Abstract

We consider how the international cross-ownership of firms affects the privatization of a public firm competing with foreign firms. We show that when firms compete á la Cournot in a third market under a linear demand function, the domestic ownership of foreign firms can impede privatization, whereas the foreign ownership of the domestic firm can promote privatization. Moreover, the domestic ownership of foreign firms can render neither complete privatization nor complete nationalization optimal under moderate conditions. Conversely, when firms compete á la Bertrand, we demonstrate that it is always optimal to pursue complete nationalization.

Similar content being viewed by others

Notes

See Gill Plimmer, “Privatisation fever takes grip,” Financial Times, June 26, 2011.

See Lin and Matsumura (2012) for examples of the sale of SOEs to foreign investors.

The Japanese government and public sector holds 35.7 % of NTT’s shares (http://www.ntt.co.jp). The Japanese firm Softbank Corporation holds 78 % of the shares of the US telecommunications company Sprint Corporation (www.sprint.com). Lastly, the Japanese government holds 33.35 % of the shares of Japan Tobacco Inc. (JT), with about another 5 % of its shares held by foreign investors (http://www.jt.co.jp).

Lin and Matsumura (2012), for example, only consider the possibility of the foreign ownership of privatized state-owned enterprises. De Fraja and Delbono (1990) provide an excellent survey of the early literature on mixed oligopoly models in a domestic context. The literature of mixed oligopoly with foreign competitors began with Corneo and Jeanne (1994) (discussion paper version in 1992). They find that, among other things, the objective of the public firms can be expressed uniquely in terms of exports in equilibrium. Mixed oligopoly models with foreign competitors are also examined in Fjell and Pal (1996), Pal and White (1998).

In addition to being listed on the New York Stock Exchange, Boeing is listed on several major European stock exchanges, with Barclays Global Investors UK Holdings Ltd. being its sixth-largest shareholder. In contrast, EADS, which owns 100 % of Airbus, is only listed on Euronext and the Frankfurt Stock Exchange.

Despite ongoing privatization programs around the world, mixed firms, i.e., partially privatized public firms, are still numerous, and governmental influence through state ownership remains relatively strong (OECD 2005). Typical industry examples include airlines, automobiles, steel, banking, and electric power suppliers in the European Union, banking, housing loans, life insurance, broadcasting, education, medical care, and overnight delivery in Japan, and banking, airlines, automobiles, and steel in China.

See Lin and Matsumura (2012) for a brief review of the literature.

Matsumura (1998) shows that for a Cournot duopoly involving a private firm and a privatized public firm that values both profits and social welfare, neither complete privatization nor complete nationalization is optimal under moderate conditions.

Long and Stähler (2009) provide an excellent survey of the literature on privatization and trade policies.

Lin and Matsumura (2012) consider the case where privatized SOEs are sold not only to domestic private investors but also to foreign investors. However, in their model, the domestic private investors are not permitted to own the shares issued by foreign private firms.

Feeney and Hillman (2001) analyze the interdependence between international financial markets, privatization, and strategic trade policy and provide a useful summary of earlier work on developments in asset markets and policy outcomes.

See Megginson and Netter (2001) for a thorough survey of the early privatization literature. Recently, Boubakri et al. (2013) use data from 55 developing countries to show that foreign direct investment and foreign portfolio investment can foster privatization, in that by making the market environment prone to competition, they provide an incentive for governments to privatize inefficient firms.

The shares of the partially privatized public firm held by the home government is \(\delta \theta ,\) while the shares held by the domestic residents is \(\delta ( {1-\theta })\).

As shown by (4), a decline in the extent of state ownership reduces the weight attached to the profit of firm 2, thus motivating the manager of firm 1 to reduce emphasis on the profit of firm 2.

The underlying mechanism differs from that in Matsumura (1998) in that in our model consumer surplus is not a part of social welfare. Matsumura (1998) suggests that complete nationalization is not optimal if the public firm is not a monopolist. This is because the slight reduction in the output of the public firm does not reduce social welfare, whereas the increase in the output of the profit-maximizing private firm improves social welfare (as the price is strictly higher than the private firm’s marginal cost).

Matsumura (1998) shows that complete privatization is not optimal if the public firm is at least as efficient as the private firm.

See Harris and Wiens (1980) for a discussion of the “procompetitive effect” of the public firm.

Using a model that considers the effect of open policies in product markets and privatization policies, Han and Ogawa (2008) find that governments choose complete privatization when the public firm is sufficiently inefficient compared with the private firm.

Note that the level of state ownership has many of the same analytical attributes as the export subsidy considered in Brander and Spencer (1985), Long and Stähler (2009). As argued in (Brander and Spencer 1985, Proposition 3), “...the optimal export subsidy moves the industry equilibrium to what would, in the absence of a subsidy, be the Stackelberg leader–follower position in output space with the domestic firm as leader.”

References

Boardman AE, Vining AR (1989) Ownership and performance in competitive environments: a comparison of the performance of private, mixed, and state-owned enterprises. J Law Econ 32:1–33

Boardman AE, Laurin C, Vining AR (2002) Privatization in Canada: operating and stock price performance with international comparisons. Can J Econ 19:137–154

Boubakri N, Cosset J-C, Debab N, Valéry P (2013) Privatization and globalization: an empirical analysis. J Bank Financ 37:1898–1914

Brada JC (1996) Privatization is transition, or is it? J Econ Perspect 10:67–86

Brander J, Spencer B (1985) Export subsidies and international market share rivalry. J Int Econ 18:83–100

Chang W (2005) Optimal trade and privatization policies in an international duopoly with cost asymmetry. J Int Trade Econ Dev 14:19–42

Chao C, Yu E (2006) Partial privatization, foreign competition, and optimum tariff. Rev Int Econ 14:87–92

Corneo G, Jeanne O (1992) Mixed oligopoly in a common market. Delta working paper 92–17, Paris

Corneo G, Jeanne O (1994) Oligopole mixte dans un marché commun. Ann d’Econ Stat 33:73–90

D’Souza J, Megginson WL (1999) The financial and operating performance of privatized firms during the 1990s. J Finance 54:1397–1438

De Fraja G, Delbono F (1990) Game theoretic models of mixed oligopoly. J Econ Surv 4:1–17

Dick A (1993) Strategic trade policy and welfare: the empirical consequences of cross-ownership. J Int Econ 35:227–249

Eaton J, Grossman G (1986) Optimal trade and industrial policy under oligopoly. Q J Econ 101:383–406

Feeney J, Hillman AL (2001) Privatization and the political economy of strategic trade policy. Int Econ Rev 42:535–556

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29:737–743

Fujiwara K (2006) Trade patterns in an international mixed oligopoly. Econ Bull 6:1–7

Han L, Ogawa H (2008) Economic integration and strategic privatization in an international mixed oligopoly. FinanzArchiv 64:352–363

Harris RG, Wiens EG (1980) Government enterprise: an instrument for the internal regulation of industry. Can J Econ 13:125–132

Lee S (1990) International equity market and trade policy. J Int Econ 29:173–184

Lin MH, Matsumura T (2012) Presence of foreign investors in privatized firms and privatization policy. J Econ 107:71–80

Long NV, Stähler F (2009) Trade policy and mixed enterprises. Can J Econ 42:590–614

Matsumura T (1998) Partial privatization in mixed duopoly. J Publ Econ 70:473–483

Matsumura T, Kanda O (2005) Mixed oligopoly at free entry markets. J Econ 84:27–48

Megginson W, Netter J (2001) From state to market: a survey of empirical studies on privatization. J Econ Lit 39:321–390

OECD (2005) Corporate governance of state-owned enterprises: a survey of OECD countries. OECD, Paris

Pal D, White MD (1998) Mixed oligopoly, privatization, and strategic trade policy. Southern Econ J 65:264–281

Vives X (1984) Duopoly information equilibrium: Cournot and Bertrand. J Econ Theory 34:71–94

Acknowledgments

The first author (the corresponding author) acknowledges financial supports from the JSPS KAKENHI (Grant Number 26780143, 26380325, and 26284014), the Daiko Foundation, and the National Social Science Fund of China (Grand Number 14BJY017). The second author acknowledges financial support from the JSPS KAKENHI (Grant Number 24530277). The authors wish to thank Ngo Van Long, Masayuki Okawa, Tsuyoshi Adachi, the managing editor, Dr. Giacomo Corneo, and two anonymous reviewers for their valuable comments. Earlier versions of this paper were presented at the JSIE 2013 Annual Meeting (Yokohama National University, Japan) and the 14th International Convention of the East Asian Economic Association (Chulalongkorn University, Thailand). The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: A Cournot competition in a third market

1.1 Appendix A.1: Stage 2

We first consider stage 2. Given \(\theta \), the first-order condition of firm 1 is:

and the second-order condition is \(( {1-\theta +\theta \delta })( {2{p}'+q_1 {p}''-{c}''_1 })+\theta \beta q_2 {p}''<0\). For firm 2, the first-order condition is:

and the second-order condition is \(2{p}'+q_2 {p}''-{c}''_2 <0\). To consider the effects of an increase in \(\theta \), we totally differentiate the systems of (A1) and (A2):

The determinant of the matrix is \(D\equiv v_{11}^1 \pi _{22}^2 -v_{12}^1 \pi _{21}^2 \), for which we assume \(D>0\). Making use of Assumption 1, we derive:

1.2 Appendix A.2: Stage 1

In stage 1, the home government chooses the optimal privatization policy that maximizes its own welfare. The welfare of the home country is given by:

Together with (A1) and (A2), the first-order condition is then:

Let \(\eta _\theta \equiv -\frac{{\frac{dq_2 }{d\theta }} /{q_2 }}{{\frac{dq_1 }{d\theta }} /{q_1 }}=\frac{\pi _2^1 \pi _{21}^2 }{\pi _1^2 \pi _{22}^2 }>0,\) where \(\eta _\theta \) is the elasticity of substitution between \(q_1 \) and \(q_2 \). We see that the optimal level of state ownership is given by:

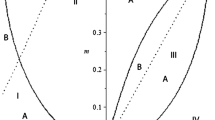

Clearly, the optimal level of \(\theta ^*\) cannot attain a value of one because \(\left. {\frac{\partial w^1}{\partial \theta }} \right| _{\theta =1} =\delta {p}'q_1 \frac{dq_2 }{d\theta }<0\). Moreover, \(\theta ^*>0\) as long as \(\beta >\eta _\theta \).

From (A7), we see that \(\frac{d\theta ^*}{d\beta }=( {\frac{\eta _\theta }{\beta ^2}})\left[ {1-{( {\frac{d\eta _\theta }{d\beta }})}/{( {\frac{\eta _\theta }{\beta }})}} \right] \frac{>}{<}0\). However, note that when the inverse demand function under consideration is a linear one, we have \(\frac{d\eta _\theta }{d\beta }=0,\)and \(\frac{d\theta ^*}{d\beta }=\frac{\eta _\theta }{\beta ^2}>0.\) Similarly, although in general we have \(\frac{d\theta ^*}{d\delta }\frac{<}{>}0,\) we have \(\frac{d\theta ^*}{d\delta }<0\) under a linear inverse demand function.

Using firm 1’s first-order condition, rewriting (A7), we have

However, this is precisely the condition that determines the pair \(( {q{ }_1^L ,q_2^F })\), which would be obtained if firm 1 was the quantity-setting leader (whose objective function would be \(\delta \pi ^1( {q_1 ,q_2 })+\beta \pi ^2( {q_1 ,q_2 }))\) and firm 2 was the quantity-setting follower. Hence, we see that:

Remark 1

The optimal level of state ownership always ensures that the stage 2 equilibrium output is identical to that obtainable if firm 1 was the quantity-setting leader and firm 2 was the quantity-setting follower.Footnote 21 Hence, we have \({d( {\frac{\pi _2^1 \pi _{21}^2 }{\pi _1^2 \pi _{22}^2 }})} /{d\theta }=0\).

Appendix B: Bertrand competition in a third market

1.1 Appendix B.1: Stage 2

Given \(\Theta \), the first-order condition of firm 1 is:

and the second-order condition is \(( {1-\Theta +\Theta \Delta })\Pi _{11}^1 +\Theta \mathrm{B}X_{11}^2 ( {P_2 -{C}'_2 })<0\).

For firm 2, the first-order condition is:

and the second-order condition is \(\Pi _{22}^2 <0\). Next, we consider the effects of an increase in \(\Theta \) on the equilibrium outputs. We totally differentiate the systems of (A9) and (A10):

The determinant of the matrix is \(J\equiv V_{11}^1 \Pi _{22}^2 -V_{12}^1 \Pi _{21}^2 \), for which we assume \(J>0\). Making use of Assumptions 2 and 3, we derive:

1.2 Appendix B.2: Stage 1

In stage 1, the home government chooses the optimal privatization policy to maximize its own welfare. The welfare of the home country is given by:

and the first-order condition is given by:

We then derive the optimal level of state ownership:

Clearly, \(\Theta ^*\) always attains a value of one in the case of international Bertrand rivalry.

Rights and permissions

About this article

Cite this article

Cai, D., Karasawa-Ohtashiro, Y. International cross-ownership of firms and strategic privatization policy. J Econ 116, 39–62 (2015). https://doi.org/10.1007/s00712-014-0429-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-014-0429-x