Abstract

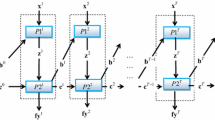

A dynamic two-stage network model of production incorporating financial regulatory constraints is developed and estimated for Japanese commercial banks. In the first stage of production bank managers use three desirable inputs (labor, physical capital, and equity capital) to produce two intermediate outputs-deposits and other raised funds. The first stage is constrained by the level of non-performing loans produced in a preceding period. In the second stage, the bank managers use the first stage intermediate outputs to produce desirable outputs of loans and securities investments and an undesirable output of non-performing loans. The dynamic framework allows resources to be allocated over time to maximize the production of desirable outputs and simultaneously minimize the production of undesirable outputs.

Similar content being viewed by others

Notes

The Japanese fiscal year begins April 1 and ends March 31 so that FY2010 uses data reported at the end of March 2011.

Note that if \(\beta^{t} ,\beta^{t + 1} ,\beta^{t + 2}\) are unrestricted, one or two of these may become negative.

Wang et al. (1997) were one of the first to treat deposits as an intermediate product in a two-stage problem, where their initial inputs are fixed assets, employees, IT investments, and others, and the final outputs are profits, loans recovered, and other investments. This framework is also used by Chen and Zhu (2004). Fukuyama and Weber’s (2010) framework incorporates Sealey and Lindley’s intermediation approach into a network model.

The account used for lending owned securities, including securities loaned on stock lending agreement.

We define time deposits as the categories of time deposits, installment deposits and negotiable CDs.

The deflator for calendar year 2005 = 100, but bank financial statements are the values at the end of March and hence we use that for fiscal year 2005 as the base year. Therefore, the deflator for fiscal year 2005 is not equal to 100 but 99.6.

See http://www.zenginkyo.or.jp/en/for the categorization of Japanese banking system.

References

Akther S, Fukuyama H, Weber WL (2013) Estimating two-stage network slacks-based inefficiency: an application to Bangladesh banking. OMEGA 41(1):88–96

Altunbas Y, Liu M, Molyneux P, Seth R (2000) Efficiency and risk in Japanese banking. J Bank Financ 58:826–839

Avkiran NK (2009) Removing the impact of environment with units-invariant efficient frontier analysis: an illustrative case study with intertemporal panel data. OMEGA 37:535–544

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98:175–212

Berger AN, Hanweck GA, Humphrey DB (1987) Competitive viability in banking: scale, scope and product mix economies. J Monet Econ 20:501–520

Bogetoft P, Färe R, Grosskopf S, Hayes K, Taylor L (2009) Dynamic network DEA: an illustration. J Oper Res Soc Jpn 52(2):147–162

Chambers RG, Chung Y, Färe R (1996) Benefit and distance functions. J Econ Theory 70:407–419

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions and Nerlovian efficiency. J Optim Theory Appl 98(2):351–364

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision making units. Eur J Oper Res 2:429–444

Chen C-M, van Dalen J (2010) Measuring dynamic efficiency: theories and an integrated methodology. Eur J Oper Res 203:749–760

Chen Y, Zhu J (2004) Measuring information technology’s indirect impact on firm performance. Inf Technol Manag J 5(1–2):9–22

Chen Y, Cook WD, Zhu J (2010) Deriving the DEA frontier for two-stage processes. Eur J Oper Res 202:138–142

Cook WD, Liang L, Zhu J (2010) Measuring performance of two-stage network structures by DEA: a review and future perspective. Omega 38:423–430

Drake L, Hall MJB (2003) Efficiency in Japanese banking: an empirical analysis. J Bank Financ 27:891–917

Drake L, Hall MJB, Simper R (2009) Bank modelling methodologies: a comparative non-parametric analysis of efficiency in the Japanese banking sector. Int J Financ Mark Inst Money 19:1–15

Emrouznejad A, Thanassoulis E (2005) A mathematical model for dynamic efficiency using data envelopment analysis. Appl Math Comput 160(2):363–378

Färe R, Grosskopf S (1996) Intertemporal production frontiers: with dynamic DEA. Kluwer Academic Publishers, Massachusetts

Färe R, Grosskopf S, Weber WL (2004) The effect of risk-based capital standards on profit efficiency in banking. Appl Econ 36:1731–1743

Färe R, Grosskopf S, Margaritis D, Weber WL (2012) Technological change and timing the reduction of greenhouse gas emissions. J Prod Anal 37:205–216

Farrell MJ (1957) The measurement of production efficiency. J R Stat Soc Series B Gen 120(Part 3):253–281

Fukuyama H, Sekitani K (2012) Decomposing the efficient frontier of the DEA production possibility set into a smallest number of convex polyhedrons by mixed integer programming. Eur J Oper Res 221(1):165–174

Fukuyama H, Weber WL (2008) Estimating inefficiency, technological change and shadow prices of problem loans for regional banks and Shinkin banks in Japan. Open Manag J 1:1–11

Fukuyama H, Weber WL (2009) A directional slacks-based measure of technical inefficiency. Socio Econ Plan Sci 43(4):274–287

Fukuyama H, Weber WL (2010) A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega 38(5):239–410

Fukuyama H, Weber WL (2012) Estimating two-stage network technology inefficiency: an application to cooperative Shinkin banks in Japan. Int J Oper Res Inf Syst 3(2):1–22

Fukuyama H, Weber WL (2013) A dynamic network DEA model with an application to Japanese cooperative Shinkin banks. Forthcoming in: Fotios Pasiouras (ed) Efficiency and productivity growth: modelling in the financial services industry. Wiley, London, Chapter 9

Goddard JA, Molyneux P, Wilson JOS (2001) European banking: efficiency, technology, and growth. John Wiley, New York

Hori K (2004) An empirical investigation of cost efficiency in Japanese banking: a non-parametric approach. Rev Monet Financ Stud 21:45–67

Kao C (2009) Efficiency measurement for parallel production systems. Eur J Oper Res 196:1107–1112

Kao C, Hwang SN (2008) Efficiency decomposition in two-stage data envelopment analysis: an application to non-life insurance companies in Taiwan. Eur J Oper Res 185(1):418–429

Lewis L, Sexton TR (2004) Network DEA: efficiency analysis of organizations with complex internal structure. Comput Oper Res 31(9):1365–1410

Liang L, Cook WD, Zhu J (2008) DEA models for two-stage processes: game approach and efficiency decomposition. Nav Res Logist 55:643–653

Liu J, Tone K (2008) A multistage method to measure efficiency and its application to Japanese banking. Socio-Econ Plan Sci 42(2):75–91

Montgomery H, Shimizutani S (2009) The effectiveness of bank recapitalization policies in Japan. Jpn World Econ 21:1–25

Nemoto J, Goto M (2003) Measurement of dynamic efficiency in production: an application of data envelopment analysis to Japanese electric utilities. J Prod Anal 19:191–210

Paradi JC, Rouatt S, Zhu H (2011) Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega 39:99–109

Park KH, Weber WL (2006) A note on efficiency and productivity growth in the Korean banking industry, 1992–2002. J Bank Financ 30:2371–2386

Saunders A, Cornett M (2011) Financial institutions management: a risk management approach, 7th edn. McGraw-Hill, Irwin

Sealey C, Lindley J (1977) Inputs, outputs, and a theory of production and cost at depository financial institutions. J Financ 32:1251–1266

Tone K, Tsutsui M (2009) Network DEA: a slacks-based measure approach. Eur J Oper Res 197:243–252

Tone K, Tsutsui M (2010) Dynamic DEA: a slacks-based measure approach. OMEGA 38:145–156

Wang CH, Gopal RD, Zionts S (1997) Use of data envelopment analysis in assessing information technology impact on firm performance. Ann Oper Res 73:191–213

Weber WL, Devaney M (1999) Bank efficiency, risk-based capital and real estate exposure: the credit crunch revisited. Real Estate Econ 27:1–25

Acknowledgments

We are grateful for the helpful and insightful suggestions of Rolf Färe, Robin Sickles and Kazuyuki Sekitani and two anonymous reviewers. We are also grateful to the Grant-in-Aid for Scientific Research from Culture, Sports, Science and Technology, Grant Numbers 23510165 (C) and 25282090 (B).

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Fukuyama, H., Weber, W.L. Measuring Japanese bank performance: a dynamic network DEA approach. J Prod Anal 44, 249–264 (2015). https://doi.org/10.1007/s11123-014-0403-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-014-0403-1

Keywords

- Data envelopment analysis

- Dynamic network model

- Two-stage system

- Japanese banks

- Carryover assets

- Efficiency

- Productivity

- Primal and dual forms