective of the 185 publications and considered how each study answered question (3). We objectively reviewed all query responses without forming an opinion on the rest of their experimental procedure with the rationale that addressing the basic concerns of a typical financial analyst represents a good starting point. Consequently, we identified only 35 papers as relevant to the research objective. Table 8 quantifies the papers reviewed by publication and year of publication. It is interesting to observe the non-linear change in the number of publications over the last 3 years as researchers have become more conscious of some of these considerations

4.2 Summary of findings

Section 3.1.3 explained the different architectures of the deep ANN that are commonly used in stock market experiments. Based on the works reviewed, we can categorize the algorithms into the following specializations:

-

Trade Strategy: Algorithmically generated methods or procedures for making buying and selling decisions in the stock market.

-

Price Prediction: Forecasting the future value of a stock or financial asset in the stock market. It is commonly used as a trading strategy.

-

Portfolio Management: Selecting and managing a group of financial assets for long term profit.

-

Market Simulation: Generating market data under various simulation what-if market scenarios.

-

Stock Selection: Selecting stocks in the stock market as part of a portfolio based on perceived or analyzed future returns. It is commonly used as a trading or portfolio management strategy.

-

Risk Management: Evaluating the risks involved in trading, to maximize returns.

-

Hedging Strategy: Mitigating the risk of investing in an asset by taking an opposite investment position in another asset.

Although a single specialization is usually the primary area of focus for a given paper, it is common to see at least one other specialization in some form. An example is testing a minor trade strategy in price prediction work or simulating market data for risk management. Table 9 illustrates the distribution of the different DL architectures across different areas of specialization for the studies reviewed by this survey. Architectures such as LSTM and DRL are more commonly used because of their inherent temporal and state awareness. In particular, lstm is favorable due to its relevant characteristic of remembering states over a relatively long period, which price prediction and trade strategy applications, in particular, require. Novel use cases (e.g., (Wang et al. 2019b) combine LSTM and RL to perform remarkably well in terms of annualized returns. There are many such combinations in trade strategy and portfolio management, where state observability is of utmost importance.

Although FFNN is seldom used by itself, there are multiple instances of it being used alongside other approaches, such as CNN and RNN. Speaking of CNN, it is surprising how popular it is, considering it is more commonly used for image data. True to its nature, attempts have been made to train models using stock market chart images (Kusuma et al. 2019; Hu et al. 2018a). Given its ability to localize features, CNN is also used with high-frequency market data to identify local time series patterns and extract useful features (Chong et al. 2017). Autoencoders and Restricted Boltzmann machine (RBM) are also used for feature extraction, with the output fed into another kind of deep neural network architecture (Table 10).

We further examined the evaluation metrics used by the reviewed works. Recall that Sect. 3.2.2 presented the different financial and ML evaluation metrics observed by our review. As Table 11 shows, returns constitute the most commonly used comparison measure for obvious reasons, especially for trade strategy and price prediction; the most common objective is profit maximization. It is also common to see different derivations of returns across different time horizons, including daily, weekly, and annual returns (Wang et al. 2019c; Théate and Ernst 2020; Zhang et al. 2020a).

Although ML metrics such as accuracy and MSE are typically combined with financial metrics, it is expected that the primary focus remains financial metrics; hence, these are the most commonly observed.

The following observations can be made based on the quantified evaluation metrics presented in Table 11:

-

Returns is the most common financial evaluation metric because it can more intuitively evaluate profitability.

-

Maximum drawdown and Sharpe ratio are also common, especially for trade strategy and price prediction specialization.

-

The Sortino and Calmar ratios are not as common, but they are useful, especially given the Sortino ratio improves upon the Sharp ratio, and the Calmar ratio adds metrics related to risk assessment. Furthermore, neither is computationally expensive.

-

For completeness, some studies include ML evaluation metrics such as accuracy and precision; however, financial evaluation metrics remains the focus when backtesting.

-

Mean square error is the more common error type used (i.e., more common than MAE or MAPE).

4.2.1 Findings: trade strategy

A good understanding of the current and historical market state is expected before making buying and selling decisions. Therefore, it is understandable that DRL is particularly popular for trade strategy, especially in combination with LSTM. The feasibility of using DRL for stock market applications is addressed in Li et al. (2020), which also articulates the credibility of using it for strategic decision-making. That paper compares implementations of three different DRL algorithms with the Adaboost ensemble-based algorithm, suggesting that better performance is achieved by using Adaboost in a hybrid approach with DRL.

The authors of Wang et al. (2019c) address challenges in quantitative financing related to balancing risks, the interrelationship between assets, and the interpretability of strategies. They propose a DRL model called AlphaStock that uses LSTM for state management to address the issue. For the interrelationship amongst assets, (Vaswani et al. 2017) proposes a Cross-Asset Attention Network (caan) using an Attention Network. This research uses the buy-winners-and-sell-losers (BWSL) trading strategy and is optimized on the Sharpe ratio, evaluating performance according to profit and risk. The approach demonstrates good performance for commutative wealth, performing over three times better than the market. Although there could be some questions regarding the way the training and test sets were divided, especially given cross-validation was not used, this work demonstrates an excellent implementation of a DL architecture using stock market data.

Elsewhere, (Théate and Ernst 2020) maximizes the Sharpe ratio using a state-of-the-art DRL architecture called the Trading Deep Q-Network (TQDN) and also proposes a performance assessment methodology. To differentiate from the Deep Q-Network (DQN), which uses a CNN algorithm as the base, the TQDN uses an FFNN along with certain hyperparameter changes. This is compared with common baseline strategies, such as buy-and-hold, sell-and-hold, trend with moving average, and reversion with moving average, producing the conclusion that there is some room for performance improvements. Meanwhile, (Zhang et al. 2020d) uses DRL as a trading strategy for futures contracts from the Continuously Linked Commodities (CLC) database for 2019. Fifty futures are investigated to understand how performance varies across different classes of commodities and equities. The model is trained specifically for the output trading position, with the objective function of maximizing wealth. While the literature also includes forex and other kinds of assets, we focused on stock/equities. Other DRL applications include (Chakole and Kurhekar 2020), which combines DRL with FFNN, and (Wu et al. 2019), which combines DRL with LSTM.

Among non-DRL architectures, the most common we observed were CNN and LSTM. In Hu et al. (2018b), Candlestick charts are used as input for a CAE, primarily to capture non-linear stock dynamics, and long periods of historical data are represented as charts. The algorithm starts by clustering stocks by sector and selects top stocks based on returns within each cluster. This procedure outperforms the FTSE 100 index over 2,000 backtested trading days. It would be interesting to observe how this compares to using the numbers directly instead of using the chart representation.

Given Moving Average Convergence/Divergence (MACD) is known to perform worse than expected in a stable market (Lei et al. 2020), uses uses Residual Network (ResNet), a layer-skipping mechanism, to improve its effectiveness. The authors propose a strategy called MACD-KURT, which is based on ResNet as an algorithm and Kurtosis as a prediction target. Meanwhile, (Chen et al. 2018b) uses a filterbank to generate 2D visualizations using historical time series data. Fed into CNN for pair trading strategy, this helps to improve accuracy and profitability. It is also common to observe LSTM-based strategies, either for converting futures into options (Wu et al. 2020), in combination with Autoencoders for training market data (Koshiyama et al. 2020), or in more general trade strategy applications (Sun et al. 2019; Silva et al. 2020; Wang et al. 2020; Chalvatzis and Hristu-Varsakelis 2020).

4.2.2 Findings: price prediction

The Random Walk Hypothesis, popularized by Malkiel (1973), suggests that stock price changes in random ways, similar to a coin toss, precluding prediction. However, because price changes are influenced by factors other than historical price, numerous papers and practical applications combine all of these to attempt to obtain some insight into price movement. Given the temporal nature of buying and selling, the price prediction specialization also requires some degree of historical context. For this reason, RNN and LSTM are, unsurprisingly, often relied on. However, what is surprising is the novel use of CNN for this purpose, either as an independent algorithm or in combination with RNN algorithms.