Abstract

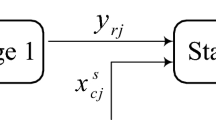

The interest rate liberalization (IRL) policy reform in China intends to improve performance of financial institutions. However, the actual effect of the reform is still unclear since China accelerated the reform of interest rate liberalization in 2012. Based on a two-stage network data envelopment analysis (DEA) approach, we evaluate the overall efficiency, fund-raising efficiency and fund-using efficiency of Chinese commercial banks using a data set of 27 commercial banks from 2006 to 2020. Then we further examine the impact of interest rate liberalization on bank efficiency by using Tobit regression. The results show that interest rate liberalization is conductive to the promotion of bank efficiency. However, the positive effect does not appear in the whole production process. It is only reflected in the fund-raising stage. Interest rate liberalization seems to hinder the improvement of fund-using efficiency, which is worth the attention of Chinese commercial banks. Finally, we conclude with several policy implications based on the findings in this paper.

Similar content being viewed by others

Notes

Other fundings mainly includes Deposits from Banks, Repos and Cash Collateral, Trading Liabilities and Derivatives.

Securities investment mainly includes Trading Securities and at FV through Income, Derivatives, Available for Sale Securities, Held to Maturity Securities, At-equity Investments in Associates and Other Securities.

RMB deposit rate, RMB loan rate, Foreign currency deposit rate, Foreign currency loan rate, Interbank offered rate, Bill discount rate, Bond issuing rate, Bond repo rate, Coupon trading rate, Bank financial product yield, Monetary fund yield, and Trust product yield.

The annual reports of commercial banks are collected from the internet by the authors, and are available from the corresponding author on reasonable request.

Data sources: www.govindicators.org.

References

Abiad A, Detragiache E, Tressel T (2010) A new database of financial reforms. IMF Staff Pap 57(2):281–302. https://doi.org/10.1057/imfsp.2009.23

Abiad A, Mody A (2005) Financial reform: what shakes it? What shapes it? Am Econ Rev 95(1):66–88. https://doi.org/10.1257/0002828053828699

Akther S, Fukuyama H, Weber WL (2013) Estimating two-stage network slacks-based inefficiency: an application to Bangladesh banking. Omega 41(1):88–96. https://doi.org/10.1016/j.omega.2011.02.009

An H, Zhang F (2017) Innovation driven, interest rate marketization and efficiency improvement of banking. Reform 3:139–149 ((in Chinese))

An Q, Chen H, Wu J, Liang L (2015) Measuring slacks-based efficiency for commercial banks in China by using a two-stage DEA model with undesirable output. Ann Oper Res 235(1):13–35. https://doi.org/10.1007/s10479-015-1987-1

Andries AM, Capraru B (2013) Impact of financial liberalization on banking sectors performance from central and eastern european countries. PLoS ONE 8(3):e59686. https://doi.org/10.1371/journal.pone.0059686

Ang JB, McKibbin WJ (2007) Financial liberalization, financial sector development and growth: evidence from Malaysia. J Dev Econ 84(1):215–233. https://doi.org/10.1016/j.jdeveco.2006.11.006

Ariff M, Can L (2008) Cost and profit efficiency of Chinese banks: a non-parametric analysis. China Econ Rev 19(2):260–273. https://doi.org/10.1016/j.chieco.2007.04.001

Avkiran NK (2009) Opening the black box of efficiency analysis: an illustration with UAE banks. Omega 37(4):930–941. https://doi.org/10.1016/j.omega.2008.08.001

Bandiera O, Caprio G, Honohan P, Schiantarelli F (2000) Does financial reform raise or reduce saving? Rev Econ Stat 82(2):239–263. https://doi.org/10.1162/003465300558768

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98(2):175–212. https://doi.org/10.1016/S0377-2217(96)00342-6

Bhattacharyya A, Pal S (2013) Financial reforms and technical efficiency in Indian commercial banking: a generalized stochastic frontier analysis. Rev Financ Econ 22(3):109–117. https://doi.org/10.1016/j.rfe.2013.04.002

Boot AW (2000) Relationship banking: what do we know? J Financ Intermed 9(1):7–25. https://doi.org/10.1006/jfin.2000.0282

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2(6):429–444. https://doi.org/10.1016/0377-2217(78)90138-8

Chen XG, Skully M, Brown K (2005) Banking efficiency in China: application of DEA to pre-and post-deregulation eras: 1993–2000. China Econ Rev 16(3):229–245. https://doi.org/10.1016/j.chieco.2005.02.001

Chen Y, Wang Y (2015) The efficiency of China’s banking industry and the determinants. Int Econ J 29(4):631–653. https://doi.org/10.1080/10168737.2015.1095217

Chen Y, Li Y, Liang L, Salo A, Wu H (2016) Frontier projection and efficiency decomposition in two-stage processes with slacks-based measures. Eur J Oper Res 250(2):543–554. https://doi.org/10.1016/j.ejor.2015.09.031

Chen Y, Wang M, Yang J (2021) Measuring Chinese bank performance with undesirable outputs: a slack-based two-stage network DEA approach. in: data-enabled analytics. Springer, Cham, https://doi.org/10.1007/978-3-030-75162-3_11

Chortareas GE, Girardone C, Ventouri A (2013) Financial freedom and bank efficiency: evidence from the European Union. J Bank Financ 37(4):1223–1231. https://doi.org/10.1016/j.jbankfin.2012.11.015

Cook WD, Liang L, Zhu J (2010) Measuring performance of two-stage network structures by DEA: a review and future perspective. Omega 38:423–430. https://doi.org/10.1016/j.omega.2009.12.001

Dakpo KH, Jeanneaux P, Latruffe L (2016) Modelling pollution-generating technologies in performance benchmarking: Recent developments, limits and future prospects in the nonparametric framework. Eur J Oper Res 250(2):347–359. https://doi.org/10.1016/j.ejor.2015.07.024

Das A, Ghosh S (2006) Financial deregulation and efficiency: an empirical analysis of Indian banks during the post reform period. Rev Financ Econ 15(3):193–221. https://doi.org/10.1016/j.rfe.2005.06.002

Das A, Ghosh S (2009) Financial deregulation and profit efficiency: a nonparametric analysis of Indian banks. J Econ Bus 61(6):509–528. https://doi.org/10.1016/j.jeconbus.2009.07.003

Deng B, Casu B, Ferrari A (2014) The Impact of Deregulation and Re-regulation on Bank Efficiency: Evidence from Asia. In: Governance, Regulation and Bank Stability. Palgrave Macmillan, London, pp 100–128 https://doi.org/10.1057/9781137413543_6

Denizer CA, Dinc M, Tarimcilar M (2007) Financial liberalization and banking efficiency: evidence from Turkey. J Prod Anal 27(3):177–195. https://doi.org/10.1007/s11123-007-0035-9

Du K, Worthington AC, Zelenyuk V (2018) Data envelopment analysis, truncated regression and double-bootstrap for panel data with application to Chinese banking. Eur J Oper Res 265(2):748–764. https://doi.org/10.1016/j.ejor.2017.08.005

Färe R, Grosskopf S (2009) A comment on weak disposability in nonparametric production analysis. Am J Agr Econ 91(2):535–538. https://doi.org/10.1111/j.1467-8276.2008.01237.x

Fernández-Val I, Weidner M (2016) Individual and time effects in nonlinear panel models with large N. T J Econometrics 192(1):291–312. https://doi.org/10.1016/j.jeconom.2015.12.014

Fu XQ, Heffernan S (2007) Cost X-efficiency in China’s banking sector. China Econ Rev 18(1):35–53. https://doi.org/10.1016/j.chieco.2006.10.002

Fukuyama H, Matousek R (2018) Nerlovian revenue inefficiency in a bank production context: evidence from Shinkin banks. Eur J Oper Res 271(1):317–330. https://doi.org/10.1016/j.ejor.2018.05.008

Fukuyama H, Mirdehghan SM (2012) Identifying the efficiency status in network DEA. Eur J Oper Res 220(1):85–92. https://doi.org/10.1016/j.ejor.2012.01.024

Fukuyama H, Tan Y (2022) Implementing strategic disposability for performance evaluation: Innovation, stability, profitability and corporate social responsibility in Chinese banking. Eur J Oper Res 296(2):652–668. https://doi.org/10.1016/j.ejor.2021.04.022

Fukuyama H, Weber WL (2010) A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega 38(5):398–409. https://doi.org/10.1016/j.omega.2009.10.006

Fukuyama H, Weber WL (2015) Measuring Japanese bank performance: a dynamic network DEA approach. J Prod Anal 44(3):249–264. https://doi.org/10.1007/s11123-014-0403-1

Fukuyama H, Weber WL (2017) Measuring bank performance with a dynamic network Luenberger indicator. Ann Oper Res 250(1):85–104. https://doi.org/10.1007/s10479-015-1922-5

Garza-García JG (2012) Determinants of bank efficiency in Mexico: a two-stage analysis. Appl Econ Lett 19(17):1679–1682. https://doi.org/10.1080/13504851.2012.665589

Hao J, Hunter WC, Yang WK (2001) Deregulation and efficiency: the case of private Korean banks. J Econ Bus 53(2–3):237–254. https://doi.org/10.1016/S0148-6195(00)00051-5

Henriques IC, Sobreiro VA, Kimura H, Mariano EB (2020) Two-stage DEA in banks: terminological controversies and future directions. Expert Syst Appl 161:113632. https://doi.org/10.1016/j.eswa.2020.113632

Hermes N, Lensink R (2008) Does financial liberalization influence saving, investment and economic growth?. Evidence from 25 emerging market economies, 1973–96. In: Financial development, institutions, growth and poverty reduction. Palgrave Macmillan, London, pp 164–189 https://doi.org/10.1057/9780230594029_8

Hermes N, Meesters A (2015) Financial liberalization, financial regulation and bank efficiency: a multi-country analysis. Appl Econ 47(21):2154–2172. https://doi.org/10.1080/00036846.2015.1005815

Holod D, Lewis HF (2011) Resolving the deposit dilemma: a new DEA bank efficiency model. J Bank Financ 35(11):2801–2810. https://doi.org/10.1016/j.jbankfin.2011.03.007

Kao C (2014) Network data envelopment analysis: a review. Eur J Oper Res 239:1–16. https://doi.org/10.1016/j.ejor.2014.02.039

Kao C (2020) Decomposition of slacks-based efficiency measures in network data envelopment analysis. Eur J Oper Res 283(2):588–600. https://doi.org/10.1016/j.ejor.2019.11.021

Kao C (2022) A maximum slacks-based measure of efficiency for closed series production systems. Omega 106:102525. https://doi.org/10.1016/j.omega.2021.102525

Kumar S, Gulati R (2014) A survey of empirical literature on bank efficiency. In: Deregulation and Efficiency of Indian Banks. New Delhi, Springer, pp 119–165 https://doi.org/10.1007/978-81-322-1545-5_4

Kumbhakar SC, Wang D (2007) Economic reforms, efficiency and productivity in Chinese banking. J Regul Econ 32(2):105–129. https://doi.org/10.1007/s11149-007-9028-x

Lancaster T (2000) The incidental parameter problem since 1948. J Econometrics 95(2):391–413. https://doi.org/10.1016/S0304-4076(99)00044-5

Lee CC, Li X, Yu CH, Zhao J (2021) Does fintech innovation improve bank efficiency? Evidence from China’s banking industry. Int Rev Econ Financ 74:468–483. https://doi.org/10.1016/j.iref.2021.03.009

Liu JS, Lu LY, Lu WM, Lin BJ (2013) A survey of DEA applications. Omega 41(5):893–902. https://doi.org/10.1016/j.omega.2012.11.004

Lozano S (2016) Slacks-based inefficiency approach for general networks with bad outputs: an application to the banking sector. Omega 60:73–84. https://doi.org/10.1016/j.omega.2015.02.012

Ma J, Guan T (2018) Interest rate liberalization and reform of monetary policy framework. China financial publishing house, Beijing

Maudos J, Solís L (2009) The determinants of net interest income in the Mexican banking system: an integrated model. J Bank Financ 33(10):1920–1931. https://doi.org/10.1016/j.jbankfin.2009.04.012

McDonald J (2009) Using least squares and tobit in second stage DEA efficiency analyses. Eur J Oper Res 197(2):792–798. https://doi.org/10.1016/j.ejor.2008.07.039

McKinnon R I (1973) Money and Capital in Economic Development. Brookings Institution, Washington, D.C. https://doi.org/10.2307/40201473

Mehdiloo M, Podinovski VV (2019) Selective strong and weak disposability in efficiency analysis. Eur J Oper Res 276(3):1154–1169. https://doi.org/10.1016/j.ejor.2019.01.064

Mester LJ (1996) A study of bank efficiency taking into account risk-preferences. J Bank Financ 20:1025–1045. https://doi.org/10.1016/0378-4266(95)00047-X

Peng J, Wang S, Guan T (2016) Does interest rate liberalization narrow interest margins of commercial bank? Empirical evidence based on chinese banking industry. J Financ Res 7:48–63 (in Chinese)

Pham MD, Zelenyuk V (2018) Slack-based directional distance function in the presence of bad outputs: theory and application to Vietnamese banking. Empir Econ 54(1):153–187. https://doi.org/10.1007/s00181-017-1232-7

Pham MD, Zelenyuk V (2019) Weak disposability in nonparametric production analysis: a new taxonomy of reference technology sets. Eur J Oper Res 274(1):186–198. https://doi.org/10.1016/j.ejor.2018.09.019

Seiford LM, Zhu J (2002) Modeling undesirable factors in efficiency evaluation. Eur J Oper Res 142(1):16–20. https://doi.org/10.1016/S0377-2217(01)00293-4

Shamshur A, Weill L (2019) Does bank efficiency influence the cost of credit? J Bank Financ 105:62–73. https://doi.org/10.1016/j.jbankfin.2019.05.002

Shaw ES (1973) Financial Deepening in Economic Development. Oxford University Press, New York

Shi X, Li Y, Emrouznejad A, Xie J, Liang L (2017) Estimation of potential gains from bank mergers: a novel two-stage cost efficiency DEA model. J Oper Res Soc 68(9):1045–1055. https://doi.org/10.1057/s41274-016-0106-2

Shi X, Emrouznejad A, Yu W (2021) Overall efficiency of operational process with undesirable outputs containing both series and parallel processes: a SBM network DEA model. Expert Syst Appl 178:115062. https://doi.org/10.1016/j.eswa.2021.115062

Sufian F (2009) The determinants of efficiency of publicly listed Chinese banks: evidence from two-stage banking models. Macroecon Financ EME 2(1):93–133. https://doi.org/10.1080/17520840902726458

Tanna S, Luo Y, De Vita G (2017) What is the net effect of financial liberalization on bank productivity? A decomposition analysis of bank total factor productivity growth. J Financ Stabil 30:67–78. https://doi.org/10.1016/j.jfs.2017.04.003

Tao X, Chen M (2013) Measure and reform implications of China’s interest rate liberalization. J Zhongnan U Econ Law 3:74–79 (in Chinese)

Tecles PL, Tabak BM (2010) Determinants of bank efficiency: the case of Brazil. Eur J Oper Res 207(3):1587–1598. https://doi.org/10.1016/j.ejor.2010.06.007

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. Eur J Oper Res 130(3):498–509. https://doi.org/10.1016/S0377-2217(99)00407-5

Tone K, Tsutsui M (2009) Network DEA: a slacks-based measure approach. Eur J Oper Res 197(1):243–252. https://doi.org/10.1016/j.ejor.2008.05.027

Tone K, Tsutsui M (2014) Dynamic DEA with network structure: a slacks-based measure approach. Omega 42(1):124–131. https://doi.org/10.1016/j.omega.2013.04.002

Wang K, Huang W, Wu J, Liu YN (2014) Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 44:5–20. https://doi.org/10.1016/j.omega.2013.09.005

Wang S, Peng J (2014) The studies on the measurement and performance of China’s interest rate liberalization: empirical analysis based on the bank credit channel. J Financ Econ 29(06):75–85 (in Chinese)

Yang C, Liu HM (2012) Managerial efficiency in Taiwan bank branches: a network DEA. Econ Modell 29(2):450–461. https://doi.org/10.1016/j.econmod.2011.12.004

Zha Y, Liang N, Wu M, Bian Y (2016) Efficiency evaluation of banks in China: a dynamic two-stage slacks-based measure approach. Omega 60:60–72. https://doi.org/10.1016/j.omega.2014.12.008

Zhao T, Casu B, Ferrari A (2010) The impact of regulatory reforms on cost structure, ownership and competition in Indian banking. J Bank Financ 34(1):246–254. https://doi.org/10.1016/j.jbankfin.2009.07.022

Zhu J (2022) DEA under big data: data enabled analytics and network data envelopment analysis. Ann Oper Res 309:761–783. https://doi.org/10.1007/s10479-020-03668-8

Acknowledgements

This research was supported by National Natural Science Foundation of China [grant numbers 71871081, 72188101, 72071067, 71801074], Major Project of the National Social Science Foundation of China [grant number 18ZDA064]. These organizations are not responsible for the views expressed in this paper.

Author information

Authors and Affiliations

Contributions

Conceptualization HW, JY ; Methodology YC, JY; Software YC, JY; Validation YC, JY , WW ; Formal analysis: JY; Investigation JY; Resources JY; Data curation JY; Writing original draft JY; Writing review & editing, HW, YC, WW; Supervision, HW, YC; Project administration, HW, YC; Funding acquisition, HW, YC, WW.

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wu, H., Yang, J., Wu, W. et al. Interest rate liberalization and bank efficiency: A DEA analysis of Chinese commercial banks. Cent Eur J Oper Res 31, 467–498 (2023). https://doi.org/10.1007/s10100-022-00817-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-022-00817-1