Abstract

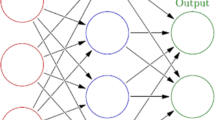

The nature of the financial time series is complex, continuous interchange of stochastic and deterministic regimes. Therefore, it is difficult to forecast with parametric techniques. Instead of parametric models, we propose three techniques and compare with each other. Neural networks and support vector regression (SVR) are two universally approximators. They are data-driven non parametric models. ARCH/GARCH models are also investigated. Our assumption is that the future value of Istanbul Stock Exchange 100 index daily return depends on the financial indicators although there is no known parametric model to explain this relationship. This relationship comes from the technical analysis. Comparison shows that the multi layer perceptron networks overperform the SVR and time series model (GARCH).

Similar content being viewed by others

References

Ancona N (1999) Classification properties of support vector machines for regression. Technical report Istituto Elaborazioni Segnali ed Immagini – Consiglio Nazionale delle Ricerche, Bari, Italy. RI-IESI/CNR- Nr 02/99

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econ 31:307–327

Chen A, Leung MT, Daouk H (2003) Application of neural networks to an emerging market: forecasting and trading the taiwan stock index. Comput Oper Res 30:901–923

Chong CW, Ahmad MI, Abdullah MY (1999) Performance of garch models in forecasting stock market volatility. J Forecast 18:333–343

Collobert R, Bengio S (2001) Svmtorch: Support vector machines for large-scale regression problems. J Mach Learning Res 1:143–160

Cortes C, Vapnik V (1995) Support vector networks. Mach Learn 20:273–297

Dourra H, Siy P (2002) Investment using technical analysis and fuzzy logic. Fuzzy Sets Syst 127:221–240

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of the united kingdom inflation. Econometrica 50:987–1008

Engle RF, Bollerslev T (1986) Modelling the persistence of conditional variances. Econ Rev 5:1–87

Engle RF, Lilien DM, Robins RP (1987) Estimating time varying risk premia in the term structure: The arch-m model. Econometrica 55:391–407

Galindo J (1998) A framework for comperative analysis of statistical and machine learning methods: An application to the black scholes option pricing equations. Techincal report Banco de Mexico, Mexico, DF, 04930

Gestel TV, Suykens J, Baesens B, Viaene S, Vanthienen J, Dedene G, Moor BD, Vandewalle J (2004) Benchmarking least squares support vector machine classifiers. Mach Learn 54:5–32

Haykin S (1994) Neural networks: a comprehensive foundation. MacMillan, New York

Herwartz H (2000) Weekday dependence of german stock market. Applied Stochastic Models in Busines and Industry 16:47–71

Hutchinson JM, Lo AW, Poggio T (1994) A nonparametic approach to pricing and hedging derivative securities via learning networks. J Finance XLIX:851–889

Joachims T (1999) Making large-scale SVM learning practical. pp 169–184, MIT Press, Cambridge

Kim K-J (2004) Artificial neural networks with feature transformation based on domain knowledge for the prediction of stock index futures. Intell Syst Account Finance Manage 12:167–176

Lamoureux CG, Lastrapes WD (1990) Persistence in variance, structural change and the garch model. J Bus Econ Stat 8:225–234

Lee Y-J, Mangasarian O (2001) Rsvm: Reduced support vector machines. First SIAM International Conference on Data Mining

Leigh W, Paz M, Purvis R (2002) An analysis of a hybrid neural network and pattern recognition technique for predicting short-term increases in the nyse. Int J Manage Sci 30:69–76

Letamendia LN (2002) Trading systems designed by genetic algorithms. Manager Finance 28:87–106

Lim G, McNelisb P (1998) The effect of the nikkei and the S and P on the all-ordinaries: A comparison of three models. Int J Finance Econ 3:217–228

Nelson DB (1990) Arch models as diffusion approximations. J Econometrics 45:7–38

Nelson DB, Cao CQ (1992) Inequality constraints in the univariate garch model. J Bus Econ Stat 10:229–235

Osuna E, Freund R, Girosi F (1997) Training support vector machines: an application to face detection. In: Proceedings of IEEE CVPR, pp 130–136

Pontil M, Verri A (1997) Properties of support vector machines. Technical report Massachusetts Institute of Technology, Artificial Intelligence Laboratory

Rifkin R (2000) Svmfu a support vector machine package. Technical report http://five-percentnation.mit.edu/PersonalPages/rif/SvmFu

Smola A, Schölkopf B (2004) A tutorial on support vector regression. Statistics and Computing 14:192–222

Steiner M, Wittkemper H (1997) Portfolio optimization with a neural network implementation of the coherent market hypothesis. Eur J Oper Res 100:27–40

Suykens JAK (2000) Least squares support vector machines for classification and nonlinear modelling. Neural Network World 10:29–48

Tay FEH, Cao L (2002) Modified support vector machines in financial time series forecasting. Neurocomputing 48:847–861

Trafalis T (1999) Artificial Neural Networks Applied to Financial Forecasting. In: Dagli, Buczak, Ghosh, Embrechts and Ersoy (eds). Smart engineering system design: neural networks, fuzzy logic, evolutionary programming, data Mining and Complex Systems. ASME Press, New York, pp 1049–1054

Trafalis TB, Ince H (2002) Benders decomposition technique for support vector regression. In: Neural networks, IJCNN ’02. Proceedings of the 2002 International Joint Conference, IEEE, vol. 3, pp 2767–2772

Trafalis TB, Ince H, Mishina T (2003) Support vector regression in option pricing. In: Procedings of Conference on Computational Intelligence and Financial Engineering (CIFer 2003), Hong Kong

Tsaih R (1999) Sensitivity analysis, neural networks and, the finance. In: IICNN’99 pp 3830–3835. Piscataway

Vapnik V (1998) Statistical learning theory. Wiley, New York

Wilder JW (1978) New concepts in technical trading systems. Trend Research, Greensboro, NC

Yao J, Tan CL (2000) A case study on using neural networks to perform technical forecasting of forex. Neurocomputing 34:79–98

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ince, H. Non-Parametric Regression Methods. CMS 3, 161–174 (2006). https://doi.org/10.1007/s10287-005-0006-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-005-0006-4