Abstract

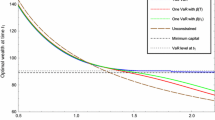

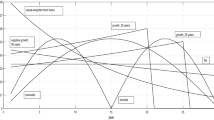

We discuss risk measures representing the minimum amount of capital a financial institution needs to raise and invest in a pre-specified eligible asset to ensure it is adequately capitalized. Most of the literature has focused on cash-additive risk measures, for which the eligible asset is a risk-free bond, on the grounds that the general case can be reduced to the cash-additive case by a change of numéraire. However, discounting does not work in all financially relevant situations, especially when the eligible asset is a defaultable bond. In this paper, we fill this gap by allowing general eligible assets. We provide a variety of finiteness and continuity results for the corresponding risk measures and apply them to risk measures based on value-at-risk and tail value-at-risk on L p spaces, as well as to shortfall risk measures on Orlicz spaces. We pay special attention to the property of cash subadditivity, which has been recently proposed as an alternative to cash additivity to deal with defaultable bonds. For important examples, we provide characterizations of cash subadditivity and show that when the eligible asset is a defaultable bond, cash subadditivity is the exception rather than the rule. Finally, we consider the situation where the eligible asset is not liquidly traded and the pricing rule is no longer linear. We establish when the resulting risk measures are quasiconvex and show that cash subadditivity is only compatible with continuous pricing rules.

Similar content being viewed by others

References

Aliprantis, Ch.D., Border, K.C.: Infinite Dimensional Analysis: A Hitchhiker’s Guide, 3rd edn. Springer, Berlin (2006)

Aliprantis, Ch.D., Tourky, R.: Cones and Duality. American Mathematical Society, Providence (2007)

Arai, T.: Good deal bounds induced by shortfall risk. SIAM J. Financ. Math. 2, 1–21 (2011)

Artzner, Ph., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Artzner, Ph., Delbaen, F., Koch-Medina, P.: Risk measures and efficient use of capital. ASTIN Bull. 39, 101–116 (2009)

Biagini, S., Frittelli, M.: A unified framework for utility maximization problems: an Orlicz space approach. Ann. Appl. Probab. 18, 929–966 (2008)

Biagini, S., Frittelli, M.: On the extension of the Namioka–Klee theorem and on the Fatou property for risk measures. In: Delbaen, F., Rasonyi, M., Stricker, C. (eds.) Optimality and Risk: Modern Trends in Mathematical Finance, pp. 1–28. Springer, Berlin (2009)

Borwein, J.M.: Automatic continuity and openness of convex relations. Proc. Am. Math. Soc. 99, 49–55 (1987)

Cerreia-Vioglio, S., Maccheroni, F., Marinacci, M., Montrucchio, L.: Risk measures: rationality and diversification. Math. Finance 21, 743–774 (2011)

Chambers, C.P.: An axiomatization of quantiles on the domain of distribution functions. Math. Finance 19, 335–342 (2009)

Cheridito, P., Li, T.: Risk measures on Orlicz hearts. Math. Finance 19, 184–214 (2009)

Delbaen, F.: Coherent risk measures on general probability spaces. In: Sandmann, K., Schönbucher, P.J. (eds.) Advances in Finance and Stochastics: Essays in Honour of Dieter Sondermann, pp. 1–37. Springer, Berlin (2002)

Drapeau, S., Kupper, M.: Risk preferences and their robust representations. Math. Oper. Res. 38, 28–62 (2013)

Edgar, G.A., Sucheston, L.: Stopping Times and Directed Processes. Cambridge University Press, Cambridge (1992)

Ekeland, I., Témam, R.: Convex Analysis and Variational Problems. SIAM, Philadelphia (1999)

El Karoui, N., Ravanelli, C.: Cash subadditive risk measures and interest rate ambiguity. Math. Finance 19, 561–590 (2009)

Farkas, W., Koch-Medina, P., Munari, C.: Capital requirements with defaultable securities. Insur. Math. Econ. (2013, forthcoming). arXiv:1203.4610 (May 2013)

Filipović, D., Kupper, M.: Monotone and cash-invariant convex functions and hulls. Insur. Math. Econ. 41, 1–16 (2007)

Föllmer, H., Schied, A.: Stochastic Finance: An Introduction in Discrete Time, 3rd edn. De Gruyter, Berlin (2011)

Frittelli, M., Rosazza Gianin, E.: Putting order in risk measures. J. Bank. Finance 26, 1473–1486 (2002)

Frittelli, M., Scandolo, G.: Risk measures and capital requirements for processes. Math. Finance 16, 589–612 (2006)

Hamel, A.H.: Translative sets and functions and their applications to risk measure theory and nonlinear separation. IMPA, Preprint Series D (2006). http://preprint.impa.br/FullText/Hamel__Fri_Mar_17_20_32_27_BRST_2006/acrm-main2.pdf

Hamel, A.H., Heyde, F., Rudloff, B.: Set-valued risk measures for conical market models. Math. Financ. Econ. 5, 1–28 (2011)

Jaschke, S., Küchler, U.: Coherent risk measures and good-deal bounds. Finance Stoch. 5, 181–200 (2001)

Kaina, M., Rüschendorf, L.: On convex risk measures on L p-spaces. Math. Methods Oper. Res. 69, 475–495 (2009)

Konstantinides, D.G., Kountzakis, C.E.: Risk measures in ordered normed linear spaces with nonempty cone-interior. Insur. Math. Econ. 48, 111–122 (2011)

Krätschmer, V., Schied, A., Zähle, H.: Comparative and qualitative robustness for law-invariant risk measures. Finance Stoch. (2013, forthcoming). arXiv:1204.2458

Orihuela, J., Ruiz Galan, M.: Lebesgue property for convex risk measures on Orlicz spaces. Math. Financ. Econ. 6, 15–35 (2012)

Schaefer, H.H.: Banach Lattices and Positive Operators. Springer, Berlin (1974)

Shapiro, A., Dentcheva, D., Ruszczyński, A.: Lectures on Stochastic Programming: Modeling and Theory. SIAM, Philadelphia (2009)

Svindland, G.: Convex risk measures beyond bounded risks. PhD Dissertation, München (2008). http://edoc.ub.uni-muenchen.de/9715/

Acknowledgements

Partial support through the SNF project 51NF40-144611 “Capital adequacy, valuation, and portfolio selection for insurance companies” is gratefully acknowledged. Financial support by the National Centre of Competence in Research “Financial Valuation and Risk Management” (NCCR FinRisk), project “Mathematical Methods in Financial Risk Management”, is gratefully acknowledged by W. Farkas and C. Munari. Part of this research was undertaken while P. Koch-Medina was employed by Swiss Re.

We gratefully acknowledge the careful review and constructive feedback provided by two anonymous referees. In particular, part of the proof of Proposition 4.6 could be significantly shortened following an idea of one of them.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Farkas, W., Koch-Medina, P. & Munari, C. Beyond cash-additive risk measures: when changing the numéraire fails. Finance Stoch 18, 145–173 (2014). https://doi.org/10.1007/s00780-013-0220-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-013-0220-9

Keywords

- Risk measures

- Acceptance sets

- General eligible assets

- Defaultable bonds

- Cash subadditivity

- Quasiconvexity

- Value-at-risk

- Tail value-at-risk

- Shortfall risk