Abstract

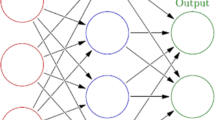

Early-warning models provide means for ex ante identification of elevated risks that may lead to a financial crisis. This paper taps into the early-warning literature by introducing biologically inspired models for predicting systemic financial crises. We create three models: a conventional statistical model, a back-propagation neural network (NN) and a neuro-genetic (NG) model that uses a genetic algorithm for choosing the optimal NN configuration. The models are calibrated and evaluated in terms of usefulness for policymakers that incorporates preferences between type I and type II errors. Generally, model evaluations show that biologically inspired models outperform the statistical model. NG models are, however, shown not only to provide largest usefulness for policymakers as an early-warning model, but also in form of decreased expertise and labor needed for, and uncertainty caused by, manual calibration of an NN. For better generalization of data-driven models, we also advocate adopting to the early-warning literature a training scheme that includes validation data.

Similar content being viewed by others

Notes

The FSI consists of five components: the spread of the 3-month interbank rate over the rate of the 3-month government bill; quarterly equity returns; realized volatility of a main equity index; realized volatility of the exchange rate; and realized volatility of the yield on the 3-month government bill.

Model robustness has been tested with respect to different forecast horizons. In general, for longer horizons (e.g. 24 months) there is a slight increase in usefulness and for shorter (e.g. 6 and 12 months) a slight decrease. However, the relative performance is similar to the benchmark results with a horizon of 18 months.

References

Reinhart CM, Rogoff KS (2008) Is the 2007 US sub-prime financial crisis so different? An international historical comparison. Am Econ Rev 98(2):339–344

Reinhart CM, Rogoff KS (2009) The aftermath of financial crises. Am Econ Rev 99(2):466–472

Edison HJ (2003) Do indicators of financial crises work? An evaluation of an early warning system. Int J Financ Econ 8(1):11–53

Ramser J, Foster L (1931) A demonstration of ratio analysis. Bureau of Business Research. University of Illinois, Urbana, IL (Bulletin 40)

Frank C, Cline W (1971) Measurement of debt servicing capacity: an application of discriminant analysis. J Int Econ 1:327–344

Kaminsky G, Lizondo S, Reinhart C (1998) Leading indicators of currency crises. IMF Staff Pap 45:1–48

Berg A, Pattillo C (1999) Predicting currency crises—the indicators approach and an alternative. J Int Money Financ 18:561–586

Demirgüc-Kunt A, Detragiache E (2000) Monitoring banking sector fragility: a multivariate logit approach. World Bank Econ Rev 14:287–307

Lo Duca M, Peltonen T (2012) Assessing systemic risks and predicting systemic events. J Bank Financ (forthcoming)

Nag A, Mitra A (1999) Neural networks and early warning indicators of currency crisis. Reserve Bank India Occas Pap 20(2):183–222

Franck R, Schmied A (2003) Predicting currency crisis contagion from East Asia to Russia and Brazil: an artificial neural network approach. AMCB Working Paper No 2

Peltonen T (2006) Are emerging market currency crises predictable? A test. ECB Working Paper. No. 571

Sarlin P, Marghescu D (2011) Visual predictions of currency crises using self-organizing maps. Intell Syst Account Financ Manage 18(1):15–38

Sarlin P, Marghescu D (2011) Neuro-genetic predictions of currency crises. Intell Syst Account Financ Manage 18(4):145–160

Fioramanti M (2008) Predicting sovereign debt crises using artificial neural networks: a comparative approach. J Financ Stab 4(2):149–164

Sarlin P, Peltonen TA (2011) Mapping the state of financial stability. ECB Working Paper No. 1382

Alessi L, Detken C (2011) Quasi real time early warning indicators for costly asset price boom/bust cycles: a role for global liquidity. Eur J Polit Econ 27(3):520–533

Hollo D, Kremer M, Lo Duca M (2012) CISS—a composite indicator of systemic stress in the financial system. ECB Working Paper No. 1426

Ripley B (1994) Neural networks and related methods for classification. J R Stat Soc 56:409–456

Hagan MT, Demuth HB, Beale M (1996) Neural network design. PWS Publishing, Boston, MA

Demyanyk YS, Hasan I (2010) Financial crises and bank failures: a review of prediction methods. Omega 38(5):315–324

Lin CS, Khan HA, Chang RY, Wang YC (2008) A new approach to modeling early warning systems for currency crises: can a machine-learning fuzzy expert system predict the currency crises effectively? J Int Money Financ 27(7):1098–1121

Karahoca D, Karahoca A, Yavuz Ö (2012) An early warning system approach for the identification of currency crises with data mining techniques. Neural Comput Appl (forthcoming). doi:10.1007/s00521-012-1206-9

Manasse P, Roubini N, Schimmelpfennig A (2003) Predicting sovereign debt crises. IMF Working Paper, WP/03/221

Marghescu D, Sarlin P, Liu S (2010) Early-warning analysis for currency crises in emerging markets: a revisit with fuzzy clustering. Intell Syst Account Financ Manage 17(3–4):143–165

Arciniegas Rueda IE, Arciniegas F (2009) SOM-based data analysis of speculative attacks’ real effects. Intell Data Anal 13(2):261–300

Resta M (2009) Early warning systems: an approach via self organizing maps with applications to emergent markets. In: Apolloni B, Bassis S, Marinaro M (eds) Proceedings of the 18th Italian workshop on neural networks. IOS Press, Amsterdam, pp 176–184

Haykin S (1998) Neural networks: a comprehensive foundation, 2nd edn. Prentice Hall, Upper Saddle River, NJ

Bishop C (2007) Pattern recognition and machine learning. Springer, Heidelberg

Holland J (1975) Adaptation in natural and artificial systems. University of Michigan Press, Ann Arbour

Borio C, Lowe P (2002) Asset prices, financial and monetary stability: exploring the nexus. BIS Working Papers, No. 114

Borio C, Lowe P (2004) Securing sustainable price stability: should credit come back from the wilderness?. BIS Working Papers, No. 157

Sarlin P (2012) On policymakers’ loss functions and the evaluation of early warning systems. TUCS Technical Report No. 1054

Sarle W (1994) Neural networks and statistical models. In: Proceedings of the nineteenth annual SAS users group international conference. SAS Institute, Cary, NC, pp 1538–1550

Hornik K, Stinchcombe M, White H (1989) Multilayer feedforward networks are universal approximators. Neural Netw 2:359–366

Rao BR, Fung G, Rosales R (2008) On the dangers of cross-validation. An experimental evaluation. In: Proceedings of the SIAM international conference on data mining (SDM), April 24–26, 2008, Atlanta, Georgia, USA

Laeven L, Valencia F (2011) The real effects of financial sector interventions during crises. IMF Working Paper, WP/11/45

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sarlin, P. On biologically inspired predictions of the global financial crisis. Neural Comput & Applic 24, 663–673 (2014). https://doi.org/10.1007/s00521-012-1281-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-012-1281-y