Abstract

Financial bubbles represent a severe problem for investors. In particular, the cryptocurrency market has witnessed the bursting of different bubbles in the last decade, which in turn have had spillovers on all the markets and real economies of countries. These kinds of markets and their unique characteristics are of great interest to researchers. Generally, investors and financial operators study market trends to understand when bubbles might occur using technical analysis tools. Such tools, which have been historically used, resulted in being precious allies at the basis of more advanced systems. In this regard, different autonomous, adaptive and automated trading agents have been introduced in the literature to study several kinds of markets. Among these, we can distinguish between agents with Zero/Minimal Intelligence (ZI/MI) and Computational Intelligence (CI)-based agents. The first ones typically trade on the market without resorting to complex learning strategies; the second ones usually use (deep) reinforcement learning mechanisms. However, these trading agents have never been tested on the cryptocurrencies market and related financial bubbles, which are still mostly overlooked in the literature. It is unclear how these agents can make profits/losses before, during, and after a bubble to adjust their strategy and avoid critical situations. This paper compares a broad set of trading agents (between ZI/MI and CI ones) and evaluates them with well-known financial indicators (e.g., volatility, returns Sharpe ratio, drawdown, Sortino and Omega ratio). Among the experiment’s outcomes, ZI/MI agents were more explainable than CI ones. Based on the results obtained above, we introduce GGSMZ, a trading agent relying on a neuro-fuzzy mechanism. The neuro-fuzzy system is able to learn from the trades performed by the agents adopted in the previous stage. GGSMZ’s performances overcome those of other tested agents. We argue that GGSMZ could be used by investors as a decision support tool.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Price prediction in financial and real markets is a problem that industry experts and scholars have always studied. Forecasting has become an increasingly complex process, especially today, where markets are fully connected, and information circulates easier and faster. However, in parallel with the increase in forecasting complexity, different tools have been developed to carry out machine-assisted forecasting. For example, various studies successfully forecast stock prices [8, 9, 11, 57, 78] (or more specifically daily close price of stocks [49]), stock market index performance [71], carbon emissions futures prices [6], the price of gold [45], the price of oil [10] and the price of various commodities [5] like coffee, cocoa, etc.

In recent years, Bitcoin has attracted considerable attention from investors, policy makers, and the media. This is not surprising since its price increased from a value of nearly zero in 2009 to almost $20,000 in December 2017. This was accompanied by a tremendous increase both in the number of Bitcoins in circulation and the Bitcoin market capitalization, being around 16.8 million Bitcoins and $300 billion, respectively. Policymakers around the world have raised concerns because Bitcoin is anonymous, decentralized and unregulated, and it could be a bubble, threatening the stability of the financial system [16, 18, 50]. Nonetheless, investors appear to be attracted by the potential to earn high returns, the introduction of Bitcoin derivatives, and the potential diversification benefits. Thanks to these features, the focus has shifted to this market, and it is possible to find a lot of studies that develop and test prediction models for the Bitcoin market. For example, Shah and Zhang [67] propose a trading strategy based on a Bayesian regression model that allows them to earn substantial returns when tested on real data. In a similar context, Madan, Saluja, and Zhao [58] propose the use of binomial regressions, support vector machines and random forest algorithms to predict the sign of the Bitcoin price change. Using machine learning optimization, Greaves and Au [39] obtain an up-down Bitcoin price movement classification accuracy of roughly 55%. In more recent times, Atsalakis et al. [7] developed a neuro-fuzzy system for Bitcoin price prediction with root mean squared error (RMSE) of 0.0376. Lastly, Mudassir et al. [61] proposed a machine learning approach exploiting joint regressors forecasting for Bitcoin price prediction, which has proven to be effective also in medium-term predictions.

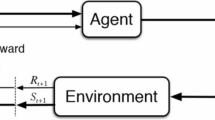

In step with the introduction of prediction methods and systems, a set of tools to study the financial market has been proposed. There is a long tradition of research to automatically discover, implement, and fine-tune strategies for autonomous adaptive automated trading in financial markets, with a sequence of research papers on this topic published at major artificial intelligence (AI) conferences and in prestigious journals. Among these, we can distinguish between two broader sets of automatic traders: Zero/Minimal Intelligence (ZI/MI) traders [19], and Computational Intelligence (CI) traders [55]. The first set concerns agents that trade on the market without resorting to complex learning strategies. The second set includes traders that usually exploit (deep) reinforcement learning mechanisms.

1.1 Overview

Objective In this paper, our goal is to study and evaluate the behavior of different agents in the Bitcoin market during financial bubbles (see a visual abstract in Fig. 1). We use two different types of trading agents to analyze their ability to identify the particular market phases (before/during/after the bubble) and their behavior in the investment phase. We want to analyze ZI/MI and CI agents in different scenarios, such as various stages of a financial bubble and compare these agents to understand which ones make more profit in anomalous situations. (Over the years, these bubbles in crypto seem to be more frequent.) Finally, based on what we have observed experimenting with such trading agents, we aim to develop our own automatic trader that operates during the bursting of a bubble. The ultimate goal is to define and introduce a trader outperforming state-of-the-art ones.

Motivation Bitcoin has particular attributes that introduce additional challenges when building a model to forecast its price movements. For example, its volatility is considerably higher than that of gold, the US dollar or stock markets [13], and it is particularly susceptible to regulatory and market events [31]. Additionally, prices may be manipulated through suspicious trading activity [34]. Our interest is driven by the absence in the literature of a comparison between two types of agents, i.e., ZI/MI and CI. Moreover, since the crypto market is subjected to the effect of financial bubbles more and more frequently, it is interesting to study how these agents behave in the different market phases [18]. Furthermore, since the capitalization of these markets is always higher, studying which agent has the best behavior could allow human traders to benefit from its strategies (added value not to be underestimated, from an economic point of view). Finally, the analyses made on this market could be transferred to newbies that have the same characteristics (e.g., high volatility, high frequency of bubbles, \(\ldots\)).

The proposed approach In order to compare the ZI/MI and CI traders, we considered the ones in [19]—a broad collection of ZI/MI agents including ZIC, ZIP, GDX, AA, and GVWY (see Sect. 2.1)—, and the ones in [55]—a collection of CI traders including A2C, DDPG, TD3, PPO and SAC (see Sect. 2.2). We compared such agents on the Bitcoin market from 2015 to 2018, from 2019 to 2021, and Ethereum market from 2019 to 2021 showing how ZI/MI agents were more explainable than CI ones. Building upon the achieved results, we introduce a neuro-fuzzy system, which is trained on the basis of the experience made by the best agents found in the previous phase and whose aim is to suggest the best operation to perform on the market in a specific period. Neuro-fuzzy systems are hybrid models that combine the functionality of fuzzy systems with the learning abilities of neural networks [59]. Consequently, one of the main advantages of a neuro-fuzzy system is its ability to learn and use linguistic variables to model the input–output relationships of a given system. In addition, using neural network learning algorithms, the fuzzy subsystem can automatically adjust the parameters of the fuzzy rules, thereby producing a data-driving-based rule for more accurate forecasting.

The adaptive network-based fuzzy inference system (ANFIS) used in the present study was proposed by [47]. It consists of five layers of adaptive networks with several inputs and one output. Such fuzzy system thus created is placed at the core of a new trading agent, namely GGSMZ, and was tested on the Bitcoin and Ethereum market also during the bubbles of 2018 and 2021. The results show how GGSMZ outperforms other agents under many indicators in various market situations, and it can be a great trading support tool.

Key points The main contributions of this paper are:

-

The study of the efficacy of Zero/Minimal Intelligence and Computational Intelligence based agents in terms of economic return in trading cryptocurrencies. In particular, we have analyzed the behavior of such trading agents also during financial bubbles. To the best of our knowledge, the current study is one of the first that compares such a broad range of trading agents (ZI/MI and CI) in similar scenarios.

-

The analyzes show that some ZI agents can identify the phase of a bubble based on volatility. While for CI agents, their behavior is always excellent at any stage of the market. However, despite the optimality of the investment phase, CI agents lose explainability due to their depth of training.

-

In the light of the above, we have built a novel learning-based trading agent, namely GGSMZ, that is based on an adaptive neuro-fuzzy inference system (ANFIS) approach. We have tested such an agent and compared its performance against the most promising ones found in the previous step of the project. The results indicate that GGSMZ was able to learn from the best choices of the CI agents and to use them to put himself in a profitable position. Investors could use our neuro-fuzzy model as a decision support tool. In the literature, few agents perform actions based on RL trading agents, placing us among the first to develop models of this type (particularly with neuro-fuzzy rules).

Paper’s organization This article is structured as follows: Sect. 2 presents the literature review, highlighting initiative and studies that show contact points with the presented paper; Sect. 3 elucidates the set of methods used and the dataset adopted; Sect. 4 provides details and a step-by-step description of the experiments carried out, ending with the discussion on the obtained results; Sect. 5 presents GGSMZ and the neuro-fuzzy system at its core. It also illustrates the methodology adopted to build the neuro-fuzzy system and the experiments made; Sect. 6 concludes the paper with final remarks and an overview of the work done, and it traces the path for future works. Finally, Appendix 1 repeats the experiments previously carried out with the same agents on a different market, that of currencies (FOREX).

2 Literature review

This section focuses on providing the key literature referring to ZI/MI trading agents (Sect. 2.1), CI agents (Sect. 2.2), and dwells on the works that compared different agents (Sect. 2.3).

2.1 Zero-intelligence and minimal intelligence trading agents

As many world’s major financial markets have lived a shift from physical stock exchanges to electronic markets, many software agents with various degrees of artificial intelligence have started to replace human traders. One relevant example of these software agents is represented by the Zero/Minimal Intelligence trading agents, which we briefly sketch in the following.

The birth of the ZI is due to Becker [14], who developed a model thanks to which he was able to discover that the taking of the supply and demand curves is associated with a behavior of the agents (traders) without any individual rationality. These behaviors are due to a market mechanism. On this idea, the first to consider a market mechanism in continuous double auctions were Gode and Sunder [38]. In particular, they consider two types of markets, each consisting of twelve agents, divided into two groups: buyer and seller. Traders can submit shouts at any time for one unit at a time. The key feature is that buyers and sellers can modify the offer after submitting a price, e.g., buyers may submit a higher price and sellers a lower price than the bid. The subjects operating in this market are human agents, who can shout prices at any time and whose price choice is governed by strategy and ZI agents (that do not learn strategies): In particular, the ZI are classifiable in ZI Unconstrained that can shout prices at a loss compared to their booking prices; and ZI Constrained (ZIC), for which this mechanism is not allowed and the shouted price cannot allow losses. As a result, Gode and Sunder found that in markets populated by human traders and ZI Constrained there is a rapid convergence toward the equilibrium price, while in markets populated by ZI Uncontrained this convergence did not occur (measuring a higher profits dispersion). According to Gode, Spear and Sunder [37], the result of this analysis highlights how the dominant factor in auctions is not the strategy chosen by the trader, but the market mechanism. The effect of this mechanism produces a rational market behavior even in the presence of irrational agents, going against the classic economic theories according to which the perfect rationality of the agents allowed an optimal allocation in the markets.

There have been several extensions of this model. Friedman [32] and Wilson [77] introduced two behavioral models for ZI agents: (i) Bayesian Game Against Nature (BGAN) with bounded rationality, to explain the bid-ask spread; (ii) Waiting Game Double Auction (WGDA) with completely rationality, to check what happens in markets with an unequal number of traders. Jamal and Sunder [46] used ZI traders whose price limits use heuristic and Bayesian rules, demonstrating the achievement of Bayesian equilibrium.

Gjerstad and Dickhaut [35] developed a trading strategy called GD to achieve competitive equilibrium outcomes (prices and allocations) in a market where individual choices are made myopically using heuristic beliefs. Their model aims to strike a balance between the approach taken by Wilson and the one by Gode and Sunder, while it also boasts the merit of avoiding the positive autocorrelation of price changes found in Friedman’s model. In addition, Gode and Sunder [36] examined the effect of unconstrained price controls, showing that traders do not adjust the strategy in the case of price controls.

Among various criticisms that have been put forward to the model of Gode and Sunder, most notably is that of Cliff and Bruten [24], which have shown that the accuracy with which the model captures the behavior of real markets is dependent on the supply and demand functions. The condition demonstrated by Gode and Sunder only occurs when these functions are symmetrical (a situation that does not occur in reality), making the ZI model weak in representing the results.

Cliff and Bruten [24] have developed an agent called Zero Intelligence Plus (ZIP) with a learning mechanism, through which the agent maintains a profit margin that reflects that individual’s belief of the profit that can be obtained from a successful transaction, therefore function of the trader’s reservation price. In this case, the authors demonstrated how ZIP behavior allows for better performance than ZI. One of the main features of the marketplace they used is that, at any given time, only one agent can announce a bid/offer. This agent is chosen at random by the market institution.

Inspired by this ZIP agent work, while considering unrealistic the marketplace bid/offer procedure, Priest and van Tol [62] have developed a new agent called PS-agent. The performance of ZIP agents and PS-agents has been compared in a marketplace characterized by a persistent shout double auction mechanism, where a trader’s current bid or offer will persist until the trader makes another. As a result, PS-agents turn out as more rapid in converging to equilibrium than the ZIP agents. Then, ZIP and a modified version of GD, renamed as MGD, have been tested by Das et al. [25] in CDA markets, in order to study the interactions between human and artificial traders. Another extension of GD model, the GDX, has been developed by Tesauro and Bredin [72]. The GDX not only involves a belief function that an agent builds to indicate whether a particular shout is likely to be accepted in the market, but it also considers the time left before the auction closes.

Inspired by Das et al. [25], Grossklags and Schmidt [40, 41] have studied the effect of knowledge/ignorance of the presence of trader-agents on the behavior of human traders, highlighting a “knowledge effect” capable of altering market dynamics. The ZIP trader has been modified by Cliff [19] through genetic algorithms to study the evolution of strategies or by extending the parameters from 8 to 60—introducing the ZIP60 [20]. In this paper, it has been observed that, thanks to a simple search/optimization process, is possible to found ZIP60 parameter-vectors that outperform ZIP8.

The introduction of ZI and ZIP agents marked an important step in trading strategies [51].

A further step forward has been made by Vytelingum et al. [74] with the presentation of a dominating strategy called Adaptive Aggressive (AA), which has been widely considered to be the best performing strategy in the public domain. The crucial peculiarity of AA is having both a short and a long-term learning mechanism to adapt its behavior to changing market conditions. Later on, AA’s supposed dominance has been tested against two novel algorithms known as GVWY and SHVR [21], which involve no AI or machine learning at all. The result is surprising: GVWY and SHVR can outperform AA and many of the other AI/ML-based trader-agent strategies.

2.2 Computational Intelligence traders

The increasingly strong use of neural networks, also in the financial field, has made it possible to combine the high ability to represent features with reinforcement learning. For example, Deng et al. [29], starting from the idea that computers can beat experienced traders, proposed a recurrent neural network (RNN) for sensing the dynamic market condition for feature learning and combined it with a RL framework that makes trading decisions. Almahdi and Yang [2] proposed a recurrent reinforcement learning (RRL) method for portfolio allocation, with a risk-adjusted performance objective function (Calmar ratio) to obtain signals and asset weights, showing how this method outperforms hedge fund benchmarks. Jiang, Xu and Liang [48] proposed a RL framework for asset allocation, consisting of a convolutional neural network (CNN), an RNN and a long short-term memory (LSTM) in a particular scheme with deep deterministic policy gradient, showing how, on a crypto market, this framework monopolize top positions in various experiments. Liu et al. [56] proposed an adaptive trading model, namely iRDPG, to develop trading strategies useful to balance exploration and exploitation combining RL techniques with GRU-based networks. Or again, on financial signal’ study, Ye et al. [79] built a new RL framework, the State-Augmented RL framework (SARL), that augments asset information with their price movement prediction as additional states, to incorporate data heterogeneity and environment uncertainty of the market, testing it on the Bitcoin and stock markets, and demonstrating the importance of state augmentation. Wang et al. [75] proposed AlphaStock, a new type of strategy based on the Attention Mechanism to model the price relations for buying and selling strategy, testing it on the USA and Chinese markets and highlighting the robustness of their model. Wang et al. [76], considering the market conditions, proposed a Deep RL method to optimize the investment policy (DeepTrader); a model that considers macro-market conditions as an indicator and is able to capture the spatial and temporal dependencies between assets.

Recently, Yang, Gao and Wang [55] due to the difficulty of developing RL models under the programming aspect, created a new open-source framework (FinRL) to help quantitative traders. Several works have been developed on this framework, such as Guan and Liu [42] who used it to explain the trading strategies of a DRL agent for portfolio management in three steps; or Bau and Liu [12] who proposed a DRL multi-agent-based on FinRL, which capture high-level complexity, to optimize the process of selling a large number of stocks (called liquidation). Thanks to the ease of implementation and the number of agents included, in line with the previous authors, we also used FinRL for the subsequent analyzes.

2.3 Comparison and evaluation of different trading agents

Since Gode and Sunder developed the ZIC agent, several papers have addressed the topic of comparing bidding strategies and agents’ behaviors. First, Cason and Friedman [17] evaluated the performances of Wilson’s waiting game/Dutch auction (WGDA) model, Friedman Bayesian game against nature (BGAN) and Gode and Sunder ZIC agent in price formation in Double Action Markets. The results suggested that models which rely most heavily on trader rationality, as WGDA and BGAN, have less ability to describe markets behavior than ZIC agents, which requires very little trader rationality. Nevertheless, the authors suggest new experiments since the conditions of their experiment did not give a fair chance to WGDA model. In 2001, in their already mentioned work, Das et al. [25] applied the laboratory methods of experimental economics to compare Extended-GD agent and ZIP agent against human traders in a continuous double auction (CDA) mechanism. Ten years later, De Luca and Cliff [26] recreated the same experiment in a trading system called OpEx, obtaining the same results as Das et al. [25] in terms of comparison between robot traders and human traders, as ZIP and GDX agents had consistently outperformed human traders, and observing that GDX had outperformed ZIP. At the same time, in 2002 Tesauro and Bredin [72] pointed out that ZIP slightly outperformed EGD. In addition, another work by De Luca and Cliff [27] confirmed that “Adaptive Aggressive” (AA) algorithmic traders of Vytelingum [74] outperformed ZIP, GD, and GDX in agent vs agent experiments in CDA markets, as Vytelingum himself claimed. A few years later, Vach [73] questioned the dominance of AA over ZIP and GDX agents by designing symmetric agent–agent experiments with a variable composition of agent population. Surprisingly, GDX is a dominant strategy over AA in many experiments in this work in contrast to the previous literature. In 2019 Cliff [23] reaches a similar result: in markets with dynamically varying supply and demand, so market environments that are in various ways more realistic and closer to real-world financial markets, AA can be routinely outperformed by more straightforward trading strategies. On the other hand, AA remains dominant only in highly simplified market scenarios and maybe because AA was designed with exactly those simplified experimental markets in mind. In the same year, Snashall and Cliff [69] made another step forward by exhaustively testing AA across a sufficiently wide range of market scenarios against GDX. The outcome was that not only AA is outperformed by GDX in more realistic market environments, but also in the simple experiment conditions that were used in the original AA papers. So, the various results achieved in the previous years and well known in the literature could no longer be fully trusted. On this path, one year later, Rollins and Cliff [64], employing a new version of BSE called Threaded-BSE (TBSE) by Rollins [64], questioned the original benchmark dominance-hierarchy AA > GDX > ZIP > ZIC, obtained in the BSE, and got a different result: The dominance-hierarchy is instead ZIP > AA > ZIC > GDX. The authors also guess that this new achievement is probably due to the previous use of simplistic simulation methodologies.

Thus, several experiments have been conducted with autonomous, adaptive, automated traders, but to the best of our knowledge the following aspects have been overlooked:

-

There is lack of throughout comparisons in the cryptocurrencies market, and, in particular, in the Bitcoin and Ethereum market;

-

There is lack of experiments on how the trading agents behave during financial bubbles—except the study by Duffy and Unver [30] that successfully verified whether ZIC traders can generate asset price bubbles and crashes of the type observed in a series of laboratory asset market experimentsFootnote 1.

-

There is lack of comparison between ZI/MI traders and other traders adopting higher degree of AI techniques, such as CI ones.

We remark that this work aims to fill the gaps mentioned above offering a comparison between ZI/MI and CI trading agents on the crypto market over different phases, including during the bursting of a financial bubble. Furthermore, building upon the experiments carried out, we propose GGSMZ, a trading agent relying on a neuro-fuzzy system which outperforms other analyzed traders.

3 Methods and materials

In this section, we first present and provide details about the traders adopted, from ZI/MI ones (Sect. 3.1) to the CI ones (Sect. 3.2). Then, we sketch technical details on adaptive neuro-fuzzy systems at the basis of the proposed GGSMZ trader (Sect. 3.3). Lastly, we show the dataset employed for running the experiments (Sect. 3.4).

3.1 Zero/Minimal Intelligence traders

We used the following ZI/MI traders:

-

Zero Intelligence Constrained (ZIC), the ZIC trader generates random bids or offers (depending on whether it is a buyer or a seller) distributed independently, identically and uniformly over the entire feasible range of trading prices from 1 to 200. The trader has no memory of past market activity, and each trader has an equal probability of being the next trader to make a bid or an ask. The assumption by Gode and Sunder [38]: (i) each ask, bid, and transaction is valid for a single unit; (ii) a transaction cancels any unaccepted bids and offers; (iii) when a bid and ask crosses, the transaction price is equal to the earlier of the two. Buyer’s profit from buying the ith unit is given by the difference between the redemption value of the unit i, \(v_i\), and its price \(p_i\): \(\pi _i^B= v_i - p_i\) Seller’s profit from selling the ith is given by the difference between the price of the unit i, \(p_i\), and its cost to the seller \(c_i\): \(\pi _i^S= p_i - c_i\). Every trader has to sell the unit i before selling the unit \(i+1\). The agents are subject to budget constraints: If they generate a bid (to buy) above their redemption value or an offer (to sell) below their cost, such actions are considered invalid and are ignored by the market. So, the market forbids traders to buy or sell at a loss. Therefore, the support of the distribution that generated the uniform random bids was restricted between 1 and the redemption value of the bidder, while the uniform distribution of random ask was restricted to the range between the seller’s cost and 200.

-

Zero Intelligence Plus (ZIP), it is an evolution of ZIC. Individual traders adjust their profit margins using market price information thanks to simple adaptive mechanisms. More specifically, they adjust the profit margins up or down based on the prices of bids and offers made by other traders and whether these shouts are accepted, leading to deals or ignored. As a result, the performances of these agents sensibly increase. The adjustments depend on four factors. The first is whether the trader is active or inactive – in other words, if it is still able to make transactions or not. The other three factors are connected to the most recent shout: its price q, whether it was a bid or an offer and whether it was accepted or rejected. At a given time t, an individual ZIP trader i calculates the shout price \(s_i(t)\) for a unit j by multiplying the trader’s real-valued profit margin \(\mu _i(t)\) by the limit price \(\lambda _{i,j}\) of the unit: \(s_i(t)=\lambda _{i,j}[1+\mu _i(t)]\). Sellers: \(\mu _i(t) \in [0,\infty ) \forall t\), so that \(s_i\) is raised by increasing \(\mu _i\) or lowered by decreasing \(\mu _i\); Buyers: \(\mu _i(t) \in [-1,0] \forall t\), so that \(s_i\) is raised by decreasing \(\mu _i\) or lowered by increasing \(\mu _i\). In principle, a ZIP buyer will buy from any seller that makes an offer less than the buyer’s current bid shout price; similarly, a ZIP seller sells to any buyer making a bid greater than the seller’s current offer shout price. The aim is that the value of \(\mu _i\) for each trader should alter dynamically, in response to the actions of other traders in the market, increasing or decreasing to maintain a competitive match between that trader’s shout-price and the shouts of the other traders.

-

Gjerstad-Dickhaut (GDX), the GDX agent is the result of an improvement process that begins from Gjerstad and Dickhaut [35] with their GD trader and ends up with Tesauro and Bredin [72]. As ZIP trader, GD agent can trade profitably by adapting its behavior over time, in response to market events. In contrast to the ZIP work, Gjerstad’s trading algorithm uses frequentist statistics, gradually constructing and refining a belief function that estimates the likelihood for a bid or offer to be accepted in the market at any particular time, mapping from price of the order to its probability of success. The original GD agent was developed for a market where there was no queue, so old bids or asks were erased as soon as there was a more favorable bid/ask or a trade. In Das et al. [25] version of the CDA market, unmatched orders can be retained in a queue, and therefore the notion of an unaccepted bid or ask becomes ill-defined. In their version of GD agent, called Modified-GD (MGD), they overcome this problem by introducing into the GD algorithm a “grace period” \(t_g\). Another modification to GD addressed the need to handle a vector of limit prices since the original algorithm assumed a single tradeable unit. Finally, an extension of MGD was reported by IBM researchers Tesauro and Bredin in 2002 and took the name of GDX [72]. In their work, Tesauro and Bredin combine the belief function with a forecast of how it changes over time. The result is an optimization of cumulative long-term discounted profitability, whereas GD traders merely optimize immediate profits.

-

Adaptive Aggressiveness (AA), the AA agent has both a short- and long-term learning mechanism to adapt its behavior to changing market. In particular, in the static case, the agent can be effective by assuming that the competitive equilibrium does not change significantly, whereas in the dynamic case, it can make no such assumption and must learn, assuming that this competitive equilibrium may change. The focus is on the bidding aggressiveness shown by the agent because it describes how the agent manages the trade-off between profit and probability of transaction. Whenever the agent submits a bid or an ask, a short-term learning mechanism is employed to adjust agent’s level of aggressiveness \(r\in [-1,1]\). For \(r<0\), the agent adopts an aggressive strategy, which trades-off profit to improve its probability of transacting in the market. For \(r>0\), the agent adopts a passive strategy, waiting for more profitable transactions than at and willing to trade-off its chance of transacting for a higher expected profit. If \(r=0\), the agent is neutral and submits offers at what it believes is the competitive equilibrium price, which is the expected transaction price. How the level of aggressiveness influences an agent’s choice of which bids or asks to submit in the market depends on a long-term learning strategy, based on market information observed after every transaction. In a few words, an AA agent has two principal decision-making components: (i) a bidding layer that specifies what bid or ask should be submitted based on its current degree of aggressiveness; (ii) an adaptive layer to update its behavior according to the prevailing market conditions. Given a target price \(\tau\) and a set of bidding rules, the first layer determines which bids or asks to submit. The aggressiveness model gives a mapping function to \(\tau\) employing the agent’s current degree of aggressiveness, its limit price \(\hat{p}^*\) and an intrinsic parameter \(\theta\).

-

Giveaway (GVWY), the GVWY agent simply sets its quote price equal to its limit price, giving away any chance of surplus. GVWY seller: \(P_{sq(GVWY)}(t)=\lambda ^S\) GVWY buyer: \(P_{bq(GVWY)}(t)=\lambda ^B\) where S and B are, respectively, the seller’s limit price and buyer’s limit price. Anyway, the GVWY trader can enter in a surplus-generating transaction: If a GVWY buyer quotes its limit price \(\lambda ^B\) and the current best ask \(p_{ask}^*<\lambda ^B\), the GVWY buyer is matched with whichever seller issued that best ask and the transaction goes through at price \(p_{ask}^*\) yielding a \(\lambda ^B-p_{ask}^*\) surplus for the GVWY buyer.

3.2 Computational Intelligence-based traders

On the other side, as previously said we used FinRL [55] as a reinforcement learning (RL) framework. This framework, consisting of 3 layers, encapsulates historical trading data in training environments and provides useful demonstrative trading tasks to users for develop their strategies. The first layer, Application, is used to transform the trading strategy into deep reinforcement learning (DRL) by defining: the state space \(\mathcal {S}\) (that describes how the agent perceives the environment), the action space \(\mathcal {A}\) (that describes the allowed actions for an agent) and the reward function (as an incentive for the agent to learn better policy, Sharpe ratio in this case). The second layer, Agent, allows the user to play with the standard DRL algorithms like Stable Baseline 3 [63], RLlib [52] and ElegantRL [54]. Finally, the third layer, Environment, simulates real world markets to learn a new strategy. Here the agent updates iteratively and obtains a trading strategy to maximize the expected return. The methods used in FinRL framework for representing the training agents are:

-

Asynchronous Advantage Actor Critic (A2C) [60], a policy optimization method that performs gradient ascent to maximize performance. Defining a state \({\textbf {s}}_t\) in which an actor selects an action \({\textbf {a}}_t\) according to the policy \(\pi\), \(r_t\) the scalar rewards such that \(R_t = \sum _{k=0}^{+\infty } \gamma ^k r_{t+k}\) is the total accumulated return from t with discount factor \(\gamma\), \(Q^{\pi }({\textbf {s}}, {\textbf {a}})) = \mathbb {E}[R_t|{\textbf {s}}_t = {\textbf {s}}, {\textbf {a}}]\) the action value following the policy \(\pi\), \(Q^*({\textbf {s}}, {\textbf {a}}) = \max _{\pi }Q^{\pi }({\textbf {s}}, {\textbf {a}})\) the maximum action value for the state s, \(V^{\pi }({\textbf {s}}) = \mathbb {E}[R_t|{\textbf {s}}_t = {\textbf {s}}]\) the value of state s under the policy \(\pi\) and \(Q({\textbf {s}}, {\textbf {a}};\theta )\) an approximate action-value function, Mnih et al. [60] starting from the one step Q-Learning loss

$$\begin{aligned} J(\theta _i) = \mathbb {E}[r + \gamma \max _{a^{'}}Q({\textbf {s}}^{'}, {\textbf {a}}^{'}; \theta _{i-1} - Q({\textbf {s}}, {\textbf {a}};\theta _i)]^2 \end{aligned}$$have designed new methods to find a RL method that is trainable through neural networks without excessive use of resources. In this vein, the authors have introduced a property modification of Asynchronous one-step Q-Learning (in which each thread interacts with its own copy of the environment and computes a gradient of the loss), Asynchronous n-step Q-Learning and Asynchronous advantage actor-critic (called A3C) that maintains a policy \(\pi ({\textbf {a}}_t|{\textbf {s}}_t;\theta )\) and an estimate of the value function \(V({\textbf {s}}_t; \theta _v)\).

-

Deep Deterministic Policy Gradient (DDPG) [53], a first type of mixed method between Q-Learning and Policy Optimization that use each to improve the other. In this situation, since it is not possible to apply Q-Learning to continuous action spaces, Lillicrap et al. [53] use an approach based on the deterministic policy gradient (DPG). Considering \({\textbf {s}}_t\) the state in which an agent takes an action \({\textbf {a}}_t\) and obtain the reward \(r_t\), \(\rho ^\pi\) the discounted state visitation distribution for a policy \(\pi\), Q the off-policy, \(\mu (s) = argmax_a Q({\textbf {s}}, {\textbf {a}})\) a greedy policy, \(\gamma\) the discount factor and \(\beta\) a stochastic behavior policy, it is possible to start from Q-Learning loss

$$\begin{aligned} J(\theta ^Q) = \mathbb {E}_{{\textbf {s}}_t\sim \rho ^\beta , {\textbf {a}}_t \sim \beta , r_t \sim E}[(Q({\textbf {s}}_t, {\textbf {a}}_t|\theta ^Q) - y_t)^2], \end{aligned}$$where \(y_t = r({\textbf {s}}_t, {\textbf {a}}_t) + \gamma Q({\textbf {s}}_{t+1}, \mu ({\textbf {s}}_{t+1})|\theta ^Q)\). The author, to make the DPG deeper and implement it through neural networks, has made several changes, e.g., to the replay buffer making it larger, improving the learning algorithm to avoid divergence, using the batch normalization technique and adopting a new policy \(\mu ^{'}({\textbf {s}}_t) = \mu ({\textbf {s}}_t|\theta ^{\mu }_t) + \mathcal {N}\) built by introducing a noisy process \(\mathcal {N}\).

-

Twin-Delayed DDPG (TD3) [33], an evolution of DDPG method that solve the problem of reducing overestimation bias by introducing a novel clipped variant of Double Q-Learning and reduce high variance estimates minimizing error at each update. In this case, Fujimoto et al. [33] maintain the loss of the DDPG model but introduce a novelty in updating the pair of critics of the actions selected by the target policy, defining

$$\begin{aligned} y = r({\textbf {s}}_t, {\textbf {a}}_t) + \gamma \min _{i=1, 2} Q_{\theta ^{'}_{i}}({\textbf {s}}^{'}, \pi _{\phi ^{'}}({\textbf {s}}^{'}) + \epsilon ) \end{aligned}$$with \(\epsilon \sim clip(\mathcal {N}(0, \sigma ), -c, c)\), where c is a constant and \(clip(\mathcal {N}(0, \sigma ), -c, c)\) clip the probability. These changes made it possible to increase the stability and performance with consideration of function approximation error.

-

Proximal Policy Optimization (PPO) [66], another policy optimization method that maximize a surrogate objective function which indicates the variations of the \(J(\pi _{\theta })\) function at each update. In particular, Schulman et al. [66] develop a loss function that combines policy surrogate and value function error term. Starting from the clipped loss

$$\begin{aligned} J^{CLIP}(\theta ) = \mathbb {E}[\min (r_t(\theta )\hat{A}_t, clip(r_t(\theta ), 1-\epsilon , 1+\epsilon )\hat{A}_t] \end{aligned}$$where \(\pi _{\theta }\) is the stochastic policy, \(\hat{A}_t\) is an estimator of the advantage function at time t, \(r_t(\theta ) = \frac{\pi _{\theta }({\textbf {a}}_t| {\textbf {s}}_t)}{{\pi _{\theta }}_\mathrm{old}({\textbf {a}}_t|{\textbf {s}}_t)}\), \(\epsilon\) is an hyperparameter and \(clip(r_t(\theta ), 1-\epsilon , 1+\epsilon )\hat{A}_t\) modifies the surrogate objective by clipping the probability ratio; the authors combined it with entropy bonus obtaining the following objective

$$J_t^{CLIP+VF+S}(\theta ) = \hat{\mathbb {E}}_t[J_t^{CLIP}(\theta ) - c_1 L_t^{VF}(\theta ) + c_2 S[\pi _{\theta }]({\textbf {s}}_t)]$$where \(c_1\) and \(c_2\) are coefficients, S is the entropy bonus and \(L_t^{VF}\) is a squared-error loss \((V_{\theta }({\textbf {s}}_t) - V_t^{targ})^2\) between state-value functions.

-

Soft Actor-Critic (SAC) [44], another mixed method between Q-Learning and Policy Optimization that uses stochastic policies and entropy regularization to stabilize learning than DDPG. In this case, the Soft Actor-Critic algorithm start from a maximum entropy variant of the policy iteration method. According to [44], we know that \({\textbf {s}}_t \in \mathcal {S}\) is the current state, \({\textbf {a}}_t \in \mathcal {A}\) is an action, \(V_{\psi }({\textbf {s}}_t)\) is the parameterized state value function, \(Q_{\theta }({\textbf {s}}_t, {\textbf {a}}_t)\) is the soft Q-function and \(\pi _{\phi }({\textbf {s}}_t, {\textbf {a}}_t)\) is the tractable policy. The parameters are: \(\psi\) learned by minimizing the square residual error

$$\begin{aligned} J_V(\psi )& = {} \mathbb {E}_{{\textbf {s}}_t \sim \mathcal {D}}\biggl [\frac{1}{2}(V_{\phi }({\textbf {s}}_t) - \mathbb {E}_{{\textbf {a}}_t \sim \pi _{psi}}[Q_{\theta }({\textbf {s}}_t, {\textbf {a}}_t)\\&\quad - \log \pi _{\psi }({\textbf {a}}_t|{\textbf {s}}_t)])^2\biggr ], \end{aligned}$$where \(\mathcal {D}\) is the distribution of previously sampled states and actions; \(\theta\) learned by minimizing the soft Bellman residual

$$\begin{aligned} J_Q(\theta ) = \mathbb {E}_{({\textbf {s}}_t, {\textbf {a}}_t) \sim \mathcal {D}}\biggl [\frac{1}{2}(Q_{\theta }({\textbf {s}}_t, {\textbf {a}}_t) - \hat{Q}({\textbf {s}}_t, {\textbf {a}}_t))^2\biggr ], \end{aligned}$$with \(\hat{Q}({\textbf {s}}_t, {\textbf {a}}_t) = r({\textbf {s}}_t, {\textbf {a}}_t) + \gamma \mathbb {E}_{{\textbf {s}}_{t+1} \sim p}[V_{\bar{\psi }}({\textbf {s}}_{t+1})]\) and \(\bar{\psi }\) the exponentially moving average of the value network weights; and finally \(\phi\) learned by minimizing the expected KL-divergence

$$\begin{aligned} J_{\pi }(\phi ) = \mathbb {E}_{{\textbf {s}}_t \sim \mathcal {D}}\biggl [D_{KL}\biggl (\pi _{\psi }(\cdot |{\textbf {s}}_t)\biggl |\biggl |\frac{\exp (Q_{\theta }({\textbf {s}}_t, \cdot ))}{Z_{\theta }({\textbf {s}}_t)}\biggr )\biggr ]. \end{aligned}$$

3.3 Neuro-fuzzy systems: ANFIS technical details

In this section, we provide basic technical details on adaptive neural fuzzy inference system (ANFIS) which is at the basis of our GGSMZ trader (see Sect. 5).

ANFIS was first proposed by Jang [47]. ANFIS constructs a fuzzy inference system (FIS) whose membership function parameters are derived from training examples. As a matter of example, we assume a FIS with two inputs x and y with two associated membership functions (MFs), and one output (z). For a typical first-order Takagi–Sugeno fuzzy model [70], a common rule set, with two fuzzy if-then rules, is presented as follows:

-

Rule 1: if x is \(A_1\) and y is \(B_1\), then \(f_1\) = \(a_1x + b_1y + c_1\),

-

Rule 2: if x is \(A_2\) and y is \(B_2\), then \(f_2\) = \(a_2x + b_2y + c_2\),

where \(A_1\), \(A_2\), \(B_1\) and \(B_2\) are the linguistic labels of the inputs x and y, respectively, and \(a_i, b_i,c_i\) \((i = 1, 2)\) are the parameters [47]. Figure 2a, b illustrate the reasoning mechanism and the corresponding ANFIS architecture, respectively [47].

As shown in Fig. 2b, ANFIS is a multilayer network. The operation of ANFIS model from layer 1 to layer 5 is briefly presented below [47].

-

Layer 1: all the nodes in this layer are adaptive nodes, which indicate that the shape of membership function can be modified through training. Taking Gaussian MFs as an example, the generalized MFs are defined as follows:

$$\begin{aligned} O_i^1=\mu _{Ai}(x)=e^{-\frac{(x-c_i)^2}{2\sigma _i^2}} \end{aligned}$$where x is crisp input to node i and Ai is the linguistic label, such as low, medium and high. \(O_i^1\) is the membership grade of fuzzy-set Ai, which can be trapezoidal, Gaussian, bell-shaped and sigmoid functions or others. The variables \((\sigma _i , c_i)\) are the parameters of the MF governing the Gaussian function.

-

Layer 2: The nodes in this layer are gray circle nodes labeled \(\Pi\), indicating that they perform as a simple multiplier. Each node output represents the firing strength of each rule.

$$\begin{aligned} O_i^2=w_i=\mu _{Ai}(x)\times \mu _{Bi}(x),\,\, i=1, 2 \end{aligned}$$ -

Layer 3: the nodes in this layer are also gray circle nodes labeled N. The ith node is the ratio of the ith rule’s firing strength to the sum of all rules’ firing strengths. The outputs of this layer can be given by

$$\begin{aligned} O_i^3=\bar{w}_i=\frac{w_i}{w_1+w_2},\,\, i=1,2 \end{aligned}$$ -

Layer 4: each node i in this layer is adaptive. Parameters in this layer are considered as consequent parameters. The outputs of this layer can be represented as

$$\begin{aligned} O_i^4=\bar{w}_if_i=\bar{w}_i(p_ix+q_iy+r_i),\,\, i=1,2 \end{aligned}$$ -

Layer 5: the node in the last layer computes the overall output as the summation of all incoming signals. The overall output is given as

$$\begin{aligned} O_{i}^{5} & = z \\ & = \sum\limits_{i} {i = 1^{2} \bar{w}_{i} f_{i} = \frac{{w_{1} (p_{1} x + q_{1} y + r_{1} ) + w_{2} (p_{2} x + q_{2} y + r_{2} )}}{{w_{1} + w_{2} }}} \\ \end{aligned}$$

In the ANFIS architecture, the major task of the training process is to make the ANFIS output fit with the training data by optimizing the fuzzy rules and parameters of membership functions. The hybrid-learning algorithm incorporating gradient method and the least-squares are used in ANFIS to estimate the initial parameters and quantify the mathematical relationship between input and output. Further details are in [47, 70].

3.4 Crypto datasets

This work uses datasets that describe the evolution of the price of some of the most famous cryptocurrencies, Bitcoin and Ethereum, in different time frames.

BTC-USD 2018 dataset Regarding the Bitcoin price and its time-division, we have chosen as a ticker the BTC-USD price recorded by CoinMarketCap through Yahoo!FinanceFootnote 2, and we have split it into 3 time frames. The entire dataset contains the prices from 01/01/2015 to 12/31/2018 (the first big bubble on this crypto) for a total of 1,460 days and consists of the classic OHLCV features used in financial sector: Open, High, Low, Close, and Volume. In Table 1, we show an extract of how the dataset is composed.

We know that the bubble in this crypto market, started on December 17, 2017, with the price of 1 BTC reaching around $20,000 and reaching its peak toward the end of January, marking the explosion point and causing the Bitcoin’s price settlement in the following months. Based on these events, we created the first time frameFootnote 3, called Before, with training from 1/1/2015 to 2/28/2017 (543 days) and tests from 3/1/2017 to 12/15/2017 (221 days); the second time frame, called During, with training from 1/1/2015 to 12/15/2017 (745 days) and tests from 12/16/2017 to 5/31/2018 (112 days); and the third time frame, called After, with training from 01/01/2015 to 5/31/2018 (858 days) and tests from 6/1/2018 to 12/31/2018 (146 days). In Fig. 3, we plot the close prices of BTC during the period of interest.

BTC-USD 2021 dataset We consider again the BTC-USD price recorded by CoinMarketCap through Yahoo!Finance, but in the famous bubble of 2021. This situation became famous thanks to the incredible advancement of the Bitcoin price up to $60,000, which has brought many other cryptos to the fore. We consider the OHLCV dataset and perform the temporal division in the three intervals. However, here, a particular situation arises of two consecutive bubbles. We can create the first time frame, Before, with training from 3/1/2019 to 4/30/2020 (294 days) and tests from 5/1/2020 to 1/31/2021 (189 days); the second time frame, During, with training from 3/1/2019 to 1/31/2021 (484 days) and tests from 2/1/2021 to 7/31/2021 (126 days); and the third time frame, After (characterized by a new bubble), with training from 3/1/2019 to 7/31/2021 (610 days) and tests from 8/1/2021 to 12/31/2021 (106 days). In particular, in this situation, we have decided to use a much smaller dataset than the previous one (with much fewer days) to verify the capabilities of the different agents. In Fig. 4, we plot the close prices of BTC during the period of interest.

ETH-USD 2021 dataset We also consider the trend of the Ether cryptocurrency (differentiated from the previous one because it is based on the Ethereum Blockchain). In particular, it is known how the trend of Bitcoin also affects the other cryptocurrencies (including Ethereum), so we decided to consider the same situation as the previous dataset and analyze the two bubbles that occurred in 2021. Ether peaked at a price and broke the $4000 per ETH barrier. The ticker is ETH-USD, again from CoinMarketCap by Yahoo!Finance, and is the classic OHLCV dataset (as in the previous cases) for 1037 days. The time frames are constructed in this way by dividing the days as for the previous crypto: Before with training from 3/1/2019 to 4/30/2020 and tests from 5/1/2020 to 1/31/2021; During with training from 3/1/2019 to 1/31/2021 and tests from 2/1/2021 to 7/31/2021; and After with training from 3/1/2019 to 7/31/2021 and tests from 8/1/2021 to 12/31/2021. In Fig. 5, we plot the close prices of ETH during the period of interest.

4 Experiment

In this section, we analyze the behavior of agents with our setup (Sect. 4.1) in the different time phases, showing which are the best (Sect. 4.2) and proposing some recommendations to investors.

4.1 Experiment setup

From the ZI/MI agents side, referring to what Cliff introduced, we used 5 buyer agents and 5 sellers for each type (to have 10 agents every day). The simulation tool used to test the predictive power of the various agents is the Bristol Stock Exchange (BSE) [22]. In this limit-order-book financial exchange written in Python, agents are free to make their own trading strategies based on their intrinsic functioning. To make the operation more realistic has been developed a Python’s multi-threading version, which allows traders to operate asynchronously of each other: the Threaded Bristol Stock Exchange (TBSE)Footnote 4. In this TBSE that we have used, some parameters are extracted from the time series of the Bitcoin/Ethereum price (OHLCV features in BTC-USD/ETH-USD datasets) that will serve to direct the exchanges between different 5 chosen agents: ZIC, ZIP, GDX, AA and GVWY. The key feature is that the returns obtained by the agents do not follow the actual price of cryptos but undergo variations according to the different situations in which the market finds itself (e.g., being inside a bubble or outside). Furthermore, these agents (by definition of the TBSE) can trade only one type of instrument (e.g., for each execution, they can trade only Bitcoin, or only Ethereum, and so on) and can only trade contracts of size 1.

On the CI side, on the other hand, some features representative of the traditional indicators use by financial analysts have been added to the dataset, e.g., moving average, convergence/divergence (MACD), relative strength index (RSI), smoothed moving average on the closing price at 30 and 60 days, commodity channel index, directional movement index and the Bollinger Band. Such indicators are reported in Table 2.

The CI agents were endowed with an initial capital equal to 20,000 price units for the BTC-USD 2018 dataset, 30,000 price units for the BTC-USD 2021 dataset (50,000 in the last two time frames given the exponential growth of the price) and 10,000 price units for the ETH-USD 2021 dataset; and based on this sum, they were able to manage it in the best possible way according to their rewards function. We have set the parameters of the different agents as shown in Table 3. These configurations are given by the authors in [55] and are those achieving the best results.

The comparison between the behaviors of the ZI/MI and CI agents takes place based on: (i) the cumulative returns on a daily basis, (ii)the volatility of these, (iii) the Sharpe ratio, (iv) the max drawdown, (v) the Sortino ratio and (vi) the Omega ratio. For cumulative returns, we can first consider the simple return \(r_t\) for one period as:

where \(P_t\) and \(P_{t-1}\) represent the price value (of cryptos in these cases), respectively, at time t and \(t-1\). Then, the cumulative return (or multiperiod) for n days is calculated as:

The Sharpe ratio, is defined as:

where r and \(\sigma\) indicate asset return and volatility respectively while \(r_f\) indicate the risk-free interest rate (set in pyfolioFootnote 5\(r_f\) = 0). The Maximum Drawdown (MDD) represents the maximum loss of a trading capital for a certain period, from a peak to a trough of a portfolio value. It is calculated as:

The Sortino ratio is a financial risk indicator. It uses the Downside Risk (DSR) to highlight how investors feel under pressure when they perform inadequately compared to the minimum acceptable. First, we can define the DSR as a measure of the downward deviation (similar to the standard deviation) of the yield from the minimum acceptable yield. In this way, the Sortino ratio is calculated as:

where also, in this case, \(r_f = 0\) represents the risk-free rate, while \(R_p\) is the expected return. Finally, the Omega ratio is a risk-return performance measure, is an alternative to the Sharpe ratio, and is calculated by creating a partition in the cumulative return distribution in order to create an area of losses and an area for gains, so that:

where F(x) is the cumulative probability distribution function of returns and \(\theta\) the target return. FinRL automatically returns all these indicators, and to choose the best agent we select the one with the highest Sharpe and the lowest Drawdown, Sortino, and Omega.

4.2 Experiment results

Based on the indicators defined above, we can compare the agents in the different situations and concerning various instruments. Our goal is to understand how they behave in particular market situations, i.e., just before, during and after a bubble. As a benchmark (also indicated in graphics as daily_return), we consider the same indicators calculated on the price series extracted from the dataset in the same reference period. In the following, we report the result of the experiments conducted on BTC2018 bubble (Sect. 4.2.1), BTC2021 bubble (Sect. 4.2.2), and ETH2021 bubble (Sect. 4.2.3). For each report, we first sketch the reference values for the benchmark during the test period (in a box fashion), then we show the results obtained by the ZI/MI and CI agents and analyze them. All the figures mentioned are available in 2. For further graphics, we refer the reader to https://bit.ly/3wrkwi7.

4.2.1 Bitcoin bubble 2018

In this section, we offer details on the results achieved by ZI/MI and CI agents on the Bitcoin bubble of 2018 in three market situations, i.e., before, during and after the bubble.

Before

In this phase, it is clear how volatility was so high because the Bitcoin price underwent a sharp price jump in the test period (caused by the bubble’s bursting).

Reference values BTC2018 Before | |

|---|---|

In the first time period, the reference values of benchmark during the test period were: | |

− Annual returns: 1574.78%; | |

− Volatility: 76.12%; | |

− Sharpe ratio: 3.33; | |

− Max Drawdown: \(-35.50\)%; | |

− Sortino ratio: 5.89; | |

− Omega ratio: 1.82. |

In Table 4, we show how the different agents behaved in the same period, reporting the assumed values of the parameters used as a comparison.

We start the analysis of the results from the ZI/MI agents. We know these agents do not follow the actual price trend of Bitcoin but absorb some parameters from the reference market; for this reason, the returns are entirely distant from the benchmark. In particular, a value that we can use to understand the market phase is volatility: the ZIC, for example, which does not pursue a specific trading strategy but only trades, has an high volatility value, but comparing it with the same value assumed in the different periods can be used as a tool to identify whether the market is in an expansion phase (e.g., before/during a bubble) or recessive (after a bubble). Furthermore, by comparing the different indicators, we can see that, in these circumstances, the best agent was the AA, which achieved the highest Sharpe ratio and the lowest Sortino ratio and Omega ratio. CI agents, on the other hand, are comparable to the benchmark since they follow the same price level. In particular, the agent carrying out the best trading strategy in this time frame was the A2C that managed to attain a return equal to \(1557\%\), the highest Sharpe ratio from which follows the lowest Omega ratio, and Sortino ratio. At the same time, the Drawdown remained reasonably constant for the various agents. Furthermore, the A2C was the only agent to achieve a close return to the benchmark. In terms of volatility, the strategies of the different agents were quite similar, with average volatility \(\bar{\sigma } = 84\%\). Also here, to test a market situation, we can compare the average volatility of this time frame with the following ones. In Fig. 11, the volatilities of the most representative agents for both categories are represented. The green line (indicated in the legend as Backtest) represents the trend of the agent’s volatility while the gray line represents the volatility followed by the BTC-USD ticker. The explosion’s point of volatility for ZIC in Fig. 12a occurs when the bubble on the Bitcoin market explodes, near October, so in subsequent periods prices will remain stable on average. We could assume that these explosion points indicate the end of a specific market phase, while the volatility value what this phase is: whether in or out of a bubble. Making an intra-category comparison, we can say that on the side of the ZI/MI agents the most significant are the ZIC, in terms of the explainability of the volatility (necessary to understand if the market is on the bubble phase or not) and AA; on the CI side, on the other hand, the agent with the best behavior was the A2C that outperforms the benchmark, followed by PPO and DDPG. Figure 12 shows the cumulative returns of the leading agents for this time phase.

During Here, we analyze the second time period. The reference values of benchmark during the test period are available in the following box.

Reference values BTC2018 During | |

|---|---|

− Annual returns: \(-61.25\)%; | |

− Volatility: 87.40%; | |

− Sharpe ratio: \(-1.23\); | |

− Max Drawdown: \(-65.28\)%; | |

− Sortino ratio: \(-1.64\); | |

− Omega ratio: 0.82. |

As in the previous case, Table 5 shows the behavior of different agents in this time period.

Here, likewise the previous time period, we can study volatility to understand what the market phase is. In particular, it is again the ZIC (for ZI/MI) that is the most explanatory of volatility; this time, however, the volatility value is halved compared to the previous situation (Before), suggesting that something has happened on the markets. During this time frame, the different agents were trained taking into account the strong price increases that occurred during the first phase of the bubble. Unlike the previous case (in which the agents were not aware of the large price increases that would have occurred due to the triggering of the bubble), in this situation, the behavior of all agents is influenced by having already registered strong increases and declines, so that the bubble bursting phase has a lighter impact, especially since prices remain stable on average in the subsequent phase. On the CI side, the volatilities of the first four agents are even more similar, with an average volatility \(\bar{\sigma } = 75\%\), while PPO has the lowest volatility (similar to the benchmark). We can also consider the behavior of the second best agent, who achieved excellent results in terms of all performance indicators: the DDPG. For what concerns the intra-category comparison, in this case, for the ZI agents the best behavior is that held by the AA agent, also in terms of Sortino and Omega ratio. On the CI side, however, despite the very similar behavior of the different agents, the winner is the DDPG, which obtains better results in terms of Drawdown, Sharpe ratio, Sortino ratio and return. Figure 13 shows the cumulative returns for these main agents.

After Finally, we can analyze the last time period. The reference values of benchmark during the last test period are available in the following box.

Reference values BTC2018 After | |

|---|---|

− Annual returns: \(-47.96\%\); | |

− Volatility: \(54.23\%\); | |

− Sharpe ratio: \(-1.17\); | |

− Max Drawdown: \(-61.57\)%; | |

− Sortino ratio: \(-1.50\); | |

− Omega ratio: 0.80. |

Table 6 shows the behavior of different agents in this last time period.

This time period is characterized by the fact that agents have observed the entire bubble from birth to burst and must trade at a later stage. Here, the volatility of the benchmark is the lowest compared to the previous ones since prices have remained constant on average (or at least have not undergone abrupt changes over a day as in prior periods). Let us consider what happens to the different agents at this stage. The ZI/MI agents, in this phase, are characterized by having a different behavior from the previous periods as regards the cumulative returns. For example, the GDX, which has always found negative returns, obtains a positive return. On the other hand, the volatility of the ZIC decreased compared to the previous phases in line with the benchmark’s. This leads us to think that the random agent can inform us about the market phase we are experiencing. CI agents also underwent a change in their behavior. In terms of volatility, we can observe how the DDPG agent got the lowest value, but the best behavior is the one followed by the A2C agent (despite not having obtained the highest return), as evidenced by Sharpe, Sortino, and Omega ratio (the closer they are to 0, the better their behavior). Furthermore, the average volatility in this frame is \(\bar{\sigma } \approx 50\%\), so also CI agents follow the trend of volatility reduction in the phase following a bubble, further confirming the fact that this volatility movement indicator is handy. In terms of performance, following the best strategy of A2C agent, Fig. 14 shows the behaviors of the various agents mentioned.

4.2.2 Bitcoin bubble 2021

In this section, we offer details on the results obtained by ZI/MI and CI agents on the Bitcoin bubble of 2021 in three market situations, i.e., before, during and after the bubble.

Before

In this first time period, the reference values of benchmark during the test period are available in the following box.

Reference values BTC2021 Before | |

|---|---|

− Annual returns: 287.10%; | |

− Volatility: 51.56%; | |

− Sharpe ratio: 2.68; | |

− Max Drawdown: \(-25.40\)%; | |

− Sortino ratio: 4.37; | |

− Omega ratio: 1.63. |

In the BTC2021 bubble, we can continue to use, for ZI agents, the volatility of the ZIC as an indicator of the pre/post-bubble phase. In this time frame, the recorded price of Bitcoin has undergone strong trends due to the ever-increasing use of cryptocurrencies and has begun its race to the top. On the side of the ZI/MI agents, as shown in Table 7, only the ZIC and the GVWY managed to get a positive return (from the extrapolation of various parameters), while the other agents obtained a negative return, as shown in Fig. 15. In particular, although chaotic, the behavior of the GVWY was proved more effective than that of the ZIC (considering only agents with positive returns given the expansionary phase of the market), achieving excellent results under all indicators. In the previous bubble of 2018 (same time frame), the best agent was AA. On the other hand, on the side of the CI agents, the A2C achieves a very different behavior from that of the opponents, starting the trading strategy late (compared to them) and obtaining a lower return, but which other indicators being equal as the best result. However, among the remaining four agents, the best strategy is the one followed by the SAC (as evidenced by the Sharpe, Sortino, and Omega ratio values).

During Observe that the second time period of 2021 deserves more attention. In such a period, the price of Bitcoin has reached a price never seen before and has continued its exponential run that began in the previous time frame. The reference values of benchmark during this test period are available in the following box.

Reference values BTC2021 During | |

|---|---|

− Annual returns: 25.93%; | |

− Volatility: 72.48%; | |

− Sharpe ratio: 0.80; | |

− Max Drawdown: \(-53.06\)%; | |

− Sortino ratio: 1.21; | |

− Omega ratio: 1.14. |

Table 8 shows the behavior of different agents in this During time period.

As in the previous bubble, let us look at the volatility of the ZIC across the different time frames to understand the situation. The reduction of the last frame is evident, from which we can deduce that we are in a subsequent phase to the initial one (in fact in the During). Compared to the 2018 bubble, this situation in 2021 demonstrates as the volatility of the ZI agents (except for ZIC) is on average lower (\(\bar{\sigma }_{2021} \approx 2000 \ge \bar{\sigma }_{2018} \approx 1300\)). Regarding the behavior of such agents, four-fifths got a negative return (also opposite to that recorded in the benchmark). At the same time, only the GVWY achieved a positive return. For this reason, despite not having obtained better results in terms of the Sortino, Omega, and Sharpe ratio, based on the ratio between the return and the recorded variance, we can classify it as the best agent. For what concerns the CI agents, on the other hand, the PPO was the only one to get a negative return and very high volatility (even compared to the average of the different time frames), which allowed it to obtain a meager Sharpe ratio for example. However, having a return opposite to that showed in the benchmark, we cannot consider it among the best agents. Moreover, a very particular behavior is followed by the TD3 agent: it did not do any trading until a few days before the last date (7/31). Hence, various indicators such as the Sortino and the Omega ratio were not calculable. Therefore, we can state that the best CI agent was the SAC, having the lowest Sharpe and Sortino ratios. Figure 16 shows the returns of SAC and GVWY.

After Finally, we consider the last time frame of the Bitcoin 2021 bubble. The reference values of benchmark during this test period are available in the following box.

Reference values BTC2021 After | |

|---|---|

− Annual returns: 20.34%; | |

− Volatility: 54.77%; | |

− Sharpe ratio: 0.84; | |

− Max Drawdown: \(-31.62\)%; | |

− Sortino ratio: 1.22; | |

− Omega ratio: 1.14. |

This period, however, is characterized by being at the same time the final phase of a bubble and the period of the bursting of a new one, which explains fairly high benchmark volatility. In addition, various news spreads on the markets and the ever-growing attention to crypto led to the follow-up of two (critical) bubbles in the same year. Table 9 shows the behavior of the different agents in this particular time frame.

The first aspect we can observe is how the volatility of the ZIC has slightly decreased compared to the time frame during (always 2021) but has remained almost constant. This means that the exit from a bubble has not been completed (as in the present case due to the entry into a new bubble). The GVWY has the best behavior among the ZI agents since the others obtained a negative return, opposite to the benchmark. From reading the additional indicators, it may seem like ZIP or AA are the best, but these values are due to the ratios between yield and volatility, which is not in line with what they should have achieved. However, among the CI agents, the two best behaviors were those of the SAC and PPO, which achieved the best values of Sharpe and Sortino (Omega ratio is, on average, stable among all). In Fig. 17 it is possible to see the returns’ behavior of GVWY and PPO.

4.2.3 Ethereum bubble 2021

In this section, we offer details on the results obtained by ZI/MI and CI agents on the Ethereum bubble of 2021 in three market situations, i.e., before, during and after the bubble.

Before Here, we analyze the performance of the Ethereum in the Before period. The reference values of benchmark during this test period are available in the following box.

Reference values ETH2021 Before | |

|---|---|

− Annual returns: 54.53%; | |

− Volatility: 72.98%; | |

− Sharpe ratio: 2.72; | |

− Max Drawdown: \(-32.68\)%; | |

− Sortino ratio: 4.44; | |

− Omega ratio: 1.62. |

Already graphically (the price plot 5), it is possible to see how the ETH bubble is very similar to the BTC one, but on a different price level. Table 10 shows the results obtained by the different agents. We continue the volatility analysis based on the ZIC. Compared to the same time frame of previous crypto (i.e., Before BTC2021), in this instance, ZIC agent experienced higher volatility that is in line with the benchmark average value. We can consider the GDX as the agent with the best behavior among the ZI agents. Therefore, we can exclude the agents with negative returns (opposite the benchmark). Among the remaining ones, even if the GDX does not have the highest Sharpe ratio, it is the agent with the lowest Sortino and Omega ratio. On the other hand, the CI agents all achieved a much higher return than the benchmark and recorded a very high level of volatility. Therefore, the best performing agent is the PPO (the highest Sharpe and the lowest Sortino and Omega ratio). Figure 18 shows the returns of GDX and PPO.

During We now consider the next time frame. The reference values of benchmark during this test period are available in the following box.

Reference values ETH2021 During | |

|---|---|

− Annual returns: 80.19%; | |

− Volatility: 96.37%; | |

− Sharpe ratio: 1.34; | |

− Max Drawdown: \(-57.12\)%; | |

− Sortino ratio: 2.00; | |

− Omega ratio: 1.25. |

Table 11 shows the behavior of the different agents in the considered situation. Observing the volatility of the ZIC, we can see that this is down by about 20% compared to the previous time frame, so we can believe that we have entered a new bubble phase. Furthermore, compared to the time frame During of Bitcoin 2021, the average volatility of these agents is higher, as also highlighted by the benchmark. As for the best ZI agent, we can say that the best was the AA, followed by the ZIP; since GDX and GVWY got an inverse return compared to the benchmark, the ZIC has extremely high Sortino and Omega ratios. Instead, for CI agents, the first noticeable thing is the weird behavior of the PPO agent. It performs few transactions and attains a reasonably satisfactory result, but this is not enough to be ranked as the best agent due to the very high Sortino ratio. In view of this, it is evident how intelligent agents have been affected by the high volatility recorded (benchmark) since (except for the PPO) they have volatility higher than 100%, much higher than that recorded in the same time frame of Bitcoin 2021. Among these, the best agent was A2C, with good results on all the various indicators. Figure 19 shows the returns of AA and A2C.

After Finally, we can consider the last time frame for Ethereum. The reference values of benchmark during this test period are in the following box.

Reference values ETH2021 After | |

|---|---|

− Annual returns: 42.28%; | |

− Volatility: 67.77%; | |

− Sharpe ratio: 1.21; | |

− Max Drawdown: \(-30.05\)%; | |

− Sortino ratio: 1.84; | |

− Omega ratio: 1.21. |

Table 12 shows the results of the different agents. Also, as for the Bitcoin 2021 bubble, the time frame After represents a second bubble, as evidenced by the volatility of the ZIC very close to the previous time frame. Among the ZI agents, the best result is attained by the ZIP; while for the CI agents, again, the PPO made few transactions (as in the During), but its behavior did not lead to good results. The best agent was the A2C again. Figure 19 shows the returns of ZIP and A2C.

4.2.4 Summarization and some recommendations for investors

From the results shown above, it is natural to ask ourselves which are the best agents to use to understand what market phase we are in and, consequently, which strategy to follow. A first answer could be that the best trading strategies are those of CI agents: Even if true as an answer, it must be said that these agents arise from a learning process complex and deep. Although these agents can follow the real price trend in the strategy and very often perform better than a human trader can do only with his own considerations, they lose in terms of explainability. Conversely, however, the ZI/MI agents are not able to follow the actual price trend of the asset considered but are entirely explainable in economic terms, and the previous results allow us to state that they can guess in which market phase we are (as before, thanks to volatility). The result of the high explainability is not to be underestimated.

For example, in Table 13 we report the volatility values recorded by the ZIC in the different time frames and for the different cryptocurrencies. The use of the ZIC agent lies in the fact that strategies do not influence its buying/selling activities, as is the case for other ZI/MI agents (albeit minimal). In this way, it is possible to notice the decrease in volatility in the passage from one frame to the next and the particular situation of 2021 in which the two frames of during and after having similar volatility (a symptom of the succession of two bubbles). Instead, with regards to the behavior of the different agents, in Table 14, we can summarize, for each time frame, the agents that have achieved the best results for the ZI/MI and the CI.

It is evident that some agents are present more often than others (e.g., the TD3, which has never been the best agent). However, the CI agents generally have a more realistic and benchmark-compliant behavior than the ZI/MI.

What we can recommend to investors is the following “rule”: If he/she intends to follow a “machine-based” strategy that is highly performing but which he is not aware of and which he may not fully understand, then the best choice is to opt for a CI agent; however, if the investor already has his own strategy that he/she intends to follow and wants to understand what market phase is (to adjust it accordingly), then the best choice is to use a ZI/MI agent. It often happens that investors do not have a real strategy, but are based on some simple economic principles which (in several cases) are the same ones that govern ZI/MI agents. In these cases, the ideal choice is to use the intuition in the market phase of this type of agent and try to imitate (within the possible price limits) their strategy.

5 GGSMZ: a neuro-fuzzy trading agent

In this section, we present and detail GGSMZ, a neuro-fuzzy trading agents that we developed in the light of the results obtained above. First, we show the methodology adopted to build the neuro-fuzzy systems at the basis of our GGSMZ trading agent (Sect. 5.1). Lastly, we present the implementation of GGSMZ and its pseudo-code (Sect. 5.3), and the results obtained when GGSMZ operates during the different time frames (Sect. 5.4).

5.1 Methodology: building a neuro-fuzzy system

To build our neuro-fuzzy system, we defined a methodology consisting of the two following steps (see Fig. 6):

-

1.

dataset building (Sect. 5.1.1): it involves the use of various datasets previously presented (Sect. 3.4) with the integration of new features computed for the samples, and a (automatic) labeling process based on a criterion defined through the CI agents output, as well as other preprocessing steps;

-

2.

tuning and testing of ANFIS (Sect. 5.2): it includes evaluating different ANFIS configurations to find the most suitable one for our problem and testing it on real-world financial bubble data.

5.1.1 Dataset building

The dataset building phase was made for each dataset defined in Sect. 3.4, i.e., BTC-USD2018, BTC-USD2021 and ETH-USD2021. For simplicity, we will only refer to BTC-USD, but the process has been repeated since they have the same features.

To create the dataset used to train and test the proposed neuro-fuzzy system, hereinafter fuzzyds, we have relied on the BTC-USD dataset presented in Sect. 3.4, which describes the Bitcoin price in USD over three years period. Each sample of fuzzyds is represented with the set of features taken from the BTC-USD dataset (i.e., OHLCV features) augmented with a set of handcrafted features (economic indicators) that are summarized in Table 2.

Formally, let s\(_i\)=\(\langle\)open\(_i\),high\(_i\),low\(_i\),close\(_i\),volume\(_i\rangle\) be the ith sample in the BTC-USD dataset, with \(i>0\). We define a sample s’\(_i\) to be inserted in fuzzyds as follows: s’\(_i\) \(=\) \(\langle\) open\(_i\), high\(_i\), low\(_i\), close\(_{i-1}\), volume\(_i\), macd, boll\(_{up}\), boll\(_{dn}\), rsi\(_{30}\), cci\(_{30}\), dx\(_{30}\), sma\(_{30}\), sma\(_{60}\), vix, turb \(\rangle\).

Table 2 provides details about the features engineered to build s’\(_i\). We remark that, if \(i=0\) the feature close\(_{i-1}\) has been taken from the BTC-USD dataset regarding the year 2014 (on 12/31/2014).