Abstract

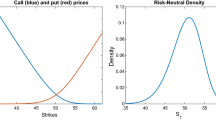

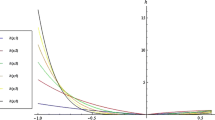

The main objective of this paper is to analyse the value of information contained in prices of options on the IBEX 35 index at the Spanish Stock Exchange Market. The forward looking information is extracted using implied risk-neutral density functions estimated by a mixture of two-lognormals and several alternative risk adjustments. Our results show that, between October 1996 and March 2000, we can reject the hypothesis that the risk-neutral densities provide accurate predictions of the distributions of future realisations of the IBEX 35 index at 4- and 8-week horizons. When forecasting through risk-adjusted densities the performance of this period is statistically improved and we no longer reject that hypothesis. We show that risk adjustments based on a power specification for the stochastic discount factor—which is the approach used so far in the literature that derives the objective density function from option prices- generates an excessive volatility of risk premia. We use alternative risk adjustments and find that the forecasting performance of the distribution improves slightly in some cases when risk aversion is allowed to be time-varying. Finally, from October 1996 to December 2004, the ex-ante risk premium perceived by investors and that are embedded in option prices is between 12 and 18% higher than the premium required to compensate the same investors for the realised volatility in stock market returns.

Similar content being viewed by others

References

Aït-Sahalia Y, Lo A (2000) Nonparametric risk management and implied risk aversion. J Econom 94: 9–51

Aït-Sahalia Y, Wang Y, Yared F (2001) Do option markets correctly price the probabilities of movement of the underlying asset?. J Econom 102: 67–110

Alonso F, Blanco R, Rubio G (2005) Testing the forecasting performance of IBEX 35 option-implied risk-neutral densities, Documentos de Trabajo no. 0505, Banco de España

Anagnou I, Bedendo M, Hodges S, Tompkins R (2005) Forecasting accuracy of implied and GARCH-based probability density functions. Rev Futures Mark 11: 41–66

Berkowitz J (2001) Testing density forecasts with applications to risk management. J Bus Econ Stat 19: 465–474

Black F (1976) The pricing of commodity contracts. J Financ Econ 3: 167–179

Bliss R, Panigirtzoglou N (2004) Option-implied risk aversion estimates. J Finance 59: 407–446

Breeden D, Litzenberger R (1978) Prices of state contingent claims implicit in option prices. J Bus 51: 621–652

Brier G (1950) Verification of forecast expressed in terms of probability. Mon Rev 75: 1–3

Brown P, Jackwerth JC (2004) The pricing kernel puzzle: reconciling index option data and economic theory, Working Paper, University of Wisconsin at Madison, Finnace Department, School of Business

Cambpell J, Cochrane J (1999) By force of habit: A consumption-based explanation of aggregate stock market behaviour. J Pol Econ 107: 205–251

Campa J, Chang K, Reider R (1998) Implied exchange rate distributions: evidence from OTC option markets. J Int Money Finance 17: 117–160

Chen X, Ludvigson S (2004) Land of addicts? An empirical investigation of habit-based asset pricing models, Working Paper, Department of Economics, New York University

Craig B, Glatzer E, Keller J, Scheicher M (2003) The forecasting performance of German stock option densities, Discussion Paper 17, Studies of the Economic Research Centre, Deutsche Bundesbank

Ghysels E, Santa-Clara P, Valkanov R (2005) There is a risk-return tradeoff after all. J Financ Econ 76: 509–548

Jackwerth J (2000) Recovering risk aversion from option prices and realised returns. Rev Financ Stud 13: 433–451

Kang B, Kim T (2006) Option-implied risk preferences: an extension to wider classes of utility functions. J Financ Mark 9: 180–198

León A, Nave J, Rubio G (2007) The relationship between risk and expected return in Europe. J Bank Finance 31: 495–512

Liu X, Shackleton M, Taylor S, Xu X (2007) Closed-form transformations from risk-neutral to real-world distributions. J Bank Finance 31: 1501–1520

Melick W, Thomas C (1997) Recovering an asset’s implied PDF from option prices: an application to crude oil during the Gulf crisis. J Financ Quant Anal 32: 91–115

Menzly L, Santos T, Veronesi P (2004) Understanding predictability. J Pol Econ 112: 1–47

Pérignon C, Villa C (2002) Extracting information from options markets: smiles, state-price densities and risk aversion. Eur Financ Manag 8: 495–513

Rosenberg J, Engle R (2002) Empirical pricing kernels. J Financ Econ 64: 341–372

Santa-Clara P, Yan S (2005) Crashes, Volatility, and the Equity Premium: Lessons from S&P 500 Options, Working Paper, The Anderson School of Business, University of California at Los Angeles

Seillier-Moiseiwisch F, Dawid P (1993) On testing the validity of sequential probability forecasts. J Am Stat Assoc 88: 355–359

Shackleton M, Taylor S, Yu P (2008) A multi-horizon comparison of density forecasts for the S&P500 using index returns and option prices, Working Paper, Department of Accounting and Finance, Lancaster University, England

Ziegler A (2003) Why does risk aversion smile? Working Paper, University of Lausanne

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Alonso, F., Blanco, R. & Rubio, G. Option-implied preferences adjustments, density forecasts, and the equity risk premium. Span Econ Rev 11, 141–164 (2009). https://doi.org/10.1007/s10108-008-9049-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10108-008-9049-3